444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Electro-Optics Infrared Systems Market has experienced significant growth over the past few years, owing to the increasing demand for advanced security and surveillance systems in various industries such as defense, aerospace, and commercial. Electro-optics infrared systems are used for a variety of applications such as detecting and tracking moving targets, identifying targets at long distances, and providing night vision capabilities.

Electro-optics infrared systems use infrared radiation to create images of the surrounding environment. These systems are capable of detecting and tracking objects even in low-light or complete darkness. Electro-optics infrared systems consist of several components such as lenses, detectors, processors, and display units. The demand for electro-optics infrared systems is increasing due to their high accuracy, reliability, and precision.

Executive Summary:

The US Electro-Optics Infrared Systems Market is expected to grow at a CAGR of XX% during the forecast period of 2021-2026. The increasing demand for advanced security and surveillance systems in various industries such as defense, aerospace, and commercial is expected to drive market growth. The market is expected to be dominated by companies such as Raytheon Technologies Corporation, Lockheed Martin Corporation, L3Harris Technologies, and BAE Systems Inc.

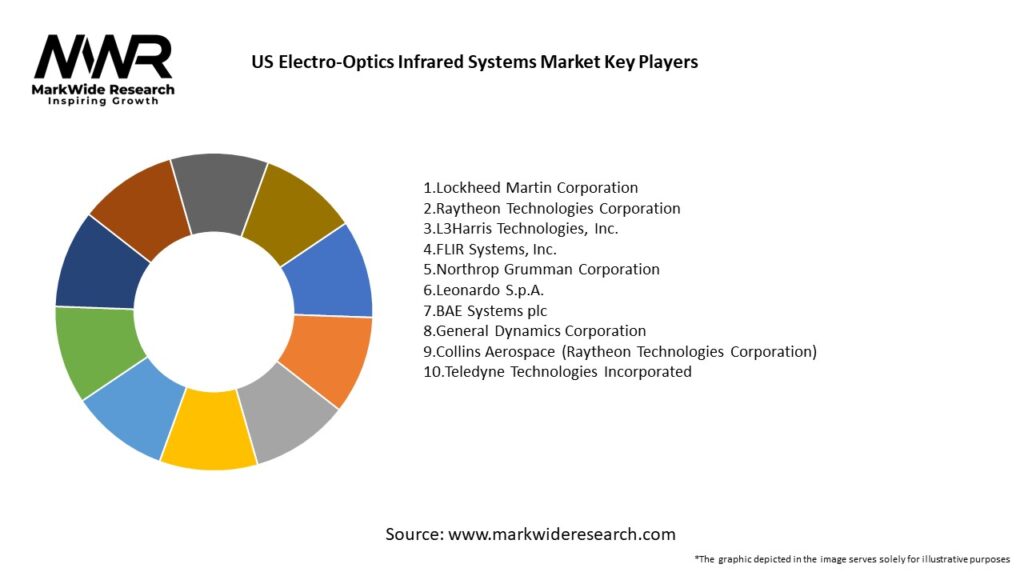

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Analysis:

The US Electro-Optics Infrared Systems Market is expected to grow at a CAGR of XX% during the forecast period of 2021-2026. The market is expected to be driven by the increasing demand for advanced security and surveillance systems in various industries such as defense, aerospace, and commercial. The defense sector is expected to hold the largest market share due to the increasing demand for advanced surveillance and targeting systems. The commercial sector is expected to grow at the highest CAGR due to the increasing demand for advanced security systems in industries such as oil and gas, mining, and transportation.

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The US Electro-Optics Infrared Systems Market is driven by several factors such as increasing demand for advanced security and surveillance systems, technological advancements in electro-optics infrared systems, and increasing investment in defense and aerospace by the US government. However, the market is also restrained by factors such as high cost of electro-optics infrared systems, limited availability of raw materials, and increasing competition from substitute products. The market presents several opportunities such as increasing demand for electro-optics infrared systems in developing countries, growing demand for unmanned aerial vehicles (UAVs) in defense and commercial sectors, and increasing use of electro-optics infrared systems in medical and scientific research.

Regional Analysis:

The US Electro-Optics Infrared Systems Market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is expected to hold the largest market share due to the presence of major companies such as Raytheon Technologies Corporation, Lockheed Martin Corporation, and L3Harris Technologies. Asia-Pacific is expected to grow at the highest CAGR due to the increasing demand for advanced security and surveillance systems in developing countries such as China and India.

Competitive Landscape:

Leading companies in the US Electro-Optics Infrared Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

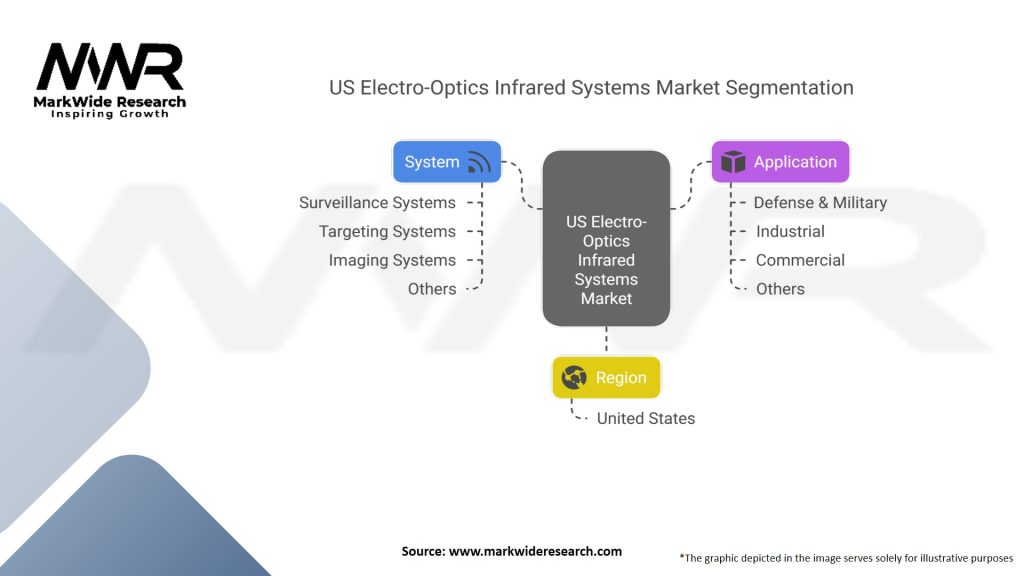

Report Segmentation:

The US Electro-Optics Infrared Systems Market is segmented by Type, Component, Wavelength, Application, and End-User. By Type, the market is segmented into Cooled Infrared Imaging Systems and Uncooled Infrared Imaging Systems. By Component, the market is segmented into Lenses, Detectors, Processors, and Display Units. By Wavelength, the market is segmented into Near Infrared, Shortwave Infrared, Midwave Infrared, and Longwave Infrared. By Application, the market is segmented into Security and Surveillance, Targeting and Tracking, Remote Sensing, and Others. By End-User, the market is segmented into Defense, Aerospace, Commercial, Medical, and Scientific Research.

Category-wise Insights:

By Type, the Uncooled Infrared Imaging Systems segment is expected to grow at the highest CAGR due to their low cost and easy maintenance. By Component, the Detectors segment is expected to hold the largest market share due to their high accuracy and sensitivity. By Wavelength, the Longwave Infrared segment is expected to hold the largest market share due to its ability to detect and identify targets at long distances. By Application, the Security and Surveillance segment is expected to hold the largest market share due to the increasing demand for advanced security systems in various industries. By End-User, the Defense segment is expected to hold the largest market share due to the increasing demand for advanced surveillance and targeting systems.

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Technological advancements in electro-optics infrared systems such as the development of advanced detectors and processors. 2. Increasing demand for unmanned aerial vehicles (UAVs) in defense and commercial sectors.

Covid-19 Impact:

The Covid-19 pandemic has had a mixed impact on the US Electro-Optics Infrared Systems Market. The pandemic has led to a slowdown in the defense and aerospace industry, resulting in a decline in demand for electro-optics infrared systems. However, the pandemic has also led to an increase in demand for advanced security and surveillance systems in the commercial sector, resulting in an increase in demand for electro-optics infrared systems. The market is expected to recover in the post-pandemic period due to the increasing demand for advanced security and surveillance systems.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The US Electro-Optics Infrared Systems Market is expected to grow at a CAGR of XX% during the forecast period of 2021-2026. The market is expected to be driven by the increasing demand for advanced security and surveillance systems in various industries such as defense, aerospace, and commercial. The defense sector is expected to hold the largest market share due to the increasing demand for advanced surveillance and targeting systems. The commercial sector is expected to grow at the highest CAGR due to the increasing demand for advanced security systems in industries such as oil and gas, mining, and transportation. The market presents several opportunities such as increasing demand for electro-optics infrared systems in developing countries, growing demand for unmanned aerial vehicles (UAVs) in defense and commercial sectors, and increasing use of electro-optics infrared systems in medical and scientific research.

Conclusion:

The US Electro-Optics Infrared Systems Market has experienced significant growth over the past few years and is expected to continue growing at a significant rate during the forecast period of 2021-2026. The market is expected to be driven by the increasing demand for advanced security and surveillance systems in various industries such as defense, aerospace, and commercial. The defense sector is expected to hold the largest market share due to the increasing demand for advanced surveillance and targeting systems. The commercial sector is expected to grow at the highest CAGR due to the increasing demand for advanced security systems in industries such as oil and gas, mining, and transportation.

The market presents several opportunities such as increasing demand for electro-optics infrared systems in developing countries, growing demand for unmanned aerial vehicles (UAVs) in defense and commercial sectors, and increasing use of electro-optics infrared systems in medical and scientific research. Companies should focus on developing advanced electro-optics infrared systems with higher accuracy, sensitivity, and reliability, expanding their product portfolios through strategic partnerships, collaborations, and mergers and acquisitions, and expanding their presence in developing countries such as China and India, which offer significant growth opportunities.

What are US Electro-Optics Infrared Systems?

US Electro-Optics Infrared Systems refer to advanced technologies that utilize infrared radiation for various applications, including surveillance, targeting, and thermal imaging. These systems are crucial in military, aerospace, and industrial sectors for enhancing visibility in low-light conditions.

Who are the key players in the US Electro-Optics Infrared Systems Market?

Key players in the US Electro-Optics Infrared Systems Market include Raytheon Technologies, Northrop Grumman, L3Harris Technologies, and FLIR Systems, among others. These companies are known for their innovative solutions and significant contributions to the development of infrared technologies.

What are the growth factors driving the US Electro-Optics Infrared Systems Market?

The growth of the US Electro-Optics Infrared Systems Market is driven by increasing defense budgets, rising demand for advanced surveillance systems, and the growing need for thermal imaging in various industries such as automotive and healthcare. Additionally, technological advancements are enhancing system capabilities.

What challenges does the US Electro-Optics Infrared Systems Market face?

The US Electro-Optics Infrared Systems Market faces challenges such as high development costs, stringent regulatory requirements, and competition from alternative technologies. These factors can hinder market growth and innovation in the sector.

What opportunities exist in the US Electro-Optics Infrared Systems Market?

Opportunities in the US Electro-Optics Infrared Systems Market include the expansion of applications in commercial sectors, such as smart homes and automotive safety, as well as advancements in miniaturization and integration of infrared systems into consumer electronics. These trends are expected to drive future growth.

What are the current trends in the US Electro-Optics Infrared Systems Market?

Current trends in the US Electro-Optics Infrared Systems Market include the increasing adoption of AI and machine learning for enhanced image processing, the development of compact and lightweight systems, and the integration of infrared technology in unmanned systems. These innovations are shaping the future of the market.

US Electro-Optics Infrared Systems Market

| Segmentation | Details |

|---|---|

| System | Surveillance Systems, Targeting Systems, Imaging Systems, Others |

| Application | Defense & Military, Industrial, Commercial, Others |

| Region | United States |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Electro-Optics Infrared Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at