444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US dangerous-hazardous goods logistics market represents a critical segment of the American supply chain infrastructure, encompassing the specialized transportation, storage, and handling of materials classified as hazardous under federal regulations. This market has experienced substantial growth driven by increasing industrial production, expanding chemical manufacturing, and heightened regulatory compliance requirements. The sector demonstrates remarkable resilience with a projected compound annual growth rate (CAGR) of 6.2% through the forecast period, reflecting the essential nature of hazardous materials in various industries.

Market dynamics indicate that the dangerous goods logistics sector serves diverse industries including chemicals, pharmaceuticals, energy, automotive, and aerospace. The market encompasses multiple transportation modes including road, rail, air, and maritime shipping, each requiring specialized equipment, trained personnel, and strict adherence to safety protocols. Regulatory compliance remains the cornerstone of market operations, with the Department of Transportation (DOT) and other federal agencies maintaining stringent oversight of hazardous materials transportation.

Geographic distribution shows concentrated activity in industrial corridors along the Gulf Coast, Great Lakes region, and major metropolitan areas where chemical production and manufacturing facilities are located. The market benefits from advanced infrastructure including specialized terminals, certified storage facilities, and trained workforce capabilities that support safe and efficient hazardous goods movement throughout the United States.

The US dangerous-hazardous goods logistics market refers to the comprehensive ecosystem of services, infrastructure, and regulatory frameworks designed to safely transport, store, and handle materials classified as dangerous or hazardous under federal transportation regulations. This specialized logistics sector encompasses the movement of substances that pose risks to health, safety, property, or the environment during transportation.

Hazardous materials classification includes nine primary categories: explosives, gases, flammable liquids, flammable solids, oxidizing substances, toxic substances, radioactive materials, corrosives, and miscellaneous dangerous goods. Each category requires specific handling procedures, packaging requirements, documentation protocols, and transportation methods to ensure public safety and environmental protection.

Logistics operations within this market involve specialized service providers who possess the necessary certifications, equipment, and expertise to manage dangerous goods throughout the supply chain. These operations require compliance with multiple regulatory frameworks including the Hazardous Materials Regulations (HMR), International Maritime Dangerous Goods (IMDG) Code, and International Air Transport Association (IATA) Dangerous Goods Regulations.

Market performance in the US dangerous-hazardous goods logistics sector demonstrates consistent expansion driven by industrial growth, regulatory evolution, and technological advancement. The market serves as a critical enabler for manufacturing industries that rely on hazardous materials as raw materials, intermediates, or finished products. Service diversification has expanded beyond traditional transportation to include comprehensive supply chain management, regulatory consulting, and emergency response services.

Key growth drivers include the resurgence of domestic chemical manufacturing, increased pharmaceutical production, and growing demand for specialty chemicals across various industries. The market benefits from approximately 78% of chemical shipments requiring hazardous materials classification, creating sustained demand for specialized logistics services. Technology adoption has accelerated with digital tracking systems, automated compliance monitoring, and advanced safety equipment becoming standard industry practices.

Competitive landscape features a mix of large integrated logistics providers and specialized hazardous materials carriers, each offering distinct capabilities and geographic coverage. Market consolidation trends have created opportunities for service expansion and operational efficiency improvements. Regulatory compliance costs represent approximately 15-20% of total operational expenses, highlighting the importance of expertise and scale in this specialized market segment.

Market segmentation reveals distinct patterns in dangerous goods logistics demand across different hazard classes and transportation modes. The following key insights define current market characteristics:

Industrial resurgence serves as the primary driver for dangerous goods logistics market expansion, with domestic manufacturing experiencing renewed growth across multiple sectors. The chemical industry renaissance has created substantial demand for hazardous materials transportation, particularly in petrochemical complexes along the Gulf Coast. Pharmaceutical manufacturing growth has generated increased requirements for temperature-controlled and security-enhanced logistics services for active pharmaceutical ingredients and controlled substances.

Regulatory evolution continues to drive market demand as federal agencies implement enhanced safety requirements and compliance standards. The Pipeline and Hazardous Materials Safety Administration (PHMSA) regularly updates regulations, creating ongoing needs for specialized expertise and equipment upgrades. Environmental regulations have increased the complexity of hazardous waste management and disposal logistics, expanding service requirements beyond traditional transportation.

Technology advancement enables improved safety, efficiency, and compliance capabilities that drive market growth. Digital transformation initiatives include real-time tracking systems, automated documentation, and predictive maintenance programs that enhance operational reliability. Safety technology improvements in vehicle design, containment systems, and monitoring equipment create competitive advantages for logistics providers investing in advanced capabilities.

Supply chain resilience requirements have elevated the importance of domestic hazardous materials logistics capabilities. Nearshoring trends in chemical and pharmaceutical manufacturing create new demand patterns for specialized logistics services. Strategic inventory positioning requires sophisticated distribution networks capable of handling diverse hazardous materials safely and efficiently.

Regulatory complexity presents significant operational challenges and cost burdens for dangerous goods logistics providers. The multi-layered regulatory environment involving federal, state, and local authorities creates compliance difficulties and potential conflicts between different jurisdictions. Regulatory changes require continuous training, equipment updates, and procedural modifications that strain operational resources and increase costs.

Infrastructure limitations constrain market growth in certain regions and transportation modes. Aging transportation infrastructure including bridges, tunnels, and rail networks may have restrictions on hazardous materials movement. Port capacity constraints limit international trade capabilities for dangerous goods, particularly during peak shipping seasons or following disruptions.

Workforce challenges significantly impact market operations due to specialized training requirements and certification processes. Driver shortages are particularly acute for hazardous materials transportation, where additional qualifications and ongoing training are mandatory. Technical expertise requirements for regulatory compliance, safety management, and emergency response create recruitment and retention difficulties.

Insurance and liability costs represent substantial operational expenses that can limit market entry and expansion opportunities. Risk assessment complexity for different hazard classes and transportation scenarios creates challenges in obtaining comprehensive coverage. Incident liability exposure requires significant financial resources and risk management capabilities that may exclude smaller operators from market participation.

Technology integration presents substantial opportunities for market expansion and service enhancement. Internet of Things (IoT) applications enable real-time monitoring of cargo conditions, vehicle performance, and environmental factors that enhance safety and compliance capabilities. Artificial intelligence and machine learning technologies offer opportunities for predictive maintenance, route optimization, and risk assessment improvements.

Service diversification creates new revenue streams beyond traditional transportation services. Regulatory consulting services address the growing complexity of hazardous materials compliance requirements. Emergency response capabilities provide value-added services that differentiate providers and create long-term customer relationships. Supply chain integration opportunities include inventory management, packaging services, and distribution center operations.

Geographic expansion opportunities exist in underserved regions and emerging industrial corridors. Renewable energy development creates new demand patterns for specialized chemicals and materials used in solar panel and wind turbine manufacturing. Battery manufacturing growth for electric vehicles and energy storage systems generates requirements for lithium, cobalt, and other hazardous materials logistics.

International trade growth presents opportunities for cross-border dangerous goods logistics services. USMCA trade agreement benefits create enhanced opportunities for North American hazardous materials trade. Export market development for US chemical and pharmaceutical products requires sophisticated international logistics capabilities.

Supply and demand dynamics in the dangerous goods logistics market reflect the cyclical nature of industrial production and seasonal variations in certain commodity movements. Chemical industry cycles significantly influence market demand, with petrochemical production levels directly correlating to logistics service requirements. Pharmaceutical seasonality creates demand peaks during flu season and other health-related events that require flexible capacity management.

Competitive dynamics feature intense competition between integrated logistics providers and specialized hazardous materials carriers. Service differentiation focuses on safety performance, regulatory expertise, and technology capabilities rather than price competition alone. Market consolidation trends create opportunities for scale economies and service integration while potentially reducing competitive options for shippers.

Regulatory dynamics continuously reshape market operations through evolving safety requirements and compliance standards. MarkWide Research analysis indicates that regulatory changes occur approximately every 18-24 months, requiring ongoing adaptation and investment by logistics providers. Enforcement patterns vary by region and transportation mode, creating operational complexities for multi-modal service providers.

Technology dynamics drive operational efficiency improvements and safety enhancements throughout the market. Digital transformation initiatives enable better visibility, control, and documentation of hazardous materials movements. Safety technology advancement continues to reduce incident rates and improve emergency response capabilities.

Primary research methodology for analyzing the US dangerous-hazardous goods logistics market incorporates comprehensive data collection from industry participants, regulatory agencies, and end-user industries. Survey instruments capture quantitative data on market size, growth rates, service utilization patterns, and competitive positioning across different market segments and geographic regions.

Secondary research utilizes extensive analysis of government databases, industry publications, regulatory filings, and company reports to validate primary research findings. Regulatory data sources include Department of Transportation statistics, Pipeline and Hazardous Materials Safety Administration reports, and state transportation agency databases. Industry association publications provide insights into market trends, technological developments, and best practices.

Market modeling techniques employ statistical analysis and forecasting methods to project future market trends and growth patterns. Regression analysis identifies key variables influencing market demand including industrial production indices, chemical manufacturing output, and regulatory compliance costs. Scenario analysis evaluates potential market outcomes under different economic and regulatory conditions.

Data validation processes ensure research accuracy through triangulation of multiple data sources and expert review panels. Industry expert interviews provide qualitative insights into market dynamics, competitive strategies, and future outlook perspectives. Quality assurance protocols maintain research integrity and reliability throughout the analysis process.

Gulf Coast region dominates the US dangerous goods logistics market, accounting for approximately 35% of total market activity due to concentrated petrochemical and refining operations. Texas and Louisiana serve as primary hubs with extensive pipeline networks, specialized terminals, and experienced logistics providers. The region benefits from integrated infrastructure connecting production facilities, storage terminals, and transportation networks.

Great Lakes region represents the second-largest market concentration with 20% market share, driven by chemical manufacturing, automotive industry requirements, and cross-border trade with Canada. Illinois, Ohio, and Michigan feature major industrial corridors with established hazardous materials logistics capabilities. Intermodal connectivity through rail, water, and highway networks provides efficient transportation options.

California market accounts for 15% of national activity, characterized by diverse industrial base including aerospace, electronics, and specialty chemicals. Port of Los Angeles and Long Beach serve as major gateways for international dangerous goods trade. Regulatory environment in California often exceeds federal requirements, creating additional compliance complexities.

Northeast corridor maintains 12% market share with pharmaceutical manufacturing, chemical processing, and port operations driving demand. New Jersey and Pennsylvania feature significant industrial concentrations requiring specialized logistics services. Population density creates additional safety considerations and routing restrictions for hazardous materials transportation.

Southeast region shows rapid growth with 10% market share and expanding chemical manufacturing investments. South Carolina and North Carolina attract international chemical companies establishing US production facilities. Infrastructure development supports growing industrial activity and logistics requirements.

Market leadership in the US dangerous goods logistics sector features a combination of large integrated logistics providers and specialized hazardous materials carriers. The competitive landscape demonstrates clear differentiation based on service capabilities, geographic coverage, and industry expertise.

Competitive strategies focus on safety performance, regulatory expertise, technology investment, and service integration. Safety differentiation remains paramount with companies investing heavily in driver training, equipment upgrades, and incident prevention programs. Technology leadership provides competitive advantages through enhanced visibility, compliance monitoring, and operational efficiency.

By Hazard Class:

By Transportation Mode:

By End-Use Industry:

Flammable liquids category represents the largest segment of the dangerous goods logistics market, driven by extensive petroleum product distribution and chemical manufacturing requirements. Transportation volumes in this category show consistent growth aligned with industrial production levels. Safety protocols for flammable liquids require specialized equipment including vapor recovery systems, grounding procedures, and fire suppression capabilities.

Corrosive materials category demonstrates steady demand growth from chemical manufacturing, metal processing, and water treatment industries. Equipment requirements include specialized tank designs, protective coatings, and emergency response equipment. Regulatory compliance for corrosives involves strict packaging standards and transportation route restrictions in populated areas.

Compressed gases category shows expanding demand from industrial applications, medical uses, and emerging technologies. Cylinder management services have become increasingly important for efficient supply chain operations. Safety considerations include pressure monitoring, leak detection, and specialized handling equipment requirements.

Toxic substances category requires the highest level of safety protocols and emergency response capabilities. Service providers in this category typically maintain specialized equipment, trained personnel, and comprehensive insurance coverage. Market growth is driven by pharmaceutical manufacturing and specialty chemical production.

Logistics service providers benefit from stable demand patterns and premium pricing for specialized dangerous goods services. Revenue stability comes from long-term contracts with industrial customers requiring consistent hazardous materials transportation. Competitive differentiation through safety performance and regulatory expertise creates barriers to entry and customer loyalty.

Chemical manufacturers gain access to specialized expertise and infrastructure required for safe and compliant product distribution. Risk mitigation through professional logistics providers reduces liability exposure and operational complexity. Supply chain efficiency improvements enable better inventory management and customer service levels.

Regulatory agencies benefit from industry professionalization and improved safety performance through specialized service providers. Compliance rates improve when shippers utilize experienced dangerous goods logistics providers. Incident reduction contributes to public safety and environmental protection objectives.

End-user industries receive reliable supply chain services that enable continuous production operations. Regulatory compliance support reduces internal resource requirements and expertise needs. Emergency response capabilities provide rapid incident management and business continuity support.

Technology providers find growing demand for specialized systems supporting dangerous goods logistics operations. Safety technology applications create new market opportunities for monitoring, tracking, and compliance systems. Digital solutions enable operational efficiency improvements and enhanced service capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the dangerous goods logistics market. Real-time tracking systems provide enhanced visibility and control over hazardous materials movements. Automated compliance monitoring reduces manual processes and improves accuracy in regulatory documentation. Predictive analytics enable proactive maintenance and risk management capabilities.

Sustainability initiatives are increasingly important in dangerous goods logistics operations. Alternative fuel adoption includes electric and hydrogen-powered vehicles for local delivery operations. Route optimization technologies reduce fuel consumption and emissions while maintaining safety standards. Packaging innovations focus on reducing environmental impact while maintaining safety performance.

Service integration trends show logistics providers expanding beyond transportation to offer comprehensive supply chain management. Inventory management services include specialized storage and handling capabilities for hazardous materials. Regulatory consulting has become a significant value-added service offering. Emergency response capabilities are increasingly integrated into standard service packages.

Safety technology advancement continues to drive operational improvements and risk reduction. Advanced monitoring systems provide real-time data on cargo conditions and vehicle performance. Communication technologies enable immediate response to incidents or emergencies. Training technologies including virtual reality and simulation improve workforce preparation and safety awareness.

Regulatory developments continue to shape market operations with recent updates to hazardous materials regulations. PHMSA rule changes have enhanced training requirements and safety protocols for dangerous goods transportation. State-level initiatives in California and other states have implemented additional safety requirements beyond federal standards.

Technology implementations across major logistics providers demonstrate industry commitment to operational excellence. IoT sensor deployment has expanded significantly with major carriers implementing comprehensive monitoring systems. Blockchain applications are being tested for improved documentation and chain of custody tracking.

Infrastructure investments by both private companies and government agencies support market growth. Terminal modernization projects enhance safety and efficiency capabilities at major facilities. Transportation infrastructure improvements include specialized routing and safety enhancements for hazardous materials movements.

Industry partnerships have expanded to address complex supply chain requirements and safety challenges. Collaborative safety initiatives between logistics providers and chemical manufacturers improve industry-wide performance. Technology partnerships accelerate innovation and implementation of advanced systems.

Investment priorities should focus on technology advancement and safety enhancement capabilities that differentiate service providers in the competitive market. Digital infrastructure investments in tracking, monitoring, and compliance systems provide long-term competitive advantages. Safety technology adoption demonstrates commitment to operational excellence and regulatory compliance.

Service diversification strategies should emphasize value-added capabilities beyond basic transportation services. MWR analysis suggests that integrated supply chain services command premium pricing and stronger customer relationships. Regulatory consulting capabilities provide additional revenue streams and customer value.

Geographic expansion opportunities exist in emerging industrial regions and underserved markets. Southeast expansion aligns with growing chemical manufacturing investments in the region. Cross-border capabilities support growing trade opportunities under USMCA provisions.

Workforce development initiatives are critical for addressing industry labor challenges and maintaining service quality. Training programs should emphasize both technical skills and safety awareness. Retention strategies must address competitive compensation and career development opportunities.

Partnership strategies can accelerate market expansion and capability development. Technology partnerships provide access to advanced systems without full development costs. Customer partnerships create opportunities for service integration and long-term contracts.

Market growth prospects remain positive driven by continued industrial expansion and evolving regulatory requirements. Chemical industry growth projections indicate sustained demand for hazardous materials logistics services. Pharmaceutical manufacturing expansion creates new opportunities for specialized transportation and storage services.

Technology evolution will continue reshaping market operations with advanced monitoring, automation, and safety systems. Autonomous vehicle development may eventually impact dangerous goods transportation, though regulatory approval will require extensive safety validation. Artificial intelligence applications in route optimization, risk assessment, and predictive maintenance show significant potential.

Regulatory evolution is expected to continue with enhanced safety requirements and environmental considerations. Climate change regulations may impact transportation modes and operational practices. International harmonization efforts could simplify cross-border dangerous goods movements.

Market consolidation trends may accelerate as companies seek scale advantages and service integration capabilities. MarkWide Research projects that market concentration will increase moderately while maintaining competitive dynamics. Specialized providers may find niche opportunities in emerging applications and technologies.

Sustainability requirements will increasingly influence operational practices and equipment selection. Alternative fuel adoption is expected to accelerate for local and regional operations. Circular economy principles may create new opportunities in hazardous waste management and recycling logistics.

The US dangerous-hazardous goods logistics market represents a critical and resilient segment of the American transportation industry, characterized by specialized expertise, regulatory complexity, and essential service requirements. Market fundamentals remain strong with consistent demand from chemical manufacturing, pharmaceutical production, and diverse industrial applications driving sustained growth opportunities.

Competitive dynamics favor providers with strong safety performance, regulatory expertise, and technology capabilities that differentiate services in this specialized market. Technology adoption continues to reshape operations with digital tracking, automated compliance, and advanced safety systems becoming standard industry practices. Service integration trends create opportunities for logistics providers to expand beyond traditional transportation into comprehensive supply chain management.

Future success in the dangerous goods logistics market will depend on continued investment in safety technology, workforce development, and service capabilities that address evolving customer requirements. Regulatory compliance remains paramount while technology advancement enables operational efficiency and enhanced safety performance. The market outlook remains positive with projected growth rates reflecting the essential nature of hazardous materials in industrial supply chains and the specialized expertise required for safe and compliant transportation services.

What is Dangerous-Hazardous Goods Logistics?

Dangerous-Hazardous Goods Logistics refers to the specialized transportation and management of goods that pose risks to health, safety, or the environment. This includes materials such as chemicals, explosives, and radioactive substances, which require strict compliance with safety regulations and handling procedures.

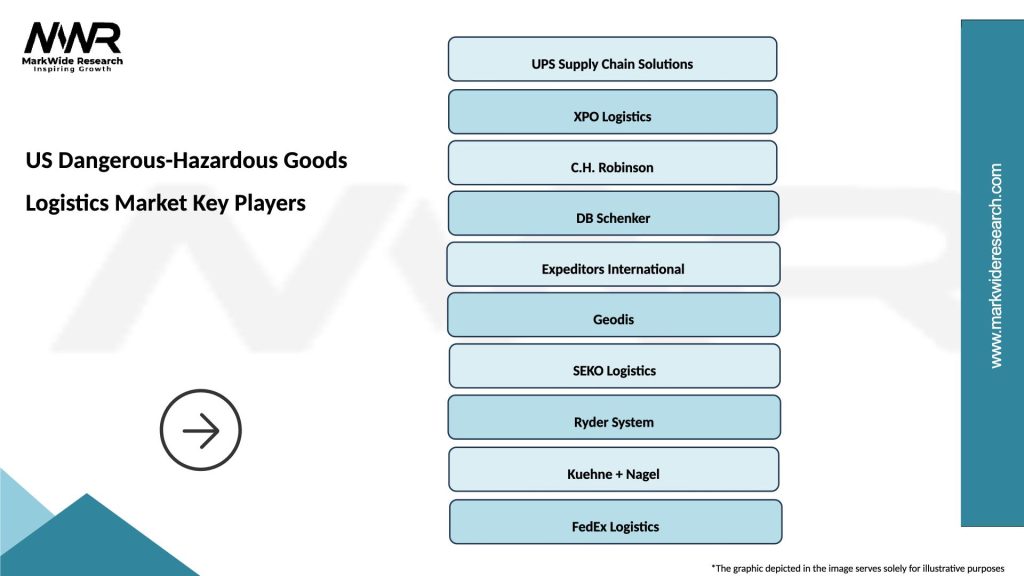

What are the key players in the US Dangerous-Hazardous Goods Logistics Market?

Key players in the US Dangerous-Hazardous Goods Logistics Market include companies like DHL Supply Chain, FedEx, and UPS, which provide tailored logistics solutions for hazardous materials. These companies focus on safety, regulatory compliance, and efficient transportation methods, among others.

What are the main drivers of the US Dangerous-Hazardous Goods Logistics Market?

The main drivers of the US Dangerous-Hazardous Goods Logistics Market include the increasing demand for chemical products, stringent regulatory requirements, and the growth of e-commerce. Additionally, the rise in industrial activities and the need for safe transportation of hazardous materials contribute to market expansion.

What challenges does the US Dangerous-Hazardous Goods Logistics Market face?

The US Dangerous-Hazardous Goods Logistics Market faces challenges such as complex regulatory compliance, high transportation costs, and the need for specialized training for personnel. Additionally, incidents involving hazardous materials can lead to significant liability and reputational risks for logistics providers.

What opportunities exist in the US Dangerous-Hazardous Goods Logistics Market?

Opportunities in the US Dangerous-Hazardous Goods Logistics Market include advancements in technology for tracking and managing hazardous materials, increased focus on sustainability, and the potential for growth in sectors like pharmaceuticals and renewable energy. These factors can enhance operational efficiency and safety.

What trends are shaping the US Dangerous-Hazardous Goods Logistics Market?

Trends shaping the US Dangerous-Hazardous Goods Logistics Market include the adoption of digital solutions for logistics management, increased automation in warehousing, and a growing emphasis on sustainability practices. Additionally, the integration of IoT technology for real-time monitoring of hazardous shipments is becoming more prevalent.

US Dangerous-Hazardous Goods Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chemicals, Explosives, Radioactive Materials, Biological Substances |

| End User | Manufacturers, Distributors, Retailers, Government Agencies |

| Service Type | Transportation, Storage, Packaging, Waste Management |

| Technology | GPS Tracking, RFID, Automated Systems, Safety Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Dangerous-Hazardous Goods Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at