444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US & Europe reusable plastic returnable transport packaging market represents a dynamic and rapidly evolving sector that addresses critical sustainability challenges in modern supply chain management. This market encompasses innovative packaging solutions designed for multiple-use cycles, significantly reducing waste generation and operational costs across various industries. Market dynamics indicate substantial growth momentum driven by increasing environmental consciousness and stringent regulatory frameworks promoting circular economy principles.

Regional leadership in this market is characterized by North America and Europe collectively accounting for approximately 68% of global adoption in reusable transport packaging solutions. The market demonstrates remarkable resilience with projected growth rates of 8.2% CAGR through the forecast period, reflecting strong demand from automotive, food and beverage, and retail sectors. Sustainability initiatives continue to drive market expansion as companies seek alternatives to single-use packaging materials.

Innovation trends within the market focus on advanced material technologies, smart tracking systems, and enhanced durability features that extend product lifecycles. The integration of IoT-enabled tracking capabilities has increased operational efficiency by approximately 35% in major distribution networks. Supply chain optimization remains a primary driver as organizations recognize the long-term cost benefits and environmental advantages of returnable transport packaging systems.

The reusable plastic returnable transport packaging market refers to the comprehensive ecosystem of durable plastic containers, crates, pallets, and specialized packaging solutions designed for repeated use in transportation and storage applications. These systems operate on closed-loop principles where packaging materials are collected, cleaned, and redistributed for continuous utilization across supply chain networks.

Core characteristics of returnable transport packaging include enhanced durability, standardized dimensions for efficient stacking and handling, and integrated tracking systems for inventory management. The market encompasses various product categories including collapsible containers, rigid crates, intermediate bulk containers, and specialized automotive packaging solutions. Operational efficiency is achieved through reduced packaging waste, lower material costs over extended periods, and streamlined logistics processes.

Market participants include packaging manufacturers, logistics service providers, and end-user industries that implement these solutions to achieve sustainability goals while optimizing operational costs. The returnable nature of these packaging systems creates value through multiple usage cycles, typically ranging from 50 to 200 trips depending on application requirements and handling conditions.

Market transformation in the US and Europe reusable plastic returnable transport packaging sector reflects a fundamental shift toward sustainable supply chain practices. The market demonstrates robust growth potential with increasing adoption rates across multiple industry verticals, driven by regulatory pressures and corporate sustainability commitments. Key performance indicators show significant improvements in cost efficiency and environmental impact reduction.

Strategic developments include technological advancements in material science, enhanced tracking capabilities, and improved design features that extend product lifecycles. Major market players are investing heavily in research and development to create innovative solutions that address specific industry requirements. Competitive dynamics favor companies that can provide comprehensive service offerings including packaging design, logistics management, and end-of-life recycling programs.

Regional analysis reveals that Europe leads in regulatory framework development, while the United States shows strong growth in adoption rates across e-commerce and retail sectors. The market benefits from increasing awareness of circular economy principles and growing pressure to reduce single-use packaging waste. Future projections indicate continued expansion with emerging applications in pharmaceutical and chemical industries driving additional growth opportunities.

Primary market drivers include escalating environmental regulations, rising raw material costs for single-use packaging, and increasing corporate focus on sustainability metrics. The market demonstrates strong correlation between regulatory stringency and adoption rates, with regions implementing stricter waste reduction policies showing higher market penetration.

Market maturity varies significantly across different application segments, with automotive and industrial sectors showing higher adoption rates compared to emerging applications in food service and pharmaceutical industries. Technology adoption rates indicate that approximately 42% of new implementations include integrated tracking and monitoring systems.

Environmental sustainability serves as the primary catalyst driving market expansion, with organizations increasingly recognizing the environmental impact of single-use packaging materials. Corporate sustainability initiatives have resulted in significant investments in returnable packaging systems, with many companies reporting carbon footprint reductions of up to 60% through implementation of reusable transport packaging solutions.

Economic incentives play a crucial role in market adoption, as organizations realize substantial cost savings through reduced material procurement, waste disposal fees, and logistics optimization. The total cost of ownership analysis consistently demonstrates favorable returns on investment, typically achieving payback periods of 18-24 months. Operational efficiency improvements include reduced packaging time, enhanced product protection, and streamlined reverse logistics processes.

Regulatory frameworks across the US and Europe continue to strengthen, with new legislation targeting packaging waste reduction and promoting circular economy principles. Extended producer responsibility programs and plastic waste taxes create additional financial incentives for adopting reusable packaging solutions. Supply chain resilience has become increasingly important, with returnable packaging systems providing greater flexibility and reduced dependence on volatile raw material markets.

Technological advancement in materials science has produced more durable and lightweight plastic formulations that extend product lifecycles while reducing transportation costs. Integration of smart technologies enables real-time tracking, inventory optimization, and predictive maintenance capabilities that enhance overall system efficiency and reliability.

Capital investment requirements represent a significant barrier to market entry, particularly for small and medium-sized enterprises that may lack the financial resources to implement comprehensive returnable packaging systems. Initial setup costs include not only packaging procurement but also infrastructure development for cleaning, maintenance, and reverse logistics operations.

Operational complexity associated with managing returnable packaging systems requires sophisticated logistics coordination and inventory management capabilities. Organizations must develop new processes for tracking, cleaning, and redistributing packaging materials, which can strain existing operational resources. System integration challenges often arise when implementing returnable packaging solutions within established supply chain networks.

Industry resistance to change remains a persistent challenge, with some sectors showing reluctance to abandon established single-use packaging practices. Cultural and procedural inertia within organizations can slow adoption rates despite clear economic and environmental benefits. Standardization issues across different suppliers and regions create compatibility challenges that complicate implementation efforts.

Quality control and hygiene standards present ongoing challenges, particularly in food and pharmaceutical applications where contamination risks must be carefully managed. The need for rigorous cleaning and inspection processes can increase operational costs and complexity. Asset management becomes increasingly challenging as system scale grows, requiring sophisticated tracking and monitoring capabilities to maintain optimal utilization rates.

Emerging market segments present substantial growth opportunities, particularly in e-commerce fulfillment, pharmaceutical distribution, and specialty chemical transportation. The rapid expansion of online retail has created new demand for efficient, sustainable packaging solutions that can handle high-volume, diverse product requirements. Market penetration in these sectors remains relatively low, indicating significant potential for expansion.

Technology integration opportunities include the development of smart packaging solutions with embedded sensors, RFID tracking, and IoT connectivity. These advanced features can provide real-time visibility into package location, condition, and utilization patterns, enabling more sophisticated supply chain optimization. Data analytics capabilities derived from smart packaging systems offer additional value propositions for end users.

Geographic expansion into emerging markets presents long-term growth potential as developing economies strengthen their environmental regulations and industrial infrastructure. International trade growth creates opportunities for standardized returnable packaging systems that can facilitate cross-border commerce while reducing environmental impact. Market development initiatives in Asia-Pacific and Latin American regions show promising early indicators.

Partnership opportunities with logistics service providers, waste management companies, and technology firms can create comprehensive service offerings that address the full lifecycle of returnable packaging systems. Collaborative business models that share costs and risks among multiple stakeholders can accelerate market adoption and reduce barriers to entry.

Supply chain evolution continues to reshape market dynamics as organizations seek greater flexibility, sustainability, and cost efficiency in their packaging strategies. The shift toward circular economy principles has fundamentally altered how companies evaluate packaging solutions, with lifecycle cost analysis and environmental impact assessment becoming standard evaluation criteria. Market forces increasingly favor solutions that can demonstrate measurable sustainability benefits.

Competitive intensity has increased significantly as new entrants recognize the growth potential in returnable packaging markets. Traditional packaging manufacturers are expanding their offerings to include reusable solutions, while specialized companies focus on innovative designs and service models. Innovation cycles have accelerated, with new product introductions occurring at approximately 15% higher frequency compared to previous periods.

Customer expectations have evolved to include comprehensive service offerings beyond basic packaging supply. End users increasingly demand integrated solutions that include logistics management, cleaning services, and performance analytics. Service differentiation has become a key competitive factor, with successful companies offering end-to-end solutions rather than standalone products.

Regulatory dynamics continue to influence market development, with policy changes creating both opportunities and challenges for market participants. The implementation of extended producer responsibility programs has shifted cost structures and created new revenue streams for companies that can effectively manage product end-of-life processes. Compliance requirements are becoming increasingly sophisticated, requiring advanced tracking and reporting capabilities.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable market insights. Primary research activities included extensive interviews with industry executives, supply chain managers, and sustainability professionals across various sectors. Data collection processes incorporated both quantitative surveys and qualitative discussions to capture market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, regulatory documents, company financial statements, and trade association publications. Market sizing and forecasting methodologies utilized historical data analysis, trend extrapolation, and econometric modeling to project future market development. Validation processes included cross-referencing multiple data sources and conducting expert interviews to verify key findings.

Regional analysis incorporated country-specific research to understand local market conditions, regulatory frameworks, and competitive landscapes. Cultural and economic factors were evaluated to assess their impact on market adoption rates and growth potential. Segmentation analysis examined market dynamics across different industry verticals, product categories, and geographic regions.

Technology assessment included evaluation of emerging innovations, patent analysis, and startup company monitoring to identify potential market disruptors and growth catalysts. Competitive intelligence gathering focused on understanding strategic initiatives, investment patterns, and partnership activities among key market participants.

European market leadership is characterized by advanced regulatory frameworks and strong corporate sustainability commitments that drive higher adoption rates of returnable packaging solutions. Countries such as Germany, Netherlands, and France demonstrate mature markets with well-established reverse logistics networks and standardized packaging systems. Market penetration in Europe reaches approximately 45% in industrial applications, significantly higher than global averages.

United States market development shows rapid acceleration driven by e-commerce growth, corporate sustainability initiatives, and increasing regulatory pressure at state and federal levels. The market benefits from advanced logistics infrastructure and strong technology adoption rates that facilitate implementation of sophisticated returnable packaging systems. Regional variations exist, with coastal states showing higher adoption rates compared to inland regions.

Cross-border trade between the US and Europe creates opportunities for standardized returnable packaging systems that can facilitate international commerce while reducing environmental impact. Harmonization efforts for packaging standards and tracking systems are progressing, though challenges remain in regulatory alignment and operational coordination. Trade volume utilizing returnable packaging systems has increased by approximately 28% over the past three years.

Investment patterns show strong capital flows into market development activities, with European companies leading in technology innovation while US companies focus on scale and operational efficiency. Public-private partnerships are emerging to support infrastructure development and market expansion initiatives. Government support through grants, tax incentives, and regulatory frameworks continues to accelerate market growth in both regions.

Market leadership is distributed among several key players who have established strong positions through innovation, service excellence, and strategic partnerships. The competitive environment favors companies that can provide comprehensive solutions including packaging design, logistics management, and technology integration.

Strategic initiatives among leading companies include significant investments in technology development, geographic expansion, and service capability enhancement. Merger and acquisition activity has increased as companies seek to expand their market presence and service offerings. Innovation focus areas include smart packaging technologies, advanced materials, and integrated service platforms.

Competitive differentiation strategies emphasize service quality, technology integration, and sustainability performance. Companies are developing proprietary tracking systems, advanced cleaning processes, and predictive maintenance capabilities to enhance customer value propositions. Partnership strategies with logistics providers and technology companies are becoming increasingly important for market success.

Product segmentation reveals diverse market categories each serving specific industry requirements and operational needs. The market encompasses various packaging formats designed for different transportation and storage applications, with each segment showing distinct growth patterns and competitive dynamics.

By Product Type:

By Application:

By Material Type:

Automotive segment represents the most mature application category with established standards and widespread adoption across major manufacturers. This segment benefits from high-volume, standardized requirements that enable efficient pooling systems and economies of scale. Innovation trends focus on lightweight designs and enhanced protection features for sensitive electronic components.

Food and beverage applications show the highest growth potential driven by increasing focus on food safety, supply chain efficiency, and sustainability. Regulatory requirements for food-grade materials and traceability create barriers to entry but also provide competitive advantages for established players. Market adoption in this segment has increased by approximately 32% over recent years.

E-commerce fulfillment represents an emerging high-growth category as online retailers seek sustainable packaging solutions for last-mile delivery. The unique requirements of this segment include variable sizing, rapid turnaround times, and integration with automated fulfillment systems. Technology integration is particularly important in this category for tracking and inventory management.

Industrial applications maintain steady growth with focus on cost optimization and operational efficiency. This segment values durability and standardization over advanced features, creating opportunities for cost-effective solutions. Market dynamics in industrial applications are driven primarily by economic factors rather than regulatory requirements.

Pharmaceutical packaging shows emerging potential with stringent quality requirements and growing emphasis on supply chain security. This segment requires specialized materials and processes that command premium pricing but offer higher margins. Regulatory compliance creates significant barriers to entry while providing competitive protection for established players.

Cost reduction benefits provide immediate financial incentives for adopting returnable packaging systems. Organizations typically achieve total cost savings of 25-40% compared to single-use alternatives through reduced material procurement, waste disposal fees, and logistics optimization. Operational efficiency improvements include faster loading and unloading times, reduced packaging waste handling, and streamlined reverse logistics processes.

Environmental advantages enable companies to meet sustainability goals and regulatory requirements while enhancing their corporate reputation. Carbon footprint reductions of up to 60% are achievable through implementation of comprehensive returnable packaging systems. Waste reduction benefits include elimination of single-use packaging materials and reduced landfill contributions.

Supply chain resilience is enhanced through reduced dependence on volatile raw material markets and improved inventory management capabilities. Returnable packaging systems provide greater flexibility in responding to demand fluctuations and supply chain disruptions. Risk mitigation benefits include reduced exposure to packaging material price volatility and supply shortages.

Brand differentiation opportunities arise from demonstrable sustainability commitments and environmental leadership. Companies using returnable packaging can leverage these initiatives in marketing communications and stakeholder engagement activities. Customer satisfaction improvements result from enhanced product protection, reduced packaging waste, and alignment with customer sustainability values.

Technology advantages include access to advanced tracking and monitoring capabilities that provide valuable supply chain visibility and optimization opportunities. Smart packaging solutions enable predictive maintenance, inventory optimization, and performance analytics that drive continuous improvement initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart packaging integration represents the most significant technological trend, with IoT-enabled tracking systems becoming standard features in new implementations. These systems provide real-time visibility into package location, condition, and utilization patterns, enabling sophisticated supply chain optimization. Adoption rates for smart packaging features have increased by approximately 55% among new system deployments.

Circular economy principles are driving fundamental changes in packaging design and business models. Companies are developing comprehensive lifecycle management approaches that maximize material utilization and minimize environmental impact. Design innovation focuses on modularity, repairability, and end-of-life recyclability to support circular economy objectives.

Service model evolution shows a shift from product sales to comprehensive service offerings that include packaging supply, logistics management, and performance optimization. This trend reflects customer preference for integrated solutions and predictable operating costs. Service revenue now represents a growing portion of total market value for leading companies.

Sustainability reporting requirements are driving demand for packaging solutions that provide detailed environmental impact data and compliance documentation. Companies need comprehensive tracking and reporting capabilities to meet stakeholder expectations and regulatory requirements. Data analytics capabilities are becoming essential for demonstrating sustainability performance and identifying optimization opportunities.

Cross-industry standardization efforts are gaining momentum as organizations recognize the benefits of compatible packaging systems. Industry associations and regulatory bodies are developing common standards for dimensions, materials, and tracking systems. Standardization initiatives can reduce costs and improve interoperability across different supply chain networks.

Strategic partnerships between packaging manufacturers and logistics service providers are creating comprehensive solutions that address the full spectrum of returnable packaging requirements. These collaborations combine manufacturing expertise with operational capabilities to deliver integrated service offerings. Partnership activity has increased significantly as companies seek to expand their market reach and service capabilities.

Technology investments in advanced materials research are producing next-generation packaging solutions with enhanced durability, reduced weight, and improved functionality. Material innovations include bio-based plastics, composite materials, and smart materials with embedded sensing capabilities. Research and development spending has increased as companies compete on innovation and performance.

Regulatory developments across multiple jurisdictions are strengthening requirements for packaging waste reduction and circular economy implementation. New legislation includes extended producer responsibility programs, plastic waste taxes, and mandatory recycling targets. Compliance requirements are becoming increasingly sophisticated and comprehensive.

Market consolidation activities include mergers, acquisitions, and strategic alliances as companies seek to achieve scale advantages and expand their geographic presence. Consolidation trends reflect the capital-intensive nature of the business and the benefits of operational scale. Investment activity includes both strategic acquisitions and private equity investments in growth companies.

Digital transformation initiatives are revolutionizing operational processes through automation, artificial intelligence, and advanced analytics. Companies are implementing sophisticated systems for demand forecasting, route optimization, and predictive maintenance. Technology adoption is accelerating as organizations recognize the competitive advantages of digital capabilities.

Strategic positioning recommendations emphasize the importance of developing comprehensive service capabilities beyond basic packaging supply. MarkWide Research analysis indicates that companies offering integrated solutions achieve higher customer retention rates and premium pricing compared to product-only providers. Organizations should invest in logistics capabilities, technology platforms, and customer service infrastructure to differentiate their offerings.

Technology investment priorities should focus on smart packaging features, data analytics capabilities, and operational automation systems. These investments provide both immediate operational benefits and long-term competitive advantages. Innovation strategies should balance proven technologies with emerging solutions to optimize risk and return profiles.

Market expansion opportunities exist in emerging application segments and geographic regions where adoption rates remain relatively low. Companies should develop targeted strategies for penetrating new markets while leveraging existing capabilities and infrastructure. Growth strategies should consider both organic expansion and strategic partnerships to accelerate market entry.

Sustainability leadership represents a critical success factor as environmental considerations become increasingly important in purchasing decisions. Companies should develop comprehensive sustainability programs that address the full lifecycle of their packaging solutions. Environmental performance metrics should be integrated into product development and marketing strategies.

Partnership development with complementary service providers can enhance value propositions and expand market reach. Strategic alliances with logistics companies, technology providers, and industry specialists can create competitive advantages and accelerate growth. Collaboration strategies should focus on mutual value creation and long-term relationship building.

Market evolution will be characterized by continued growth driven by environmental regulations, corporate sustainability initiatives, and economic incentives. The market is expected to maintain robust expansion with projected growth rates of 8.2% CAGR through the forecast period. Growth drivers include increasing adoption in emerging segments and geographic expansion into developing markets.

Technology advancement will accelerate with continued development of smart packaging solutions, advanced materials, and integrated service platforms. Artificial intelligence and machine learning applications will enhance operational efficiency and predictive capabilities. Innovation cycles will continue to shorten as competitive pressure drives rapid technology development and deployment.

Regulatory environment will become increasingly supportive with strengthened environmental legislation and government incentives for circular economy implementation. Extended producer responsibility programs and plastic waste taxes will create additional economic incentives for returnable packaging adoption. Policy support will accelerate market development and create competitive advantages for early adopters.

Market consolidation is expected to continue as companies seek scale advantages and expanded service capabilities. Strategic partnerships and acquisitions will reshape the competitive landscape while creating opportunities for innovation and efficiency improvements. Industry structure will evolve toward fewer, larger players with comprehensive service offerings.

Global expansion will accelerate as developing markets strengthen their environmental regulations and industrial infrastructure. International standardization efforts will facilitate cross-border trade and create opportunities for global service providers. MWR projections indicate that emerging markets will represent approximately 35% of global growth over the next decade.

Market transformation in the US and Europe reusable plastic returnable transport packaging sector reflects a fundamental shift toward sustainable supply chain practices that deliver both environmental and economic benefits. The market demonstrates exceptional growth potential driven by regulatory pressures, corporate sustainability commitments, and proven cost advantages over traditional single-use packaging solutions.

Strategic opportunities exist across multiple dimensions including technology innovation, service model evolution, and geographic expansion. Companies that can successfully integrate advanced technologies with comprehensive service offerings will achieve competitive advantages and superior market positions. Investment priorities should focus on smart packaging capabilities, operational automation, and customer service excellence.

Industry evolution will continue to favor solutions that demonstrate measurable sustainability benefits while delivering operational efficiency and cost optimization. The convergence of environmental regulations, technology advancement, and economic incentives creates a favorable environment for continued market expansion. Future success will depend on companies’ ability to adapt to changing market requirements while maintaining operational excellence and customer satisfaction.

What is Reusable Plastic Returnable Transport Packaging?

Reusable Plastic Returnable Transport Packaging refers to durable containers and pallets made from plastic that can be used multiple times for transporting goods. This type of packaging is designed to reduce waste and improve efficiency in supply chains across various industries.

What are the key players in the US & Europe Reusable Plastic Returnable Transport Packaging Market?

Key players in the US & Europe Reusable Plastic Returnable Transport Packaging Market include companies like Schoeller Allibert, ORBIS Corporation, and Brambles Limited, among others. These companies are known for their innovative solutions and extensive product offerings in the reusable packaging sector.

What are the growth factors driving the US & Europe Reusable Plastic Returnable Transport Packaging Market?

The growth of the US & Europe Reusable Plastic Returnable Transport Packaging Market is driven by increasing environmental concerns, the need for cost-effective logistics solutions, and the rising demand for sustainable packaging options in industries such as food and beverage, automotive, and retail.

What challenges does the US & Europe Reusable Plastic Returnable Transport Packaging Market face?

Challenges in the US & Europe Reusable Plastic Returnable Transport Packaging Market include high initial investment costs, the need for proper cleaning and maintenance of reusable packaging, and competition from single-use packaging alternatives that may be perceived as more convenient.

What opportunities exist in the US & Europe Reusable Plastic Returnable Transport Packaging Market?

Opportunities in the US & Europe Reusable Plastic Returnable Transport Packaging Market include the expansion of e-commerce, which requires efficient packaging solutions, and the increasing adoption of circular economy practices that promote the use of reusable materials across various sectors.

What trends are shaping the US & Europe Reusable Plastic Returnable Transport Packaging Market?

Trends shaping the US & Europe Reusable Plastic Returnable Transport Packaging Market include the integration of smart technology for tracking and managing packaging, the development of lightweight materials to enhance efficiency, and a growing emphasis on sustainability and reducing carbon footprints in supply chains.

US & Europe Reusable Plastic Returnable Transport Packaging Market

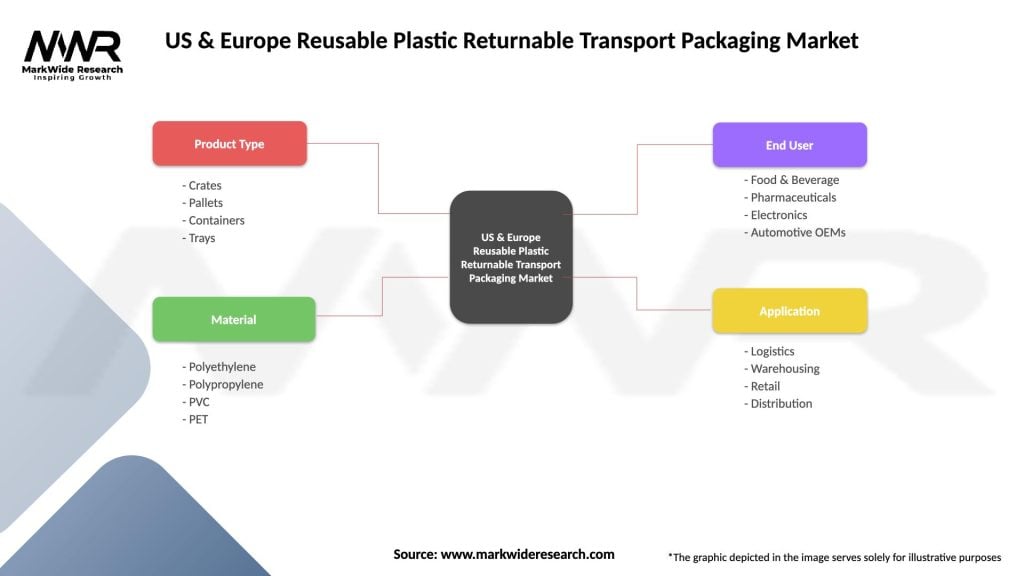

| Segmentation Details | Description |

|---|---|

| Product Type | Crates, Pallets, Containers, Trays |

| Material | Polyethylene, Polypropylene, PVC, PET |

| End User | Food & Beverage, Pharmaceuticals, Electronics, Automotive OEMs |

| Application | Logistics, Warehousing, Retail, Distribution |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US & Europe Reusable Plastic Returnable Transport Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at