444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Electric Vehicle (EV) Charging Equipment Market represents one of the most dynamic and rapidly expanding sectors within the American clean energy infrastructure landscape. As electric vehicle adoption accelerates across the United States, the demand for comprehensive charging solutions has reached unprecedented levels, driving substantial investments in both public and private charging infrastructure. Market dynamics indicate robust growth patterns, with the sector experiencing a compound annual growth rate (CAGR) of 28.5% as manufacturers, utilities, and government entities collaborate to build a comprehensive charging network.

Infrastructure development has become a critical priority as the United States transitions toward electrified transportation. The charging equipment market encompasses various technologies, from residential Level 1 and Level 2 chargers to commercial DC fast charging stations capable of delivering rapid charging solutions. Regional adoption varies significantly, with states like California, Texas, and Florida leading in charging infrastructure deployment, accounting for approximately 45% of total installations nationwide.

Government initiatives continue to shape market trajectories through federal funding programs, state-level incentives, and regulatory frameworks designed to accelerate charging infrastructure development. The Infrastructure Investment and Jobs Act has allocated substantial resources toward expanding charging networks, particularly in underserved communities and along major transportation corridors. Private sector investment has complemented public funding, with major corporations establishing workplace charging programs and retail locations integrating charging amenities.

The US Electric Vehicle (EV) Charging Equipment Market refers to the comprehensive ecosystem of hardware, software, and services designed to provide electrical power to electric vehicles across residential, commercial, and public applications. This market encompasses charging stations, connectors, cables, power electronics, network management systems, and associated installation and maintenance services that enable electric vehicle operation throughout the United States.

Charging equipment categories include Level 1 chargers operating on standard household current, Level 2 chargers providing faster charging through 240-volt connections, and DC fast chargers delivering rapid charging capabilities for commercial and highway applications. The market also encompasses smart charging solutions that integrate with grid management systems, renewable energy sources, and demand response programs to optimize charging efficiency and grid stability.

Market expansion in the US electric vehicle charging equipment sector reflects the convergence of technological advancement, regulatory support, and consumer adoption trends. The charging infrastructure landscape has evolved from basic residential solutions to sophisticated networks capable of supporting diverse vehicle types and charging requirements. Technology integration has enabled smart charging capabilities, grid connectivity, and user-friendly interfaces that enhance the overall electric vehicle ownership experience.

Investment patterns demonstrate strong confidence in long-term market potential, with venture capital, corporate funding, and government grants supporting innovation across charging technologies. Major automotive manufacturers have established strategic partnerships with charging network operators, while utility companies have expanded their role in charging infrastructure development and operation. Market penetration continues to accelerate, with charging port installations growing at a rate of 35% annually across key metropolitan areas.

Competitive dynamics have intensified as established players and new entrants compete for market share across different charging segments. Companies are differentiating through charging speed, network reliability, user experience, and integration capabilities with vehicle systems and energy management platforms. Strategic partnerships between charging equipment manufacturers, network operators, and real estate developers have become essential for scaling deployment and ensuring optimal site selection.

Market insights reveal several critical trends shaping the US electric vehicle charging equipment landscape:

Government policy support serves as the primary catalyst driving US electric vehicle charging equipment market expansion. Federal tax credits, state rebates, and utility incentive programs have significantly reduced the financial barriers associated with charging infrastructure deployment. The Infrastructure Investment and Jobs Act represents a watershed moment, providing unprecedented funding for charging network development across urban and rural areas.

Electric vehicle adoption acceleration creates sustained demand for charging infrastructure across all market segments. As major automotive manufacturers commit to electric vehicle production targets and introduce diverse model offerings, the need for comprehensive charging networks becomes increasingly critical. Consumer confidence in electric vehicle technology continues to grow as charging availability and reliability improve.

Technological advancement in charging equipment has enhanced performance, reduced costs, and improved user experience. Innovations in power electronics, battery management systems, and grid integration capabilities have made charging solutions more efficient and accessible. Smart charging features enable load management, renewable energy integration, and demand response participation, providing additional value propositions for users and utilities.

Corporate sustainability initiatives have driven significant investment in workplace and fleet charging infrastructure. Companies across various industries are integrating electric vehicle charging into their environmental, social, and governance strategies, recognizing the dual benefits of employee satisfaction and carbon footprint reduction. Real estate development increasingly incorporates charging amenities as standard features to attract tenants and enhance property values.

High capital investment requirements continue to challenge charging infrastructure deployment, particularly for DC fast charging installations that require substantial electrical infrastructure upgrades. The costs associated with site preparation, electrical connections, and ongoing maintenance can create financial barriers for smaller operators and property owners. Permitting complexities and lengthy approval processes in some jurisdictions further increase deployment timelines and costs.

Grid capacity limitations in certain regions pose constraints on charging infrastructure expansion, particularly for high-power DC fast charging applications. Utility infrastructure upgrades may be necessary to support multiple fast chargers, creating additional costs and delays. Demand charges and time-of-use electricity rates can impact the economic viability of charging operations, particularly for commercial installations.

Technology standardization challenges persist despite industry efforts to establish common protocols and connector types. Different charging standards and network compatibility issues can create confusion for consumers and complicate infrastructure planning. Maintenance and reliability concerns affect user confidence, particularly when charging stations experience downtime or technical issues that impact vehicle charging capability.

Real estate constraints limit optimal charging station placement in dense urban areas where land costs are high and available space is limited. Parking availability and site accessibility considerations can restrict charging infrastructure deployment in high-demand locations. Vandalism and security concerns in some areas require additional protective measures and monitoring systems that increase operational costs.

Rural market expansion presents significant opportunities as federal and state programs focus on addressing charging gaps in underserved communities. The development of charging corridors along interstate highways and rural routes will require substantial infrastructure investment, creating opportunities for equipment manufacturers and installation services. Agricultural and rural business applications offer potential for specialized charging solutions tailored to specific operational requirements.

Fleet electrification trends across delivery, logistics, and public transportation sectors create substantial demand for dedicated charging infrastructure. Commercial fleet operators require customized charging solutions that can accommodate diverse vehicle types, operational schedules, and power requirements. Depot charging systems for overnight fleet charging represent a growing market segment with specific technical and operational needs.

Renewable energy integration opportunities enable charging infrastructure to serve dual purposes as grid stabilization assets and clean energy utilization points. Solar-powered charging stations and battery storage integration can provide energy independence and grid services while supporting electric vehicle charging. Vehicle-to-grid technology development creates potential for electric vehicles to serve as distributed energy resources.

Smart city initiatives across major metropolitan areas are incorporating electric vehicle charging into comprehensive urban planning strategies. Integration with smart traffic management, parking systems, and energy management platforms creates opportunities for advanced charging solutions. Multi-use development projects increasingly include charging amenities as essential infrastructure components.

Supply chain evolution within the US electric vehicle charging equipment market reflects the transition from imported components to domestic manufacturing capabilities. Recent federal policies encouraging domestic production have prompted major manufacturers to establish US-based production facilities, reducing supply chain risks and supporting local economic development. Component availability has improved as semiconductor shortages that previously impacted production have largely resolved.

Pricing dynamics continue to evolve as manufacturing scale increases and competition intensifies across different charging segments. Equipment costs have decreased by approximately 15% annually for Level 2 chargers, while DC fast charging costs have shown more modest reductions due to complexity and power electronics requirements. Installation costs vary significantly based on site conditions, electrical infrastructure requirements, and local labor markets.

Network effects are becoming increasingly important as charging network operators seek to establish comprehensive coverage and user loyalty. Interoperability agreements and roaming partnerships enable users to access multiple networks through single payment systems and mobile applications. Data analytics capabilities provide valuable insights into usage patterns, enabling optimized network expansion and operational efficiency improvements.

Regulatory landscape continues to evolve as federal, state, and local governments refine policies to support charging infrastructure development while ensuring safety and accessibility standards. Building codes and electrical standards are being updated to accommodate electric vehicle charging requirements, while accessibility regulations ensure charging infrastructure serves all users effectively.

Comprehensive market analysis for the US electric vehicle charging equipment market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes extensive interviews with industry executives, charging network operators, equipment manufacturers, and end users across residential, commercial, and public charging segments. Survey data collection encompasses charging behavior patterns, technology preferences, and infrastructure utilization metrics from diverse geographic regions.

Secondary research incorporates analysis of government databases, industry reports, patent filings, and regulatory documents to understand market trends and policy impacts. Financial analysis of public companies provides insights into investment patterns, revenue streams, and profitability metrics across different business models. MarkWide Research methodology includes cross-validation of data sources to ensure reliability and accuracy of market assessments.

Market modeling techniques incorporate various scenarios to project future growth patterns under different policy and adoption assumptions. Statistical analysis of historical installation data, vehicle sales trends, and infrastructure utilization rates provides foundation for growth projections. Geographic analysis examines regional variations in charging infrastructure deployment, regulatory environments, and market conditions.

West Coast leadership in electric vehicle charging infrastructure reflects early adoption of environmental policies and strong state-level support for clean transportation initiatives. California maintains the largest charging network in the United States, with approximately 38% of total public charging stations located within the state. Oregon and Washington have established comprehensive charging corridors and innovative utility programs supporting residential and commercial installations.

Northeast corridor development has accelerated through regional cooperation initiatives and metropolitan area planning efforts. States including New York, Massachusetts, and New Jersey have implemented aggressive charging infrastructure targets supported by utility investment programs and real estate development requirements. Urban density in northeastern cities creates unique challenges and opportunities for charging infrastructure deployment.

Southeast expansion has gained momentum as states like Florida, Georgia, and North Carolina recognize the economic development potential of electric vehicle infrastructure. Major automotive manufacturing investments in the region have catalyzed charging network development to support both production facilities and consumer adoption. Tourism corridors along the Atlantic coast have become priority areas for charging infrastructure investment.

Midwest and Southwest regions are experiencing rapid growth in charging infrastructure deployment, driven by federal funding programs and state-level initiatives. Texas has emerged as a major market due to its size, economic growth, and increasing electric vehicle adoption. Interstate highway corridors connecting major metropolitan areas have become focal points for DC fast charging network development.

Market leadership in the US electric vehicle charging equipment sector is distributed among several key categories of participants, each bringing distinct capabilities and market approaches:

Strategic partnerships have become essential for market success, with equipment manufacturers collaborating with network operators, utilities, and real estate developers to accelerate deployment. Vertical integration strategies are emerging as companies seek to control more aspects of the charging value chain, from equipment manufacturing to network operation and customer service.

By Charging Level:

By Application:

By Connector Type:

Residential charging equipment represents the largest segment by unit volume, with Level 2 home chargers becoming standard equipment for electric vehicle owners. Smart charging features including WiFi connectivity, mobile app control, and load management capabilities are increasingly common in residential installations. Installation services have become a critical component of the residential market, with certified electricians and specialized installation companies supporting deployment.

Commercial charging solutions focus on workplace and destination charging applications where vehicles are parked for extended periods. Multi-port charging stations and load management systems enable efficient utilization of electrical infrastructure while serving multiple vehicles simultaneously. Payment processing and access control features are essential for commercial applications serving diverse user populations.

Public DC fast charging infrastructure emphasizes high-power capability, reliability, and user experience optimization. Next-generation chargers capable of delivering 350kW power levels are being deployed along major highway corridors to support long-distance electric vehicle travel. Site selection and amenities integration have become critical success factors for public charging installations.

Fleet charging systems require specialized solutions tailored to operational requirements including overnight depot charging, opportunity charging, and route optimization integration. Fleet operators prioritize total cost of ownership, charging reliability, and integration with fleet management systems. Scalability and future expansion capability are essential considerations for fleet charging infrastructure investments.

Equipment manufacturers benefit from sustained demand growth driven by electric vehicle adoption and infrastructure development initiatives. Opportunities for product differentiation through smart charging features, grid integration capabilities, and user experience enhancements create competitive advantages. Manufacturing scale economies enable cost reduction and improved profitability as production volumes increase.

Network operators can develop recurring revenue streams through charging service fees, subscription models, and value-added services. Data analytics capabilities provide insights for network optimization, demand forecasting, and strategic expansion planning. Strategic partnerships with automotive manufacturers, utilities, and real estate developers create multiple revenue opportunities and market access channels.

Utility companies benefit from increased electricity demand and opportunities to provide grid services through smart charging programs. Demand response capabilities and load management features enable utilities to optimize grid operations while supporting electric vehicle charging. Rate design innovation can encourage off-peak charging and renewable energy utilization.

Real estate developers can enhance property values and attract tenants by incorporating charging amenities into residential and commercial developments. Electric vehicle charging infrastructure has become a competitive differentiator in many markets, particularly for premium properties and corporate tenants. Future-proofing considerations make charging-ready infrastructure a valuable long-term investment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Ultra-fast charging technology development continues to push the boundaries of charging speed and convenience. Next-generation DC fast chargers capable of delivering 350kW and higher power levels are being deployed to support vehicles with advanced battery technologies and thermal management systems. Charging time reduction to under 15 minutes for significant range addition is becoming a key competitive differentiator.

Smart charging integration with renewable energy systems and grid management platforms is transforming charging infrastructure into distributed energy resources. Solar-powered charging stations with battery storage provide energy independence while supporting grid stability during peak demand periods. Demand response participation enables charging infrastructure to provide grid services and generate additional revenue streams.

Wireless charging technology is emerging as a potential game-changer for certain applications, particularly fleet and public transportation where vehicles follow predictable routes and parking patterns. Inductive charging systems eliminate the need for physical connections while enabling automated charging processes. Dynamic wireless charging for highway applications remains in development but could revolutionize long-distance electric vehicle travel.

Subscription and membership models are evolving to provide predictable pricing and enhanced user experience for frequent charging network users. Unlimited charging plans and preferential access programs create customer loyalty while providing stable revenue streams for network operators. Corporate partnerships enable employers to provide charging benefits as part of employee compensation packages.

Tesla Supercharger network opening to non-Tesla vehicles represents a significant industry development that could reshape competitive dynamics and accelerate overall market growth. The expansion of access to Tesla’s extensive fast charging network addresses range anxiety concerns while potentially increasing utilization rates. Standardization efforts around the North American Charging Standard (NACS) could simplify the charging landscape for consumers and infrastructure operators.

Major automotive manufacturer investments in charging infrastructure demonstrate the industry’s commitment to supporting electric vehicle adoption. Companies like General Motors, Ford, and Stellantis have announced substantial investments in charging networks and partnerships with existing operators. Vertical integration strategies are emerging as automakers seek greater control over the charging experience for their customers.

Utility sector engagement has intensified as electric companies recognize the strategic importance of transportation electrification for load growth and grid modernization. Regulated utilities are investing in charging infrastructure through rate-based programs while competitive suppliers are developing market-based charging services. Rate design innovation includes time-of-use pricing and demand charge modifications to encourage optimal charging behavior.

Federal funding deployment through the Infrastructure Investment and Jobs Act is accelerating charging infrastructure development across the United States. The National Electric Vehicle Infrastructure (NEVI) program is focusing on highway corridor development while additional programs address community charging needs. Buy America requirements are encouraging domestic manufacturing and supply chain development.

Strategic positioning recommendations for market participants emphasize the importance of developing comprehensive charging solutions that address diverse customer needs across residential, commercial, and public applications. Companies should focus on building scalable platforms that can accommodate future technology developments while maintaining backward compatibility with existing installations. Partnership strategies with complementary service providers can accelerate market penetration and reduce customer acquisition costs.

Technology investment priorities should focus on smart charging capabilities, grid integration features, and user experience optimization. According to MarkWide Research analysis, companies that invest in advanced software platforms and data analytics capabilities are better positioned to capture value from charging infrastructure operations. Interoperability standards compliance ensures long-term viability and customer acceptance.

Market entry strategies for new participants should consider regional focus areas where competition is less intense and regulatory support is strong. Rural and suburban markets offer significant growth potential with less competitive pressure than major metropolitan areas. Niche specialization in specific applications like fleet charging or renewable energy integration can provide competitive advantages and premium pricing opportunities.

Financial planning considerations should account for the capital-intensive nature of charging infrastructure development and the importance of securing long-term funding commitments. Revenue diversification through multiple service offerings and customer segments can improve financial stability and growth prospects. Government incentive optimization requires careful coordination of federal, state, and local programs to maximize financial benefits.

Market expansion projections indicate continued robust growth in the US electric vehicle charging equipment market, driven by accelerating electric vehicle adoption and supportive policy frameworks. The charging infrastructure landscape is expected to evolve toward higher power levels, improved reliability, and enhanced user experience as technology advances and competition intensifies. Network density will increase significantly, with charging availability becoming comparable to traditional fuel stations in major metropolitan areas.

Technology evolution will focus on charging speed improvements, smart grid integration, and renewable energy optimization. Next-generation charging systems will incorporate artificial intelligence for predictive maintenance, dynamic pricing, and optimal energy management. Vehicle-to-grid capabilities will transform electric vehicles into distributed energy storage assets, creating new revenue opportunities for charging infrastructure operators.

Market consolidation trends are expected to continue as larger players acquire smaller operators and technology companies to build comprehensive charging solutions. Vertical integration strategies will become more common as companies seek to control more aspects of the charging value chain. International expansion opportunities will emerge as US companies leverage domestic experience for global market development.

Regulatory evolution will continue to shape market development through updated building codes, accessibility requirements, and grid interconnection standards. Federal and state policies will likely maintain strong support for charging infrastructure development while potentially introducing new requirements for network interoperability and data sharing. MWR projections suggest that charging infrastructure investment will continue growing at a CAGR of 25-30% through the remainder of the decade.

The US Electric Vehicle (EV) Charging Equipment Market stands at a pivotal moment in its development, characterized by unprecedented growth opportunities, technological innovation, and strong policy support. As electric vehicle adoption accelerates across all market segments, the charging infrastructure ecosystem continues to evolve toward more sophisticated, reliable, and user-friendly solutions that address diverse customer needs and operational requirements.

Market fundamentals remain exceptionally strong, supported by federal and state government initiatives, private sector investment, and growing consumer acceptance of electric vehicle technology. The convergence of environmental sustainability goals, technological advancement, and economic incentives has created a favorable environment for sustained market expansion and innovation. Competitive dynamics continue to intensify as established players and new entrants compete across different market segments and geographic regions.

Future success in the US electric vehicle charging equipment market will depend on companies’ ability to adapt to evolving customer needs, integrate advanced technologies, and build scalable business models that can accommodate rapid market growth. The transition toward electrified transportation represents one of the most significant infrastructure transformations in modern history, creating substantial opportunities for companies positioned to capitalize on this fundamental shift in the American transportation landscape.

What is Electric Vehicle (EV) Charging Equipment?

Electric Vehicle (EV) Charging Equipment refers to the devices and infrastructure used to charge electric vehicles. This includes home chargers, public charging stations, and fast chargers that facilitate the charging process for various types of electric vehicles.

What are the key players in the US Electric Vehicle (EV) Charging Equipment Market?

Key players in the US Electric Vehicle (EV) Charging Equipment Market include ChargePoint, Blink Charging, and Tesla, among others. These companies are involved in the development and deployment of charging solutions across various locations.

What are the main drivers of the US Electric Vehicle (EV) Charging Equipment Market?

The main drivers of the US Electric Vehicle (EV) Charging Equipment Market include the increasing adoption of electric vehicles, government incentives for EV infrastructure, and the growing demand for sustainable transportation solutions. These factors contribute to the expansion of charging networks.

What challenges does the US Electric Vehicle (EV) Charging Equipment Market face?

The US Electric Vehicle (EV) Charging Equipment Market faces challenges such as the high cost of installation, limited charging infrastructure in certain areas, and the need for standardization across different charging technologies. These issues can hinder widespread adoption.

What opportunities exist in the US Electric Vehicle (EV) Charging Equipment Market?

Opportunities in the US Electric Vehicle (EV) Charging Equipment Market include advancements in charging technology, the expansion of renewable energy integration, and partnerships between private and public sectors to enhance charging infrastructure. These developments can drive market growth.

What trends are shaping the US Electric Vehicle (EV) Charging Equipment Market?

Trends shaping the US Electric Vehicle (EV) Charging Equipment Market include the rise of ultra-fast charging stations, the integration of smart technology for user convenience, and the increasing focus on sustainability in charging solutions. These trends are influencing consumer preferences and industry standards.

US Electric Vehicle (EV) Charging Equipment Market

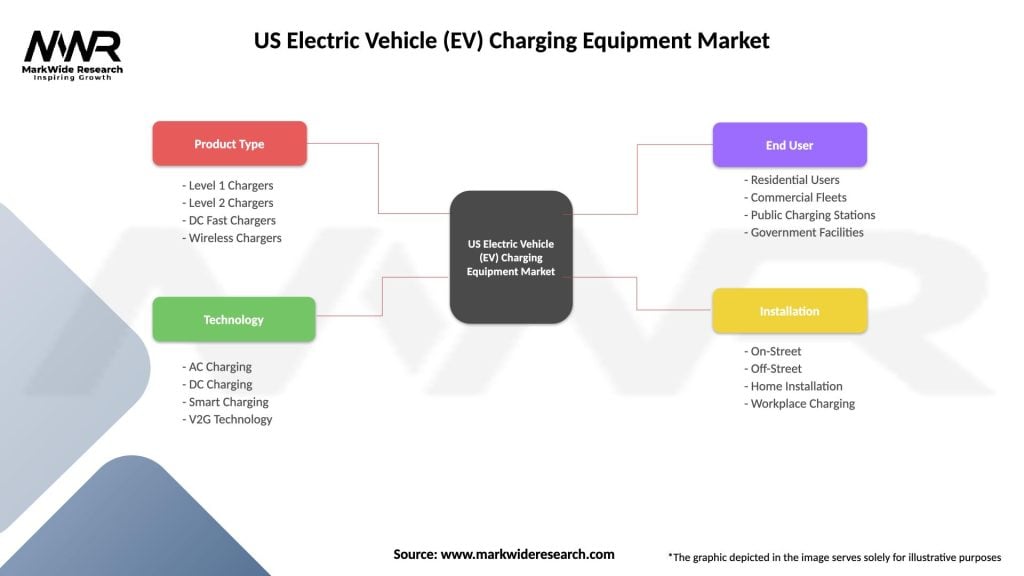

| Segmentation Details | Description |

|---|---|

| Product Type | Level 1 Chargers, Level 2 Chargers, DC Fast Chargers, Wireless Chargers |

| Technology | AC Charging, DC Charging, Smart Charging, V2G Technology |

| End User | Residential Users, Commercial Fleets, Public Charging Stations, Government Facilities |

| Installation | On-Street, Off-Street, Home Installation, Workplace Charging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Electric Vehicle (EV) Charging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at