444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US e-commerce logistics market represents a dynamic and rapidly evolving sector that serves as the backbone of digital commerce operations across the United States. This comprehensive market encompasses warehousing, transportation, order fulfillment, last-mile delivery, and supply chain management services specifically designed to support online retail activities. Market dynamics indicate robust expansion driven by increasing consumer demand for fast, reliable delivery services and the continuous growth of online shopping behaviors.

Digital transformation has fundamentally reshaped logistics operations, with companies investing heavily in automation, artificial intelligence, and advanced tracking systems. The market demonstrates significant growth potential with projected expansion at a 12.5% CAGR through the forecast period. Consumer expectations for same-day and next-day delivery options continue to drive innovation in logistics infrastructure, creating opportunities for both established players and emerging technology providers.

Regional distribution shows concentrated activity in major metropolitan areas, with California, Texas, and New York accounting for approximately 45% of total market activity. The integration of omnichannel strategies has become essential, as retailers seek to optimize inventory management across multiple touchpoints while maintaining cost-effective operations.

The US e-commerce logistics market refers to the comprehensive ecosystem of services, technologies, and infrastructure that enables the efficient movement, storage, and delivery of goods purchased through online channels. This market encompasses all logistical activities from the point of order placement to final delivery at the customer’s doorstep, including inventory management, order processing, packaging, shipping, and returns handling.

Core components include fulfillment centers, distribution networks, transportation services, technology platforms, and last-mile delivery solutions. The market serves various stakeholders including online retailers, third-party logistics providers, shipping carriers, technology vendors, and ultimately, end consumers who demand seamless shopping experiences.

Market leadership in the US e-commerce logistics sector is characterized by intense competition and continuous innovation. The landscape features established logistics giants, emerging technology companies, and specialized service providers all vying for market share in this rapidly expanding sector. Key performance indicators demonstrate strong momentum with delivery speed improvements of 35% over the past three years and customer satisfaction rates reaching 78% for premium delivery services.

Strategic investments in automation and robotics have transformed traditional warehouse operations, with many facilities achieving 40% efficiency improvements through advanced sorting systems and AI-powered inventory management. The integration of sustainable practices has become increasingly important, with 62% of major logistics providers implementing green delivery initiatives to meet environmental regulations and consumer preferences.

Competitive differentiation now centers on delivery speed, cost optimization, and service reliability. Companies are expanding their fulfillment networks closer to population centers, reducing average delivery times while managing operational costs. The market continues to attract significant investment in infrastructure development and technology advancement.

Market intelligence reveals several critical insights that define the current state and future trajectory of US e-commerce logistics:

Consumer behavior shifts represent the primary catalyst driving US e-commerce logistics market expansion. The permanent adoption of online shopping habits, accelerated by recent global events, has created sustained demand for reliable delivery services. Convenience expectations continue to rise, with consumers increasingly willing to pay premium prices for faster delivery options and flexible scheduling.

Technological advancement serves as another crucial driver, enabling logistics providers to offer more sophisticated services while optimizing operational efficiency. Machine learning algorithms improve route optimization, predictive analytics enhance inventory management, and IoT sensors provide real-time visibility throughout the supply chain. These innovations directly translate to improved service quality and reduced operational costs.

Retail digitization accelerates market growth as traditional brick-and-mortar retailers expand their online presence. This omnichannel approach requires integrated logistics solutions that can seamlessly handle both online orders and in-store fulfillment. Small and medium enterprises are increasingly leveraging third-party logistics services to compete with larger retailers, expanding the addressable market for specialized providers.

Geographic expansion into previously underserved markets creates new opportunities for logistics providers. Rural and suburban areas are experiencing improved delivery coverage as companies invest in expanding their network reach to capture additional market share.

Infrastructure limitations pose significant challenges to market expansion, particularly in densely populated urban areas where traffic congestion and limited parking affect delivery efficiency. The existing transportation network struggles to accommodate the increasing volume of delivery vehicles, leading to longer delivery times and higher operational costs during peak periods.

Labor shortages continue to impact the logistics sector, with high turnover rates and difficulty recruiting qualified drivers and warehouse workers. This challenge is particularly acute for last-mile delivery services, where driver availability directly affects service capacity and reliability. Wage pressures resulting from labor market tightness contribute to increased operational expenses.

Regulatory compliance requirements add complexity and cost to logistics operations. Environmental regulations, safety standards, and local delivery restrictions vary significantly across different jurisdictions, requiring companies to adapt their operations accordingly. Data privacy regulations also impact how logistics providers can collect and utilize customer information for service optimization.

Rising fuel costs and transportation expenses directly impact profit margins, particularly for companies offering free or low-cost shipping options. Economic volatility and supply chain disruptions can create unpredictable cost fluctuations that challenge long-term planning and pricing strategies.

Emerging technologies present substantial opportunities for market participants to differentiate their services and improve operational efficiency. Autonomous delivery vehicles, drone technology, and advanced robotics offer potential solutions to current logistics challenges while opening new service possibilities. Early adopters of these technologies can establish competitive advantages and capture premium market segments.

Sustainability initiatives create opportunities for companies to align with environmental goals while potentially reducing operational costs. Electric vehicle fleets, renewable energy-powered facilities, and optimized routing algorithms can appeal to environmentally conscious consumers while improving long-term cost structures. Green logistics services command premium pricing in many market segments.

Rural market penetration represents an underserved opportunity as logistics providers expand coverage to previously challenging delivery areas. Innovative solutions such as consolidated delivery points and flexible pickup options can make rural delivery economically viable while serving growing e-commerce demand in these regions.

International expansion opportunities exist for US-based logistics providers to leverage their expertise in global markets. Cross-border e-commerce growth creates demand for integrated international shipping solutions that can navigate complex customs and regulatory requirements while maintaining service quality standards.

Competitive intensity continues to escalate as traditional logistics companies, technology startups, and retail giants compete for market share. This competition drives continuous innovation in service offerings, pricing strategies, and operational efficiency. Market consolidation trends are emerging as larger players acquire specialized companies to expand their capabilities and geographic reach.

Customer expectations evolve rapidly, with delivery speed, reliability, and transparency becoming baseline requirements rather than differentiators. Companies must continuously invest in service improvements to maintain competitive positioning. Personalization demands are increasing, with customers expecting customized delivery options and communication preferences.

Technology integration accelerates across all market segments, with artificial intelligence, machine learning, and predictive analytics becoming essential tools for operational optimization. Data analytics capabilities enable more sophisticated demand forecasting, route optimization, and inventory management, directly impacting service quality and cost efficiency.

Partnership strategies are becoming increasingly important as companies seek to leverage complementary capabilities rather than building all services internally. Strategic alliances between logistics providers, technology companies, and retailers create synergies that benefit all stakeholders while improving end-customer experiences.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, logistics managers, technology providers, and key stakeholders across the e-commerce logistics value chain. Survey data collection from both service providers and end customers provides insights into market trends, satisfaction levels, and future requirements.

Secondary research incorporates analysis of industry reports, financial statements, regulatory filings, and trade publications to validate primary findings and identify broader market patterns. Quantitative analysis utilizes statistical modeling to project market trends and growth trajectories based on historical data and current market indicators.

Market segmentation analysis examines different service categories, geographic regions, and customer segments to identify specific growth opportunities and competitive dynamics. Competitive intelligence gathering includes monitoring of company announcements, service launches, pricing changes, and strategic partnerships to understand market positioning and competitive strategies.

Technology assessment evaluates emerging innovations and their potential market impact through expert interviews, patent analysis, and pilot program monitoring. This approach ensures comprehensive coverage of both current market conditions and future development trajectories.

West Coast dominance characterizes the US e-commerce logistics market, with California leading in both market activity and innovation adoption. The region benefits from proximity to major ports, technology hubs, and dense population centers that support efficient logistics operations. Los Angeles and San Francisco serve as critical distribution nodes for both domestic and international shipments.

East Coast markets demonstrate strong growth, particularly in the New York metropolitan area and surrounding regions. The concentration of financial centers, corporate headquarters, and affluent consumer populations drives demand for premium logistics services. Regional distribution centers in Pennsylvania, New Jersey, and Virginia support efficient coverage of major East Coast markets.

Central regions are experiencing rapid expansion as logistics providers establish strategic fulfillment centers to optimize nationwide delivery capabilities. Texas, Illinois, and Ohio have become critical logistics hubs due to their central geographic positions and transportation infrastructure. These locations enable two-day ground delivery to most US markets.

Southern markets show increasing importance, with Florida and Georgia serving as key distribution points for Southeast regional coverage. The region’s growing population and increasing e-commerce adoption rates create expanding opportunities for logistics service providers.

Market leadership is distributed among several categories of companies, each bringing different strengths and capabilities to the e-commerce logistics sector:

Competitive differentiation focuses on delivery speed, service reliability, technology integration, and cost efficiency. Companies are investing heavily in automation, artificial intelligence, and sustainable delivery solutions to maintain competitive advantages in this rapidly evolving market.

Service-based segmentation reveals distinct market categories with unique characteristics and growth patterns:

By Service Type:

By End-User Industry:

Warehousing and fulfillment services represent the foundation of e-commerce logistics operations, with companies investing heavily in automated sorting systems, robotics, and AI-powered inventory management. Fulfillment center efficiency improvements of 25-30% are being achieved through advanced technology integration. Strategic location selection near major population centers reduces shipping costs and delivery times.

Last-mile delivery solutions continue to evolve rapidly, with innovative approaches including drone delivery trials, autonomous vehicle testing, and crowd-sourced delivery networks. Same-day delivery availability has expanded to cover 75% of major metropolitan areas, driven by consumer demand for immediate gratification. Flexible delivery options such as locker systems and pickup points address the challenge of failed delivery attempts.

Returns management has become increasingly sophisticated as online retailers recognize the importance of seamless return experiences for customer retention. Reverse logistics optimization reduces processing time and costs while improving customer satisfaction. Advanced analytics help predict return patterns and optimize inventory management accordingly.

Cross-border e-commerce logistics presents both opportunities and challenges as US retailers expand internationally and foreign retailers enter the US market. Compliance with customs regulations, duty management, and international shipping coordination require specialized expertise and technology platforms.

Online retailers benefit from access to sophisticated logistics capabilities without requiring significant capital investment in infrastructure. Third-party logistics providers offer scalable solutions that can accommodate seasonal demand fluctuations and business growth. Cost optimization through shared resources and economies of scale enables smaller retailers to compete effectively with larger competitors.

Logistics service providers gain access to growing market opportunities driven by e-commerce expansion. Technology investments in automation and analytics create competitive advantages while improving operational efficiency. Revenue diversification across multiple client segments reduces business risk and creates stable cash flows.

Technology vendors find expanding opportunities to provide specialized solutions for logistics optimization, inventory management, and customer communication. The integration of artificial intelligence, machine learning, and IoT technologies creates new revenue streams and partnership opportunities.

End consumers benefit from improved delivery speed, reliability, and convenience options. Enhanced tracking capabilities and flexible delivery choices improve the overall shopping experience. Competitive pricing results from market competition and operational efficiency improvements across the logistics sector.

Economic stakeholders benefit from job creation in logistics, technology, and related sectors. Infrastructure investment stimulates local economic development and supports broader supply chain resilience.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration continues to transform logistics operations, with robotic systems handling increasing percentages of warehouse tasks. Artificial intelligence integration optimizes routing, inventory management, and demand forecasting, resulting in improved efficiency and reduced operational costs. Machine learning algorithms continuously improve performance through data analysis and pattern recognition.

Sustainability focus drives adoption of electric delivery vehicles, renewable energy systems, and carbon-neutral shipping options. Environmental consciousness among consumers creates market demand for green logistics solutions, while regulatory pressures encourage sustainable practices. Companies are investing in alternative fuel technologies and optimized routing to reduce environmental impact.

Micro-fulfillment expansion brings inventory closer to consumers through smaller, strategically located distribution centers. This approach enables faster delivery times while reducing transportation costs and environmental impact. Urban fulfillment centers integrate with existing retail locations to create omnichannel capabilities.

Real-time visibility becomes standard expectation as customers demand precise delivery tracking and communication. Advanced tracking systems provide detailed shipment information and enable proactive issue resolution. Predictive analytics help anticipate potential delivery problems and implement preventive measures.

Strategic partnerships between logistics providers and technology companies accelerate innovation adoption and capability expansion. Recent collaborations focus on autonomous vehicle development, drone delivery systems, and advanced analytics platforms. These partnerships enable companies to access specialized expertise while sharing development costs and risks.

Infrastructure investments continue across the sector, with major players expanding fulfillment center networks and upgrading existing facilities with advanced automation systems. MarkWide Research analysis indicates significant capital allocation toward technology integration and capacity expansion to meet growing demand.

Regulatory developments impact operations as governments address environmental concerns, labor standards, and safety requirements. New regulations regarding autonomous vehicles, drone operations, and data privacy require companies to adapt their strategies and operational procedures accordingly.

Market consolidation accelerates as larger companies acquire specialized providers to expand their service capabilities and geographic coverage. These acquisitions enable rapid scaling of innovative solutions and integration of complementary technologies.

Technology investment should focus on solutions that provide measurable operational improvements and competitive differentiation. Companies should prioritize automation technologies that address specific pain points such as labor shortages, processing speed, and accuracy requirements. Phased implementation approaches reduce risk while enabling continuous learning and optimization.

Geographic expansion strategies should consider both market opportunity and operational feasibility. Rural markets present growth potential but require innovative delivery solutions to achieve economic viability. Partnership approaches may be more effective than direct investment in challenging markets.

Sustainability initiatives should align with both regulatory requirements and customer preferences while considering long-term cost implications. Electric vehicle adoption, renewable energy integration, and carbon offset programs can provide competitive advantages while supporting environmental goals.

Customer experience optimization requires continuous monitoring of satisfaction metrics and proactive service improvements. Companies should invest in communication systems, tracking capabilities, and flexible delivery options to meet evolving consumer expectations.

Market evolution will be characterized by continued technology integration, sustainability focus, and service innovation. MWR projections indicate sustained growth driven by e-commerce expansion and evolving consumer expectations. The integration of artificial intelligence, robotics, and autonomous systems will fundamentally transform logistics operations over the next decade.

Competitive dynamics will intensify as traditional boundaries between retailers, logistics providers, and technology companies continue to blur. Companies that successfully integrate advanced technologies while maintaining cost efficiency will capture increasing market share. Innovation cycles will accelerate, requiring continuous adaptation and investment.

Regulatory environment will likely become more complex as governments address environmental concerns, labor issues, and safety requirements related to emerging technologies. Companies must develop compliance capabilities while advocating for reasonable regulatory frameworks that support innovation.

Consumer expectations will continue evolving toward faster delivery, greater convenience, and environmental responsibility. The market will reward companies that can deliver superior customer experiences while maintaining operational efficiency and sustainable practices.

The US e-commerce logistics market represents a dynamic and rapidly evolving sector that continues to transform in response to changing consumer behaviors, technological advancement, and competitive pressures. Market fundamentals remain strong, supported by sustained e-commerce growth, infrastructure investment, and continuous innovation in service delivery.

Strategic success in this market requires balancing operational efficiency with service quality while adapting to emerging technologies and evolving customer expectations. Companies that invest in automation, sustainability, and customer experience optimization will be best positioned to capture growth opportunities and maintain competitive advantages.

Future market development will be shaped by technology integration, regulatory evolution, and changing consumer preferences. The sector’s ability to address current challenges while embracing innovation will determine long-term growth trajectories and competitive positioning in the broader logistics industry.

What is E-commerce Logistics?

E-commerce logistics refers to the process of managing the flow of goods and services from the point of origin to the end consumer in the online retail space. It encompasses warehousing, inventory management, order fulfillment, and shipping, all tailored to meet the demands of e-commerce businesses.

What are the key players in the US E-commerce Logistics Market?

Key players in the US E-commerce Logistics Market include companies like Amazon Logistics, FedEx, UPS, and DHL. These companies provide a range of services including last-mile delivery, warehousing solutions, and supply chain management, among others.

What are the main drivers of growth in the US E-commerce Logistics Market?

The main drivers of growth in the US E-commerce Logistics Market include the increasing adoption of online shopping, advancements in technology such as automation and AI, and the rising consumer expectations for faster delivery times. These factors are reshaping logistics strategies to enhance efficiency.

What challenges does the US E-commerce Logistics Market face?

The US E-commerce Logistics Market faces challenges such as rising transportation costs, supply chain disruptions, and the need for sustainable practices. Additionally, managing returns and maintaining service quality during peak seasons can be difficult for logistics providers.

What opportunities exist in the US E-commerce Logistics Market?

Opportunities in the US E-commerce Logistics Market include the growth of omnichannel retailing, the expansion of same-day delivery services, and the integration of innovative technologies like drones and robotics. These trends can enhance operational efficiency and customer satisfaction.

What trends are shaping the US E-commerce Logistics Market?

Trends shaping the US E-commerce Logistics Market include the increasing use of automation in warehouses, the rise of sustainable logistics practices, and the growing importance of data analytics for optimizing supply chains. These trends are driving significant changes in how logistics operations are conducted.

US E-commerce Logistics Market

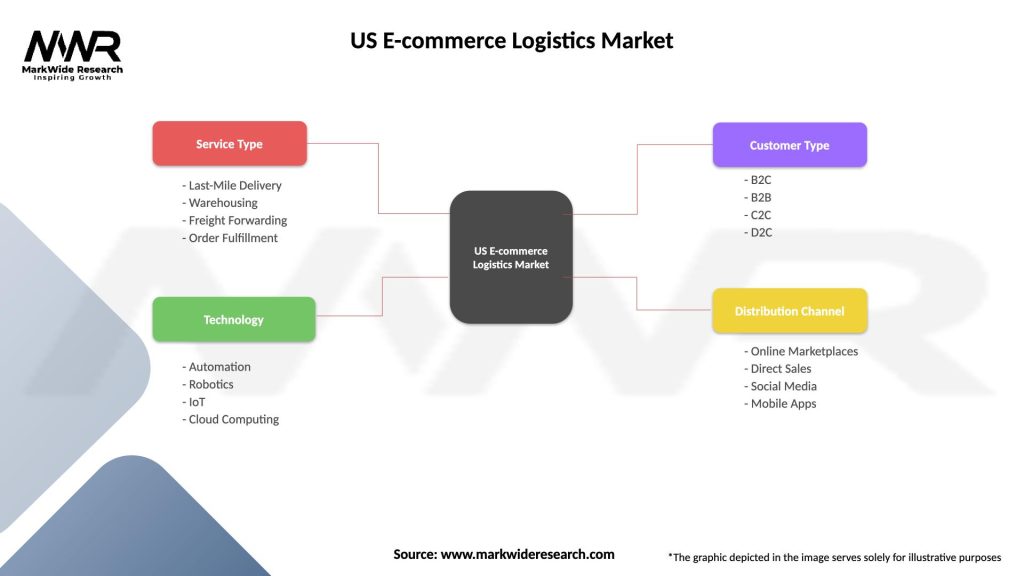

| Segmentation Details | Description |

|---|---|

| Service Type | Last-Mile Delivery, Warehousing, Freight Forwarding, Order Fulfillment |

| Technology | Automation, Robotics, IoT, Cloud Computing |

| Customer Type | B2C, B2B, C2C, D2C |

| Distribution Channel | Online Marketplaces, Direct Sales, Social Media, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US E-commerce Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at