444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US electric commercial vehicle battery pack market represents a transformative segment within the broader electrification ecosystem, driving unprecedented changes across transportation and logistics industries. Commercial fleet operators are increasingly recognizing the strategic advantages of electric powertrains, with battery pack technology serving as the cornerstone of this revolutionary shift. The market encompasses diverse applications ranging from last-mile delivery vehicles to heavy-duty trucks, each requiring specialized battery solutions optimized for specific operational demands.

Market dynamics indicate robust adoption patterns across multiple commercial vehicle categories, with delivery and logistics companies leading the charge toward electrification. The growing emphasis on sustainability initiatives and regulatory compliance has accelerated investment in advanced battery technologies, creating substantial opportunities for manufacturers and technology providers. Battery pack innovations continue to address critical challenges including energy density, charging speed, and operational durability, positioning the market for sustained growth at a compound annual growth rate exceeding 15% through the forecast period.

Regional concentration within the United States shows particular strength in California, Texas, and Northeast corridors, where supportive infrastructure and regulatory frameworks facilitate commercial vehicle electrification. The market benefits from increasing federal and state incentives, with approximately 40% of commercial fleet operators actively evaluating or implementing electric vehicle strategies within their operational frameworks.

The US electric commercial vehicle battery pack market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and servicing of battery systems specifically engineered for commercial electric vehicles operating within American markets. Battery pack systems represent integrated solutions combining multiple battery cells, thermal management systems, battery management systems, and protective enclosures designed to meet the demanding requirements of commercial vehicle applications.

Commercial vehicle applications within this market context include delivery vans, medium-duty trucks, heavy-duty freight vehicles, buses, and specialized commercial equipment requiring electric propulsion systems. The market encompasses both original equipment manufacturer installations and aftermarket retrofit solutions, addressing diverse operational requirements across various commercial vehicle segments.

Technology integration within battery pack systems includes advanced lithium-ion chemistries, sophisticated battery management systems, thermal regulation technologies, and safety mechanisms designed to ensure reliable performance under demanding commercial operating conditions. The market also encompasses supporting infrastructure including charging systems, maintenance services, and battery lifecycle management solutions.

Strategic market positioning reveals the US electric commercial vehicle battery pack market as a critical enabler of transportation electrification, with significant implications for logistics efficiency and environmental sustainability. Market participants include established automotive suppliers, specialized battery manufacturers, technology innovators, and emerging startups focused on commercial vehicle applications.

Key growth drivers encompass regulatory mandates for emissions reduction, corporate sustainability commitments, total cost of ownership advantages, and technological advancements improving battery performance and reliability. Commercial fleet operators increasingly recognize electric vehicles as viable alternatives to traditional internal combustion engine vehicles, with operational cost savings reaching 30-40% in optimal deployment scenarios.

Market segmentation reveals distinct opportunities across vehicle weight classes, with light-duty commercial vehicles showing the highest adoption rates, followed by medium-duty applications and emerging heavy-duty segments. Battery technology preferences vary by application, with lithium iron phosphate gaining traction for commercial applications requiring enhanced safety and longevity characteristics.

Competitive dynamics feature both established automotive suppliers leveraging existing relationships and innovative technology companies introducing disruptive solutions. The market benefits from increasing manufacturing capacity and supply chain optimization, supporting broader commercial vehicle electrification initiatives across diverse industry sectors.

Market intelligence reveals several critical insights shaping the US electric commercial vehicle battery pack landscape. Technology evolution continues advancing battery energy density, charging capabilities, and operational durability, addressing historical limitations that previously constrained commercial vehicle electrification adoption.

Market maturation indicators suggest the transition from early adoption to mainstream deployment, with commercial fleet operators increasingly viewing electric vehicles as standard operational tools rather than experimental technologies. Battery pack reliability and performance consistency have reached levels supporting demanding commercial applications across various operational environments.

Primary market drivers propelling the US electric commercial vehicle battery pack market encompass regulatory, economic, and technological factors creating compelling value propositions for commercial fleet operators. Environmental regulations at federal, state, and local levels mandate emissions reductions, creating regulatory pressure for commercial vehicle electrification initiatives.

Economic incentives include federal tax credits, state rebates, utility programs, and local incentives that significantly reduce the total cost of ownership for electric commercial vehicles. Operational cost advantages become increasingly apparent as fuel costs fluctuate and maintenance requirements for electric vehicles prove substantially lower than traditional vehicles.

Corporate sustainability commitments drive major logistics and delivery companies to establish aggressive electrification timelines, creating substantial demand for commercial vehicle battery pack solutions. Customer preferences increasingly favor environmentally responsible logistics providers, creating competitive advantages for companies adopting electric vehicle fleets.

Technological advancements in battery chemistry, thermal management, and charging infrastructure address previous limitations constraining commercial vehicle electrification. Battery pack performance improvements enable electric commercial vehicles to match or exceed the operational capabilities of traditional vehicles across most applications.

Supply chain considerations including fuel price volatility and energy security concerns motivate fleet operators to reduce dependency on petroleum-based fuels through electrification initiatives. Grid integration opportunities allow commercial vehicle fleets to participate in demand response programs and energy storage applications, creating additional revenue streams.

Market constraints affecting the US electric commercial vehicle battery pack market include technological limitations, infrastructure challenges, and economic considerations that may slow adoption rates in certain applications. Initial capital requirements for electric commercial vehicles remain substantially higher than traditional alternatives, creating financial barriers for smaller fleet operators.

Charging infrastructure limitations particularly affect long-haul and heavy-duty applications where charging time and availability constraints impact operational efficiency. Battery pack weight considerations reduce payload capacity for certain commercial applications, affecting operational economics and customer acceptance.

Range limitations continue constraining electric commercial vehicle deployment in applications requiring extended operational ranges without charging opportunities. Cold weather performance degradation affects battery pack efficiency and range in northern climates, impacting year-round operational reliability.

Supply chain constraints including raw material availability and manufacturing capacity limitations may constrain market growth during periods of high demand. Technical complexity of battery pack systems requires specialized maintenance capabilities and trained technicians, creating operational challenges for some fleet operators.

Regulatory uncertainty regarding future incentive programs and emissions standards creates planning challenges for fleet operators considering long-term electrification investments. Technology evolution risks may concern fleet operators worried about obsolescence of current battery pack technologies.

Emerging opportunities within the US electric commercial vehicle battery pack market encompass technological innovations, market expansion, and strategic partnerships creating substantial growth potential. Second-life applications for commercial vehicle battery packs offer opportunities in stationary energy storage markets, extending battery pack value propositions.

Battery-as-a-Service models enable fleet operators to access electric vehicle technology without large capital investments, expanding market accessibility and reducing adoption barriers. Wireless charging technologies may revolutionize commercial vehicle operations by enabling continuous charging during loading and unloading operations.

Advanced battery chemistries including solid-state technologies promise significant improvements in energy density, safety, and charging speed for commercial applications. Vehicle-to-grid integration opportunities allow commercial vehicle fleets to provide grid services and energy storage capabilities, creating additional revenue streams.

Autonomous vehicle integration with electric powertrains creates synergistic opportunities for commercial vehicle applications, particularly in controlled environments like ports and distribution centers. Modular battery pack designs enable customization for specific commercial applications while maintaining manufacturing economies of scale.

International expansion opportunities exist for US-based battery pack manufacturers as global commercial vehicle electrification accelerates. Recycling and circular economy initiatives create opportunities for battery pack material recovery and sustainable manufacturing processes.

Market dynamics shaping the US electric commercial vehicle battery pack landscape reflect the complex interplay between technological advancement, regulatory frameworks, and economic factors. Supply and demand balance continues evolving as manufacturing capacity expands to meet growing commercial vehicle electrification requirements.

Competitive pressures drive continuous innovation in battery pack technology, with manufacturers focusing on energy density improvements, cost reductions, and enhanced safety features. Market consolidation trends may emerge as smaller players seek partnerships with established manufacturers to access necessary scale and resources.

Technology standardization efforts aim to improve interoperability and reduce costs across the commercial vehicle battery pack ecosystem. Vertical integration strategies by major commercial vehicle manufacturers may reshape supplier relationships and market dynamics.

Regional market variations reflect differences in regulatory environments, infrastructure development, and economic incentives across different states and metropolitan areas. Seasonal demand patterns influence battery pack requirements and charging infrastructure utilization across different geographic regions.

Investment flows into battery pack manufacturing capacity and research and development activities indicate strong confidence in long-term market growth prospects. Partnership formations between battery manufacturers, vehicle OEMs, and fleet operators create integrated solutions addressing complete commercial vehicle electrification needs.

Comprehensive research methodology employed in analyzing the US electric commercial vehicle battery pack market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research activities include extensive interviews with industry stakeholders, fleet operators, battery manufacturers, and technology providers across the commercial vehicle ecosystem.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and technical publications to understand technology trends and market developments. Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to project future market conditions and growth trajectories.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research findings accuracy and reliability. Quantitative analysis focuses on market sizing, growth rate calculations, and segmentation analysis using established statistical methodologies.

Qualitative insights derive from stakeholder interviews, industry expert consultations, and observational research of market trends and competitive dynamics. Technology assessment includes evaluation of battery pack performance characteristics, manufacturing processes, and innovation trajectories affecting market development.

Regional analysis incorporates state-level regulatory frameworks, infrastructure development patterns, and economic incentive programs affecting commercial vehicle electrification adoption rates. Competitive intelligence gathering includes analysis of company strategies, product offerings, and market positioning across key industry participants.

Regional market dynamics within the United States reveal significant variations in electric commercial vehicle battery pack adoption patterns, driven by regulatory environments, infrastructure development, and economic incentives. California leads market adoption with approximately 35% of national electric commercial vehicle deployments, supported by aggressive emissions standards and substantial incentive programs.

Northeast corridor states including New York, Massachusetts, and Connecticut demonstrate strong market growth driven by urban delivery applications and supportive regulatory frameworks. Texas markets show increasing adoption particularly in metropolitan areas like Dallas, Houston, and Austin, where logistics operations benefit from electric vehicle cost advantages.

Pacific Northwest regions including Washington and Oregon leverage abundant renewable energy resources and environmental consciousness to drive commercial vehicle electrification initiatives. Florida markets demonstrate growing adoption in logistics and delivery applications, particularly in Miami, Tampa, and Orlando metropolitan areas.

Midwest adoption patterns focus on specific applications where electric vehicles provide clear operational advantages, with gradual expansion as infrastructure development progresses. Mountain West states show emerging opportunities particularly in urban delivery applications and specialized commercial vehicle segments.

Infrastructure development varies significantly by region, with coastal states generally leading in charging infrastructure deployment while interior regions focus on corridor development. Regulatory support differs substantially across states, creating varying market conditions and adoption incentives for commercial vehicle electrification.

Competitive dynamics within the US electric commercial vehicle battery pack market feature diverse participants ranging from established automotive suppliers to innovative technology companies. Market leadership positions continue evolving as companies develop specialized solutions for commercial vehicle applications.

Strategic partnerships between battery manufacturers and commercial vehicle OEMs create integrated solutions addressing complete electrification needs. Technology differentiation focuses on energy density, charging speed, safety features, and operational durability for demanding commercial applications.

Manufacturing capacity expansion by major players indicates strong confidence in market growth prospects and commitment to serving commercial vehicle electrification needs. Innovation investments continue advancing battery pack technology capabilities and reducing costs for commercial vehicle applications.

Market segmentation analysis reveals distinct opportunities across multiple dimensions including vehicle type, battery chemistry, application, and end-user categories. Vehicle weight classification represents a primary segmentation approach, with different battery pack requirements for light-duty, medium-duty, and heavy-duty commercial vehicles.

By Vehicle Type:

By Battery Chemistry:

By Application:

Light commercial vehicle segment demonstrates the highest adoption rates with approximately 60% of current electric commercial vehicle deployments, driven by favorable economics and operational suitability. Battery pack requirements for this segment emphasize cost-effectiveness, moderate range capabilities, and fast charging compatibility for urban delivery applications.

Medium-duty commercial vehicles represent emerging opportunities as battery technology advances enable viable solutions for regional delivery and service applications. Performance requirements include extended range capabilities, durability for frequent charging cycles, and integration with specialized commercial vehicle equipment.

Heavy-duty vehicle applications remain challenging but show increasing viability as battery energy density improves and charging infrastructure develops. Technology focus emphasizes maximum energy capacity, fast charging capabilities, and integration with advanced vehicle systems for optimal efficiency.

Specialized commercial vehicles including refuse trucks, utility vehicles, and construction equipment create niche opportunities for customized battery pack solutions. Application-specific requirements drive innovation in battery pack design, thermal management, and integration with hydraulic and pneumatic systems.

Transit and bus applications benefit from predictable routes and centralized charging infrastructure, enabling successful electric vehicle deployments with current battery technology. Safety and reliability requirements for passenger transportation drive stringent battery pack design and testing standards.

Fleet operators benefit from significant operational cost reductions, with electric commercial vehicles typically achieving 40-60% lower operating costs compared to traditional vehicles. Maintenance advantages include reduced service requirements, longer component life, and simplified drivetrain systems reducing downtime and maintenance expenses.

Environmental benefits enable fleet operators to meet sustainability commitments and regulatory requirements while potentially accessing green financing options and customer preferences for environmentally responsible logistics providers. Performance advantages include instant torque delivery, quiet operation, and precise control characteristics beneficial for commercial applications.

Battery manufacturers access expanding market opportunities with growing demand for specialized commercial vehicle solutions. Technology development for commercial applications drives innovation benefiting broader battery industry applications and market positioning.

Commercial vehicle manufacturers differentiate product offerings through electric powertrain integration, accessing new market segments and customer requirements. Regulatory compliance advantages position manufacturers favorably for future emissions standards and market requirements.

Infrastructure providers benefit from growing demand for commercial vehicle charging solutions, creating opportunities for specialized charging networks and energy management systems. Utility companies access new revenue streams through commercial vehicle charging services and demand response programs.

Government stakeholders achieve environmental and energy security objectives through commercial vehicle electrification while supporting domestic manufacturing and technology development initiatives. Economic development benefits include job creation in manufacturing, infrastructure, and service sectors supporting electric commercial vehicle adoption.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological trends shaping the US electric commercial vehicle battery pack market include advancement toward higher energy density solutions, faster charging capabilities, and improved safety characteristics. Solid-state battery development promises revolutionary improvements in performance and safety for commercial vehicle applications.

Manufacturing trends emphasize domestic production capacity expansion, supply chain localization, and automated manufacturing processes reducing costs and improving quality. Vertical integration strategies by major commercial vehicle manufacturers create integrated solutions and supply chain control.

Business model innovation includes Battery-as-a-Service offerings, leasing programs, and performance-based contracts reducing adoption barriers for fleet operators. Circular economy initiatives focus on battery pack recycling, second-life applications, and sustainable manufacturing processes.

Infrastructure trends include deployment of high-power charging systems, wireless charging technologies, and smart charging networks optimizing energy costs and grid integration. Vehicle-to-grid integration enables commercial vehicle fleets to provide grid services and energy storage capabilities.

Market consolidation trends may emerge as smaller players seek partnerships or acquisition by larger companies with necessary scale and resources. Standardization efforts aim to improve interoperability and reduce costs across the commercial vehicle battery pack ecosystem.

Recent industry developments demonstrate accelerating momentum in the US electric commercial vehicle battery pack market. Major fleet operators including Amazon, FedEx, and UPS have announced substantial electric vehicle procurement commitments, creating significant demand for battery pack solutions.

Manufacturing capacity expansion by leading battery manufacturers includes new facilities and production line additions specifically targeting commercial vehicle applications. MarkWide Research analysis indicates these investments represent confidence in sustained market growth and commercial vehicle electrification trends.

Technology partnerships between battery manufacturers and commercial vehicle OEMs create integrated solutions addressing complete electrification needs. Government initiatives including the Infrastructure Investment and Jobs Act provide substantial funding for charging infrastructure development supporting commercial vehicle electrification.

Regulatory developments include California’s Advanced Clean Trucks Rule and similar regulations in other states mandating commercial vehicle electrification timelines. Innovation breakthroughs in battery chemistry and thermal management systems address previous limitations constraining commercial vehicle applications.

Investment activities include venture capital funding for innovative battery technology companies and strategic investments by established industry players. International partnerships facilitate technology transfer and manufacturing scale for US market applications.

Strategic recommendations for market participants emphasize the importance of technology differentiation, manufacturing scale, and customer relationship development. Battery manufacturers should focus on commercial vehicle-specific solutions addressing unique performance requirements and operational demands.

Fleet operators should develop comprehensive electrification strategies including vehicle selection, infrastructure planning, and operational optimization to maximize electric vehicle benefits. Pilot programs enable fleet operators to gain experience and optimize deployment strategies before large-scale implementation.

Infrastructure investment coordination between public and private stakeholders ensures adequate charging capacity for growing commercial vehicle electrification needs. Standardization participation helps ensure interoperability and reduces long-term operational costs for all market participants.

Supply chain diversification reduces risks associated with raw material availability and manufacturing capacity constraints. Technology partnerships enable smaller companies to access necessary resources and market channels for commercial vehicle applications.

Regulatory engagement ensures market participants understand and influence policy developments affecting commercial vehicle electrification. Customer education programs help fleet operators understand electric vehicle benefits and optimize deployment strategies.

Future market prospects for the US electric commercial vehicle battery pack market indicate sustained growth driven by technology advancement, regulatory support, and economic advantages. MWR projections suggest the market will experience robust expansion as battery technology continues improving and commercial vehicle electrification becomes mainstream.

Technology evolution toward solid-state batteries, advanced thermal management, and wireless charging integration will address current limitations and enable new commercial vehicle applications. Manufacturing scale expansion will drive cost reductions making electric commercial vehicles increasingly competitive with traditional alternatives.

Market maturation will see transition from early adoption to mainstream deployment, with electric commercial vehicles becoming standard operational tools across diverse applications. Infrastructure development will reach critical mass supporting widespread commercial vehicle electrification across all geographic regions.

Regulatory frameworks will continue evolving to support commercial vehicle electrification while ensuring grid stability and environmental benefits. International competitiveness of US-based battery pack manufacturers will strengthen through technology innovation and manufacturing efficiency improvements.

Long-term growth trajectory suggests the market will achieve significant scale with penetration rates exceeding 25% of new commercial vehicle sales by the end of the forecast period. Application expansion will encompass virtually all commercial vehicle categories as technology capabilities and infrastructure support continue advancing.

The US electric commercial vehicle battery pack market represents a transformative opportunity within the broader transportation electrification landscape, driven by compelling economic advantages, regulatory support, and technological advancement. Market dynamics indicate sustained growth potential as battery pack technology continues addressing commercial vehicle operational requirements while reducing costs and improving performance characteristics.

Strategic positioning within this market requires understanding diverse commercial vehicle applications, technology requirements, and operational constraints affecting battery pack design and deployment. Success factors include technology differentiation, manufacturing scale, customer relationship development, and adaptation to evolving market requirements and regulatory frameworks.

Future market development will benefit from continued technology innovation, infrastructure expansion, and regulatory support creating favorable conditions for commercial vehicle electrification. Market participants positioned to address commercial vehicle-specific requirements while achieving manufacturing scale will capture the greatest opportunities within this expanding market segment.

What is Electric Commercial Vehicle Battery Pack?

Electric Commercial Vehicle Battery Pack refers to the energy storage systems used in electric commercial vehicles, providing the necessary power for propulsion and operation. These battery packs are crucial for the performance, range, and efficiency of electric trucks, buses, and vans.

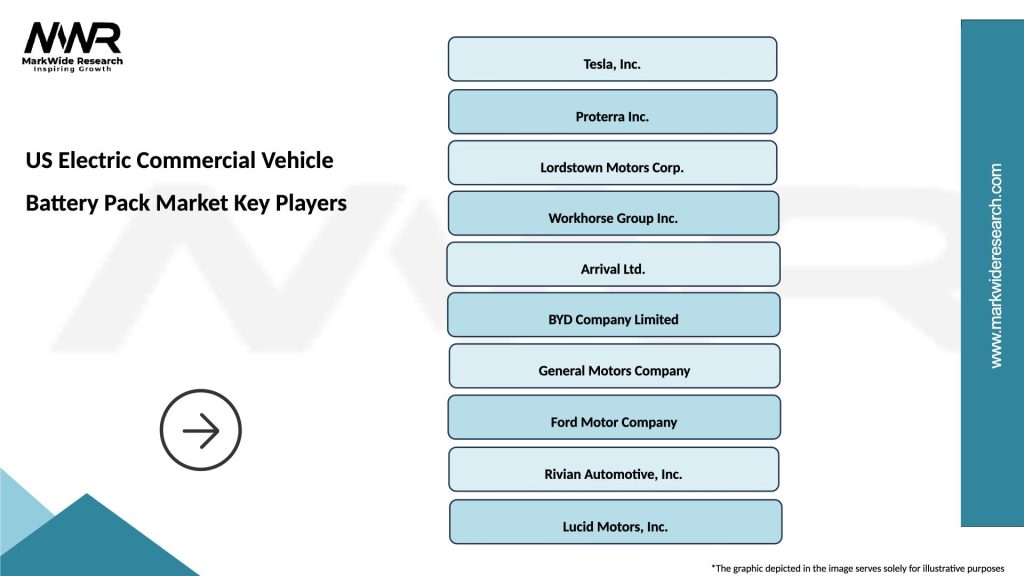

What are the key players in the US Electric Commercial Vehicle Battery Pack Market?

Key players in the US Electric Commercial Vehicle Battery Pack Market include Tesla, Proterra, and Rivian, which are known for their innovative battery technologies and electric vehicle solutions. Other notable companies include BYD and Workhorse Group, among others.

What are the growth factors driving the US Electric Commercial Vehicle Battery Pack Market?

The growth of the US Electric Commercial Vehicle Battery Pack Market is driven by increasing demand for sustainable transportation, government incentives for electric vehicles, and advancements in battery technology. Additionally, the rising cost of fossil fuels and the need for reduced emissions are significant factors.

What challenges does the US Electric Commercial Vehicle Battery Pack Market face?

The US Electric Commercial Vehicle Battery Pack Market faces challenges such as high initial costs of battery systems, limited charging infrastructure, and concerns over battery lifespan and recycling. These factors can hinder widespread adoption and market growth.

What opportunities exist in the US Electric Commercial Vehicle Battery Pack Market?

Opportunities in the US Electric Commercial Vehicle Battery Pack Market include the development of new battery technologies, such as solid-state batteries, and the expansion of charging networks. Additionally, increasing investments in electric commercial vehicles by logistics and transportation companies present significant growth potential.

What trends are shaping the US Electric Commercial Vehicle Battery Pack Market?

Trends shaping the US Electric Commercial Vehicle Battery Pack Market include the shift towards electrification of fleets, advancements in battery management systems, and the integration of renewable energy sources for charging. Furthermore, there is a growing focus on sustainability and reducing the carbon footprint of commercial transportation.

US Electric Commercial Vehicle Battery Pack Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid State, Lead Acid |

| End User | Logistics, Public Transport, Delivery Services, Construction |

| Technology | Fast Charging, Regenerative Braking, Battery Management Systems, Thermal Management |

| Capacity | 100 kWh, 200 kWh, 300 kWh, 400 kWh |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Electric Commercial Vehicle Battery Pack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at