444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US diabetes drugs and devices market represents one of the most critical and rapidly evolving healthcare sectors in the United States, driven by the increasing prevalence of diabetes and continuous technological innovations. Market dynamics indicate substantial growth potential as approximately 37.3 million Americans currently live with diabetes, representing 11.3% of the population. The market encompasses a comprehensive range of therapeutic solutions including insulin products, oral antidiabetic medications, glucose monitoring devices, insulin delivery systems, and advanced continuous glucose monitoring technologies.

Healthcare transformation continues to reshape the diabetes management landscape through digital health integration, personalized medicine approaches, and innovative drug delivery mechanisms. The market demonstrates robust expansion driven by aging demographics, lifestyle-related diabetes incidence, and increasing awareness of diabetes complications. Technology convergence between pharmaceutical innovations and medical device advancements creates unprecedented opportunities for improved patient outcomes and market growth.

Regulatory support from the FDA accelerates market development through streamlined approval processes for breakthrough diabetes therapies and devices. The market benefits from strong healthcare infrastructure, advanced research capabilities, and significant investment in diabetes care innovation. Patient-centric approaches drive demand for user-friendly devices, personalized treatment regimens, and integrated care solutions that improve quality of life for diabetes patients.

The US diabetes drugs and devices market refers to the comprehensive healthcare sector encompassing pharmaceutical products, medical devices, and technological solutions specifically designed for the prevention, management, and treatment of diabetes mellitus in the United States. This market includes both Type 1 and Type 2 diabetes therapeutic options, ranging from traditional insulin formulations to cutting-edge continuous glucose monitoring systems and smart insulin delivery devices.

Market scope extends beyond basic glucose control to include comprehensive diabetes management ecosystems that integrate medication therapy, device technology, digital health platforms, and patient support services. The sector encompasses prescription medications such as insulin analogs, GLP-1 receptor agonists, SGLT-2 inhibitors, and traditional oral antidiabetic drugs, alongside medical devices including glucose meters, continuous glucose monitors, insulin pumps, and pen injectors.

Innovation focus centers on developing integrated solutions that combine pharmaceutical efficacy with device convenience, enabling better patient adherence and improved clinical outcomes. The market represents a critical component of the broader US healthcare system, addressing one of the most prevalent chronic conditions affecting millions of Americans across all demographic segments.

Strategic analysis reveals the US diabetes drugs and devices market as a high-growth sector characterized by continuous innovation, strong demand drivers, and significant investment opportunities. The market benefits from favorable demographic trends, including an aging population and increasing diabetes prevalence, which create sustained demand for advanced therapeutic solutions. Technology integration emerges as a key differentiator, with companies developing smart devices, connected health platforms, and personalized treatment approaches.

Competitive landscape features established pharmaceutical giants alongside innovative medical device manufacturers and emerging digital health companies. Market leaders focus on developing comprehensive diabetes care ecosystems that combine drug efficacy with device convenience and digital connectivity. Regulatory environment supports innovation through expedited approval pathways for breakthrough therapies and devices that demonstrate significant clinical benefits.

Growth projections indicate robust market expansion driven by increasing diabetes incidence, technological advancement, and growing emphasis on personalized medicine. The market demonstrates resilience against economic fluctuations due to the essential nature of diabetes care and strong insurance coverage for diabetes treatments. Investment trends show continued capital allocation toward research and development, particularly in areas of artificial intelligence, continuous monitoring, and automated insulin delivery systems.

Market intelligence reveals several critical insights shaping the US diabetes drugs and devices landscape. MarkWide Research analysis indicates that technological convergence between pharmaceuticals and medical devices creates the most significant growth opportunities in the sector.

Primary growth drivers propelling the US diabetes drugs and devices market include the escalating prevalence of diabetes across all age groups, driven by lifestyle factors, dietary changes, and demographic shifts. Obesity epidemic serves as a significant catalyst, with obesity-related Type 2 diabetes cases increasing substantially. The aging US population contributes to market expansion as diabetes risk increases with age, creating sustained demand for therapeutic solutions.

Technological advancement drives market growth through development of innovative drug formulations, smart delivery devices, and integrated monitoring systems. Continuous glucose monitoring technology revolutionizes diabetes management by providing real-time glucose data, enabling better treatment decisions and improved patient outcomes. Artificial intelligence integration enhances predictive capabilities and personalized treatment recommendations.

Healthcare policy support accelerates market development through favorable reimbursement policies, Medicare coverage expansion, and regulatory initiatives promoting diabetes care innovation. Insurance coverage improvements for diabetes devices and medications increase patient access and market penetration. Patient empowerment trends drive demand for user-friendly devices and self-management tools that enable greater patient autonomy in diabetes care.

Clinical evidence supporting the benefits of intensive diabetes management motivates healthcare providers and patients to adopt advanced therapeutic approaches. Research demonstrating the long-term cost benefits of effective diabetes management encourages healthcare system investment in innovative solutions.

Cost considerations represent the primary restraint affecting market growth, as advanced diabetes technologies and newer medications often carry premium pricing that may limit patient access. Insurance coverage gaps create barriers for some patients, particularly for newer devices and innovative therapies not yet included in standard formularies. High out-of-pocket costs for diabetes supplies and medications impact patient adherence and market penetration.

Regulatory complexity can delay product launches and increase development costs, particularly for combination products that require coordination between drug and device approval pathways. Clinical trial requirements for demonstrating safety and efficacy extend development timelines and increase investment risks for manufacturers. Stringent FDA oversight, while ensuring patient safety, can slow the introduction of innovative solutions.

Technology adoption barriers include patient resistance to complex devices, healthcare provider training requirements, and integration challenges with existing healthcare systems. Digital divide issues affect adoption of connected devices and digital health platforms, particularly among older patients and underserved populations. Device reliability concerns and technical support requirements may limit widespread adoption.

Market competition intensifies pricing pressure, particularly in mature product categories where generic alternatives and biosimilar products compete with branded offerings. Patent expiration for key diabetes medications creates market disruption and revenue challenges for innovator companies.

Innovation opportunities abound in the US diabetes drugs and devices market, particularly in areas of personalized medicine, artificial intelligence integration, and comprehensive care platforms. Digital therapeutics represent a significant growth opportunity, combining behavioral interventions with technology to improve diabetes management outcomes. Development of smart insulin formulations that respond to glucose levels automatically presents revolutionary treatment possibilities.

Underserved populations offer substantial market expansion opportunities, including pediatric diabetes patients, elderly populations, and rural communities with limited access to specialized diabetes care. Preventive care solutions targeting pre-diabetes and diabetes risk reduction create new market segments with significant growth potential. Workplace diabetes management programs and population health initiatives expand market reach beyond traditional clinical settings.

International expansion opportunities exist for US companies to leverage their technological advantages in global markets. Partnership strategies between pharmaceutical companies, device manufacturers, and digital health platforms create synergistic opportunities for comprehensive diabetes care solutions. Integration with electronic health records and healthcare analytics platforms enables value-based care models.

Emerging technologies such as continuous ketone monitoring, smart contact lenses for glucose monitoring, and implantable glucose sensors represent frontier opportunities for market leaders. Regenerative medicine approaches, including beta cell replacement therapies and stem cell treatments, offer long-term transformative potential for diabetes care.

Dynamic forces shaping the US diabetes drugs and devices market include the interplay between technological innovation, regulatory evolution, and changing patient expectations. Competitive dynamics drive continuous product improvement and pricing optimization as companies strive to differentiate their offerings in an increasingly crowded marketplace. Market consolidation trends create opportunities for synergistic combinations between pharmaceutical and device companies.

Healthcare delivery transformation influences market dynamics through the shift toward value-based care models that emphasize patient outcomes over volume of services. Telemedicine integration accelerates remote diabetes management capabilities, expanding market reach and improving patient access to specialized care. Digital health platform adoption changes how patients interact with their diabetes management tools and healthcare providers.

Supply chain considerations impact market dynamics, particularly regarding manufacturing capacity, raw material availability, and distribution efficiency. Global economic factors influence research and development investment levels, pricing strategies, and market access initiatives. Currency fluctuations and trade policies affect international operations and component sourcing for medical devices.

Patient advocacy and diabetes organizations play increasingly important roles in shaping market dynamics through their influence on policy development, reimbursement decisions, and clinical practice guidelines. Social media and online communities create new channels for patient education and product awareness, influencing adoption patterns and market preferences.

Comprehensive research methodology employed in analyzing the US diabetes drugs and devices market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare professionals, diabetes specialists, patients, and industry executives to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture quantitative data on usage patterns, satisfaction levels, and purchasing decisions across diverse patient populations.

Secondary research encompasses analysis of clinical literature, regulatory filings, company financial reports, and industry publications to establish market baselines and identify emerging trends. Database analysis utilizes healthcare claims data, prescription tracking information, and device utilization statistics to quantify market dynamics and growth patterns. Patent analysis reveals innovation trends and competitive positioning among market participants.

Market modeling employs statistical techniques to project future market scenarios based on demographic trends, epidemiological data, and technology adoption curves. Competitive intelligence gathering includes monitoring of product launches, clinical trial results, regulatory approvals, and strategic partnerships. Expert panel discussions provide validation of research findings and insights into future market directions.

Data validation processes ensure research accuracy through triangulation of multiple sources and cross-verification of key findings. Quality assurance protocols maintain research integrity and reliability throughout the analytical process.

Geographic distribution of the US diabetes drugs and devices market reveals significant regional variations driven by demographic differences, healthcare infrastructure, and economic factors. Northeast region demonstrates high market penetration for advanced diabetes technologies, supported by concentrated healthcare systems, higher income levels, and strong insurance coverage. The region accounts for approximately 28% of total market share despite representing 17% of the US population.

Southeast region shows the highest diabetes prevalence rates, creating substantial market demand but facing challenges related to healthcare access and affordability. Rural areas throughout the Southeast experience particular challenges in accessing specialized diabetes care and advanced technologies. The region represents 32% of diabetes patients but only 24% of advanced device adoption.

Western states lead in adoption of digital health solutions and innovative diabetes management approaches, driven by technology-forward healthcare systems and patient populations. California alone accounts for approximately 15% of the total US diabetes drugs and devices market, reflecting both population size and high adoption rates for premium products.

Midwest region demonstrates steady market growth with strong penetration of traditional diabetes management approaches and increasing adoption of newer technologies. Urban centers across all regions show higher adoption rates for advanced diabetes devices compared to rural areas, creating opportunities for targeted market development strategies.

Market leadership in the US diabetes drugs and devices sector is characterized by a mix of established pharmaceutical giants, innovative medical device companies, and emerging digital health platforms. Competitive positioning varies significantly between drug and device segments, with different companies dominating specific therapeutic areas and technology categories.

Strategic partnerships between pharmaceutical and device companies create comprehensive diabetes care ecosystems. Innovation focus centers on developing integrated solutions that combine drug efficacy with device convenience and digital connectivity. Market consolidation trends create opportunities for synergistic combinations and expanded product portfolios.

Market segmentation of the US diabetes drugs and devices market reveals distinct categories based on product type, diabetes type, patient demographics, and distribution channels. Product segmentation divides the market into pharmaceutical products and medical devices, each with unique growth dynamics and competitive landscapes.

By Product Type:

By Diabetes Type:

By Distribution Channel:

Insulin category represents the largest segment of the diabetes drugs market, driven by essential nature of insulin therapy for Type 1 diabetes patients and increasing usage among Type 2 diabetes patients. Long-acting insulin analogs demonstrate the strongest growth within this category due to improved convenience and glycemic control compared to traditional insulin formulations. Biosimilar insulin products create pricing pressure while expanding patient access.

GLP-1 receptor agonists emerge as the fastest-growing drug category, driven by proven cardiovascular benefits and weight loss effects that appeal to Type 2 diabetes patients. Weekly formulations gain market share due to improved patient adherence compared to daily injection requirements. Oral GLP-1 formulations represent significant innovation opportunities.

Continuous glucose monitoring dominates the device category growth, with adoption rates increasing rapidly among both Type 1 and Type 2 diabetes patients. Flash glucose monitoring systems provide cost-effective alternatives to traditional CGM while offering significant advantages over fingerstick testing. Integration with insulin pumps creates comprehensive automated diabetes management systems.

Smart insulin pens represent the fastest-growing device subcategory, combining traditional insulin delivery with digital connectivity and dose tracking capabilities. Connected health platforms integrate multiple diabetes management tools into comprehensive care ecosystems that improve patient outcomes and healthcare provider efficiency.

Healthcare providers benefit from advanced diabetes drugs and devices through improved patient outcomes, enhanced treatment monitoring capabilities, and more efficient care delivery models. Clinical decision support tools integrated with glucose monitoring systems enable more precise treatment adjustments and better patient management. Remote monitoring capabilities allow providers to track patient progress between office visits and intervene proactively when needed.

Patients experience significant benefits including better glucose control, reduced hypoglycemia risk, improved quality of life, and greater treatment convenience. Technology integration enables patients to take more active roles in their diabetes management while receiving personalized insights and recommendations. Continuous monitoring reduces the burden of frequent fingerstick testing while providing comprehensive glucose data.

Healthcare systems realize benefits through reduced diabetes-related complications, lower long-term treatment costs, and improved population health outcomes. Value-based care models benefit from comprehensive diabetes management solutions that demonstrate measurable improvements in clinical metrics and patient satisfaction. Integrated care platforms enable better care coordination and resource utilization.

Industry participants benefit from strong market demand, innovation opportunities, and potential for sustainable competitive advantages through technology differentiation. Partnership opportunities between pharmaceutical and device companies create synergistic value propositions and expanded market reach. Digital health integration opens new revenue streams and customer engagement models.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the US diabetes drugs and devices market, with connected devices, mobile applications, and artificial intelligence integration becoming standard features rather than premium options. Automated insulin delivery systems gain mainstream adoption as technology reliability improves and clinical evidence demonstrates superior outcomes compared to traditional management approaches.

Personalized medicine trends drive development of tailored diabetes treatments based on individual patient characteristics, genetic profiles, and lifestyle factors. Precision dosing algorithms optimize medication regimens for individual patients, improving efficacy while minimizing side effects. Pharmacogenomic testing influences drug selection and dosing decisions.

Value-based care models increasingly influence product development and market strategies, with companies focusing on demonstrating real-world outcomes and cost-effectiveness. Outcome-based pricing arrangements tie product costs to clinical results and patient satisfaction metrics. Risk-sharing agreements between manufacturers and healthcare systems become more common.

Patient empowerment trends drive demand for user-friendly devices, comprehensive education resources, and peer support platforms. Social connectivity features enable patients to share experiences and support each other in diabetes management journeys. Gamification elements encourage patient engagement and adherence to treatment regimens.

Regulatory milestones continue to shape the US diabetes drugs and devices market through FDA approvals of breakthrough therapies and innovative devices. Interoperability standards development enables better integration between different diabetes management tools and healthcare systems. MWR analysis indicates that regulatory harmonization efforts accelerate product development timelines and reduce compliance costs.

Strategic partnerships between pharmaceutical companies, device manufacturers, and technology firms create comprehensive diabetes care ecosystems. Acquisition activity consolidates market participants and combines complementary capabilities. Major pharmaceutical companies acquire digital health startups to enhance their diabetes care portfolios.

Clinical breakthrough developments include advanced insulin formulations, novel drug delivery mechanisms, and innovative glucose monitoring technologies. Artificial pancreas systems receive regulatory approval and demonstrate significant improvements in glucose control and patient quality of life. Gene therapy approaches show promise for Type 1 diabetes treatment.

Manufacturing innovations improve product quality, reduce costs, and enhance supply chain reliability. Biosimilar development expands access to expensive diabetes medications while creating competitive pressure on innovator companies. 3D printing technology enables customized medical devices and personalized treatment solutions.

Strategic recommendations for market participants include focusing on integrated solution development that combines pharmaceutical efficacy with device convenience and digital connectivity. Partnership strategies should prioritize collaborations that create comprehensive diabetes care ecosystems rather than standalone products. Companies should invest in patient education and support programs to drive adoption and improve outcomes.

Innovation priorities should emphasize user experience design, making complex diabetes technologies more accessible and intuitive for diverse patient populations. Artificial intelligence integration offers significant opportunities for predictive analytics, personalized treatment recommendations, and automated care optimization. Companies should develop robust cybersecurity protocols for connected devices.

Market access strategies must address affordability concerns through value-based pricing models, patient assistance programs, and partnerships with healthcare systems. Reimbursement advocacy should focus on demonstrating long-term cost savings and improved outcomes to support coverage decisions. International expansion strategies should leverage US innovation advantages in global markets.

Regulatory engagement should proactively address evolving requirements for digital health solutions, data privacy, and device interoperability. Clinical evidence generation must focus on real-world outcomes and patient-reported measures that resonate with healthcare decision-makers and patients.

Long-term projections for the US diabetes drugs and devices market indicate sustained growth driven by demographic trends, technological advancement, and increasing focus on preventive care. Market evolution will likely favor integrated solutions that combine multiple diabetes management functions into seamless patient experiences. MarkWide Research forecasts continued market expansion with growth rates exceeding 8% annually over the next decade.

Technology convergence will accelerate development of artificial pancreas systems, smart insulin formulations, and comprehensive digital health platforms. Artificial intelligence integration will enable predictive diabetes management, automated treatment adjustments, and personalized care recommendations. Wearable technology advancement will make continuous monitoring more convenient and accessible.

Healthcare delivery transformation will emphasize remote monitoring, telemedicine integration, and value-based care models that reward outcomes over volume. Population health approaches will expand market opportunities in diabetes prevention and risk reduction. Workplace wellness programs and community health initiatives will create new distribution channels.

Regulatory evolution will likely streamline approval processes for combination products while maintaining rigorous safety standards. International harmonization efforts will facilitate global market expansion for US companies. Reimbursement policies will increasingly emphasize demonstrated value and patient outcomes rather than traditional fee-for-service models.

The US diabetes drugs and devices market stands at the forefront of healthcare innovation, driven by the urgent need to address the growing diabetes epidemic through advanced therapeutic solutions and cutting-edge technology. Market dynamics reveal a sector characterized by robust growth potential, continuous innovation, and significant opportunities for companies that can successfully integrate pharmaceutical efficacy with device convenience and digital connectivity.

Strategic positioning in this market requires a comprehensive understanding of patient needs, healthcare system requirements, and regulatory landscapes. Success factors include developing user-friendly solutions, demonstrating real-world value, and creating sustainable competitive advantages through technology differentiation and strategic partnerships. The market rewards companies that prioritize patient outcomes while addressing affordability and accessibility challenges.

Future success will depend on the ability to navigate evolving regulatory requirements, changing reimbursement models, and increasing competition from both established players and innovative startups. Investment priorities should focus on digital health integration, artificial intelligence capabilities, and comprehensive care platforms that address the full spectrum of diabetes management needs. The US diabetes drugs and devices market represents a critical healthcare sector with tremendous potential for improving patient lives while generating sustainable business growth for innovative companies committed to advancing diabetes care.

What is Diabetes Drugs and Devices?

Diabetes Drugs and Devices refer to the medications and tools used to manage diabetes, including insulin, oral hypoglycemics, glucose monitors, and insulin delivery systems.

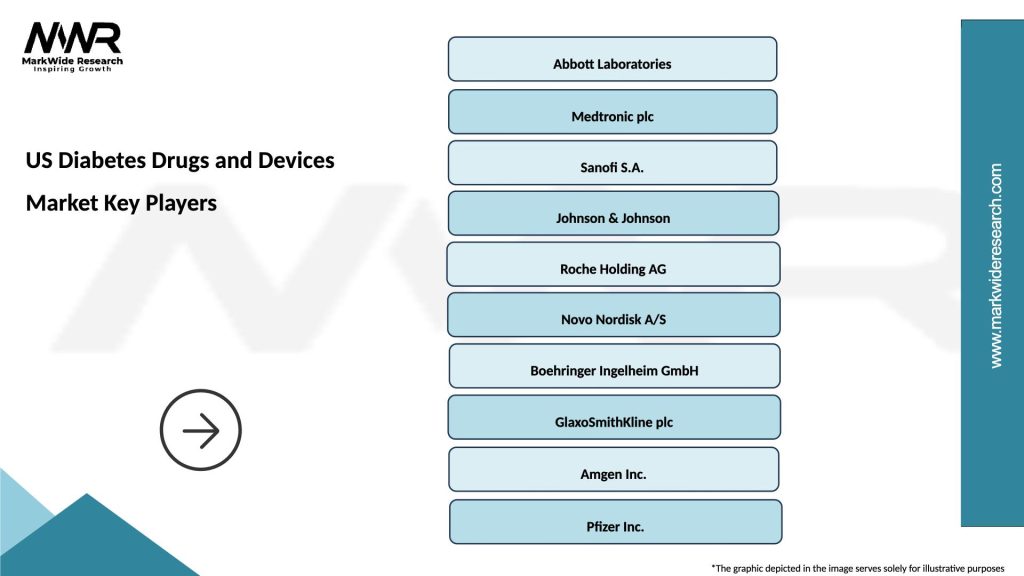

What are the key players in the US Diabetes Drugs and Devices Market?

Key players in the US Diabetes Drugs and Devices Market include companies like Novo Nordisk, Sanofi, and Medtronic, which are known for their innovative products and extensive market reach, among others.

What are the main drivers of growth in the US Diabetes Drugs and Devices Market?

The main drivers of growth in the US Diabetes Drugs and Devices Market include the rising prevalence of diabetes, advancements in technology for diabetes management, and increasing awareness about diabetes care.

What challenges does the US Diabetes Drugs and Devices Market face?

Challenges in the US Diabetes Drugs and Devices Market include high costs of diabetes management, regulatory hurdles for new products, and the need for continuous innovation to meet patient needs.

What opportunities exist in the US Diabetes Drugs and Devices Market?

Opportunities in the US Diabetes Drugs and Devices Market include the development of personalized medicine, integration of digital health solutions, and expansion into underserved markets.

What trends are shaping the US Diabetes Drugs and Devices Market?

Trends shaping the US Diabetes Drugs and Devices Market include the increasing use of continuous glucose monitoring systems, the rise of telehealth services for diabetes management, and the growing focus on patient-centric care.

US Diabetes Drugs and Devices Market

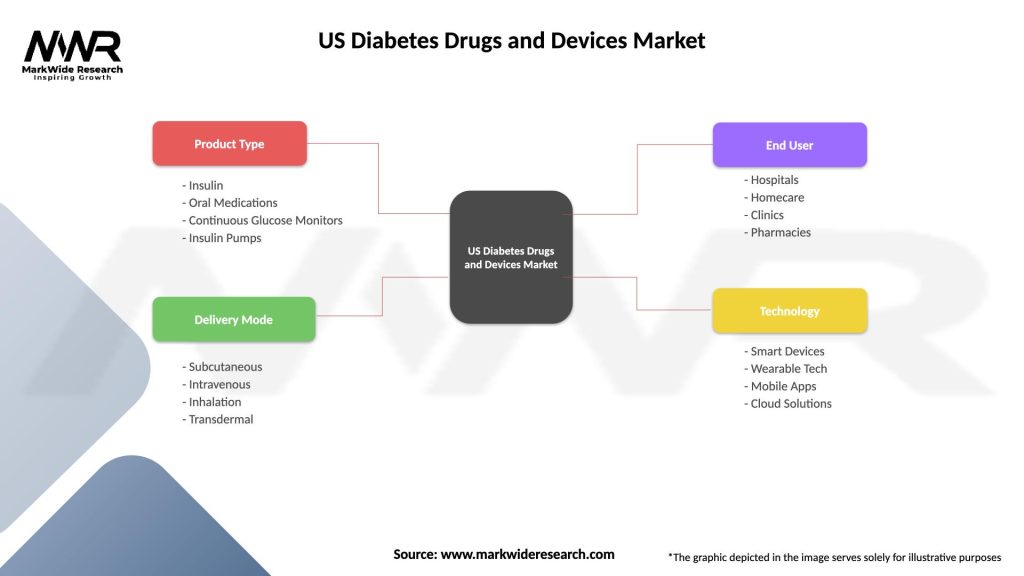

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Medications, Continuous Glucose Monitors, Insulin Pumps |

| Delivery Mode | Subcutaneous, Intravenous, Inhalation, Transdermal |

| End User | Hospitals, Homecare, Clinics, Pharmacies |

| Technology | Smart Devices, Wearable Tech, Mobile Apps, Cloud Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Diabetes Drugs and Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at