444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US e-commerce market represents one of the most dynamic and rapidly evolving sectors in the global digital economy. This comprehensive marketplace encompasses online retail transactions, digital payment systems, and electronic commerce platforms that facilitate the buying and selling of goods and services through internet-based channels. Market dynamics indicate unprecedented growth driven by changing consumer behaviors, technological advancements, and the widespread adoption of mobile commerce solutions.

Digital transformation has fundamentally reshaped how American consumers interact with retailers, creating a robust ecosystem that spans multiple industries and demographic segments. The market demonstrates remarkable resilience and adaptability, with growth rates consistently outpacing traditional retail channels. Consumer preferences have shifted dramatically toward online shopping experiences, particularly accelerated by recent global events that emphasized the importance of digital commerce infrastructure.

Technology integration continues to drive innovation within the sector, with artificial intelligence, machine learning, and advanced analytics playing crucial roles in personalizing customer experiences and optimizing supply chain operations. The market encompasses various segments including business-to-consumer (B2C), business-to-business (B2B), and consumer-to-consumer (C2C) transactions, each contributing to the overall market expansion at impressive rates exceeding 12% annual growth in key categories.

The US e-commerce market refers to the comprehensive ecosystem of online commercial activities where businesses and consumers engage in buying and selling products and services through digital platforms and internet-based technologies. This market encompasses all electronic transactions conducted via websites, mobile applications, social media platforms, and other digital channels that facilitate commercial exchanges without requiring physical presence at traditional brick-and-mortar locations.

E-commerce platforms serve as the foundation for this digital marketplace, providing the technological infrastructure necessary for product catalogs, payment processing, inventory management, and customer service operations. The market includes various business models such as direct-to-consumer sales, marketplace platforms, subscription services, and digital product offerings that collectively form the modern digital commerce landscape.

Market participants range from large multinational corporations and established retailers to small businesses and individual entrepreneurs who leverage digital technologies to reach customers across geographical boundaries. The ecosystem also includes supporting services such as payment processors, logistics providers, digital marketing agencies, and technology vendors that enable seamless online shopping experiences for millions of American consumers.

Strategic analysis reveals that the US e-commerce market continues to experience robust expansion across multiple sectors, driven by fundamental shifts in consumer behavior and technological innovation. Market penetration has reached significant levels, with online retail accounting for approximately 15% of total retail sales, demonstrating the substantial impact of digital commerce on the broader economy.

Key growth drivers include the widespread adoption of mobile commerce, improved logistics infrastructure, enhanced payment security, and the integration of artificial intelligence in customer experience optimization. Consumer demographics show increasing participation across all age groups, with millennials and Generation Z leading adoption rates while older demographics demonstrate accelerating engagement with digital shopping platforms.

Competitive dynamics within the market reflect intense innovation and strategic positioning among major players, with companies investing heavily in technology infrastructure, fulfillment capabilities, and customer acquisition strategies. Market consolidation trends indicate that successful companies are those that effectively combine technological sophistication with operational excellence and customer-centric approaches.

Future projections suggest continued growth momentum, with emerging technologies such as augmented reality, voice commerce, and social shopping expected to drive the next wave of market expansion. Investment patterns show sustained capital allocation toward digital transformation initiatives, indicating strong confidence in the long-term viability and growth potential of the e-commerce sector.

Market intelligence reveals several critical insights that define the current state and future trajectory of the US e-commerce landscape. These insights provide valuable understanding of market dynamics, consumer behavior patterns, and technological trends shaping the industry.

Primary market drivers propelling the US e-commerce sector forward encompass technological, social, and economic factors that create favorable conditions for continued growth and innovation. These drivers represent fundamental forces reshaping the retail landscape and consumer behavior patterns.

Digital native generations entering their peak spending years bring inherent comfort with online shopping platforms and expectations for seamless digital experiences. Technological advancement in areas such as artificial intelligence, machine learning, and data analytics enables increasingly sophisticated personalization and customer service capabilities that enhance the overall shopping experience.

Infrastructure improvements in logistics and fulfillment networks support faster delivery times and expanded geographic reach, making e-commerce accessible to previously underserved markets. Payment innovation through digital wallets, buy-now-pay-later services, and cryptocurrency integration reduces friction in the purchasing process and appeals to diverse consumer preferences.

Economic factors including urbanization trends, dual-income households, and time-constrained lifestyles create demand for convenient shopping solutions that e-commerce platforms effectively address. Global connectivity and improved internet infrastructure ensure reliable access to online shopping platforms across diverse geographic and demographic segments.

Competitive pricing enabled by reduced overhead costs and direct-to-consumer models allows e-commerce retailers to offer attractive value propositions compared to traditional retail channels. Product variety and availability through online platforms exceed what physical stores can typically offer, creating compelling reasons for consumers to embrace digital shopping alternatives.

Market challenges within the US e-commerce sector present obstacles that companies must navigate to achieve sustainable growth and profitability. These restraints reflect both systemic issues and evolving market conditions that impact industry participants across various segments.

Cybersecurity concerns remain a significant barrier to consumer adoption, with data breaches and privacy violations creating hesitation among potential customers who prioritize personal information security. Logistics complexity associated with last-mile delivery, returns processing, and inventory management creates operational challenges that require substantial investment and expertise to address effectively.

Regulatory compliance requirements across different states and jurisdictions create complexity for e-commerce operators, particularly regarding sales tax collection, consumer protection laws, and data privacy regulations. Customer acquisition costs continue to rise as digital advertising becomes more competitive and expensive, pressuring profit margins and requiring more sophisticated marketing strategies.

Technology infrastructure demands require continuous investment in platform development, security measures, and performance optimization to meet evolving consumer expectations and competitive pressures. Supply chain disruptions can significantly impact e-commerce operations, affecting inventory availability, shipping times, and customer satisfaction levels.

Market saturation in certain segments creates intense competition that pressures pricing strategies and requires differentiation through value-added services or unique product offerings. Consumer behavior variations across different demographic groups necessitate tailored approaches that increase operational complexity and resource requirements.

Emerging opportunities within the US e-commerce market present significant potential for growth and innovation, driven by technological advancement, changing consumer preferences, and evolving market dynamics. These opportunities represent areas where forward-thinking companies can establish competitive advantages and capture market share.

Artificial intelligence integration offers opportunities to enhance customer experiences through improved product recommendations, chatbot customer service, and predictive analytics that anticipate consumer needs. Augmented reality technology enables virtual try-on experiences and product visualization that bridge the gap between online and in-store shopping experiences.

Sustainability initiatives create opportunities for companies to differentiate themselves through environmentally conscious practices, sustainable packaging, and carbon-neutral shipping options that appeal to environmentally aware consumers. Niche market specialization allows smaller players to compete effectively by focusing on specific product categories or customer segments with tailored offerings.

International expansion through cross-border e-commerce platforms enables US companies to access global markets while foreign companies can tap into the lucrative American consumer base. B2B e-commerce development represents a substantial opportunity as business customers increasingly expect consumer-grade digital experiences in their professional purchasing activities.

Voice commerce and Internet of Things integration create new channels for customer engagement and automated purchasing that can drive recurring revenue and customer loyalty. Social commerce expansion through platforms like Instagram, TikTok, and Facebook provides direct sales opportunities within social media environments where consumers already spend significant time.

Market dynamics within the US e-commerce sector reflect the complex interplay of technological innovation, consumer behavior evolution, and competitive forces that continuously reshape the industry landscape. According to MarkWide Research analysis, these dynamics create both challenges and opportunities for market participants across different segments and business models.

Consumer expectations continue to evolve rapidly, with demands for faster delivery, personalized experiences, and seamless omnichannel integration driving operational requirements and investment priorities. Technology adoption cycles accelerate as companies race to implement cutting-edge solutions that enhance customer experiences and operational efficiency.

Competitive intensity increases as traditional retailers expand their digital presence while pure-play e-commerce companies diversify into new product categories and services. Market fragmentation occurs simultaneously with consolidation trends, creating opportunities for specialized players while larger companies acquire complementary capabilities and market share.

Supply chain evolution toward more distributed and flexible models enables faster fulfillment and reduced costs, while also creating new dependencies and risk factors that companies must manage effectively. Payment ecosystem development introduces new options and security measures that enhance transaction convenience while requiring ongoing adaptation to emerging technologies and consumer preferences.

Regulatory landscape changes impact operational requirements and compliance costs, particularly in areas such as data privacy, consumer protection, and taxation policies that vary across different jurisdictions and continue to evolve.

Comprehensive research methodology employed in analyzing the US e-commerce market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of insights and projections. The methodology combines quantitative analysis with qualitative assessment to provide a holistic understanding of market dynamics and trends.

Primary research involves direct engagement with industry participants through surveys, interviews, and focus groups that capture firsthand insights from e-commerce executives, technology providers, logistics companies, and consumer representatives. Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and academic studies that provide historical context and market intelligence.

Data collection processes utilize both traditional market research techniques and advanced digital analytics tools that monitor online behavior, transaction patterns, and social media sentiment to understand consumer preferences and market trends. Statistical analysis employs sophisticated modeling techniques to identify correlations, predict future trends, and validate research findings through multiple analytical approaches.

Market segmentation analysis examines different customer demographics, product categories, business models, and geographic regions to understand variations in market behavior and growth patterns. Competitive analysis evaluates company strategies, market positioning, financial performance, and innovation initiatives to assess competitive dynamics and market structure.

Validation procedures include cross-referencing multiple data sources, expert review processes, and sensitivity analysis to ensure research conclusions are robust and reliable for strategic decision-making purposes.

Regional market analysis reveals significant variations in e-commerce adoption, growth patterns, and consumer behavior across different geographic areas within the United States. These regional differences reflect local economic conditions, demographic characteristics, infrastructure development, and cultural preferences that influence online shopping patterns.

West Coast markets including California, Washington, and Oregon demonstrate the highest e-commerce penetration rates, with technology-savvy populations and robust digital infrastructure supporting advanced online shopping behaviors. California alone accounts for approximately 18% of total US e-commerce activity, driven by both high population density and above-average household incomes that support premium online shopping experiences.

Northeast corridor markets including New York, Massachusetts, and New Jersey show strong e-commerce adoption rates, particularly in urban areas where convenience and time-saving benefits of online shopping align with fast-paced lifestyles. Metropolitan areas in this region demonstrate higher adoption of same-day delivery services and premium e-commerce offerings.

Southeast markets exhibit rapid growth rates as infrastructure improvements and demographic changes create favorable conditions for e-commerce expansion. Texas and Florida represent particularly dynamic markets with diverse populations and growing technology sectors that support digital commerce development.

Midwest regions show steady adoption patterns with particular strength in B2B e-commerce segments related to manufacturing and agriculture industries. Rural markets across various regions increasingly embrace e-commerce as a solution to limited local retail options, driving growth in categories such as home goods, apparel, and specialty products.

Competitive dynamics within the US e-commerce market reflect intense rivalry among established players, emerging disruptors, and traditional retailers expanding their digital presence. The landscape encompasses various business models and strategic approaches that create a complex and rapidly evolving competitive environment.

Market positioning strategies vary significantly among competitors, with some focusing on price leadership, others emphasizing customer experience, and many pursuing differentiation through specialized product offerings or unique value propositions.

Market segmentation within the US e-commerce sector reveals distinct categories based on various criteria including business model, product type, customer demographics, and transaction characteristics. This segmentation provides insight into different market dynamics and growth opportunities across the e-commerce ecosystem.

By Business Model:

By Product Category:

By Customer Demographics:

Category analysis reveals distinct characteristics, growth patterns, and competitive dynamics across different product segments within the US e-commerce market. Each category demonstrates unique consumer behavior patterns, operational requirements, and strategic considerations that influence business success.

Electronics and Technology category maintains strong performance with consumers comfortable purchasing high-value items online due to standardized specifications and comprehensive product information. Mobile devices, computers, and gaming equipment show particularly strong online adoption rates, with consumer electronics representing approximately 22% of total e-commerce volume in this segment.

Apparel and Fashion segment demonstrates rapid growth as retailers overcome traditional barriers through improved size guides, virtual fitting technologies, and generous return policies. Fast fashion and direct-to-consumer brands particularly benefit from online channels that enable rapid product launches and targeted marketing campaigns.

Home and Garden category experiences significant growth driven by home improvement trends and the convenience of online furniture shopping. Home décor, furniture, and appliances benefit from detailed product visualization tools and augmented reality applications that help consumers make confident purchasing decisions.

Health and Beauty products show strong online adoption with subscription models and personalized product recommendations driving customer loyalty and repeat purchases. Skincare and cosmetics particularly benefit from social media integration and influencer marketing strategies that drive discovery and conversion.

Grocery and Food delivery services experience accelerated adoption with improved logistics capabilities and changing consumer preferences toward convenient shopping options. Meal kits and specialty food products demonstrate particularly strong growth in online channels.

Industry participants across the US e-commerce ecosystem realize substantial benefits from the continued growth and evolution of digital commerce platforms. These benefits extend beyond immediate financial returns to include strategic advantages, operational efficiencies, and market positioning improvements.

Retailers and Merchants benefit from expanded market reach that transcends geographical limitations, enabling access to customers across the entire United States and potentially global markets. Operational efficiency improvements through automated processes, data-driven inventory management, and streamlined customer service reduce costs while improving service quality.

Technology Providers experience increased demand for e-commerce platforms, payment processing solutions, logistics software, and customer experience tools that support the growing digital commerce ecosystem. Innovation opportunities in areas such as artificial intelligence, augmented reality, and blockchain technology create new revenue streams and competitive advantages.

Logistics Companies benefit from increased shipping volumes and demand for specialized services such as same-day delivery, returns processing, and inventory management. Last-mile delivery innovations create opportunities for new business models and service differentiation.

Financial Services providers gain from increased transaction volumes, demand for digital payment solutions, and opportunities to offer specialized financing products such as buy-now-pay-later services. Fraud prevention and security services become increasingly valuable as transaction volumes grow.

Consumers enjoy enhanced convenience, broader product selection, competitive pricing, and personalized shopping experiences that traditional retail channels often cannot match. Time savings and accessibility benefits particularly appeal to busy professionals and consumers in underserved geographic areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the US e-commerce market reflect technological advancement, changing consumer preferences, and evolving business models that define the future direction of digital commerce. These trends represent both opportunities and challenges for industry participants across different segments.

Mobile-First Commerce continues to dominate with smartphone transactions accounting for an increasing share of total e-commerce activity. Progressive web applications and mobile-optimized experiences become essential for competitive success as consumers expect seamless functionality across all devices.

Social Commerce Integration transforms social media platforms into direct sales channels, with Instagram Shopping, Facebook Marketplace, and TikTok Commerce enabling discovery and purchase within social environments. Influencer partnerships and user-generated content drive authentic product recommendations and social proof.

Artificial Intelligence Personalization enables increasingly sophisticated customer experiences through predictive analytics, chatbot customer service, and dynamic pricing strategies. Machine learning algorithms improve product recommendations and inventory management while reducing operational costs.

Sustainability Initiatives gain importance as environmentally conscious consumers prioritize eco-friendly packaging, carbon-neutral shipping, and sustainable product sourcing. Circular economy models including product refurbishment and recycling programs create new revenue streams.

Voice Commerce emerges as a significant channel through smart speakers and virtual assistants that enable hands-free shopping experiences. Voice search optimization becomes crucial for product discovery and brand visibility in this growing segment.

Recent industry developments demonstrate the dynamic nature of the US e-commerce market, with major companies, technology providers, and regulatory bodies implementing changes that reshape competitive dynamics and market structure. These developments reflect ongoing innovation and adaptation within the sector.

Platform Expansion initiatives by major retailers include the development of marketplace capabilities, third-party seller programs, and advertising platforms that create additional revenue streams while expanding product selection. Omnichannel integration projects connect online and offline operations through buy-online-pickup-in-store services, curbside delivery, and unified inventory systems.

Technology Acquisitions by e-commerce companies focus on artificial intelligence capabilities, logistics automation, and customer experience enhancement tools that provide competitive advantages. Strategic partnerships between retailers, technology companies, and logistics providers create integrated solutions that improve operational efficiency.

Regulatory Developments include new data privacy regulations, sales tax collection requirements, and antitrust investigations that impact business operations and strategic planning. International trade policies affect cross-border e-commerce operations and supply chain strategies.

Infrastructure Investments in fulfillment centers, delivery networks, and technology platforms support capacity expansion and service improvement initiatives. Sustainability programs including electric delivery vehicles, renewable energy adoption, and packaging reduction demonstrate corporate responsibility commitments.

Payment Innovation through digital wallets, cryptocurrency acceptance, and buy-now-pay-later services expand payment options and reduce transaction friction for consumers across different demographic segments.

Strategic recommendations for e-commerce market participants emphasize the importance of technological innovation, customer experience optimization, and operational excellence in maintaining competitive advantages within the evolving digital commerce landscape. MWR analysis indicates that successful companies will be those that effectively balance growth investments with profitability considerations.

Technology Investment priorities should focus on artificial intelligence capabilities, mobile optimization, and data analytics platforms that enable personalized customer experiences and operational efficiency improvements. Cybersecurity measures require continuous attention and investment to protect customer data and maintain trust in digital transactions.

Customer Experience enhancement through omnichannel integration, faster delivery options, and superior customer service creates sustainable competitive advantages that drive customer loyalty and repeat purchases. Personalization capabilities using customer data and behavioral analytics improve conversion rates and average order values.

Operational Excellence in areas such as inventory management, supply chain optimization, and fulfillment efficiency directly impacts profitability and customer satisfaction. Automation technologies in warehousing, customer service, and marketing processes reduce costs while improving service quality.

Market Expansion strategies should consider both geographic expansion within the United States and international market entry opportunities that leverage existing capabilities and infrastructure investments. Category diversification enables revenue growth while reducing dependence on specific product segments.

Partnership Development with complementary service providers, technology companies, and logistics partners creates synergies that enhance competitive positioning while sharing investment costs and risks associated with market expansion initiatives.

Future projections for the US e-commerce market indicate continued robust growth driven by technological innovation, demographic shifts, and evolving consumer preferences that favor digital shopping experiences. Market evolution will likely accelerate as emerging technologies mature and become more widely adopted across different industry segments.

Growth trajectory analysis suggests that e-commerce will continue gaining market share relative to traditional retail channels, with online penetration rates expected to reach 25% of total retail sales within the next five years. Mobile commerce will likely account for an even larger proportion of online transactions as smartphone capabilities and user experiences continue improving.

Technology integration will deepen with artificial intelligence, augmented reality, and Internet of Things devices creating more immersive and convenient shopping experiences. Voice commerce and social commerce channels will mature into significant revenue drivers as consumer adoption increases and platform capabilities expand.

Market consolidation trends may continue as successful companies acquire complementary capabilities and smaller players, while new entrants focus on niche markets or innovative business models. International expansion opportunities will grow as cross-border e-commerce infrastructure and regulatory frameworks continue developing.

Sustainability considerations will become increasingly important competitive factors as environmental consciousness influences consumer purchasing decisions and regulatory requirements evolve. Supply chain resilience and operational flexibility will remain critical success factors in managing market volatility and disruption risks.

Investment patterns will likely favor companies that demonstrate strong unit economics, sustainable competitive advantages, and clear paths to profitability while maintaining growth momentum in an increasingly competitive market environment.

The US e-commerce market represents a dynamic and rapidly evolving sector that continues to transform the retail landscape through technological innovation, changing consumer behaviors, and competitive dynamics. Market fundamentals remain strong with robust growth rates, increasing consumer adoption, and continuous infrastructure improvements supporting long-term expansion prospects.

Strategic success in this market requires companies to balance multiple priorities including technology investment, customer experience optimization, operational efficiency, and sustainable business practices. Competitive advantages increasingly depend on the ability to integrate advanced technologies with superior customer service and operational excellence across all touchpoints.

Future opportunities abound for companies that can effectively navigate the challenges of cybersecurity, regulatory compliance, and intense competition while capitalizing on emerging trends such as social commerce, voice shopping, and artificial intelligence personalization. The US e-commerce market will continue serving as a global benchmark for digital commerce innovation and consumer experience excellence, creating substantial value for participants who adapt successfully to its evolving demands and opportunities.

What is e-commerce?

E-commerce refers to the buying and selling of goods and services over the internet. It encompasses various online transactions, including retail sales, digital downloads, and online services.

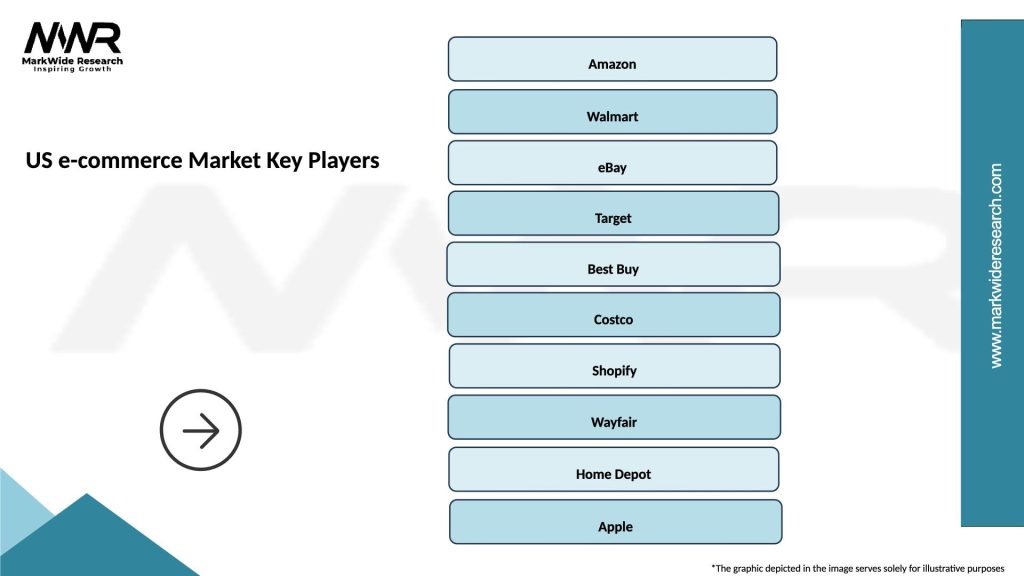

What are the key players in the US e-commerce Market?

Key players in the US e-commerce market include Amazon, eBay, and Walmart, which dominate online retail. Other notable companies include Shopify and Target, among others.

What are the main drivers of growth in the US e-commerce Market?

The main drivers of growth in the US e-commerce market include the increasing adoption of smartphones, the rise of social media shopping, and the growing preference for online shopping due to convenience and variety.

What challenges does the US e-commerce Market face?

Challenges in the US e-commerce market include intense competition, cybersecurity threats, and logistical issues related to shipping and returns. These factors can impact customer satisfaction and operational efficiency.

What opportunities exist in the US e-commerce Market?

Opportunities in the US e-commerce market include the expansion of subscription services, the growth of personalized shopping experiences, and the increasing use of artificial intelligence for customer service and inventory management.

What trends are shaping the US e-commerce Market?

Trends shaping the US e-commerce market include the rise of mobile commerce, the integration of augmented reality in shopping experiences, and the increasing focus on sustainability in packaging and delivery practices.

US e-commerce Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electronics, Apparel, Home Goods, Beauty Products |

| Customer Type | Millennials, Gen Z, Baby Boomers, Professionals |

| Distribution Channel | Online Marketplaces, Brand Websites, Social Media, Mobile Apps |

| Price Tier | Budget, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US e-commerce Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at