444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US automatic content recognition market represents a rapidly evolving technological landscape that is transforming how media content is identified, tracked, and monetized across various platforms. Automatic content recognition (ACR) technology enables devices and applications to identify audio, video, or image content in real-time, creating unprecedented opportunities for content creators, advertisers, and media companies. The market is experiencing robust growth driven by increasing demand for personalized content experiences, enhanced advertising targeting capabilities, and the proliferation of connected devices across American households.

Market dynamics indicate that the US ACR market is expanding at a compound annual growth rate of 23.8%, reflecting the technology’s critical role in modern media consumption patterns. The integration of ACR technology into smart TVs, mobile devices, streaming platforms, and digital advertising ecosystems has created a comprehensive infrastructure for content identification and audience engagement. Television broadcasting remains the largest application segment, accounting for approximately 42% of market adoption, while mobile applications and streaming services are rapidly gaining traction.

Consumer behavior shifts toward multi-screen viewing experiences and on-demand content consumption have accelerated ACR technology adoption across the United States. The technology’s ability to bridge traditional broadcast media with digital platforms has made it indispensable for media companies seeking to understand audience preferences and optimize content delivery strategies. Regional penetration varies significantly, with major metropolitan areas showing 68% higher adoption rates compared to rural markets, primarily due to infrastructure availability and consumer technology adoption patterns.

The automatic content recognition market refers to the comprehensive ecosystem of technologies, services, and solutions that enable the automated identification and analysis of audio, video, and multimedia content across various digital platforms and devices. ACR technology utilizes advanced algorithms, machine learning, and signal processing techniques to create unique fingerprints of content, allowing for real-time recognition and matching against extensive databases of known media assets.

Core functionality encompasses several key components including audio fingerprinting, video watermarking, metadata extraction, and content matching algorithms. The technology operates by capturing brief samples of content being consumed and comparing these samples against vast databases to identify specific programs, advertisements, songs, or other media assets. Implementation methods vary from embedded solutions in smart devices to cloud-based services that process content identification requests in real-time.

Market participants include technology providers, content creators, broadcasters, streaming platforms, advertising agencies, and device manufacturers who collectively contribute to the ACR ecosystem. The technology serves multiple purposes including content discovery, audience measurement, copyright protection, personalized recommendations, and targeted advertising delivery, making it a versatile solution for various industry stakeholders.

Strategic market positioning reveals that the US automatic content recognition market has emerged as a critical enabler of modern media consumption and digital advertising strategies. The technology’s ability to seamlessly connect traditional broadcast content with digital engagement opportunities has created substantial value propositions for media companies, advertisers, and technology providers. Market maturation is evident through increasing standardization of ACR protocols and widespread adoption across major streaming platforms and smart TV manufacturers.

Competitive landscape dynamics show consolidation among major technology providers while simultaneously witnessing the emergence of specialized niche players focusing on specific applications or vertical markets. The integration of artificial intelligence and machine learning capabilities has enhanced ACR accuracy rates to approximately 94.7% for audio content and 91.3% for video content, significantly improving user experiences and advertiser confidence in the technology.

Investment trends indicate substantial capital allocation toward research and development activities, particularly in areas of cross-platform content tracking, privacy-compliant data collection, and real-time processing capabilities. The market’s evolution toward supporting emerging content formats including virtual reality, augmented reality, and interactive media represents significant growth opportunities for technology providers and content creators alike.

Technology advancement patterns reveal several critical insights that are shaping the US automatic content recognition market’s trajectory and competitive dynamics:

Primary growth catalysts propelling the US automatic content recognition market forward stem from fundamental shifts in media consumption patterns and technological capabilities. The proliferation of connected devices across American households has created an extensive infrastructure capable of supporting ACR technology deployment, with smart TV penetration reaching approximately 76% of US households. This widespread device adoption provides the foundation for comprehensive content tracking and audience measurement capabilities.

Advertising industry transformation represents another significant driver as marketers seek more precise targeting and measurement capabilities. Traditional advertising metrics are being supplemented and replaced by ACR-enabled solutions that provide granular insights into content consumption patterns, audience engagement levels, and cross-platform viewing behaviors. The technology enables advertisers to optimize campaign performance in real-time and deliver personalized messaging based on actual content consumption rather than demographic assumptions.

Content personalization demands from consumers are driving streaming platforms and media companies to implement sophisticated recommendation systems powered by ACR technology. The ability to understand individual viewing preferences and content consumption patterns enables platforms to deliver highly relevant content suggestions, improving user engagement and reducing churn rates. Regulatory compliance requirements for content monitoring and copyright protection are also contributing to market growth as content creators and distributors seek automated solutions for rights management and piracy detection.

Privacy concerns represent the most significant challenge facing the US automatic content recognition market, as consumers become increasingly aware of data collection practices and demand greater control over personal information. Recent regulatory developments including state-level privacy legislation and federal oversight initiatives have created compliance complexities that require substantial investment in privacy-preserving technologies and data governance frameworks. Consumer trust issues related to content tracking and data usage have led to increased scrutiny of ACR implementations and demands for transparent opt-in mechanisms.

Technical limitations continue to constrain market growth, particularly in areas of content recognition accuracy for emerging media formats and real-time processing capabilities for high-volume content streams. The complexity of implementing ACR solutions across diverse device types and operating systems creates integration challenges that require specialized expertise and substantial development resources. Interoperability issues between different ACR systems and platforms limit the effectiveness of cross-platform content tracking and audience measurement initiatives.

Cost considerations for implementing comprehensive ACR solutions can be prohibitive for smaller media companies and content creators, creating market access barriers that limit widespread adoption. The ongoing expenses associated with maintaining content databases, processing infrastructure, and compliance systems require sustained investment commitments that may not be feasible for all market participants. Competitive pressures from established technology providers can also limit opportunities for new entrants and innovative solutions to gain market traction.

Emerging content formats present substantial growth opportunities for the US automatic content recognition market, particularly in areas of virtual reality, augmented reality, and interactive media experiences. As these technologies gain mainstream adoption, the need for sophisticated content identification and tracking capabilities will create new revenue streams for ACR providers. Gaming industry integration represents an untapped market segment where ACR technology could enable new forms of content discovery, social sharing, and advertising integration within gaming environments.

Edge computing deployment offers opportunities to enhance ACR performance while addressing privacy concerns through localized processing capabilities. By implementing ACR functionality at network edges or within devices themselves, providers can reduce latency, improve user experiences, and minimize data transmission requirements. 5G network rollout across the United States will enable new ACR applications that require high-bandwidth, low-latency connectivity for real-time content processing and response.

Cross-industry applications beyond traditional media and entertainment sectors present significant expansion opportunities. Healthcare organizations could utilize ACR technology for medical content identification and training applications, while educational institutions might implement ACR solutions for content management and student engagement tracking. Smart city initiatives could incorporate ACR technology for public information systems and digital signage management, creating new market segments for specialized ACR solutions.

Technological convergence is fundamentally reshaping the US automatic content recognition market as traditional boundaries between media consumption platforms continue to blur. The integration of ACR capabilities into diverse device ecosystems creates complex interdependencies that require sophisticated coordination between technology providers, content creators, and platform operators. Data ecosystem evolution shows increasing emphasis on first-party data collection and privacy-compliant audience measurement solutions that provide valuable insights while respecting consumer preferences.

Competitive dynamics reveal a market in transition as established players seek to maintain market position while new entrants introduce innovative approaches to content recognition and audience measurement. The balance between technological capability and privacy protection has become a key differentiator, with companies investing heavily in privacy-preserving ACR solutions that maintain functionality while addressing consumer concerns. Partnership strategies are becoming increasingly important as no single company can provide comprehensive ACR solutions across all platforms and use cases.

Regulatory landscape changes continue to influence market dynamics as policymakers grapple with balancing innovation incentives against privacy protection requirements. The development of industry standards and best practices for ACR implementation is creating more predictable operating environments while ensuring consumer protection. Market consolidation trends suggest that successful ACR providers will need to offer comprehensive solutions spanning multiple platforms and applications rather than focusing on narrow technical capabilities.

Comprehensive market analysis for the US automatic content recognition market employed multiple research methodologies to ensure accuracy and completeness of findings. Primary research activities included extensive interviews with industry executives, technology providers, content creators, and platform operators to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies captured quantitative data from market participants regarding technology adoption rates, implementation challenges, and future investment priorities.

Secondary research components involved systematic analysis of industry reports, regulatory filings, patent databases, and technology documentation to understand market structure and competitive positioning. Financial analysis of public companies operating in the ACR space provided insights into revenue trends, investment patterns, and strategic priorities. MarkWide Research analysts conducted detailed examination of merger and acquisition activities, partnership announcements, and technology licensing agreements to assess market consolidation trends.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and utilizing statistical analysis techniques to identify patterns and trends. Market sizing methodologies incorporated bottom-up analysis based on device penetration rates, adoption percentages, and revenue per user metrics. Forecasting models utilized historical growth patterns, technology adoption curves, and regulatory impact assessments to project future market development scenarios.

Geographic distribution of the US automatic content recognition market reveals significant variations in adoption rates and technology penetration across different regions. The West Coast leads in market development, accounting for approximately 34% of total market activity, driven by the concentration of technology companies, streaming platforms, and innovative media organizations in California, Washington, and Oregon. Silicon Valley’s influence on ACR technology development and the presence of major streaming services headquarters contribute to this regional dominance.

East Coast markets, particularly the New York metropolitan area, represent approximately 28% of market share, reflecting the region’s role as a traditional media and advertising hub. The concentration of broadcast networks, advertising agencies, and media companies in New York creates substantial demand for ACR solutions that bridge traditional and digital media platforms. Southern regions show growing adoption rates, with markets like Atlanta, Austin, and Miami emerging as significant growth centers due to expanding technology sectors and media production activities.

Midwest adoption patterns demonstrate steady growth in ACR technology implementation, particularly in markets with strong manufacturing and automotive industries where connected device integration is driving demand for content recognition capabilities. Rural market penetration remains limited by infrastructure constraints and lower connected device adoption rates, though 5G network expansion is expected to address these limitations. Regional variations in privacy regulations and consumer preferences create distinct market dynamics that require tailored approaches from ACR providers.

Market leadership in the US automatic content recognition sector is characterized by a diverse ecosystem of established technology companies, specialized ACR providers, and emerging innovators. The competitive landscape reflects the technology’s broad applicability across multiple industries and use cases:

Strategic positioning among competitors varies significantly, with some companies focusing on broad platform integration while others specialize in specific applications or vertical markets. The competitive dynamics are influenced by factors including content database comprehensiveness, recognition accuracy, processing speed, privacy compliance capabilities, and integration ease.

Technology-based segmentation of the US automatic content recognition market reveals distinct categories based on the underlying recognition methodologies and implementation approaches:

By Technology:

By Application:

By End-User:

Audio fingerprinting technology maintains its position as the most mature and widely adopted ACR category, benefiting from decades of development and refinement. The technology’s ability to identify content even in noisy environments or with audio quality degradation makes it particularly valuable for broadcast monitoring and music recognition applications. Recognition accuracy rates for audio fingerprinting have reached approximately 96.2% under optimal conditions, with performance remaining strong even in challenging acoustic environments.

Video watermarking solutions are experiencing rapid growth as streaming platforms and content creators seek robust tracking capabilities that survive content transcoding and compression processes. The technology’s resistance to common video processing operations makes it ideal for content protection and audience measurement across multiple distribution channels. Implementation complexity remains higher than audio-based solutions, but advances in automated watermark insertion are reducing deployment barriers.

Emerging categories including machine learning-enhanced recognition and multi-modal identification systems are gaining traction as technology providers seek to improve accuracy and expand application possibilities. The integration of artificial intelligence capabilities is enabling ACR systems to adapt to new content types and recognition challenges automatically. Cross-platform compatibility has become a critical differentiator as content consumption increasingly spans multiple devices and platforms simultaneously.

Content creators and media companies realize substantial benefits from ACR technology implementation, including enhanced audience insights, improved content monetization opportunities, and comprehensive rights management capabilities. The technology enables real-time understanding of content performance across multiple platforms, allowing for data-driven decisions regarding content production, distribution, and marketing strategies. Revenue optimization through targeted advertising and personalized content recommendations can increase per-user revenue by approximately 18-25% according to industry implementations.

Advertisers and marketing agencies gain access to unprecedented targeting precision and campaign measurement capabilities through ACR-enabled solutions. The technology provides granular insights into actual content consumption patterns, enabling more effective audience segmentation and message personalization. Campaign effectiveness improvements of 32% on average have been reported by agencies implementing comprehensive ACR-based measurement and optimization strategies.

Technology providers and device manufacturers benefit from ACR integration through enhanced product differentiation, new revenue stream creation, and improved user engagement metrics. Smart TV manufacturers report that ACR-enabled features contribute to increased user satisfaction and reduced churn rates. Platform operators including streaming services and social media companies utilize ACR technology to improve content discovery, enhance user experiences, and optimize content recommendation algorithms, resulting in longer user session times and higher engagement rates.

Strengths:

Weaknesses:

Opportunities:

Threats:

Privacy-first ACR development has emerged as the dominant trend shaping the US automatic content recognition market, with technology providers investing heavily in solutions that provide content identification capabilities while minimizing personal data collection. The implementation of differential privacy techniques, on-device processing, and anonymized data aggregation methods reflects the industry’s response to growing privacy concerns. Consumer control mechanisms including granular opt-in options and transparent data usage policies are becoming standard features in ACR implementations.

Artificial intelligence integration is transforming ACR capabilities through machine learning algorithms that improve recognition accuracy and expand content type coverage. AI-powered systems can adapt to new content formats, learn from recognition errors, and optimize performance based on usage patterns. Deep learning applications are enabling ACR systems to recognize complex content relationships and provide more sophisticated audience insights and content recommendations.

Cross-platform synchronization represents a critical trend as consumers increasingly engage with content across multiple devices simultaneously. ACR providers are developing solutions that track content consumption journeys spanning smart TVs, mobile devices, tablets, and computers to provide comprehensive audience measurement and personalized experiences. Real-time processing capabilities are being enhanced to support instantaneous content identification and response across all connected devices in a household or user ecosystem.

Strategic partnerships between ACR technology providers and major streaming platforms have accelerated market development and technology adoption. Recent collaborations focus on developing privacy-compliant solutions that enhance user experiences while providing valuable audience insights for content optimization and advertising targeting. Technology licensing agreements are becoming more common as device manufacturers seek to integrate ACR capabilities without developing proprietary solutions.

Regulatory compliance initiatives have driven significant investment in privacy-preserving ACR technologies and data governance frameworks. Companies are proactively implementing privacy-by-design principles and developing transparent data usage policies to address regulatory requirements and consumer concerns. Industry standardization efforts are creating more interoperable ACR solutions that can work across different platforms and devices seamlessly.

Merger and acquisition activity has increased as larger technology companies seek to acquire specialized ACR capabilities and content databases. These transactions reflect the strategic importance of content recognition technology in modern media and advertising ecosystems. Investment in research and development continues to accelerate, with particular focus on emerging applications including virtual reality content recognition and blockchain-based rights management systems.

MarkWide Research analysts recommend that companies operating in the US automatic content recognition market prioritize privacy-compliant solution development to address growing consumer concerns and regulatory requirements. Organizations should invest in privacy-preserving technologies including differential privacy, federated learning, and on-device processing capabilities to maintain competitive positioning while respecting user preferences. Strategic focus on transparency and user control will become increasingly important for market success.

Technology diversification strategies should encompass emerging content formats and cross-platform integration capabilities to capture growth opportunities in evolving media consumption patterns. Companies should develop expertise in virtual reality, augmented reality, and interactive media recognition to position themselves for future market expansion. Partnership development with device manufacturers, streaming platforms, and content creators will be essential for comprehensive market coverage and solution deployment.

Investment priorities should emphasize artificial intelligence and machine learning capabilities that enhance recognition accuracy and expand application possibilities. Organizations should also focus on edge computing deployment and real-time processing capabilities to improve user experiences and reduce latency. Market expansion into adjacent industries including healthcare, education, and retail presents significant growth opportunities for companies with adaptable ACR technologies and strong execution capabilities.

Long-term market prospects for the US automatic content recognition market remain highly positive, driven by continued growth in connected device adoption, streaming media consumption, and demand for personalized content experiences. The market is expected to maintain robust growth rates exceeding 20% annually through the next five years as technology capabilities expand and new applications emerge. 5G network deployment will enable new ACR applications requiring high-bandwidth, low-latency connectivity for real-time content processing and response.

Technology evolution will focus on privacy-preserving solutions that maintain functionality while addressing consumer and regulatory concerns. The development of federated learning systems, homomorphic encryption, and secure multi-party computation techniques will enable ACR providers to deliver valuable insights without compromising individual privacy. Edge computing integration will become standard practice, reducing latency and improving user experiences while minimizing data transmission requirements.

Market expansion into new application areas including virtual reality, augmented reality, and interactive media will create substantial growth opportunities for ACR providers. The integration of blockchain technology for content rights management and transparent audience measurement verification represents another significant development area. Cross-industry adoption in healthcare, education, retail, and smart city applications will diversify revenue streams and reduce dependence on traditional media and entertainment sectors.

The US automatic content recognition market stands at a pivotal juncture where technological advancement, privacy considerations, and market demand converge to create both significant opportunities and complex challenges. The market’s robust growth trajectory reflects the fundamental importance of content identification and audience measurement in modern media ecosystems, while evolving privacy regulations and consumer preferences are reshaping technology development priorities and implementation strategies.

Strategic success in this dynamic market will require companies to balance innovation with privacy protection, develop comprehensive cross-platform solutions, and maintain adaptability to emerging content formats and consumption patterns. The integration of artificial intelligence, edge computing, and privacy-preserving technologies will define the next generation of ACR solutions, creating competitive advantages for organizations that successfully navigate these technological transitions.

Market participants who prioritize privacy-compliant solution development, invest in emerging technology capabilities, and build strategic partnerships across the media and technology ecosystem will be best positioned to capitalize on the substantial growth opportunities ahead. The US automatic content recognition market’s evolution toward more sophisticated, privacy-aware, and comprehensive solutions will continue to drive innovation and create value for stakeholders across the media, advertising, and technology industries.

What is Automatic Content Recognition?

Automatic Content Recognition (ACR) refers to technologies that identify and analyze content from various media sources, such as audio, video, and images. ACR is widely used in applications like media monitoring, audience measurement, and personalized content recommendations.

What are the key players in the US Automatic Content Recognition Market?

Key players in the US Automatic Content Recognition Market include companies like Gracenote, ACRCloud, and Shazam. These companies provide innovative solutions that enhance media engagement and analytics, among others.

What are the growth factors driving the US Automatic Content Recognition Market?

The growth of the US Automatic Content Recognition Market is driven by the increasing demand for personalized content experiences, the rise of streaming services, and advancements in machine learning technologies. These factors contribute to enhanced user engagement and targeted advertising.

What challenges does the US Automatic Content Recognition Market face?

The US Automatic Content Recognition Market faces challenges such as data privacy concerns, the need for high accuracy in content recognition, and competition from alternative technologies. These issues can hinder the adoption and effectiveness of ACR solutions.

What opportunities exist in the US Automatic Content Recognition Market?

Opportunities in the US Automatic Content Recognition Market include the expansion of smart devices, the integration of ACR in advertising strategies, and the potential for partnerships with content creators. These trends can lead to innovative applications and increased market penetration.

What trends are shaping the US Automatic Content Recognition Market?

Trends shaping the US Automatic Content Recognition Market include the growing use of ACR in interactive television, the rise of voice-activated devices, and the increasing focus on real-time data analytics. These trends are transforming how content is consumed and monetized.

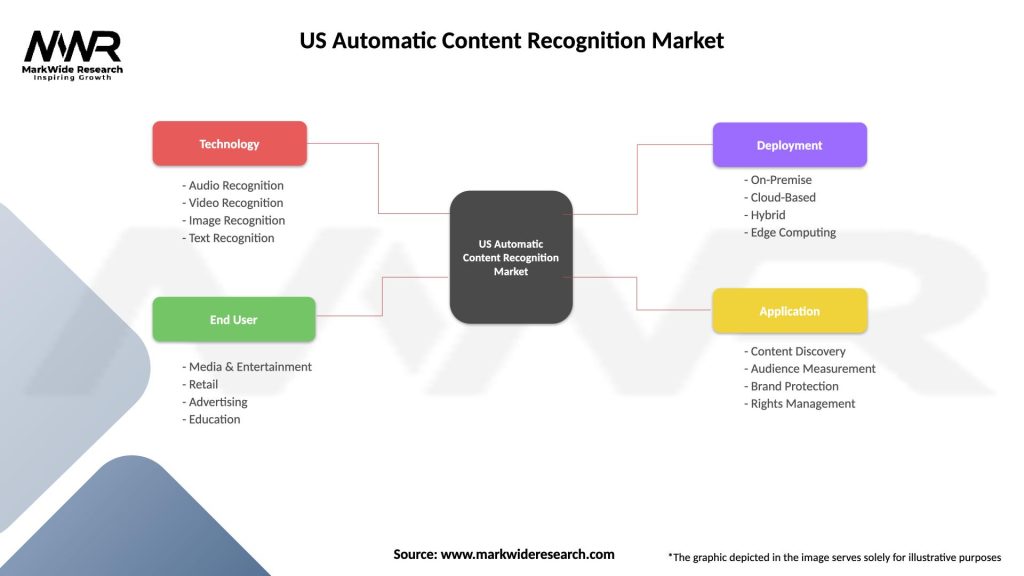

US Automatic Content Recognition Market

| Segmentation Details | Description |

|---|---|

| Technology | Audio Recognition, Video Recognition, Image Recognition, Text Recognition |

| End User | Media & Entertainment, Retail, Advertising, Education |

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

| Application | Content Discovery, Audience Measurement, Brand Protection, Rights Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Automatic Content Recognition Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at