444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US evidence management market represents a critical component of the nation’s law enforcement and judicial infrastructure, encompassing comprehensive solutions for the collection, storage, tracking, and analysis of physical and digital evidence. This specialized market has experienced substantial growth driven by increasing crime rates, technological advancements, and stringent regulatory requirements for evidence handling protocols. The market demonstrates robust expansion with a projected CAGR of 8.2% through the forecast period, reflecting the growing emphasis on forensic accuracy and chain of custody integrity.

Digital transformation has fundamentally reshaped evidence management practices, with law enforcement agencies increasingly adopting cloud-based solutions and automated tracking systems. The integration of artificial intelligence and machine learning technologies has enhanced evidence analysis capabilities, while blockchain technology ensures tamper-proof documentation of evidence handling procedures. Modern evidence management systems now incorporate advanced features including barcode scanning, RFID tracking, and real-time location monitoring to maintain comprehensive audit trails.

Market dynamics indicate strong demand across federal, state, and local law enforcement agencies, with particular growth in digital evidence management solutions. The increasing volume of digital evidence from smartphones, surveillance systems, and IoT devices has created unprecedented storage and processing requirements. According to MarkWide Research analysis, digital evidence now comprises approximately 75% of all evidence collected in criminal investigations, driving significant investment in specialized storage and analysis infrastructure.

The US evidence management market refers to the comprehensive ecosystem of technologies, services, and solutions designed to facilitate the secure collection, storage, tracking, analysis, and presentation of physical and digital evidence throughout the criminal justice process. This market encompasses software platforms, hardware systems, storage facilities, and professional services that ensure evidence integrity, maintain chain of custody documentation, and support forensic analysis requirements across law enforcement agencies, courts, and legal organizations.

Evidence management systems serve as centralized platforms that automate evidence handling workflows, from initial collection at crime scenes through final disposition after legal proceedings. These systems integrate multiple technologies including database management, barcode scanning, digital imaging, secure storage protocols, and audit trail documentation to maintain the evidentiary value of collected materials. The market includes both on-premises and cloud-based solutions, with increasing adoption of hybrid deployment models that balance security requirements with operational flexibility.

Strategic market positioning reveals the US evidence management market as a rapidly evolving sector driven by technological innovation and regulatory compliance requirements. The market encompasses diverse solution categories including digital evidence management platforms, physical evidence storage systems, forensic analysis tools, and chain of custody documentation software. Key growth drivers include increasing crime complexity, expanding digital evidence volumes, and heightened focus on forensic accuracy in judicial proceedings.

Technology adoption patterns demonstrate accelerating migration toward cloud-based evidence management platforms, with approximately 62% of agencies planning cloud implementations within the next three years. The market benefits from strong government funding support, particularly through federal grant programs that subsidize evidence management system upgrades for local law enforcement agencies. Integration capabilities with existing law enforcement systems, including records management systems and computer-aided dispatch platforms, represent critical competitive differentiators.

Competitive landscape analysis indicates market consolidation trends, with leading vendors expanding solution portfolios through strategic acquisitions and partnerships. The market demonstrates strong regional variations in adoption patterns, with urban metropolitan areas leading implementation of advanced evidence management technologies. Emerging technologies including artificial intelligence, machine learning, and blockchain integration are reshaping market dynamics and creating new growth opportunities for innovative solution providers.

Market intelligence reveals several critical insights shaping the US evidence management landscape:

Primary growth catalysts propelling the US evidence management market include escalating crime complexity and the corresponding increase in evidence volumes requiring sophisticated management solutions. The proliferation of digital devices and surveillance technologies has created exponential growth in digital evidence collection, with law enforcement agencies reporting annual increases of 35% in digital evidence volumes. This trend necessitates advanced storage, processing, and analysis capabilities that traditional evidence management approaches cannot accommodate.

Regulatory compliance requirements serve as significant market drivers, with federal and state mandates establishing strict protocols for evidence handling, storage, and chain of custody documentation. The implementation of updated forensic standards and accreditation requirements compels law enforcement agencies to invest in compliant evidence management systems. Additionally, court decisions emphasizing the importance of proper evidence handling procedures have increased liability concerns, driving adoption of automated tracking and documentation solutions.

Technological advancement in forensic science capabilities creates demand for integrated evidence management platforms that support advanced analysis techniques. The integration of artificial intelligence and machine learning algorithms enables automated evidence categorization, pattern recognition, and predictive analytics that enhance investigative capabilities. Furthermore, the growing emphasis on data-driven policing strategies requires comprehensive evidence management systems that support analytics and reporting functions for operational intelligence and performance measurement.

Budget constraints represent the most significant challenge facing evidence management market growth, particularly among smaller law enforcement agencies with limited financial resources. The high initial investment required for comprehensive evidence management system implementation, including software licensing, hardware infrastructure, and staff training, creates barriers to adoption. Many agencies struggle to justify the substantial upfront costs despite long-term operational benefits, resulting in delayed implementation timelines and continued reliance on legacy systems.

Technical complexity and integration challenges pose substantial obstacles for evidence management system deployment. Legacy law enforcement systems often lack modern integration capabilities, requiring extensive customization and system modifications that increase implementation costs and complexity. Staff resistance to new technologies and the learning curve associated with advanced evidence management platforms can impede successful adoption and utilization of system capabilities.

Data security concerns and privacy considerations create additional market restraints, particularly regarding cloud-based evidence management solutions. Law enforcement agencies express concerns about storing sensitive evidence data in external cloud environments, citing potential security vulnerabilities and jurisdictional issues. Compliance with various data protection regulations and evidence handling standards adds complexity to system selection and implementation processes, potentially slowing market adoption rates.

Emerging technology integration presents substantial opportunities for evidence management market expansion, particularly through the incorporation of artificial intelligence, machine learning, and blockchain technologies. AI-powered evidence analysis capabilities can automate pattern recognition, suspect identification, and case correlation processes, significantly enhancing investigative efficiency. Blockchain technology offers tamper-proof evidence tracking and chain of custody documentation, addressing critical concerns about evidence integrity and admissibility in legal proceedings.

Federal funding initiatives and grant programs create significant market opportunities by providing financial support for evidence management system upgrades and implementations. The availability of federal grants specifically targeting law enforcement technology modernization enables smaller agencies to invest in advanced evidence management solutions that would otherwise be financially prohibitive. These funding opportunities drive market growth while improving overall law enforcement capabilities across diverse jurisdictions.

Public-private partnerships offer innovative approaches to evidence management system deployment and operation, creating new business models and market opportunities. Collaborative arrangements between technology vendors and law enforcement agencies can address budget constraints while ensuring access to cutting-edge evidence management capabilities. Additionally, the growing trend toward regional evidence management consortiums presents opportunities for shared system implementations that reduce individual agency costs while maintaining operational effectiveness.

Supply chain dynamics within the US evidence management market reflect the complex interplay between technology vendors, system integrators, and end-user law enforcement agencies. The market demonstrates increasing consolidation among solution providers, with larger vendors acquiring specialized companies to expand their evidence management portfolios. This consolidation trend creates more comprehensive solution offerings while potentially reducing competitive pricing pressures in certain market segments.

Demand patterns vary significantly across different law enforcement agency types and geographic regions, with federal agencies typically leading adoption of advanced evidence management technologies. State and local agencies often follow implementation patterns established by federal counterparts, creating predictable market expansion cycles. The market experiences seasonal fluctuations related to budget cycles and grant funding availability, with peak implementation activity typically occurring during the second and third quarters of fiscal years.

Innovation cycles in the evidence management market are increasingly driven by advances in related technology sectors, including cloud computing, artificial intelligence, and cybersecurity. The rapid evolution of digital forensics capabilities creates continuous demand for evidence management system updates and enhancements. Market dynamics also reflect the growing importance of interoperability standards and data sharing capabilities as law enforcement agencies increasingly collaborate on multi-jurisdictional investigations.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the US evidence management market landscape. Primary research activities included extensive surveys and interviews with law enforcement officials, evidence management system administrators, and technology vendors across diverse geographic regions and agency types. These primary research efforts provided firsthand insights into market trends, adoption patterns, and operational challenges facing evidence management stakeholders.

Secondary research components encompassed detailed analysis of industry reports, government publications, regulatory documents, and vendor marketing materials to establish comprehensive market context. Data validation processes included cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market projections. The research methodology incorporated both quantitative and qualitative analysis techniques to provide balanced perspectives on market dynamics and growth opportunities.

Market segmentation analysis utilized statistical modeling techniques to identify distinct market segments and evaluate their respective growth potential. Geographic analysis incorporated demographic data, crime statistics, and law enforcement agency characteristics to understand regional market variations. Technology adoption analysis examined implementation patterns, user satisfaction metrics, and return on investment calculations to assess market maturity and future growth prospects across different solution categories.

Northeast region demonstrates the highest concentration of advanced evidence management system implementations, driven by dense urban populations and well-funded law enforcement agencies. Major metropolitan areas including New York, Boston, and Philadelphia lead adoption of cloud-based evidence management platforms, with approximately 78% of agencies in the region utilizing digital evidence management solutions. The region benefits from strong technology infrastructure and proximity to major solution vendors, facilitating rapid implementation and support services.

West Coast markets exhibit strong growth in innovative evidence management technologies, particularly in California, Washington, and Oregon. The region’s technology-forward culture and substantial state funding for law enforcement modernization drive adoption of cutting-edge evidence management capabilities. Silicon Valley’s influence promotes integration of artificial intelligence and machine learning technologies in evidence analysis processes, with regional agencies serving as early adopters for emerging solution categories.

Southeast and Southwest regions show rapidly accelerating adoption rates, supported by federal grant funding and interstate collaboration initiatives. Texas, Florida, and Georgia lead regional implementation efforts, with state-level coordination promoting standardized evidence management approaches across multiple jurisdictions. The regions benefit from lower implementation costs and strong vendor support networks, enabling smaller agencies to access advanced evidence management capabilities previously limited to larger departments.

Market leadership is characterized by a mix of established technology companies and specialized evidence management solution providers. The competitive landscape includes both large enterprise software vendors and niche players focused exclusively on law enforcement applications:

By Solution Type:

By Deployment Model:

By End User:

Digital Evidence Management represents the fastest-growing segment within the US evidence management market, driven by the exponential increase in digital evidence collection from smartphones, surveillance cameras, and IoT devices. This category demonstrates particularly strong growth in cloud-based solutions, with agencies seeking scalable storage options for large video files and digital media. Advanced features including automated metadata extraction, duplicate detection, and intelligent categorization are becoming standard requirements for digital evidence management platforms.

Physical Evidence Tracking maintains steady growth through automation and integration improvements, with RFID and barcode scanning technologies streamlining evidence handling processes. This segment benefits from integration with digital evidence management systems, creating comprehensive platforms that manage both physical and digital evidence types. Automated storage and retrieval systems are gaining adoption in larger agencies, reducing manual handling requirements and improving evidence security protocols.

Forensic Analysis Tools show strong market expansion driven by advances in artificial intelligence and machine learning capabilities. This category includes specialized solutions for mobile device forensics, computer forensics, and multimedia analysis that integrate with broader evidence management platforms. The growing complexity of digital evidence requires sophisticated analysis tools that can process encrypted data, recover deleted files, and identify relevant evidence patterns across large datasets.

Law enforcement agencies benefit significantly from modern evidence management systems through improved operational efficiency, reduced administrative burden, and enhanced investigative capabilities. Automated evidence tracking eliminates manual paperwork and reduces the risk of evidence mishandling or loss, while integrated analytics tools accelerate case resolution timelines. Agencies report average efficiency improvements of 40% in evidence processing workflows following comprehensive system implementations.

Legal professionals and prosecutors gain access to better-organized evidence presentations and more reliable chain of custody documentation, strengthening case preparation and courtroom presentations. Digital evidence management systems provide advanced search and filtering capabilities that enable rapid identification of relevant evidence materials. The improved evidence organization and accessibility contribute to more effective legal proceedings and higher conviction rates in criminal cases.

Technology vendors benefit from the growing market demand and opportunities for long-term customer relationships through ongoing support and system enhancement services. The recurring revenue model associated with cloud-based solutions provides stable income streams while enabling continuous product development and innovation. Vendors also benefit from cross-selling opportunities as agencies expand their evidence management capabilities and integrate additional law enforcement technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first strategies are reshaping the evidence management landscape, with agencies increasingly prioritizing cloud-based solutions for their scalability, cost-effectiveness, and accessibility advantages. This trend reflects growing confidence in cloud security measures and recognition of the operational benefits associated with centralized, remotely accessible evidence management platforms. The shift toward cloud deployment models enables smaller agencies to access enterprise-grade capabilities previously available only to larger departments with substantial IT resources.

Artificial intelligence integration represents a transformative trend enabling automated evidence analysis, pattern recognition, and predictive analytics capabilities. AI-powered solutions can automatically categorize evidence, identify potential matches across cases, and flag anomalies requiring investigator attention. Machine learning algorithms continuously improve analysis accuracy and efficiency, reducing manual review requirements while enhancing investigative outcomes. This trend is particularly impactful in digital forensics applications where AI can process vast amounts of data more quickly and accurately than traditional manual methods.

Mobile-first design approaches reflect the growing importance of field-based evidence collection and management capabilities. Modern evidence management systems increasingly prioritize mobile accessibility, enabling officers to collect, document, and upload evidence directly from crime scenes using smartphones and tablets. This trend improves evidence collection accuracy and reduces processing delays while ensuring immediate integration with central evidence management databases.

Strategic acquisitions and partnerships are reshaping the competitive landscape as major technology companies expand their law enforcement solution portfolios. Recent acquisitions include established evidence management vendors being acquired by larger enterprise software companies seeking to enter the public safety market. These consolidation activities create more comprehensive solution offerings while potentially reducing the number of independent vendors in the market.

Regulatory updates and compliance standard revisions continue to influence market development, with new requirements for evidence handling, storage, and documentation driving system upgrade cycles. Recent updates to forensic laboratory accreditation standards have increased emphasis on digital evidence management capabilities and chain of custody documentation. These regulatory changes create market opportunities for vendors offering compliant solutions while potentially obsoleting older systems that cannot meet updated requirements.

Technology partnerships between evidence management vendors and cloud service providers are accelerating market growth by combining specialized law enforcement expertise with enterprise-grade infrastructure capabilities. These partnerships enable rapid deployment of scalable evidence management solutions while ensuring compliance with government security requirements. According to MWR analysis, such partnerships have contributed to accelerated adoption rates of 25% among participating agencies.

Investment prioritization should focus on cloud-based evidence management platforms that offer comprehensive integration capabilities and scalable storage options. Agencies should evaluate solutions based on total cost of ownership rather than initial purchase price, considering ongoing operational savings and efficiency improvements. Priority should be given to systems that support both current evidence types and emerging digital evidence formats to ensure long-term viability and return on investment.

Implementation strategies should emphasize phased deployment approaches that minimize operational disruption while ensuring staff training and system integration success. Agencies should establish clear performance metrics and success criteria before implementation begins, enabling objective evaluation of system effectiveness and return on investment. Collaboration with other agencies and participation in regional consortiums can reduce individual costs while improving interoperability and information sharing capabilities.

Vendor selection criteria should prioritize companies with proven law enforcement experience, strong financial stability, and comprehensive support capabilities. Agencies should evaluate vendor roadmaps and technology partnerships to ensure alignment with future needs and emerging technology trends. Security certifications, compliance capabilities, and data protection measures should be thoroughly evaluated given the sensitive nature of evidence data and strict regulatory requirements.

Market trajectory indicates continued strong growth driven by increasing digital evidence volumes, technological advancement, and regulatory compliance requirements. The market is expected to maintain robust expansion with projected growth rates exceeding 8% annually through the next five years. Cloud-based solutions will likely dominate new implementations, while artificial intelligence and machine learning capabilities become standard features rather than premium options.

Technology evolution will focus on enhanced automation, improved user interfaces, and advanced analytics capabilities that support data-driven policing strategies. Blockchain integration for tamper-proof evidence tracking and IoT connectivity for automated evidence collection will become increasingly important market differentiators. The convergence of evidence management with broader law enforcement technology ecosystems will create more integrated and efficient operational workflows.

Market maturation will likely result in further vendor consolidation and standardization of core functionality across solution providers. Smaller agencies will benefit from improved affordability and accessibility of advanced evidence management capabilities through shared services and regional collaboration models. The market will increasingly emphasize interoperability standards and data sharing capabilities to support multi-jurisdictional investigations and regional law enforcement cooperation initiatives.

The US evidence management market represents a dynamic and rapidly evolving sector that plays a crucial role in supporting effective law enforcement operations and judicial proceedings. The market demonstrates strong growth potential driven by increasing evidence volumes, technological advancement, and regulatory compliance requirements that necessitate sophisticated management solutions. Cloud-based platforms, artificial intelligence integration, and mobile accessibility are reshaping market dynamics while creating new opportunities for innovation and efficiency improvement.

Strategic market positioning reveals significant opportunities for both established vendors and emerging technology companies to address evolving law enforcement needs through comprehensive evidence management solutions. The market benefits from strong government support, consistent demand growth, and technological advancement that continuously expand solution capabilities and market potential. Success in this market requires deep understanding of law enforcement workflows, regulatory compliance requirements, and the unique challenges associated with evidence handling and management.

Future market development will be characterized by continued technology integration, improved affordability, and enhanced interoperability that supports collaborative law enforcement efforts. The market’s trajectory indicates sustained growth and innovation that will benefit all stakeholders through improved operational efficiency, enhanced investigative capabilities, and stronger support for the criminal justice system. As digital evidence continues to dominate law enforcement activities, the US evidence management market will remain essential for ensuring evidence integrity, supporting successful prosecutions, and maintaining public safety across all jurisdictions.

What is Evidence Management?

Evidence Management refers to the systematic process of collecting, storing, and analyzing evidence in legal and law enforcement contexts. It encompasses various practices and technologies aimed at ensuring the integrity and accessibility of evidence throughout its lifecycle.

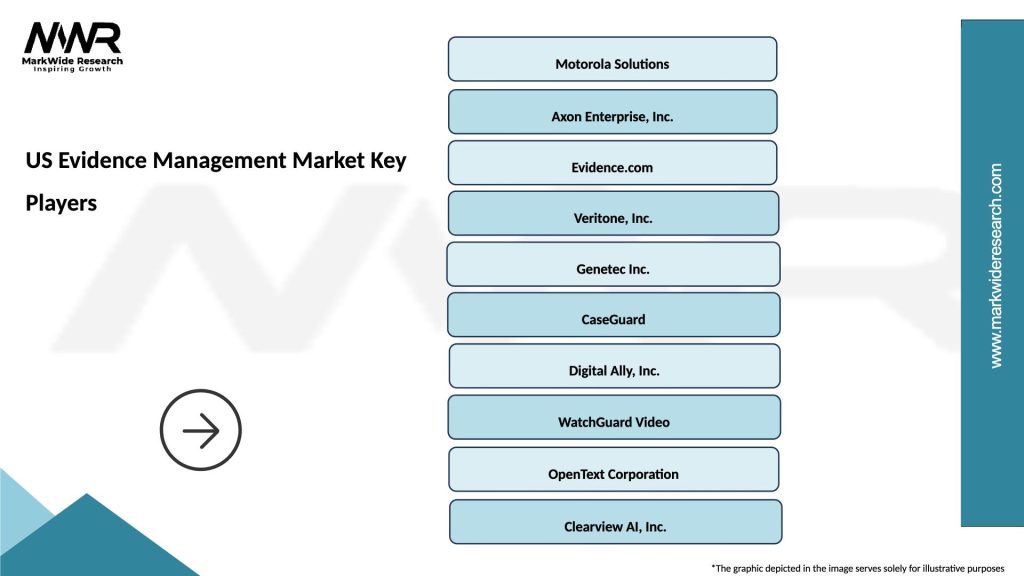

What are the key players in the US Evidence Management Market?

Key players in the US Evidence Management Market include companies like Motorola Solutions, Inc., Axon Enterprise, Inc., and Evidence.com, among others. These companies provide innovative solutions for evidence collection, storage, and management to law enforcement agencies.

What are the main drivers of growth in the US Evidence Management Market?

The main drivers of growth in the US Evidence Management Market include the increasing need for transparency in law enforcement, advancements in technology such as digital evidence management systems, and the rising demand for efficient case management solutions.

What challenges does the US Evidence Management Market face?

The US Evidence Management Market faces challenges such as the high costs associated with implementing advanced evidence management systems and concerns regarding data privacy and security. Additionally, the integration of new technologies with existing systems can be complex.

What opportunities exist in the US Evidence Management Market?

Opportunities in the US Evidence Management Market include the growing adoption of cloud-based solutions, the potential for AI and machine learning to enhance evidence analysis, and the increasing focus on improving public trust in law enforcement through better evidence handling.

What trends are shaping the US Evidence Management Market?

Trends shaping the US Evidence Management Market include the shift towards digital evidence management, the integration of mobile solutions for on-the-go evidence collection, and the increasing use of body-worn cameras by law enforcement agencies to enhance accountability.

US Evidence Management Market

| Segmentation Details | Description |

|---|---|

| Product Type | Digital Evidence Management, Physical Evidence Storage, Chain of Custody Solutions, Evidence Tracking Systems |

| End User | Law Enforcement Agencies, Legal Firms, Government Institutions, Private Investigators |

| Technology | Cloud-Based Solutions, On-Premises Systems, Mobile Applications, AI-Driven Analytics |

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Evidence Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at