444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US defense composites market represents a critical segment of the nation’s military-industrial complex, encompassing advanced materials that combine two or more constituent materials to create superior performance characteristics for defense applications. Defense composites have become increasingly vital in modern military systems, offering exceptional strength-to-weight ratios, corrosion resistance, and electromagnetic properties that traditional materials cannot match. The market encompasses a diverse range of applications including aircraft structures, naval vessels, ground vehicles, missile systems, and protective equipment.

Market dynamics indicate robust growth driven by increasing defense spending, technological advancement requirements, and the need for lighter, more durable military equipment. The sector benefits from continuous innovation in fiber reinforcement technologies, resin systems, and manufacturing processes that enhance performance while reducing costs. Growth projections suggest the market will expand at a 6.2% CAGR through the forecast period, supported by modernization programs across all military branches.

Strategic importance of composites in defense applications cannot be overstated, as these materials enable next-generation military platforms to achieve superior performance metrics while maintaining operational efficiency. The integration of advanced composites supports national security objectives by providing technological advantages in critical defense systems.

The US defense composites market refers to the comprehensive ecosystem of advanced composite materials specifically designed, manufactured, and deployed for military and defense applications within the United States. Defense composites are engineered materials consisting of reinforcing fibers embedded in a matrix material, creating structures that exhibit superior mechanical, thermal, and electrical properties compared to conventional materials like steel or aluminum.

These materials encompass various fiber types including carbon fiber, glass fiber, aramid fiber, and ceramic fibers, combined with polymer, metal, or ceramic matrix systems. The market includes raw materials, intermediate products, finished components, and associated manufacturing services that support defense contractors, military branches, and government agencies in developing advanced military systems.

Applications span across aerospace platforms, naval systems, ground vehicles, weapons systems, and personal protection equipment, where weight reduction, durability, stealth characteristics, and performance enhancement are critical requirements for mission success and personnel safety.

The US defense composites market demonstrates exceptional growth potential driven by increasing military modernization efforts and the critical need for advanced materials in next-generation defense systems. Key market drivers include rising defense budgets, technological advancement requirements, and the imperative to maintain military superiority through material innovation.

Market segmentation reveals significant opportunities across multiple application areas, with aerospace and defense aircraft representing the largest segment, followed by naval applications and ground vehicle systems. Carbon fiber composites dominate the market due to their exceptional strength-to-weight ratios and performance characteristics essential for military applications.

Competitive landscape features established aerospace and defense contractors alongside specialized composite manufacturers, creating a dynamic ecosystem that supports innovation and technological advancement. Regional concentration remains strong in traditional defense manufacturing hubs, with 75% of production capacity located in key states with established military-industrial infrastructure.

Future outlook indicates sustained growth supported by emerging technologies, increased focus on unmanned systems, and the ongoing need for material solutions that enhance military capability while reducing operational costs and logistical complexity.

Strategic analysis reveals several critical insights that define the current and future state of the US defense composites market:

These insights collectively indicate a market positioned for sustained growth and technological advancement, supported by strong government investment and industry innovation capabilities.

Multiple factors contribute to the robust growth trajectory of the US defense composites market, creating a favorable environment for sustained expansion and innovation.

Defense Budget Increases represent the primary driver, with consistent government investment in military modernization programs requiring advanced materials for next-generation platforms. Congressional appropriations continue to prioritize technological superiority, directly benefiting composite material applications across all military branches.

Weight reduction requirements drive significant demand as military systems become more complex while requiring enhanced mobility and fuel efficiency. Composite materials enable substantial weight savings compared to traditional materials, improving operational range, payload capacity, and overall system performance.

Stealth technology advancement creates specialized demand for composites with specific electromagnetic properties that support radar-absorbing and low-observable characteristics essential for modern military platforms. These applications require sophisticated material engineering and represent high-value market segments.

Durability and maintenance considerations favor composites due to their superior corrosion resistance and reduced maintenance requirements compared to metallic alternatives. Lifecycle cost advantages make composites increasingly attractive for long-term military programs where operational efficiency is paramount.

Technological innovation in manufacturing processes continues to expand application possibilities while reducing costs, making composites viable for broader military applications beyond traditional aerospace uses.

Several challenges constrain market growth and present ongoing obstacles for industry participants in the US defense composites sector.

High initial costs remain a significant barrier, as advanced composite materials and manufacturing processes require substantial capital investment compared to conventional materials. Budget constraints at program levels can limit adoption despite long-term cost advantages.

Manufacturing complexity presents technical challenges requiring specialized equipment, skilled personnel, and stringent quality control processes. Production scalability issues can limit the ability to meet large-volume defense contracts efficiently.

Supply chain vulnerabilities create risks related to raw material availability, particularly for specialized fibers and resin systems that may have limited supplier bases. Geopolitical factors can impact access to critical materials, affecting production continuity.

Regulatory compliance requirements add complexity and cost to development and manufacturing processes, as defense applications must meet stringent military specifications and certification standards. Qualification processes can be lengthy and expensive, delaying market entry for new products.

Technical limitations in certain applications where composites may not provide optimal solutions compared to traditional materials, particularly in high-temperature or impact-critical applications where alternative materials may be preferred.

Emerging opportunities within the US defense composites market present significant potential for growth and innovation across multiple application areas and technology segments.

Unmanned systems expansion creates substantial opportunities as military branches increase investment in drone technology, autonomous vehicles, and robotic systems where composite materials provide critical weight and performance advantages. These platforms often require specialized composite solutions for optimal functionality.

Space and hypersonic applications represent high-growth segments requiring advanced composite materials capable of withstanding extreme temperatures and stresses. National security priorities in space defense and hypersonic weapon systems drive demand for cutting-edge composite technologies.

Additive manufacturing integration offers opportunities to develop new composite manufacturing processes that enable complex geometries and customized solutions for specific military applications. 3D printing technologies combined with composite materials open new possibilities for rapid prototyping and small-batch production.

Smart materials development presents opportunities for composites with integrated sensing, self-healing, or adaptive properties that enhance military system capabilities. These innovations could revolutionize military equipment design and functionality.

Export market expansion through foreign military sales programs creates opportunities for US composite manufacturers to serve allied nations’ defense requirements while supporting domestic industry growth and technological leadership.

Complex interactions between various market forces shape the evolution and growth trajectory of the US defense composites market, creating a dynamic environment that requires strategic adaptation.

Supply and demand dynamics reflect the cyclical nature of defense procurement, with demand patterns influenced by military budget cycles, threat assessments, and technological development timelines. Market participants must navigate these cycles while maintaining production capabilities and innovation momentum.

Technology evolution drives continuous market transformation as new composite materials, manufacturing processes, and application techniques emerge. Research and development investments by both government and industry create ongoing opportunities for market expansion and competitive differentiation.

Competitive pressures intensify as traditional aerospace companies, specialized composite manufacturers, and emerging technology firms compete for defense contracts. Market consolidation trends may reshape the competitive landscape through mergers, acquisitions, and strategic partnerships.

Regulatory environment influences market dynamics through defense acquisition policies, export controls, and material certification requirements. Policy changes can significantly impact market access, pricing structures, and competitive positioning.

According to MarkWide Research analysis, market dynamics indicate increasing integration between composite manufacturers and defense contractors, creating more collaborative relationships that accelerate innovation and improve cost efficiency across the value chain.

Comprehensive research methodology employed in analyzing the US defense composites market combines multiple data sources and analytical approaches to ensure accuracy and reliability of market insights and projections.

Primary research involves extensive interviews with industry executives, defense contractors, military procurement officials, and composite material manufacturers to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture quantitative data on market size, growth rates, and competitive positioning.

Secondary research encompasses analysis of government defense budgets, military procurement documents, industry reports, and academic research to validate primary findings and provide comprehensive market context. Data triangulation ensures consistency and accuracy across multiple information sources.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends based on historical data, current market conditions, and identified growth drivers. Scenario analysis considers various potential outcomes based on different market conditions and policy environments.

Expert validation involves review of findings by industry experts and defense analysts to ensure conclusions accurately reflect market realities and provide actionable insights for stakeholders. Continuous monitoring of market developments ensures research remains current and relevant.

Geographic distribution of the US defense composites market reflects the concentration of defense manufacturing capabilities and military installations across key regions, with distinct characteristics and growth patterns.

West Coast regions dominate aerospace and defense composite manufacturing, particularly in California and Washington, where major aerospace contractors maintain significant production facilities. These areas benefit from established supply chains, skilled workforce, and proximity to major defense contractors, representing approximately 35% of national production capacity.

Southeast regions have emerged as significant manufacturing hubs, with states like South Carolina, Georgia, and Alabama attracting defense contractors through favorable business environments and workforce development programs. Regional growth in this area accounts for 28% of market expansion over recent years.

Northeast corridor maintains strong presence in advanced composite research and development, with Connecticut, Massachusetts, and Pennsylvania hosting specialized facilities focused on next-generation materials and technologies. Innovation centers in these regions drive technological advancement and maintain competitive advantages.

Southwest regions contribute significantly through aerospace and defense manufacturing in Texas and Arizona, where favorable operating conditions and government support create attractive environments for composite manufacturing operations. Market share in these regions continues to expand with new facility investments.

Midwest regions provide specialized capabilities in ground vehicle and industrial applications, supporting defense programs requiring robust composite solutions for harsh operating environments.

The competitive environment within the US defense composites market features a diverse mix of established aerospace giants, specialized composite manufacturers, and emerging technology companies, each contributing unique capabilities and market positioning.

Market positioning varies significantly among competitors, with some focusing on large-scale platform integration while others specialize in advanced materials development or niche applications. Strategic partnerships between prime contractors and material suppliers create collaborative relationships that drive innovation and market growth.

Market segmentation of the US defense composites market reveals distinct categories based on material type, application, manufacturing process, and end-user requirements, each presenting unique characteristics and growth opportunities.

By Fiber Type:

By Matrix Material:

By Application:

Detailed analysis of market categories reveals specific trends, growth patterns, and opportunities within each segment of the US defense composites market.

Aerospace Applications continue to represent the largest market category, driven by ongoing aircraft modernization programs and the development of next-generation fighter jets. Carbon fiber composites dominate this segment due to weight reduction requirements and performance specifications that traditional materials cannot meet. Growth rates in this category remain strong at 8.1% annually, supported by major military aircraft programs.

Naval Applications demonstrate increasing adoption of composite materials for both surface vessels and submarine systems, where corrosion resistance and weight optimization provide significant operational advantages. Glass fiber composites find extensive use in non-critical structures, while carbon fiber solutions are employed in high-performance applications requiring superior strength characteristics.

Ground Vehicle Systems represent an emerging growth category as military branches seek to improve vehicle performance while reducing weight and fuel consumption. Ballistic protection applications drive demand for specialized aramid and ceramic fiber composites that provide enhanced crew protection capabilities.

Weapons Systems create demand for highly specialized composite materials with unique property requirements, including radar transparency, thermal management, and structural integrity under extreme conditions. These applications often require custom material development and represent high-value market opportunities.

Multiple stakeholders within the US defense composites market ecosystem realize significant benefits from participation in this growing and strategically important sector.

Defense Contractors benefit from access to advanced materials that enable superior military platform performance, competitive differentiation, and the ability to meet increasingly demanding military specifications. Composite integration allows contractors to offer enhanced capabilities while potentially reducing long-term maintenance costs and improving operational efficiency.

Material Manufacturers gain access to high-value market segments with stable long-term demand driven by national security requirements. Defense applications often justify premium pricing for advanced materials and create opportunities for technology development that can benefit commercial markets.

Military End Users realize operational advantages including reduced weight, improved performance, enhanced durability, and lower maintenance requirements that translate to cost savings and improved mission effectiveness. Advanced composites enable military systems to achieve performance levels impossible with traditional materials.

Government Agencies benefit from improved military capabilities, technological leadership maintenance, and support for domestic manufacturing capabilities that enhance national security and economic competitiveness. Investment in composites supports broader defense industrial base objectives.

Research Institutions gain opportunities for advanced materials research, technology development partnerships, and workforce development programs that support both academic objectives and national defense requirements.

Comprehensive SWOT analysis reveals the strategic position and key factors influencing the US defense composites market’s current status and future prospects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several significant trends are reshaping the US defense composites market, influencing technology development, manufacturing approaches, and application strategies.

Additive Manufacturing Integration represents a transformative trend as 3D printing technologies enable new possibilities for composite part production, including complex geometries and rapid prototyping capabilities. This trend is particularly relevant for low-volume, high-value defense applications where traditional manufacturing may not be cost-effective.

Smart Materials Development drives innovation in composites with integrated sensing, self-healing, or adaptive properties that enhance military system capabilities. These advanced materials could revolutionize defense applications by providing real-time structural health monitoring and autonomous repair capabilities.

Sustainability Focus influences material selection and manufacturing processes as defense organizations increasingly consider environmental impact and lifecycle sustainability. Recyclable composites and bio-based materials are gaining attention for appropriate defense applications.

Automation Advancement in manufacturing processes improves production efficiency, quality consistency, and cost-effectiveness while addressing skilled workforce limitations. Automated fiber placement and robotic manufacturing systems are becoming standard in high-volume production.

Multifunctional Materials trend toward composites that provide multiple capabilities beyond structural support, including electromagnetic shielding, thermal management, and energy storage. MWR data indicates that 43% of new defense composite applications incorporate multifunctional capabilities.

Recent industry developments highlight the dynamic nature of the US defense composites market and indicate future direction and growth opportunities.

Major Contract Awards continue to drive market growth, with significant defense programs incorporating advanced composite materials for next-generation military platforms. These contracts provide long-term revenue visibility and support continued investment in manufacturing capabilities and technology development.

Technology Partnerships between defense contractors, material suppliers, and research institutions accelerate innovation and reduce development timelines for advanced composite solutions. Collaborative programs leverage combined expertise to address complex military requirements more effectively.

Manufacturing Facility Investments demonstrate industry confidence in long-term market growth, with companies expanding production capabilities and implementing advanced manufacturing technologies. These investments support increased production capacity and improved cost competitiveness.

Research and Development Initiatives focus on next-generation materials and manufacturing processes that will define future market opportunities. Government funding for advanced materials research supports industry innovation and maintains technological leadership.

Supply Chain Strengthening efforts address strategic vulnerabilities and ensure reliable access to critical materials and components. Domestic sourcing initiatives reduce dependence on foreign suppliers and enhance supply chain security for defense applications.

Strategic recommendations for market participants focus on positioning for long-term success in the evolving US defense composites market environment.

Investment in Advanced Manufacturing capabilities should prioritize automation, quality control systems, and scalable production processes that can meet increasing demand while maintaining cost competitiveness. Manufacturing excellence will become increasingly important as market competition intensifies.

Technology Development Focus should emphasize multifunctional materials, smart composites, and sustainable solutions that address emerging military requirements and differentiate offerings in competitive markets. Innovation leadership will be critical for maintaining market position.

Supply Chain Diversification strategies should reduce dependence on single sources for critical materials while building relationships with domestic suppliers to enhance supply security. Supply chain resilience is essential for reliable defense contractor relationships.

Workforce Development Programs should address skilled labor shortages through training initiatives, partnerships with educational institutions, and retention strategies that maintain manufacturing expertise. Human capital represents a critical competitive advantage in advanced manufacturing.

Market Expansion Opportunities should explore emerging applications, international markets through foreign military sales, and adjacent market segments where defense-developed technologies can create value. Diversification strategies can reduce dependence on cyclical defense spending patterns.

Long-term prospects for the US defense composites market remain highly favorable, supported by fundamental drivers that are expected to sustain growth and innovation throughout the forecast period.

Market expansion is projected to continue at a robust pace, with MarkWide Research projections indicating sustained growth driven by military modernization requirements, emerging threat responses, and technological advancement needs. Growth momentum is expected to accelerate as new military platforms enter production phases.

Technology evolution will drive market transformation through advanced materials, manufacturing processes, and application techniques that expand the addressable market and create new opportunities. Next-generation composites with enhanced capabilities will command premium pricing and support market value growth.

Application diversification beyond traditional aerospace uses will create new market segments and reduce cyclical dependence on major aircraft programs. Emerging applications in space systems, hypersonic vehicles, and directed energy systems present significant growth potential.

International opportunities through foreign military sales and allied nation partnerships will expand the addressable market while supporting domestic manufacturing capabilities. Export growth could represent 25% of market expansion over the next decade.

Industry consolidation may reshape the competitive landscape through mergers, acquisitions, and strategic partnerships that create larger, more capable organizations better positioned to serve complex defense requirements and invest in advanced technologies.

The US defense composites market represents a strategically important and rapidly growing sector that plays a critical role in maintaining national security capabilities and technological leadership. Market fundamentals remain strong, supported by consistent defense investment, technological advancement requirements, and the ongoing need for superior military capabilities.

Growth prospects are highly favorable, driven by multiple factors including military modernization programs, emerging threat responses, and the continuous evolution of composite technologies that expand application possibilities. Market participants who invest in advanced capabilities, maintain innovation leadership, and build resilient supply chains are well-positioned for long-term success.

Strategic importance of the sector extends beyond immediate market opportunities to encompass broader national security objectives, technological competitiveness, and industrial base maintenance. Continued investment in defense composites supports multiple national priorities while creating sustainable business opportunities for industry participants.

Future success in this market will require balanced attention to technological innovation, manufacturing excellence, supply chain security, and workforce development. Organizations that excel in these areas while maintaining strong customer relationships and market positioning will capture the significant opportunities available in this dynamic and growing market.

What is Defense Composites?

Defense composites are advanced materials used in military applications, characterized by their lightweight, high strength, and durability. They are commonly utilized in aerospace, naval, and ground vehicle manufacturing to enhance performance and reduce weight.

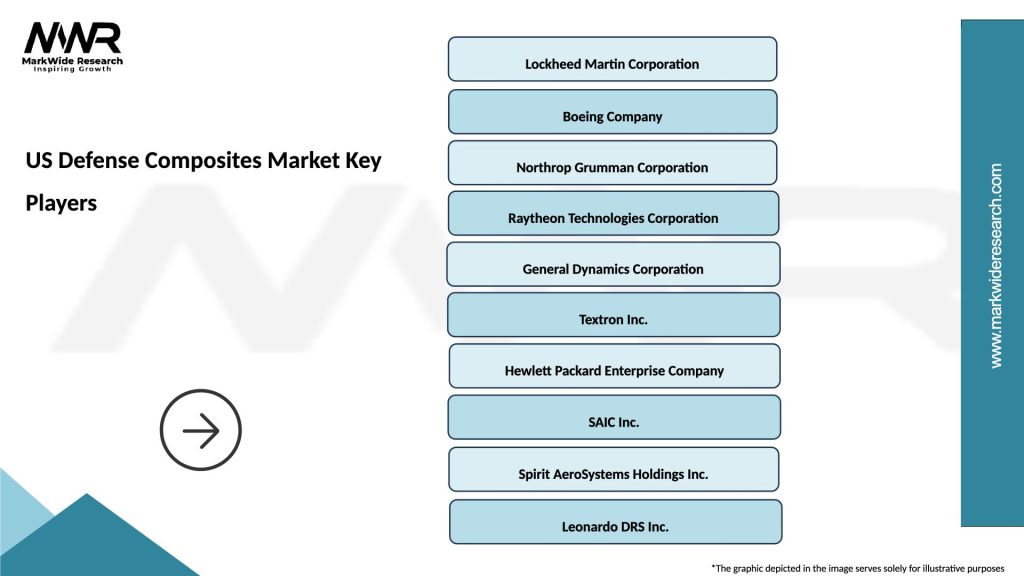

What are the key players in the US Defense Composites Market?

Key players in the US Defense Composites Market include companies like Northrop Grumman, Lockheed Martin, and Boeing, which are known for their innovative composite solutions in defense applications, among others.

What are the growth factors driving the US Defense Composites Market?

The US Defense Composites Market is driven by the increasing demand for lightweight materials that improve fuel efficiency and performance in military vehicles and aircraft. Additionally, advancements in composite manufacturing technologies are enhancing the capabilities of these materials.

What challenges does the US Defense Composites Market face?

Challenges in the US Defense Composites Market include the high costs associated with advanced composite materials and the complexities involved in their manufacturing processes. Additionally, regulatory compliance and the need for specialized skills can hinder market growth.

What future opportunities exist in the US Defense Composites Market?

The US Defense Composites Market presents opportunities in the development of new composite materials that offer improved performance and sustainability. Innovations in recycling and eco-friendly composites are also gaining traction, aligning with defense sustainability goals.

What trends are shaping the US Defense Composites Market?

Trends in the US Defense Composites Market include the increasing integration of smart materials and nanotechnology in composite designs. Additionally, there is a growing focus on lightweight armor solutions and enhanced structural components for military applications.

US Defense Composites Market

| Segmentation Details | Description |

|---|---|

| Product Type | Carbon Fiber, Glass Fiber, Aramid Fiber, Hybrid Fiber |

| Application | Aerospace, Military Vehicles, Naval Systems, Personal Armor |

| End User | Government Agencies, Defense Contractors, Research Institutions, OEMs |

| Technology | Resin Transfer Molding, Vacuum Infusion, Prepreg, 3D Printing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Defense Composites Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at