444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US dental insurance market represents a critical component of the American healthcare landscape, providing essential coverage for preventive, basic, and major dental procedures. This market encompasses various insurance products including employer-sponsored plans, individual policies, and government-funded programs that collectively serve millions of Americans seeking affordable dental care solutions.

Market dynamics indicate robust growth driven by increasing awareness of oral health importance, rising healthcare costs, and expanding employer benefit packages. The market demonstrates significant expansion potential with approximately 77% of Americans having some form of dental coverage, while demand continues to grow across all demographic segments.

Insurance providers are adapting to evolving consumer needs by offering flexible plan options, enhanced digital services, and comprehensive coverage packages. The market benefits from technological advancements in claims processing, teledentistry integration, and preventive care programs that improve patient outcomes while controlling costs.

Regional variations across the United States reflect diverse economic conditions, state regulations, and population demographics. Urban markets typically show higher penetration rates compared to rural areas, creating opportunities for targeted expansion strategies and innovative service delivery models.

The US dental insurance market refers to the comprehensive ecosystem of insurance products, services, and providers that offer financial protection and coverage for dental care expenses across the United States. This market encompasses traditional indemnity plans, preferred provider organizations, health maintenance organizations, and discount dental plans designed to make oral healthcare more accessible and affordable for consumers.

Coverage typically includes preventive services such as cleanings and examinations, basic procedures like fillings and extractions, and major treatments including crowns, bridges, and orthodontics. The market operates through various distribution channels including employer-sponsored group plans, individual direct-purchase policies, and government programs serving specific populations.

Market participants include national insurance carriers, regional providers, dental service organizations, and third-party administrators who collectively serve diverse customer segments with varying coverage needs and budget requirements.

The US dental insurance market demonstrates sustained growth momentum driven by increasing consumer awareness of oral health importance and expanding access to dental benefits. Market expansion reflects growing employer adoption of comprehensive benefit packages and individual consumer demand for affordable dental care solutions.

Key growth drivers include rising healthcare costs that make insurance coverage essential, demographic shifts toward aging populations requiring more dental care, and technological innovations improving service delivery and patient experience. The market benefits from approximately 65% employer-sponsored coverage penetration among working adults.

Competitive landscape features established national carriers alongside regional specialists and emerging digital-first providers. Market leaders focus on network expansion, technology integration, and value-based care models to differentiate their offerings and capture market share.

Future prospects remain positive with projected growth supported by healthcare reform initiatives, increasing preventive care emphasis, and expanding coverage mandates in various states. The market continues evolving toward more consumer-centric models with enhanced digital capabilities and personalized coverage options.

Market analysis reveals several critical insights shaping the US dental insurance landscape:

Rising healthcare costs serve as a primary driver for dental insurance adoption, as consumers seek financial protection against expensive dental procedures. The increasing cost of dental care makes insurance coverage essential for maintaining oral health without significant financial burden.

Employer benefit expansion continues driving market growth as companies recognize dental insurance as a valuable employee benefit. Organizations increasingly include comprehensive dental coverage in benefit packages to attract talent and improve employee satisfaction, with approximately 85% of large employers offering dental benefits.

Health awareness trends contribute significantly to market expansion as consumers better understand connections between oral health and overall wellness. Growing recognition of preventive care importance drives demand for insurance coverage that supports regular dental visits and early intervention.

Demographic shifts including aging populations and growing middle-class segments create sustained demand for dental insurance products. Older adults require more extensive dental care while younger consumers increasingly prioritize health benefits and preventive care access.

Technology advancement enables more efficient service delivery and improved customer experience, making dental insurance more attractive to consumers. Digital platforms, teledentistry integration, and streamlined claims processing enhance the overall value proposition of dental insurance products.

High premium costs present significant barriers for individual consumers and small businesses considering dental insurance coverage. Premium expenses often strain budgets, particularly for comprehensive plans covering major dental procedures and orthodontic treatments.

Coverage limitations including annual maximums, waiting periods, and exclusions create consumer frustration and limit market penetration. These restrictions often result in significant out-of-pocket expenses for major dental work, reducing the perceived value of insurance coverage.

Provider network constraints in certain geographic areas limit consumer choice and access to preferred dentists. Rural and underserved areas particularly face challenges with limited in-network provider availability, affecting coverage utility and consumer satisfaction.

Complex benefit structures and varying coverage levels create confusion for consumers evaluating dental insurance options. The complexity of understanding deductibles, copayments, and coverage percentages often deters potential customers from purchasing coverage.

Economic uncertainties and budget constraints affect both individual and employer purchasing decisions. Economic downturns typically result in reduced discretionary spending on benefits, impacting market growth and coverage adoption rates.

Digital transformation presents substantial opportunities for market expansion through improved customer experience and operational efficiency. Technology integration enables personalized coverage options, streamlined claims processing, and enhanced communication between insurers, providers, and patients.

Underserved market segments including rural populations, gig economy workers, and small business employees represent significant growth opportunities. Targeted products and distribution strategies can address unique needs of these segments while expanding market reach.

Preventive care emphasis creates opportunities for innovative coverage models that incentivize regular dental visits and early intervention. Value-based care approaches can reduce long-term costs while improving patient outcomes and satisfaction.

Partnership opportunities with healthcare systems, dental service organizations, and technology companies enable market expansion and service enhancement. Strategic alliances can improve network coverage, reduce costs, and create comprehensive healthcare solutions.

Government program expansion including Medicaid dental benefits and Medicare Advantage plans with dental coverage create new market opportunities. Policy changes supporting expanded dental coverage access drive market growth and improve population health outcomes.

Competitive intensity continues increasing as established carriers face challenges from new market entrants and alternative coverage models. Traditional insurers must adapt to changing consumer expectations while maintaining profitability and network adequacy.

Regulatory environment significantly influences market dynamics through state insurance regulations, coverage mandates, and consumer protection requirements. Regulatory changes create both opportunities and challenges for market participants adapting to evolving compliance requirements.

Consumer behavior shifts toward digital-first experiences and personalized coverage options drive market evolution. Insurance providers must invest in technology and customer service capabilities to meet changing expectations and remain competitive.

Provider relationships play crucial roles in market success as insurers work to maintain adequate networks while controlling costs. Successful companies balance provider satisfaction with cost management to ensure network stability and consumer access.

Economic factors including employment levels, wage growth, and healthcare inflation directly impact market demand and pricing strategies. Market participants must navigate economic uncertainties while maintaining affordable coverage options for diverse consumer segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US dental insurance market. The research approach combines quantitative data analysis with qualitative insights from industry experts and market participants.

Primary research activities include structured interviews with insurance executives, dental providers, employers, and consumers to gather firsthand insights into market trends, challenges, and opportunities. Survey data collection provides statistical validation of market trends and consumer preferences.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and government databases to establish market baselines and identify growth patterns. Data triangulation ensures accuracy and reliability of market insights.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth scenarios. Advanced analytics help identify key drivers and potential market disruptions affecting long-term industry dynamics.

Validation processes include expert review panels and cross-referencing with multiple data sources to ensure research accuracy and reliability. Continuous monitoring of market developments ensures research findings remain current and relevant.

Northeast region demonstrates the highest dental insurance penetration rates with approximately 82% coverage among working adults, driven by strong employer benefit traditions and higher income levels. States like Massachusetts and Connecticut lead in comprehensive coverage adoption and innovative insurance products.

West Coast markets show robust growth in individual coverage purchases and alternative insurance models. California’s large population and diverse demographics create opportunities for targeted products serving specific ethnic and income segments with varying coverage needs.

Southeast region experiences rapid market expansion driven by population growth and increasing employer benefit adoption. States like Florida and Texas demonstrate strong demand for affordable coverage options serving diverse populations including retirees and young families.

Midwest markets maintain stable coverage levels with strong employer-sponsored plan participation. The region benefits from established insurance infrastructure and competitive pricing, though rural areas face challenges with provider network adequacy.

Mountain West region shows emerging growth opportunities as population centers expand and economic development attracts new businesses. States like Colorado and Utah demonstrate increasing demand for comprehensive dental benefits among growing professional populations.

Market leadership remains concentrated among several major national carriers who dominate through extensive networks, comprehensive product portfolios, and established employer relationships:

Competitive strategies focus on network expansion, technology integration, and value-based care models. Leading companies invest heavily in digital platforms, customer service capabilities, and provider relationship management to maintain market position.

Emerging competitors include technology-focused startups and alternative coverage models challenging traditional insurance approaches. These new entrants often target underserved segments with innovative products and distribution strategies.

By Coverage Type:

By Distribution Channel:

By Customer Segment:

Preventive Care Coverage represents the most utilized benefit category with approximately 95% utilization rates among covered members. This category includes routine cleanings, examinations, and basic diagnostic services that form the foundation of oral health maintenance.

Basic Restorative Services encompass fillings, extractions, and emergency treatments that address common dental problems. These services typically feature moderate copayments and represent significant value for consumers facing unexpected dental issues.

Major Restorative Procedures including crowns, bridges, and dentures require higher patient cost-sharing but provide essential coverage for complex dental needs. These benefits often include waiting periods and annual maximum limitations.

Orthodontic Coverage serves growing demand for teeth straightening treatments among both children and adults. This category typically features separate benefit maximums and age restrictions varying by plan design.

Specialty Services including periodontics, endodontics, and oral surgery provide coverage for specialized dental care. These benefits often require referrals and pre-authorization to manage costs and ensure appropriate utilization.

Insurance Carriers benefit from stable premium revenue streams and predictable claim patterns that enable effective risk management and profitability. The dental insurance market provides diversification opportunities and cross-selling potential with medical insurance products.

Dental Providers gain access to larger patient populations and predictable payment streams through insurance network participation. Provider relationships with insurers create referral opportunities and practice growth potential while reducing administrative burden.

Employers enhance employee attraction and retention capabilities through comprehensive dental benefit offerings. Dental insurance provides cost-effective employee benefits that improve workplace satisfaction and productivity while managing healthcare costs.

Consumers receive financial protection against expensive dental procedures and improved access to preventive care services. Insurance coverage enables regular dental visits and early intervention that prevent more costly treatments.

Healthcare Systems benefit from improved population oral health outcomes and reduced emergency department visits for dental problems. Comprehensive dental coverage supports overall health improvement and healthcare cost reduction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first customer experience emerges as a dominant trend with insurers investing heavily in mobile applications, online portals, and digital claims processing. These technological improvements enhance customer satisfaction while reducing operational costs and processing times.

Teledentistry integration gains momentum as insurers begin covering virtual consultations and remote monitoring services. This trend expands access to dental care, particularly in underserved areas, while providing cost-effective alternatives to traditional office visits.

Value-based care models increasingly replace traditional fee-for-service approaches as insurers and providers collaborate on outcome-based payment structures. These models emphasize preventive care and long-term oral health improvement over procedure volume.

Personalized coverage options reflect growing consumer demand for customized insurance products tailored to individual needs and preferences. Insurers develop flexible plan designs allowing consumers to select coverage levels and benefit combinations.

Wellness program integration connects dental benefits with broader health and wellness initiatives. Employers increasingly recognize oral health connections to overall wellness, driving demand for comprehensive health benefit packages.

Regulatory initiatives in several states expand dental coverage requirements and consumer protections. Recent legislation in states like California and New York mandates certain dental benefits and improves coverage accessibility for underserved populations.

Technology partnerships between insurance carriers and dental technology companies create innovative service delivery models. These collaborations focus on improving patient outcomes, reducing costs, and enhancing the overall dental care experience.

Merger and acquisition activity continues reshaping the competitive landscape as companies seek scale advantages and market expansion opportunities. Recent transactions focus on geographic expansion and technology capability enhancement.

Product innovation includes development of hybrid insurance models combining traditional coverage with discount programs and alternative payment arrangements. These innovations address diverse consumer needs and price sensitivity concerns.

Network expansion initiatives focus on improving provider access in underserved areas and adding specialty services to comprehensive coverage options. Insurers invest in provider recruitment and retention programs to enhance network adequacy.

MarkWide Research recommends that insurance carriers prioritize digital transformation initiatives to meet evolving consumer expectations and improve operational efficiency. Investment in technology platforms and customer service capabilities will differentiate successful companies in competitive markets.

Market expansion strategies should focus on underserved segments including individual consumers, small businesses, and rural populations. Targeted products and distribution approaches can capture significant growth opportunities while addressing unmet market needs.

Partnership development with healthcare systems, dental service organizations, and technology companies can create competitive advantages and improve service delivery. Strategic alliances enable market expansion while sharing risks and investment requirements.

Product innovation should emphasize flexibility, transparency, and value to address consumer concerns about traditional dental insurance limitations. Simplified benefit structures and enhanced coverage options can improve market penetration and customer satisfaction.

Preventive care emphasis creates opportunities for value-based coverage models that improve patient outcomes while controlling costs. Insurers should develop programs incentivizing regular dental visits and early intervention to reduce long-term treatment needs.

Market growth prospects remain positive with projected expansion driven by demographic trends, employer benefit adoption, and increasing health awareness. The market is expected to grow at approximately 6.2% CAGR over the next five years, supported by expanding coverage access and innovative product development.

Technology integration will continue transforming the dental insurance landscape through artificial intelligence, predictive analytics, and automated claims processing. These advancements will improve customer experience while reducing operational costs and processing times.

Regulatory evolution may expand coverage mandates and consumer protections, creating both opportunities and challenges for market participants. Policy changes supporting expanded dental coverage access will drive market growth while potentially increasing compliance requirements.

Consumer expectations will continue evolving toward more personalized, transparent, and digital-first insurance experiences. Successful companies will adapt their products and services to meet these changing demands while maintaining cost competitiveness.

MWR analysis indicates that market consolidation may continue as companies seek scale advantages and technology capabilities. However, opportunities remain for innovative companies addressing specific market segments or developing alternative coverage models.

The US dental insurance market demonstrates robust growth potential driven by increasing health awareness, employer benefit expansion, and technological innovation. Market participants who successfully adapt to changing consumer expectations while maintaining cost competitiveness will capture significant growth opportunities in this evolving landscape.

Strategic success requires focus on digital transformation, network expansion, and product innovation to address diverse consumer needs and market segments. Companies must balance coverage comprehensiveness with affordability while improving customer experience through technology integration.

Future market leaders will distinguish themselves through innovative coverage models, strategic partnerships, and superior customer service capabilities. The market continues evolving toward more consumer-centric approaches that emphasize value, transparency, and accessibility in dental insurance coverage.

What is Dental Insurance?

Dental insurance is a type of health insurance designed to pay a portion of the costs associated with dental care, including preventive services, basic procedures, and major treatments. It helps individuals manage their dental expenses and encourages regular dental visits.

What are the key players in the US Dental Insurance Market?

Key players in the US Dental Insurance Market include Delta Dental, MetLife, and Cigna, which offer a variety of dental plans catering to individuals and families. These companies compete on coverage options, network size, and customer service, among others.

What are the growth factors driving the US Dental Insurance Market?

The US Dental Insurance Market is driven by increasing awareness of oral health, rising dental care costs, and a growing emphasis on preventive care. Additionally, the expansion of employer-sponsored dental plans contributes to market growth.

What challenges does the US Dental Insurance Market face?

The US Dental Insurance Market faces challenges such as regulatory changes, high out-of-pocket costs for patients, and a lack of dental insurance coverage among certain demographics. These factors can limit access to necessary dental care.

What opportunities exist in the US Dental Insurance Market?

Opportunities in the US Dental Insurance Market include the development of innovative insurance products, expansion into underserved markets, and partnerships with dental care providers to enhance service delivery. These strategies can help insurers attract new customers.

What trends are shaping the US Dental Insurance Market?

Trends in the US Dental Insurance Market include the rise of tele-dentistry, increased focus on integrated health plans, and the adoption of technology for claims processing. These trends are transforming how dental services are delivered and insured.

US Dental Insurance Market

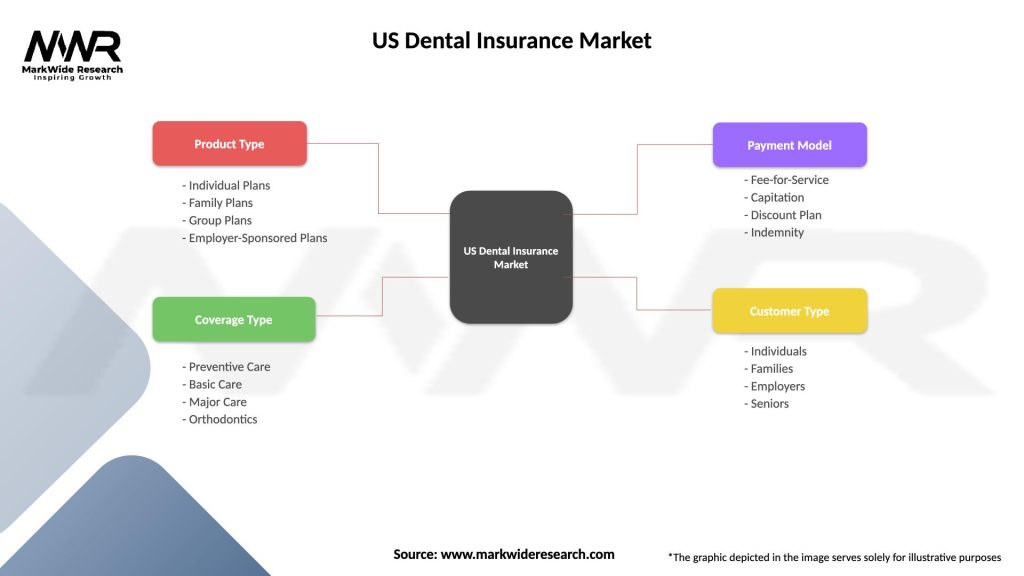

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Family Plans, Group Plans, Employer-Sponsored Plans |

| Coverage Type | Preventive Care, Basic Care, Major Care, Orthodontics |

| Payment Model | Fee-for-Service, Capitation, Discount Plan, Indemnity |

| Customer Type | Individuals, Families, Employers, Seniors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Dental Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at