444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US Banking-as-a-Service (BaaS) Market is a rapidly growing segment within the financial services industry that focuses on providing banking services through application programming interfaces (APIs) to other companies. BaaS enables non-bank businesses, such as fintech startups, e-commerce platforms, and tech companies, to offer banking services to their customers without the need for a traditional banking infrastructure. This innovative model allows businesses to access banking capabilities, such as account creation, payments processing, and compliance services, through APIs provided by licensed banks or financial institutions. The US BaaS market has witnessed significant growth due to the increasing demand for seamless digital financial services and the rise of fintech collaborations. This comprehensive analysis will explore the meaning of BaaS, key market insights, drivers, restraints, opportunities, regional analysis, competitive landscape, and the potential impact of the COVID-19 pandemic on the market.

Meaning

Banking-as-a-Service (BaaS) refers to the provision of banking products and services by licensed banks or financial institutions to non-bank businesses through APIs. BaaS enables these businesses to embed banking services directly into their own applications, websites, or platforms, providing their customers with seamless and integrated financial services. This model allows businesses to focus on their core offerings while leveraging the expertise and infrastructure of established banks. BaaS has emerged as a disruptive force in the financial services industry, fostering collaboration between traditional banks and fintech innovators, and driving the democratization of banking services.

Executive Summary

The US Banking-as-a-Service (BaaS) Market is experiencing rapid growth as businesses seek to enhance their offerings with seamless and integrated financial services. The BaaS model has gained popularity due to its ability to facilitate innovation, improve customer experiences, and create new revenue streams for both banks and non-bank businesses. With increased digitalization and the rise of fintech startups, the BaaS market is poised for significant expansion in the coming years.

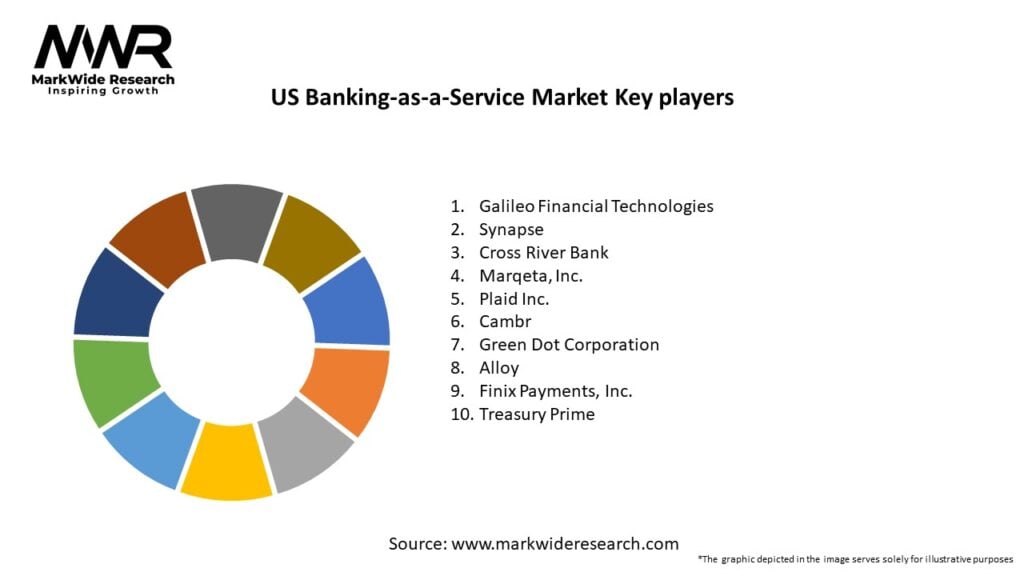

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The US Banking-as-a-Service Market is characterized by several critical insights that influence its current dynamics and future potential:

These insights reflect a market that is dynamic and rapidly evolving, with significant opportunities for growth driven by technology and customer-centric strategies.

Market Drivers

Several key factors are propelling the growth of the US Banking-as-a-Service Market:

These drivers create a robust environment for growth, enabling a broad spectrum of players to leverage banking capabilities in innovative ways.

Market Restraints

Despite its promising outlook, the US BaaS market faces several challenges:

Addressing these restraints will require continuous investment in technology, cybersecurity, and regulatory expertise to ensure sustainable growth.

Market Opportunities

The US Banking-as-a-Service Market presents numerous opportunities for expansion and innovation:

Capitalizing on these opportunities can help market participants expand their service offerings, enter new markets, and drive long-term growth.

Market Dynamics

The dynamics of the US Banking-as-a-Service Market are influenced by a combination of supply-side and demand-side factors, as well as broader economic and technological trends:

Supply Side Factors:

Demand Side Factors:

Economic Considerations:

These dynamics illustrate a vibrant market environment driven by technological innovation, evolving consumer demands, and strategic collaborations.

Regional Analysis

The US Banking-as-a-Service Market is predominantly concentrated within the United States; however, regional variations exist that influence market adoption and growth:

Coastal Metropolitan Areas:

Midwestern and Southern Regions:

Rural and Emerging Areas:

These regional insights underscore the importance of targeted strategies that address the unique needs and opportunities across different parts of the United States.

Competitive Landscape

Leading Companies in the US Banking-as-a-Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The US Banking-as-a-Service Market can be segmented based on various criteria to provide a detailed understanding of its structure and applications:

By Service Type:

By End-User:

By Deployment Model:

By Geography:

This segmentation framework allows stakeholders to tailor their strategies, optimize product offerings, and focus on high-growth market segments.

Category-wise Insights

Each category within the US Banking-as-a-Service Market offers unique benefits and value propositions:

These insights underscore the need for targeted solutions that cater to the specific requirements of diverse market segments.

Key Benefits for Industry Participants and Stakeholders

The US Banking-as-a-Service Market offers numerous benefits for banks, fintech companies, and non-banking enterprises:

These benefits collectively contribute to a more agile, innovative, and customer-centric financial ecosystem in the US.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the evolution of the US Banking-as-a-Service Market:

These trends underscore the dynamic nature of the US BaaS market and its potential to drive significant industry transformation.

Covid-19 Impact

The Covid-19 pandemic has had a substantial impact on the US Banking-as-a-Service Market:

These impacts have reinforced the critical role of BaaS in ensuring resilient, secure, and efficient banking operations during and after the pandemic.

Key Industry Developments

The US Banking-as-a-Service Market has witnessed several significant industry developments:

These developments highlight the dynamic nature of the market and its continued evolution in response to technological, regulatory, and consumer demands.

Analyst Suggestions

Industry analysts recommend the following strategies for stakeholders in the US Banking-as-a-Service Market:

Implementing these strategies will enable companies to capitalize on emerging opportunities, drive innovation, and secure a competitive advantage in the evolving BaaS landscape.

Future Outlook

The future outlook for the US Banking-as-a-Service Market is highly promising, with significant growth anticipated over the next decade. Key factors driving this expansion include:

Overall, the US BaaS market is set to become a cornerstone of digital financial services, transforming traditional banking models and delivering enhanced value to both consumers and businesses.

Conclusion

The US Banking-as-a-Service Market is at the forefront of a financial revolution, reshaping how banking products and services are delivered in a digital era. Driven by rapid technological innovation, evolving consumer expectations, and strategic collaborations between traditional banks and fintech innovators, BaaS is enabling more agile, cost-efficient, and customer-centric financial services. Despite challenges such as cybersecurity risks and integration complexities, the market is poised for robust growth as it adapts to a dynamic regulatory landscape and emerging digital trends. Stakeholders that invest in advanced R&D, strategic partnerships, and innovative digital solutions will be well-positioned to capitalize on the transformative opportunities offered by the US BaaS market, ultimately driving the future of banking.

What is Banking-as-a-Service?

Banking-as-a-Service refers to the provision of banking services through APIs, allowing third-party developers to build financial products on top of existing banking infrastructure. This model enables companies to offer services like payment processing, account management, and lending without needing to become a fully licensed bank.

What are the key players in the US Banking-as-a-Service Market?

Key players in the US Banking-as-a-Service Market include companies like Synapse, Solarisbank, and Galileo Financial Technologies. These firms provide essential infrastructure and services that enable businesses to integrate banking functionalities into their applications, among others.

What are the growth factors driving the US Banking-as-a-Service Market?

The US Banking-as-a-Service Market is driven by the increasing demand for digital banking solutions, the rise of fintech startups, and the need for financial institutions to innovate and enhance customer experiences. Additionally, regulatory changes are encouraging banks to collaborate with technology providers.

What challenges does the US Banking-as-a-Service Market face?

Challenges in the US Banking-as-a-Service Market include regulatory compliance complexities, data security concerns, and the need for robust technological infrastructure. These factors can hinder the ability of new entrants to compete effectively in the market.

What opportunities exist in the US Banking-as-a-Service Market?

The US Banking-as-a-Service Market presents opportunities for growth through partnerships between traditional banks and fintech companies, the expansion of personalized financial services, and the development of innovative payment solutions. These trends are likely to shape the future landscape of banking.

What trends are shaping the US Banking-as-a-Service Market?

Trends in the US Banking-as-a-Service Market include the increasing adoption of open banking, the rise of embedded finance, and advancements in artificial intelligence for customer service. These innovations are transforming how consumers interact with financial services.

US Banking-as-a-Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Payment Processing, Account Management, Compliance Solutions, Lending Services |

| End User | Fintech Startups, Traditional Banks, Credit Unions, E-commerce Platforms |

| Deployment Model | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

| Integration Level | API Integration, White-Label Solutions, Custom Solutions, Plug-and-Play |

Leading Companies in the US Banking-as-a-Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at