444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US engineering services market represents a cornerstone of American industrial innovation and technological advancement, encompassing a diverse range of specialized services that support critical infrastructure development, manufacturing excellence, and digital transformation initiatives. This comprehensive market includes mechanical engineering, electrical engineering, civil engineering, software engineering, and emerging disciplines such as environmental and biomedical engineering services.

Market dynamics indicate robust growth driven by increasing infrastructure modernization needs, digital transformation requirements, and the ongoing shift toward sustainable engineering solutions. The market demonstrates remarkable resilience with projected growth rates of 6.2% CAGR through the forecast period, reflecting strong demand across multiple industry verticals including aerospace, automotive, energy, healthcare, and telecommunications.

Regional distribution shows concentrated activity in technology hubs such as California’s Silicon Valley, Texas’s energy corridor, and the Northeast manufacturing belt, with emerging growth centers in the Southeast and Mountain West regions. The market benefits from a highly skilled workforce, advanced technological infrastructure, and strong research and development capabilities that position the United States as a global leader in engineering services innovation.

The US engineering services market refers to the comprehensive ecosystem of professional engineering consulting, design, development, and implementation services provided by specialized firms and independent contractors to support industrial, commercial, and governmental projects across diverse sectors. This market encompasses traditional engineering disciplines alongside emerging specializations that address contemporary challenges in sustainability, digitalization, and advanced manufacturing.

Engineering services include conceptual design, detailed engineering, project management, technical consulting, system integration, testing and validation, maintenance support, and regulatory compliance services. These services span the entire project lifecycle from initial feasibility studies through final commissioning and ongoing operational support, providing critical expertise that enables organizations to achieve their technical objectives while maintaining safety, quality, and cost-effectiveness standards.

Strategic analysis reveals the US engineering services market as a dynamic and rapidly evolving sector characterized by increasing specialization, technological integration, and growing emphasis on sustainable solutions. The market demonstrates strong fundamentals with consistent demand growth across key industry segments, supported by substantial infrastructure investment initiatives and accelerating digital transformation programs.

Key market drivers include aging infrastructure requiring modernization, increasing complexity of engineering projects, growing regulatory requirements, and the need for specialized expertise in emerging technologies such as artificial intelligence, Internet of Things, and renewable energy systems. The market shows particular strength in areas where 85% of companies report increasing demand for specialized engineering consulting services.

Competitive landscape features a mix of large multinational engineering firms, specialized boutique consultancies, and emerging technology-focused service providers. Market consolidation trends indicate strategic acquisitions aimed at expanding service capabilities and geographic reach, while innovation-driven startups continue to enter niche segments with disruptive technologies and service delivery models.

Market intelligence reveals several critical insights that define the current and future trajectory of the US engineering services sector:

Infrastructure modernization serves as the primary catalyst for engineering services demand, with aging transportation systems, power grids, water treatment facilities, and telecommunications networks requiring comprehensive upgrades and replacements. Government infrastructure investment programs and private sector modernization initiatives create sustained demand for specialized engineering expertise across multiple disciplines.

Technological advancement drives continuous need for engineering services as organizations implement emerging technologies such as artificial intelligence, robotics, renewable energy systems, and advanced manufacturing processes. The complexity of these technologies requires specialized knowledge and experience that most organizations cannot maintain internally, creating opportunities for external engineering service providers.

Regulatory compliance requirements increasingly influence engineering services demand as safety, environmental, and quality standards become more stringent across industries. Organizations require specialized expertise to navigate complex regulatory frameworks and ensure compliance with evolving standards, particularly in highly regulated sectors such as aerospace, healthcare, and energy.

Cost optimization pressures encourage organizations to outsource non-core engineering functions to specialized service providers who can deliver higher efficiency and expertise while reducing internal overhead costs. This trend particularly benefits engineering services firms that can demonstrate clear value propositions through improved project outcomes and reduced time-to-market.

Skilled workforce shortages represent a significant constraint on market growth, with many engineering disciplines experiencing difficulty recruiting and retaining qualified professionals. The aging workforce in traditional engineering fields combined with insufficient new graduate production in certain specializations creates capacity limitations that can restrict service delivery capabilities.

Economic sensitivity affects engineering services demand as many projects depend on capital investment decisions that can be delayed or cancelled during economic uncertainty. Cyclical industries such as oil and gas, mining, and construction particularly impact engineering services demand through their investment patterns and project timing decisions.

Technology disruption risks challenge traditional engineering service delivery models as automation, artificial intelligence, and digital design tools potentially reduce demand for certain types of routine engineering work. Service providers must continuously invest in new capabilities and adapt their service offerings to remain competitive in an evolving technological landscape.

Client budget constraints limit engineering services spending as organizations face pressure to reduce costs and maximize return on investment. This environment requires engineering services firms to demonstrate clear value propositions and measurable outcomes to justify their fees and maintain client relationships.

Emerging technology integration presents substantial opportunities for engineering services firms that can develop expertise in artificial intelligence, machine learning, Internet of Things, and advanced analytics applications. These technologies enable new service offerings and enhanced value propositions that command premium pricing while solving complex client challenges.

Sustainability consulting represents a rapidly growing opportunity as organizations increasingly prioritize environmental responsibility and regulatory compliance. Engineering services firms with expertise in renewable energy, energy efficiency, waste reduction, and environmental remediation can capitalize on growing demand for sustainable solutions across industries.

Digital transformation services offer significant growth potential as organizations modernize their operations, implement smart manufacturing systems, and develop connected product offerings. Engineering services firms that can bridge traditional engineering disciplines with digital technologies are well-positioned to capture this expanding market segment.

International expansion provides opportunities for US engineering services firms to leverage their expertise and reputation in global markets, particularly in developing countries with substantial infrastructure development needs. Strategic partnerships and joint ventures can facilitate market entry while minimizing risks and investment requirements.

Supply and demand equilibrium in the US engineering services market reflects complex interactions between client needs, service provider capabilities, and external factors such as economic conditions and regulatory changes. MarkWide Research analysis indicates that demand consistently outpaces supply in specialized areas such as cybersecurity engineering, environmental compliance, and advanced manufacturing support.

Pricing dynamics vary significantly across engineering disciplines and service types, with specialized expertise commanding premium rates while commoditized services face pricing pressure. Market leaders demonstrate 25% higher margins through value-added services and long-term client relationships that emphasize outcomes rather than hourly billing models.

Innovation cycles drive continuous evolution in service offerings as engineering firms invest in new technologies, methodologies, and capabilities to maintain competitive advantages. Successful firms allocate significant resources to research and development, professional development, and technology infrastructure to stay ahead of market trends and client expectations.

Client relationship evolution shows increasing preference for strategic partnerships over transactional project relationships, with clients seeking engineering services partners who understand their business objectives and can provide ongoing support across multiple projects and initiatives.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, engineering services professionals, and client organizations across diverse sectors to understand current trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, government data, academic studies, and company financial information to validate primary research findings and provide quantitative context for market trends. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review panels to ensure research findings accurately represent market conditions and trends. Quality assurance measures maintain high standards for data accuracy and analytical rigor throughout the research process.

Analytical frameworks combine quantitative modeling with qualitative assessment to provide balanced perspectives on market opportunities, competitive dynamics, and future trends. This methodology enables comprehensive understanding of complex market interactions and their implications for industry participants.

West Coast dominance continues with California leading the market through its concentration of technology companies, aerospace manufacturers, and renewable energy projects. The region accounts for approximately 28% of national engineering services demand, driven by Silicon Valley’s innovation ecosystem and substantial infrastructure modernization requirements.

Texas energy corridor represents the second-largest regional market, with Houston and Dallas metropolitan areas generating substantial demand for energy engineering, petrochemical processing, and industrial automation services. The region benefits from ongoing energy sector investment and diversification into renewable energy technologies.

Northeast manufacturing belt maintains strong demand for engineering services through its established industrial base, financial services sector, and infrastructure modernization needs. States such as New York, Pennsylvania, and Massachusetts contribute significantly to market growth through their diverse economic bases and substantial capital investment programs.

Emerging regional markets in the Southeast and Mountain West show accelerating growth as companies relocate operations and establish new facilities in these areas. States such as North Carolina, Georgia, Colorado, and Arizona demonstrate above-average growth rates in engineering services demand driven by population growth and economic development initiatives.

Market leadership features a diverse mix of large multinational firms, specialized consultancies, and emerging technology-focused service providers competing across different segments and service categories:

By Service Type:

By Industry Vertical:

Civil Engineering Services demonstrate steady growth driven by infrastructure modernization needs and urbanization trends. This category benefits from government investment programs and private sector development projects, with particular strength in transportation, water management, and sustainable infrastructure solutions.

Mechanical Engineering Services show robust demand across manufacturing, energy, and aerospace sectors. Advanced manufacturing technologies, automation systems, and energy efficiency initiatives drive consistent growth in this segment, with specialized HVAC and industrial systems showing particular strength.

Electrical Engineering Services experience accelerated growth through digitalization trends, renewable energy adoption, and smart infrastructure development. Power systems, control systems, and telecommunications engineering represent high-growth areas within this category.

Software Engineering Services demonstrate the highest growth rates as organizations implement digital transformation initiatives, develop connected products, and modernize legacy systems. This category benefits from increasing integration between traditional engineering disciplines and software development capabilities.

Environmental Engineering Services show strong growth driven by regulatory compliance requirements, sustainability initiatives, and climate change adaptation needs. Specialized services in air quality, water treatment, and waste management demonstrate consistent demand growth across industries.

Engineering Services Firms benefit from diverse revenue opportunities, recurring client relationships, and premium pricing for specialized expertise. The market provides opportunities for geographic expansion, service line diversification, and strategic acquisitions to enhance capabilities and market position.

Client Organizations gain access to specialized expertise without maintaining internal capabilities, enabling cost optimization, risk reduction, and improved project outcomes. Engineering services partnerships provide flexibility to scale resources based on project requirements and access cutting-edge technologies and methodologies.

Technology Vendors benefit from increased demand for engineering software, simulation tools, and digital platforms as service providers invest in technology infrastructure to enhance their capabilities and competitive positioning. Strategic partnerships with engineering services firms provide market access and validation for new technologies.

Educational Institutions experience growing demand for engineering graduates and continuing education programs as the industry requires increasingly sophisticated skills and knowledge. Partnerships with engineering services firms provide practical experience opportunities and curriculum development guidance.

Government Agencies leverage engineering services expertise to implement infrastructure projects, regulatory compliance programs, and technology modernization initiatives while maintaining cost-effectiveness and accessing specialized capabilities not available internally.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration represents the most significant trend transforming engineering services delivery, with firms investing heavily in artificial intelligence, machine learning, and advanced analytics capabilities. This trend enables enhanced design optimization, predictive maintenance, and automated quality assurance processes that improve service quality while reducing delivery time and costs.

Sustainability Focus drives increasing demand for environmental engineering services, renewable energy system design, and green building technologies. Engineering services firms develop specialized capabilities in carbon footprint reduction, energy efficiency optimization, and sustainable material selection to meet growing client sustainability requirements.

Remote Collaboration technologies enable distributed engineering teams and virtual project delivery models that expand talent access while reducing travel costs and project timelines. Cloud-based design platforms, virtual reality visualization, and collaborative project management tools facilitate seamless remote engineering services delivery.

Outcome-based Pricing models gain traction as clients seek value-based relationships rather than traditional hourly billing arrangements. Engineering services firms develop performance metrics and guarantee structures that align their compensation with client success and project outcomes.

Interdisciplinary Integration becomes increasingly important as complex projects require expertise spanning multiple engineering disciplines, software development, and business strategy. Successful firms develop cross-functional teams and collaborative approaches that deliver comprehensive solutions rather than narrow technical services.

Strategic acquisitions continue reshaping the competitive landscape as major engineering services firms acquire specialized boutique consultancies and technology companies to expand their capabilities and market reach. Recent transactions focus on digital engineering, environmental services, and emerging technology expertise.

Technology partnerships between engineering services firms and software vendors create integrated solutions that combine domain expertise with advanced tools and platforms. These partnerships enable enhanced service delivery capabilities and access to cutting-edge technologies that improve client outcomes.

Workforce development initiatives address talent shortage challenges through partnerships with educational institutions, apprenticeship programs, and internal training programs. Leading firms invest significantly in professional development and skills enhancement to maintain competitive advantages in specialized areas.

Sustainability certifications and green engineering credentials become increasingly important as clients prioritize environmental responsibility. Engineering services firms pursue relevant certifications and develop specialized expertise in sustainable design and environmental compliance.

International expansion accelerates as US engineering services firms establish operations in high-growth international markets, particularly in Asia-Pacific and Latin America regions where infrastructure development creates substantial opportunities for experienced service providers.

Investment in digital capabilities represents the highest priority for engineering services firms seeking to maintain competitive advantages and capture growth opportunities. MWR recommends substantial investment in artificial intelligence, machine learning, and advanced analytics tools that enhance service delivery efficiency and enable new value propositions.

Talent development strategies should focus on both recruitment of emerging talent and reskilling of existing workforce to address evolving client needs and technology requirements. Successful firms will develop comprehensive training programs and strategic partnerships with educational institutions to ensure adequate talent pipeline.

Service portfolio diversification enables engineering services firms to reduce risk and capture opportunities across multiple market segments. Firms should consider strategic acquisitions or partnerships that expand their capabilities into high-growth areas such as cybersecurity, environmental services, and digital transformation consulting.

Client relationship deepening through strategic partnerships and outcome-based service models creates sustainable competitive advantages and recurring revenue streams. Engineering services firms should invest in client success capabilities and develop long-term relationship management strategies that extend beyond individual projects.

Geographic expansion into emerging regional markets and international opportunities provides growth potential while diversifying market risk. Firms should carefully evaluate market entry strategies and consider partnerships or joint ventures that minimize investment requirements while providing market access.

Market growth trajectory indicates sustained expansion driven by infrastructure modernization needs, technological advancement, and increasing complexity of engineering projects. The market demonstrates resilience through economic cycles and benefits from long-term trends that support consistent demand growth across multiple segments.

Technology integration will accelerate as artificial intelligence, machine learning, and automation technologies become standard tools in engineering services delivery. Firms that successfully integrate these technologies will achieve competitive advantages through improved efficiency, enhanced quality, and expanded service capabilities.

Sustainability requirements will increasingly influence engineering services demand as organizations prioritize environmental responsibility and regulatory compliance. Engineering services firms with expertise in sustainable design, renewable energy, and environmental remediation will capture disproportionate growth opportunities.

Workforce evolution will continue as engineering roles require increasing interdisciplinary knowledge combining traditional engineering skills with data analytics, software development, and business strategy capabilities. Successful firms will adapt their recruitment, training, and retention strategies to attract and develop this evolved talent profile.

Global integration will expand as US engineering services firms leverage their expertise and reputation in international markets while foreign firms establish US operations to serve American clients. This trend will increase competition while creating opportunities for strategic partnerships and knowledge exchange.

The US engineering services market represents a dynamic and essential component of American industrial capability, demonstrating consistent growth potential driven by infrastructure modernization, technological advancement, and increasing project complexity. Market fundamentals remain strong with diverse demand sources, skilled workforce capabilities, and continuous innovation driving sustained expansion across multiple industry segments.

Strategic opportunities abound for engineering services firms that can successfully navigate evolving client requirements, integrate emerging technologies, and develop specialized expertise in high-growth areas such as sustainability, digitalization, and advanced manufacturing. The market rewards firms that invest in talent development, technology infrastructure, and client relationship management while maintaining operational excellence and quality standards.

Future success will depend on engineering services firms’ ability to adapt to changing market dynamics, embrace technological innovation, and develop comprehensive service offerings that address complex client challenges. Organizations that can demonstrate clear value propositions, maintain competitive pricing, and deliver measurable outcomes will capture disproportionate growth opportunities in this evolving market landscape. The outlook remains positive for firms that align their strategies with long-term market trends and client needs while maintaining the flexibility to adapt to emerging opportunities and challenges.

What is Engineering Services?

Engineering services encompass a range of professional services that include design, development, and management of engineering projects across various sectors such as construction, manufacturing, and technology.

What are the key players in the US Engineering Services Market?

Key players in the US Engineering Services Market include AECOM, Jacobs Engineering, and Bechtel, which provide a variety of engineering solutions across infrastructure, environmental, and industrial sectors, among others.

What are the main drivers of growth in the US Engineering Services Market?

The main drivers of growth in the US Engineering Services Market include increasing infrastructure investments, advancements in technology, and the rising demand for sustainable engineering solutions across various industries.

What challenges does the US Engineering Services Market face?

Challenges in the US Engineering Services Market include regulatory compliance issues, skilled labor shortages, and fluctuating material costs, which can impact project timelines and budgets.

What opportunities exist in the US Engineering Services Market?

Opportunities in the US Engineering Services Market include the expansion of renewable energy projects, smart city initiatives, and the integration of digital technologies in engineering processes, which can enhance efficiency and innovation.

What trends are shaping the US Engineering Services Market?

Trends shaping the US Engineering Services Market include the adoption of Building Information Modeling (BIM), increased focus on sustainability, and the use of artificial intelligence and automation in engineering design and project management.

US Engineering Services Market

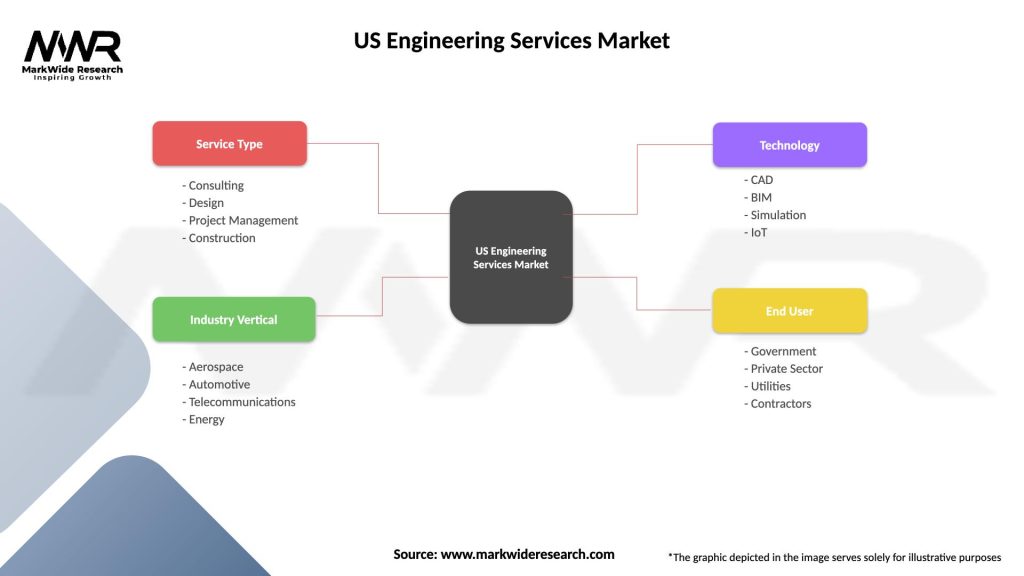

| Segmentation Details | Description |

|---|---|

| Service Type | Consulting, Design, Project Management, Construction |

| Industry Vertical | Aerospace, Automotive, Telecommunications, Energy |

| Technology | CAD, BIM, Simulation, IoT |

| End User | Government, Private Sector, Utilities, Contractors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Engineering Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at