444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US baby food packaging market represents a critical segment within the broader food packaging industry, driven by evolving consumer preferences, stringent safety regulations, and innovative packaging technologies. Market dynamics indicate substantial growth potential as American parents increasingly prioritize convenience, safety, and sustainability in baby food products. The sector encompasses various packaging formats including glass jars, plastic containers, pouches, and cartons, each serving specific consumer needs and product requirements.

Consumer behavior has shifted significantly toward premium packaging solutions that offer enhanced protection, extended shelf life, and improved convenience features. The market demonstrates robust expansion with a projected CAGR of 6.2% through the forecast period, driven by rising birth rates in certain demographics and increased spending on infant nutrition products. Packaging innovation continues to play a pivotal role in market differentiation, with manufacturers investing heavily in sustainable materials and smart packaging technologies.

Regulatory compliance remains a fundamental driver, as baby food packaging must meet stringent FDA requirements for food contact materials and safety standards. The market benefits from strong domestic demand and established distribution networks, positioning US manufacturers as leaders in packaging technology and quality assurance.

The US baby food packaging market refers to the comprehensive industry segment focused on developing, manufacturing, and distributing specialized packaging solutions designed specifically for infant and toddler food products. This market encompasses all packaging materials, formats, and technologies used to contain, protect, and preserve baby food while ensuring safety, convenience, and regulatory compliance throughout the supply chain.

Packaging solutions within this market include primary packaging that directly contacts the food product, secondary packaging for distribution and retail display, and tertiary packaging for bulk transportation. The market serves various stakeholders including baby food manufacturers, packaging converters, raw material suppliers, and ultimately, parents and caregivers who rely on safe, convenient feeding solutions for their children.

Market scope extends beyond traditional packaging to include innovative features such as resealable closures, portion control mechanisms, temperature indicators, and sustainable material compositions that address modern consumer demands for functionality and environmental responsibility.

Market performance in the US baby food packaging sector demonstrates consistent growth momentum, supported by demographic trends, technological advancement, and evolving consumer preferences. The industry has successfully adapted to changing market conditions, including increased demand for organic products, sustainable packaging materials, and convenient feeding solutions that accommodate busy lifestyles.

Key growth drivers include the rising number of working mothers requiring convenient feeding options, increased awareness of nutrition and food safety, and growing preference for premium packaging that ensures product integrity. The market benefits from approximately 78% of parents prioritizing packaging safety features when selecting baby food products, indicating strong consumer focus on protective packaging solutions.

Competitive landscape features established packaging manufacturers alongside innovative startups developing next-generation solutions. Market leaders continue to invest in research and development, focusing on sustainable materials, smart packaging technologies, and enhanced barrier properties that extend product shelf life while maintaining nutritional value.

Future prospects remain positive, with anticipated growth in premium packaging segments and continued expansion of sustainable packaging alternatives. The market is expected to benefit from technological innovations in materials science and manufacturing processes that deliver improved functionality at competitive costs.

Market segmentation reveals distinct preferences across different packaging formats, with flexible pouches gaining significant market share due to their convenience and portability advantages. Consumer research indicates strong demand for packaging innovations that address specific pain points in infant feeding routines.

Demographic trends serve as primary market drivers, with millennial parents representing a significant consumer base that values convenience, quality, and sustainability in baby food packaging. This generation demonstrates willingness to pay premium prices for packaging solutions that offer enhanced safety features and environmental benefits.

Working parent dynamics create substantial demand for convenient packaging formats that support on-the-go feeding and busy lifestyle requirements. Research indicates that 85% of working mothers prioritize packaging convenience when selecting baby food products, driving innovation in portable and easy-to-use packaging solutions.

Health consciousness among parents fuels demand for packaging that preserves nutritional value and prevents contamination. Advanced barrier technologies and protective packaging materials address these concerns while supporting the growing organic baby food segment that requires specialized packaging solutions.

Regulatory requirements continue to drive market growth as manufacturers invest in compliant packaging materials and technologies. Stringent FDA regulations for food contact materials create opportunities for innovative packaging solutions that exceed minimum safety standards while providing competitive advantages.

Sustainability initiatives increasingly influence purchasing decisions, with environmentally conscious parents seeking packaging options that minimize environmental impact. This trend drives investment in recyclable materials, reduced packaging waste, and innovative sustainable packaging technologies.

Cost pressures represent significant market restraints, particularly for premium packaging solutions that require advanced materials and manufacturing processes. Price-sensitive consumers may opt for basic packaging options, limiting market growth potential for innovative packaging technologies.

Regulatory complexity creates barriers for new market entrants and increases compliance costs for existing manufacturers. Stringent safety requirements and extensive testing procedures can delay product launches and increase development expenses, particularly for smaller packaging companies.

Supply chain challenges affect raw material availability and pricing stability, impacting packaging manufacturers’ ability to maintain consistent production costs and delivery schedules. Global supply chain disruptions can create temporary shortages and price volatility in key packaging materials.

Consumer price sensitivity in certain market segments limits adoption of premium packaging solutions, particularly during economic downturns when parents may prioritize cost savings over packaging innovation. This constraint affects market growth potential for high-value packaging technologies.

Technical limitations in sustainable packaging materials may compromise performance characteristics such as barrier properties or shelf life, creating challenges for manufacturers seeking to balance environmental responsibility with product protection requirements.

Sustainable packaging innovation presents substantial growth opportunities as consumer demand for environmentally responsible products continues to increase. Manufacturers investing in biodegradable materials, recyclable packaging designs, and reduced packaging waste solutions can capture significant market share among environmentally conscious consumers.

Smart packaging technologies offer opportunities for market differentiation through features such as freshness indicators, temperature monitoring, and interactive packaging elements that enhance consumer engagement and product safety assurance. These technologies can command premium pricing while providing valuable consumer benefits.

E-commerce expansion creates opportunities for packaging solutions specifically designed for online retail and direct-to-consumer shipping. Packaging that protects products during shipping while providing excellent unboxing experiences can capture growing online sales channels.

Customization capabilities enable manufacturers to serve niche market segments with specialized packaging requirements. Personalized packaging solutions, limited edition designs, and culturally specific packaging formats can drive premium pricing and brand loyalty.

International expansion opportunities exist for US packaging manufacturers to export innovative solutions to global markets, leveraging American expertise in safety standards and packaging technology to capture international market share.

Supply and demand dynamics in the US baby food packaging market reflect complex interactions between consumer preferences, regulatory requirements, and technological capabilities. MarkWide Research analysis indicates that demand growth consistently outpaces supply capacity in premium packaging segments, creating opportunities for market expansion and investment.

Competitive pressures drive continuous innovation as packaging manufacturers seek to differentiate their offerings through enhanced functionality, improved sustainability, and superior performance characteristics. Market leaders maintain competitive advantages through economies of scale, established customer relationships, and ongoing research and development investments.

Technology adoption rates vary across different packaging segments, with flexible packaging showing rapid innovation cycles compared to traditional rigid packaging formats. Advanced manufacturing technologies enable cost-effective production of complex packaging designs that were previously economically unfeasible.

Consumer behavior shifts influence market dynamics through changing preferences for packaging formats, sustainability features, and convenience attributes. These shifts create both opportunities and challenges for manufacturers adapting their product portfolios to meet evolving market demands.

Regulatory evolution continues to shape market dynamics as safety standards become more stringent and environmental regulations increasingly impact packaging material selection and design choices.

Market research approach encompasses comprehensive primary and secondary research methodologies designed to provide accurate, reliable insights into US baby food packaging market trends, opportunities, and challenges. Research activities include extensive industry interviews, consumer surveys, and detailed analysis of market data from multiple sources.

Primary research involves direct engagement with key market stakeholders including packaging manufacturers, baby food producers, retailers, and consumers. Structured interviews and surveys collect qualitative and quantitative data regarding market preferences, purchasing behaviors, and future expectations.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and trade association data to validate primary research findings and provide comprehensive market context. This approach ensures research accuracy and completeness.

Data validation processes include cross-referencing multiple data sources, statistical analysis of survey responses, and expert review of research findings to ensure reliability and accuracy of market insights and projections.

Market modeling techniques incorporate historical data analysis, trend identification, and scenario planning to develop realistic market forecasts and identify potential growth opportunities and challenges.

Geographic distribution across the United States reveals distinct regional preferences and market characteristics that influence packaging demand patterns. The Northeast region demonstrates strong preference for premium packaging solutions, accounting for approximately 32% of market share due to higher disposable incomes and greater emphasis on product quality and safety features.

West Coast markets show significant demand for sustainable packaging solutions, driven by environmental consciousness and regulatory initiatives in states like California. This region leads in adoption of innovative packaging materials and technologies, representing 28% of total market demand for eco-friendly packaging solutions.

Midwest regions demonstrate balanced demand across packaging formats, with strong preference for value-oriented solutions that provide reliable protection and convenience without premium pricing. Traditional packaging formats maintain stronger market presence in these areas compared to coastal regions.

Southern markets show growing demand for convenient packaging solutions that support busy lifestyles and hot climate considerations. Temperature-resistant packaging materials and extended shelf life solutions perform particularly well in these markets.

Urban versus rural market dynamics reveal different packaging preferences, with urban consumers favoring convenient, portable packaging while rural consumers often prioritize value and traditional packaging formats that offer proven reliability and safety.

Market leadership is distributed among several key players who have established strong positions through innovation, quality, and customer relationships. The competitive environment encourages continuous improvement and technological advancement as companies seek to maintain and expand market share.

By Material Type: The market segments into distinct material categories, each serving specific performance requirements and consumer preferences. Plastic packaging dominates volume sales due to cost-effectiveness and versatility, while glass packaging maintains premium positioning through superior barrier properties and consumer perception of safety.

By Packaging Format: Format segmentation reveals evolving consumer preferences toward convenient, portable solutions. Flexible pouches demonstrate the highest growth rates, capturing approximately 42% market share growth over recent years due to convenience and reduced packaging waste benefits.

By Product Type: Different baby food categories require specialized packaging solutions. Purees and blended foods favor flexible packaging formats, while dry cereals and snacks typically utilize rigid containers or pouches with barrier properties that prevent moisture and maintain product texture.

By Distribution Channel: Retail channel segmentation shows strong performance across multiple channels. Supermarkets and hypermarkets remain dominant distribution channels, while online retail shows rapid growth requiring specialized packaging solutions for shipping and handling.

By End User: Consumer segmentation reveals distinct preferences based on lifestyle factors, income levels, and environmental consciousness, influencing packaging format selection and willingness to pay premium prices for enhanced features.

Flexible Packaging Category: This segment demonstrates exceptional growth potential, driven by consumer demand for convenience and portability. Pouch packaging offers superior convenience for on-the-go feeding while reducing packaging waste compared to traditional rigid formats. Innovation focuses on improved barrier properties, resealable closures, and sustainable material compositions.

Rigid Packaging Category: Traditional rigid packaging maintains strong market presence through proven performance and consumer trust. Glass jars continue to command premium pricing due to superior barrier properties and consumer perception of safety, while plastic containers offer cost-effective solutions with design flexibility.

Sustainable Packaging Category: Environmental consciousness drives rapid growth in sustainable packaging solutions. Biodegradable materials and recyclable packaging designs attract environmentally conscious consumers willing to pay premium prices for reduced environmental impact.

Smart Packaging Category: Emerging technology integration creates new market opportunities through enhanced functionality. Intelligent packaging features such as freshness indicators and temperature monitoring provide added value while supporting premium pricing strategies.

Specialty Packaging Category: Niche market segments require customized packaging solutions for specific dietary needs, organic products, and premium positioning. These categories often command higher margins while serving targeted consumer segments with specialized requirements.

Manufacturers Benefits: Baby food packaging manufacturers gain competitive advantages through innovation, quality differentiation, and customer relationship development. Advanced packaging technologies enable premium pricing while sustainable solutions attract environmentally conscious customers and support corporate responsibility initiatives.

Brand Owner Advantages: Baby food brands benefit from packaging innovations that enhance product protection, extend shelf life, and improve consumer convenience. Packaging differentiation supports brand positioning and marketing strategies while ensuring regulatory compliance and product safety.

Retailer Benefits: Retail partners gain advantages through packaging solutions that optimize shelf space utilization, reduce handling costs, and enhance product presentation. Efficient packaging designs support inventory management and reduce waste throughout the supply chain.

Consumer Value: Parents and caregivers benefit from packaging innovations that ensure product safety, provide feeding convenience, and support busy lifestyles. Enhanced packaging features deliver peace of mind regarding product quality while simplifying feeding routines.

Environmental Impact: Sustainable packaging solutions benefit society through reduced environmental impact, supporting circular economy principles and addressing climate change concerns. Eco-friendly packaging alternatives contribute to waste reduction and resource conservation efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration represents the most significant market trend, with manufacturers increasingly adopting eco-friendly materials and circular economy principles. Biodegradable packaging and recyclable materials gain market acceptance as consumers prioritize environmental responsibility in purchasing decisions.

Smart Packaging Adoption accelerates as technology costs decrease and consumer acceptance increases. Intelligent packaging features including freshness indicators, temperature monitoring, and interactive elements enhance product safety while providing marketing opportunities for brand differentiation.

Convenience Enhancement drives packaging innovation toward solutions that simplify feeding routines and support busy lifestyles. Portion control packaging, resealable closures, and portable formats address specific consumer pain points while commanding premium pricing.

Premium Positioning trends show consumers increasingly willing to pay higher prices for packaging that ensures safety, quality, and convenience. Luxury packaging aesthetics and enhanced functionality support brand differentiation and margin improvement strategies.

Customization Demand grows as brands seek unique packaging solutions that support marketing strategies and consumer engagement. Personalized packaging and limited edition designs create emotional connections while supporting premium pricing strategies.

Material Innovation continues to drive industry advancement through development of new barrier technologies, sustainable materials, and enhanced performance characteristics. Recent breakthroughs in bio-based polymers offer promising alternatives to traditional packaging materials while maintaining required performance standards.

Manufacturing Technology improvements enable cost-effective production of complex packaging designs that were previously economically unfeasible. Advanced manufacturing processes support customization capabilities while maintaining competitive pricing for innovative packaging solutions.

Regulatory Updates influence industry development through evolving safety standards and environmental regulations. Recent FDA guidance updates provide clarity on acceptable materials and testing requirements while supporting innovation in safe packaging solutions.

Partnership Strategies emerge as companies collaborate to develop integrated solutions that address complex market requirements. Strategic alliances between packaging manufacturers and technology providers accelerate innovation while sharing development costs and risks.

Investment Activity increases as companies recognize growth potential in baby food packaging market. Capital investments in manufacturing capacity, research and development, and sustainable technology development support long-term market expansion strategies.

Investment Priorities should focus on sustainable packaging technologies and smart packaging capabilities that address evolving consumer demands. MWR analysis indicates that companies investing in these areas achieve superior market performance and customer loyalty compared to traditional packaging providers.

Market Entry Strategies for new participants should emphasize niche market segments where specialized expertise can provide competitive advantages. Targeted approaches focusing on specific packaging formats or consumer segments offer better success potential than broad market entry strategies.

Innovation Focus should prioritize packaging solutions that address multiple consumer needs simultaneously, such as convenience, safety, and sustainability. Multi-benefit packaging designs command premium pricing while providing clear value propositions for consumers and brand partners.

Partnership Development represents a critical success factor for companies seeking to expand capabilities and market reach. Strategic collaborations with technology providers, material suppliers, and brand owners accelerate innovation while sharing development costs and market risks.

Geographic Expansion opportunities exist for established players to leverage expertise in international markets where safety standards and packaging technology lag behind US capabilities. Export strategies can provide growth opportunities while diversifying revenue sources.

Market trajectory indicates continued growth driven by demographic trends, technological innovation, and evolving consumer preferences. The industry is expected to maintain a robust growth rate of 6.2% CAGR through the forecast period, supported by strong domestic demand and export opportunities.

Technology evolution will likely accelerate adoption of smart packaging features and sustainable materials as costs decrease and performance improves. Next-generation packaging solutions incorporating artificial intelligence, IoT connectivity, and advanced materials will create new market opportunities and competitive advantages.

Sustainability requirements will increasingly influence market development as regulatory pressure and consumer demand drive adoption of eco-friendly packaging solutions. Companies investing early in sustainable technologies will likely capture significant market share as these trends accelerate.

Market consolidation may occur as smaller players struggle to meet increasing regulatory requirements and investment needs for advanced technologies. Strategic acquisitions and partnerships will likely reshape the competitive landscape while accelerating innovation and market development.

Consumer expectations will continue evolving toward more sophisticated packaging solutions that provide enhanced functionality, safety assurance, and environmental responsibility. Meeting these expectations will require ongoing investment in research, development, and manufacturing capabilities.

The US baby food packaging market demonstrates strong growth potential supported by favorable demographic trends, technological innovation, and evolving consumer preferences toward premium packaging solutions. Market participants who invest in sustainable technologies, smart packaging capabilities, and consumer-centric design approaches are well-positioned to capture significant market opportunities and achieve superior performance.

Strategic success in this market requires balancing multiple priorities including safety compliance, cost management, innovation investment, and sustainability initiatives. Companies that effectively integrate these elements while maintaining focus on consumer needs and market trends will likely achieve sustainable competitive advantages and long-term growth.

Future market development will be shaped by continued emphasis on sustainability, technology integration, and convenience enhancement. The industry’s ability to address these trends while maintaining safety standards and cost competitiveness will determine overall market growth and individual company success in this dynamic and evolving marketplace.

What is Baby Food Packaging?

Baby food packaging refers to the materials and methods used to contain and protect baby food products. This includes jars, pouches, and containers designed to ensure safety, freshness, and convenience for parents and caregivers.

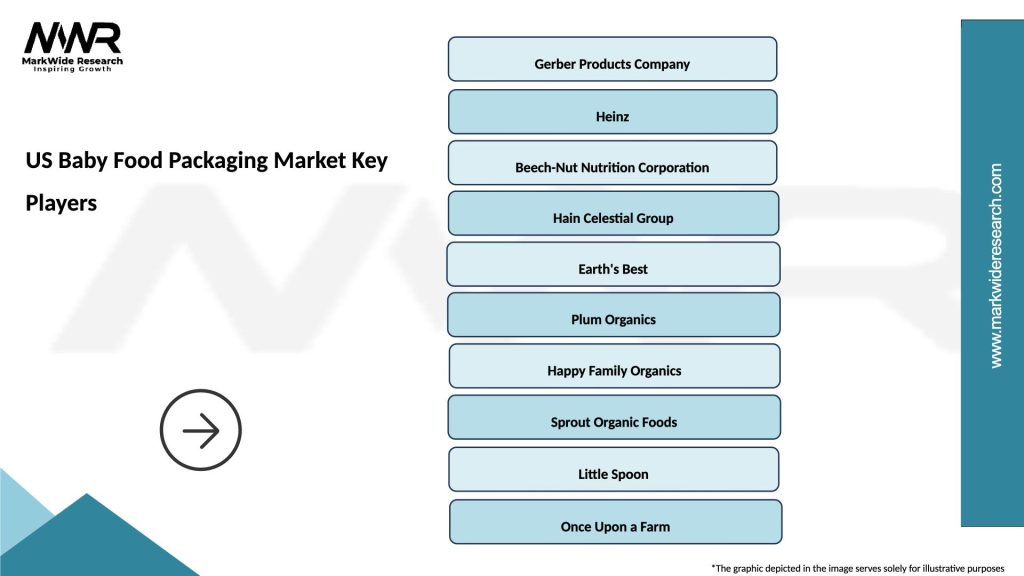

What are the key companies in the US Baby Food Packaging Market?

Key companies in the US Baby Food Packaging Market include Gerber Products Company, Beech-Nut Nutrition Company, and Plum Organics, among others.

What are the main drivers of the US Baby Food Packaging Market?

The main drivers of the US Baby Food Packaging Market include the increasing demand for convenient and ready-to-eat baby food products, rising health consciousness among parents, and innovations in packaging technology that enhance product safety and shelf life.

What challenges does the US Baby Food Packaging Market face?

Challenges in the US Baby Food Packaging Market include stringent regulations regarding food safety and packaging materials, competition from alternative feeding options, and the need for sustainable packaging solutions to meet consumer preferences.

What opportunities exist in the US Baby Food Packaging Market?

Opportunities in the US Baby Food Packaging Market include the growing trend towards organic and natural baby food products, advancements in eco-friendly packaging materials, and the potential for innovative designs that cater to on-the-go parents.

What trends are shaping the US Baby Food Packaging Market?

Trends shaping the US Baby Food Packaging Market include the rise of single-serve packaging options, increased focus on sustainability and recyclable materials, and the incorporation of smart packaging technologies that provide information on freshness and safety.

US Baby Food Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Glass Jars, Pouches, Tetra Packs, Cans |

| Material | Plastic, Paperboard, Aluminum, Biodegradable |

| Closure Type | Screw Caps, Snap-On Lids, Peel-Off Seals, Twist-Off Caps |

| End User | Retailers, Wholesalers, Online Stores, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Baby Food Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at