444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Engineering, Procurement, and Construction Management (EPCM) market represents a critical segment of the nation’s infrastructure and industrial development ecosystem. This comprehensive service model integrates engineering design, procurement coordination, and construction management into a unified approach that delivers complex projects across multiple industries. The market has experienced substantial growth driven by increasing infrastructure modernization needs, energy sector expansion, and manufacturing facility upgrades throughout the United States.

Market dynamics indicate robust expansion with the sector demonstrating resilience across economic cycles. The EPCM model has gained significant traction among project owners seeking streamlined project delivery while maintaining cost control and quality standards. Current market trends show a compound annual growth rate (CAGR) of 6.2%, reflecting strong demand across key industrial sectors including oil and gas, power generation, chemicals, and manufacturing.

Regional distribution across the United States shows concentrated activity in industrial corridors, with Texas, Louisiana, California, and the Gulf Coast region accounting for approximately 45% of total market activity. The market’s evolution reflects broader economic trends toward infrastructure renewal, energy transition initiatives, and advanced manufacturing reshoring efforts that require sophisticated project management capabilities.

The US Engineering, Procurement, and Construction Management (EPCM) market refers to a comprehensive project delivery methodology where specialized firms provide integrated engineering design, procurement coordination, and construction management services for complex industrial and infrastructure projects. Unlike traditional Engineering, Procurement, and Construction (EPC) contracts, EPCM arrangements position the service provider as the owner’s representative, managing project execution while the owner retains direct contractual relationships with major contractors and suppliers.

EPCM services encompass front-end engineering design, detailed engineering, procurement strategy development, vendor management, construction oversight, commissioning support, and project controls. This model provides owners with enhanced transparency, cost control, and technical expertise while distributing project risks more effectively across multiple specialized contractors. The approach has become increasingly popular for large-scale industrial projects where owners seek to maintain greater control over project outcomes while leveraging specialized technical capabilities.

The US EPCM market demonstrates strong fundamentals supported by sustained infrastructure investment, energy sector modernization, and manufacturing capacity expansion. Key market drivers include aging industrial infrastructure requiring replacement, environmental compliance mandates driving facility upgrades, and reshoring initiatives creating demand for new manufacturing facilities. The market benefits from a mature ecosystem of specialized service providers, advanced project management technologies, and established regulatory frameworks.

Competitive landscape features both large multinational engineering firms and specialized regional providers, creating a diverse market structure that serves projects ranging from small facility modifications to multi-billion-dollar industrial complexes. Technology adoption has accelerated, with digital project management tools, Building Information Modeling (BIM), and advanced analytics becoming standard practice. Market participants report project efficiency improvements of 15-20% through digital transformation initiatives.

Future growth prospects remain positive, supported by federal infrastructure legislation, state-level industrial development incentives, and private sector capital investment in manufacturing and energy projects. The market is expected to benefit from emerging opportunities in renewable energy infrastructure, carbon capture projects, and advanced manufacturing facilities supporting domestic supply chain resilience.

Market segmentation analysis reveals distinct patterns across industry verticals and project types. The following key insights characterize current market dynamics:

Infrastructure modernization needs serve as the primary catalyst for EPCM market growth across the United States. Aging industrial facilities, power generation assets, and processing plants require comprehensive upgrades to maintain operational efficiency and regulatory compliance. The Infrastructure Investment and Jobs Act has allocated substantial funding for infrastructure renewal, creating sustained demand for engineering and construction management services.

Energy sector transformation drives significant EPCM demand as utilities and energy companies invest in grid modernization, renewable energy integration, and traditional asset upgrades. The transition toward cleaner energy sources requires sophisticated engineering solutions and project management expertise that EPCM providers deliver effectively. Natural gas infrastructure expansion, renewable energy projects, and energy storage installations represent growing market segments.

Manufacturing reshoring initiatives create substantial opportunities for EPCM service providers as companies establish domestic production capabilities. Supply chain resilience concerns, labor cost considerations, and proximity to end markets motivate manufacturing investment in the United States. These projects require specialized engineering expertise and construction management capabilities that favor the EPCM delivery model.

Regulatory compliance requirements increasingly drive facility modifications and upgrades across multiple industries. Environmental regulations, safety standards, and operational requirements necessitate complex engineering solutions that benefit from integrated EPCM approaches. Compliance-driven projects often require specialized technical expertise and careful coordination with regulatory authorities.

Skilled workforce shortages represent a significant constraint on EPCM market growth, particularly in specialized engineering disciplines and experienced project management roles. The industry faces demographic challenges as experienced professionals retire while educational institutions struggle to produce sufficient qualified graduates. This talent gap affects project delivery timelines and increases labor costs across the market.

Economic uncertainty and capital allocation constraints can limit industrial investment in major projects that drive EPCM demand. Economic downturns, commodity price volatility, and financial market conditions influence corporate capital expenditure decisions. Project delays or cancellations during economic stress periods directly impact EPCM service demand.

Supply chain disruptions have created challenges for procurement coordination and project scheduling, core components of EPCM services. Material availability, transportation constraints, and vendor capacity limitations affect project delivery and cost predictability. These challenges require enhanced supply chain management capabilities and alternative sourcing strategies.

Technology integration costs and complexity can present barriers for smaller EPCM providers seeking to compete effectively. Advanced project management systems, digital collaboration tools, and specialized software require significant investment and technical expertise. The pace of technological change creates ongoing adaptation challenges for market participants.

Renewable energy infrastructure development presents substantial growth opportunities for EPCM providers as the United States accelerates clean energy deployment. Solar farms, wind installations, energy storage projects, and grid integration initiatives require specialized engineering and construction management expertise. The renewable energy sector’s rapid expansion creates sustained demand for EPCM services with strong growth potential.

Carbon capture and storage projects represent an emerging opportunity segment as industrial companies and utilities invest in carbon reduction technologies. These complex projects require sophisticated engineering solutions, specialized procurement capabilities, and careful construction management. Early market development in carbon capture creates competitive advantages for EPCM providers developing relevant expertise.

Advanced manufacturing facilities supporting semiconductor production, electric vehicle components, and high-tech industries offer premium EPCM opportunities. These projects demand precise engineering standards, specialized construction techniques, and sophisticated project coordination. The high-value nature of advanced manufacturing creates attractive margins for qualified EPCM providers.

Digital transformation services enable EPCM providers to expand service offerings beyond traditional project delivery. Digital twin development, predictive maintenance systems, and smart facility integration represent value-added services that enhance client relationships and create recurring revenue opportunities.

Competitive intensity varies significantly across market segments, with large-scale industrial projects attracting major international firms while regional providers serve smaller projects effectively. Market consolidation trends have created larger, more capable service providers while specialized niche firms continue to find opportunities in specific industry verticals or geographic regions.

Client relationship dynamics emphasize long-term partnerships and repeat business, as project owners value proven performance and established working relationships. Successful EPCM providers invest heavily in client relationship management and demonstrate consistent project delivery capabilities. Trust and technical credibility serve as key differentiators in competitive situations.

Technology adoption patterns show accelerating integration of digital tools and advanced project management systems. MarkWide Research analysis indicates that technology-enabled efficiency improvements are becoming essential for competitive positioning. Providers investing in digital capabilities report improved project outcomes and enhanced client satisfaction.

Risk allocation preferences continue evolving as project owners seek optimal balance between cost control and risk management. The EPCM model’s flexibility in risk distribution appeals to sophisticated owners who prefer maintaining direct contractor relationships while accessing specialized project management expertise. This dynamic supports continued EPCM market growth relative to traditional EPC approaches.

Primary research activities encompassed comprehensive interviews with industry executives, project managers, and technical specialists across the EPCM value chain. Survey data collection targeted key market participants including service providers, project owners, contractors, and suppliers to gather quantitative insights on market trends, competitive dynamics, and growth projections.

Secondary research analysis incorporated industry publications, regulatory filings, company reports, and government data sources to validate primary findings and establish market context. Historical project data, industry statistics, and economic indicators provided foundation for market sizing and trend analysis. Academic research and technical publications contributed specialized insights on emerging technologies and industry best practices.

Market modeling techniques utilized statistical analysis, regression modeling, and scenario planning to develop growth projections and market forecasts. Multiple validation approaches ensured data accuracy and reliability across different market segments and geographic regions. Expert panel reviews provided additional validation of key findings and conclusions.

Data triangulation methods cross-referenced multiple information sources to ensure comprehensive market coverage and accurate representation of industry dynamics. Quantitative analysis combined with qualitative insights created a balanced perspective on market opportunities and challenges facing EPCM service providers.

Texas leads regional market activity with approximately 22% of total US EPCM demand, driven by extensive oil and gas infrastructure, petrochemical facilities, and power generation projects. The state’s business-friendly environment, skilled workforce availability, and established industrial base create favorable conditions for EPCM service providers. Houston serves as a major hub for engineering and project management capabilities.

Gulf Coast region including Louisiana, Mississippi, and Alabama represents another significant market concentration with 18% market share. The region’s petrochemical industry, refining capacity, and port infrastructure generate consistent EPCM demand. Recent industrial investment announcements indicate continued growth potential in this region.

California’s market presence reflects the state’s diverse industrial base, renewable energy initiatives, and infrastructure modernization needs. Environmental regulations drive facility upgrades while clean energy mandates create opportunities for renewable energy EPCM projects. The state’s 12% market share includes both traditional industrial and emerging clean technology projects.

Midwest industrial states including Ohio, Indiana, Illinois, and Michigan collectively account for 15% of market activity. Manufacturing facility upgrades, power plant modernization, and infrastructure renewal drive demand in this region. The area’s established industrial base and transportation infrastructure support continued EPCM market growth.

Northeast corridor markets focus primarily on infrastructure renewal, power generation upgrades, and specialized manufacturing projects. While representing a smaller market share, the region’s projects often involve complex urban environments and sophisticated technical requirements that command premium pricing for EPCM services.

Market leadership includes both large multinational engineering firms and specialized regional providers, creating a diverse competitive environment. The following companies represent key market participants:

Competitive differentiation occurs through technical expertise, industry specialization, geographic presence, and client relationship strength. Successful providers develop deep capabilities in specific industry verticals while maintaining broad project management competencies. Technology adoption and digital project delivery capabilities increasingly influence competitive positioning.

By Industry Vertical:

By Project Type:

By Service Scope:

Oil and Gas segment continues representing the largest EPCM market category, driven by refinery upgrades, petrochemical expansion, and pipeline infrastructure development. Environmental compliance requirements and operational efficiency improvements sustain demand for engineering and construction management services. The segment benefits from established client relationships and proven project delivery capabilities.

Power Generation category shows strong growth potential as utilities invest in grid modernization, renewable energy integration, and traditional asset upgrades. The energy transition creates opportunities for both conventional power plant modifications and new renewable energy installations. EPCM providers with power sector expertise command premium pricing for specialized projects.

Manufacturing segment experiences growth from reshoring initiatives, automation upgrades, and capacity expansion projects. Advanced manufacturing facilities require sophisticated engineering solutions and precise construction management. The category’s diversity across multiple industries provides market stability and growth opportunities.

Infrastructure category benefits from federal and state investment programs targeting transportation, water systems, and public facilities. These projects often involve complex stakeholder coordination and regulatory compliance requirements that favor experienced EPCM providers. Long-term infrastructure investment commitments support sustained market growth.

Project owners benefit from enhanced cost control, technical expertise access, and risk management flexibility through EPCM arrangements. The model provides transparency in project execution while maintaining direct relationships with major contractors and suppliers. Owners retain greater control over project outcomes while accessing specialized capabilities they may not possess internally.

EPCM service providers enjoy recurring revenue opportunities, long-term client relationships, and reduced financial risk compared to traditional EPC contracts. The model allows firms to focus on their core engineering and project management competencies while avoiding construction execution risks. Successful providers build valuable intellectual property and client relationships that support business growth.

Contractors and suppliers benefit from direct client relationships and clear project specifications developed through professional EPCM management. The model often results in more competitive bidding processes and better project coordination. Established EPCM providers facilitate smoother project execution and timely payments.

Industry stakeholders including regulatory agencies, local communities, and financial institutions benefit from improved project outcomes, enhanced safety performance, and more predictable project delivery. Professional EPCM management typically results in better compliance with regulations and industry standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend reshaping the EPCM market, with providers investing heavily in advanced project management systems, Building Information Modeling (BIM), and data analytics capabilities. These technologies enable improved project visualization, enhanced collaboration, and better decision-making throughout project lifecycles. MWR data indicates that digitally-enabled projects demonstrate 15-20% efficiency improvements compared to traditional approaches.

Sustainability integration has become a central consideration in EPCM project delivery, with clients increasingly demanding environmentally responsible solutions and carbon footprint reduction. Service providers are developing specialized capabilities in green building design, renewable energy systems, and sustainable construction practices. This trend creates differentiation opportunities for providers with demonstrated sustainability expertise.

Modular construction adoption is gaining traction as a method to improve project delivery speed, quality control, and cost predictability. EPCM providers are incorporating modular approaches into project designs and construction strategies. The trend particularly benefits projects with repetitive elements or standardized components.

Supply chain localization efforts aim to reduce dependency on international suppliers and improve project delivery reliability. EPCM providers are developing domestic supplier networks and alternative sourcing strategies to mitigate supply chain risks. This trend supports broader reshoring initiatives and supply chain resilience objectives.

Technology partnerships between EPCM providers and software companies are accelerating digital capability development. Major service providers are forming strategic alliances to access cutting-edge project management tools, artificial intelligence applications, and advanced analytics platforms. These partnerships enable faster technology adoption and competitive differentiation.

Workforce development initiatives address skilled labor shortages through expanded training programs, university partnerships, and apprenticeship development. Industry associations and leading companies are investing in workforce development to ensure adequate talent pipeline for future growth. These efforts include both technical skills training and project management capability development.

Regulatory framework evolution continues shaping industry practices, particularly in environmental compliance, safety standards, and permitting processes. EPCM providers are adapting service offerings to address changing regulatory requirements and help clients navigate complex approval processes. Regulatory expertise becomes increasingly valuable for competitive positioning.

Market consolidation activities include both horizontal integration among EPCM providers and vertical integration with specialized contractors or technology companies. Strategic acquisitions enable capability expansion, geographic reach extension, and technology platform development. Consolidation trends create larger, more capable service providers while maintaining market competition.

Technology investment prioritization should focus on digital project management platforms, data analytics capabilities, and client collaboration tools that demonstrate clear return on investment. EPCM providers should evaluate technology solutions based on client value creation and competitive differentiation potential rather than pursuing technology for its own sake.

Workforce development strategies require long-term commitment and creative approaches to attract and retain skilled professionals. Companies should consider partnerships with educational institutions, mentorship programs, and competitive compensation packages to address talent shortages. Remote work capabilities and flexible arrangements may help access broader talent pools.

Market diversification efforts can reduce dependence on cyclical industry segments and create more stable revenue streams. EPCM providers should evaluate opportunities in emerging sectors such as renewable energy, advanced manufacturing, and infrastructure renewal while maintaining core competencies in established markets.

Client relationship management deserves continued investment as long-term partnerships provide competitive advantages and revenue stability. Providers should focus on delivering exceptional project outcomes, maintaining technical expertise, and developing trusted advisor relationships with key clients across multiple project cycles.

Market growth prospects remain positive over the next decade, supported by infrastructure investment legislation, energy sector transformation, and manufacturing reshoring trends. MarkWide Research projects continued expansion at a compound annual growth rate of 6.2% through 2030, driven by sustained industrial investment and infrastructure renewal requirements.

Technology integration will accelerate as digital tools become essential for competitive positioning and project delivery efficiency. Artificial intelligence, machine learning, and advanced analytics will enable more sophisticated project management capabilities and predictive decision-making. Providers investing early in these technologies will gain competitive advantages.

Industry specialization trends suggest successful EPCM providers will develop deeper expertise in specific sectors while maintaining broad project management capabilities. Renewable energy, advanced manufacturing, and carbon capture projects represent high-growth specialization opportunities with premium pricing potential.

Geographic expansion opportunities exist as industrial development spreads beyond traditional centers to emerging markets in the Southeast, Southwest, and Mountain West regions. Providers with geographic flexibility and local market knowledge will benefit from these expansion trends.

The US Engineering, Procurement, and Construction Management market demonstrates strong fundamentals and positive growth trajectory supported by infrastructure investment, energy sector transformation, and manufacturing reshoring initiatives. The market’s maturity, established client relationships, and proven service delivery models provide stability while emerging opportunities in renewable energy, advanced manufacturing, and digital services create growth potential.

Success factors for market participants include technology adoption, workforce development, client relationship management, and strategic market positioning. Companies that invest in digital capabilities, develop specialized expertise, and maintain strong client partnerships will be best positioned to capitalize on market opportunities and navigate industry challenges.

Long-term outlook remains favorable as the United States continues investing in infrastructure renewal, energy transition, and domestic manufacturing capacity. The EPCM model’s flexibility, risk management benefits, and technical expertise access ensure continued relevance in an evolving industrial landscape. Market participants who adapt to changing client needs and technological capabilities will thrive in this dynamic environment.

What is Engineering, Procurement, And Construction Management?

Engineering, Procurement, And Construction Management (EPCM) refers to a project delivery method where a single entity is responsible for the design, procurement, and construction of a project. This approach is commonly used in large-scale infrastructure projects, such as power plants and industrial facilities.

What are the key players in the US Engineering, Procurement, And Construction Management (EPCM) Market?

Key players in the US Engineering, Procurement, And Construction Management (EPCM) Market include Bechtel, Fluor Corporation, and Kiewit Corporation, among others. These companies are known for their expertise in managing complex projects across various sectors, including energy, transportation, and industrial construction.

What are the main drivers of growth in the US Engineering, Procurement, And Construction Management (EPCM) Market?

The main drivers of growth in the US Engineering, Procurement, And Construction Management (EPCM) Market include increasing infrastructure investments, the need for efficient project delivery methods, and the rising demand for sustainable construction practices. Additionally, advancements in technology are enhancing project management capabilities.

What challenges does the US Engineering, Procurement, And Construction Management (EPCM) Market face?

The US Engineering, Procurement, And Construction Management (EPCM) Market faces challenges such as project delays, cost overruns, and regulatory compliance issues. Additionally, the shortage of skilled labor and fluctuating material costs can impact project timelines and budgets.

What opportunities exist in the US Engineering, Procurement, And Construction Management (EPCM) Market?

Opportunities in the US Engineering, Procurement, And Construction Management (EPCM) Market include the expansion of renewable energy projects, smart city initiatives, and the integration of digital technologies in construction processes. These trends are expected to drive innovation and efficiency in project delivery.

What trends are shaping the US Engineering, Procurement, And Construction Management (EPCM) Market?

Trends shaping the US Engineering, Procurement, And Construction Management (EPCM) Market include the adoption of Building Information Modeling (BIM), increased focus on sustainability, and the use of modular construction techniques. These trends are transforming how projects are designed and executed.

US Engineering, Procurement, And Construction Management (EPCM) Market

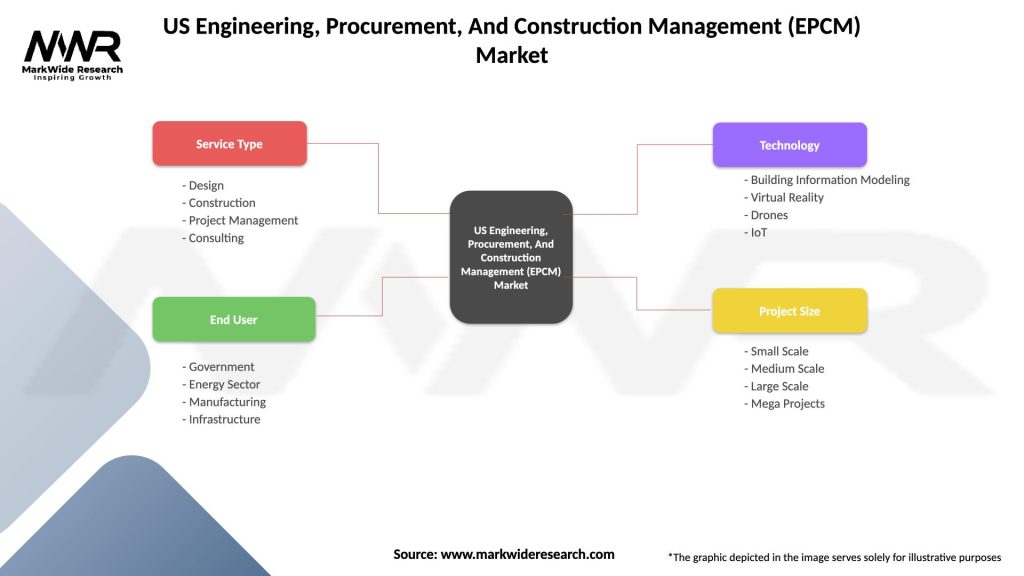

| Segmentation Details | Description |

|---|---|

| Service Type | Design, Construction, Project Management, Consulting |

| End User | Government, Energy Sector, Manufacturing, Infrastructure |

| Technology | Building Information Modeling, Virtual Reality, Drones, IoT |

| Project Size | Small Scale, Medium Scale, Large Scale, Mega Projects |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Engineering, Procurement, And Construction Management (EPCM) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at