444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US dairy packaging market represents a critical component of America’s food packaging industry, serving as the backbone for preserving and distributing dairy products across the nation. This dynamic sector encompasses a comprehensive range of packaging solutions designed specifically for milk, cheese, yogurt, butter, and other dairy products. Market dynamics indicate robust growth driven by evolving consumer preferences, technological innovations, and sustainability initiatives.

Consumer demand for convenient, sustainable, and functional dairy packaging has intensified significantly, with the market experiencing a 6.2% annual growth rate in recent years. The sector benefits from America’s substantial dairy consumption patterns, where the average American consumes approximately 655 pounds of dairy products annually. Packaging innovations continue to reshape the landscape, with smart packaging technologies and eco-friendly materials gaining substantial traction.

Regional distribution shows concentrated activity in major dairy-producing states including Wisconsin, California, New York, and Pennsylvania, where packaging facilities strategically align with production centers. The market demonstrates resilience through diverse packaging formats ranging from traditional glass bottles to advanced multilayer flexible packaging systems. Technological advancement remains a key differentiator, with manufacturers investing heavily in barrier technologies, extended shelf-life solutions, and consumer-friendly packaging designs.

The US dairy packaging market refers to the comprehensive ecosystem of packaging materials, technologies, and solutions specifically designed for containing, preserving, and distributing dairy products throughout the United States. This specialized sector encompasses rigid packaging formats such as bottles, containers, and cartons, alongside flexible packaging options including pouches, films, and wraps.

Primary functions of dairy packaging extend beyond simple containment to include product protection, shelf-life extension, brand differentiation, and consumer convenience. The market integrates various materials including plastic polymers, paperboard, glass, and metal, each selected based on specific product requirements and consumer preferences. Advanced packaging technologies incorporate barrier properties, tamper-evident features, and sustainability considerations to meet evolving market demands.

Market scope includes packaging solutions for liquid dairy products like milk and cream, semi-solid products such as yogurt and sour cream, and solid dairy items including cheese and butter. The definition encompasses both primary packaging that directly contacts the product and secondary packaging used for distribution and retail presentation.

Strategic analysis reveals the US dairy packaging market as a mature yet evolving sector characterized by steady demand growth and continuous innovation. The market benefits from America’s position as a leading global dairy producer and consumer, creating substantial opportunities for packaging manufacturers and suppliers. Key growth drivers include increasing health consciousness, demand for convenient packaging formats, and rising emphasis on sustainable packaging solutions.

Market segmentation demonstrates diversity across material types, with plastic packaging commanding approximately 45% market share, followed by paperboard at 32%, and glass maintaining a 15% share. The remaining 8% comprises metal and other specialized materials. Product categories show liquid dairy products accounting for the largest packaging volume, driven by consistent milk consumption patterns across American households.

Competitive dynamics feature established packaging giants alongside specialized dairy packaging providers, creating a balanced ecosystem of innovation and cost efficiency. The market demonstrates resilience through economic cycles, supported by dairy products’ essential nature and consistent consumer demand. Future projections indicate continued growth with sustainability and smart packaging technologies driving the next phase of market evolution.

Market intelligence reveals several critical insights shaping the US dairy packaging landscape. The sector demonstrates remarkable adaptability to changing consumer preferences while maintaining focus on product integrity and safety standards.

Primary growth catalysts propelling the US dairy packaging market forward encompass both consumer-driven demands and industry-specific requirements. These drivers create sustained momentum for market expansion and innovation.

Health and wellness trends significantly influence packaging requirements as consumers increasingly seek products with extended freshness, nutritional transparency, and portion control features. The growing popularity of organic and premium dairy products necessitates specialized packaging solutions that preserve product quality while communicating brand values effectively.

Convenience factors drive substantial innovation in packaging design, with busy lifestyles demanding portable, resealable, and easy-to-use packaging formats. Single-serve portions, on-the-go packaging, and microwave-safe containers respond to evolving consumption patterns. Technological advancement enables smart packaging features including temperature indicators, freshness sensors, and interactive labeling that enhance consumer experience.

Sustainability imperatives create powerful market drivers as environmental consciousness influences purchasing decisions across all demographic segments. Regulatory pressures and corporate responsibility initiatives accelerate adoption of recyclable materials, reduced packaging waste, and circular economy principles. Supply chain efficiency demands drive packaging optimization for transportation, storage, and distribution cost reduction while maintaining product integrity throughout the value chain.

Significant challenges constrain market growth and present ongoing obstacles for industry participants. These restraints require strategic navigation and innovative solutions to minimize their impact on market development.

Raw material costs represent a primary constraint, with petroleum-based plastics subject to price volatility that directly impacts packaging production costs. Fluctuating resin prices, supply chain disruptions, and geopolitical factors create uncertainty in cost planning and profit margin management. Regulatory compliance adds complexity and expense, with food safety regulations, environmental standards, and labeling requirements demanding continuous investment in compliance systems.

Technical limitations in sustainable packaging materials sometimes compromise performance characteristics essential for dairy product preservation. Biodegradable materials may lack sufficient barrier properties, while recyclable options might not provide adequate shelf-life extension. Consumer resistance to packaging changes can slow adoption of innovative solutions, particularly when new formats require behavioral adjustments or education.

Infrastructure constraints limit rapid market transformation, as existing packaging lines, distribution systems, and retail displays require substantial investment to accommodate new packaging formats. Competition pressure from low-cost alternatives and private label products constrains pricing flexibility and limits investment capacity for premium packaging innovations.

Emerging opportunities present substantial potential for market expansion and value creation across the US dairy packaging sector. These opportunities align with evolving consumer preferences and technological capabilities.

Sustainable packaging innovation offers tremendous growth potential as consumers increasingly prioritize environmental responsibility. Development of advanced biodegradable materials, improved recyclability, and reduced packaging waste creates competitive advantages and market differentiation. Smart packaging technologies present opportunities for value-added solutions including freshness monitoring, tamper detection, and interactive consumer engagement features.

E-commerce expansion creates new packaging requirements for direct-to-consumer dairy delivery, subscription services, and online retail channels. Specialized packaging for temperature control, damage prevention, and brand presentation in digital commerce environments represents significant growth potential. Premium product segments offer opportunities for high-value packaging solutions that enhance product positioning and justify price premiums.

Regional market development provides expansion opportunities in underserved geographic areas and emerging demographic segments. International export packaging requirements create opportunities for specialized solutions that meet diverse regulatory standards and cultural preferences. Functional packaging innovations including portion control, nutritional enhancement, and convenience features align with health and wellness trends driving market growth.

Complex interactions between supply and demand factors, technological innovations, and regulatory influences shape the dynamic landscape of the US dairy packaging market. These dynamics create both challenges and opportunities for market participants.

Supply chain integration demonstrates increasing sophistication as packaging manufacturers collaborate closely with dairy producers to optimize packaging solutions for specific products and distribution channels. This integration enables customized solutions that enhance product performance while reducing overall system costs. Technology convergence brings together materials science, digital printing, and smart sensors to create next-generation packaging solutions.

Consumer behavior evolution drives continuous adaptation in packaging design and functionality. Generational differences in preferences, environmental consciousness, and convenience expectations require flexible approaches to product development. Regulatory dynamics influence market direction through food safety standards, environmental regulations, and labeling requirements that shape packaging specifications.

Competitive pressures intensify as market maturity increases, driving innovation, cost optimization, and service differentiation. MarkWide Research analysis indicates that successful companies increasingly focus on value-added services, technical expertise, and sustainable solutions to maintain competitive positioning. Economic factors including raw material costs, labor availability, and transportation expenses create ongoing challenges requiring operational flexibility and strategic planning.

Comprehensive research approach employs multiple data collection and analysis methodologies to ensure accurate and reliable market insights. The methodology integrates quantitative and qualitative research techniques to provide holistic market understanding.

Primary research includes extensive interviews with industry executives, packaging manufacturers, dairy producers, and retail partners to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture consumer preferences, purchasing behaviors, and satisfaction levels across diverse demographic segments. Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and trade publications to supplement primary findings.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. Market sizing methodologies employ bottom-up and top-down approaches to validate findings and ensure consistency. Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide strategic context for market insights.

Geographic coverage spans all major US regions with particular focus on key dairy-producing states and metropolitan markets. Temporal analysis examines historical trends, current market conditions, and future projections to provide comprehensive market perspective. Quality assurance protocols ensure research findings meet professional standards for accuracy, reliability, and actionability.

Geographic distribution of the US dairy packaging market reflects the concentration of dairy production and consumption patterns across different regions. Each region demonstrates unique characteristics, opportunities, and challenges that influence market dynamics.

Midwest region dominates the market with approximately 38% market share, led by Wisconsin, Illinois, and Minnesota. This region benefits from concentrated dairy production, established packaging infrastructure, and proximity to major consumer markets. Western states account for 28% of market activity, with California leading in both production and innovation, particularly in sustainable packaging solutions and premium product segments.

Northeast corridor represents 22% of the market, characterized by high-value products, premium packaging requirements, and sophisticated consumer preferences. Dense population centers drive demand for convenient packaging formats and specialty dairy products. Southern region comprises the remaining 12% market share, showing rapid growth potential driven by population expansion and increasing dairy consumption.

Regional preferences vary significantly, with coastal areas showing higher demand for sustainable packaging options and inland regions prioritizing cost-effective solutions. Distribution networks influence packaging requirements, with longer transportation distances necessitating enhanced barrier properties and durability features. Climate considerations affect packaging specifications, particularly in regions with extreme temperatures requiring specialized thermal protection.

Market competition features a diverse ecosystem of established packaging giants, specialized dairy packaging providers, and innovative technology companies. The competitive environment drives continuous innovation while maintaining focus on cost efficiency and service quality.

Competitive strategies emphasize technological innovation, sustainability leadership, and customer partnership development. Market consolidation continues as larger players acquire specialized capabilities and regional market access through strategic acquisitions and partnerships.

Market segmentation reveals distinct categories based on material type, product application, packaging format, and end-use requirements. Each segment demonstrates unique growth patterns and competitive dynamics.

By Material Type:

By Product Application:

By Packaging Format:

Detailed analysis of individual market categories reveals specific trends, challenges, and opportunities within each segment of the US dairy packaging market.

Liquid Dairy Packaging represents the largest and most established category, benefiting from consistent consumption patterns and mature distribution networks. Innovation focuses on extended shelf-life technologies, sustainable materials, and convenience features such as resealable closures and pour spouts. Market trends show increasing demand for smaller package sizes and premium positioning through enhanced graphics and materials.

Cheese Packaging demonstrates significant diversity in requirements ranging from flexible films for sliced products to rigid containers for specialty cheeses. Growth drivers include artisanal cheese popularity, convenience packaging for snacking applications, and extended shelf-life requirements for distribution efficiency. Barrier technologies and modified atmosphere packaging gain importance for maintaining product quality.

Yogurt and Cultured Products show strong growth potential driven by health consciousness and convenience trends. Packaging innovations focus on portion control, multi-compartment designs, and sustainable materials. Single-serve formats dominate growth while family-size packages maintain steady demand. Premium positioning through packaging design becomes increasingly important for brand differentiation.

Specialty Dairy Products including organic, lactose-free, and plant-based alternatives create new packaging requirements and opportunities. These products often command premium pricing that supports investment in advanced packaging technologies and sustainable materials.

Strategic advantages accrue to various stakeholders throughout the dairy packaging value chain, creating mutual benefits and sustainable competitive positioning.

For Dairy Producers:

For Packaging Manufacturers:

For Retailers:

Strategic assessment through SWOT analysis provides comprehensive evaluation of internal capabilities and external market conditions affecting the US dairy packaging market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshape the US dairy packaging landscape, driving innovation and creating new market opportunities while challenging traditional approaches.

Sustainability Revolution dominates market evolution as environmental consciousness influences every aspect of packaging design and material selection. Circular economy principles drive development of recyclable, biodegradable, and reusable packaging solutions. Companies invest heavily in sustainable materials research, with some achieving 75% recycled content in their packaging portfolios.

Smart Packaging Integration introduces digital technologies that enhance functionality and consumer engagement. Internet of Things (IoT) sensors monitor product freshness, temperature exposure, and handling conditions throughout the supply chain. QR codes and NFC technology enable interactive consumer experiences, product authentication, and supply chain transparency.

Convenience Innovation responds to busy lifestyles with packaging formats that prioritize ease of use, portability, and storage efficiency. Resealable features become standard across categories, while portion-controlled packaging addresses health-conscious consumption patterns. On-the-go formats capture growing demand for mobile consumption occasions.

Premium Positioning through packaging design becomes increasingly important as consumers associate packaging quality with product quality. Artisanal aesthetics, premium materials, and sophisticated graphics support brand differentiation in competitive markets. Limited edition packaging creates excitement and drives consumer engagement.

Recent developments demonstrate the dynamic nature of the US dairy packaging market, with significant investments in technology, sustainability, and market expansion shaping industry direction.

Technology Investments accelerate as major packaging companies allocate substantial resources to research and development. Advanced barrier technologies, smart packaging features, and sustainable materials receive priority funding. Digital printing capabilities enable customization and shorter production runs for specialized products and regional preferences.

Sustainability Initiatives gain momentum with industry-wide commitments to environmental responsibility. MWR analysis indicates that leading companies establish ambitious targets for recyclable content, carbon footprint reduction, and waste elimination. Partnerships with recycling organizations and investment in collection infrastructure support circular economy objectives.

Merger and Acquisition Activity continues as companies seek to expand capabilities, geographic reach, and technology portfolios. Strategic acquisitions focus on sustainable packaging technologies, specialized materials expertise, and regional market access. Vertical integration strategies bring packaging production closer to dairy processing facilities.

Regulatory Compliance drives significant investment in food safety systems, environmental compliance, and labeling capabilities. Companies proactively address evolving regulations through enhanced quality management systems and sustainable packaging development. Industry collaboration increases through trade associations and sustainability initiatives.

Strategic recommendations for market participants focus on positioning for long-term success while addressing immediate market challenges and opportunities.

Sustainability Leadership emerges as a critical success factor requiring immediate attention and substantial investment. Companies should develop comprehensive sustainability strategies encompassing materials selection, manufacturing processes, and end-of-life considerations. Circular economy participation through recycling partnerships and take-back programs creates competitive advantages and regulatory compliance.

Technology Investment priorities should focus on smart packaging capabilities, advanced barrier technologies, and digital integration. Innovation partnerships with technology companies, research institutions, and startup organizations accelerate development timelines and reduce investment risks. Pilot programs enable market testing of new technologies before full-scale implementation.

Customer Partnership Development becomes increasingly important as dairy producers seek integrated solutions rather than commodity packaging products. Value-added services including supply chain optimization, inventory management, and technical support create differentiation and customer loyalty. Co-innovation programs with key customers drive mutual success and market leadership.

Geographic Expansion strategies should target high-growth regions and underserved market segments. Regional customization addresses local preferences, regulatory requirements, and distribution characteristics. E-commerce capabilities require specialized packaging solutions and direct-to-consumer expertise.

Market projections indicate continued growth and evolution in the US dairy packaging market, driven by technological innovation, sustainability imperatives, and changing consumer preferences. The outlook remains positive despite challenges from raw material costs and regulatory complexity.

Growth trajectory shows sustained expansion with projected annual growth rates of 5.8% through 2030. Sustainability transformation accelerates with recyclable packaging expected to reach 85% market penetration within the next decade. Smart packaging adoption grows rapidly, with intelligent features projected in 40% of premium dairy products by 2028.

Technology evolution continues reshaping market dynamics through advanced materials, digital integration, and automation. Biodegradable packaging overcomes current performance limitations, achieving comparable barrier properties to traditional materials. Personalization capabilities through digital printing and variable data enable mass customization for regional and demographic preferences.

Market consolidation progresses as scale advantages and technology requirements favor larger, more integrated companies. MarkWide Research projects that the top five companies will control approximately 60% market share by 2030, compared to current levels of 45%. Sustainability leadership becomes a key differentiator, with environmentally advanced companies commanding premium pricing and preferred supplier status.

Consumer trends continue driving packaging innovation toward convenience, sustainability, and health consciousness. Premium segments show strongest growth potential, supported by packaging investments that justify higher pricing. E-commerce packaging requirements create new market segments and specialized solution opportunities.

The US dairy packaging market stands at a transformative juncture, balancing traditional strengths with emerging opportunities and challenges. Market maturity provides stability while innovation drives future growth potential across diverse segments and applications.

Sustainability imperatives reshape industry priorities, creating both challenges and opportunities for market participants. Companies that successfully navigate the transition to environmentally responsible packaging solutions position themselves for long-term success and competitive advantage. Technology integration enables new value propositions while addressing evolving consumer expectations for convenience, quality, and environmental responsibility.

Strategic success requires balanced investment in innovation, sustainability, and customer partnership development. The market rewards companies that demonstrate leadership in environmental stewardship while maintaining focus on product performance and cost efficiency. Future growth depends on the industry’s ability to adapt to changing consumer preferences, regulatory requirements, and competitive dynamics while preserving the essential functions of product protection and brand communication that define successful dairy packaging solutions.

What is Dairy Packaging?

Dairy Packaging refers to the materials and methods used to package dairy products such as milk, cheese, yogurt, and butter. It plays a crucial role in preserving product freshness, ensuring safety, and providing convenience to consumers.

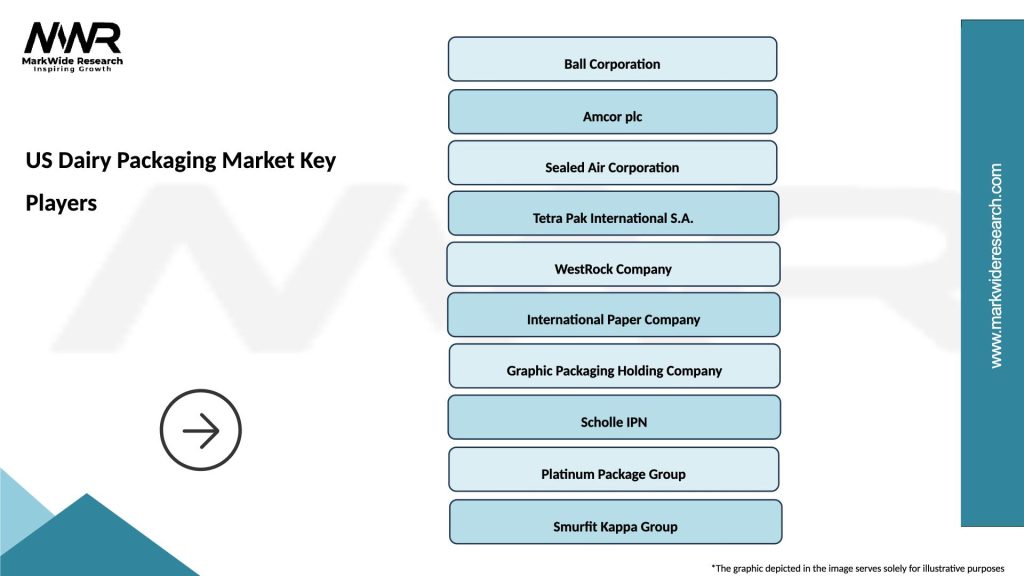

What are the key players in the US Dairy Packaging Market?

Key players in the US Dairy Packaging Market include Tetra Pak, Amcor, and Sealed Air. These companies are known for their innovative packaging solutions that enhance product shelf life and consumer appeal, among others.

What are the growth factors driving the US Dairy Packaging Market?

The US Dairy Packaging Market is driven by increasing consumer demand for convenient and sustainable packaging solutions. Additionally, the rise in health consciousness and the popularity of dairy alternatives are influencing packaging innovations.

What challenges does the US Dairy Packaging Market face?

The US Dairy Packaging Market faces challenges such as rising raw material costs and stringent regulations regarding food safety and packaging waste. These factors can impact production efficiency and profitability.

What opportunities exist in the US Dairy Packaging Market?

Opportunities in the US Dairy Packaging Market include the development of eco-friendly packaging materials and the integration of smart packaging technologies. These innovations can cater to the growing consumer preference for sustainability and enhanced product information.

What trends are shaping the US Dairy Packaging Market?

Trends in the US Dairy Packaging Market include the shift towards recyclable and biodegradable materials, as well as the adoption of innovative designs that improve user experience. Additionally, the rise of e-commerce is influencing packaging formats to ensure safe delivery.

US Dairy Packaging Market

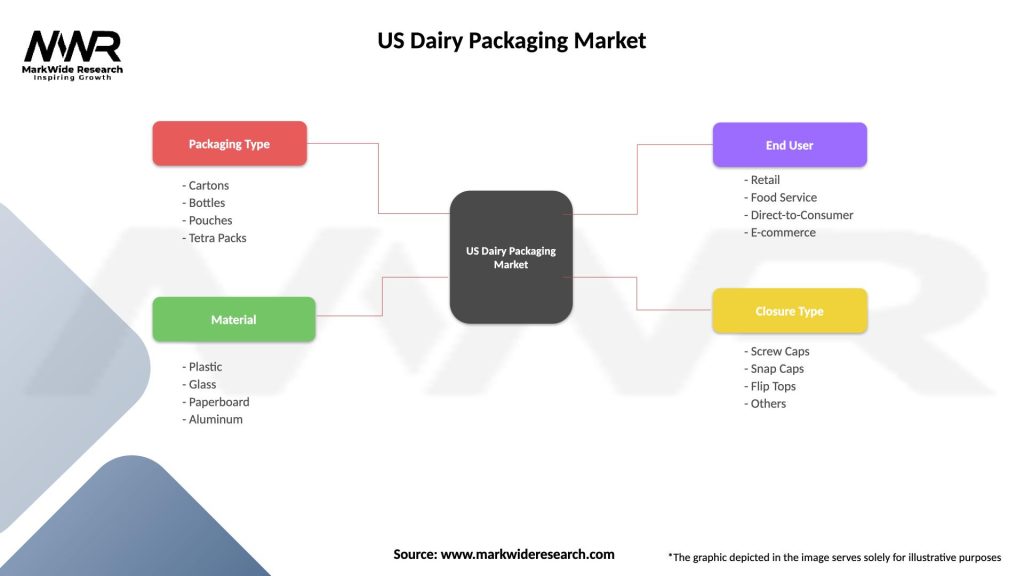

| Segmentation Details | Description |

|---|---|

| Packaging Type | Cartons, Bottles, Pouches, Tetra Packs |

| Material | Plastic, Glass, Paperboard, Aluminum |

| End User | Retail, Food Service, Direct-to-Consumer, E-commerce |

| Closure Type | Screw Caps, Snap Caps, Flip Tops, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Dairy Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at