444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US facial recognition market represents one of the most rapidly evolving segments within the broader biometric technology landscape. This sophisticated technology leverages advanced algorithms and artificial intelligence to identify and verify individuals through facial features, creating substantial opportunities across multiple industries. Market dynamics indicate robust growth driven by increasing security concerns, technological advancements, and widespread adoption across government and commercial sectors.

Government agencies continue to be primary adopters, utilizing facial recognition systems for border control, law enforcement, and national security applications. The technology has achieved 95% accuracy rates in controlled environments, making it increasingly reliable for critical security applications. Commercial adoption spans retail, banking, healthcare, and transportation sectors, where organizations seek enhanced security measures and improved customer experiences.

Technological innovations in deep learning and neural networks have significantly improved recognition accuracy and processing speed. The integration of 3D facial recognition and liveness detection capabilities addresses previous concerns about spoofing and security vulnerabilities. Cloud-based solutions are gaining traction, offering scalable deployment options with reduced infrastructure costs.

Privacy regulations and ethical considerations continue to shape market development, with several states implementing specific legislation governing facial recognition use. Despite regulatory challenges, the market demonstrates strong growth momentum with increasing acceptance in contactless applications, particularly accelerated by post-pandemic hygiene considerations.

The US facial recognition market refers to the comprehensive ecosystem of technologies, solutions, and services that enable automatic identification and verification of individuals through analysis of facial characteristics within the United States territory. This market encompasses hardware components, software algorithms, cloud-based platforms, and professional services that collectively deliver facial recognition capabilities across various applications and industries.

Core technology components include image capture devices, processing units, database management systems, and analytical software that work together to extract, analyze, and match facial features. The market covers both identification systems that determine who a person is from a database of known individuals, and verification systems that confirm whether a person is who they claim to be.

Application domains within this market span law enforcement, border security, access control, retail analytics, banking authentication, healthcare patient identification, and consumer device security. The market also includes emerging applications in smart cities, autonomous vehicles, and augmented reality platforms.

Market leadership in the US facial recognition sector is characterized by intense competition between established technology giants and innovative startups. The landscape features significant investment in research and development, with companies focusing on improving accuracy, reducing bias, and enhancing privacy protection measures.

Government sector demand remains the largest market driver, with federal agencies investing heavily in advanced facial recognition capabilities for national security applications. The Department of Homeland Security and various law enforcement agencies continue expanding their facial recognition infrastructure, contributing to sustained market growth.

Commercial adoption rates have accelerated significantly, with 78% of retail organizations considering or implementing facial recognition solutions for loss prevention and customer analytics. Financial institutions increasingly deploy these systems for fraud prevention and secure authentication, while healthcare organizations utilize the technology for patient identification and access control.

Technological advancement focuses on addressing accuracy disparities across demographic groups, with major vendors investing in bias reduction algorithms and diverse training datasets. Edge computing integration enables real-time processing capabilities, reducing latency and improving system responsiveness for time-critical applications.

Primary market drivers include escalating security threats, increasing demand for contactless authentication, and growing acceptance of biometric technologies among consumers and organizations. The following key insights shape current market dynamics:

Security concerns represent the primary catalyst driving facial recognition adoption across the United States. Rising incidents of identity fraud, unauthorized access, and security breaches compel organizations to implement more sophisticated authentication mechanisms. Government agencies lead adoption efforts, implementing comprehensive facial recognition systems for border control, airport security, and law enforcement applications.

Technological maturation has significantly improved system reliability and accuracy, addressing previous concerns about false positives and demographic bias. Modern algorithms achieve 99.7% accuracy rates under optimal conditions, making the technology suitable for critical security applications. Deep learning advancements enable systems to perform effectively across diverse lighting conditions and facial orientations.

Contactless interaction demand accelerated dramatically following the global pandemic, with organizations seeking touchless authentication solutions. Healthcare facilities, retail establishments, and office buildings increasingly prefer contactless access control systems that maintain security while reducing physical contact points.

Cost reduction benefits drive adoption as organizations recognize long-term savings from automated identification processes. Labor cost reductions in security and access control operations, combined with improved operational efficiency, create compelling return on investment scenarios for many organizations.

Privacy concerns constitute the most significant restraint affecting market growth, with consumers and advocacy groups expressing concerns about surveillance overreach and data misuse. State-level legislation in California, Illinois, and other jurisdictions imposes strict requirements on facial recognition deployment, creating compliance challenges for organizations.

Algorithmic bias remains a persistent challenge, with studies demonstrating accuracy disparities across different demographic groups. False positive rates vary significantly based on race, gender, and age, raising concerns about discriminatory impacts in law enforcement and commercial applications. Organizations must invest substantially in bias mitigation measures and diverse training datasets.

Technical limitations include performance degradation in challenging environmental conditions such as poor lighting, extreme angles, or partial facial occlusion. Spoofing vulnerabilities through photographs, videos, or masks continue to pose security risks, requiring additional liveness detection capabilities.

Implementation costs for comprehensive facial recognition systems can be substantial, particularly for smaller organizations. Infrastructure requirements, ongoing maintenance, and staff training create significant upfront and operational expenses that may limit adoption among cost-sensitive organizations.

Emerging applications in smart city initiatives present substantial growth opportunities, with municipalities exploring facial recognition integration for traffic management, public safety, and citizen services. Smart transportation systems increasingly incorporate facial recognition for passenger identification, fare collection, and security monitoring.

Healthcare sector expansion offers significant potential, with hospitals and clinics recognizing benefits for patient identification, medication administration safety, and access control. Telemedicine platforms explore facial recognition integration for patient verification and fraud prevention in remote healthcare delivery.

Retail analytics evolution creates opportunities beyond security applications, with retailers utilizing facial recognition for customer demographics analysis, personalized marketing, and inventory optimization. Loss prevention applications continue expanding as retailers seek more effective shoplifting deterrence methods.

Financial services innovation drives demand for advanced authentication solutions, with banks and fintech companies implementing facial recognition for mobile banking, ATM access, and fraud prevention. Digital payment systems increasingly incorporate biometric authentication to enhance transaction security.

Competitive intensity continues escalating as technology giants, specialized biometric companies, and emerging startups compete for market share. Innovation cycles accelerate rapidly, with companies investing heavily in artificial intelligence, machine learning, and edge computing capabilities to differentiate their offerings.

Regulatory landscape evolution significantly impacts market dynamics, with federal and state governments developing comprehensive frameworks governing facial recognition use. Compliance requirements create both challenges and opportunities, as organizations seek solutions that meet regulatory standards while delivering required functionality.

Partnership strategies become increasingly important, with technology vendors collaborating with system integrators, security consultants, and industry specialists to deliver comprehensive solutions. Ecosystem development focuses on creating interoperable platforms that integrate seamlessly with existing security and business systems.

Customer education initiatives play crucial roles in market development, as vendors work to address privacy concerns and demonstrate technology benefits. Transparency measures regarding data handling, algorithmic decision-making, and bias mitigation help build trust and acceptance among potential users.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US facial recognition market. Primary research includes extensive interviews with industry executives, technology vendors, end-users, and regulatory experts to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, government publications, academic studies, and company financial statements to validate primary findings and identify broader market patterns. Patent analysis provides insights into technological innovation trends and competitive positioning among market participants.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing adoption rates across different sectors and applications. Growth projections consider technological advancement rates, regulatory developments, and changing customer preferences to forecast future market evolution.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market insights. Continuous monitoring of market developments enables regular updates to research findings and projections.

Geographic distribution across the United States reveals significant variations in facial recognition adoption and regulatory approaches. West Coast states lead in technology innovation and deployment, with California hosting numerous facial recognition technology companies and early adopter organizations.

Northeast corridor demonstrates strong adoption in financial services and government applications, with New York and Washington D.C. serving as major deployment centers for federal agencies and financial institutions. The region accounts for approximately 35% of total market activity due to high concentration of government and financial sector organizations.

Southern states show increasing adoption in retail and hospitality sectors, with Texas and Florida leading regional growth. Border states demonstrate particularly strong demand for security applications, driven by federal immigration and customs enforcement requirements.

Midwest adoption focuses primarily on manufacturing and logistics applications, with companies utilizing facial recognition for employee access control and facility security. Regulatory variations across states create complex compliance landscapes that influence deployment strategies and market development patterns.

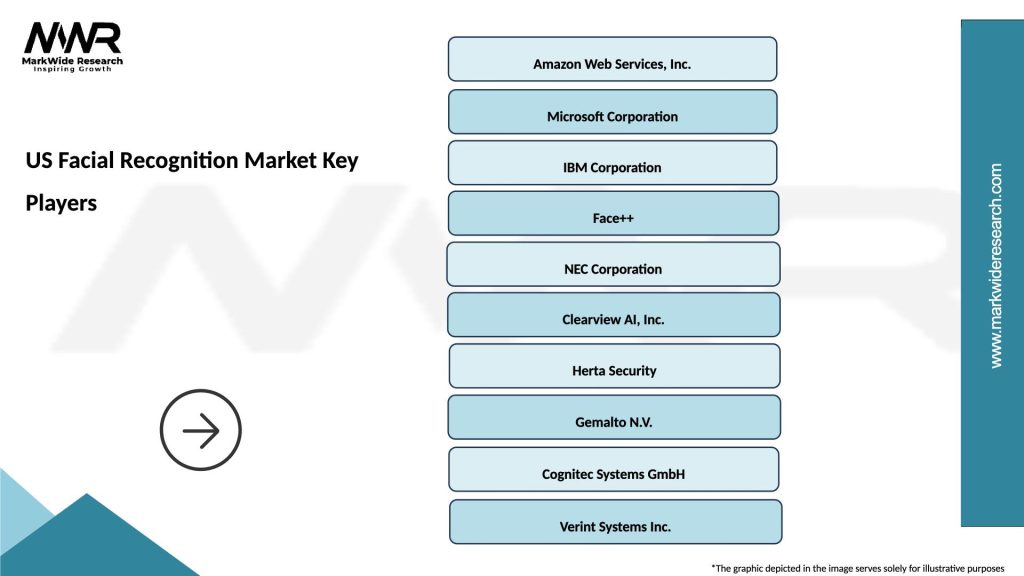

Market leadership is distributed among several categories of companies, each bringing distinct strengths and capabilities to the facial recognition ecosystem. The competitive landscape includes:

Competitive strategies focus on technological differentiation, strategic partnerships, and vertical market specialization. Innovation investments concentrate on improving accuracy, reducing bias, and enhancing privacy protection capabilities.

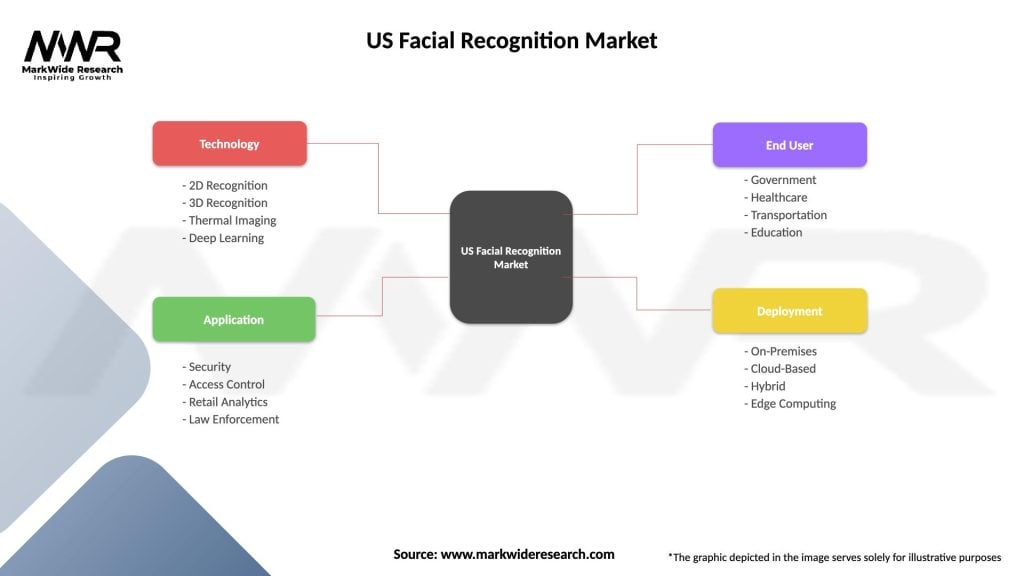

Technology segmentation divides the market into distinct categories based on underlying recognition methodologies and implementation approaches:

By Technology:

By Application:

By End-User Industry:

Government sector applications continue driving the largest portion of market demand, with federal agencies implementing comprehensive facial recognition systems for national security purposes. Border control systems achieve 92% efficiency improvements in passenger processing while maintaining enhanced security protocols.

Retail sector adoption focuses on dual-purpose applications combining security and analytics capabilities. Loss prevention systems demonstrate 67% reduction in shoplifting incidents while providing valuable customer demographic insights. Personalized marketing applications show promising results in improving customer engagement and sales conversion rates.

Financial services implementation emphasizes fraud prevention and secure authentication, with mobile banking applications showing 89% user satisfaction rates for facial recognition login systems. ATM security enhancements reduce unauthorized access attempts while improving customer convenience.

Healthcare applications focus on patient safety and operational efficiency, with medication administration systems showing significant improvements in patient identification accuracy. Access control in sensitive areas maintains security while enabling seamless workflow for authorized personnel.

Transportation sector deployment spans airport security, public transit, and smart traffic management systems. Airport implementations reduce passenger processing time while maintaining comprehensive security screening capabilities.

Technology vendors benefit from expanding market opportunities across multiple industry verticals, with increasing demand for specialized solutions and integration services. Revenue diversification opportunities emerge as vendors develop industry-specific applications and expand into emerging market segments.

System integrators gain competitive advantages through facial recognition expertise, offering comprehensive security solutions that combine multiple biometric technologies. Service revenue streams expand through implementation, maintenance, and consulting services for complex facial recognition deployments.

End-user organizations achieve multiple operational benefits including enhanced security, improved operational efficiency, and better customer experiences. Cost savings from automated processes and reduced security staffing requirements provide compelling return on investment scenarios.

Government agencies enhance public safety capabilities while improving operational efficiency in citizen services. Law enforcement benefits from improved investigation capabilities and enhanced officer safety through advanced identification systems.

Consumers experience improved convenience through faster authentication processes and enhanced security protection. Contactless interactions provide hygiene benefits while maintaining security standards in various applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping market evolution, with vendors incorporating advanced machine learning algorithms to improve accuracy and reduce bias. Neural network architectures enable more sophisticated facial feature analysis and recognition capabilities.

Edge computing adoption accelerates as organizations seek real-time processing capabilities without cloud dependency. Local processing addresses privacy concerns while reducing latency and improving system responsiveness for time-critical applications.

Multimodal biometric systems gain popularity as organizations implement comprehensive security solutions combining facial recognition with fingerprint, iris, and voice recognition technologies. Fusion algorithms improve overall system accuracy and security by leveraging multiple biometric modalities.

Privacy-preserving technologies emerge as key differentiators, with vendors developing solutions that protect individual privacy while maintaining identification capabilities. Homomorphic encryption and federated learning approaches enable secure facial recognition without exposing sensitive biometric data.

Mobile integration expands rapidly as smartphones and tablets incorporate advanced facial recognition capabilities for authentication and security applications. Consumer acceptance of mobile facial recognition drives broader market adoption across various applications.

Regulatory developments significantly impact market dynamics, with several states implementing comprehensive facial recognition legislation. California’s privacy laws and Illinois’ Biometric Information Privacy Act create compliance requirements that influence technology development and deployment strategies.

Technology partnerships accelerate between major cloud providers and specialized biometric companies, creating comprehensive solutions that combine infrastructure capabilities with advanced algorithms. Strategic alliances enable faster market penetration and expanded customer reach.

Acquisition activities consolidate market participants as larger companies acquire specialized facial recognition startups to enhance their technology portfolios. Vertical integration strategies enable companies to control entire solution stacks from hardware to software.

Standards development progresses through industry organizations and government agencies, with efforts to establish interoperability requirements and performance benchmarks. Certification programs emerge to validate system accuracy and security capabilities.

International expansion accelerates as US companies seek growth opportunities in global markets, while international vendors establish US operations to access the large domestic market.

MarkWide Research recommends that organizations considering facial recognition implementation develop comprehensive privacy and ethical use policies before deployment. Stakeholder engagement including employees, customers, and community representatives helps address concerns and build acceptance for new systems.

Technology selection should prioritize solutions with demonstrated bias reduction capabilities and transparent algorithmic decision-making processes. Vendor evaluation must include assessment of ongoing bias mitigation efforts and commitment to ethical AI practices.

Pilot program implementation enables organizations to test facial recognition capabilities in controlled environments before full-scale deployment. Performance monitoring during pilot phases helps identify potential issues and optimization opportunities.

Regulatory compliance requires ongoing attention as legislation continues evolving at federal and state levels. Legal consultation ensures deployment strategies align with current and anticipated regulatory requirements.

Integration planning should consider existing security infrastructure and business systems to maximize return on investment. Phased implementation approaches reduce risk while enabling organizations to realize benefits incrementally.

Market evolution will be shaped by continued technological advancement, regulatory development, and changing social acceptance of biometric technologies. MWR analysis indicates that successful market participants will be those who effectively balance technological capability with privacy protection and ethical considerations.

Growth projections suggest continued expansion across multiple industry verticals, with particularly strong growth expected in healthcare, retail, and smart city applications. Adoption rates will likely accelerate as technology costs decrease and accuracy improvements address current limitations.

Innovation focus will continue emphasizing bias reduction, privacy protection, and edge computing capabilities. Next-generation systems will likely incorporate advanced AI techniques including federated learning and differential privacy to address current market concerns.

Regulatory landscape will continue evolving with potential federal legislation providing nationwide standards for facial recognition use. Industry self-regulation initiatives may emerge to address public concerns and prevent restrictive government intervention.

Market consolidation is expected to continue as larger technology companies acquire specialized vendors and smaller companies struggle to compete with well-funded competitors. Ecosystem development will favor companies that can provide comprehensive solutions rather than point products.

The US facial recognition market stands at a critical juncture where technological capability meets societal concerns about privacy and ethical use. Market fundamentals remain strong with continued demand from government and commercial sectors, supported by ongoing technological improvements and expanding application opportunities.

Success factors for market participants include commitment to ethical AI practices, investment in bias reduction technologies, and proactive engagement with regulatory and privacy concerns. Organizations that effectively balance technological innovation with responsible deployment practices will likely achieve sustainable competitive advantages.

Future market development will depend significantly on the industry’s ability to address current limitations while maintaining the security and operational benefits that drive adoption. Collaborative efforts between technology vendors, regulators, and civil society organizations will be essential for creating frameworks that enable beneficial use while protecting individual rights and privacy.

What is Facial Recognition?

Facial recognition is a technology that identifies or verifies a person by analyzing facial features from images or video. It is widely used in security systems, mobile device authentication, and social media tagging, among other applications.

What are the key players in the US Facial Recognition Market?

Key players in the US Facial Recognition Market include companies like Clearview AI, NEC Corporation, and FaceFirst, which provide various solutions for security, law enforcement, and retail analytics, among others.

What are the growth factors driving the US Facial Recognition Market?

The growth of the US Facial Recognition Market is driven by increasing demand for security solutions, advancements in artificial intelligence, and the rising adoption of biometric systems across various sectors such as banking, healthcare, and retail.

What challenges does the US Facial Recognition Market face?

The US Facial Recognition Market faces challenges such as privacy concerns, regulatory scrutiny, and potential biases in algorithm performance, which can affect public trust and acceptance of the technology.

What opportunities exist in the US Facial Recognition Market?

Opportunities in the US Facial Recognition Market include the integration of facial recognition with other technologies like IoT and big data analytics, as well as expanding applications in areas such as personalized marketing and smart city initiatives.

What trends are shaping the US Facial Recognition Market?

Trends shaping the US Facial Recognition Market include the development of more accurate and efficient algorithms, increased use of cloud-based solutions, and growing interest in ethical AI practices to address privacy and bias issues.

US Facial Recognition Market

| Segmentation Details | Description |

|---|---|

| Technology | 2D Recognition, 3D Recognition, Thermal Imaging, Deep Learning |

| Application | Security, Access Control, Retail Analytics, Law Enforcement |

| End User | Government, Healthcare, Transportation, Education |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Facial Recognition Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at