444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US bioplastics market is gaining prominence as the demand for sustainable and eco-friendly materials rises across various industries. Bioplastics, derived from renewable biomass sources, offer a viable alternative to traditional plastics, reducing environmental impact and promoting circular economy principles. With increasing consumer awareness and stringent regulations, the US bioplastics market is poised for significant growth in the coming years.

Meaning

Bioplastics are a category of biodegradable or bio-based polymers derived from renewable biomass sources such as corn starch, sugarcane, cellulose, and vegetable oils. Unlike conventional plastics derived from fossil fuels, bioplastics decompose naturally through biological processes, reducing carbon footprint and environmental pollution. Bioplastics find applications in packaging, automotive, consumer goods, agriculture, and textiles, offering sustainable solutions to address global plastic waste challenges.

Executive Summary

The US bioplastics market is experiencing robust growth driven by increasing consumer demand for sustainable packaging solutions, stringent regulations promoting biodegradability and compostability, and growing emphasis on corporate sustainability initiatives. The market offers lucrative opportunities for industry players to innovate, develop bio-based materials, and capitalize on the shift towards a circular economy model.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US bioplastics market operates within a dynamic ecosystem shaped by regulatory trends, consumer preferences, technological innovations, and market forces. Market dynamics influence investment decisions, product development strategies, and business models for bioplastic manufacturers, converters, brand owners, and retailers.

Regional Analysis

The US bioplastics market exhibits regional variations in demand, adoption rates, and regulatory frameworks across different states, metropolitan areas, and geographic regions. Key regions such as California, New York, Oregon, and Washington lead in sustainability initiatives, waste reduction policies, and market demand for bioplastics, creating favorable conditions for market growth and innovation.

Competitive Landscape

Leading Companies in the US Bioplastics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

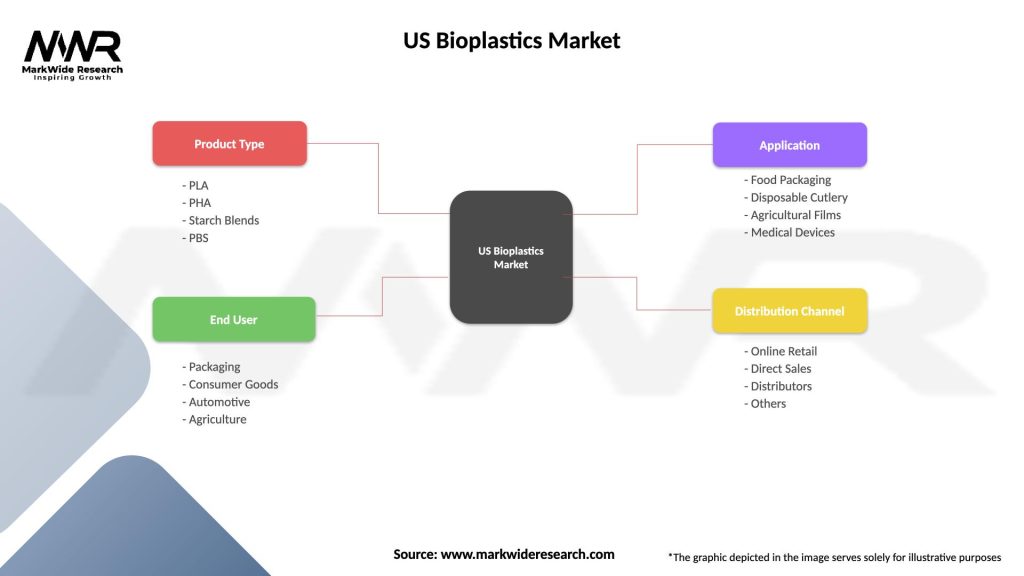

Segmentation

The US bioplastics market can be segmented based on material type, application, end-use industry, and processing technology. Segmentation enables stakeholders to identify market opportunities, target customer segments, and develop tailored solutions to meet specific market needs and regulatory requirements.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The US bioplastics market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the US bioplastics market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors helps stakeholders identify strategic opportunities, mitigate risks, and navigate market challenges in the dynamic US bioplastics landscape.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has influenced the US bioplastics market in various ways, including:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the US bioplastics market is characterized by growth opportunities, technological innovations, and regulatory developments driving market expansion and adoption. As consumer preferences shift towards sustainable products, circular economy principles gain traction, and environmental concerns escalate, the demand for bioplastics is expected to grow across diverse industries and applications.

Conclusion

The US bioplastics market represents a dynamic and evolving ecosystem driven by sustainability, innovation, and market forces shaping the transition towards a circular economy and resource-efficient materials. As stakeholders navigate challenges and capitalize on opportunities in the bioplastics landscape, strategic investments in research, technology, and collaboration will drive market growth, competitiveness, and environmental sustainability in the years to come. By embracing sustainable practices, circular economy principles, and responsible stewardship, the US bioplastics industry can contribute to a greener, cleaner, and more sustainable future for generations to come.

What is Bioplastics?

Bioplastics are materials derived from renewable biomass sources, such as plant starches, vegetable fats, and oils, which can be used as alternatives to conventional plastics. They are designed to reduce environmental impact and can be biodegradable or recyclable.

What are the key players in the US Bioplastics Market?

Key players in the US Bioplastics Market include companies like NatureWorks LLC, BASF SE, and Novamont S.p.A., which are known for their innovative bioplastic solutions and sustainable practices, among others.

What are the growth factors driving the US Bioplastics Market?

The US Bioplastics Market is driven by increasing consumer demand for sustainable products, government regulations promoting eco-friendly materials, and advancements in bioplastic technology. These factors contribute to a growing interest in bioplastics across various industries, including packaging and automotive.

What challenges does the US Bioplastics Market face?

The US Bioplastics Market faces challenges such as high production costs, limited availability of raw materials, and competition from traditional plastics. These factors can hinder the widespread adoption of bioplastics in various applications.

What opportunities exist in the US Bioplastics Market?

Opportunities in the US Bioplastics Market include the development of new bioplastic materials, expansion into emerging markets, and increasing collaboration between companies and research institutions. These trends can enhance innovation and market growth.

What trends are shaping the US Bioplastics Market?

Trends shaping the US Bioplastics Market include the rise of biodegradable plastics, increased investment in sustainable packaging solutions, and the growing focus on circular economy practices. These trends reflect a shift towards more environmentally responsible materials in various sectors.

US Bioplastics Market

| Segmentation Details | Description |

|---|---|

| Product Type | PLA, PHA, Starch Blends, PBS |

| End User | Packaging, Consumer Goods, Automotive, Agriculture |

| Application | Food Packaging, Disposable Cutlery, Agricultural Films, Medical Devices |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the US Bioplastics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at