444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US electric motor market represents a cornerstone of American industrial infrastructure, powering everything from manufacturing equipment to consumer appliances. This dynamic sector encompasses a diverse range of motor technologies, including AC motors, DC motors, servo motors, and stepper motors, each serving critical applications across multiple industries. Market dynamics indicate robust growth driven by increasing automation, energy efficiency mandates, and the transition toward sustainable manufacturing practices.

Industrial applications dominate the landscape, with manufacturing facilities, HVAC systems, and automotive production lines representing the largest consumption segments. The market demonstrates remarkable resilience, with growth rates consistently outpacing broader industrial equipment sectors. Technological advancement continues to reshape the competitive environment, as manufacturers integrate smart technologies, IoT connectivity, and advanced control systems into traditional motor designs.

Regional distribution shows concentrated activity in manufacturing hubs across the Midwest, Southeast, and West Coast, with 65% of market demand originating from industrial and commercial applications. The remaining segments include residential applications, transportation systems, and emerging sectors like renewable energy infrastructure. Innovation cycles accelerate as companies respond to stricter energy efficiency standards and growing demand for precision control in automated systems.

The US electric motor market refers to the comprehensive ecosystem of electric motor manufacturing, distribution, and application within the United States, encompassing all motor types from fractional horsepower units to large industrial drives used across residential, commercial, and industrial sectors.

Electric motors serve as the fundamental conversion mechanism between electrical energy and mechanical motion, making them indispensable components in modern society. These devices range from simple single-phase motors powering household appliances to sophisticated servo systems enabling precision manufacturing processes. Market scope includes original equipment manufacturer sales, replacement parts, aftermarket services, and specialized motor solutions for emerging applications.

Industry classification typically segments motors by power rating, application type, and technology platform. The market encompasses both standardized commodity motors and highly specialized custom solutions designed for specific industrial processes. Value chain participants include motor manufacturers, component suppliers, distributors, system integrators, and end-users across virtually every sector of the American economy.

Strategic positioning within the US electric motor market reveals a mature yet evolving industry characterized by steady demand growth, technological innovation, and increasing focus on energy efficiency. The sector benefits from strong fundamentals including robust manufacturing activity, infrastructure modernization, and regulatory support for energy-efficient technologies. Market leaders continue investing in research and development to maintain competitive advantages in an increasingly sophisticated marketplace.

Key performance indicators demonstrate healthy market conditions with consistent growth across most application segments. Industrial motor demand remains particularly strong, driven by manufacturing reshoring initiatives and factory automation projects. Energy efficiency regulations create both challenges and opportunities, as manufacturers must balance compliance costs with market demand for higher-performance products.

Competitive dynamics favor companies with strong engineering capabilities, established distribution networks, and comprehensive product portfolios. The market shows increasing consolidation as smaller players struggle to compete with the scale and resources of major manufacturers. Innovation focus centers on smart motor technologies, predictive maintenance capabilities, and integration with industrial IoT platforms, representing 23% of new product development investments across leading companies.

Fundamental market drivers reveal several critical trends shaping the US electric motor landscape:

Market maturity varies significantly across application segments, with traditional industrial applications showing steady growth while emerging sectors like electric mobility demonstrate rapid expansion potential. Technology adoption rates indicate accelerating acceptance of variable frequency drives and smart motor systems, particularly in energy-intensive applications where operational savings justify premium pricing.

Industrial automation stands as the primary catalyst driving US electric motor demand, with manufacturing facilities investing heavily in robotic systems, conveyor networks, and precision machinery. These applications require motors with exceptional reliability, precise speed control, and seamless integration capabilities. Automation projects typically specify motors with advanced feedback systems and communication protocols, creating premium market segments with higher profit margins.

Energy efficiency regulations continue reshaping market dynamics as the Department of Energy implements increasingly stringent standards for motor performance. These requirements eliminate less efficient products from the market while creating opportunities for manufacturers offering high-efficiency alternatives. Compliance costs drive consolidation among smaller manufacturers unable to invest in advanced motor technologies, while larger companies benefit from economies of scale in developing compliant products.

Infrastructure modernization generates substantial replacement demand as aging industrial facilities upgrade equipment to maintain competitiveness. Many installed motors exceed their optimal service life, creating opportunities for energy-efficient replacements that reduce operating costs. Retrofit projects often specify motors with improved power density and reliability characteristics, supporting market premiumization trends.

Renewable energy expansion creates new application segments requiring specialized motor solutions for wind turbines, solar tracking systems, and energy storage facilities. These applications demand motors capable of operating in challenging environmental conditions while maintaining high efficiency and reliability standards. Clean energy investments represent approximately 12% of total motor demand growth in emerging market segments.

Raw material costs present ongoing challenges for motor manufacturers, with copper, steel, and rare earth elements experiencing price volatility that impacts production economics. These materials represent significant portions of motor manufacturing costs, making price fluctuations difficult to absorb without affecting competitiveness. Supply chain disruptions compound these challenges by creating availability constraints and forcing manufacturers to maintain higher inventory levels.

Competitive pricing pressure intensifies as global manufacturers compete for market share in commodity motor segments. Low-cost imports challenge domestic producers, particularly in standardized applications where differentiation opportunities remain limited. Price competition erodes margins and forces manufacturers to focus on operational efficiency improvements and value-added services to maintain profitability.

Regulatory compliance costs burden manufacturers with substantial investments in testing, certification, and product redesign activities. Energy efficiency standards require extensive engineering resources and specialized testing equipment, creating barriers for smaller companies. Compliance timelines often compress development cycles, increasing risks and development costs for new product introductions.

Technology transition challenges emerge as customers balance performance improvements against implementation costs and compatibility requirements. Legacy systems may require significant modifications to accommodate advanced motor technologies, creating resistance to upgrades. Integration complexity increases project costs and extends implementation timelines, potentially delaying adoption of newer motor technologies.

Smart motor technologies represent significant growth opportunities as industrial customers seek enhanced monitoring, predictive maintenance, and operational optimization capabilities. These advanced systems command premium pricing while creating recurring revenue streams through software subscriptions and data analytics services. IoT integration enables new business models based on performance monitoring and condition-based maintenance contracts.

Electric vehicle infrastructure creates emerging market segments for charging station motors, cooling system pumps, and auxiliary drive systems. As EV adoption accelerates, supporting infrastructure requirements generate new demand patterns for specialized motor applications. Charging network expansion represents a particularly attractive opportunity given the high reliability and efficiency requirements for commercial charging equipment.

Reshoring initiatives benefit domestic motor manufacturers as companies prioritize supply chain resilience and reduced dependence on overseas suppliers. Manufacturing reshoring creates demand for new production equipment while supporting preferences for domestically produced motors. Supply chain localization trends favor manufacturers with established US production capabilities and comprehensive service networks.

Energy storage applications emerge as grid-scale battery systems require sophisticated motor-driven cooling, ventilation, and positioning systems. These installations demand motors with exceptional reliability and precise control characteristics. Grid modernization projects increasingly specify motors with smart grid compatibility and remote monitoring capabilities, creating opportunities for technology-forward manufacturers.

Supply and demand balance within the US electric motor market reflects complex interactions between industrial activity levels, replacement cycles, and new application development. Manufacturing capacity utilization rates influence pricing dynamics, with tight supply conditions supporting premium pricing for high-performance products. Demand patterns show seasonal variations tied to construction activity and industrial maintenance schedules, requiring manufacturers to manage production and inventory levels strategically.

Technology evolution accelerates as digitalization transforms traditional motor applications into smart, connected systems. This transition creates opportunities for manufacturers with advanced engineering capabilities while challenging companies focused on commodity products. Innovation cycles compress as customers demand faster time-to-market for new solutions, requiring more agile development processes and closer customer collaboration.

Competitive intensity varies across market segments, with commodity applications experiencing significant price pressure while specialized segments support higher margins. Market leaders leverage scale advantages and technical expertise to maintain position in premium segments. Market share dynamics show gradual consolidation as smaller players struggle to compete with the resources and capabilities of major manufacturers.

Customer behavior evolves toward total cost of ownership considerations rather than initial purchase price optimization. This shift benefits manufacturers offering high-efficiency, reliable products with comprehensive service support. Purchasing decisions increasingly incorporate lifecycle cost analysis, energy consumption projections, and maintenance requirements, favoring premium motor solutions with proven performance records.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US electric motor market dynamics. Primary research includes extensive interviews with industry executives, engineering professionals, and end-user representatives across key application segments. Survey methodologies capture quantitative data on purchasing patterns, technology preferences, and market outlook perspectives from diverse stakeholder groups.

Secondary research incorporates analysis of industry publications, regulatory filings, patent databases, and trade association reports to validate primary findings and identify emerging trends. Government statistics, customs data, and economic indicators provide macroeconomic context for market developments. Data triangulation ensures consistency across multiple information sources while identifying potential discrepancies requiring additional investigation.

Market modeling utilizes statistical analysis techniques to project future market conditions based on historical trends, economic indicators, and industry-specific drivers. Regression analysis identifies key variables influencing market growth while scenario planning explores potential outcomes under different economic conditions. Forecasting accuracy improves through continuous model refinement and validation against actual market performance data.

Industry expertise from MarkWide Research analysts with extensive experience in industrial equipment markets ensures appropriate interpretation of research findings and identification of strategic implications. Expert knowledge helps distinguish between temporary market fluctuations and fundamental structural changes affecting long-term market dynamics.

Geographic distribution of US electric motor demand reflects the concentration of manufacturing activity, with the Midwest region accounting for approximately 35% of total market consumption due to its extensive automotive and heavy industry presence. States like Michigan, Ohio, and Illinois host major motor manufacturing facilities and represent significant end-user markets. Industrial density in these regions supports both original equipment demand and robust aftermarket activity.

Southeast markets demonstrate strong growth driven by manufacturing expansion, particularly in automotive, aerospace, and chemical processing industries. States including North Carolina, South Carolina, and Tennessee attract significant industrial investment, creating demand for new motor installations. Regional growth rates exceed national averages as companies establish new production facilities and modernize existing operations.

West Coast demand concentrates in technology manufacturing, food processing, and renewable energy applications. California’s stringent energy efficiency standards drive adoption of premium motor technologies while creating regulatory compliance requirements that influence product specifications. Innovation clusters in Silicon Valley and other technology centers generate demand for specialized motor solutions supporting advanced manufacturing processes.

Northeast markets focus on replacement and upgrade applications as mature industrial infrastructure requires modernization to maintain competitiveness. The region’s emphasis on energy efficiency and environmental compliance supports demand for high-performance motor technologies. Urban concentration creates opportunities for commercial HVAC applications and building automation systems requiring sophisticated motor control solutions.

Market leadership within the US electric motor industry reflects a combination of manufacturing scale, technological capabilities, and distribution reach. The competitive environment includes both large multinational corporations and specialized niche players serving specific application segments.

Competitive strategies emphasize differentiation through technology innovation, service capabilities, and application expertise. Leading companies invest heavily in research and development to maintain technological advantages while building comprehensive service networks to support customer requirements. Market positioning varies from low-cost commodity suppliers to premium solution providers offering integrated motor and control systems.

By Motor Type:

By Power Rating:

By Application:

AC motor segment maintains market dominance due to its versatility, reliability, and cost-effectiveness across diverse applications. Three-phase induction motors represent the largest subsegment, serving industrial applications requiring constant speed operation. Technology improvements focus on efficiency enhancements and smart monitoring capabilities while maintaining compatibility with existing infrastructure.

Servo motor applications experience rapid growth driven by automation expansion and precision manufacturing requirements. These motors command premium pricing due to their sophisticated control systems and high-performance characteristics. Market demand concentrates in robotics, CNC machinery, and packaging equipment where precise positioning and speed control are critical.

DC motor segment serves specialized applications requiring variable speed control and high starting torque. While smaller than AC motors in overall volume, DC motors maintain strong positions in specific niches including material handling, automotive, and battery-powered applications. Brushless DC motors gain market share due to their improved efficiency and reduced maintenance requirements.

High-efficiency motors represent the fastest-growing category as energy regulations and cost considerations drive adoption. These products typically achieve efficiency ratings exceeding 92% while meeting or surpassing regulatory requirements. Premium pricing reflects advanced materials and manufacturing processes required to achieve superior performance characteristics.

Manufacturers benefit from diverse market opportunities spanning multiple application segments and technology platforms. The market’s stability and growth potential support long-term investment planning while technological advancement creates differentiation opportunities. Scale advantages favor larger manufacturers through procurement efficiencies, research and development capabilities, and comprehensive distribution networks.

End-users gain from continuous technology improvements delivering enhanced efficiency, reliability, and control capabilities. Modern motors offer significantly improved performance compared to legacy products while providing integration capabilities with digital control systems. Total cost of ownership improvements justify premium pricing for advanced motor technologies through reduced energy consumption and maintenance requirements.

Distributors capitalize on market fragmentation and the need for local technical support and inventory management. The complexity of motor applications creates opportunities for value-added services including application engineering, system integration, and aftermarket support. Service revenues provide recurring income streams complementing product sales.

System integrators benefit from increasing demand for turnkey automation solutions incorporating motors, drives, and control systems. These companies leverage motor technology advancements to deliver comprehensive solutions addressing customer productivity and efficiency objectives. Integration expertise commands premium pricing while creating long-term customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization transformation reshapes the electric motor landscape as manufacturers integrate smart sensors, wireless connectivity, and predictive analytics into traditional products. These capabilities enable condition monitoring, performance optimization, and predictive maintenance applications that reduce downtime and operating costs. Digital twins and simulation technologies support motor design optimization and application-specific customization.

Energy efficiency focus intensifies as regulations become more stringent and energy costs represent significant operational expenses. Motor manufacturers invest heavily in advanced materials, optimized designs, and manufacturing processes to achieve superior efficiency ratings. Premium efficiency motors demonstrate efficiency improvements of 2-5% compared to standard products while meeting increasingly demanding regulatory requirements.

Customization demand increases as customers seek motor solutions optimized for specific applications rather than standard products requiring adaptation. This trend favors manufacturers with flexible production capabilities and strong engineering resources. Application-specific designs command premium pricing while creating competitive differentiation opportunities.

Sustainability considerations influence purchasing decisions as companies prioritize environmental responsibility and lifecycle impact assessment. Motor manufacturers respond by developing products with improved recyclability, reduced material consumption, and enhanced durability. Circular economy principles drive design changes emphasizing repairability and component reuse capabilities.

Technology advancement accelerates across multiple fronts as motor manufacturers invest in next-generation products and capabilities. Recent developments include permanent magnet motor improvements, advanced bearing technologies, and integrated drive systems offering simplified installation and enhanced performance. Research partnerships between manufacturers and universities drive innovation in materials science and electromagnetic design optimization.

Manufacturing modernization initiatives focus on automation, quality improvement, and production flexibility to meet diverse customer requirements. Companies implement advanced manufacturing technologies including additive manufacturing for prototyping and specialized components. Production efficiency improvements help offset raw material cost pressures while supporting competitive pricing strategies.

Strategic acquisitions reshape the competitive landscape as companies seek to expand product portfolios, enter new market segments, or acquire specialized technologies. Recent transactions focus on smart motor technologies, niche application expertise, and geographic expansion capabilities. Market consolidation continues as smaller players struggle to compete with the scale and resources of major manufacturers.

Regulatory developments create both challenges and opportunities as energy efficiency standards become more stringent. The Department of Energy continues updating motor efficiency requirements while state-level regulations add additional compliance complexity. Standards harmonization efforts aim to reduce regulatory burden while maintaining environmental protection objectives.

Strategic positioning recommendations emphasize the importance of technology differentiation and customer intimacy in an increasingly competitive market environment. Companies should focus on developing unique capabilities that create sustainable competitive advantages rather than competing solely on price. Value proposition development should emphasize total cost of ownership benefits and application-specific performance advantages.

Investment priorities should focus on digital technology integration, manufacturing automation, and customer service capabilities that support long-term market position. Research and development spending should emphasize smart motor technologies and application-specific solutions rather than incremental improvements to commodity products. Technology roadmaps should align with customer digitalization initiatives and Industry 4.0 implementation plans.

Market expansion opportunities exist in emerging application segments including electric vehicle infrastructure, renewable energy systems, and advanced manufacturing processes. Companies should evaluate these segments carefully to identify areas where their capabilities provide competitive advantages. Partnership strategies may provide efficient entry paths into new markets without substantial capital investments.

Operational excellence remains critical for success in commodity motor segments where price competition intensifies. Companies should implement lean manufacturing principles, supply chain optimization, and quality improvement initiatives to maintain cost competitiveness. Service differentiation offers opportunities to create additional value and strengthen customer relationships beyond product sales.

Long-term growth prospects for the US electric motor market remain positive, supported by industrial automation trends, infrastructure modernization requirements, and emerging applications in renewable energy and electric mobility. MarkWide Research analysis indicates sustained demand growth across most application segments, with particularly strong performance expected in smart motor technologies and high-efficiency products.

Technology evolution will continue transforming the market as digitalization, artificial intelligence, and advanced materials enable new motor capabilities and applications. The integration of motors with IoT platforms and predictive analytics will create new business models based on performance monitoring and optimization services. Innovation cycles are expected to accelerate, requiring manufacturers to maintain agile development processes and strong customer collaboration.

Market structure will likely experience continued consolidation as scale advantages become more important in technology development and global competition. Smaller companies may find success in specialized niches or through partnership strategies with larger manufacturers. Competitive dynamics will increasingly favor companies with comprehensive product portfolios, advanced technologies, and strong service capabilities.

Regulatory environment will continue driving market evolution through energy efficiency standards and environmental requirements. These regulations create both challenges and opportunities, eliminating less efficient products while supporting demand for advanced motor technologies. Compliance requirements will likely become more stringent over time, requiring ongoing investment in product development and testing capabilities.

The US electric motor market demonstrates remarkable resilience and growth potential despite facing challenges from global competition, raw material costs, and regulatory complexity. The market’s fundamental drivers including industrial automation, energy efficiency requirements, and infrastructure modernization provide solid foundations for continued expansion. Technology advancement creates opportunities for differentiation and premium positioning while emerging applications in electric mobility and renewable energy offer new growth avenues.

Success factors in this evolving market emphasize technology innovation, customer intimacy, and operational excellence rather than simple cost competition. Companies that invest in smart motor technologies, develop application-specific solutions, and build comprehensive service capabilities are best positioned for long-term success. Market dynamics favor manufacturers with scale advantages, strong engineering capabilities, and established distribution networks.

Future opportunities will emerge from the intersection of digitalization, sustainability, and industrial transformation trends. The motor industry’s role in enabling automation, improving energy efficiency, and supporting clean energy initiatives positions it as a critical enabler of broader economic and environmental objectives. Strategic focus on these emerging trends will determine which companies capture the greatest value from market evolution and growth opportunities ahead.

What is Electric Motor?

Electric motors are devices that convert electrical energy into mechanical energy through electromagnetic interactions. They are widely used in various applications, including industrial machinery, household appliances, and electric vehicles.

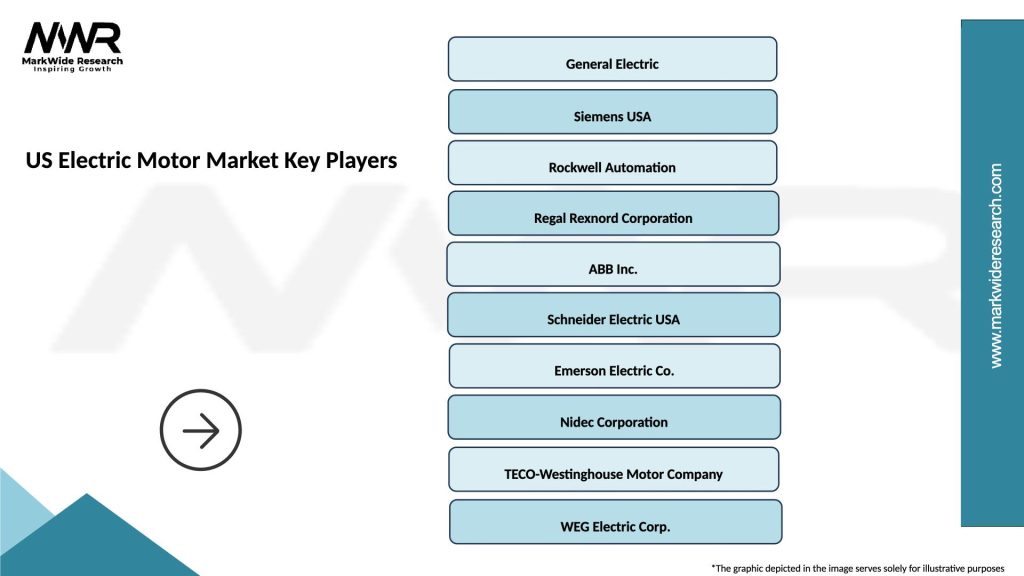

What are the key players in the US Electric Motor Market?

Key players in the US Electric Motor Market include companies such as General Electric, Siemens, and Nidec Corporation, which are known for their innovative motor technologies and extensive product offerings, among others.

What are the main drivers of the US Electric Motor Market?

The main drivers of the US Electric Motor Market include the increasing demand for energy-efficient solutions, the growth of the electric vehicle sector, and advancements in automation technologies across various industries.

What challenges does the US Electric Motor Market face?

The US Electric Motor Market faces challenges such as the high initial costs of advanced electric motors and competition from alternative technologies. Additionally, supply chain disruptions can impact production and availability.

What opportunities exist in the US Electric Motor Market?

Opportunities in the US Electric Motor Market include the rising adoption of renewable energy sources, the expansion of smart grid technologies, and the increasing focus on sustainability and reducing carbon emissions in industrial applications.

What trends are shaping the US Electric Motor Market?

Trends shaping the US Electric Motor Market include the integration of IoT technologies for enhanced monitoring and control, the development of more compact and lightweight motor designs, and the growing emphasis on electric mobility solutions.

US Electric Motor Market

| Segmentation Details | Description |

|---|---|

| Product Type | AC Motors, DC Motors, Servo Motors, Stepper Motors |

| End User | Manufacturing, Automotive OEMs, Aerospace, Consumer Electronics |

| Technology | Brushless, Induction, Synchronous, Permanent Magnet |

| Application | Industrial Automation, HVAC Systems, Electric Vehicles, Robotics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Electric Motor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at