444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US automotive smart keys market represents a rapidly evolving segment within the broader automotive security and convenience technology landscape. Smart key systems have revolutionized vehicle access and ignition processes, offering enhanced security features and improved user convenience compared to traditional mechanical keys. The market encompasses various technologies including proximity sensors, radio frequency identification (RFID), and near-field communication (NFC) systems that enable keyless entry and push-button start functionality.

Market dynamics indicate robust growth driven by increasing consumer demand for advanced automotive technologies and enhanced vehicle security features. The adoption rate of smart key technology has accelerated significantly, with penetration rates reaching approximately 78% in premium vehicle segments and 45% in mid-range vehicles. Automotive manufacturers are increasingly integrating these systems as standard equipment rather than optional features, reflecting the technology’s transition from luxury to necessity.

Technological advancement continues to shape market evolution, with manufacturers developing more sophisticated systems that incorporate biometric authentication, smartphone integration, and artificial intelligence capabilities. The market benefits from strong collaboration between automotive OEMs and technology suppliers, fostering innovation in areas such as cybersecurity, battery life optimization, and multi-device connectivity.

The US automotive smart keys market refers to the comprehensive ecosystem of advanced keyless entry and ignition systems designed for passenger vehicles, commercial vehicles, and specialty automotive applications across the United States. Smart key technology encompasses electronic devices that communicate wirelessly with vehicle systems to provide secure access, engine start capabilities, and various convenience features without requiring physical key insertion.

Core functionality includes proximity detection, where the vehicle automatically unlocks when the smart key is within a predetermined range, typically 3-5 feet from the vehicle. The system utilizes encrypted communication protocols to prevent unauthorized access and incorporates multiple security layers including rolling codes, challenge-response authentication, and frequency hopping mechanisms.

Modern smart key systems extend beyond basic access control to include features such as personalized vehicle settings, remote engine start, climate control activation, and theft deterrent systems. The technology represents a significant advancement in automotive convenience and security, addressing consumer demands for seamless vehicle interaction while maintaining robust protection against theft and unauthorized use.

Market leadership in the US automotive smart keys sector is characterized by intense competition among established automotive suppliers and emerging technology companies. The market demonstrates strong growth momentum, with adoption rates increasing at approximately 12% annually across all vehicle categories. Premium automotive brands continue to drive innovation, while mainstream manufacturers rapidly integrate smart key technology to meet consumer expectations.

Key market drivers include rising consumer awareness of vehicle security, increasing preference for convenience features, and regulatory support for advanced automotive technologies. The market benefits from technological convergence, where smart key systems integrate with broader vehicle connectivity platforms, mobile applications, and Internet of Things (IoT) ecosystems.

Competitive dynamics reveal significant investment in research and development, with companies focusing on cybersecurity enhancements, battery life improvements, and cost reduction strategies. The market structure includes tier-one automotive suppliers, semiconductor manufacturers, and specialized technology providers working collaboratively to advance smart key capabilities.

Future prospects indicate continued expansion driven by electric vehicle adoption, autonomous driving development, and connected car initiatives. Market participants are positioning for growth through strategic partnerships, technology licensing agreements, and vertical integration strategies.

Strategic analysis reveals several critical insights shaping the US automotive smart keys market landscape:

Primary growth drivers propelling the US automotive smart keys market include multiple interconnected factors that create sustained demand for advanced keyless entry and ignition systems.

Consumer convenience expectations represent the most significant driver, as modern vehicle owners increasingly demand seamless interaction with their vehicles. Lifestyle changes and urbanization trends contribute to preferences for hands-free vehicle access, particularly in situations involving packages, children, or adverse weather conditions. The convenience factor extends beyond basic access to include personalized vehicle settings, automatic climate control activation, and integrated mobile connectivity.

Security enhancement requirements drive adoption as traditional mechanical keys prove increasingly vulnerable to theft and unauthorized duplication. Smart key systems offer multiple layers of protection including encrypted communication, rolling security codes, and proximity-based authentication. Insurance companies increasingly recognize these security benefits, often providing premium discounts for vehicles equipped with advanced smart key systems.

Automotive industry evolution toward connected vehicles and autonomous driving creates natural synergies with smart key technology. Vehicle-to-everything (V2X) communication, over-the-air updates, and predictive maintenance systems benefit from the secure communication infrastructure established by smart key systems.

Regulatory support through federal safety initiatives and state-level automotive technology promotion programs provides favorable market conditions. Government incentives for advanced automotive technologies and cybersecurity standards development create structured growth opportunities for market participants.

Significant challenges facing the US automotive smart keys market include various technical, economic, and operational constraints that may limit growth potential or create implementation difficulties.

High implementation costs remain a primary constraint, particularly for entry-level vehicle segments where price sensitivity limits adoption of advanced technologies. Component costs, integration complexity, and manufacturing requirements create financial barriers that manufacturers must address through cost optimization strategies and economies of scale.

Technical complexity associated with smart key systems presents ongoing challenges in areas such as electromagnetic interference, battery life management, and system reliability. Environmental factors including extreme temperatures, moisture, and physical stress can affect system performance and require robust design solutions.

Cybersecurity concerns create both opportunities and constraints, as increasing awareness of potential vulnerabilities demands continuous investment in security technologies and threat mitigation strategies. Hacking incidents and security breaches in automotive systems can negatively impact consumer confidence and require comprehensive response strategies.

Consumer education requirements present ongoing challenges as smart key systems become more sophisticated. User interface complexity, feature understanding, and proper usage protocols require comprehensive education programs and intuitive system design.

Standardization limitations across different automotive manufacturers and technology suppliers can create compatibility issues and limit aftermarket opportunities. Proprietary technologies and closed ecosystems may restrict consumer choice and increase replacement costs.

Emerging opportunities within the US automotive smart keys market present significant potential for growth, innovation, and market expansion across multiple dimensions.

Electric vehicle integration offers substantial opportunities as EV adoption accelerates nationwide. Electric vehicles provide unique advantages for smart key systems including always-on connectivity, advanced battery management, and integrated charging control. Smart key systems can enable remote charging initiation, energy management optimization, and grid integration capabilities.

Smartphone convergence represents a transformative opportunity as mobile device capabilities continue expanding. Digital key technology enables smartphones to function as smart keys, offering enhanced security, remote functionality, and seamless user experience. Mobile wallet integration and biometric authentication through smartphones create additional value propositions.

Autonomous vehicle preparation creates opportunities for smart key systems to evolve beyond traditional access control toward vehicle summoning, autonomous parking, and fleet management applications. Vehicle-as-a-Service (VaaS) models and shared mobility platforms require sophisticated access control systems that smart key technology can provide.

Aftermarket expansion offers growth opportunities as consumers seek to upgrade existing vehicles with smart key capabilities. Retrofit solutions, universal smart key systems, and third-party integration services create new market segments and revenue streams.

Commercial vehicle applications present untapped opportunities in fleet management, logistics optimization, and driver authentication. Commercial smart key systems can enable usage tracking, maintenance scheduling, and operational efficiency improvements.

Complex market dynamics shape the US automotive smart keys market through interconnected forces that influence supply, demand, competition, and technological development patterns.

Supply chain dynamics reflect the global nature of automotive component manufacturing, with semiconductor availability, raw material costs, and manufacturing capacity significantly impacting market conditions. Supply chain resilience has become increasingly important following recent global disruptions, driving investment in domestic manufacturing capabilities and supplier diversification strategies.

Demand patterns show strong correlation with overall automotive sales cycles, but smart key adoption rates consistently exceed general market growth. Consumer preferences increasingly favor vehicles equipped with advanced technology features, creating sustained demand pressure that influences OEM integration strategies and supplier development priorities.

Competitive dynamics involve multiple layers including OEM competition, supplier competition, and technology platform competition. Vertical integration trends see some manufacturers developing in-house capabilities, while others rely on specialized suppliers for smart key technology development and production.

Innovation cycles accelerate as technology convergence enables rapid advancement in smart key capabilities. Cross-industry collaboration between automotive, telecommunications, and technology sectors drives innovation in areas such as 5G connectivity, edge computing, and artificial intelligence integration.

Regulatory dynamics continue evolving as government agencies develop frameworks for automotive cybersecurity, data privacy, and connected vehicle standards. Policy developments at federal and state levels influence market conditions and create both opportunities and compliance requirements for market participants.

Comprehensive research methodology employed for analyzing the US automotive smart keys market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights.

Primary research activities include extensive interviews with industry executives, technology developers, automotive engineers, and market participants across the smart key ecosystem. Survey methodologies capture consumer preferences, adoption patterns, and satisfaction levels with existing smart key technologies. Expert consultations with automotive industry specialists provide insights into technological trends and market development patterns.

Secondary research encompasses analysis of industry reports, patent filings, regulatory documents, and academic publications related to automotive smart key technology. Market data aggregation from multiple sources ensures comprehensive coverage of market segments, geographic regions, and technology categories.

Analytical frameworks include quantitative modeling for market sizing and growth projections, qualitative analysis for trend identification and competitive assessment, and scenario planning for future market development evaluation. Statistical analysis validates data consistency and identifies significant market patterns and correlations.

Data validation processes involve cross-referencing multiple sources, expert review panels, and market participant feedback to ensure accuracy and completeness of research findings. Continuous monitoring of market developments enables real-time updates and refinements to analytical conclusions.

Regional market dynamics within the United States reveal distinct patterns of smart key adoption, technological preferences, and growth opportunities across different geographic areas.

West Coast markets, particularly California, Washington, and Oregon, demonstrate the highest adoption rates for automotive smart key technology, with penetration reaching approximately 68% of new vehicle sales. Technology-forward consumer preferences, high disposable income levels, and early adopter mentality drive strong demand for advanced automotive features. Electric vehicle concentration in these markets creates additional opportunities for smart key integration with charging infrastructure and energy management systems.

Northeast corridor markets including New York, Massachusetts, and New Jersey show robust smart key adoption driven by urban lifestyle requirements and security concerns. Dense urban environments create strong demand for convenience features, while vehicle theft rates drive security-focused smart key adoption. Commercial vehicle applications in logistics and delivery services create additional market opportunities.

Southeast markets demonstrate growing adoption rates, with Florida, Texas, and Georgia leading regional growth. Population growth, economic development, and automotive manufacturing presence contribute to market expansion. Climate considerations in these regions drive demand for remote climate control and pre-conditioning features enabled by smart key systems.

Midwest markets show steady adoption patterns influenced by automotive manufacturing heritage and practical consumer preferences. Cost sensitivity in some market segments requires value-oriented smart key solutions, while harsh weather conditions create demand for reliable, cold-weather performance capabilities.

Competitive market structure in the US automotive smart keys market includes diverse participants ranging from global automotive suppliers to specialized technology companies and emerging startups.

Market competition intensifies through technological differentiation, cost leadership strategies, and customer relationship management. Strategic partnerships between suppliers and OEMs create competitive advantages through co-development programs and exclusive technology agreements.

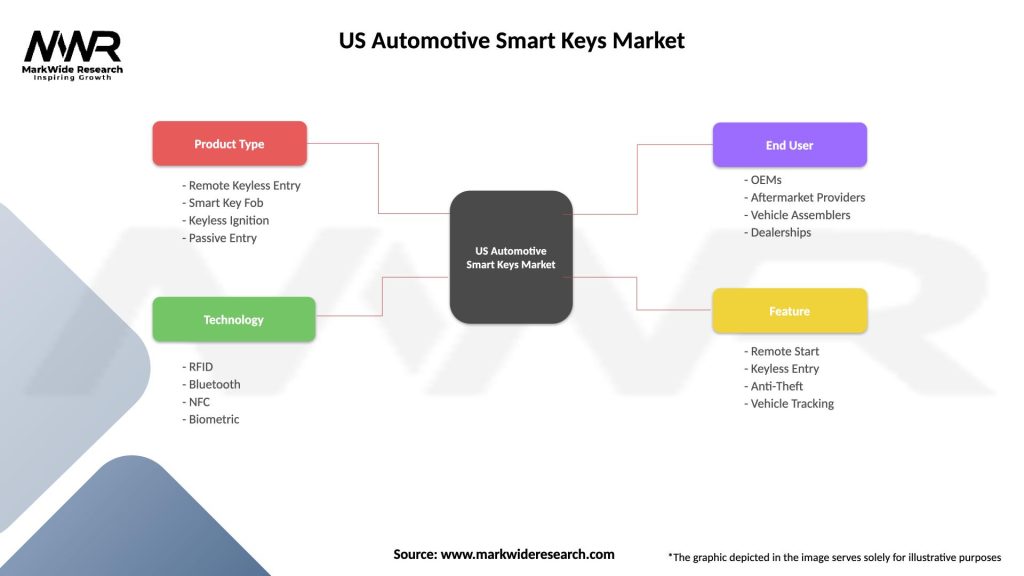

Market segmentation analysis reveals distinct categories within the US automotive smart keys market based on technology, application, vehicle type, and end-user characteristics.

By Technology:

By Vehicle Type:

By Application:

Detailed category analysis provides specific insights into performance, trends, and opportunities within each major segment of the US automotive smart keys market.

RFID Technology Category maintains significant market presence despite being considered mature technology. Cost effectiveness and proven reliability ensure continued adoption in entry-level vehicles and cost-sensitive applications. Manufacturing economies of scale enable competitive pricing, while established supply chains provide reliable availability. However, limited functionality compared to newer technologies creates pressure for upgrades and replacements.

Bluetooth Low Energy Category demonstrates the strongest growth trajectory, with adoption rates increasing approximately 25% annually. Smartphone integration capabilities drive consumer preference, while extended range functionality provides enhanced convenience. Energy efficiency improvements address battery life concerns, and software update capabilities enable feature enhancements over vehicle lifetime.

Passenger Car Segment represents the largest market category, accounting for approximately 72% of smart key installations. Consumer preference trends favor convenience and security features, driving steady adoption growth. OEM integration strategies increasingly position smart keys as standard equipment rather than optional features, expanding market penetration across price segments.

Electric Vehicle Category shows exceptional growth potential with unique integration opportunities. Always-connected architecture in electric vehicles enables advanced smart key functionality including charging control, energy management, and grid integration. Software-defined vehicle concepts create opportunities for over-the-air updates and feature expansion throughout vehicle lifecycle.

Comprehensive benefits from smart key market participation extend across multiple stakeholder categories, creating value through various mechanisms and strategic advantages.

Automotive Manufacturers benefit through product differentiation, customer satisfaction improvement, and brand positioning enhancement. Smart key integration enables manufacturers to offer advanced convenience features that justify premium pricing and improve competitive positioning. Customer loyalty increases through enhanced user experience, while service revenue opportunities emerge through software updates and feature subscriptions.

Technology Suppliers gain access to growing market opportunities with recurring revenue potential through component supply, software licensing, and maintenance services. Innovation leadership in smart key technology creates competitive advantages and enables premium pricing strategies. Cross-industry applications of smart key technology provide diversification opportunities beyond automotive markets.

Consumers receive significant value through enhanced convenience, improved security, and advanced functionality. Time savings from streamlined vehicle access and personalized settings improve daily driving experience. Security enhancements provide peace of mind and may result in insurance premium reductions. Integration capabilities with smartphones and smart home systems create seamless technology ecosystems.

Fleet Operators benefit from operational efficiency improvements, enhanced security, and better asset management. Driver authentication and usage tracking capabilities enable improved fleet management and maintenance optimization. Remote access control provides flexibility in fleet deployment and reduces administrative overhead.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the US automotive smart keys market reflect broader technological evolution and changing consumer expectations in the automotive industry.

Smartphone Integration Acceleration represents the most significant trend, with digital key technology enabling smartphones to replace physical smart keys entirely. Apple CarKey and Google Smart Lock initiatives demonstrate industry momentum toward mobile-first approaches. Biometric authentication through smartphones adds security layers while improving user convenience. Cross-platform compatibility challenges drive standardization efforts and open ecosystem development.

Ultra-Wideband Technology Adoption gains momentum as manufacturers seek enhanced security and precise positioning capabilities. UWB technology provides centimeter-level accuracy for vehicle location detection and enables advanced security features such as relay attack prevention. Apple and Samsung integration of UWB in smartphones creates consumer familiarity and adoption readiness.

Cybersecurity Enhancement Focus intensifies as connected vehicle vulnerabilities receive increased attention. Multi-factor authentication, blockchain integration, and quantum-resistant encryption represent emerging security approaches. Continuous security updates and threat monitoring systems become standard features in advanced smart key implementations.

Artificial Intelligence Integration enables predictive functionality and personalized user experiences. Machine learning algorithms optimize battery life, predict maintenance needs, and customize vehicle settings based on user behavior patterns. Voice recognition and gesture control expand interaction modalities beyond traditional button-based interfaces.

Sustainability Considerations drive development of eco-friendly smart key solutions including recyclable materials, energy harvesting technology, and extended product lifecycles. Solar charging capabilities and kinetic energy harvesting reduce battery replacement requirements and environmental impact.

Recent industry developments demonstrate accelerating innovation and market evolution within the US automotive smart keys sector, according to MarkWide Research analysis.

Technology Partnerships between automotive manufacturers and technology companies create new capabilities and market opportunities. Ford and Apple collaboration on CarKey integration demonstrates industry commitment to smartphone-based access control. BMW and Samsung partnership for UWB technology implementation showcases premium brand innovation leadership.

Cybersecurity Initiatives gain prominence as manufacturers address growing security concerns. General Motors investment in cybersecurity research and Tesla implementation of advanced encryption protocols reflect industry-wide security enhancement efforts. Government partnerships with automotive manufacturers create frameworks for cybersecurity standards and threat response protocols.

Manufacturing Investments in domestic smart key production capabilities reduce supply chain dependencies and improve cost competitiveness. Continental expansion of US manufacturing facilities and Denso investment in advanced production technologies demonstrate supplier commitment to market growth.

Startup Innovation introduces disruptive technologies and business models. Digital key startups develop software-only solutions that eliminate hardware requirements, while blockchain security companies create decentralized authentication systems. Venture capital investment in automotive technology startups reaches record levels, funding innovation in smart key and related technologies.

Regulatory Developments create structured frameworks for smart key technology deployment. NHTSA guidelines for connected vehicle cybersecurity and FCC spectrum allocation for automotive applications provide regulatory clarity and market confidence.

Strategic recommendations for market participants in the US automotive smart keys sector focus on positioning for sustained growth and competitive advantage in an evolving technological landscape.

Technology Investment Priorities should emphasize cybersecurity capabilities, smartphone integration, and artificial intelligence functionality. Research and development spending allocation should prioritize UWB technology development, battery life optimization, and cross-platform compatibility. Patent portfolio development in emerging technologies creates competitive moats and licensing opportunities.

Partnership Strategy Development requires careful selection of technology partners, OEM relationships, and ecosystem participants. Vertical integration versus horizontal collaboration decisions should consider core competencies, market positioning, and resource availability. Startup partnerships and acquisition opportunities provide access to disruptive technologies and innovative capabilities.

Market Segmentation Focus should target high-growth segments including electric vehicles, premium automotive brands, and commercial fleet applications. Geographic expansion strategies should consider regional preferences, regulatory requirements, and competitive dynamics. Aftermarket opportunities require different approaches than OEM integration strategies.

Customer Experience Optimization through user interface design, feature integration, and support services creates differentiation opportunities. Consumer education programs and technical support capabilities address adoption barriers and improve customer satisfaction. Feedback collection systems enable continuous improvement and feature development.

Risk Management Strategies should address cybersecurity threats, supply chain disruptions, and technology obsolescence risks. Diversification strategies across technology platforms, market segments, and geographic regions reduce concentration risks and improve resilience.

The US automotive smart keys market is positioned for continued evolution driven by advancing vehicle connectivity, digital key technologies, and smartphone integration becoming standard features across vehicle segments through 2030 and beyond. Market projections indicate substantial transformation supported by electric vehicle adoption, autonomous driving development, and consumer expectations for seamless digital experiences extending to vehicle access and control systems. Technology convergence between automotive manufacturers and consumer electronics companies will accelerate innovation in keyless entry, remote vehicle management, and personalized user authentication.

Digital key proliferation will reshape traditional smart key dynamics as smartphone-based vehicle access gains widespread adoption across mainstream vehicle segments. Ultra-wideband technology integration will enable precise positioning, enhanced security, and passive entry experiences eliminating physical key fob requirements entirely. Biometric authentication including fingerprint recognition and facial identification may supplement or replace traditional key fobs for premium vehicle applications emphasizing security and personalization.

Vehicle sharing and subscription models will drive demand for flexible access solutions enabling temporary key sharing, time-limited permissions, and remote access management through mobile applications. Cybersecurity enhancements will become critical as connected vehicle vulnerabilities receive increased attention from regulators and consumers concerned about digital theft risks. Over-the-air updates will enable smart key functionality improvements, security patch deployment, and feature additions throughout vehicle ownership lifecycles.

Electric vehicle specific features including remote climate preconditioning, charging status monitoring, and battery management integration will expand smart key functionality beyond traditional access control. Aftermarket opportunities will emerge for digital key retrofit solutions enabling older vehicles to gain smartphone connectivity and advanced keyless entry capabilities. Standardization efforts including Car Connectivity Consortium specifications will facilitate cross-platform compatibility and multi-device access management.

Consumer preferences will shift toward integrated digital ecosystems connecting smart home devices, mobile wallets, and vehicle access through unified authentication platforms. Sustainability considerations may influence physical key fob design with manufacturers exploring biodegradable materials, rechargeable batteries, and extended product lifecycles. Innovation investment in next-generation technologies including quantum encryption, advanced relay attack prevention, and AI-powered user recognition will shape long-term competitive dynamics across the US automotive smart keys landscape.

The US automotive smart keys market represents a mature yet rapidly evolving technology segment within vehicle electronics, driven by continuous security enhancements, connectivity advancements, and consumer expectations for convenient, seamless vehicle access experiences. Market dynamics demonstrate steady growth potential supported by new vehicle sales, technology upgrades in existing vehicle fleets, and expanding functionality beyond traditional keyless entry to comprehensive vehicle management systems. Digital transformation and smartphone integration continue reshaping traditional smart key paradigms while creating new opportunities for innovation and differentiation.

Strategic positioning in this competitive market requires balancing security imperatives with user convenience while adapting to rapidly evolving technology standards and consumer preferences. Companies that prioritize cybersecurity excellence, smartphone ecosystem integration, and flexible platform architectures will be best positioned to capture opportunities in this transitioning market. Automotive manufacturer partnerships and tier-one supplier relationships remain essential for market access while aftermarket channels present opportunities for retrofit and replacement products.

Technology leadership in ultra-wideband positioning, digital key platforms, and biometric authentication positions innovative suppliers as strategic partners enabling next-generation vehicle access solutions. Security advancement remains paramount as relay attacks and digital vulnerabilities require continuous innovation in encryption, authentication protocols, and anti-theft technologies. User experience optimization through intuitive interfaces, reliable performance, and seamless smartphone integration drives consumer satisfaction and brand loyalty in this functional yet increasingly sophisticated product category.

The competitive landscape continues evolving as traditional automotive electronics suppliers face competition from consumer electronics companies and software providers bringing digital expertise to vehicle access solutions. Long-term success will require ongoing investment in technology development, cybersecurity capabilities, and cross-industry partnerships to meet increasingly complex vehicle connectivity requirements and consumer expectations. Innovation-focused approaches emphasizing security, convenience, and digital ecosystem integration will become increasingly critical differentiators in this essential and continuously transforming US automotive smart keys market.

What is Automotive Smart Keys?

Automotive Smart Keys are advanced keyless entry systems that allow vehicle owners to unlock and start their cars without traditional keys. These systems often utilize technologies such as RFID, Bluetooth, and NFC for enhanced convenience and security.

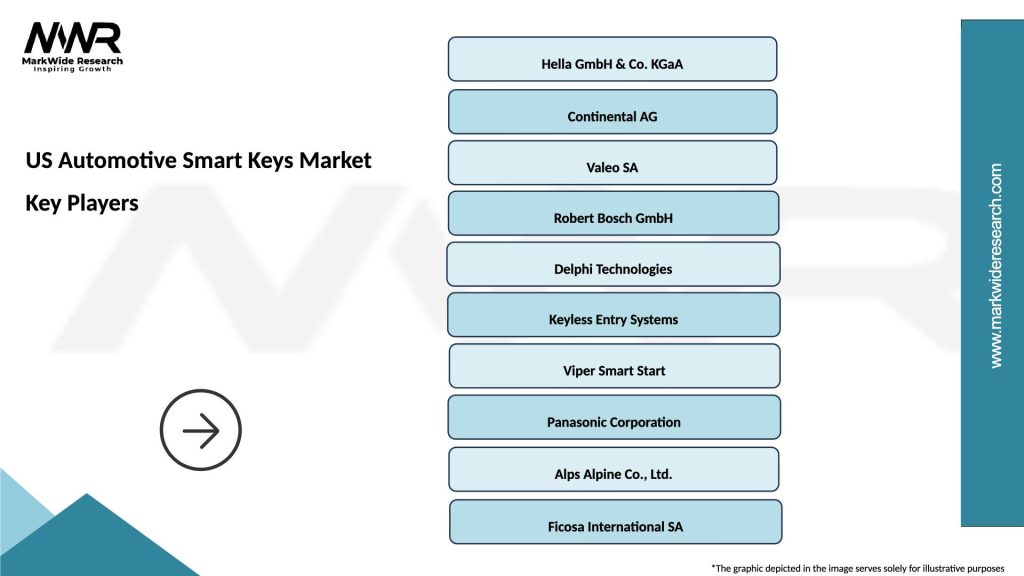

What are the key players in the US Automotive Smart Keys Market?

Key players in the US Automotive Smart Keys Market include companies like Continental AG, Bosch, and Valeo, which are known for their innovative automotive technologies. These companies focus on developing secure and user-friendly smart key solutions, among others.

What are the main drivers of growth in the US Automotive Smart Keys Market?

The growth of the US Automotive Smart Keys Market is driven by increasing consumer demand for convenience and security features in vehicles. Additionally, advancements in technology, such as improved connectivity and integration with smart devices, are contributing to market expansion.

What challenges does the US Automotive Smart Keys Market face?

The US Automotive Smart Keys Market faces challenges such as cybersecurity threats and the potential for key fob hacking. Additionally, the high cost of advanced smart key systems can deter some consumers from adopting this technology.

What opportunities exist in the US Automotive Smart Keys Market?

Opportunities in the US Automotive Smart Keys Market include the integration of smart keys with emerging technologies like autonomous vehicles and IoT. Furthermore, the growing trend of electric vehicles presents new avenues for smart key innovations.

What trends are shaping the US Automotive Smart Keys Market?

Trends in the US Automotive Smart Keys Market include the increasing adoption of biometric authentication methods and the development of smartphone-based keyless entry systems. Additionally, there is a rising focus on enhancing user experience through seamless connectivity and personalization.

US Automotive Smart Keys Market

| Segmentation Details | Description |

|---|---|

| Product Type | Remote Keyless Entry, Smart Key Fob, Keyless Ignition, Passive Entry |

| Technology | RFID, Bluetooth, NFC, Biometric |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Dealerships |

| Feature | Remote Start, Keyless Entry, Anti-Theft, Vehicle Tracking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Automotive Smart Keys Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at