444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US electrical kettles market represents a dynamic segment of the small kitchen appliances industry, experiencing remarkable transformation driven by evolving consumer preferences and technological innovations. American households are increasingly embracing electrical kettles as essential kitchen appliances, moving beyond traditional stovetop methods for water heating. The market demonstrates robust growth momentum with a projected compound annual growth rate of 8.2% CAGR through the forecast period, reflecting strong consumer adoption across diverse demographic segments.

Market dynamics indicate significant shifts in consumer behavior, with younger generations particularly driving demand for convenient, energy-efficient water heating solutions. The integration of smart technology features and premium design aesthetics has elevated electrical kettles from basic appliances to sophisticated kitchen accessories. Regional adoption patterns show accelerating penetration rates, with urban markets leading the charge at approximately 72% adoption rate compared to rural areas at 45% penetration.

Product innovation continues to reshape the competitive landscape, with manufacturers introducing advanced features including temperature control, keep-warm functions, and connectivity options. The market encompasses various price segments, from budget-friendly models to premium offerings, catering to diverse consumer needs and preferences across the United States.

The US electrical kettles market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail sale of electric-powered water heating appliances designed for household and commercial use across the United States. These appliances utilize electrical heating elements to rapidly boil water for various purposes including tea preparation, coffee brewing, cooking applications, and general hot water needs.

Electrical kettles represent a category of small kitchen appliances that have gained significant traction in American households, traditionally dominated by stovetop kettles and microwave heating methods. The market includes various product types ranging from basic models with simple on-off functionality to sophisticated units featuring precise temperature control, programmable settings, and smart connectivity options.

Market scope encompasses both corded and cordless variants, with materials ranging from stainless steel and glass to plastic constructions. The definition extends to include specialty kettles designed for specific beverages, variable temperature models for different tea types, and commercial-grade units for foodservice applications.

Strategic market analysis reveals the US electrical kettles market as a rapidly expanding segment within the broader small appliances category, driven by changing lifestyle patterns and increased appreciation for specialty beverage preparation. Consumer adoption has accelerated significantly, with penetration rates climbing steadily as American households recognize the convenience and efficiency benefits of electrical kettles over traditional heating methods.

Key growth drivers include the rising popularity of tea culture, increased home cooking trends, and growing awareness of energy efficiency benefits. The market benefits from demographic shifts, particularly among millennials and Gen Z consumers who prioritize convenience and technology integration in kitchen appliances. Premium segment growth outpaces basic models, with consumers willing to invest in advanced features and superior design aesthetics.

Competitive landscape features both established international brands and emerging domestic players, creating a dynamic environment for innovation and market expansion. Distribution channels have evolved to include strong online presence alongside traditional retail, with e-commerce accounting for approximately 38% market share in sales channels.

Future prospects remain highly favorable, supported by continued urbanization, smaller household sizes, and increasing focus on kitchen efficiency and convenience solutions across American markets.

Market intelligence reveals several critical insights shaping the US electrical kettles landscape:

MarkWide Research analysis indicates that consumer education regarding electrical kettle benefits continues to drive market expansion, particularly in regions with historically low adoption rates.

Primary growth catalysts propelling the US electrical kettles market include several interconnected factors that align with broader consumer lifestyle trends and technological advancement.

Convenience Culture represents the most significant driver, as American consumers increasingly prioritize time-saving appliances that streamline daily routines. Rapid heating capabilities of electrical kettles, typically boiling water in 3-5 minutes compared to 8-12 minutes for stovetop methods, appeal to busy households and working professionals seeking efficiency.

Energy Efficiency Awareness drives adoption as consumers recognize the superior energy utilization of electrical kettles compared to heating water on electric stovetops or in microwaves. Environmental consciousness among younger demographics supports this trend, with electrical kettles consuming approximately 50% less energy than conventional heating methods.

Beverage Culture Evolution significantly impacts market growth, with increasing American interest in specialty teas, pour-over coffee, and artisanal hot beverages requiring precise water temperatures. Premium beverage preparation demands have elevated electrical kettles from basic appliances to essential brewing tools.

Smart Home Integration trends drive demand for connected appliances, with consumers seeking kettles that integrate with home automation systems and offer remote control capabilities through smartphone applications.

Market challenges present obstacles to widespread electrical kettle adoption across certain consumer segments and geographic regions within the United States.

Cultural Resistance remains a significant barrier, as many American households maintain strong preferences for traditional coffee makers and microwave heating methods. Established cooking habits and skepticism about adopting new appliances slow market penetration in conservative consumer segments.

Kitchen Space Constraints limit adoption in smaller households and apartments where counter space represents a premium consideration. Appliance proliferation concerns lead some consumers to avoid adding another electrical device to already crowded kitchen environments.

Initial Investment Costs for premium models with advanced features may deter price-sensitive consumers, particularly when compared to low-cost alternatives like stovetop kettles or microwave heating. Economic uncertainty periods typically reduce discretionary spending on non-essential kitchen appliances.

Regional Infrastructure variations, including electrical system differences and power supply reliability, may impact performance and adoption rates in certain areas. Maintenance requirements and descaling needs present ongoing considerations for some consumer segments.

Emerging opportunities within the US electrical kettles market present substantial potential for growth and market expansion across multiple dimensions.

Untapped Geographic Markets offer significant expansion potential, particularly in rural and suburban areas where adoption rates remain below 50% penetration. Regional market development strategies targeting these areas could unlock substantial growth opportunities through targeted marketing and distribution initiatives.

Product Innovation Frontiers present opportunities for manufacturers to differentiate through advanced features including voice control integration, precise temperature programming, and sustainable material utilization. Smart technology advancement enables new product categories and premium pricing opportunities.

Commercial Segment Expansion represents an underexplored opportunity, with offices, hotels, and foodservice establishments increasingly recognizing the efficiency benefits of electrical kettles for hot beverage service. B2B market development could significantly expand total addressable market size.

Sustainability Positioning offers opportunities to capture environmentally conscious consumers through energy-efficient designs, recyclable materials, and carbon footprint reduction messaging. Green appliance trends align with growing consumer environmental awareness.

Partnership Opportunities with beverage brands, subscription services, and kitchen appliance ecosystems could create new distribution channels and cross-selling opportunities.

Complex market forces shape the competitive environment and growth trajectory of the US electrical kettles market through interconnected supply and demand factors.

Supply Chain Evolution reflects global manufacturing trends, with most electrical kettles produced in Asia and imported to the US market. Manufacturing cost pressures and international trade dynamics influence pricing strategies and product availability across different market segments.

Competitive Intensity continues to increase as both established appliance manufacturers and new market entrants compete for market share. Innovation cycles accelerate as companies invest in product development to differentiate their offerings and capture consumer attention.

Consumer Behavior Shifts drive market dynamics, with increasing emphasis on product reviews, social media influence, and peer recommendations affecting purchasing decisions. Digital marketing effectiveness has become crucial for brand success and market penetration.

Retail Channel Evolution impacts market dynamics significantly, with traditional retail facing competition from e-commerce platforms and direct-to-consumer sales models. Omnichannel strategies become essential for manufacturers seeking comprehensive market coverage.

Seasonal Fluctuations create predictable demand patterns, with peak sales occurring during holiday seasons and gift-giving periods, requiring strategic inventory and marketing planning.

Comprehensive research approach employed for analyzing the US electrical kettles market combines multiple data collection and analysis methodologies to ensure accuracy and reliability of market insights.

Primary Research Components include extensive consumer surveys, retailer interviews, and manufacturer consultations to gather firsthand market intelligence. Survey methodology encompasses both online and telephone interviews with representative samples across demographic and geographic segments.

Secondary Research Integration incorporates industry reports, trade publications, government statistics, and company financial disclosures to provide comprehensive market context. Data triangulation methods ensure consistency and accuracy across multiple information sources.

Market Sizing Methodology utilizes bottom-up and top-down approaches, analyzing unit sales, pricing trends, and market penetration rates across different product categories and distribution channels. Statistical modeling incorporates historical trends and forward-looking projections.

Competitive Analysis Framework examines market share distribution, product positioning, pricing strategies, and innovation trends among key market participants. SWOT analysis provides strategic insights into competitive advantages and market positioning.

Quality Assurance Protocols include data validation, peer review processes, and expert consultation to ensure research reliability and analytical rigor throughout the study process.

Geographic market distribution reveals distinct regional patterns in electrical kettle adoption and growth potential across the United States, influenced by demographic, cultural, and economic factors.

Northeast Region demonstrates the highest adoption rates at approximately 68% household penetration, driven by urban density, higher disposable incomes, and cultural openness to kitchen innovation. Metropolitan areas including New York, Boston, and Philadelphia lead regional demand, with premium product segments performing particularly well.

West Coast Markets show strong growth momentum, with California representing the largest state market by volume. Tech-savvy consumers in Silicon Valley and Seattle drive demand for smart-enabled kettles, while health-conscious demographics support specialty tea preparation trends.

Southern States present significant growth opportunities despite historically lower adoption rates around 42% penetration. Cultural preferences for traditional cooking methods create challenges, but urbanization and demographic shifts support gradual market expansion.

Midwest Region demonstrates steady growth patterns, with practical-minded consumers favoring reliable, value-oriented products over premium features. Rural-urban divide remains pronounced, with cities showing higher adoption rates than agricultural areas.

Mountain States represent emerging markets with growing adoption driven by lifestyle changes and increasing urban population density in cities like Denver and Salt Lake City.

Market competition features a diverse mix of international appliance manufacturers, specialty kitchen brands, and emerging direct-to-consumer companies competing across multiple product segments and price points.

Competitive strategies vary significantly, with established brands leveraging distribution networks and brand recognition while newer entrants focus on innovation, direct-to-consumer sales, and digital marketing approaches.

Market consolidation trends suggest potential acquisition activity as larger appliance manufacturers seek to strengthen their small appliance portfolios and capture growing market opportunities.

Market segmentation analysis reveals distinct consumer preferences and purchasing patterns across multiple classification dimensions, enabling targeted marketing and product development strategies.

By Product Type:

By Capacity Range:

By Price Segment:

By Distribution Channel:

Detailed category analysis provides specific insights into performance patterns and growth opportunities across different electrical kettle segments.

Standard Electric Kettles continue to dominate unit sales volume, appealing to practical consumers seeking reliable water heating without advanced features. Price competition remains intense in this segment, with manufacturers focusing on build quality and basic safety features to differentiate their offerings.

Variable Temperature Kettles represent the fastest-growing category, driven by increasing consumer sophistication regarding beverage preparation. Tea enthusiasts and specialty coffee drinkers particularly value precise temperature control capabilities, supporting premium pricing strategies.

Smart Connected Kettles appeal to tech-savvy consumers and early adopters, though adoption remains limited by price sensitivity and perceived complexity. Integration challenges with home automation systems present both opportunities and obstacles for market expansion.

Glass Electric Kettles attract design-conscious consumers who prioritize aesthetics alongside functionality. Visual appeal and kitchen décor coordination drive purchasing decisions, though durability concerns limit broader market adoption.

Commercial-grade Models serve business applications including offices, hotels, and foodservice establishments, representing an underexplored growth opportunity with distinct requirements for durability and capacity.

Industry stakeholders across the electrical kettles value chain realize significant advantages from market participation and strategic positioning within this growing segment.

Manufacturers benefit from expanding market opportunities, with growing consumer acceptance creating demand for both basic and premium product offerings. Innovation potential enables product differentiation and premium pricing strategies, while economies of scale support competitive cost structures.

Retailers gain from strong profit margins and consistent consumer demand, with electrical kettles representing attractive impulse purchase opportunities and gift items. Cross-selling potential with complementary kitchen appliances and accessories enhances overall transaction values.

Distributors benefit from reliable demand patterns and established supply chains, with electrical kettles offering predictable inventory turnover and seasonal sales spikes during holiday periods.

Consumers realize substantial value through improved convenience, energy efficiency, and enhanced beverage preparation capabilities. Time savings and consistent results justify purchase decisions across demographic segments.

Component Suppliers including heating element manufacturers, plastic molders, and electronic control system providers benefit from steady demand growth and opportunities for technological advancement.

Service Providers including warranty companies, repair services, and customer support organizations benefit from expanding installed base and ongoing service requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shape the future direction of the US electrical kettles market, reflecting broader consumer preferences and technological advancement patterns.

Smart Home Integration represents the most significant trend, with consumers increasingly seeking appliances that connect to home automation systems and offer remote control capabilities. Voice control compatibility with Amazon Alexa and Google Assistant becomes standard expectation rather than premium feature.

Sustainability Focus drives demand for energy-efficient models and environmentally responsible manufacturing practices. Recyclable materials and reduced packaging appeal to environmentally conscious consumers, particularly younger demographics.

Design Aesthetics gain importance as consumers view electrical kettles as kitchen décor elements rather than purely functional appliances. Color coordination and premium material finishes influence purchasing decisions significantly.

Specialty Beverage Culture continues expanding, with consumers seeking precise temperature control for different tea types and coffee brewing methods. Artisanal beverage preparation drives demand for advanced functionality and professional-grade features.

Compact Living Solutions reflect urbanization trends and smaller household sizes, with manufacturers developing space-efficient designs for apartment living and minimal kitchen environments.

Health and Wellness considerations influence product development, with features like BPA-free construction and water filtration capabilities appealing to health-conscious consumers.

Recent industry developments demonstrate the dynamic nature of the US electrical kettles market and ongoing innovation efforts by manufacturers and technology providers.

Product Launch Activities accelerate as manufacturers introduce new models with enhanced features and improved designs. Smart connectivity becomes increasingly standard across price segments, with even budget models incorporating basic app control functionality.

Strategic Partnerships emerge between appliance manufacturers and beverage companies, creating co-branded products and integrated marketing campaigns. Cross-industry collaboration expands market reach and enhances consumer value propositions.

Manufacturing Investments include facility expansions and automation upgrades to meet growing demand and improve production efficiency. Quality control enhancements address consumer concerns about product reliability and safety.

Distribution Channel Evolution reflects changing retail landscapes, with manufacturers investing in direct-to-consumer capabilities and enhanced online presence. Omnichannel strategies become essential for comprehensive market coverage.

Technology Integration advances include improved heating elements, better insulation materials, and more sophisticated control systems. User interface improvements enhance ease of use and consumer satisfaction.

Sustainability Initiatives encompass packaging reduction, recyclable material utilization, and energy efficiency improvements responding to environmental concerns and regulatory requirements.

Strategic recommendations for market participants focus on capitalizing on growth opportunities while addressing competitive challenges and market constraints.

Market Entry Strategies should prioritize geographic expansion into underserved regions, particularly rural and suburban markets with low penetration rates. Targeted marketing campaigns emphasizing convenience and energy efficiency benefits can accelerate adoption in these areas.

Product Development Focus should emphasize smart technology integration while maintaining affordability across price segments. Feature prioritization should balance advanced functionality with user-friendly operation to appeal to diverse consumer preferences.

Distribution Strategy Enhancement requires strengthening both online and offline presence, with particular attention to e-commerce optimization and social media marketing. Retailer partnerships remain crucial for market penetration and brand visibility.

Competitive Positioning should leverage unique value propositions including design aesthetics, advanced features, or superior customer service. Brand differentiation becomes increasingly important as market competition intensifies.

MWR analysis suggests that companies investing in consumer education and demonstration programs will achieve higher conversion rates and market share growth.

Innovation Investment should focus on emerging technologies including voice control, energy monitoring, and integration with smart home ecosystems. Future-proofing product development ensures long-term competitive advantage.

Long-term market prospects for the US electrical kettles market remain highly favorable, supported by fundamental demographic and lifestyle trends that align with product benefits and consumer preferences.

Growth Trajectory projects continued expansion with accelerating adoption rates across previously underserved market segments. Penetration rates are expected to reach 75% household adoption within the next five years, driven by generational shifts and increased consumer awareness.

Technology Evolution will transform electrical kettles from simple appliances to sophisticated kitchen devices with advanced connectivity and automation capabilities. AI integration and machine learning algorithms may enable personalized brewing recommendations and usage optimization.

Market Maturation patterns suggest eventual stabilization of growth rates as adoption approaches saturation levels, shifting competitive focus toward replacement cycles and premium feature upgrades. Innovation cycles will become crucial for maintaining consumer interest and driving purchase decisions.

Sustainability Requirements will increasingly influence product development and consumer preferences, with energy efficiency and environmental impact becoming key differentiating factors. Regulatory compliance may drive industry-wide improvements in environmental performance.

MarkWide Research projects that the market will continue evolving toward premium segments as consumers become more sophisticated and willing to invest in advanced features and superior design quality.

The US electrical kettles market represents a compelling growth opportunity within the broader small appliances sector, characterized by strong consumer adoption trends, technological innovation potential, and significant untapped market segments. Market fundamentals remain robust, supported by changing lifestyle patterns, increased convenience preferences, and growing appreciation for specialty beverage preparation.

Strategic positioning for market success requires understanding diverse consumer preferences across geographic and demographic segments, while maintaining focus on product innovation and competitive differentiation. Technology integration and smart home compatibility will increasingly determine market leadership as consumers seek connected appliance solutions.

Growth prospects extend beyond traditional household applications, with commercial market opportunities and specialty product segments offering additional expansion potential. Sustainability considerations and energy efficiency benefits align with broader consumer trends toward environmental responsibility and cost-conscious purchasing decisions.

Market participants who successfully navigate competitive challenges while capitalizing on emerging opportunities will realize substantial benefits from this dynamic and expanding market segment, positioning themselves for long-term success in the evolving US electrical kettles landscape.

What is an Electrical Kettle?

An electrical kettle is a kitchen appliance used for boiling water quickly and efficiently. It typically features an electric heating element and is designed for various applications, including making tea, coffee, and instant meals.

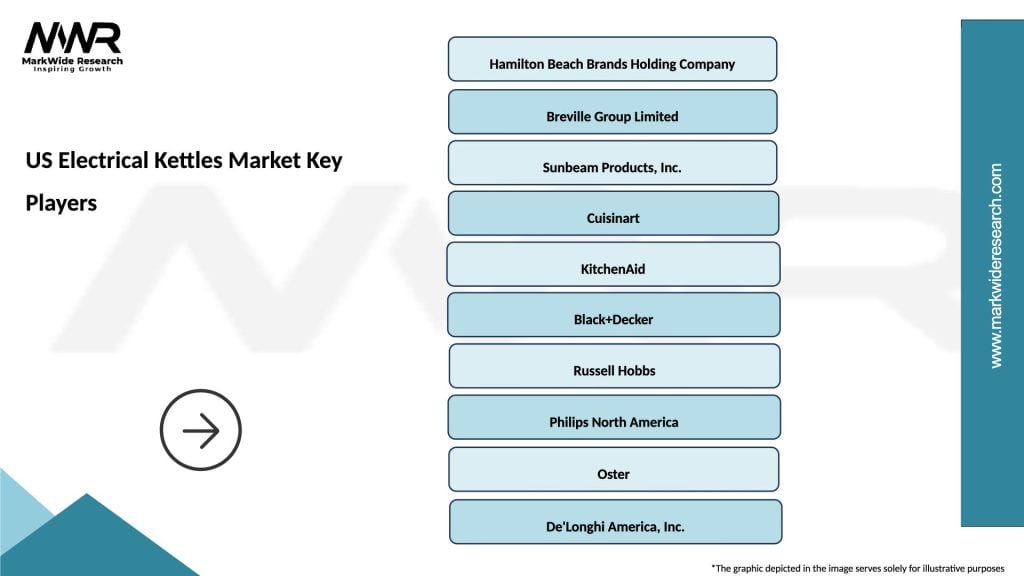

What are the key players in the US Electrical Kettles Market?

Key players in the US Electrical Kettles Market include companies like Hamilton Beach, Breville, and Cuisinart, which offer a range of products catering to different consumer preferences and needs, among others.

What are the growth factors driving the US Electrical Kettles Market?

The US Electrical Kettles Market is driven by factors such as the increasing demand for convenience in cooking, the rise in health-conscious consumers preferring hot beverages, and innovations in kettle technology that enhance energy efficiency.

What challenges does the US Electrical Kettles Market face?

Challenges in the US Electrical Kettles Market include intense competition among manufacturers, fluctuating raw material prices, and the need for compliance with safety regulations, which can impact production costs.

What opportunities exist in the US Electrical Kettles Market?

Opportunities in the US Electrical Kettles Market include the growing trend of smart kitchen appliances, increasing consumer interest in eco-friendly products, and the potential for expansion into new retail channels.

What trends are shaping the US Electrical Kettles Market?

Trends in the US Electrical Kettles Market include the rise of multifunctional kettles that offer features like temperature control and keep-warm functions, as well as a growing preference for stylish designs that complement modern kitchen aesthetics.

US Electrical Kettles Market

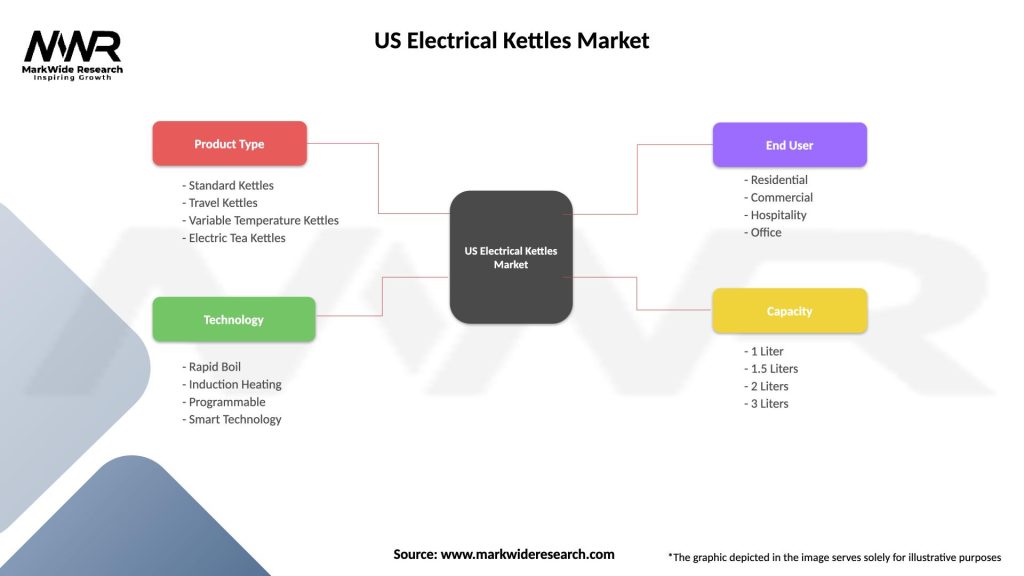

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Kettles, Travel Kettles, Variable Temperature Kettles, Electric Tea Kettles |

| Technology | Rapid Boil, Induction Heating, Programmable, Smart Technology |

| End User | Residential, Commercial, Hospitality, Office |

| Capacity | 1 Liter, 1.5 Liters, 2 Liters, 3 Liters |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Electrical Kettles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at