444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US event logistics market represents a dynamic and rapidly evolving sector that encompasses comprehensive planning, coordination, and execution of events across various industries. This market serves as the backbone for corporate conferences, trade shows, entertainment events, sporting competitions, and cultural celebrations throughout the United States. Event logistics providers offer end-to-end solutions including venue management, transportation coordination, equipment rental, catering services, and technology integration to ensure seamless event experiences.

Market dynamics indicate robust growth driven by increasing corporate spending on events, rising demand for experiential marketing, and the recovery of the events industry following pandemic-related disruptions. The sector demonstrates remarkable resilience with annual growth rates exceeding 8.5% as organizations recognize the value of face-to-face interactions and immersive brand experiences. Digital transformation within event logistics has accelerated adoption of advanced technologies including virtual reality, artificial intelligence, and real-time tracking systems.

Regional distribution shows concentrated activity in major metropolitan areas including New York, Los Angeles, Chicago, Las Vegas, and Orlando, which collectively account for approximately 45% of total market activity. The market encompasses diverse service categories ranging from basic logistical support to comprehensive event management solutions, catering to clients from small businesses to Fortune 500 corporations.

The US event logistics market refers to the comprehensive ecosystem of services, technologies, and solutions designed to facilitate the planning, coordination, and execution of events across the United States. This market encompasses all logistical aspects required to transform event concepts into successful experiences, including venue selection, transportation management, equipment procurement, staffing coordination, and post-event analysis.

Event logistics extends beyond traditional event planning to include sophisticated supply chain management, real-time coordination systems, and integrated technology platforms that ensure seamless event delivery. The market serves diverse sectors including corporate events, entertainment productions, sports competitions, trade exhibitions, and cultural celebrations, providing specialized solutions tailored to each segment’s unique requirements.

Service integration represents a key characteristic of modern event logistics, where providers offer holistic solutions combining physical logistics with digital technologies, sustainability practices, and data analytics to optimize event outcomes and participant experiences.

Strategic positioning of the US event logistics market reflects strong fundamentals driven by recovering corporate event spending, increased emphasis on experiential marketing, and growing demand for hybrid event solutions. The market demonstrates exceptional adaptability, having successfully navigated pandemic-related challenges while emerging with enhanced digital capabilities and flexible service models.

Technology adoption has accelerated significantly, with over 70% of event logistics providers now incorporating advanced digital tools including mobile applications, RFID tracking, and cloud-based management platforms. This technological evolution has improved operational efficiency, enhanced attendee experiences, and provided valuable data insights for event optimization.

Market consolidation trends show increasing collaboration between traditional logistics providers and technology companies, creating comprehensive service ecosystems that address evolving client expectations. The sector benefits from strong demand across multiple verticals, with corporate events representing the largest segment, followed by entertainment and sports logistics.

Sustainability initiatives have gained prominence, with approximately 60% of clients now requesting environmentally conscious event solutions, driving innovation in waste reduction, energy efficiency, and sustainable transportation options.

Market intelligence reveals several critical insights shaping the US event logistics landscape:

Corporate investment in experiential marketing represents the primary driver of market growth, as organizations recognize the superior engagement and brand impact achieved through well-executed events. Companies are allocating larger portions of marketing budgets to events that create memorable experiences and foster direct customer relationships.

Digital transformation within the events industry has created new opportunities for logistics providers to offer enhanced services including virtual event integration, mobile applications, and real-time coordination platforms. This technological evolution enables more efficient operations while providing valuable data insights for continuous improvement.

Economic recovery following pandemic-related disruptions has unleashed pent-up demand for in-person events, driving significant growth across all market segments. Organizations are eager to reconnect with customers, partners, and employees through face-to-face interactions after extended periods of virtual-only engagement.

Venue diversification has expanded beyond traditional conference centers and hotels to include unique locations such as museums, outdoor spaces, and pop-up venues, creating new logistical challenges and opportunities for specialized service providers. This trend requires innovative solutions for equipment transportation, power management, and environmental considerations.

Regulatory compliance requirements across safety, accessibility, and environmental standards have increased demand for professional logistics expertise, as organizations seek to ensure full compliance while maintaining event quality and attendee satisfaction.

Labor shortages continue to challenge the event logistics sector, with skilled professionals in high demand across venue management, technical production, and coordination roles. This constraint has led to increased labor costs and potential service delivery challenges during peak event seasons.

Supply chain disruptions affecting equipment availability, transportation costs, and material procurement have created operational complexities for event logistics providers. These challenges require enhanced planning capabilities and flexible sourcing strategies to ensure reliable service delivery.

Economic uncertainty can impact corporate event budgets, leading to reduced spending or event cancellations during challenging economic periods. This cyclical nature requires logistics providers to maintain flexible cost structures and diversified service offerings.

Regulatory complexity across different states and municipalities creates compliance challenges for multi-location events, requiring specialized knowledge and coordination capabilities that may limit market entry for smaller providers.

Technology integration costs associated with implementing advanced logistics platforms and digital tools can strain smaller providers’ resources, potentially creating competitive disadvantages in an increasingly technology-driven market.

Hybrid event solutions present significant growth opportunities as organizations seek to combine the benefits of in-person and virtual experiences. This trend requires innovative logistics approaches that seamlessly integrate physical and digital event components while maintaining high-quality experiences for all participants.

Sustainability services offer expanding opportunities as environmental consciousness drives demand for eco-friendly event solutions. Providers can differentiate themselves by offering carbon-neutral transportation, waste reduction programs, and sustainable venue options that align with corporate environmental goals.

Technology partnerships with software developers, hardware manufacturers, and digital platform providers create opportunities for comprehensive service offerings that address evolving client needs. These collaborations can enhance service capabilities while creating new revenue streams.

Niche market specialization in sectors such as medical conferences, technology summits, or cultural events allows providers to develop deep expertise and command premium pricing for specialized knowledge and capabilities.

Geographic expansion into emerging markets and secondary cities presents growth opportunities as event activity spreads beyond traditional major metropolitan areas, driven by cost considerations and venue availability.

Competitive intensity within the US event logistics market has increased as providers differentiate themselves through technology adoption, service specialization, and geographic coverage. Market leaders are investing heavily in digital platforms and strategic partnerships to maintain competitive advantages.

Client expectations have evolved significantly, with organizations demanding more comprehensive solutions, real-time visibility, and measurable outcomes from their event logistics partners. This shift requires providers to enhance their service offerings and develop sophisticated reporting capabilities.

Seasonal fluctuations continue to influence market dynamics, with peak activity during spring and fall conference seasons creating capacity constraints and pricing pressures. Successful providers are developing strategies to balance seasonal demand through diversified service offerings and flexible resource allocation.

Technology disruption is reshaping traditional logistics approaches, with artificial intelligence, automation, and data analytics enabling more efficient operations and enhanced service delivery. Providers must continuously adapt to remain competitive in this evolving landscape.

Partnership ecosystems are becoming increasingly important as no single provider can offer all required services independently. Strategic alliances and vendor networks enable comprehensive solution delivery while maintaining operational efficiency.

Comprehensive analysis of the US event logistics market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, service providers, and end-users across various market segments to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and trade publications to validate primary findings and provide comprehensive market context. This approach ensures thorough coverage of market dynamics and competitive landscape factors.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends, and expert review to ensure research accuracy and reliability. Quantitative analysis focuses on growth rates, market share distributions, and operational metrics while avoiding specific market size valuations.

Market segmentation analysis examines various dimensions including service types, end-user industries, geographic regions, and technology adoption patterns to provide detailed insights into market structure and dynamics.

Northeast region dominates the US event logistics market, anchored by major metropolitan areas including New York, Boston, and Philadelphia. This region benefits from high corporate concentration, established venue infrastructure, and proximity to international business centers, accounting for approximately 35% of total market activity.

West Coast markets demonstrate strong growth driven by technology sector events, entertainment industry activities, and innovative venue concepts. Los Angeles, San Francisco, and Seattle serve as key hubs for specialized event logistics services, particularly in technology integration and creative event solutions.

Southeast region has emerged as a significant growth area, with cities like Atlanta, Miami, and Orlando offering competitive venue costs, favorable weather conditions, and strategic geographic positioning. Florida’s tourism infrastructure provides particular advantages for large-scale events and conventions.

Midwest markets centered around Chicago, Detroit, and Minneapolis offer strong industrial and corporate event opportunities, supported by established transportation networks and diverse venue options. This region shows steady growth rates of approximately 6-7% annually.

Southwest expansion in markets like Dallas, Houston, and Phoenix reflects growing corporate presence and favorable business climates, creating new opportunities for event logistics providers seeking geographic diversification.

Market leadership is distributed among several categories of providers, each offering distinct competitive advantages and service specializations:

Competitive differentiation occurs through technology adoption, service specialization, geographic coverage, and strategic partnerships. Market leaders are investing in digital platforms, sustainability initiatives, and workforce development to maintain competitive advantages.

By Service Type:

By End-User Industry:

By Event Size:

Corporate events represent the largest market segment, driven by increasing investment in employee engagement, customer relationship building, and brand promotion activities. This category shows consistent growth rates exceeding 9% annually as organizations recognize the value of face-to-face interactions in building business relationships.

Trade shows and exhibitions demonstrate strong recovery following pandemic-related disruptions, with enhanced safety protocols and hybrid integration becoming standard features. This segment benefits from specialized venue infrastructure and established industry partnerships.

Entertainment and sports logistics require highly specialized capabilities including crowd management, security coordination, and complex technical production support. This category commands premium pricing due to its technical complexity and time-sensitive nature.

Technology integration across all categories has become essential, with clients expecting seamless digital experiences including mobile applications, real-time updates, and virtual participation options. Providers investing in technology capabilities are capturing larger market shares.

Sustainability focus is influencing all event categories, with environmental considerations affecting approximately 65% of planning decisions. This trend is driving innovation in waste reduction, energy efficiency, and carbon footprint minimization.

Event organizers benefit from comprehensive logistics support that reduces planning complexity, ensures professional execution, and provides access to specialized expertise and vendor networks. Professional logistics providers offer risk mitigation, cost optimization, and enhanced attendee experiences that would be difficult to achieve independently.

Corporate clients gain access to scalable solutions that can accommodate varying event sizes and requirements while maintaining consistent quality standards. Logistics providers offer valuable market intelligence, venue recommendations, and best practices that enhance event outcomes and return on investment.

Venue operators benefit from partnerships with logistics providers that bring consistent business, professional event management, and enhanced facility utilization. These relationships often result in improved venue capabilities and expanded service offerings.

Attendees and participants experience improved event quality through professional coordination, seamless logistics, and enhanced amenities that create memorable and valuable experiences. Professional logistics ensure accessibility, safety, and convenience throughout the event lifecycle.

Technology partners find opportunities to showcase innovative solutions and reach target markets through logistics provider partnerships, creating mutually beneficial relationships that drive technology adoption and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid event integration has emerged as a dominant trend, with organizations seeking to combine the benefits of in-person and virtual experiences. This approach requires sophisticated logistics coordination to ensure seamless integration of physical and digital event components while maintaining high-quality experiences for all participants.

Sustainability initiatives are reshaping event logistics practices, with providers developing comprehensive environmental programs including carbon-neutral transportation, waste reduction strategies, and sustainable venue selection. This trend reflects growing corporate environmental consciousness and regulatory requirements.

Data-driven optimization is becoming standard practice, with logistics providers leveraging analytics to improve operational efficiency, predict attendee behavior, and optimize resource allocation. Real-time data collection and analysis enable continuous improvement and enhanced decision-making capabilities.

Personalization technologies are enabling customized event experiences through mobile applications, RFID tracking, and artificial intelligence-powered recommendations. These capabilities enhance attendee engagement while providing valuable insights for event optimization.

Flexible service models have gained prominence as clients seek adaptable solutions that can accommodate changing requirements and uncertain planning environments. Providers are developing modular service offerings that can be scaled and customized based on specific event needs.

Technology acquisitions have accelerated as traditional logistics providers seek to enhance their digital capabilities through strategic partnerships and acquisitions of technology companies. These developments are creating more comprehensive service ecosystems and improved operational efficiency.

Sustainability certifications are becoming increasingly important, with major providers pursuing environmental certifications and developing green event standards. MarkWide Research indicates that sustainability credentials now influence over 60% of vendor selection decisions.

Venue partnerships are expanding beyond traditional relationships to include technology integration, exclusive service agreements, and joint marketing initiatives. These strategic alliances create competitive advantages and enhanced service capabilities.

Workforce development programs are addressing labor shortages through training initiatives, certification programs, and partnerships with educational institutions. Industry leaders are investing in talent development to ensure adequate skilled workforce availability.

International expansion by US-based providers is creating global service networks and enhanced capabilities for multinational corporate clients. This trend reflects the increasing globalization of business events and client requirements.

Technology investment should remain a top priority for event logistics providers seeking to maintain competitive advantages and meet evolving client expectations. Focus areas should include mobile applications, data analytics platforms, and automation technologies that improve operational efficiency.

Sustainability integration is essential for long-term market success, with providers needing to develop comprehensive environmental programs that address client requirements and regulatory compliance. This includes carbon footprint reduction, waste minimization, and sustainable sourcing practices.

Workforce development strategies must address ongoing labor shortages through training programs, competitive compensation packages, and career development opportunities. Building a skilled and stable workforce is crucial for service quality and business growth.

Strategic partnerships with technology providers, venue operators, and specialized service companies can enhance service capabilities while maintaining operational efficiency. These relationships enable comprehensive solution delivery without requiring internal development of all capabilities.

Market diversification across geographic regions, industry verticals, and service categories can provide stability and growth opportunities while reducing dependence on any single market segment or economic cycle.

Market expansion is expected to continue driven by recovering corporate event spending, increasing emphasis on experiential marketing, and growing demand for professional logistics expertise. The sector is positioned for sustained growth rates of 8-10% annually over the next five years.

Technology evolution will continue reshaping service delivery through artificial intelligence, automation, and advanced analytics capabilities. Providers investing in these technologies will capture larger market shares and command premium pricing for enhanced services.

Sustainability requirements will become increasingly stringent, with environmental considerations becoming standard evaluation criteria for vendor selection. Providers developing comprehensive sustainability programs will gain competitive advantages in client acquisition and retention.

Geographic expansion into secondary markets and international locations will create new growth opportunities as event activity spreads beyond traditional major metropolitan areas. This trend reflects cost considerations, venue availability, and changing corporate preferences.

Service integration will continue evolving toward comprehensive event experience management, with logistics providers expanding their offerings to include strategic consulting, marketing support, and post-event analysis. According to MWR projections, integrated service models will capture increasing market share approaching 40% by 2028.

The US event logistics market demonstrates exceptional resilience and growth potential, having successfully navigated pandemic-related challenges while emerging with enhanced capabilities and expanded service offerings. The sector benefits from strong fundamentals including recovering corporate event spending, increasing emphasis on experiential marketing, and growing recognition of professional logistics value.

Technology integration continues driving market evolution, with providers leveraging digital platforms, data analytics, and automation technologies to improve operational efficiency and enhance client experiences. Sustainability initiatives have gained prominence as environmental consciousness influences vendor selection and service delivery approaches.

Competitive dynamics favor providers that invest in technology capabilities, develop comprehensive sustainability programs, and build strategic partnerships to deliver integrated solutions. Market leaders are differentiating themselves through specialized expertise, geographic coverage, and innovative service models that address evolving client requirements.

Future prospects remain highly positive, with the US event logistics market positioned for sustained growth driven by technology adoption, sustainability focus, and expanding service integration. Success in this dynamic environment requires continuous adaptation, strategic investment, and commitment to delivering exceptional event experiences that create lasting value for all stakeholders.

What is Event Logistics?

Event logistics refers to the planning, execution, and management of all logistical aspects of an event, including transportation, venue selection, equipment rental, and on-site coordination. It ensures that all elements come together seamlessly to create a successful event experience.

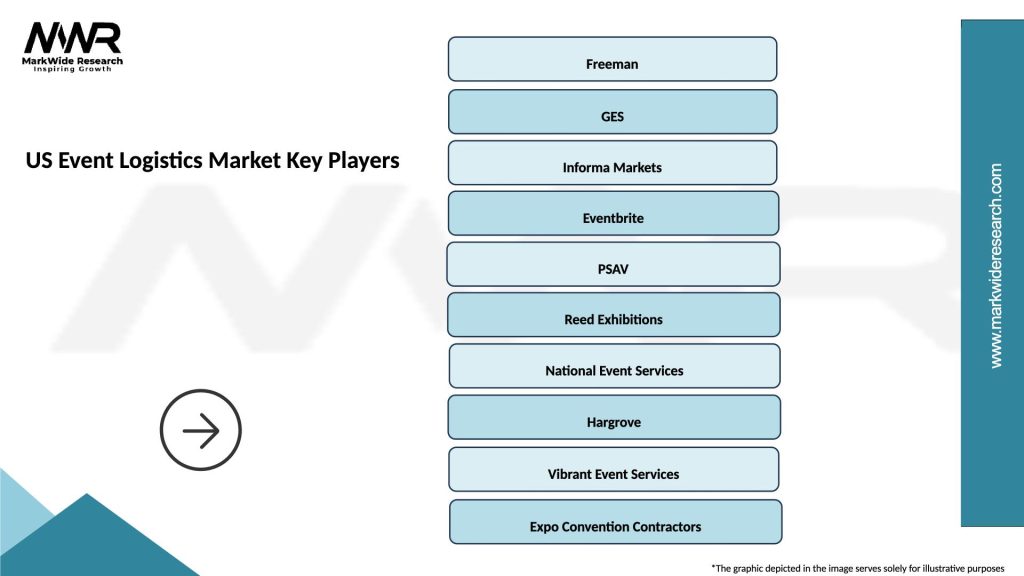

What are the key players in the US Event Logistics Market?

Key players in the US Event Logistics Market include companies like Freeman, GES, and Cvent, which provide comprehensive event management and logistics services. These companies specialize in various aspects such as venue sourcing, transportation, and event technology solutions, among others.

What are the main drivers of growth in the US Event Logistics Market?

The main drivers of growth in the US Event Logistics Market include the increasing demand for corporate events, the rise of experiential marketing, and advancements in event technology. Additionally, the growing trend of hybrid events is also contributing to market expansion.

What challenges does the US Event Logistics Market face?

The US Event Logistics Market faces challenges such as fluctuating costs of materials and services, logistical complexities in large-scale events, and the need for compliance with health and safety regulations. These factors can impact the overall efficiency and success of event planning.

What opportunities exist in the US Event Logistics Market?

Opportunities in the US Event Logistics Market include the integration of technology for virtual and hybrid events, the growing focus on sustainability in event planning, and the potential for personalized attendee experiences. These trends can enhance engagement and operational efficiency.

What trends are shaping the US Event Logistics Market?

Trends shaping the US Event Logistics Market include the increasing use of digital tools for event management, a focus on sustainability practices, and the rise of data analytics to improve event outcomes. These trends are transforming how events are planned and executed.

US Event Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Venue Management, Catering, Security |

| Event Type | Corporate Events, Trade Shows, Concerts, Festivals |

| Technology | Event Management Software, RFID Tracking, Virtual Platforms, Mobile Apps |

| Customer Type | Corporations, Nonprofits, Government Agencies, Individuals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Event Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at