444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US distributed solar power generation market represents a transformative segment of America’s renewable energy landscape, characterized by decentralized solar installations across residential, commercial, and industrial sectors. Distributed solar systems encompass rooftop installations, community solar gardens, and small-scale ground-mounted arrays that generate electricity close to the point of consumption, reducing transmission losses and enhancing grid resilience.

Market dynamics indicate robust expansion driven by declining solar panel costs, favorable net metering policies, and increasing environmental consciousness among consumers and businesses. The sector has experienced remarkable growth, with annual installation rates increasing by approximately 15-20% across various market segments. Technological advancements in photovoltaic efficiency, energy storage integration, and smart inverter capabilities continue to enhance the attractiveness of distributed solar solutions.

Regional variations across the United States reflect diverse policy environments, solar resource availability, and utility rate structures. States like California, Texas, Florida, and North Carolina lead in distributed solar deployment, while emerging markets in the Northeast and Midwest show accelerating adoption rates. The market encompasses various stakeholder categories including residential homeowners, commercial property owners, utilities, and third-party solar developers.

The US distributed solar power generation market refers to the comprehensive ecosystem of small-scale solar photovoltaic installations that generate electricity at or near the point of consumption, typically ranging from residential rooftop systems to commercial and industrial installations under 20 megawatts capacity. Distributed generation contrasts with centralized utility-scale solar farms by emphasizing local energy production, grid integration flexibility, and customer ownership models.

Key characteristics of distributed solar systems include their modular nature, scalability, and ability to provide energy independence while contributing to grid stability. These systems typically feature net metering arrangements that allow excess electricity generation to be fed back into the grid, creating credits for system owners. Financing mechanisms such as solar leases, power purchase agreements, and direct ownership models have democratized access to solar technology across diverse customer segments.

Market participants include equipment manufacturers, installation contractors, financing companies, utilities, and end customers, creating a complex value chain that supports job creation and economic development. The distributed nature of these installations contributes to grid modernization efforts and supports the transition toward a more resilient and sustainable energy infrastructure.

Strategic market positioning reveals the US distributed solar power generation sector as a cornerstone of America’s clean energy transition, with cumulative installations representing approximately 40% of total solar capacity nationwide. The market demonstrates exceptional resilience and growth potential, supported by favorable economics, policy incentives, and technological innovation across multiple deployment segments.

Competitive dynamics showcase a mature ecosystem with established national players, regional specialists, and emerging technology providers competing across installation, financing, and equipment supply chains. Market consolidation trends indicate increasing integration between installation services, financing solutions, and energy management platforms, creating comprehensive customer value propositions.

Growth trajectories suggest continued expansion driven by declining system costs, which have decreased by approximately 70% over the past decade, making distributed solar increasingly competitive with traditional electricity sources. Policy support through federal tax credits, state renewable portfolio standards, and local incentive programs provides sustained market momentum across diverse geographic regions.

Future market evolution anticipates enhanced integration with energy storage systems, electric vehicle charging infrastructure, and smart home technologies, creating expanded value propositions for distributed solar investments. Grid modernization initiatives and utility business model evolution support increased distributed solar penetration while maintaining system reliability and customer service quality.

Market segmentation analysis reveals distinct growth patterns across residential, commercial, and community solar sectors, each characterized by unique customer motivations, financing structures, and deployment challenges. Residential installations continue to dominate market volume, driven by homeowner interest in energy independence and long-term cost savings.

Technological convergence with energy storage, electric vehicle infrastructure, and building automation systems creates synergistic opportunities for enhanced customer value and grid services. Market intelligence indicates increasing sophistication in system design, performance prediction, and lifecycle management capabilities across the distributed solar ecosystem.

Economic competitiveness serves as the primary market driver, with distributed solar achieving grid parity or better economics in most US markets through continued cost reductions and performance improvements. Levelized cost advantages make solar installations attractive investments for property owners seeking long-term energy cost stability and predictability.

Environmental consciousness motivates increasing numbers of consumers and businesses to adopt renewable energy solutions, driven by climate change awareness and corporate sustainability commitments. Carbon footprint reduction goals align with distributed solar deployment, creating market demand beyond pure economic considerations.

Energy independence aspirations resonate strongly with American consumers and businesses seeking reduced dependence on utility companies and volatile energy markets. Grid resilience benefits become increasingly valuable as extreme weather events and infrastructure challenges highlight the importance of distributed energy resources.

Policy support mechanisms including the federal Investment Tax Credit, state renewable portfolio standards, and local incentive programs provide crucial market development support. Net metering policies enable favorable economics by allowing customers to receive credit for excess electricity generation fed back into the grid.

Technological advancement continues driving market expansion through improved panel efficiency, enhanced inverter capabilities, and integrated energy management systems. Installation process improvements reduce project timelines and costs while enhancing customer experience and satisfaction levels.

Regulatory uncertainty poses significant challenges as policy changes at federal, state, and local levels can impact project economics and market stability. Net metering reforms in various states create uncertainty about long-term value propositions for distributed solar investments, potentially slowing adoption rates.

Grid integration challenges emerge as distributed solar penetration increases, requiring utility infrastructure upgrades and advanced grid management capabilities. Interconnection delays and technical requirements can extend project timelines and increase development costs for solar installations.

Financing accessibility remains a barrier for certain customer segments, particularly those with limited credit history or property ownership constraints. Capital requirements for system purchases can exclude potential customers despite favorable long-term economics and available financing alternatives.

Market saturation concerns in early-adopter regions may limit growth potential as the most suitable customers and properties have already installed solar systems. Customer acquisition costs tend to increase as markets mature and competition intensifies among installation companies.

Technical complexity associated with system design, permitting, and installation can create barriers for smaller contractors and limit market participation. Workforce development challenges may constrain growth as the industry requires skilled technicians and project managers to support continued expansion.

Energy storage integration presents substantial opportunities for enhanced distributed solar value propositions, enabling customers to maximize self-consumption and provide grid services. Battery cost reductions and performance improvements make solar-plus-storage systems increasingly attractive across residential and commercial segments.

Community solar expansion offers opportunities to serve customers unable to install rooftop systems, including renters, condominium residents, and businesses with unsuitable roof conditions. Virtual power purchase agreements and subscription models democratize access to solar benefits across broader customer populations.

Commercial sector growth represents significant untapped potential as businesses increasingly prioritize sustainability goals and seek energy cost management solutions. Corporate renewable energy procurement trends support distributed solar deployment for companies seeking local clean energy sources.

Emerging market penetration in regions with traditionally limited solar adoption offers substantial growth opportunities as costs decline and awareness increases. Rural market development benefits from distributed solar’s ability to provide energy independence and economic benefits in areas with limited grid infrastructure.

Technology convergence with electric vehicle charging, smart building systems, and grid modernization initiatives creates opportunities for integrated energy solutions. Digitalization trends enable enhanced system monitoring, predictive maintenance, and performance optimization services that add customer value.

Supply chain evolution reflects increasing domestic manufacturing capabilities and reduced dependence on international component suppliers, supporting market stability and job creation. Manufacturing investments in solar panels, inverters, and mounting systems enhance supply security while reducing transportation costs and delivery times.

Competitive landscape shifts demonstrate ongoing consolidation among installation companies while new entrants continue emerging with innovative business models and technology solutions. Market differentiation strategies focus on customer experience, financing flexibility, and integrated energy management capabilities.

Utility business model adaptation shows increasing recognition of distributed solar’s role in grid modernization and customer service enhancement. Partnership opportunities between utilities and solar developers create collaborative approaches to distributed energy resource integration and management.

Customer behavior evolution indicates growing sophistication in solar system evaluation, with buyers increasingly considering energy storage, smart home integration, and long-term performance factors. Market education efforts by industry associations and companies continue improving customer understanding of solar benefits and options.

Regulatory landscape development shows gradual adaptation to distributed solar growth through updated interconnection standards, grid modernization investments, and evolving rate structures. Policy innovation at state and local levels creates diverse market conditions that drive technological and business model advancement.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US distributed solar power generation market. Primary research activities include extensive interviews with industry executives, installation contractors, equipment manufacturers, financing companies, and utility representatives across diverse market segments and geographic regions.

Secondary research integration incorporates analysis of government databases, industry association reports, regulatory filings, and company financial statements to validate market trends and quantify growth patterns. Data triangulation methods ensure consistency and accuracy across multiple information sources and analytical approaches.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project future market development under various policy and economic conditions. Segmentation analysis examines market dynamics across residential, commercial, community, and industrial customer categories to identify distinct growth drivers and challenges.

Geographic analysis encompasses state-level market assessment, regional trend identification, and local policy impact evaluation to understand market heterogeneity across the United States. Competitive intelligence gathering includes company profiling, market share analysis, and strategic initiative tracking across the distributed solar value chain.

Technology assessment evaluates equipment performance trends, cost reduction trajectories, and innovation impacts on market development and customer adoption patterns. Policy analysis examines federal, state, and local regulatory frameworks and their influence on market growth and investment decisions.

California leadership continues with the state maintaining approximately 35% of national distributed solar capacity, driven by aggressive renewable energy policies, favorable net metering rules, and high electricity rates. Market maturation in California demonstrates the potential for sustained growth even in established markets through technology advancement and customer segment expansion.

Texas emergence as a major distributed solar market reflects the state’s abundant solar resources, competitive electricity markets, and growing environmental awareness among consumers and businesses. Commercial sector adoption in Texas shows particularly strong growth driven by corporate sustainability initiatives and favorable project economics.

Florida expansion demonstrates rapid market development supported by excellent solar resources, growing population, and evolving utility policies toward distributed generation. Residential market penetration in Florida benefits from high electricity costs and increasing hurricane resilience awareness among homeowners.

Northeast market development shows accelerating growth despite challenging weather conditions, driven by high electricity rates, strong environmental policies, and innovative financing mechanisms. Community solar programs in states like New York and Massachusetts expand market access beyond traditional rooftop installations.

Midwest opportunities emerge as declining costs make distributed solar economically viable in regions with moderate solar resources but favorable policy environments. Rural market potential in agricultural areas offers opportunities for agrivoltaics and farm-based distributed generation projects.

Market leadership reflects a diverse ecosystem of national installers, regional specialists, and emerging technology providers competing across multiple customer segments and service offerings. Competitive differentiation increasingly focuses on customer experience, financing flexibility, and integrated energy solutions rather than pure price competition.

Strategic partnerships between installers, equipment manufacturers, and financing companies create integrated value propositions that enhance customer experience and market competitiveness. Technology integration with energy storage, smart home systems, and electric vehicle charging expands service offerings and customer value.

Market consolidation trends show ongoing merger and acquisition activity as companies seek scale advantages, geographic expansion, and complementary capabilities. Innovation focus emphasizes digital customer acquisition, automated system design, and enhanced installation efficiency to reduce costs and improve margins.

Customer segment analysis reveals distinct market characteristics across residential, commercial, industrial, and community solar categories, each with unique drivers, challenges, and growth trajectories. Market dynamics vary significantly between segments based on customer motivations, project scale, and financing requirements.

By Customer Type:

By System Size:

By Ownership Model:

Residential category dominance continues with homeowner installations representing approximately 60% of distributed solar capacity additions annually. Customer motivations include energy cost reduction, environmental impact mitigation, and property value enhancement, with financing flexibility playing a crucial role in adoption decisions.

Commercial segment acceleration shows robust growth driven by corporate sustainability commitments and favorable project economics for businesses with suitable roof space and energy consumption patterns. Tax incentive optimization and depreciation benefits make commercial solar particularly attractive for companies with sufficient tax appetite.

Community solar expansion addresses market segments unable to install rooftop systems, including renters, condominium residents, and properties with shading or structural limitations. Subscription models provide accessible entry points for customers seeking solar benefits without property ownership requirements.

Industrial applications demonstrate growing adoption among manufacturing facilities, warehouses, and data centers seeking to reduce operational costs and meet sustainability targets. Large-scale installations benefit from economies of scale and can provide significant portions of facility energy requirements.

Technology integration trends show increasing coupling with energy storage systems, with approximately 25% of new residential installations including battery storage capabilities. Smart inverter deployment enhances grid compatibility and enables advanced energy management features that optimize system performance and value.

Economic advantages for customers include reduced electricity costs, predictable energy expenses, and potential property value increases. Environmental benefits encompass carbon footprint reduction, air quality improvement, and contribution to national renewable energy goals and climate commitments.

Grid benefits include reduced transmission losses, peak demand management, and enhanced system resilience through distributed generation resources. Utility advantages emerge from deferred infrastructure investments, reduced wholesale energy purchases, and improved customer satisfaction through renewable energy options.

Economic development impacts support job creation across manufacturing, installation, sales, and maintenance sectors while attracting investment and supporting local economic growth. Energy security enhancement reduces dependence on fossil fuel imports and price volatility while supporting domestic energy production.

Innovation catalyst effects drive technological advancement in energy storage, grid management, and smart building systems that benefit broader energy sector development. Market competition increases customer choice and drives continued cost reductions and service improvements across the energy sector.

Social equity opportunities emerge through community solar programs, workforce development initiatives, and expanded access to clean energy benefits across diverse communities and income levels. Educational benefits increase public awareness of renewable energy technologies and sustainable living practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Energy storage integration represents the most significant trend reshaping distributed solar markets, with battery adoption rates accelerating as costs decline and performance improves. Solar-plus-storage systems provide enhanced value through increased self-consumption, backup power capabilities, and grid service opportunities.

Digitalization advancement transforms customer acquisition, system design, and project management through online platforms, remote monitoring, and automated processes. Artificial intelligence applications optimize system performance, predict maintenance needs, and enhance customer experience across the solar value chain.

Community solar growth expands market access beyond traditional rooftop installations, serving customers unable to install on-site systems through shared facilities and subscription models. Virtual power purchase agreements enable corporate customers to support local renewable energy development while meeting sustainability goals.

Grid modernization integration positions distributed solar as a key component of smart grid development, providing voltage support, frequency regulation, and other ancillary services. Vehicle-to-grid integration creates synergies between electric vehicle adoption and distributed solar deployment.

Financing innovation continues expanding customer access through new ownership models, improved credit assessment, and integrated energy service offerings. Green financing initiatives from banks and financial institutions support market growth through favorable lending terms and specialized solar loan products.

Manufacturing expansion in the United States reduces supply chain risks and supports domestic job creation while improving delivery times and reducing transportation costs. Technology partnerships between equipment manufacturers and installation companies create integrated solutions that enhance customer value and market competitiveness.

Utility program evolution shows increasing collaboration between utilities and distributed solar developers through shared solar programs, demand response integration, and grid modernization initiatives. Regulatory adaptation at state levels addresses grid integration challenges while maintaining customer benefits and system reliability.

Corporate procurement growth demonstrates increasing business adoption of distributed solar through on-site installations and virtual power purchase agreements. Sustainability reporting requirements drive corporate demand for renewable energy solutions that support environmental, social, and governance objectives.

Technology advancement in panel efficiency, inverter capabilities, and system monitoring creates opportunities for enhanced performance and reduced costs. Installation process innovation through prefabrication, standardization, and automation reduces project timelines and labor requirements.

Market consolidation activity includes strategic acquisitions, partnerships, and vertical integration initiatives that reshape competitive dynamics and create scale advantages. International expansion by US companies leverages domestic market expertise in global distributed solar opportunities.

Strategic positioning recommendations emphasize the importance of integrated service offerings that combine solar installation, energy storage, and smart energy management capabilities. MarkWide Research analysis suggests companies should focus on customer experience differentiation and technology integration to maintain competitive advantages in maturing markets.

Market expansion strategies should prioritize underserved geographic regions and customer segments while developing specialized solutions for commercial and industrial applications. Partnership development with utilities, energy storage providers, and smart home technology companies can create synergistic value propositions and market access opportunities.

Technology investment priorities should focus on digitalization, automation, and artificial intelligence applications that enhance operational efficiency and customer experience. Supply chain diversification and domestic manufacturing capabilities provide strategic advantages in managing costs and delivery reliability.

Policy engagement remains crucial for industry participants to support favorable regulatory frameworks and address grid integration challenges through collaborative stakeholder processes. Workforce development initiatives should address skilled labor shortages that could constrain market growth in high-demand regions.

Financial strategy optimization should emphasize flexible customer financing options, risk management capabilities, and capital efficiency to support sustainable growth and profitability. Data analytics capabilities provide competitive advantages through improved customer targeting, system performance optimization, and predictive maintenance services.

Growth trajectory projections indicate continued market expansion with annual growth rates expected to maintain 12-18% over the next five years, driven by cost reductions, technology improvements, and expanding customer adoption. Market maturation will likely shift competitive focus toward service quality, technology integration, and customer relationship management.

Technology evolution anticipates significant advancement in energy storage integration, with storage attachment rates potentially reaching 50% of new installations within the next decade. Smart grid integration will enable distributed solar systems to provide enhanced grid services and participate in energy markets as virtual power plants.

Policy landscape development suggests gradual transition from incentive-dependent growth toward market-driven adoption as distributed solar achieves full cost competitiveness. Grid modernization investments will support higher penetration levels while maintaining system reliability and power quality standards.

Market segmentation evolution points toward increased commercial and industrial adoption as businesses prioritize sustainability goals and energy cost management. Community solar expansion will democratize access to solar benefits across broader customer populations, particularly in urban and multifamily housing markets.

Industry consolidation trends are expected to continue as companies seek scale advantages, geographic expansion, and integrated service capabilities. Innovation focus will emphasize customer experience, system performance optimization, and integration with emerging technologies such as electric vehicle charging and smart building systems.

Market transformation in the US distributed solar power generation sector reflects a fundamental shift toward decentralized, customer-controlled renewable energy systems that provide economic, environmental, and resilience benefits. Sustained growth momentum demonstrates the sector’s evolution from niche market to mainstream energy solution across residential, commercial, and community applications.

Strategic opportunities abound for industry participants who can effectively integrate technology advancement, customer experience enhancement, and market expansion initiatives. MWR analysis indicates that companies focusing on comprehensive energy solutions, digital innovation, and strategic partnerships will be best positioned for long-term success in this dynamic market environment.

Future market development will be characterized by continued cost reductions, technology integration, and policy evolution that supports sustainable growth while addressing grid integration challenges. The US distributed solar power generation market represents a cornerstone of America’s clean energy transition, providing a foundation for economic development, environmental progress, and energy security enhancement across diverse communities and regions.

What is Distributed Solar Power Generation?

Distributed Solar Power Generation refers to the production of solar energy from small-scale systems located close to the point of use, such as residential rooftops or community solar projects. This approach allows for localized energy generation and can reduce transmission losses.

What are the key players in the US Distributed Solar Power Generation Market?

Key players in the US Distributed Solar Power Generation Market include Sunrun, Vivint Solar, and First Solar, among others. These companies are involved in various aspects of solar power generation, from installation to financing and technology development.

What are the main drivers of the US Distributed Solar Power Generation Market?

The main drivers of the US Distributed Solar Power Generation Market include the decreasing cost of solar technology, increasing consumer demand for renewable energy, and supportive government policies promoting clean energy adoption. Additionally, advancements in energy storage solutions are enhancing the viability of distributed solar systems.

What challenges does the US Distributed Solar Power Generation Market face?

The US Distributed Solar Power Generation Market faces challenges such as regulatory hurdles, grid integration issues, and competition from traditional energy sources. Additionally, fluctuations in policy incentives can impact market growth and investment.

What opportunities exist in the US Distributed Solar Power Generation Market?

Opportunities in the US Distributed Solar Power Generation Market include the expansion of community solar projects, increased adoption of energy storage technologies, and the potential for innovative financing models. These factors can enhance accessibility and affordability for consumers.

What trends are shaping the US Distributed Solar Power Generation Market?

Trends shaping the US Distributed Solar Power Generation Market include the rise of smart solar technologies, increased focus on sustainability, and the integration of solar with electric vehicle charging infrastructure. These trends are driving innovation and consumer engagement in solar energy solutions.

US Distributed Solar Power Generation Market

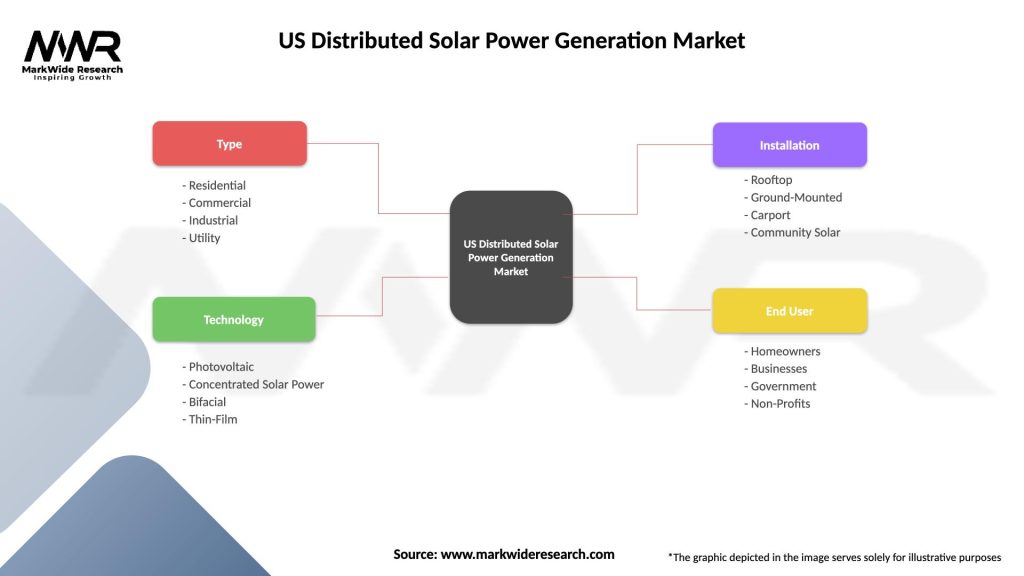

| Segmentation Details | Description |

|---|---|

| Type | Residential, Commercial, Industrial, Utility |

| Technology | Photovoltaic, Concentrated Solar Power, Bifacial, Thin-Film |

| Installation | Rooftop, Ground-Mounted, Carport, Community Solar |

| End User | Homeowners, Businesses, Government, Non-Profits |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Distributed Solar Power Generation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at