444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US casein and caseinates market represents a dynamic segment within the broader protein ingredients industry, experiencing robust growth driven by increasing demand for high-quality protein sources across multiple applications. Casein proteins, derived from milk through various processing methods, have established themselves as essential ingredients in food manufacturing, nutritional supplements, and industrial applications throughout the United States.

Market dynamics indicate that the sector is witnessing significant expansion, with growth rates reaching approximately 6.2% CAGR over recent years. This growth trajectory reflects the increasing consumer awareness of protein benefits and the versatility of casein-based products in meeting diverse nutritional and functional requirements. The market encompasses various forms including acid casein, rennet casein, sodium caseinate, calcium caseinate, and potassium caseinate, each serving specific industrial and consumer applications.

Regional distribution shows concentrated activity in major dairy-producing states, with approximately 45% of production capacity located in Wisconsin, California, and New York. The market benefits from the United States’ position as a leading dairy producer, providing abundant raw material supply and established processing infrastructure. Consumer trends toward clean label products and natural protein sources continue to drive demand for casein and caseinate ingredients across multiple sectors.

The US casein and caseinates market refers to the commercial sector encompassing the production, processing, distribution, and consumption of casein proteins and their derivative compounds within the United States. Casein represents the primary protein component found in mammalian milk, constituting approximately 80% of total milk proteins, while caseinates are the sodium, calcium, or potassium salts of casein that offer enhanced solubility and functional properties.

Processing methods involve separating casein from milk through acid precipitation or enzymatic coagulation, followed by purification and conversion into various caseinate forms. These proteins exhibit unique functional characteristics including excellent emulsification properties, thermal stability, and superior amino acid profiles, making them valuable ingredients across food, beverage, nutritional supplement, and industrial applications.

Market participants include dairy processors, protein ingredient manufacturers, food and beverage companies, supplement producers, and industrial users who utilize casein and caseinates for their binding, texturizing, and nutritional enhancement properties. The market serves both domestic consumption and export opportunities, contributing to the broader US agricultural and food processing economy.

Strategic positioning of the US casein and caseinates market demonstrates strong fundamentals supported by robust domestic dairy production, advanced processing capabilities, and diverse end-use applications. The market benefits from established supply chains, technological innovation, and growing consumer demand for high-quality protein ingredients across multiple sectors.

Key growth drivers include increasing health consciousness among consumers, with approximately 73% of Americans actively seeking protein-enriched products, expanding sports nutrition market, and rising demand for functional food ingredients. The market also benefits from the clean label trend, as casein and caseinates are perceived as natural, minimally processed protein sources compared to synthetic alternatives.

Competitive dynamics feature a mix of large-scale dairy cooperatives, specialized protein ingredient companies, and integrated food manufacturers. Market leaders focus on product innovation, quality enhancement, and sustainable production practices to maintain competitive advantages. Technological advancements in processing methods and product formulations continue to expand application possibilities and improve functional performance.

Future prospects indicate continued market expansion driven by demographic trends, increasing protein consumption, and growing applications in emerging sectors such as plant-based food alternatives and pharmaceutical applications. The market is positioned to benefit from ongoing innovation in protein processing and formulation technologies.

Market segmentation reveals diverse applications across multiple industries, with food and beverage applications accounting for the largest share, followed by nutritional supplements and industrial uses. The following key insights characterize the current market landscape:

Primary growth drivers propelling the US casein and caseinates market include fundamental shifts in consumer behavior, technological advancement, and expanding application opportunities. The increasing focus on protein consumption represents a cornerstone driver, with dietary protein intake recommendations and health awareness campaigns driving demand for high-quality protein sources.

Health and wellness trends significantly influence market dynamics, as consumers increasingly recognize the importance of complete proteins containing essential amino acids. Casein’s unique slow-digestion properties make it particularly valuable for sports nutrition applications, where sustained amino acid release supports muscle recovery and growth. This has resulted in approximately 28% growth in sports nutrition applications over recent years.

Food industry evolution creates substantial opportunities as manufacturers seek functional ingredients that enhance product quality while meeting clean label requirements. Casein and caseinates provide excellent emulsification, binding, and texturizing properties, enabling food manufacturers to create products with improved mouthfeel, stability, and nutritional profiles without relying on artificial additives.

Demographic factors including aging population and increasing health consciousness among millennials and Generation Z consumers drive demand for protein-enriched products. The growing awareness of protein’s role in healthy aging, weight management, and overall wellness creates sustained market demand across age demographics.

Cost considerations present significant challenges for market participants, as casein and caseinate production requires substantial capital investment in processing equipment and quality control systems. Raw material price volatility, particularly milk prices, directly impacts production costs and profit margins, creating uncertainty for manufacturers and downstream users.

Regulatory complexity poses ongoing challenges, with stringent FDA requirements for protein ingredient safety, labeling, and manufacturing practices. Compliance costs and regulatory uncertainty can limit market entry for smaller players and increase operational expenses for existing participants. International trade regulations also affect export opportunities and competitive positioning in global markets.

Competition from alternatives intensifies as plant-based proteins and other protein sources gain market acceptance. While casein offers unique functional properties, the growing popularity of vegan and vegetarian lifestyles creates headwinds for dairy-derived proteins. Approximately 15% of consumers actively avoid dairy products, limiting potential market reach.

Supply chain vulnerabilities including dependence on dairy farming conditions, weather patterns, and feed costs create potential disruptions. Environmental concerns related to dairy production and sustainability pressures may impact long-term supply availability and social acceptance of dairy-derived ingredients.

Emerging applications present substantial growth opportunities, particularly in pharmaceutical and nutraceutical sectors where casein’s bioactive properties and controlled-release characteristics offer unique advantages. The development of specialized casein formulations for medical nutrition and therapeutic applications represents a high-value market segment with significant growth potential.

International expansion opportunities continue to develop, especially in Asian markets where growing middle-class populations and increasing protein consumption create demand for high-quality protein ingredients. Export market development could provide substantial revenue growth for US producers, leveraging the country’s reputation for quality and food safety standards.

Product innovation in functional foods and beverages creates opportunities for specialized caseinate formulations that enhance nutritional profiles while maintaining taste and texture preferences. The growing market for protein-enriched snacks, beverages, and convenience foods provides platforms for casein and caseinate integration.

Sustainability initiatives offer opportunities for market differentiation through environmentally responsible production practices, waste reduction, and circular economy approaches. Companies implementing sustainable practices may capture premium market segments and meet growing corporate sustainability requirements from food manufacturers and retailers.

Supply-demand equilibrium in the US casein and caseinates market reflects the interplay between domestic dairy production capacity, processing capabilities, and end-use demand across multiple sectors. The market demonstrates relative stability due to established supply chains and consistent demand patterns, though seasonal variations in milk production create periodic supply fluctuations.

Pricing dynamics are influenced by raw material costs, processing expenses, and competitive pressures from alternative protein sources. Market participants employ various strategies including long-term supply contracts, vertical integration, and product differentiation to manage price volatility and maintain profitability. Value-added products command premium pricing, with specialized formulations achieving approximately 25-30% higher margins compared to commodity grades.

Innovation cycles drive market evolution through continuous product development, process improvements, and application expansion. Research and development investments focus on enhancing functional properties, improving processing efficiency, and developing new applications that leverage casein’s unique characteristics. Technology adoption rates indicate approximately 65% of major producers have implemented advanced processing technologies within the past five years.

Market consolidation trends reflect strategic positioning by major players seeking economies of scale, expanded product portfolios, and enhanced market reach. Mergers and acquisitions activity continues to reshape the competitive landscape, with companies pursuing vertical integration and geographic expansion strategies.

Comprehensive analysis of the US casein and caseinates market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines primary data collection, secondary source analysis, and quantitative modeling to provide a complete market perspective.

Primary research involves extensive interviews with industry stakeholders including manufacturers, suppliers, distributors, and end-users across the value chain. Survey methodologies capture market trends, pricing dynamics, competitive positioning, and future outlook perspectives from key market participants. Expert consultations with industry specialists provide technical insights and market intelligence.

Secondary research encompasses analysis of industry publications, regulatory filings, company reports, and trade association data to validate primary findings and provide historical context. Government statistics, trade data, and economic indicators support market sizing and trend analysis. Database integration ensures comprehensive coverage of market segments and geographic regions.

Analytical frameworks include market modeling, competitive analysis, and trend projection methodologies that account for various market drivers, restraints, and opportunities. Statistical analysis and forecasting models provide quantitative insights while qualitative assessment captures market nuances and strategic implications.

Geographic distribution of the US casein and caseinates market reflects the concentration of dairy production and processing capabilities across key regions. The Midwest region dominates market activity, accounting for approximately 52% of total production capacity, led by Wisconsin’s extensive dairy infrastructure and established processing facilities.

Western states, particularly California, represent the second-largest regional market, contributing approximately 28% of national production. California’s large-scale dairy operations and proximity to export facilities provide strategic advantages for both domestic and international market access. The region benefits from advanced processing technologies and strong research and development capabilities.

Northeast corridor maintains significant market presence through established dairy cooperatives and proximity to major food manufacturing centers. New York, Vermont, and Pennsylvania contribute approximately 15% of national production, serving regional food manufacturers and export markets through Atlantic port facilities.

Southern regions show growing market participation, with states like Texas and North Carolina expanding dairy processing capabilities. While representing a smaller market share currently, the South demonstrates strong growth potential driven by population growth, expanding food manufacturing, and favorable business climates.

Market integration across regions benefits from established transportation networks, standardized quality systems, and coordinated supply chain management. Regional specialization in specific product grades and applications creates efficiency advantages while maintaining national market coherence.

Market leadership in the US casein and caseinates sector features a combination of large dairy cooperatives, specialized protein ingredient companies, and integrated food manufacturers. The competitive environment emphasizes product quality, innovation capabilities, and supply chain efficiency as key differentiating factors.

Competitive strategies focus on product differentiation through specialized formulations, technical service capabilities, and sustainable production practices. Companies invest heavily in research and development to create value-added products that command premium pricing and strengthen customer relationships.

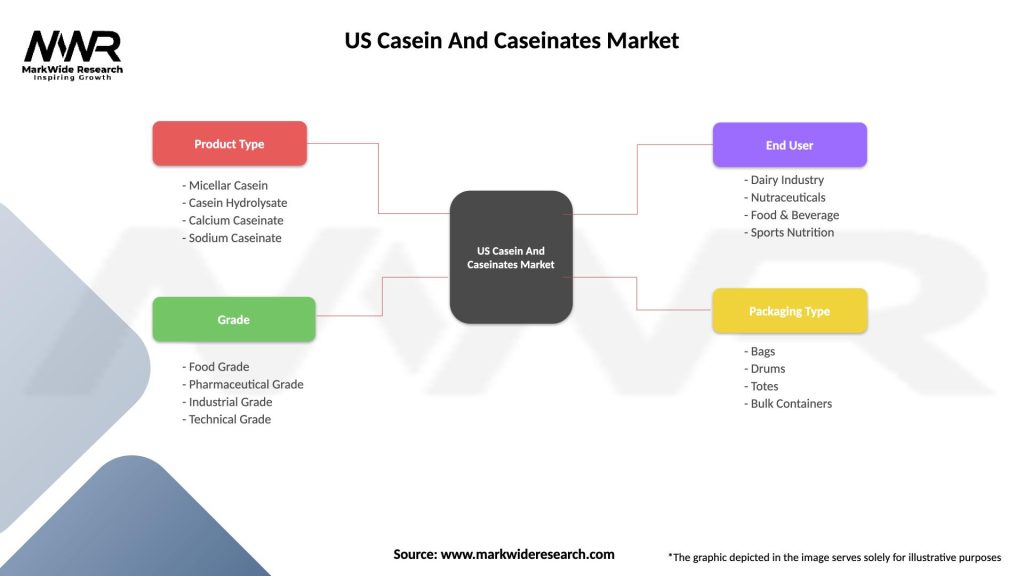

Product segmentation of the US casein and caseinates market encompasses various forms and grades tailored to specific applications and functional requirements. The market divides into distinct categories based on processing methods, chemical composition, and end-use applications.

By Product Type:

By Application:

Food and beverage applications represent the dominant market category, driven by casein’s exceptional functional properties in product formulation. Bakery applications utilize casein for dough strengthening, moisture retention, and protein enrichment, while processed meat products benefit from casein’s binding and emulsification capabilities.

Nutritional supplement category demonstrates the highest growth rates, with approximately 8.5% annual growth driven by increasing consumer focus on fitness and wellness. Sports nutrition products particularly value casein’s slow-digestion properties, which provide sustained amino acid release for muscle recovery and growth.

Beverage applications show significant innovation potential, with protein-enriched drinks, coffee creamers, and nutritional beverages incorporating various caseinate forms. The category benefits from clean label trends and consumer preference for natural protein sources over synthetic alternatives.

Industrial applications maintain steady demand for specialized casein grades used in adhesives, paper coatings, and technical applications. While representing a smaller market segment, industrial uses provide stable demand and often command premium pricing for specialized formulations.

Emerging categories including pharmaceutical and nutraceutical applications present growth opportunities as research continues to identify bioactive properties and therapeutic potential of casein-derived compounds.

Manufacturers benefit from casein and caseinates’ versatile functionality, enabling product innovation and differentiation in competitive markets. The ingredients provide excellent emulsification, binding, and texturizing properties while meeting clean label requirements, allowing food companies to create products with improved quality and consumer appeal.

Nutritional advantages include complete amino acid profiles, high biological value, and unique digestion characteristics that support various health and wellness applications. Sports nutrition companies particularly benefit from casein’s slow-release properties, which provide sustained amino acid availability for muscle protein synthesis and recovery.

Supply chain stakeholders benefit from established infrastructure, reliable supply sources, and standardized quality systems that ensure consistent product availability and performance. The mature market structure provides stability and predictability for long-term planning and investment decisions.

End consumers receive high-quality protein sources that support health and wellness goals while enjoying improved product taste, texture, and nutritional profiles. The natural origin and minimal processing of casein and caseinates align with consumer preferences for clean label products.

Economic benefits extend to rural communities through dairy farming support, processing employment, and related economic activity. The industry contributes to agricultural sustainability and rural economic development while providing valuable export opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues to drive market evolution as consumers increasingly demand products with recognizable, minimally processed ingredients. Casein and caseinates benefit from this trend due to their natural origin and straightforward processing methods, positioning them favorably against synthetic protein alternatives.

Personalized nutrition emerges as a significant trend, with approximately 42% of consumers interested in customized nutritional products. This creates opportunities for specialized casein formulations targeting specific demographic groups, health conditions, or performance goals. Companies are developing targeted products for seniors, athletes, and individuals with specific dietary requirements.

Sustainability focus intensifies across the food industry, driving demand for environmentally responsible production practices. Casein producers are implementing sustainable farming partnerships, waste reduction programs, and carbon footprint reduction initiatives to meet corporate sustainability requirements and consumer expectations.

Functional food innovation accelerates as manufacturers seek ingredients that provide both nutritional and functional benefits. Casein’s unique properties enable the development of products with enhanced texture, stability, and nutritional profiles, supporting the growing functional foods market.

Digital transformation impacts market operations through improved supply chain visibility, quality monitoring, and customer engagement. Companies are leveraging technology to enhance production efficiency, ensure product traceability, and provide technical support to customers.

Recent innovations in processing technology have enhanced product quality and expanded application possibilities for casein and caseinates. Advanced filtration systems and gentle processing methods preserve protein functionality while improving yield and reducing environmental impact. These technological improvements enable the production of higher-quality products with enhanced functional properties.

Strategic partnerships between casein producers and food manufacturers have strengthened market relationships and driven product innovation. Collaborative development programs focus on creating customized solutions that meet specific application requirements while optimizing cost and performance characteristics.

Regulatory developments including updated FDA guidelines for protein ingredients and labeling requirements have influenced market practices and product positioning. Companies have invested in compliance programs and quality assurance systems to meet evolving regulatory standards and maintain market access.

Sustainability initiatives have gained prominence, with major producers implementing environmental management programs and sustainable sourcing practices. MarkWide Research indicates that approximately 78% of major casein producers have established formal sustainability programs within the past three years.

Market consolidation through mergers and acquisitions has reshaped the competitive landscape, creating larger, more integrated companies with enhanced capabilities and market reach. These developments have improved operational efficiency and innovation capacity while maintaining competitive market dynamics.

Strategic recommendations for market participants emphasize the importance of product differentiation through innovation and specialized formulations. Companies should focus on developing value-added products that command premium pricing while meeting specific customer requirements and market trends.

Investment priorities should include processing technology upgrades, quality assurance systems, and sustainability initiatives that enhance competitive positioning and operational efficiency. Research and development investments in new applications and product formulations can create growth opportunities and market differentiation.

Market expansion strategies should consider international opportunities, particularly in emerging markets with growing protein consumption and middle-class populations. Export market development requires investment in quality certifications, regulatory compliance, and distribution partnerships.

Partnership development with food manufacturers, supplement companies, and research institutions can accelerate innovation and market penetration. Collaborative relationships enable companies to leverage complementary capabilities and share development costs while accessing new market segments.

Sustainability integration should become a core business strategy rather than a peripheral consideration. Companies that proactively address environmental concerns and implement sustainable practices will be better positioned for long-term success and market acceptance.

Long-term prospects for the US casein and caseinates market remain positive, supported by fundamental demographic trends, health consciousness, and expanding application opportunities. MWR analysis projects continued market growth driven by increasing protein consumption, aging population, and innovation in functional foods and nutritional products.

Growth projections indicate sustained expansion at approximately 6.8% CAGR over the next five years, with particularly strong growth expected in nutritional supplements and specialized food applications. The market will benefit from ongoing product innovation, quality improvements, and expanding international opportunities.

Technology advancement will continue to drive market evolution through improved processing methods, enhanced product functionality, and new application development. Emerging technologies in protein modification and formulation science will create opportunities for next-generation casein products with superior performance characteristics.

Market maturation will likely result in increased consolidation, with larger companies gaining market share through economies of scale, innovation capabilities, and global reach. However, opportunities will remain for specialized producers focusing on niche applications and premium products.

Regulatory environment is expected to remain supportive, with continued recognition of casein and caseinates as safe, beneficial protein ingredients. However, companies must maintain vigilance regarding evolving food safety, labeling, and environmental regulations that may impact operations and market access.

The US casein and caseinates market demonstrates strong fundamentals and positive growth prospects supported by diverse applications, established infrastructure, and growing consumer demand for high-quality protein ingredients. The market benefits from favorable demographic trends, health consciousness, and ongoing innovation in product development and applications.

Strategic positioning requires companies to balance traditional strengths in functionality and nutrition with emerging opportunities in sustainability, personalization, and international expansion. Success will depend on continuous innovation, quality excellence, and adaptability to changing market conditions and consumer preferences.

Future success in the casein and caseinates market will favor companies that invest in technology advancement, sustainable practices, and customer partnerships while maintaining focus on product quality and regulatory compliance. The market’s evolution toward higher-value applications and specialized formulations creates opportunities for differentiation and premium positioning.

Overall market outlook remains optimistic, with sustained growth expected across multiple application segments and geographic regions. The combination of established market foundations and emerging growth opportunities positions the US casein and caseinates market for continued expansion and value creation for industry participants and stakeholders.

What is Casein and Caseinates?

Casein and caseinates are milk proteins that are widely used in food products, dietary supplements, and various industrial applications. They are known for their excellent emulsifying and thickening properties, making them valuable in the food industry.

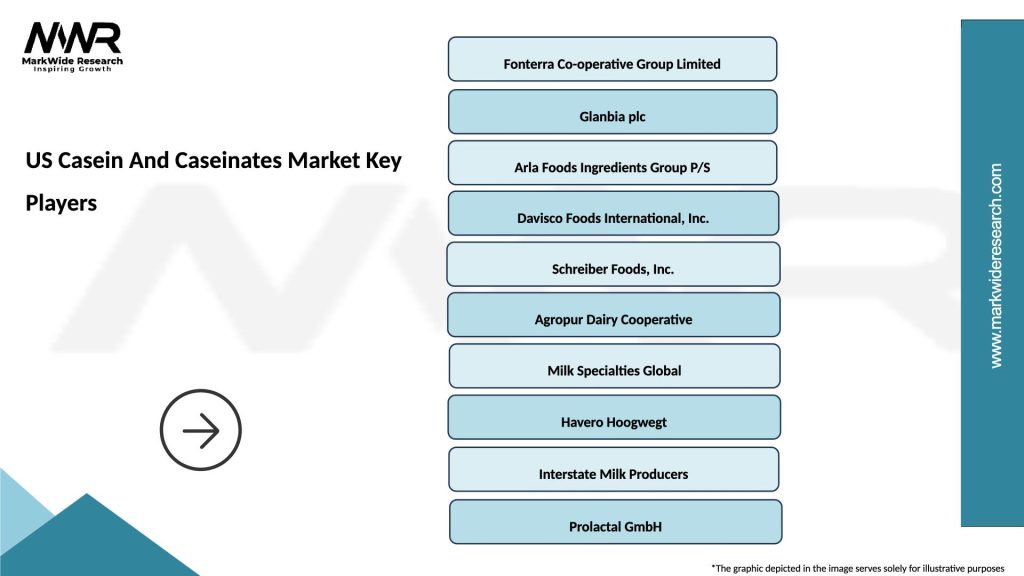

What are the key players in the US Casein And Caseinates Market?

Key players in the US Casein And Caseinates Market include companies like Fonterra Co-operative Group, FrieslandCampina, and Saputo Inc. These companies are involved in the production and distribution of casein and caseinates for various applications, among others.

What are the growth factors driving the US Casein And Caseinates Market?

The growth of the US Casein And Caseinates Market is driven by increasing demand for protein-rich foods, the rise in health consciousness among consumers, and the expanding use of caseinates in sports nutrition products. Additionally, the versatility of casein in various food applications contributes to its market growth.

What challenges does the US Casein And Caseinates Market face?

The US Casein And Caseinates Market faces challenges such as fluctuating raw material prices and stringent regulations regarding food safety and labeling. Additionally, competition from alternative protein sources can impact market dynamics.

What opportunities exist in the US Casein And Caseinates Market?

Opportunities in the US Casein And Caseinates Market include the growing trend of plant-based diets, which may lead to innovations in dairy alternatives. Furthermore, the increasing demand for functional foods and supplements presents avenues for market expansion.

What trends are shaping the US Casein And Caseinates Market?

Trends shaping the US Casein And Caseinates Market include the rising popularity of clean label products, advancements in processing technologies, and the growing interest in personalized nutrition. These trends are influencing product development and consumer preferences.

US Casein And Caseinates Market

| Segmentation Details | Description |

|---|---|

| Product Type | Micellar Casein, Casein Hydrolysate, Calcium Caseinate, Sodium Caseinate |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Technical Grade |

| End User | Dairy Industry, Nutraceuticals, Food & Beverage, Sports Nutrition |

| Packaging Type | Bags, Drums, Totes, Bulk Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Casein And Caseinates Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at