444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US data center rack market represents a critical infrastructure component driving the digital transformation across American enterprises and cloud service providers. Data center racks serve as the fundamental housing units for servers, networking equipment, and storage systems that power modern computing environments. The market has experienced robust growth driven by increasing demand for cloud computing services, edge computing deployment, and enterprise digitalization initiatives.

Market dynamics indicate substantial expansion opportunities as organizations continue investing in data center infrastructure to support artificial intelligence workloads, Internet of Things applications, and hybrid cloud architectures. The sector demonstrates strong momentum with a projected compound annual growth rate of 8.2% through 2030, reflecting the critical role of rack infrastructure in supporting America’s digital economy.

Regional distribution shows concentrated activity in major metropolitan areas including Northern Virginia, Silicon Valley, Dallas, and Chicago, where hyperscale data centers and colocation facilities drive significant rack deployment. The market encompasses various rack configurations from traditional 42U units to specialized high-density solutions designed for modern server architectures and cooling requirements.

The US data center rack market refers to the comprehensive ecosystem of standardized mounting frameworks, enclosures, and supporting infrastructure components used to organize and house IT equipment within American data center facilities. These specialized structures provide physical support, power distribution, cooling airflow management, and cable organization for servers, switches, storage arrays, and other critical computing hardware.

Data center racks typically follow industry-standard dimensions measured in rack units (RU or U), with each unit representing 1.75 inches of vertical mounting space. The market includes various rack types such as open frame racks, enclosed server cabinets, wall-mount units, and specialized configurations for specific applications like network closets, edge computing deployments, and high-performance computing environments.

Modern rack systems integrate advanced features including intelligent power distribution units, environmental monitoring sensors, cable management solutions, and security mechanisms. The market encompasses both the physical rack structures and complementary accessories that enable efficient data center operations, equipment maintenance, and infrastructure scalability.

Strategic analysis reveals the US data center rack market positioned for sustained expansion driven by accelerating digital infrastructure investments and evolving computing requirements. Key market drivers include the proliferation of cloud services, edge computing deployment, artificial intelligence workload growth, and increasing data generation across industries.

Technology evolution toward higher server densities and specialized computing architectures creates demand for innovative rack solutions with enhanced cooling capabilities, improved power efficiency, and flexible configuration options. The market benefits from 65% of enterprises actively expanding their data center footprints to support digital transformation initiatives.

Competitive landscape features established infrastructure providers alongside emerging technology companies developing next-generation rack solutions. Market participants focus on product innovation, sustainability initiatives, and comprehensive service offerings to capture growing demand from hyperscale operators, colocation providers, and enterprise customers.

Future prospects indicate continued market expansion supported by 5G network rollouts, Internet of Things proliferation, and increasing adoption of hybrid cloud architectures requiring distributed computing infrastructure across the United States.

Critical market insights demonstrate the transformative impact of evolving computing requirements on rack infrastructure demand and design specifications:

Primary market drivers propel sustained growth in the US data center rack market through fundamental shifts in computing infrastructure requirements and business digitalization trends.

Cloud computing expansion represents the dominant growth catalyst as organizations migrate workloads to public, private, and hybrid cloud environments. This transition drives massive data center construction projects requiring thousands of standardized rack units to house cloud infrastructure equipment. Enterprise cloud adoption continues accelerating with 78% of organizations implementing multi-cloud strategies that necessitate distributed rack deployments.

Artificial intelligence and machine learning workloads create unprecedented demand for specialized computing infrastructure requiring high-performance rack configurations. These applications demand enhanced power delivery, advanced cooling systems, and optimized airflow management to support GPU-intensive server architectures.

Edge computing deployment emerges as a significant driver as organizations seek to reduce latency and improve application performance through distributed computing architectures. This trend creates demand for compact, ruggedized rack solutions suitable for deployment in retail locations, manufacturing facilities, and telecommunications infrastructure.

Digital transformation initiatives across industries drive increased data generation, processing, and storage requirements that translate directly into expanded data center infrastructure needs. Organizations invest heavily in modernizing their IT infrastructure to support digital business models and competitive advantages.

Market restraints present challenges that could potentially limit growth momentum in the US data center rack market, requiring strategic mitigation approaches from industry participants.

High capital investment requirements for comprehensive rack infrastructure deployment create barriers for smaller organizations and limit market expansion in certain segments. The total cost of ownership includes not only rack hardware but also associated power distribution, cooling systems, and facility modifications that can represent substantial financial commitments.

Supply chain complexities affect rack manufacturing and delivery timelines, particularly for customized solutions requiring specialized components or materials. Global supply chain disruptions can impact project schedules and increase costs for data center operators seeking to expand their infrastructure rapidly.

Technical complexity associated with modern rack systems requires specialized expertise for proper installation, configuration, and maintenance. Organizations may face challenges finding qualified personnel with the necessary skills to manage advanced rack infrastructure effectively.

Space limitations in prime data center locations create constraints on rack deployment opportunities, particularly in established metropolitan markets where real estate availability and costs present significant challenges. These limitations can force organizations to consider less optimal locations or delay expansion plans.

Regulatory compliance requirements related to energy efficiency, environmental standards, and safety regulations add complexity and cost to rack procurement and deployment processes, potentially slowing market adoption in certain applications.

Significant market opportunities emerge from technological advancement, changing business requirements, and evolving infrastructure deployment models that create new avenues for growth and innovation.

5G network deployment creates substantial opportunities for edge computing rack solutions as telecommunications providers build distributed infrastructure to support ultra-low latency applications. This trend requires specialized rack configurations optimized for outdoor environments and remote monitoring capabilities.

Sustainability initiatives drive demand for energy-efficient rack designs incorporating renewable materials, improved thermal management, and reduced environmental impact throughout the product lifecycle. Organizations increasingly prioritize green infrastructure solutions that support their environmental commitments.

Modular data center concepts present opportunities for pre-configured rack solutions that enable rapid deployment and scalability. These standardized approaches reduce complexity and accelerate time-to-market for data center projects across various industries and applications.

Internet of Things proliferation creates demand for distributed computing infrastructure requiring compact rack solutions suitable for deployment in industrial environments, smart buildings, and transportation systems. This trend expands the addressable market beyond traditional data center facilities.

Hybrid cloud architectures drive demand for flexible rack solutions that can accommodate diverse equipment types and support seamless integration between on-premises and cloud infrastructure components.

Market dynamics reflect the complex interplay of technological innovation, customer requirements, and competitive forces shaping the evolution of the US data center rack market.

Technology convergence drives integration of intelligent features into rack infrastructure, including automated monitoring systems, predictive maintenance capabilities, and remote management interfaces. These advances enable 25% improvement in operational efficiency while reducing manual intervention requirements.

Customer expectations evolve toward comprehensive solutions that combine rack hardware with professional services, installation support, and ongoing maintenance programs. This shift creates opportunities for providers offering integrated value propositions beyond traditional equipment sales.

Competitive intensity increases as established infrastructure providers face competition from technology companies developing innovative rack solutions with enhanced capabilities and differentiated features. Market participants invest heavily in research and development to maintain competitive advantages.

Standardization efforts within the industry promote interoperability and reduce complexity while enabling economies of scale in manufacturing and deployment. Industry organizations work to establish common specifications that benefit both suppliers and customers.

Global supply chain considerations influence manufacturing strategies and cost structures as companies balance quality, cost, and delivery requirements across international markets and regulatory environments.

Comprehensive research methodology employed for analyzing the US data center rack market combines quantitative data analysis with qualitative insights from industry experts and market participants to ensure accuracy and reliability of findings.

Primary research involves direct engagement with key stakeholders including data center operators, rack manufacturers, system integrators, and end-user organizations through structured interviews, surveys, and focus group discussions. This approach provides firsthand insights into market trends, customer requirements, and competitive dynamics.

Secondary research encompasses analysis of industry publications, company financial reports, government databases, and trade association data to establish market context and validate primary research findings. MarkWide Research leverages multiple data sources to ensure comprehensive market coverage and analytical rigor.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify growth opportunities. The methodology accounts for various factors including technological advancement, regulatory changes, and economic conditions.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review, and consistency checks across different market segments and geographic regions. This rigorous approach maintains the integrity and reliability of research conclusions.

Regional analysis reveals distinct patterns in US data center rack market development driven by local economic conditions, infrastructure investments, and industry concentrations across different geographic areas.

Northern Virginia maintains its position as the largest data center market in the United States, accounting for 28% of national rack deployments due to its proximity to federal agencies, major internet exchanges, and established fiber infrastructure. The region benefits from favorable regulatory environment and abundant power availability supporting continued expansion.

Silicon Valley and the broader San Francisco Bay Area represent 18% of market activity driven by technology companies, cloud service providers, and innovation-focused enterprises requiring high-performance computing infrastructure. The region emphasizes cutting-edge rack technologies and sustainable infrastructure solutions.

Dallas-Fort Worth emerges as a major growth market capturing 15% market share through strategic geographic positioning, competitive real estate costs, and robust telecommunications infrastructure. The region attracts hyperscale operators and enterprise customers seeking cost-effective data center solutions.

Chicago serves as a central hub for financial services and manufacturing industries, representing 12% of rack deployments with focus on low-latency trading infrastructure and industrial IoT applications. The market emphasizes reliability and security features in rack configurations.

Other regions including Atlanta, Phoenix, and Seattle collectively account for the remaining market share, each developing specialized strengths in particular industry verticals or application areas that drive unique rack requirements and deployment patterns.

Competitive landscape in the US data center rack market features a diverse ecosystem of established infrastructure providers, specialized manufacturers, and emerging technology companies competing across different market segments and customer categories.

Market competition intensifies as companies differentiate through product innovation, service capabilities, and vertical market specialization while maintaining competitive pricing and delivery performance.

Market segmentation analysis reveals distinct categories within the US data center rack market based on product types, applications, end-user industries, and deployment models that exhibit different growth patterns and requirements.

By Product Type:

By Application:

By End-User Industry:

Category-wise insights provide detailed analysis of specific market segments within the US data center rack market, highlighting unique characteristics, growth drivers, and competitive dynamics.

Hyperscale Segment dominates market volume with standardized rack configurations optimized for massive deployment scales. These customers prioritize cost efficiency, rapid deployment capabilities, and consistent quality across thousands of units. The segment drives innovation in manufacturing processes and supply chain optimization.

Enterprise Segment emphasizes customization, security features, and integration capabilities to support diverse IT infrastructure requirements. Organizations in this category often require specialized rack configurations to accommodate legacy equipment alongside modern systems, creating demand for flexible solutions.

Edge Computing Category represents the fastest-growing segment with 22% annual growth driven by 5G deployment, IoT applications, and distributed computing requirements. This category demands compact, ruggedized solutions suitable for deployment in challenging environments with limited space and environmental controls.

Colocation Segment focuses on flexibility and customer service capabilities, requiring rack solutions that can accommodate diverse customer requirements while maintaining operational efficiency. Providers in this category emphasize modular designs and rapid reconfiguration capabilities.

High-Density Computing emerges as a specialized category driven by artificial intelligence and high-performance computing applications requiring enhanced cooling, power delivery, and structural support capabilities beyond traditional rack specifications.

Industry participants and stakeholders realize substantial benefits from the expanding US data center rack market through various value creation opportunities and operational advantages.

Data Center Operators benefit from improved infrastructure efficiency, reduced operational complexity, and enhanced scalability through modern rack solutions. Advanced monitoring and management capabilities enable 30% reduction in maintenance costs while improving equipment reliability and performance optimization.

Equipment Manufacturers gain access to growing market opportunities driven by digital transformation trends and infrastructure modernization requirements. The market provides platforms for innovation, product differentiation, and value-added service offerings that enhance customer relationships and revenue streams.

System Integrators leverage comprehensive rack solutions to deliver complete infrastructure projects with reduced complexity and improved project timelines. Standardized rack systems enable more predictable deployments and simplified maintenance procedures.

End-User Organizations achieve improved IT infrastructure performance, reduced total cost of ownership, and enhanced operational flexibility through modern rack deployments. Organizations report 25% improvement in space utilization and energy efficiency compared to legacy infrastructure.

Technology Vendors benefit from standardized mounting and integration platforms that simplify product development and reduce deployment complexity across diverse customer environments and applications.

SWOT analysis provides comprehensive evaluation of internal and external factors affecting the US data center rack market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shape the evolution of the US data center rack market through technological advancement, changing customer requirements, and industry transformation initiatives.

Intelligent Infrastructure emerges as a dominant trend with rack systems incorporating sensors, monitoring capabilities, and automated management features. These smart racks enable predictive maintenance, real-time optimization, and remote management capabilities that reduce operational costs and improve reliability.

Sustainability Integration becomes increasingly important as organizations prioritize environmental responsibility in infrastructure decisions. Manufacturers develop racks using recyclable materials, energy-efficient designs, and lifecycle optimization approaches that support customer sustainability goals.

Modular Design Philosophy gains traction as customers seek flexible, scalable solutions that can adapt to changing requirements without major infrastructure overhauls. Pre-configured rack modules enable rapid deployment and simplified management across diverse applications.

High-Density Computing drives demand for specialized rack configurations capable of supporting increased power densities, advanced cooling systems, and structural requirements for modern server architectures including GPU-based systems and high-performance computing clusters.

Edge Computing Optimization creates demand for compact, ruggedized rack solutions suitable for deployment in non-traditional environments including retail locations, manufacturing facilities, and outdoor installations requiring environmental protection and remote monitoring capabilities.

Recent industry developments demonstrate the dynamic nature of the US data center rack market with significant innovations, partnerships, and strategic initiatives shaping competitive positioning and market evolution.

Product Innovation accelerates with manufacturers introducing next-generation rack systems featuring integrated cooling solutions, intelligent power distribution, and advanced cable management capabilities. These developments address increasing power densities and operational complexity in modern data centers.

Strategic Partnerships emerge between rack manufacturers and technology providers to develop integrated solutions combining hardware, software, and services. These collaborations enable comprehensive offerings that address complete customer requirements rather than individual components.

Manufacturing Expansion occurs as companies invest in domestic production capabilities to reduce supply chain risks and improve delivery performance. Several major providers announce new manufacturing facilities and capacity expansion projects within the United States.

Sustainability Initiatives gain momentum with manufacturers implementing circular economy principles, renewable energy usage, and carbon reduction programs throughout their operations. Industry leaders commit to environmental targets and transparent reporting on sustainability metrics.

Technology Integration advances through partnerships with software companies, monitoring system providers, and automation specialists to create comprehensive infrastructure management platforms that extend beyond traditional rack hardware offerings.

Strategic recommendations from MarkWide Research analysis provide actionable insights for market participants seeking to optimize their positioning and capitalize on growth opportunities in the US data center rack market.

Product Portfolio Optimization should focus on developing modular, scalable solutions that address diverse customer requirements while maintaining manufacturing efficiency. Companies should invest in flexible design platforms that can accommodate various configurations and customization options without significant cost penalties.

Market Segmentation Strategy requires targeted approaches for different customer categories including hyperscale operators, enterprise customers, and edge computing applications. Each segment has distinct requirements for pricing, features, and service levels that demand specialized go-to-market strategies.

Technology Investment priorities should emphasize intelligent features, sustainability enhancements, and integration capabilities that differentiate offerings in increasingly competitive markets. Companies should balance innovation investments with cost management to maintain competitive pricing.

Partnership Development becomes critical for accessing new markets, technologies, and customer segments. Strategic alliances with complementary providers can enhance value propositions and expand addressable market opportunities without significant internal investment.

Geographic Expansion should target emerging data center markets and edge computing deployments that offer growth potential beyond traditional metropolitan concentrations. Companies should evaluate regional requirements and develop appropriate distribution and support capabilities.

Future market outlook for the US data center rack market indicates sustained growth driven by fundamental technology trends, infrastructure modernization requirements, and evolving business models that create long-term demand for advanced rack solutions.

Technology Evolution will continue driving demand for specialized rack configurations supporting artificial intelligence workloads, quantum computing systems, and next-generation networking equipment. These applications require enhanced power delivery, cooling capabilities, and structural support beyond current standard specifications.

Edge Computing Expansion represents the most significant growth opportunity with distributed infrastructure deployments expected to accelerate through 2030. This trend creates demand for ruggedized, compact rack solutions suitable for deployment in challenging environments with limited space and environmental controls.

Sustainability Requirements will increasingly influence purchasing decisions as organizations implement environmental commitments and regulatory compliance requirements. Manufacturers must develop solutions that minimize environmental impact throughout the product lifecycle while maintaining performance and cost competitiveness.

Market Consolidation may occur as smaller players face challenges competing with established providers having scale advantages and comprehensive product portfolios. However, opportunities exist for specialized companies focusing on niche applications or innovative technologies.

Service Integration will become increasingly important as customers seek comprehensive solutions including installation, maintenance, and managed services rather than standalone hardware purchases. This trend creates opportunities for recurring revenue models and enhanced customer relationships.

The US data center rack market stands positioned for continued expansion driven by fundamental shifts in computing infrastructure requirements, digital transformation initiatives, and emerging technology applications. Market analysis reveals robust growth prospects supported by cloud computing adoption, edge computing deployment, and increasing data center investments across various industry sectors.

Key success factors for market participants include product innovation, customer-focused solutions, and strategic positioning across different market segments. Companies that effectively balance standardization with customization capabilities while maintaining competitive cost structures will capture the greatest market opportunities.

Future growth will be driven primarily by edge computing expansion, artificial intelligence infrastructure requirements, and sustainability initiatives that create demand for advanced rack solutions with enhanced capabilities and environmental performance. Organizations investing in these areas while maintaining operational excellence will achieve sustainable competitive advantages in this dynamic market environment.

What is Data Center Rack?

Data Center Rack refers to a standardized frame or enclosure used to house servers, networking equipment, and other hardware in data centers. These racks are designed to optimize space, improve airflow, and facilitate organization within the data center environment.

What are the key players in the US Data Center Rack Market?

Key players in the US Data Center Rack Market include companies like Schneider Electric, Dell Technologies, and Vertiv, which provide a range of solutions for data center infrastructure. These companies focus on innovation and efficiency to meet the growing demands of data storage and processing, among others.

What are the main drivers of growth in the US Data Center Rack Market?

The main drivers of growth in the US Data Center Rack Market include the increasing demand for cloud computing services, the rise of big data analytics, and the need for efficient data management solutions. Additionally, the expansion of IT infrastructure across various industries contributes to this growth.

What challenges does the US Data Center Rack Market face?

The US Data Center Rack Market faces challenges such as the high costs associated with advanced data center technologies and the need for continuous upgrades to keep pace with rapid technological advancements. Furthermore, space limitations in urban areas can hinder the expansion of data center facilities.

What opportunities exist in the US Data Center Rack Market?

Opportunities in the US Data Center Rack Market include the growing trend of edge computing and the increasing adoption of green data center practices. These trends encourage the development of more efficient and sustainable rack solutions that can meet evolving consumer needs.

What trends are shaping the US Data Center Rack Market?

Trends shaping the US Data Center Rack Market include the integration of smart technologies for monitoring and management, the shift towards modular data center designs, and the emphasis on energy efficiency. These trends reflect the industry’s response to the need for more adaptable and sustainable data center solutions.

US Data Center Rack Market

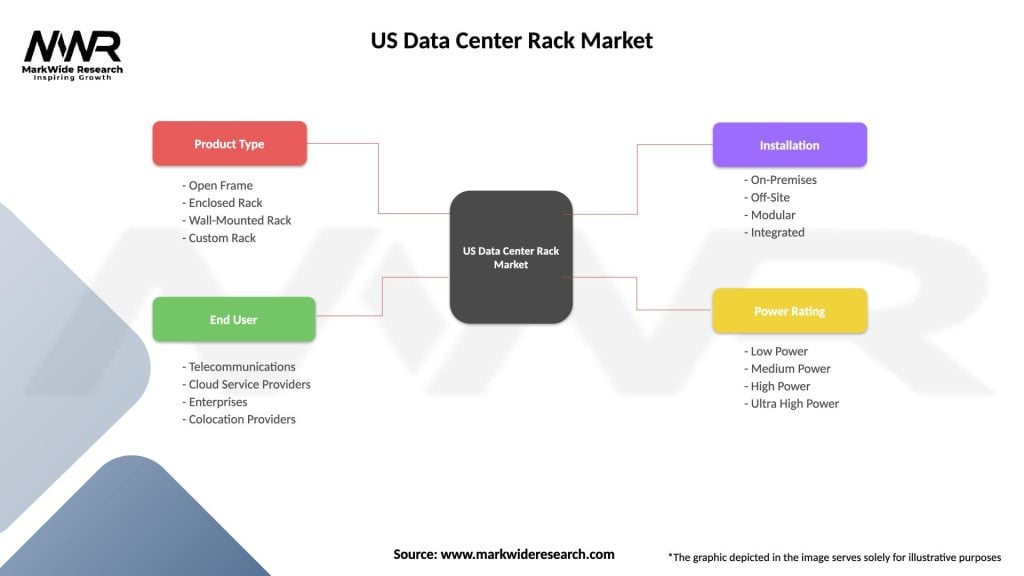

| Segmentation Details | Description |

|---|---|

| Product Type | Open Frame, Enclosed Rack, Wall-Mounted Rack, Custom Rack |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Colocation Providers |

| Installation | On-Premises, Off-Site, Modular, Integrated |

| Power Rating | Low Power, Medium Power, High Power, Ultra High Power |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Data Center Rack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at