444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US conducted energy weapons market represents a rapidly evolving sector within the broader law enforcement and defense technology landscape. These non-lethal weapons, commonly known as TASER devices or electroshock weapons, have become increasingly integral to modern policing strategies across the United States. The market encompasses various types of conducted energy devices designed to temporarily incapacitate individuals through electrical discharge, providing law enforcement officers with alternatives to lethal force.

Market dynamics indicate robust growth driven by increasing emphasis on officer safety, public demand for non-lethal alternatives, and technological advancements in weapon design. The sector has experienced significant expansion with adoption rates reaching 85% among major police departments nationwide. Federal agencies, state police forces, and local law enforcement departments constitute the primary customer base, while private security firms represent an emerging market segment.

Technological innovation continues to shape market evolution, with manufacturers developing more sophisticated devices featuring enhanced safety protocols, improved accuracy, and advanced data recording capabilities. The integration of body-worn cameras and digital evidence management systems has created new opportunities for market expansion, as agencies seek comprehensive solutions for accountability and training purposes.

The US conducted energy weapons market refers to the commercial sector encompassing the development, manufacturing, distribution, and servicing of electroshock devices designed for law enforcement and security applications within the United States. These weapons utilize electrical current to temporarily disable individuals by causing involuntary muscle contractions, providing a non-lethal alternative to firearms in appropriate situations.

Conducted energy devices operate by delivering high-voltage, low-amperage electrical pulses through two electrode probes connected to the main unit by insulated wires. The electrical discharge disrupts the body’s neuromuscular system, causing temporary incapacitation typically lasting five seconds per trigger pull. Modern devices incorporate multiple safety features, including automatic shut-off mechanisms, spark testing capabilities, and comprehensive data logging systems.

Market participants include device manufacturers, training service providers, maintenance contractors, and accessory suppliers. The ecosystem extends beyond hardware to encompass software solutions, data management platforms, and comprehensive training programs designed to ensure proper deployment and minimize liability risks for law enforcement agencies.

Strategic market positioning reveals the US conducted energy weapons sector as a mature yet continuously evolving industry characterized by technological innovation and expanding applications. The market benefits from strong institutional support, with federal funding programs facilitating widespread adoption across law enforcement agencies of varying sizes and jurisdictions.

Key growth drivers include increasing focus on officer safety, public pressure for police reform emphasizing de-escalation techniques, and ongoing technological improvements enhancing device effectiveness and safety. The market has demonstrated resilience through various economic cycles, supported by essential nature of law enforcement equipment and long-term procurement contracts with government agencies.

Competitive landscape features established market leaders alongside emerging technology companies developing next-generation solutions. Innovation focuses on improving accuracy, reducing deployment risks, and integrating devices with broader law enforcement technology ecosystems. Training and certification programs represent significant revenue streams, with agencies requiring regular recertification to maintain operational readiness.

Future prospects indicate continued market expansion driven by technological advancement, regulatory evolution, and changing law enforcement practices. The integration of artificial intelligence, enhanced data analytics, and improved safety protocols positions the market for sustained growth throughout the forecast period.

Market intelligence reveals several critical insights shaping the US conducted energy weapons landscape. MarkWide Research analysis indicates that technological sophistication continues to drive purchasing decisions, with agencies prioritizing devices offering enhanced safety features and comprehensive data collection capabilities.

Primary market drivers propelling growth in the US conducted energy weapons sector stem from evolving law enforcement needs, technological advancement, and societal demands for improved policing practices. These factors create sustained demand for innovative non-lethal weapons solutions across various law enforcement applications.

Officer safety concerns represent the most significant driver, with law enforcement agencies prioritizing tools that provide effective suspect control while minimizing risk to officers and civilians. Statistical evidence demonstrates that proper use of conducted energy weapons can reduce officer injuries during confrontations, making these devices essential components of modern law enforcement equipment.

Public accountability demands have intensified focus on non-lethal alternatives to firearms, creating political and social pressure for agencies to adopt conducted energy weapons. Community relations initiatives emphasize de-escalation techniques, positioning these devices as valuable tools for reducing lethal force incidents while maintaining public safety.

Technological advancement continues driving market growth through improved device capabilities, enhanced safety features, and better integration with existing law enforcement systems. Modern devices offer superior accuracy, extended range, and comprehensive data recording capabilities that support training programs and legal proceedings.

Federal funding programs provide crucial support for agency procurement, with various grant opportunities enabling smaller departments to acquire conducted energy weapons and associated training. These programs ensure broader market penetration across diverse law enforcement organizations regardless of budget constraints.

Significant market restraints challenge growth in the US conducted energy weapons sector, primarily centered around cost considerations, regulatory complexities, and public perception issues. These factors require careful navigation by manufacturers and law enforcement agencies to ensure successful market participation.

High acquisition costs represent a primary barrier for smaller law enforcement agencies, particularly when considering total ownership expenses including devices, training, maintenance, and liability insurance. Budget constraints often force agencies to prioritize other equipment needs, delaying conducted energy weapon adoption despite recognized benefits.

Regulatory uncertainty creates challenges for both manufacturers and end users, with varying state and local regulations governing device specifications, training requirements, and deployment protocols. Compliance costs and administrative burdens can discourage adoption, particularly among agencies with limited administrative resources.

Liability concerns continue influencing purchasing decisions, as agencies must balance operational benefits against potential legal exposure from device deployment. Insurance costs and legal settlements related to conducted energy weapon use can create financial pressures that impact procurement budgets.

Public perception challenges occasionally create political obstacles to adoption, particularly in communities with heightened sensitivity to law enforcement practices. Negative media coverage of device-related incidents can generate public opposition that influences agency decision-making processes.

Training requirements impose ongoing operational burdens, requiring agencies to allocate significant time and resources to initial certification and regular recertification programs. These commitments can strain agency resources and complicate implementation timelines.

Emerging opportunities in the US conducted energy weapons market present significant potential for growth and innovation across multiple dimensions. These opportunities arise from technological advancement, market expansion, and evolving law enforcement needs that create new applications for conducted energy devices.

Private security markets represent substantial untapped potential, with growing demand from corporate security teams, private investigators, and personal protection services. This sector offers opportunities for specialized device configurations and training programs tailored to civilian security applications.

International expansion through export opportunities allows US manufacturers to leverage domestic expertise in global markets, particularly in countries modernizing their law enforcement capabilities. Strategic partnerships with international distributors can facilitate market entry while maintaining compliance with export regulations.

Technology integration opportunities include developing devices with enhanced connectivity features, artificial intelligence capabilities, and improved data analytics. Integration with smart city initiatives and comprehensive public safety platforms creates new revenue streams and competitive advantages.

Training and simulation markets offer expansion potential through virtual reality training systems, advanced simulation platforms, and comprehensive certification programs. These services provide recurring revenue opportunities while supporting proper device deployment and risk mitigation.

Accessory and service markets present opportunities for holsters, cartridges, maintenance equipment, and comprehensive service contracts. These ancillary products and services can generate substantial revenue while strengthening customer relationships and market positioning.

Complex market dynamics shape the US conducted energy weapons landscape through interactions between technological innovation, regulatory evolution, and changing law enforcement practices. Understanding these dynamics is essential for stakeholders seeking to navigate market challenges and capitalize on emerging opportunities.

Supply chain considerations influence market stability, with manufacturers requiring reliable access to specialized components including batteries, electronics, and precision manufacturing capabilities. Global supply chain disruptions can impact production schedules and pricing strategies, necessitating robust contingency planning.

Competitive pressures drive continuous innovation as manufacturers seek to differentiate their offerings through enhanced features, improved performance, and superior customer service. Market leaders must balance innovation investments with cost management to maintain competitive positioning.

Procurement cycles create predictable demand patterns, with government agencies typically following structured purchasing processes that can span multiple years. Understanding these cycles enables manufacturers to optimize production planning and resource allocation strategies.

Technological convergence with other law enforcement technologies creates opportunities for integrated solutions while potentially disrupting traditional market boundaries. Manufacturers must adapt to evolving customer expectations for comprehensive technology platforms rather than standalone devices.

Regulatory evolution continues shaping market dynamics through changing standards, certification requirements, and deployment protocols. Proactive engagement with regulatory bodies and industry associations helps stakeholders anticipate and adapt to regulatory changes.

Comprehensive research methodology employed for analyzing the US conducted energy weapons market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of findings. The methodology combines quantitative analysis with qualitative insights to provide complete market understanding.

Primary research activities include structured interviews with law enforcement officials, procurement specialists, and industry executives to gather firsthand insights into market trends, challenges, and opportunities. These interviews provide valuable context for quantitative data and help identify emerging market dynamics.

Secondary research encompasses analysis of government procurement records, industry publications, regulatory documents, and financial reports from publicly traded companies. This information provides historical context and enables trend analysis across multiple market dimensions.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review, and statistical analysis. Triangulation techniques help identify and resolve data inconsistencies while maintaining research integrity throughout the analytical process.

Market modeling approaches utilize statistical techniques to project future trends, assess market size dynamics, and evaluate competitive positioning. These models incorporate various scenarios to account for potential market disruptions and changing conditions.

Expert consultation with industry specialists, law enforcement professionals, and technology experts provides additional validation and insight into market developments. This consultation process helps ensure research findings reflect real-world market conditions and stakeholder perspectives.

Regional market analysis reveals significant variations in conducted energy weapon adoption patterns across different US geographic regions, influenced by factors including population density, crime rates, budget availability, and local political considerations. These regional differences create distinct market opportunities and challenges.

Northeast region demonstrates high adoption rates among urban police departments, with 88% penetration in major metropolitan areas. Dense population centers and substantial municipal budgets support comprehensive conducted energy weapon programs including advanced training and technology integration initiatives.

Southeast markets show strong growth driven by expanding law enforcement agencies and increasing focus on officer safety. State-level funding programs have facilitated broader adoption across smaller departments, creating opportunities for manufacturers offering cost-effective solutions and comprehensive training programs.

Midwest region exhibits steady adoption patterns with emphasis on practical, reliable devices suitable for diverse operational environments. Rural and suburban departments prioritize durability and ease of maintenance, influencing product development and service delivery strategies.

Western states lead in technology adoption, with agencies frequently serving as early adopters of innovative features and integrated solutions. California and Washington markets show particularly strong demand for devices with advanced data collection and connectivity capabilities.

Southwest region demonstrates growing market potential driven by population growth and expanding law enforcement agencies. Border security applications create unique requirements for specialized devices and training programs tailored to specific operational challenges.

Competitive landscape analysis reveals a market structure characterized by established industry leaders alongside emerging technology companies developing innovative solutions. Competition focuses on technological advancement, customer service excellence, and comprehensive solution offerings that address evolving law enforcement needs.

Market competition increasingly centers on technological differentiation, with companies investing heavily in research and development to create next-generation devices. Key competitive factors include device reliability, safety features, data collection capabilities, and integration with broader law enforcement technology platforms.

Strategic partnerships play crucial roles in competitive positioning, with manufacturers collaborating with training organizations, software developers, and distribution partners to create comprehensive solutions. These partnerships enable companies to offer complete ecosystems rather than standalone products.

Customer service excellence has become a critical differentiator, with agencies valuing responsive technical support, comprehensive training programs, and reliable maintenance services. Companies that excel in customer service often achieve higher customer retention rates and stronger market positioning.

Market segmentation analysis reveals distinct categories within the US conducted energy weapons market, each characterized by specific requirements, applications, and growth patterns. Understanding these segments enables stakeholders to develop targeted strategies and optimize resource allocation.

By Technology:

By End User:

By Application:

Category-specific analysis provides detailed insights into performance characteristics, market dynamics, and growth prospects across different conducted energy weapon segments. These insights help stakeholders understand category-specific opportunities and challenges.

Handheld Devices Category represents the largest market segment, with agencies preferring portable units that officers can easily carry and deploy during routine patrol activities. This category benefits from continuous technological improvement, with manufacturers developing lighter, more reliable devices featuring extended battery life and enhanced accuracy. Market penetration in this category exceeds 78% among participating agencies.

Vehicle-Mounted Systems constitute a specialized but growing category, particularly popular among agencies operating in rural areas or requiring extended-range capabilities. These systems offer enhanced power and range compared to handheld devices, making them suitable for specific operational scenarios where traditional devices may be insufficient.

Training Equipment Category generates substantial recurring revenue through specialized training cartridges, simulation devices, and virtual reality systems. This category supports the broader market by ensuring proper device deployment and maintaining officer certification requirements mandated by most agencies.

Accessory Markets include holsters, batteries, cartridges, and maintenance equipment that generate ongoing revenue streams. These products often feature higher profit margins than primary devices and create opportunities for customer relationship strengthening through regular interaction and support services.

Software and Data Management represents an emerging high-growth category as agencies increasingly require comprehensive digital evidence management and analytics capabilities. Integration with body cameras and other law enforcement technologies creates opportunities for comprehensive platform solutions.

Industry participants in the US conducted energy weapons market enjoy numerous strategic advantages and benefits that support business growth, market positioning, and stakeholder value creation. These benefits extend across the entire value chain from manufacturers to end users.

Manufacturers benefit from stable, predictable demand driven by essential nature of law enforcement equipment and long-term government procurement contracts. The market offers opportunities for premium pricing on innovative products while generating recurring revenue through training, maintenance, and accessory sales.

Law enforcement agencies gain access to effective non-lethal alternatives that enhance officer safety while providing tools for de-escalation and suspect control. Proper deployment of conducted energy weapons can reduce liability exposure, improve community relations, and support comprehensive use-of-force policies.

Technology providers benefit from opportunities to integrate conducted energy weapons with broader law enforcement technology ecosystems, creating comprehensive solutions that address multiple agency needs. Software and data management capabilities offer high-margin revenue streams with strong customer retention characteristics.

Training organizations enjoy sustained demand for certification and recertification programs, creating stable revenue streams while supporting proper device deployment and risk mitigation. Specialized training programs can command premium pricing and generate long-term customer relationships.

Distribution partners benefit from exclusive territorial arrangements and comprehensive support programs that enable effective market penetration. The essential nature of these products creates resilient demand patterns that support sustainable business models.

Service providers find opportunities in maintenance, repair, and technical support services that generate recurring revenue while strengthening customer relationships. Comprehensive service contracts provide predictable income streams and competitive differentiation opportunities.

Comprehensive SWOT analysis provides strategic insights into internal strengths and weaknesses alongside external opportunities and threats facing the US conducted energy weapons market. This analysis helps stakeholders develop effective strategies and risk mitigation approaches.

Strengths:

Weaknesses:

Opportunities:

Threats:

Significant market trends are reshaping the US conducted energy weapons landscape, driven by technological advancement, changing law enforcement practices, and evolving stakeholder expectations. These trends create both opportunities and challenges for market participants.

Digital Integration Trend represents the most significant development, with devices increasingly featuring connectivity capabilities that enable real-time data transmission, remote monitoring, and integration with comprehensive law enforcement platforms. This trend supports accountability initiatives while providing valuable operational insights.

Enhanced Safety Protocols continue evolving through improved device design, better training programs, and comprehensive risk assessment procedures. Manufacturers are developing devices with multiple safety mechanisms that reduce deployment risks while maintaining operational effectiveness.

Data Analytics Integration enables agencies to analyze deployment patterns, assess training effectiveness, and optimize operational procedures. MWR analysis indicates that agencies utilizing comprehensive data analytics report 23% improvement in deployment outcomes and reduced liability exposure.

Artificial Intelligence Applications are emerging in training simulation systems and decision support tools that help officers make appropriate deployment decisions. These technologies enhance training effectiveness while supporting real-time operational guidance.

Sustainability Initiatives influence product development through emphasis on recyclable materials, extended product lifecycles, and environmentally responsible manufacturing processes. Agencies increasingly consider environmental impact in procurement decisions.

Customization Trends reflect growing demand for devices tailored to specific operational requirements, agency preferences, and regional considerations. Manufacturers are developing modular systems that enable configuration optimization for diverse applications.

Recent industry developments demonstrate the dynamic nature of the US conducted energy weapons market, with significant advances in technology, regulatory frameworks, and market structure. These developments shape competitive positioning and future growth prospects.

Technology Breakthroughs include development of next-generation devices with improved accuracy, extended range, and enhanced safety features. Recent innovations focus on reducing deployment risks while maintaining operational effectiveness through advanced engineering and materials science applications.

Regulatory Updates have established new standards for device performance, training requirements, and deployment protocols. These developments create opportunities for compliant manufacturers while potentially challenging companies that must adapt existing products to meet evolving requirements.

Strategic Partnerships between device manufacturers and technology companies have created comprehensive solutions combining conducted energy weapons with body cameras, evidence management systems, and communication platforms. These partnerships enable integrated offerings that address multiple agency needs.

Market Consolidation activities include acquisitions and mergers that strengthen competitive positions while expanding product portfolios and market reach. These developments create opportunities for enhanced customer service and comprehensive solution offerings.

International Expansion efforts by US manufacturers have opened new markets while leveraging domestic expertise and technology leadership. Export opportunities provide growth potential while supporting domestic manufacturing and employment.

Training Innovation includes development of virtual reality systems, advanced simulation platforms, and comprehensive certification programs that improve officer preparation and reduce deployment risks. These innovations support market growth while addressing liability concerns.

Strategic recommendations for US conducted energy weapons market participants focus on leveraging emerging opportunities while addressing key challenges through innovative approaches and strategic positioning. These suggestions support sustainable growth and competitive advantage development.

Technology Investment Priorities should emphasize integration capabilities, enhanced safety features, and comprehensive data management systems. Companies investing in connectivity and analytics capabilities are positioned to capture growing demand for integrated law enforcement solutions.

Market Expansion Strategies should consider private security markets, international opportunities, and adjacent applications that leverage existing technology and expertise. Diversification reduces dependence on government procurement while creating new revenue streams.

Customer Relationship Management requires emphasis on comprehensive service offerings, responsive technical support, and long-term partnership development. Companies that excel in customer service achieve higher retention rates and stronger competitive positioning.

Regulatory Engagement should involve proactive participation in standards development, industry associations, and regulatory discussions. Early engagement helps shape favorable regulatory environments while ensuring compliance readiness.

Training Program Development offers opportunities for recurring revenue generation while supporting proper device deployment and liability mitigation. Comprehensive training programs create competitive advantages and strengthen customer relationships.

Supply Chain Optimization should focus on resilience, cost management, and quality assurance to ensure reliable product delivery and competitive pricing. Robust supply chains support market leadership and customer satisfaction.

Future market prospects for the US conducted energy weapons sector indicate continued growth driven by technological innovation, expanding applications, and evolving law enforcement needs. MarkWide Research projections suggest sustained market expansion with growth rates potentially reaching 6.2% annually over the next five years.

Technology evolution will likely focus on artificial intelligence integration, enhanced connectivity, and improved safety mechanisms that address current deployment challenges while expanding operational capabilities. Smart devices with predictive analytics and real-time guidance systems represent significant development opportunities.

Market expansion beyond traditional law enforcement applications appears promising, with private security, international markets, and specialized applications offering growth potential. These opportunities require tailored products and service approaches that address specific market segment needs.

Regulatory development will continue shaping market dynamics through evolving standards, certification requirements, and deployment protocols. Proactive engagement with regulatory processes helps ensure favorable outcomes while maintaining market access.

Integration trends suggest increasing demand for comprehensive law enforcement technology platforms that combine conducted energy weapons with other essential tools. Companies developing integrated solutions are positioned to capture growing market share and command premium pricing.

Sustainability considerations will likely influence future product development and procurement decisions as agencies increasingly prioritize environmental responsibility. Manufacturers incorporating sustainable practices and materials may gain competitive advantages in future procurement cycles.

The US conducted energy weapons market represents a dynamic and essential sector within the broader law enforcement technology landscape, characterized by continuous innovation, stable demand, and expanding applications. Market participants benefit from the critical nature of these devices while navigating challenges related to costs, regulations, and public perception.

Strategic opportunities abound for companies that can successfully integrate advanced technologies, expand into adjacent markets, and develop comprehensive solutions addressing evolving law enforcement needs. The emphasis on officer safety, accountability, and effective non-lethal alternatives creates sustained demand for innovative conducted energy weapons and related services.

Future success in this market will depend on technological leadership, customer service excellence, and strategic positioning that addresses both current needs and emerging requirements. Companies that invest in research and development, maintain strong customer relationships, and adapt to regulatory evolution are positioned for sustained growth and market leadership in the evolving US conducted energy weapons market.

What is Conducted Energy Weapons?

Conducted Energy Weapons (CEWs) are non-lethal devices designed to incapacitate individuals through electric shock. They are commonly used in law enforcement and military applications for crowd control and self-defense.

What are the key players in the US Conducted Energy Weapons Market?

Key players in the US Conducted Energy Weapons Market include Axon Enterprise, Inc., TASER International, and BAE Systems, among others. These companies are known for their innovative technologies and product offerings in the field of conducted energy weapons.

What are the growth factors driving the US Conducted Energy Weapons Market?

The growth of the US Conducted Energy Weapons Market is driven by increasing demand for non-lethal weapons in law enforcement, rising concerns over public safety, and advancements in technology that enhance the effectiveness of these weapons.

What challenges does the US Conducted Energy Weapons Market face?

The US Conducted Energy Weapons Market faces challenges such as regulatory scrutiny, public perception issues regarding safety, and the potential for misuse in various situations. These factors can hinder market growth and adoption.

What opportunities exist in the US Conducted Energy Weapons Market?

Opportunities in the US Conducted Energy Weapons Market include the development of advanced CEWs with improved safety features, expanding applications in private security sectors, and increasing interest from military organizations for non-lethal options.

What trends are shaping the US Conducted Energy Weapons Market?

Trends in the US Conducted Energy Weapons Market include the integration of smart technology for enhanced targeting and control, growing emphasis on training for law enforcement personnel, and a shift towards more humane policing methods.

US Conducted Energy Weapons Market

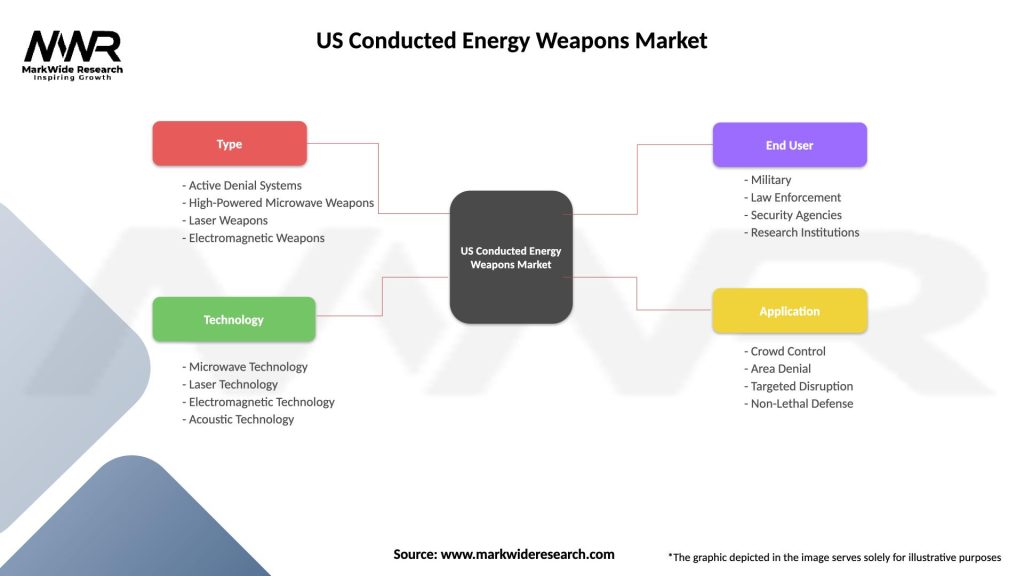

| Segmentation Details | Description |

|---|---|

| Type | Active Denial Systems, High-Powered Microwave Weapons, Laser Weapons, Electromagnetic Weapons |

| Technology | Microwave Technology, Laser Technology, Electromagnetic Technology, Acoustic Technology |

| End User | Military, Law Enforcement, Security Agencies, Research Institutions |

| Application | Crowd Control, Area Denial, Targeted Disruption, Non-Lethal Defense |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Conducted Energy Weapons Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at