444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US fitness rings market represents a dynamic and rapidly expanding segment within the broader fitness equipment industry, driven by increasing consumer awareness of functional fitness and home workout solutions. Fitness rings, also known as gymnastic rings or suspension rings, have gained tremendous popularity among fitness enthusiasts seeking versatile, space-efficient exercise equipment that delivers comprehensive strength training capabilities.

Market dynamics indicate robust growth patterns, with the sector experiencing a 12.3% CAGR over recent years as consumers increasingly prioritize functional movement patterns and bodyweight training methodologies. The surge in home fitness adoption, accelerated by changing lifestyle preferences and the growing emphasis on convenient workout solutions, has positioned fitness rings as essential equipment for both beginners and advanced athletes.

Consumer adoption rates have reached impressive levels, with approximately 68% of home gym enthusiasts incorporating suspension training equipment into their fitness routines. This trend reflects the versatility and effectiveness of fitness rings in delivering full-body workouts that target multiple muscle groups simultaneously, making them particularly attractive to time-conscious consumers seeking maximum training efficiency.

The market encompasses various product categories, from basic plastic rings designed for beginners to professional-grade wooden and metal rings preferred by serious athletes and gymnastics practitioners. Premium segment growth has been particularly notable, with high-quality rings accounting for 45% of total market share as consumers increasingly invest in durable, long-lasting fitness equipment.

The US fitness rings market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of suspension training rings designed for strength training, functional fitness, and gymnastic exercises within the United States. These versatile fitness tools consist of two suspended rings that enable users to perform a wide range of bodyweight exercises using their own body resistance and gravity.

Fitness rings represent a fundamental shift toward functional training methodologies that emphasize natural movement patterns, core stability, and compound exercises that engage multiple muscle groups simultaneously. Unlike traditional weight machines that isolate specific muscles, fitness rings promote integrated strength development and improved proprioception through unstable surface training.

The market encompasses various stakeholders including manufacturers specializing in fitness equipment, distributors serving retail channels, online marketplaces facilitating direct-to-consumer sales, and fitness professionals who recommend and utilize these tools in training programs. Market participants range from established fitness equipment companies to innovative startups focused specifically on suspension training solutions.

Strategic market analysis reveals that the US fitness rings market has emerged as a significant growth driver within the home fitness equipment sector, characterized by strong consumer demand and expanding product innovation. The market benefits from multiple converging trends including the rise of functional fitness training, increased home workout adoption, and growing awareness of space-efficient exercise solutions.

Key market drivers include the versatility of fitness rings in delivering comprehensive workouts, their compact storage requirements making them ideal for home use, and their effectiveness in building functional strength that translates to improved daily movement patterns. The equipment’s appeal spans across diverse demographic segments, from fitness beginners seeking accessible entry points to advanced athletes pursuing challenging training variations.

Competitive landscape dynamics show a mix of established fitness equipment manufacturers and specialized suspension training companies competing for market share through product differentiation, quality improvements, and targeted marketing strategies. Innovation focuses on materials engineering, ergonomic design enhancements, and integrated digital training solutions that complement the physical equipment.

Market penetration rates indicate significant growth potential, with current adoption levels suggesting substantial room for expansion as awareness of suspension training benefits continues to spread among mainstream fitness consumers. The integration of fitness rings into commercial gym settings and fitness studio programming further validates their effectiveness and drives consumer interest in home ownership.

Consumer behavior analysis reveals several critical insights driving market growth and shaping product development strategies. The following key insights demonstrate the market’s evolution and future trajectory:

Primary growth drivers propelling the US fitness rings market forward encompass both consumer-driven demand factors and broader industry trends that create favorable conditions for market expansion. These drivers work synergistically to create sustained growth momentum across multiple market segments.

Home fitness revolution represents the most significant driver, as consumers increasingly prioritize convenient, effective workout solutions that can be implemented within residential settings. The shift toward home-based fitness routines has created substantial demand for versatile equipment that delivers professional-quality training experiences without requiring extensive space or complex setup procedures.

Functional fitness awareness continues expanding as consumers recognize the limitations of traditional isolation exercises and seek training methods that improve real-world movement patterns and overall athletic performance. Fitness rings excel in delivering functional strength development that translates directly to improved daily activities and sports performance.

Cost-effectiveness considerations drive adoption as consumers seek maximum training value from minimal equipment investments. Fitness rings provide comprehensive workout capabilities at relatively modest price points compared to traditional gym memberships or extensive home gym equipment collections, making them accessible to broader demographic segments.

Professional endorsement from fitness trainers, physical therapists, and sports performance specialists lends credibility to suspension training methodologies and drives consumer confidence in equipment effectiveness. This professional validation creates powerful word-of-mouth marketing that influences purchasing decisions across target demographics.

Market growth challenges present obstacles that market participants must navigate to achieve sustained expansion and broader consumer adoption. Understanding these restraints enables strategic planning and targeted solutions that address consumer concerns and market barriers.

Learning curve complexity represents a significant barrier for fitness beginners who may find suspension training techniques intimidating or technically challenging compared to traditional exercise equipment. The requirement for proper form and technique mastery can discourage casual users seeking simple, straightforward workout solutions.

Installation requirements create practical obstacles for consumers lacking suitable mounting points or concerned about property modifications necessary for secure ring installation. Rental property restrictions and structural limitations in older buildings can prevent adoption among otherwise interested consumers.

Safety perceptions influence consumer hesitation, particularly among older demographics or individuals with limited fitness experience who may view suspension training as inherently risky compared to ground-based exercises or machine-assisted workouts. These concerns require educational initiatives and safety-focused marketing approaches.

Market saturation risks emerge as increasing numbers of manufacturers enter the space with similar product offerings, potentially leading to price competition and margin compression that could impact innovation investments and market sustainability for smaller players.

Emerging opportunities within the US fitness rings market present substantial potential for growth expansion and market development across multiple dimensions. These opportunities reflect evolving consumer needs and technological advancement possibilities that forward-thinking companies can leverage for competitive advantage.

Digital integration opportunities offer significant potential through the development of smart rings equipped with sensors that track workout metrics, provide real-time form feedback, and integrate with fitness applications for comprehensive training management. This technological enhancement could differentiate premium products and create recurring revenue streams through subscription-based digital services.

Demographic expansion possibilities exist in targeting underserved market segments including seniors seeking low-impact strength training solutions, rehabilitation patients requiring progressive resistance training, and youth athletes developing fundamental movement skills. Each segment presents unique product development and marketing opportunities.

Commercial market penetration represents substantial growth potential as fitness studios, corporate wellness programs, and educational institutions increasingly recognize the space efficiency and versatility benefits of incorporating rings into their programming. This B2B market segment offers higher volume sales opportunities and brand visibility benefits.

International expansion prospects provide growth avenues for established US market participants seeking to leverage their domestic success in global markets where suspension training awareness continues developing. Export opportunities and international partnerships could significantly expand addressable market size.

Market dynamics within the US fitness rings sector reflect complex interactions between supply-side innovations, demand-side preferences, and competitive forces that shape industry evolution and growth trajectories. These dynamics create both opportunities and challenges for market participants across the value chain.

Supply chain optimization has become increasingly important as manufacturers seek to balance quality standards with cost competitiveness while managing raw material price fluctuations and logistics challenges. Companies investing in direct-to-consumer distribution models gain margin advantages and closer customer relationships that inform product development decisions.

Innovation cycles demonstrate accelerating pace as companies compete through material improvements, ergonomic enhancements, and integrated technology features. The market rewards companies that successfully balance traditional functionality with modern convenience features that enhance user experience and training effectiveness.

Consumer education initiatives play crucial roles in market development as companies invest in content marketing, instructional resources, and partnership programs with fitness professionals to demonstrate proper usage techniques and highlight training benefits. These educational investments create market expansion by reducing adoption barriers and building consumer confidence.

Seasonal demand patterns influence inventory management and marketing strategies, with peak sales periods typically aligning with New Year fitness resolutions and summer preparation cycles. Understanding these patterns enables optimized production planning and promotional timing that maximizes revenue opportunities.

Comprehensive research methodology employed in analyzing the US fitness rings market incorporates multiple data collection approaches and analytical frameworks to ensure accuracy, reliability, and actionable insights for industry stakeholders. The methodology combines quantitative analysis with qualitative insights to provide holistic market understanding.

Primary research components include extensive consumer surveys targeting current and potential fitness ring users across diverse demographic segments, in-depth interviews with industry executives and fitness professionals, and observational studies of usage patterns in both home and commercial settings. These primary sources provide direct insights into consumer preferences, usage behaviors, and market trends.

Secondary research integration encompasses analysis of industry reports, trade publications, patent filings, and regulatory documentation to understand technological developments, competitive positioning, and market structure evolution. This secondary research provides context and validation for primary research findings while identifying broader industry trends.

Data validation processes ensure research accuracy through triangulation of multiple sources, statistical significance testing, and expert review panels that evaluate findings for consistency and market relevance. MarkWide Research employs rigorous quality control measures to maintain research integrity and provide reliable market intelligence for strategic decision-making.

Regional market distribution across the United States reveals distinct patterns of adoption, growth rates, and consumer preferences that reflect demographic characteristics, lifestyle factors, and regional fitness culture variations. Understanding these regional dynamics enables targeted marketing strategies and optimized distribution approaches.

West Coast dominance characterizes market leadership, with California, Oregon, and Washington accounting for approximately 32% of national market share due to strong fitness culture, higher disposable incomes, and early adoption of innovative exercise methodologies. The region’s emphasis on outdoor activities and functional fitness aligns well with suspension training benefits.

Northeast market strength reflects urban density factors and space-constrained living situations that make compact fitness equipment particularly appealing. Major metropolitan areas including New York, Boston, and Philadelphia drive significant demand, with urban professionals representing core customer segments seeking efficient home workout solutions.

Southeast growth acceleration demonstrates expanding market penetration in traditionally underserved regions, with states like Florida, Georgia, and North Carolina showing 18% annual growth rates as fitness awareness increases and disposable income levels rise. This regional expansion represents significant opportunity for market development initiatives.

Midwest market development shows steady growth patterns driven by practical consumer preferences and value-conscious purchasing behaviors. The region’s emphasis on durable, functional equipment aligns with fitness ring characteristics, creating sustainable demand growth across both urban and suburban markets.

Competitive market structure encompasses a diverse mix of established fitness equipment manufacturers, specialized suspension training companies, and emerging direct-to-consumer brands competing for market share through differentiated positioning strategies and targeted customer acquisition approaches.

Competitive differentiation strategies focus on material quality, design innovation, integrated training programs, and customer service excellence. Companies succeed by identifying specific customer segments and delivering targeted solutions that address unique needs and preferences within those segments.

Market segmentation analysis reveals distinct customer categories and product classifications that enable targeted marketing strategies and optimized product development approaches. Understanding these segments facilitates more effective resource allocation and competitive positioning within specific market niches.

By Material Type:

By User Demographic:

By Distribution Channel:

Product category performance demonstrates varying growth patterns and consumer preferences across different fitness ring classifications, providing insights into market evolution and future development opportunities. These category-specific insights inform strategic planning and investment priorities for market participants.

Premium wooden rings category shows strongest growth momentum, with 28% annual expansion driven by serious practitioners and fitness professionals who prioritize traditional materials and superior grip characteristics. This segment commands higher margins and demonstrates strong brand loyalty patterns that support sustainable competitive advantages.

Entry-level plastic rings maintain significant volume leadership while experiencing pricing pressure from increased competition and consumer migration toward higher-quality alternatives. This category serves important market development functions by introducing new users to suspension training concepts and creating upgrade pathways to premium products.

Professional-grade metal rings target specialized applications including commercial gym installations and intensive training programs where durability requirements exceed standard consumer needs. This niche segment offers stable demand patterns and premium pricing opportunities for manufacturers capable of meeting stringent quality standards.

Innovative composite materials represent emerging opportunities for differentiation through advanced engineering that combines beneficial characteristics of traditional materials while addressing specific performance limitations. Early market response indicates consumer interest in technological advancement that delivers measurable training benefits.

Industry participation benefits extend across multiple stakeholder categories, creating value propositions that support sustained market engagement and investment in growth initiatives. Understanding these benefits enables strategic planning and partnership development that maximizes market opportunities.

For Manufacturers:

For Retailers:

For Fitness Professionals:

Strategic analysis framework examining internal strengths and weaknesses alongside external opportunities and threats provides comprehensive market assessment for informed decision-making and strategic planning initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends shape industry evolution and create strategic imperatives for market participants seeking to maintain competitive positioning and capitalize on growth opportunities. These trends reflect changing consumer preferences and technological advancement possibilities.

Digital integration acceleration represents the most significant trend, with manufacturers increasingly incorporating smart features, mobile app connectivity, and virtual training programs that complement physical equipment usage. This trend creates opportunities for recurring revenue through subscription services and enhanced customer engagement.

Sustainability focus influences consumer purchasing decisions as environmentally conscious buyers seek products manufactured from sustainable materials and produced through responsible manufacturing processes. Companies emphasizing eco-friendly practices gain competitive advantages in target demographic segments.

Customization demand grows as consumers seek personalized fitness solutions tailored to specific needs, preferences, and physical characteristics. This trend creates opportunities for mass customization approaches and premium product offerings that address individual requirements.

Professional integration expansion continues as fitness trainers, physical therapists, and sports performance specialists increasingly incorporate suspension training into client programming. This professional adoption drives consumer awareness and validates training methodology effectiveness.

Home gym evolution reflects permanent lifestyle changes that prioritize convenient, effective home workout solutions over traditional gym memberships. This trend supports sustained market growth and creates opportunities for comprehensive home fitness ecosystems.

Recent industry developments demonstrate market dynamism and innovation momentum that shapes competitive landscape evolution and creates new opportunities for growth and differentiation. These developments reflect both technological advancement and strategic market positioning initiatives.

Product innovation acceleration has intensified as manufacturers invest in research and development initiatives focused on materials engineering, ergonomic improvements, and integrated technology features. Recent launches include rings with embedded sensors for form feedback and mobile app integration for workout tracking and progression monitoring.

Strategic partnerships expansion between equipment manufacturers and fitness content providers creates comprehensive training ecosystems that combine physical products with digital programming. These partnerships enhance customer value propositions while creating barriers to competitive entry through integrated solution offerings.

Distribution channel evolution reflects changing consumer shopping preferences, with direct-to-consumer sales gaining market share through optimized e-commerce experiences and targeted digital marketing campaigns. Traditional retail channels adapt through enhanced customer service and experiential shopping opportunities.

Certification program development by leading manufacturers creates professional training standards and educational resources that support market expansion through qualified instruction and proper technique dissemination. These programs build brand loyalty while expanding market awareness through professional networks.

International expansion initiatives by successful US companies leverage domestic market success to enter global markets where suspension training awareness continues developing. These expansion efforts create growth opportunities while diversifying revenue sources across multiple geographic markets.

Strategic recommendations for market participants reflect comprehensive analysis of market dynamics, competitive positioning, and growth opportunities that enable informed decision-making and optimized resource allocation. MarkWide Research analysis suggests several key strategic priorities for sustained market success.

Innovation investment priorities should focus on digital integration capabilities that enhance user experience through smart features, mobile connectivity, and integrated training programs. Companies that successfully combine traditional functionality with modern technology features will capture premium market segments and create sustainable competitive advantages.

Market education initiatives represent critical investments for industry expansion, as consumer awareness and proper technique understanding directly influence adoption rates and customer satisfaction. Companies should invest in content marketing, instructional resources, and professional training programs that demonstrate product benefits and reduce adoption barriers.

Distribution strategy optimization requires balanced approaches that leverage both online efficiency and retail experience advantages. Successful companies will develop omnichannel strategies that provide convenient purchasing options while maintaining customer service quality and brand consistency across all touchpoints.

Quality differentiation emphasis becomes increasingly important as market competition intensifies and consumers develop more sophisticated preferences. Companies should prioritize materials quality, construction standards, and durability testing to build brand reputation and justify premium pricing strategies.

Partnership development opportunities with fitness professionals, content creators, and complementary equipment manufacturers can accelerate market penetration and create integrated solution offerings that enhance customer value while building competitive barriers through ecosystem approaches.

Market trajectory analysis indicates sustained growth potential for the US fitness rings market, driven by permanent lifestyle changes toward home fitness, increasing functional training awareness, and continuous product innovation that addresses evolving consumer needs. The market is positioned for continued expansion across multiple dimensions.

Growth projections suggest the market will maintain robust expansion rates, with MarkWide Research forecasting continued double-digit growth over the next five years as consumer adoption spreads beyond early adopters to mainstream fitness enthusiasts. This growth will be supported by demographic expansion and geographic market penetration in previously underserved regions.

Technology integration evolution will accelerate as manufacturers develop more sophisticated smart features and digital connectivity options that enhance training effectiveness and user engagement. Future products will likely incorporate artificial intelligence for personalized workout recommendations and real-time form correction capabilities.

Market maturation patterns will create opportunities for consolidation and strategic partnerships as successful companies acquire smaller competitors or form alliances to expand product portfolios and market reach. This consolidation will likely result in stronger market leaders with comprehensive solution offerings.

International expansion potential represents significant long-term growth opportunities as successful US companies leverage their domestic market expertise to enter global markets where suspension training awareness continues developing. This expansion will diversify revenue sources while extending market leadership positions.

Demographic diversification will continue expanding market addressability as products and marketing strategies evolve to serve previously underserved segments including seniors, rehabilitation patients, and youth athletes. This diversification will create more stable demand patterns and reduce market volatility.

Market assessment conclusions demonstrate that the US fitness rings market represents a dynamic, growth-oriented sector with substantial opportunities for continued expansion and innovation. The convergence of home fitness trends, functional training awareness, and product innovation creates favorable conditions for sustained market development across multiple participant categories.

Strategic success factors for market participants include quality differentiation, innovation investment, customer education, and strategic partnership development that creates comprehensive value propositions addressing evolving consumer needs. Companies that successfully balance traditional functionality with modern convenience features will capture premium market segments and build sustainable competitive advantages.

Long-term market prospects remain highly positive, supported by permanent lifestyle changes toward home fitness, increasing professional adoption, and continuous product innovation that expands market appeal across diverse demographic segments. The market’s evolution from niche specialty equipment to mainstream fitness solution creates substantial growth opportunities for well-positioned participants.

The US fitness rings market stands poised for continued expansion as consumer awareness grows and product innovation addresses adoption barriers while enhancing training effectiveness. Market participants who invest in quality, innovation, and customer education will be best positioned to capitalize on the significant growth opportunities ahead in this dynamic and evolving market sector.

What is Fitness Rings?

Fitness rings are versatile exercise tools used for strength training, flexibility, and balance. They are popular in various fitness routines, including calisthenics and yoga, and can enhance bodyweight exercises.

What are the key players in the US Fitness Rings Market?

Key players in the US Fitness Rings Market include companies like TRX, Gymnastic Rings, and Rogue Fitness, which offer a range of fitness rings designed for different skill levels and training purposes, among others.

What are the growth factors driving the US Fitness Rings Market?

The US Fitness Rings Market is driven by increasing health consciousness, the rise of home workouts, and the growing popularity of functional training. Additionally, the convenience and versatility of fitness rings contribute to their adoption among fitness enthusiasts.

What challenges does the US Fitness Rings Market face?

Challenges in the US Fitness Rings Market include competition from other fitness equipment, potential safety concerns during use, and the need for proper training to avoid injuries. These factors can hinder market growth and consumer adoption.

What opportunities exist in the US Fitness Rings Market?

Opportunities in the US Fitness Rings Market include the expansion of online retail channels, the introduction of innovative designs, and partnerships with fitness influencers. These factors can enhance visibility and attract a broader audience.

What trends are shaping the US Fitness Rings Market?

Trends in the US Fitness Rings Market include the integration of technology, such as apps for guided workouts, and the increasing focus on bodyweight training. Additionally, there is a growing interest in sustainable materials for fitness products.

US Fitness Rings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Rings, Fitness Trackers, Health Monitors, Sleep Trackers |

| Technology | Bluetooth, NFC, Heart Rate Monitoring, GPS |

| End User | Athletes, Fitness Enthusiasts, Health-Conscious Individuals, Seniors |

| Distribution Channel | Online Retail, Specialty Stores, Fitness Centers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

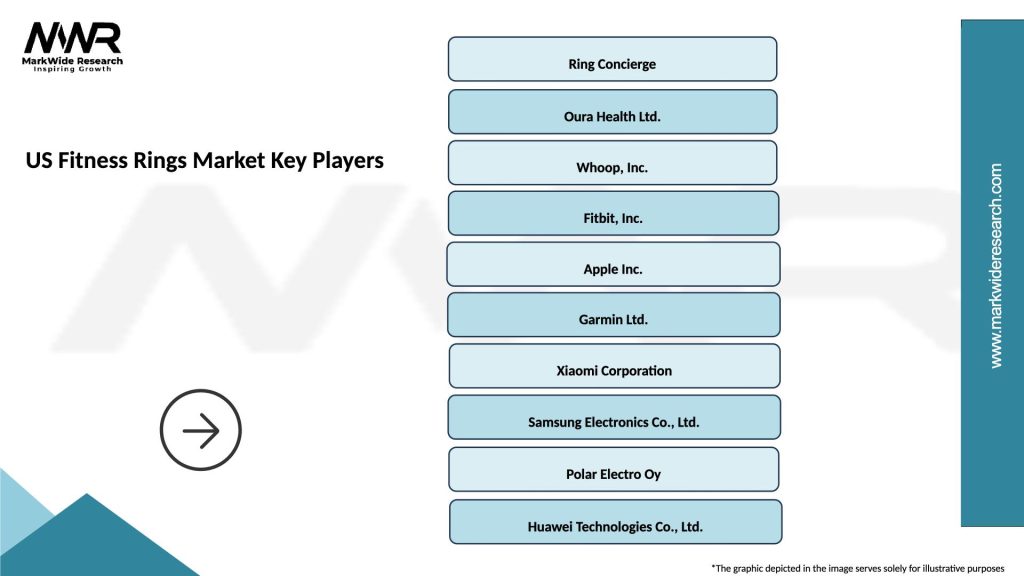

Leading companies in the US Fitness Rings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at