444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US ceramic tiles market represents a dynamic and rapidly evolving segment within the broader construction and home improvement industry. Ceramic tiles have established themselves as a preferred flooring and wall covering solution across residential, commercial, and industrial applications throughout the United States. The market demonstrates robust growth patterns driven by increasing construction activities, renovation projects, and evolving consumer preferences toward durable and aesthetically appealing surface solutions.

Market dynamics indicate significant expansion opportunities as homeowners and commercial property developers increasingly recognize the long-term value proposition of ceramic tile installations. The sector benefits from technological advancements in manufacturing processes, innovative design capabilities, and enhanced product durability. Growth projections suggest the market will experience a compound annual growth rate of 6.2% over the forecast period, reflecting strong underlying demand fundamentals.

Regional distribution shows concentrated activity in high-growth metropolitan areas, with California, Texas, and Florida representing approximately 35% of total market demand. The market landscape encompasses diverse product categories, from traditional ceramic options to advanced porcelain formulations, each serving specific application requirements and consumer preferences.

The US ceramic tiles market refers to the comprehensive ecosystem encompassing the production, distribution, and installation of ceramic-based flooring and wall covering products across residential, commercial, and industrial sectors within the United States. This market includes various ceramic tile types, from basic wall tiles to sophisticated porcelain formulations designed for high-traffic applications.

Ceramic tiles are manufactured products created from clay, minerals, and other natural materials that undergo high-temperature firing processes to achieve durability, water resistance, and aesthetic appeal. The market encompasses the entire value chain, including raw material suppliers, manufacturers, distributors, retailers, and installation professionals who collectively serve end-user demand across diverse application segments.

Market participants include domestic manufacturers, international suppliers, specialty retailers, home improvement chains, and professional contractors who facilitate product availability and installation services. The ecosystem supports both new construction projects and renovation activities, serving homeowners, commercial developers, and institutional buyers seeking durable surface solutions.

Strategic analysis reveals the US ceramic tiles market positioned for sustained growth driven by favorable demographic trends, increased construction spending, and evolving consumer preferences toward premium surface materials. The market benefits from strong residential construction activity, commercial development projects, and robust renovation spending across established metropolitan markets.

Key growth drivers include rising homeownership rates, increased focus on home improvement investments, and growing appreciation for ceramic tiles’ durability and design versatility. Market penetration continues expanding as consumers recognize the long-term cost benefits and aesthetic advantages of ceramic tile installations compared to alternative flooring options.

Competitive landscape features a mix of established domestic manufacturers and international suppliers offering diverse product portfolios spanning entry-level to premium ceramic tile solutions. Innovation focuses on enhanced design capabilities, improved installation systems, and sustainable manufacturing practices that appeal to environmentally conscious consumers.

Future prospects indicate continued market expansion supported by demographic trends, urbanization patterns, and increasing consumer investment in home improvement projects. The market demonstrates resilience through economic cycles while adapting to changing design preferences and technological advancements in ceramic tile manufacturing.

Market intelligence reveals several critical insights shaping the US ceramic tiles landscape. Consumer behavior analysis indicates increasing preference for larger format tiles, natural stone aesthetics, and enhanced durability features that support long-term value retention in residential and commercial applications.

Primary growth catalysts propelling the US ceramic tiles market include robust residential construction activity, increasing renovation spending, and evolving consumer preferences toward durable and aesthetically appealing surface materials. Housing market dynamics create sustained demand as new home construction and existing home improvements drive ceramic tile installations across diverse price segments.

Demographic trends support market expansion as millennials enter peak homebuying years and prioritize home improvement investments. This demographic cohort demonstrates strong preference for ceramic tiles due to durability, maintenance advantages, and design flexibility that accommodates changing lifestyle preferences over time.

Commercial construction growth provides additional demand drivers as hospitality, retail, healthcare, and educational facilities increasingly specify ceramic tiles for their durability, hygiene benefits, and design versatility. Infrastructure development and urban renewal projects further expand market opportunities across metropolitan areas.

Technological advancements in ceramic tile manufacturing enable enhanced product performance, expanded design options, and improved installation efficiency. These innovations reduce total project costs while delivering superior aesthetic and functional outcomes that drive consumer adoption across residential and commercial applications.

Market challenges facing the US ceramic tiles industry include intense price competition from alternative flooring materials, skilled labor shortages affecting installation capacity, and economic sensitivity that impacts discretionary home improvement spending during uncertain economic periods.

Installation complexity remains a significant barrier for some consumer segments, as ceramic tile projects require specialized tools, techniques, and expertise that may discourage do-it-yourself installations. Labor costs associated with professional installation can represent substantial portions of total project expenses, potentially limiting market accessibility for price-sensitive consumers.

Supply chain disruptions periodically impact product availability and pricing stability, particularly for imported ceramic tile products that depend on international manufacturing and shipping networks. Raw material cost fluctuations affect manufacturer margins and may translate to consumer price increases that impact demand patterns.

Competitive pressure from luxury vinyl tile, engineered hardwood, and other flooring alternatives challenges ceramic tile market share in certain application segments. These alternatives often offer easier installation, lower upfront costs, or specific performance advantages that appeal to particular consumer preferences.

Emerging opportunities within the US ceramic tiles market include expanding applications in outdoor living spaces, growing demand for sustainable building materials, and increasing adoption of large format tiles that create seamless aesthetic experiences in residential and commercial environments.

Smart home integration presents innovative opportunities as ceramic tile manufacturers explore heated flooring systems, embedded sensors, and other technology integrations that enhance functionality while maintaining traditional ceramic tile benefits. Customization capabilities enabled by digital printing technologies allow manufacturers to serve niche market segments with personalized design solutions.

E-commerce expansion creates new distribution channels that connect manufacturers directly with consumers, potentially reducing costs while improving product accessibility across geographic markets. Online visualization tools help consumers make confident purchasing decisions by previewing ceramic tile installations in their specific spaces.

Renovation market growth offers substantial opportunities as aging housing stock requires updates and homeowners invest in property improvements. Commercial retrofit projects provide additional demand sources as existing buildings upgrade surface materials to meet modern aesthetic and performance standards.

Market forces shaping the US ceramic tiles landscape include evolving consumer preferences, technological innovation, competitive pressures, and regulatory influences that collectively determine industry growth trajectories and profitability patterns across market participants.

Supply-demand equilibrium reflects the balance between manufacturing capacity, import volumes, and end-user consumption patterns that vary seasonally and regionally based on construction activity levels and consumer spending behaviors. Price dynamics respond to raw material costs, transportation expenses, and competitive positioning strategies employed by manufacturers and retailers.

Innovation cycles drive market evolution as manufacturers introduce new product formulations, design capabilities, and installation systems that differentiate their offerings while addressing emerging consumer needs. Sustainability initiatives increasingly influence purchasing decisions as environmentally conscious consumers seek products with reduced environmental impact.

Distribution channel evolution impacts market accessibility and consumer experience as traditional retail models adapt to e-commerce growth and changing shopping preferences. Professional contractor networks remain critical for market development, providing installation expertise and product recommendations that influence consumer choices.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US ceramic tiles market dynamics, trends, and future prospects. Primary research includes extensive interviews with industry participants, including manufacturers, distributors, retailers, contractors, and end-users across diverse geographic markets.

Secondary research incorporates analysis of industry publications, trade association data, government statistics, and company financial reports to establish market baselines and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market trends and identify growth opportunities across product categories and application segments.

Market segmentation analysis examines consumption patterns, pricing trends, and competitive dynamics across residential, commercial, and industrial applications. Regional analysis evaluates market variations across major metropolitan areas and geographic regions to identify localized growth opportunities and challenges.

Competitive intelligence assesses manufacturer strategies, product portfolios, distribution networks, and market positioning approaches to understand competitive dynamics and identify strategic opportunities for market participants seeking to enhance their market presence.

Geographic distribution of the US ceramic tiles market reveals significant regional variations driven by population density, construction activity levels, climate considerations, and local design preferences that influence product demand patterns across different metropolitan areas.

Western region markets demonstrate strong growth momentum, with California leading national consumption due to robust residential construction, renovation activity, and consumer preference for premium surface materials. Market share analysis indicates the West Coast represents approximately 28% of total national demand, supported by high property values and active construction sectors.

Southern region expansion reflects rapid population growth and construction activity across Texas, Florida, Georgia, and North Carolina. These markets benefit from favorable demographics, business relocations, and sustained residential development that drives ceramic tile demand across price segments. Regional growth rates in the South exceed national averages by 15-20% annually.

Northeast markets focus on renovation and replacement applications as mature housing stock requires updates and improvements. Premium product segments perform particularly well in metropolitan areas like New York, Boston, and Philadelphia, where consumers invest in high-quality surface materials for long-term value retention.

Midwest region dynamics reflect steady demand patterns driven by stable construction activity and replacement cycles. Commercial applications show particular strength in industrial and institutional projects that specify ceramic tiles for durability and maintenance advantages.

Market competition within the US ceramic tiles industry features a diverse mix of domestic manufacturers, international suppliers, and specialized distributors competing across multiple product categories and price segments. Industry consolidation trends create opportunities for scale advantages while maintaining competitive pricing and innovation capabilities.

Competitive strategies emphasize product differentiation, distribution network expansion, and customer service excellence to maintain market position and drive growth. Innovation investments focus on manufacturing efficiency, design capabilities, and sustainable practices that appeal to evolving consumer preferences.

Market segmentation analysis reveals distinct product categories and application segments that serve different consumer needs and price points within the US ceramic tiles market. Product differentiation enables manufacturers to target specific market segments while optimizing production efficiency and distribution strategies.

By Product Type:

By Application:

By Size Format:

Residential applications dominate ceramic tile consumption patterns, representing the largest and most diverse market segment. Kitchen installations show particular strength as homeowners prioritize durable, easy-to-clean surfaces that withstand daily use while maintaining aesthetic appeal over extended periods.

Bathroom renovations drive significant ceramic tile demand as consumers invest in water-resistant, hygienic surface materials that enhance property values. Design trends favor larger format tiles, natural stone aesthetics, and coordinated wall and floor installations that create cohesive visual experiences.

Commercial segment growth reflects increasing specification of ceramic tiles in hospitality, healthcare, and retail environments where durability, maintenance efficiency, and design flexibility provide operational advantages. Performance requirements in commercial applications emphasize slip resistance, stain resistance, and long-term appearance retention.

Premium product categories demonstrate accelerated growth as consumers invest in high-quality ceramic tiles for long-term value retention. Porcelain tiles particularly benefit from superior performance characteristics and expanding design options that justify premium pricing in residential and commercial applications.

Outdoor applications represent emerging opportunities as homeowners extend living spaces and commercial properties enhance exterior aesthetics. Weather-resistant formulations enable ceramic tile installations in patios, walkways, and outdoor entertainment areas previously dominated by alternative materials.

Manufacturers benefit from sustained market demand, opportunities for product innovation, and expanding distribution channels that support revenue growth and market share expansion. Operational advantages include economies of scale, technological improvements, and supply chain optimization that enhance profitability and competitive positioning.

Distributors and retailers capitalize on steady product demand, attractive margins, and diverse customer segments that provide revenue stability and growth opportunities. Market expansion through e-commerce channels and professional contractor relationships creates additional revenue streams and customer touchpoints.

Contractors and installers benefit from consistent project demand, premium pricing for specialized skills, and opportunities to build long-term customer relationships through quality installations. Professional development in advanced installation techniques and product knowledge enhances service capabilities and market positioning.

End-users gain access to durable, aesthetically appealing surface solutions that provide long-term value through minimal maintenance requirements, design versatility, and property value enhancement. Product innovations continuously expand options for achieving desired aesthetic and functional outcomes.

Suppliers of raw materials, equipment, and related products benefit from stable demand patterns and opportunities to develop specialized solutions that serve ceramic tile manufacturing requirements. Technology partnerships enable innovation collaboration and market development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Design evolution within the US ceramic tiles market emphasizes larger format tiles, natural material aesthetics, and seamless installation techniques that create sophisticated visual experiences in residential and commercial environments. Consumer preferences increasingly favor wood-look and stone-look ceramic tiles that combine natural aesthetics with ceramic durability advantages.

Sustainability initiatives gain momentum as manufacturers implement eco-friendly production processes, increase recycled content utilization, and develop products that contribute to green building certification programs. Environmental consciousness among consumers drives demand for ceramic tiles with reduced environmental impact throughout their lifecycle.

Technology integration transforms ceramic tile functionality through heated flooring systems, antimicrobial surface treatments, and smart home compatibility features that enhance user experience while maintaining traditional ceramic tile benefits. Digital printing advances enable increasingly realistic textures and patterns that expand design possibilities.

Installation innovation focuses on systems and techniques that reduce labor requirements, improve installation quality, and minimize project timelines. Click-lock systems and advanced adhesives simplify installation processes while maintaining long-term performance standards.

Customization capabilities allow consumers to specify unique designs, sizes, and finishes that reflect personal preferences and specific application requirements. Digital design tools enable visualization and customization services that enhance the customer experience and reduce installation uncertainties.

Manufacturing innovations continue advancing ceramic tile production efficiency, quality consistency, and design capabilities through automated systems, digital printing technologies, and advanced kiln operations that reduce costs while improving product performance characteristics.

Merger and acquisition activity shapes competitive dynamics as industry participants seek scale advantages, expanded product portfolios, and enhanced distribution capabilities. Strategic partnerships between manufacturers and technology companies enable innovation development and market expansion initiatives.

Sustainability certifications become increasingly important as manufacturers pursue third-party validation of environmental performance and sustainable manufacturing practices. Green building standards influence product development priorities and market positioning strategies across the industry.

Distribution channel evolution reflects changing consumer shopping preferences and the growing importance of e-commerce platforms in ceramic tile sales. Omnichannel strategies integrate online and offline customer touchpoints to improve accessibility and customer experience.

International trade developments impact supply chain dynamics, pricing structures, and competitive positioning as manufacturers navigate tariff policies, shipping costs, and global supply chain challenges that affect product availability and market pricing.

Strategic recommendations for ceramic tile industry participants emphasize innovation investment, distribution network expansion, and customer experience enhancement to maintain competitive positioning and capitalize on market growth opportunities. MarkWide Research analysis indicates successful companies will focus on differentiation strategies that leverage technology, sustainability, and design innovation.

Market entry strategies should prioritize regional market understanding, contractor relationship development, and product portfolio optimization to serve local consumer preferences and application requirements. Distribution partnerships with established retailers and e-commerce platforms provide market access while minimizing infrastructure investment requirements.

Product development priorities should address sustainability requirements, installation efficiency improvements, and design innovation that differentiates offerings in competitive market segments. Technology integration opportunities enable functionality enhancements that justify premium pricing and expand market appeal.

Customer engagement strategies must adapt to changing shopping behaviors and decision-making processes that increasingly involve online research, visualization tools, and professional consultation. Educational content and installation support services enhance customer confidence and reduce project uncertainties.

Supply chain optimization becomes critical for managing costs, ensuring product availability, and maintaining quality standards across diverse geographic markets. Inventory management and logistics efficiency directly impact profitability and customer satisfaction levels.

Long-term prospects for the US ceramic tiles market remain positive, supported by demographic trends, urbanization patterns, and sustained investment in residential and commercial construction projects. Market projections indicate continued growth at a compound annual growth rate of 6.2% through the forecast period, driven by renovation activity and new construction demand.

Innovation trajectories will focus on enhanced functionality, improved sustainability, and expanded design capabilities that address evolving consumer preferences and application requirements. Technology integration will enable new product categories and functionality enhancements that differentiate ceramic tiles from alternative flooring materials.

Market evolution will reflect changing consumer behaviors, distribution channel preferences, and installation practices that influence how ceramic tiles are marketed, sold, and installed across residential and commercial applications. Digital transformation will continue reshaping customer experience and business operations throughout the value chain.

Competitive dynamics will emphasize differentiation through innovation, sustainability, and customer service excellence as market participants seek to maintain margins and market share in an increasingly competitive environment. MWR analysis suggests successful companies will invest in capabilities that support long-term market leadership and customer loyalty.

Regulatory influences may impact manufacturing processes, product specifications, and environmental compliance requirements that shape industry practices and competitive positioning. Building code evolution and green building standards will continue influencing product development and market demand patterns.

The US ceramic tiles market demonstrates robust growth potential supported by favorable demographic trends, sustained construction activity, and evolving consumer preferences toward durable and aesthetically appealing surface materials. Market fundamentals remain strong across residential, commercial, and industrial application segments, with particular strength in renovation and replacement markets.

Strategic opportunities exist for industry participants who invest in innovation, sustainability, and customer experience enhancement while adapting to changing market dynamics and competitive pressures. Technology integration and design innovation will continue driving market differentiation and premium positioning opportunities.

Future success will depend on manufacturers’ ability to balance cost competitiveness with product innovation, quality consistency, and customer service excellence. MarkWide Research projects continued market expansion as ceramic tiles maintain their position as preferred surface materials for applications requiring durability, aesthetic appeal, and long-term value retention across diverse market segments.

What is Ceramic Tiles?

Ceramic tiles are durable, hard-wearing materials made from clay and other natural resources, often used for flooring, walls, and countertops. They are known for their aesthetic appeal and versatility in various applications, including residential and commercial spaces.

What are the key players in the US Ceramic Tiles Market?

Key players in the US Ceramic Tiles Market include Mohawk Industries, Daltile, and American Olean, among others. These companies are known for their innovative designs and extensive product ranges catering to different consumer preferences.

What are the growth factors driving the US Ceramic Tiles Market?

The growth of the US Ceramic Tiles Market is driven by increasing demand for sustainable building materials, rising home renovation activities, and the popularity of ceramic tiles in commercial spaces due to their durability and low maintenance.

What challenges does the US Ceramic Tiles Market face?

The US Ceramic Tiles Market faces challenges such as fluctuating raw material prices, competition from alternative flooring options, and the environmental impact of tile production processes.

What opportunities exist in the US Ceramic Tiles Market?

Opportunities in the US Ceramic Tiles Market include the growing trend of eco-friendly products, advancements in tile manufacturing technology, and increasing consumer interest in unique designs and textures for home interiors.

What trends are shaping the US Ceramic Tiles Market?

Current trends in the US Ceramic Tiles Market include the rise of large-format tiles, the integration of digital printing technology for custom designs, and a shift towards tiles that mimic natural materials like wood and stone.

US Ceramic Tiles Market

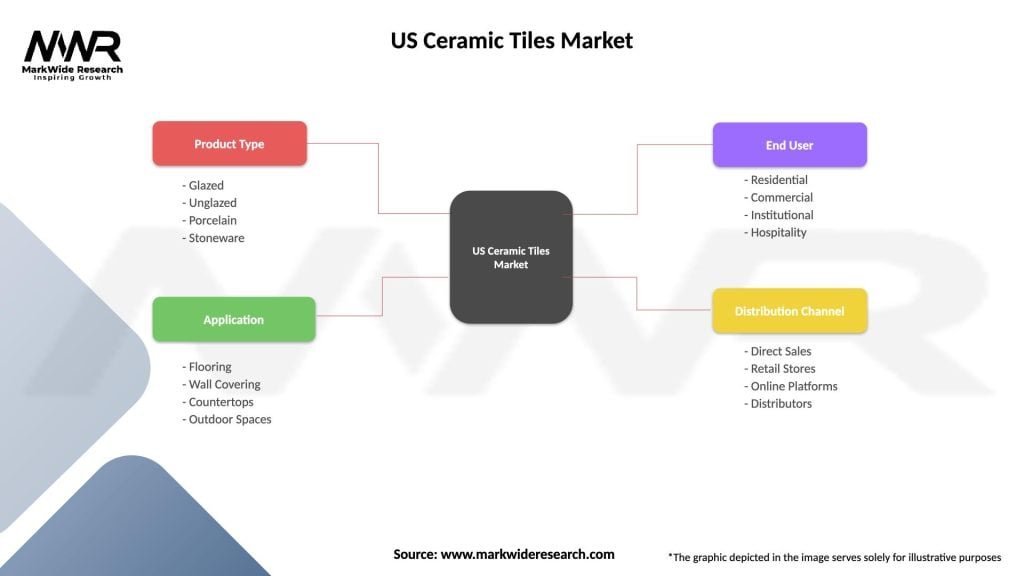

| Segmentation Details | Description |

|---|---|

| Product Type | Glazed, Unglazed, Porcelain, Stoneware |

| Application | Flooring, Wall Covering, Countertops, Outdoor Spaces |

| End User | Residential, Commercial, Institutional, Hospitality |

| Distribution Channel | Direct Sales, Retail Stores, Online Platforms, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Ceramic Tiles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at