444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Courier, Express, and Parcel (CEP) market represents a dynamic and rapidly evolving sector that serves as the backbone of modern commerce and logistics. This comprehensive market encompasses traditional postal services, express delivery companies, and specialized parcel delivery providers that facilitate the movement of packages, documents, and goods across the United States. Market dynamics indicate robust growth driven by e-commerce expansion, same-day delivery demands, and evolving consumer expectations for faster, more reliable shipping solutions.

Digital transformation has fundamentally reshaped the CEP landscape, with companies investing heavily in automation, artificial intelligence, and last-mile delivery innovations. The market demonstrates remarkable resilience and adaptability, experiencing accelerated growth of approximately 8.5% annually as businesses and consumers increasingly rely on efficient parcel delivery services. Technology integration continues to drive operational efficiency improvements, with many providers achieving 25% reduction in delivery times through advanced routing algorithms and real-time tracking systems.

Regional distribution patterns show concentrated activity in major metropolitan areas, with urban markets accounting for approximately 70% of total delivery volume. The market’s evolution reflects broader economic trends, including the shift toward omnichannel retail, increased business-to-business logistics requirements, and growing demand for specialized delivery services such as temperature-controlled transport and secure document handling.

The US Courier, Express, and Parcel market refers to the comprehensive ecosystem of companies and services dedicated to the collection, transportation, and delivery of packages, documents, and parcels throughout the United States. This market encompasses various delivery models, from traditional ground shipping to express overnight services, specialized courier operations, and innovative last-mile delivery solutions.

Service categories within this market include standard parcel delivery, express shipping, same-day courier services, international shipping, freight forwarding, and specialized logistics solutions. The market serves diverse customer segments ranging from individual consumers and small businesses to large corporations and government entities, each with unique delivery requirements and service expectations.

Operational infrastructure includes extensive networks of distribution centers, sorting facilities, transportation fleets, and technology platforms that enable efficient package processing and delivery. Modern CEP operations leverage advanced tracking systems, automated sorting equipment, and sophisticated route optimization software to ensure reliable and cost-effective service delivery across urban, suburban, and rural markets.

Market leadership in the US CEP sector is characterized by intense competition among established players and emerging technology-driven companies. The market demonstrates strong fundamentals with consistent growth driven by e-commerce expansion, which now represents approximately 60% of total parcel volume. Consumer behavior shifts toward online shopping and expectations for faster delivery have created unprecedented demand for innovative logistics solutions.

Technological advancement serves as a primary differentiator, with leading companies investing significantly in automation, artificial intelligence, and drone delivery technologies. The integration of Internet of Things (IoT) devices and real-time tracking capabilities has improved delivery accuracy by approximately 15% while enhancing customer satisfaction through increased transparency and communication.

Market consolidation trends indicate ongoing acquisition activity as companies seek to expand geographic coverage, enhance service capabilities, and achieve operational efficiencies. The competitive landscape features a mix of national carriers, regional specialists, and innovative startups focused on niche markets such as same-day delivery, crowdsourced logistics, and sustainable transportation solutions.

Strategic positioning within the US CEP market requires understanding of several critical success factors that drive competitive advantage and market share growth:

E-commerce expansion continues to serve as the primary catalyst for CEP market growth, with online retail sales driving approximately 75% of parcel volume increases. The proliferation of digital marketplaces, direct-to-consumer brands, and omnichannel retail strategies has created sustained demand for reliable, cost-effective delivery services across all market segments.

Consumer expectations for faster delivery have intensified competitive pressures, with same-day and next-day delivery becoming standard offerings rather than premium services. This shift has prompted significant investments in local distribution infrastructure, advanced logistics technology, and innovative delivery methods including autonomous vehicles and drone systems.

Business digitization trends have accelerated adoption of integrated logistics solutions, with companies seeking seamless connectivity between their e-commerce platforms, inventory management systems, and shipping providers. The demand for real-time visibility, automated shipping processes, and comprehensive analytics has driven development of sophisticated technology platforms that enhance operational efficiency and customer satisfaction.

Urbanization patterns and demographic shifts toward metropolitan areas have created concentrated demand centers that support efficient last-mile delivery operations. The growth of apartment living, mixed-use developments, and urban commercial districts has necessitated innovative delivery solutions including secure locker systems, consolidated delivery points, and flexible scheduling options.

Infrastructure limitations present significant challenges for CEP providers, particularly in rural and remote areas where delivery costs can exceed revenue potential. The need for extensive transportation networks, distribution facilities, and technology systems requires substantial capital investment that may limit market entry for smaller competitors.

Labor shortages in the transportation and logistics sector have created operational constraints and increased wage pressures across the industry. The physically demanding nature of delivery work, combined with seasonal demand fluctuations, makes it difficult to maintain adequate staffing levels while controlling operational costs.

Regulatory complexity surrounding transportation, environmental standards, and international shipping creates compliance burdens that require specialized expertise and ongoing investment. Changes in trade policies, security requirements, and local delivery regulations can significantly impact operational procedures and cost structures.

Environmental concerns related to transportation emissions and packaging waste have prompted increased scrutiny from regulators and consumers. The pressure to implement sustainable practices while maintaining competitive pricing and service levels creates operational challenges that require innovative solutions and long-term strategic planning.

Technology integration presents substantial opportunities for market expansion and operational improvement. The implementation of artificial intelligence, machine learning, and predictive analytics can optimize routing efficiency by approximately 20% while reducing operational costs and improving delivery reliability.

Sustainable logistics initiatives offer competitive differentiation opportunities as consumers and businesses increasingly prioritize environmental responsibility. Electric vehicle adoption, carbon-neutral shipping options, and circular economy packaging solutions can attract environmentally conscious customers while potentially reducing long-term operational costs.

Healthcare logistics represents a rapidly growing market segment with specialized requirements for temperature-controlled transport, secure handling, and time-sensitive delivery. The expansion of telemedicine, home healthcare services, and pharmaceutical direct-to-patient programs creates demand for specialized CEP services with stringent quality and compliance standards.

International expansion opportunities exist for US-based CEP providers seeking to leverage their operational expertise and technology platforms in global markets. Cross-border e-commerce growth and international trade expansion create demand for integrated logistics solutions that can seamlessly handle customs clearance, regulatory compliance, and multi-modal transportation.

Competitive intensity within the US CEP market continues to escalate as traditional carriers face challenges from technology-enabled startups and alternative delivery models. The market demonstrates characteristics of both consolidation and fragmentation, with large players acquiring specialized companies while new entrants focus on niche segments and innovative service offerings.

Pricing pressures reflect the commoditization of standard delivery services, forcing providers to compete on value-added features, service quality, and operational efficiency rather than price alone. The emergence of free shipping expectations among consumers has shifted cost considerations to retailers and manufacturers, influencing logistics strategy and carrier selection decisions.

Technology disruption continues to reshape operational models, with automation reducing labor requirements by approximately 30% in sorting and processing operations. The integration of Internet of Things sensors, blockchain technology, and advanced analytics enables new service capabilities while improving operational transparency and efficiency.

Customer relationship dynamics have evolved from transactional interactions to strategic partnerships, particularly in the business-to-business segment. CEP providers increasingly serve as logistics consultants, offering supply chain optimization, inventory management, and customer experience enhancement services that extend beyond traditional transportation functions.

Comprehensive analysis of the US CEP market incorporates multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, operational managers, and technology leaders representing major market participants across different service segments and geographic regions.

Secondary research encompasses analysis of public company financial reports, industry publications, regulatory filings, and trade association data to establish market trends, competitive positioning, and operational benchmarks. MarkWide Research methodology emphasizes triangulation of data sources to validate findings and ensure comprehensive market coverage.

Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and competitive dynamics. The research framework incorporates economic indicators, demographic trends, and technology adoption patterns to develop robust forecasting models that account for multiple variables affecting market development.

Qualitative insights are derived from expert interviews, focus groups, and observational research to understand customer preferences, operational challenges, and emerging trends that may not be captured in quantitative data. This mixed-methods approach provides a holistic view of market dynamics and future development potential.

Northeast region demonstrates the highest market concentration with approximately 35% of total CEP activity, driven by dense urban populations, extensive commercial activity, and proximity to major international gateways. The region benefits from established transportation infrastructure, sophisticated logistics networks, and high e-commerce adoption rates among consumers and businesses.

West Coast markets account for approximately 28% of market share, with California leading in both volume and innovation. The region’s technology sector concentration, international trade activity through Pacific ports, and progressive environmental regulations drive demand for advanced logistics solutions and sustainable delivery options.

Southeast region represents the fastest-growing market segment with approximately 12% annual growth, supported by population migration, industrial development, and expanding e-commerce infrastructure. The region’s strategic location, favorable business climate, and growing urban centers create opportunities for market expansion and operational efficiency improvements.

Midwest markets provide stable demand with approximately 20% market share, characterized by manufacturing activity, agricultural logistics, and established transportation networks. The region’s central location offers strategic advantages for distribution operations, while growing urban areas drive demand for enhanced delivery services and last-mile solutions.

Market leadership is characterized by intense competition among established national carriers, regional specialists, and innovative technology companies. The competitive environment features both collaboration and competition, with companies forming strategic partnerships while competing for market share in overlapping segments.

Service type segmentation reveals distinct market dynamics across different delivery categories, each with unique customer requirements, operational characteristics, and competitive positioning strategies.

By Service Type:

By End User:

Express delivery services continue to demonstrate strong growth with approximately 15% annual expansion, driven by e-commerce demands and business requirements for time-sensitive shipments. This segment commands premium pricing while requiring significant infrastructure investment in sorting facilities, transportation networks, and technology systems.

Last-mile delivery represents the most innovative and rapidly evolving market category, with companies experimenting with autonomous vehicles, drone delivery, and crowdsourced logistics models. The segment faces unique challenges including urban congestion, delivery density optimization, and customer availability coordination.

International shipping services require specialized expertise in customs regulations, documentation requirements, and multi-modal transportation coordination. This segment offers higher margins but involves complex operational requirements and regulatory compliance obligations that limit market participation to established players.

Specialized logistics categories including healthcare, automotive, and high-value goods delivery create niche opportunities for providers with specific capabilities and certifications. These segments often require temperature control, security measures, and specialized handling procedures that command premium pricing.

Operational efficiency improvements through technology integration enable CEP providers to reduce costs while enhancing service quality. Advanced routing algorithms, automated sorting systems, and real-time tracking capabilities create competitive advantages that translate into improved profitability and customer satisfaction.

Market expansion opportunities exist for companies that can successfully navigate regulatory requirements, invest in appropriate infrastructure, and develop differentiated service offerings. The growing demand for specialized logistics services creates revenue diversification opportunities beyond traditional parcel delivery.

Strategic partnerships with retailers, manufacturers, and technology companies provide access to new customer segments and innovative service capabilities. Collaborative relationships can reduce operational costs, expand geographic coverage, and accelerate technology development initiatives.

Customer loyalty benefits accrue to providers that consistently deliver reliable service, competitive pricing, and innovative solutions that address evolving market needs. Strong customer relationships create barriers to competitive entry and support premium pricing for value-added services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration continues to reshape CEP operations with robotic sorting systems, automated guided vehicles, and artificial intelligence-driven route optimization becoming standard operational components. These technologies improve processing speed by approximately 40% while reducing labor requirements and operational errors.

Sustainable logistics initiatives are gaining momentum as companies respond to environmental regulations and consumer preferences for eco-friendly delivery options. Electric vehicle adoption, carbon-neutral shipping programs, and sustainable packaging solutions are becoming competitive differentiators rather than optional features.

Customer experience enhancement through digital platforms, real-time tracking, and flexible delivery options has become essential for market competitiveness. Companies are investing in mobile applications, predictive delivery notifications, and personalized service options that improve customer satisfaction and loyalty.

Same-day delivery expansion reflects changing consumer expectations and competitive pressures from e-commerce platforms. The proliferation of local fulfillment centers, micro-distribution facilities, and innovative last-mile solutions enables broader same-day service coverage in metropolitan markets.

Technology partnerships between CEP providers and software companies are accelerating innovation in areas such as predictive analytics, route optimization, and customer communication systems. These collaborations enable faster development and deployment of advanced capabilities that improve operational efficiency and service quality.

Infrastructure expansion projects include new sorting facilities, automated distribution centers, and strategic acquisitions that enhance geographic coverage and operational capacity. MWR analysis indicates that major providers are investing heavily in next-generation facilities designed for increased automation and efficiency.

Regulatory developments affecting drone delivery, autonomous vehicles, and international shipping continue to evolve, creating both opportunities and challenges for market participants. Companies are actively engaging with regulatory agencies to shape policy development and ensure compliance readiness.

Sustainability initiatives include commitments to carbon neutrality, electric vehicle fleet conversion, and sustainable packaging programs. These developments reflect both regulatory requirements and market demand for environmentally responsible logistics solutions.

Strategic focus should prioritize technology integration and operational automation to maintain competitive positioning in an increasingly challenging market environment. Companies that successfully implement advanced analytics, artificial intelligence, and robotic systems will achieve sustainable competitive advantages through improved efficiency and service quality.

Market differentiation through specialized services, sustainability initiatives, and superior customer experience will become increasingly important as standard delivery services become commoditized. Providers should invest in capabilities that create unique value propositions and support premium pricing strategies.

Partnership strategies with retailers, technology companies, and logistics specialists can accelerate innovation and market expansion while sharing investment risks and operational complexities. Collaborative approaches enable access to new capabilities and customer segments without requiring full internal development.

Geographic expansion should focus on high-growth markets and underserved regions where competitive intensity may be lower and growth potential higher. Strategic market entry requires careful analysis of local regulations, competitive dynamics, and infrastructure requirements.

Market evolution will be characterized by continued technology integration, sustainability focus, and customer experience enhancement. The next five years are expected to see significant advancement in automation technologies, with sorting and delivery operations becoming increasingly autonomous and efficient.

Growth projections indicate sustained expansion driven by e-commerce growth, urbanization trends, and evolving consumer expectations for faster, more convenient delivery services. MarkWide Research forecasts suggest the market will maintain robust growth momentum with particular strength in same-day delivery and specialized logistics segments.

Competitive dynamics will likely feature continued consolidation among traditional providers while new entrants focus on innovative service models and niche market segments. The market structure may evolve toward a hybrid model combining large-scale network operators with specialized service providers.

Technology advancement will enable new service capabilities including predictive delivery, autonomous last-mile solutions, and integrated supply chain management platforms. These developments will create opportunities for market expansion and operational efficiency improvements that benefit both providers and customers.

The US Courier, Express, and Parcel market represents a dynamic and essential component of the modern economy, facilitating commerce and connecting businesses with consumers across the nation. The market demonstrates remarkable resilience and adaptability, continuously evolving to meet changing customer expectations and technological possibilities.

Strategic success in this competitive environment requires balanced investment in technology innovation, operational efficiency, and customer experience enhancement. Companies that can effectively navigate regulatory requirements, implement sustainable practices, and deliver reliable service will be positioned for long-term growth and profitability.

Future opportunities abound for market participants willing to embrace change and invest in next-generation capabilities. The convergence of e-commerce growth, technology advancement, and evolving consumer preferences creates a favorable environment for continued market expansion and innovation, ensuring the CEP sector remains vital to economic growth and commercial success.

What is Courier, Express, and Parcel?

Courier, Express, and Parcel refers to services that facilitate the rapid delivery of goods and documents. These services are essential for businesses and individuals needing timely shipping solutions across various distances.

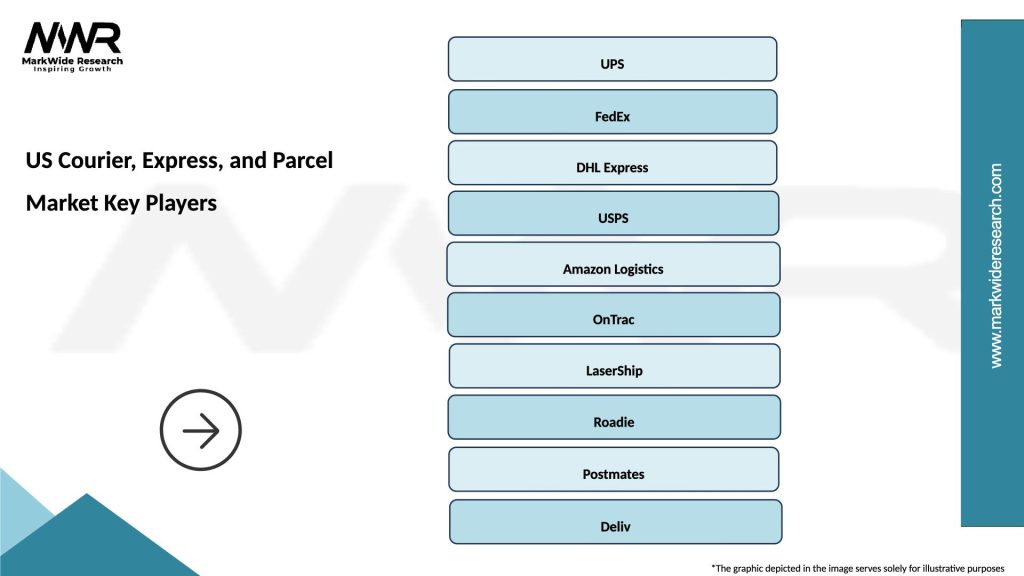

Who are the key players in the US Courier, Express, and Parcel Market?

Key players in the US Courier, Express, and Parcel Market include FedEx, UPS, and DHL, which dominate the sector with extensive logistics networks and diverse service offerings, among others.

What are the main drivers of growth in the US Courier, Express, and Parcel Market?

The growth of the US Courier, Express, and Parcel Market is driven by the rise of e-commerce, increasing consumer demand for fast delivery, and advancements in logistics technology that enhance operational efficiency.

What challenges does the US Courier, Express, and Parcel Market face?

Challenges in the US Courier, Express, and Parcel Market include rising fuel costs, regulatory compliance issues, and the need for sustainable practices to meet environmental standards.

What opportunities exist in the US Courier, Express, and Parcel Market?

Opportunities in the US Courier, Express, and Parcel Market include the expansion of same-day delivery services, the integration of automation and AI in logistics, and the growth of cross-border shipping solutions.

What trends are shaping the US Courier, Express, and Parcel Market?

Trends in the US Courier, Express, and Parcel Market include the increasing use of drones for delivery, the adoption of green logistics practices, and the rise of omnichannel fulfillment strategies to enhance customer experience.

US Courier, Express, and Parcel Market

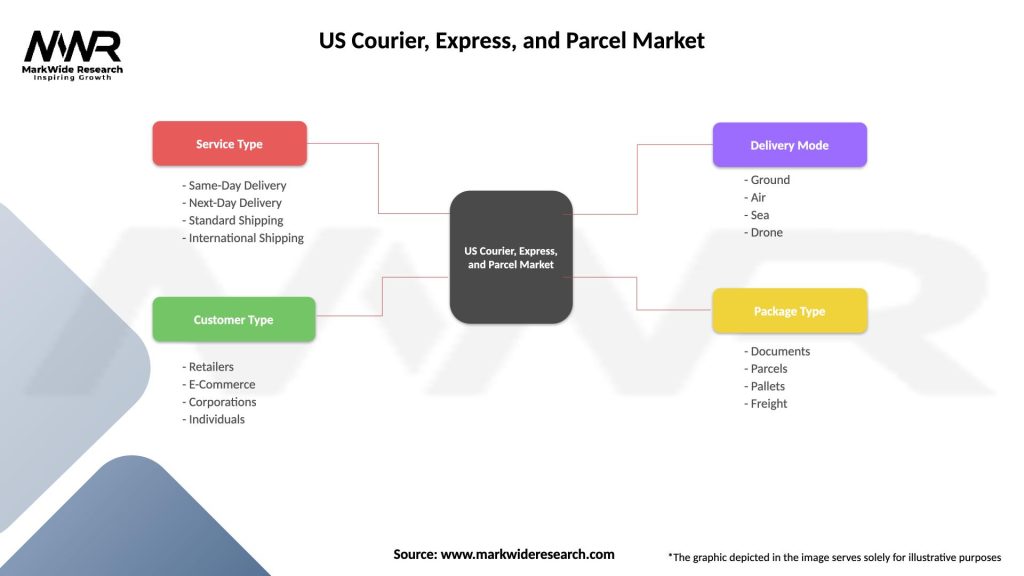

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Standard Shipping, International Shipping |

| Customer Type | Retailers, E-Commerce, Corporations, Individuals |

| Delivery Mode | Ground, Air, Sea, Drone |

| Package Type | Documents, Parcels, Pallets, Freight |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Courier, Express, and Parcel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at