444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Buy Now Pay Later services market has emerged as a transformative force in the American financial technology landscape, fundamentally reshaping consumer payment behaviors and retail commerce dynamics. This innovative payment solution allows consumers to make purchases immediately while spreading payments across multiple installments, typically without traditional credit checks or interest charges. The market has experienced unprecedented growth, driven by changing consumer preferences, technological advancement, and the increasing digitization of retail transactions.

Market dynamics indicate that the sector is expanding at a remarkable CAGR of 24.3%, reflecting the strong consumer adoption and merchant acceptance of these flexible payment solutions. The rise of e-commerce, particularly accelerated by recent global events, has created fertile ground for BNPL service providers to establish significant market presence across diverse retail categories including fashion, electronics, home goods, and travel services.

Consumer demographics show particularly strong adoption among millennials and Generation Z consumers, who represent approximately 73% of total BNPL users in the United States. These digital-native generations appreciate the transparency, convenience, and financial flexibility that buy now pay later platforms provide, often preferring these solutions over traditional credit cards for both online and in-store purchases.

The US Buy Now Pay Later services market refers to the comprehensive ecosystem of financial technology companies, payment platforms, and integrated solutions that enable consumers to purchase goods and services immediately while deferring payment through structured installment plans. These services typically divide the total purchase amount into equal payments spread over weeks or months, often without interest charges if payments are made on time.

BNPL providers generate revenue through merchant fees rather than consumer interest, creating a business model that appeals to cost-conscious shoppers while providing merchants with increased conversion rates and higher average order values. The market encompasses various service models including point-of-sale financing, embedded checkout solutions, virtual card programs, and mobile payment applications that integrate seamlessly with both online and offline retail environments.

Market leadership in the US Buy Now Pay Later services sector is characterized by intense competition among established fintech companies and emerging payment solution providers. The market has witnessed significant consolidation through strategic partnerships, acquisitions, and technology integrations that enhance service capabilities and expand merchant networks.

Consumer adoption patterns reveal that approximately 56% of American consumers have used BNPL services at least once, with repeat usage rates indicating strong customer satisfaction and loyalty. The average transaction value for BNPL purchases ranges from $50 to $200, demonstrating the service’s effectiveness for both everyday purchases and higher-value discretionary spending.

Regulatory developments are shaping market evolution, with increasing scrutiny from financial regulators regarding consumer protection, credit reporting, and responsible lending practices. These regulatory considerations are driving innovation in risk assessment, customer verification, and transparent communication of terms and conditions.

Strategic market insights reveal several critical factors driving the sustained growth and evolution of the US Buy Now Pay Later services market:

Primary market drivers propelling the US Buy Now Pay Later services market include fundamental shifts in consumer financial behavior and retail commerce dynamics. The increasing preference for transparent, flexible payment solutions reflects broader generational changes in attitudes toward debt, credit, and financial management.

E-commerce acceleration has created unprecedented opportunities for BNPL integration, with online retailers seeking competitive advantages through enhanced checkout experiences. The seamless integration of payment solutions into existing e-commerce platforms has reduced technical barriers and implementation costs for merchants of all sizes.

Consumer financial wellness trends are driving demand for payment solutions that provide greater control over spending and cash flow management. Unlike traditional credit products, BNPL services offer predetermined payment schedules and clear end dates, appealing to consumers seeking to avoid revolving debt cycles.

Merchant benefits including increased conversion rates, higher average order values, and reduced cart abandonment are compelling retailers to adopt BNPL solutions. Studies indicate that merchants experience conversion rate improvements of 20-30% when offering flexible payment options at checkout.

Regulatory uncertainty represents a significant challenge for the US Buy Now Pay Later services market, as federal and state regulators develop frameworks for oversight and consumer protection. The evolving regulatory landscape creates compliance costs and operational complexity for service providers.

Consumer debt concerns have emerged as stakeholders question the potential for BNPL services to contribute to over-borrowing and financial stress among vulnerable populations. Critics argue that the ease of access and marketing messaging may encourage impulsive purchasing behavior.

Credit reporting inconsistencies create challenges for both consumers and traditional lenders, as BNPL payment history may not be consistently reported to credit bureaus. This limitation affects consumers’ ability to build credit history through responsible BNPL usage.

Market saturation risks are increasing as numerous competitors enter the space, potentially leading to margin compression and unsustainable customer acquisition costs. The proliferation of BNPL providers may create consumer confusion and decision fatigue.

Emerging market opportunities in the US Buy Now Pay Later services sector span multiple dimensions of financial services innovation and retail commerce evolution. The integration of artificial intelligence and machine learning technologies presents opportunities for enhanced risk assessment, personalized payment plans, and improved customer experiences.

B2B payment solutions represent a significant untapped opportunity, as businesses seek flexible payment options for procurement, equipment purchases, and service contracts. The application of BNPL principles to business-to-business transactions could substantially expand market addressability.

Financial inclusion initiatives offer opportunities to serve underbanked and credit-invisible populations through alternative credit assessment methods and transparent payment structures. BNPL providers can leverage transaction data and behavioral analytics to extend credit access to previously underserved segments.

International expansion and cross-border commerce present growth opportunities as US-based providers explore global markets and international companies establish US operations. The globalization of e-commerce creates demand for seamless payment solutions that work across multiple currencies and regulatory environments.

Competitive dynamics in the US Buy Now Pay Later services market are characterized by rapid innovation, strategic partnerships, and evolving business models. The market features both established financial technology companies and emerging startups competing for merchant partnerships and consumer mindshare.

Technology evolution continues to drive market dynamics, with providers investing heavily in user experience optimization, fraud prevention, and integration capabilities. The development of embedded finance solutions allows BNPL services to be seamlessly integrated into various digital touchpoints beyond traditional checkout processes.

Consumer behavior patterns show increasing sophistication in BNPL usage, with users becoming more strategic about payment timing and service selection. Research indicates that repeat usage rates exceed 85% among satisfied customers, demonstrating strong product-market fit.

Merchant adoption strategies are evolving beyond simple payment option additions to comprehensive customer acquisition and retention tools. Retailers are leveraging BNPL data insights to optimize inventory management, marketing campaigns, and customer segmentation strategies.

Comprehensive market analysis for the US Buy Now Pay Later services market employs multiple research methodologies to ensure accuracy, reliability, and actionable insights. The research approach combines quantitative data analysis with qualitative market intelligence to provide a holistic view of market dynamics and trends.

Primary research activities include structured interviews with industry executives, merchant partners, regulatory officials, and consumer focus groups. These direct interactions provide insights into market challenges, opportunities, and strategic priorities that may not be apparent through secondary data analysis alone.

Secondary research sources encompass industry reports, regulatory filings, company financial statements, and academic studies related to consumer finance and payment technologies. This comprehensive data collection ensures broad market coverage and validation of key findings.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends and patterns, and expert review of findings and conclusions. The methodology emphasizes accuracy and objectivity in presenting market insights and projections.

Geographic distribution of the US Buy Now Pay Later services market reveals significant regional variations in adoption rates, regulatory approaches, and merchant acceptance. The West Coast states, particularly California, lead in market penetration with approximately 38% of total market activity, driven by high e-commerce adoption and technology-forward consumer behaviors.

Northeast markets including New York, Massachusetts, and Pennsylvania represent approximately 28% of market share, characterized by diverse retail ecosystems and high consumer spending power. These markets show strong adoption across both online and in-store BNPL transactions.

Southern states demonstrate rapidly growing adoption rates, with Texas, Florida, and Georgia leading regional expansion efforts. The Southeast region accounts for roughly 22% of market activity, with particular strength in fashion, home goods, and automotive-related purchases.

Midwest penetration represents approximately 12% of total market share, with opportunities for growth in traditional retail markets and agricultural communities. The region shows increasing acceptance of digital payment solutions as rural broadband infrastructure improves and e-commerce adoption accelerates.

Market leadership in the US Buy Now Pay Later services sector is distributed among several key players, each with distinct competitive advantages and strategic positioning:

Competitive strategies focus on merchant acquisition, consumer experience optimization, and technological innovation. Companies are investing heavily in artificial intelligence, data analytics, and mobile-first user interfaces to differentiate their offerings and capture market share.

Market segmentation analysis reveals distinct categories based on service model, target demographics, transaction types, and integration approaches. Understanding these segments is crucial for strategic positioning and market opportunity assessment.

By Service Model:

By Integration Type:

Fashion and apparel represent the largest category for BNPL usage, accounting for approximately 35% of total transaction volume. This segment benefits from seasonal purchasing patterns, trend-driven buying behavior, and higher average order values when flexible payment options are available.

Electronics and technology purchases show strong BNPL adoption, particularly for smartphones, laptops, and gaming equipment. The category appeals to consumers seeking to manage cash flow for high-value purchases while avoiding traditional credit card interest charges.

Home and garden categories demonstrate growing BNPL usage as consumers invest in home improvement and furnishing projects. The segment shows particular strength in furniture purchases and seasonal outdoor equipment buying patterns.

Travel and experiences represent an emerging growth category, with BNPL providers partnering with airlines, hotels, and experience platforms to offer flexible payment options for vacation and leisure spending. This segment shows potential for significant expansion as travel demand recovers.

Health and wellness services including dental care, cosmetic procedures, and fitness equipment show increasing BNPL adoption. The category addresses consumer needs for elective healthcare financing and wellness investment flexibility.

Consumer benefits from BNPL services extend beyond simple payment flexibility to include improved financial management, transparent pricing, and enhanced shopping experiences. Users appreciate the ability to spread costs without traditional credit checks or hidden fees.

Merchant advantages include increased conversion rates, higher average order values, and reduced cart abandonment. Retailers report that BNPL integration helps attract younger demographics and compete more effectively with larger e-commerce platforms.

Financial institutions benefit from partnership opportunities that expand their digital payment capabilities without developing proprietary BNPL technology. Banks can leverage existing customer relationships while offering modern payment solutions.

Technology providers find opportunities in API development, fraud prevention, and integration services that support the BNPL ecosystem. The market creates demand for specialized fintech solutions and payment infrastructure.

Regulatory bodies benefit from increased consumer choice and competition in the payment services sector, while maintaining oversight responsibilities for consumer protection and financial stability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Embedded finance integration represents a transformative trend where BNPL services become seamlessly integrated into various digital experiences beyond traditional checkout processes. This evolution enables contextual payment solutions that appear naturally within shopping, social media, and content consumption environments.

Artificial intelligence advancement is revolutionizing credit decisions, fraud prevention, and customer experience personalization. Machine learning algorithms enable real-time risk assessment and customized payment plans based on individual consumer behavior and financial profiles.

Sustainability focus is emerging as BNPL providers develop solutions that promote conscious consumption and responsible spending. Some platforms are introducing features that encourage sustainable purchasing decisions and support environmentally friendly merchants.

Financial wellness tools are being integrated into BNPL platforms to help consumers manage their overall financial health. These features include spending tracking, budgeting assistance, and credit score monitoring capabilities.

Cross-border capabilities are expanding as providers develop solutions for international commerce and multi-currency transactions. This trend supports the globalization of e-commerce and seamless international shopping experiences.

Strategic partnerships between BNPL providers and major retailers continue to reshape the competitive landscape. Recent collaborations include exclusive arrangements with leading e-commerce platforms and integration with major payment processors.

Regulatory developments include proposed federal oversight frameworks and state-level consumer protection initiatives. The Consumer Financial Protection Bureau has increased scrutiny of BNPL practices, leading to enhanced disclosure requirements and responsible lending guidelines.

Technology acquisitions are accelerating as companies seek to enhance their capabilities in areas such as fraud prevention, data analytics, and mobile user experience. These strategic investments demonstrate the industry’s commitment to technological innovation.

International expansion continues with several US-based providers entering global markets while international companies establish significant US operations. This cross-border activity is creating a more globally integrated BNPL ecosystem.

Product diversification efforts include the development of B2B payment solutions, longer-term financing options, and specialized products for specific industries such as healthcare and automotive.

MarkWide Research analysis suggests that successful BNPL providers should prioritize regulatory compliance and consumer protection initiatives to ensure sustainable growth in an evolving oversight environment. Proactive engagement with regulators and transparent communication of terms and risks will be crucial for maintaining consumer trust and market access.

Technology investment in artificial intelligence and machine learning capabilities should focus on improving risk assessment accuracy while enhancing user experience personalization. Companies that can effectively balance growth with responsible lending practices will likely achieve the strongest long-term market positions.

Merchant relationship development should extend beyond simple payment processing to include value-added services such as customer insights, marketing support, and inventory management tools. These comprehensive partnerships create competitive differentiation and stronger merchant loyalty.

Consumer education initiatives should be prioritized to ensure users understand payment obligations and make informed financial decisions. Companies that invest in financial literacy programs and transparent communication will build stronger customer relationships and reduce default risks.

International expansion strategies should consider local regulatory requirements, consumer preferences, and competitive dynamics. Successful global growth requires adaptation to regional market conditions while maintaining core service quality and brand consistency.

Market evolution over the next five years will be shaped by regulatory developments, technological advancement, and changing consumer financial behaviors. The industry is expected to mature with increased standardization, improved consumer protections, and more sophisticated risk management capabilities.

Growth projections indicate continued expansion at a CAGR of approximately 22-26% through 2028, driven by increasing merchant adoption, consumer acceptance, and international market development. However, growth rates may moderate as the market matures and regulatory frameworks stabilize.

Technology integration will deepen with the development of more sophisticated embedded finance solutions, enhanced mobile experiences, and improved integration with traditional banking services. MWR forecasts indicate that seamless omnichannel experiences will become standard expectations rather than competitive advantages.

Regulatory maturation is expected to bring clearer guidelines for consumer protection, credit reporting, and responsible lending practices. These developments will likely favor established providers with strong compliance capabilities while potentially creating barriers for new entrants.

Market consolidation may accelerate as competitive pressures intensify and regulatory compliance costs increase. Strategic mergers and acquisitions could reshape the competitive landscape, with successful companies likely to be those that achieve scale while maintaining innovation capabilities.

The US Buy Now Pay Later services market represents a dynamic and rapidly evolving sector that has fundamentally transformed consumer payment behaviors and retail commerce dynamics. The market’s impressive growth trajectory, driven by changing consumer preferences and technological innovation, demonstrates the strong product-market fit for flexible payment solutions.

Key success factors for market participants include maintaining regulatory compliance, investing in technology infrastructure, building strong merchant partnerships, and prioritizing consumer education and protection. Companies that can effectively balance growth ambitions with responsible lending practices are positioned for sustainable long-term success.

Future market development will be influenced by regulatory evolution, technological advancement, and competitive dynamics. While growth opportunities remain substantial, particularly in B2B applications and international expansion, market participants must navigate increasing regulatory scrutiny and competitive pressures.

Strategic positioning for the evolving market requires focus on differentiation through superior user experience, comprehensive merchant value propositions, and innovative product development. The companies that successfully adapt to changing market conditions while maintaining their core value propositions will likely emerge as long-term market leaders in this transformative financial services sector.

What is Buy Now Pay Later Services?

Buy Now Pay Later Services are financial solutions that allow consumers to purchase goods and services immediately while deferring payment over a set period. This model is increasingly popular in e-commerce, enabling consumers to manage their budgets more effectively.

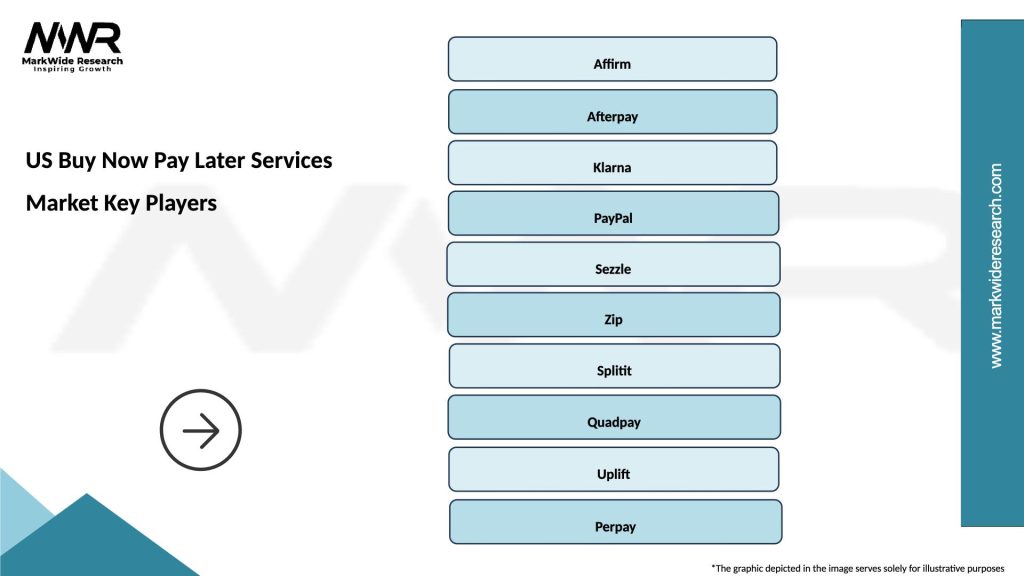

What are the key players in the US Buy Now Pay Later Services Market?

Key players in the US Buy Now Pay Later Services Market include Affirm, Afterpay, and Klarna, which provide various payment solutions to consumers and retailers. These companies are known for their user-friendly platforms and partnerships with numerous online retailers, among others.

What are the growth factors driving the US Buy Now Pay Later Services Market?

The growth of the US Buy Now Pay Later Services Market is driven by increasing consumer demand for flexible payment options, the rise of e-commerce, and the desire for improved cash flow management among consumers. Additionally, younger consumers are particularly attracted to these services.

What challenges does the US Buy Now Pay Later Services Market face?

The US Buy Now Pay Later Services Market faces challenges such as regulatory scrutiny, potential consumer debt accumulation, and competition from traditional credit options. These factors can impact the sustainability and growth of these services.

What opportunities exist in the US Buy Now Pay Later Services Market?

Opportunities in the US Buy Now Pay Later Services Market include expanding into new retail sectors, enhancing technology for better user experiences, and developing partnerships with financial institutions. These strategies can help companies reach a broader audience.

What trends are shaping the US Buy Now Pay Later Services Market?

Trends shaping the US Buy Now Pay Later Services Market include the integration of artificial intelligence for credit assessments, the rise of mobile payment solutions, and increasing consumer awareness of financial literacy. These trends are influencing how consumers engage with payment services.

US Buy Now Pay Later Services Market

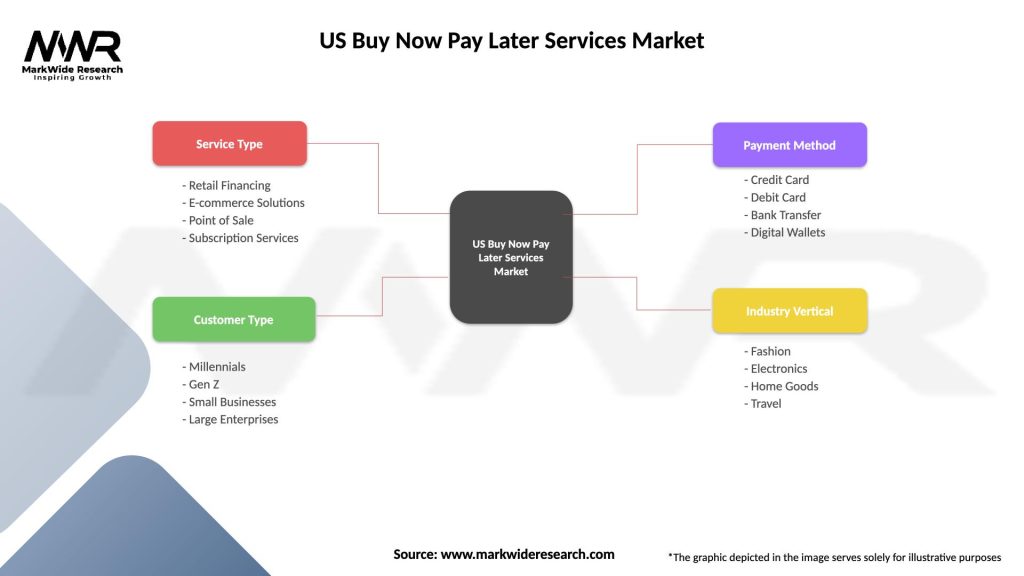

| Segmentation Details | Description |

|---|---|

| Service Type | Retail Financing, E-commerce Solutions, Point of Sale, Subscription Services |

| Customer Type | Millennials, Gen Z, Small Businesses, Large Enterprises |

| Payment Method | Credit Card, Debit Card, Bank Transfer, Digital Wallets |

| Industry Vertical | Fashion, Electronics, Home Goods, Travel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Buy Now Pay Later Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at