444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US auto loan market represents a fundamental pillar of American consumer finance, facilitating vehicle purchases for millions of consumers across the nation. This dynamic financial sector encompasses traditional banks, credit unions, captive finance companies, and emerging fintech lenders, all competing to provide competitive financing solutions for new and used vehicle purchases. Market dynamics indicate robust growth driven by steady vehicle demand, evolving consumer preferences, and technological innovations in lending processes.

Consumer financing patterns have evolved significantly, with digital lending platforms gaining substantial traction alongside traditional brick-and-mortar institutions. The market demonstrates resilience through economic cycles, supported by the essential nature of vehicle ownership in American society. Interest rate fluctuations and regulatory changes continue to shape lending practices, while competitive pressures drive innovation in loan products and approval processes.

Technology integration has revolutionized the auto lending landscape, enabling faster approvals, enhanced risk assessment, and improved customer experiences. Digital-first lenders are capturing increasing market share, particularly among younger demographics who prefer streamlined online applications and instant decision-making capabilities. The market shows strong growth potential with annual expansion rates consistently outpacing broader financial services sectors.

The US auto loan market refers to the comprehensive ecosystem of financial institutions, lending products, and services that provide credit facilities for vehicle purchases and refinancing across the United States. This market encompasses various lending channels including banks, credit unions, captive finance companies, and alternative lenders, offering diverse loan products tailored to different consumer segments and credit profiles.

Auto loans typically involve secured financing where the purchased vehicle serves as collateral, enabling lenders to offer competitive interest rates compared to unsecured credit products. The market includes both direct lending, where consumers obtain financing directly from lenders, and indirect lending through dealership partnerships. Loan terms generally range from 24 to 84 months, with varying interest rates based on creditworthiness, loan-to-value ratios, and market conditions.

Market participants compete across multiple dimensions including interest rates, loan terms, approval speed, and customer service quality. The sector serves diverse consumer needs from first-time buyers seeking affordable financing to luxury vehicle purchasers requiring specialized loan products. Regulatory oversight ensures consumer protection while maintaining competitive market dynamics that benefit borrowers through improved products and services.

Strategic analysis reveals the US auto loan market maintains strong fundamentals supported by consistent vehicle demand and evolving consumer financing preferences. The sector demonstrates remarkable adaptability, successfully navigating economic uncertainties while embracing technological innovations that enhance operational efficiency and customer satisfaction. Digital transformation initiatives have accelerated market evolution, with online lending platforms capturing approximately 35% market penetration among new loan originations.

Competitive dynamics intensify as traditional lenders face challenges from fintech disruptors offering streamlined application processes and faster approval times. Credit unions continue expanding their market presence, leveraging member-focused service models and competitive rates to attract borrowers. Captive finance companies maintain strong positions through manufacturer partnerships and promotional financing programs that drive vehicle sales.

Market resilience reflects the essential nature of vehicle ownership in American society, with consistent demand supporting steady loan origination volumes. Interest rate sensitivity remains a key factor influencing borrowing costs and lender profitability. Risk management practices have evolved significantly, incorporating advanced analytics and machine learning algorithms to improve credit decisions and reduce default rates by approximately 22% improvement in recent years.

Consumer behavior analysis reveals significant shifts toward digital-first lending experiences, with mobile applications accounting for increasing portions of loan applications. Borrowers demonstrate growing preference for transparent pricing, simplified processes, and rapid decision-making capabilities. Credit accessibility has improved across various consumer segments, supported by enhanced risk assessment technologies and expanded lending criteria.

Economic fundamentals support sustained auto loan market growth, driven by stable employment levels, rising consumer confidence, and continued vehicle replacement cycles. The essential nature of transportation in American society creates consistent demand for vehicle financing, regardless of economic fluctuations. Population growth and demographic shifts toward vehicle ownership among younger generations contribute to expanding borrower bases.

Technological advancement serves as a primary growth catalyst, enabling lenders to streamline operations, reduce processing costs, and improve customer experiences. Digital platforms facilitate faster loan approvals, automated underwriting, and enhanced risk assessment capabilities. Data analytics empowers lenders to make more informed credit decisions while expanding access to previously underserved market segments.

Vehicle market dynamics influence lending demand, with new model introductions, manufacturer incentives, and seasonal sales patterns driving loan origination volumes. The growing popularity of electric and hybrid vehicles creates opportunities for specialized financing products. Used vehicle market expansion provides additional lending opportunities, particularly as vehicle quality and longevity improve, making older vehicles viable collateral for extended loan terms.

Regulatory environment supports market growth through consumer protection measures that enhance borrower confidence while maintaining competitive lending practices. Fair lending regulations ensure equal access to credit, expanding market opportunities across diverse demographic segments. Interest rate policies influence borrowing costs and demand patterns, with accommodative monetary policies generally supporting loan origination growth.

Economic volatility poses significant challenges to auto loan market stability, with recession risks potentially reducing consumer demand for vehicle purchases and increasing default rates. Unemployment fluctuations directly impact borrower ability to service loans, creating credit risk concerns for lenders. Interest rate sensitivity affects both borrowing demand and lender profitability, with rising rates potentially constraining loan origination volumes.

Regulatory compliance costs burden lenders with substantial operational expenses, particularly affecting smaller institutions with limited resources for compliance infrastructure. Evolving regulations require continuous system updates and staff training, diverting resources from growth initiatives. Consumer protection requirements while beneficial for borrowers, increase administrative complexity and processing costs for lenders.

Credit risk management challenges intensify during economic downturns, requiring sophisticated risk assessment tools and conservative lending practices that may limit market expansion. Rising default rates can significantly impact lender profitability and capital adequacy. Competition intensity pressures profit margins as lenders compete aggressively on rates and terms to maintain market share.

Technology infrastructure requirements demand substantial capital investments for digital transformation initiatives, creating barriers for traditional lenders adapting to modern consumer expectations. Cybersecurity concerns and data protection requirements add complexity and costs to technology implementations. Market saturation in certain segments limits growth opportunities, forcing lenders to explore new markets or product innovations.

Digital transformation presents substantial opportunities for lenders to enhance operational efficiency, reduce costs, and improve customer experiences through innovative technology solutions. Mobile-first lending platforms can capture growing segments of tech-savvy consumers seeking convenient financing options. Artificial intelligence and machine learning applications enable more accurate risk assessment and personalized loan products tailored to individual borrower profiles.

Underserved market segments offer significant expansion potential, particularly among younger demographics, immigrants, and consumers with limited credit histories. Alternative credit scoring methods using non-traditional data sources can expand lending opportunities while maintaining acceptable risk levels. Geographic expansion into emerging markets and rural areas provides growth avenues for established lenders.

Electric vehicle financing represents a rapidly growing opportunity as EV adoption accelerates across the United States. Specialized loan products addressing unique EV characteristics, such as battery warranties and charging infrastructure, can differentiate lenders in competitive markets. Green financing initiatives appeal to environmentally conscious consumers while potentially qualifying for favorable regulatory treatment.

Partnership opportunities with automotive manufacturers, dealers, and technology companies can create competitive advantages through integrated financing solutions and enhanced customer experiences. Fintech collaborations enable traditional lenders to leverage innovative technologies without substantial internal development costs. Data partnerships provide valuable insights for improved risk management and customer targeting strategies.

Competitive landscape evolution reflects ongoing shifts between traditional financial institutions and emerging fintech lenders, creating dynamic market conditions that benefit consumers through improved products and services. Established banks leverage their capital strength and regulatory expertise while adapting to digital-first consumer expectations. Credit unions maintain competitive positions through member-focused service models and often favorable lending terms.

Interest rate environment significantly influences market dynamics, affecting both borrowing demand and lender profitability margins. Rate fluctuations create opportunities for refinancing activities while potentially constraining new loan originations during rising rate periods. Monetary policy changes require lenders to adjust pricing strategies and risk management approaches accordingly.

Consumer preferences continue evolving toward digital-first experiences, forcing traditional lenders to invest heavily in technology infrastructure and process automation. Mobile applications and online platforms become essential competitive tools rather than optional enhancements. Speed and convenience increasingly influence borrower decisions, with same-day approvals becoming standard expectations rather than premium services.

Regulatory dynamics shape market evolution through consumer protection measures, fair lending requirements, and capital adequacy standards. Compliance costs influence competitive positioning, particularly affecting smaller lenders with limited resources. Data privacy regulations impact technology implementations and customer data utilization strategies across the industry.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US auto loan market dynamics. Primary research includes extensive surveys of industry participants, consumer interviews, and expert consultations with lending professionals across various market segments. Secondary research incorporates analysis of regulatory filings, industry reports, and economic data from authoritative sources.

Data collection processes utilize both quantitative and qualitative approaches to capture market trends, competitive dynamics, and consumer behavior patterns. Statistical analysis of loan origination data, default rates, and market share information provides quantitative foundations for market assessments. Qualitative insights emerge from stakeholder interviews, focus groups, and industry expert discussions.

Market segmentation analysis examines various lending channels, borrower demographics, and product categories to identify growth opportunities and competitive positioning. Geographic analysis considers regional variations in lending practices, regulatory environments, and consumer preferences. Trend analysis incorporates historical data patterns and forward-looking projections based on identified market drivers and constraints.

Validation procedures ensure research accuracy through cross-referencing multiple data sources, expert review processes, and statistical verification methods. Market projections undergo sensitivity analysis to account for various economic scenarios and regulatory changes. Continuous monitoring of market developments enables real-time updates to research findings and recommendations.

Geographic distribution of auto loan market activity reflects regional economic conditions, population density, and vehicle ownership patterns across the United States. The Northeast region demonstrates strong market activity driven by high population density and established financial services infrastructure, accounting for approximately 28% regional market share. Urban centers in this region show particular strength in digital lending adoption and competitive rate environments.

Southeast markets exhibit robust growth potential supported by population migration, economic development, and expanding automotive manufacturing presence. States like Florida, Texas, and North Carolina show strong loan origination volumes and competitive lending environments. Credit union penetration remains particularly strong in southeastern markets, providing competitive alternatives to traditional banking institutions.

Western region dynamics reflect diverse economic conditions ranging from technology-driven markets in California to resource-based economies in mountain states. California’s large population and high vehicle costs create substantial lending opportunities, while environmental consciousness drives electric vehicle financing demand. Pacific Northwest markets demonstrate strong adoption of digital lending platforms and sustainable financing products.

Midwest characteristics include strong manufacturing presence, stable employment patterns, and conservative lending practices that support consistent market performance. Agricultural regions within the Midwest show seasonal lending patterns aligned with farming cycles and equipment financing needs. Regional banks and credit unions maintain strong market positions through community-focused service models and competitive pricing strategies.

Market leadership remains distributed among various lender categories, with no single institution dominating the entire market. Traditional banks maintain substantial market presence through extensive branch networks and established customer relationships, while adapting to digital transformation requirements. Major players continue investing heavily in technology infrastructure to compete effectively with fintech challengers.

Competitive strategies increasingly emphasize digital capabilities, customer experience enhancement, and operational efficiency improvements. Lenders differentiate through specialized products, competitive pricing, and superior service delivery. Technology investments become essential for maintaining competitive positions in rapidly evolving market conditions.

Market segmentation analysis reveals diverse lending channels serving different consumer needs and preferences across the US auto loan market. Traditional segmentation approaches consider lender types, borrower demographics, vehicle categories, and loan characteristics to identify distinct market opportunities and competitive dynamics.

By Lender Type:

By Credit Segment:

By Vehicle Type:

New vehicle financing represents the premium segment of the auto loan market, characterized by competitive interest rates, extended warranty coverage, and manufacturer promotional programs. Lenders compete aggressively for new vehicle loans due to lower risk profiles and stronger collateral values. Captive finance companies maintain significant advantages through manufacturer partnerships and promotional rate programs that support vehicle sales objectives.

Used vehicle lending demonstrates substantial growth potential as vehicle quality improvements enable longer loan terms and broader credit accessibility. This segment requires sophisticated valuation capabilities and risk assessment tools to manage collateral depreciation risks. Market expansion in used vehicle lending reflects growing consumer acceptance of pre-owned vehicles and improved financing options.

Electric vehicle financing emerges as a high-growth category driven by environmental consciousness, government incentives, and expanding model availability. Specialized loan products address unique EV characteristics including battery warranties, charging infrastructure, and resale value considerations. Green financing programs attract environmentally conscious consumers while potentially qualifying for favorable regulatory treatment.

Subprime lending requires specialized expertise in risk management, collections, and regulatory compliance while serving important market segments with limited credit access. Technology improvements enable better risk assessment and automated decision-making in subprime segments. Regulatory scrutiny remains high in subprime lending, requiring careful compliance management and fair lending practices.

Lenders benefit from diversified revenue streams, stable collateralized lending products, and opportunities for customer relationship expansion through auto loan products. The secured nature of auto loans provides favorable risk-adjusted returns compared to unsecured credit products. Technology investments enable operational efficiency improvements and enhanced customer experiences that drive competitive advantages.

Consumers gain access to competitive financing options that enable vehicle ownership and mobility solutions essential for employment and daily life activities. Digital lending platforms provide convenient application processes and faster approval times that improve borrower experiences. Rate competition among lenders results in favorable borrowing costs and flexible loan terms for qualified borrowers.

Automotive dealers benefit from financing partnerships that facilitate vehicle sales and customer satisfaction through integrated purchase experiences. Dealer financing programs enable sales to customers who might otherwise lack adequate financing options. Technology integration streamlines the sales process and improves customer satisfaction through efficient financing arrangements.

Economic stakeholders benefit from auto loan market activity that supports vehicle manufacturing, dealership operations, and related service industries. Consumer mobility enabled by vehicle financing supports employment opportunities and economic productivity. Financial system stability benefits from diversified lending portfolios that include secured auto loan products with favorable risk characteristics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping the auto loan market as lenders invest heavily in mobile applications, online platforms, and automated underwriting systems. Consumer expectations for instant approvals and seamless digital experiences drive technology adoption across all lender categories. Artificial intelligence and machine learning applications enhance risk assessment accuracy while reducing processing times significantly.

Extended loan terms become increasingly common as lenders accommodate consumer preferences for lower monthly payments despite higher total interest costs. Average loan terms now frequently exceed 60 months, with 72-month and 84-month loans gaining market acceptance. Risk management practices evolve to address longer-term credit exposure and collateral depreciation concerns associated with extended terms.

Electric vehicle financing gains momentum as EV adoption accelerates and manufacturers expand model offerings across various price segments. Specialized loan products address unique EV characteristics while government incentives support market growth. Green financing initiatives appeal to environmentally conscious consumers and may qualify for favorable regulatory treatment in the future.

Alternative credit scoring methods incorporate non-traditional data sources to expand lending opportunities for consumers with limited credit histories. Bank account data, utility payments, and rental history provide additional insights for risk assessment. Financial inclusion initiatives supported by alternative scoring methods help address underserved market segments while maintaining acceptable risk levels.

Regulatory evolution continues shaping industry practices through enhanced consumer protection measures and fair lending requirements. Recent regulatory guidance emphasizes responsible lending practices, particularly in subprime segments, while supporting market competition and innovation. Data privacy regulations impact technology implementations and customer data utilization strategies across the industry.

Technology partnerships between traditional lenders and fintech companies accelerate digital transformation initiatives while leveraging specialized expertise. These collaborations enable established institutions to adopt innovative technologies without extensive internal development costs. API integration facilitates seamless data sharing and process automation across lending ecosystems.

Manufacturer financing programs evolve to support electric vehicle adoption through specialized incentives and promotional rates. Captive finance companies develop expertise in EV residual value assessment and battery warranty considerations. Sustainability initiatives influence lending practices as environmental considerations become increasingly important to consumers and regulators.

Market consolidation activities continue as larger institutions acquire specialized lenders to expand market presence and capabilities. These transactions enable scale economies and technology sharing while potentially reducing competition in certain market segments. Strategic partnerships provide alternative approaches to market expansion without full acquisition requirements.

Technology investment priorities should focus on customer-facing applications that enhance user experiences while improving operational efficiency through automation. Lenders must balance technology spending with regulatory compliance requirements and risk management capabilities. Digital transformation initiatives require careful planning and execution to avoid disrupting existing customer relationships and operational processes.

Risk management enhancement becomes increasingly important as loan terms extend and market competition intensifies. Advanced analytics and machine learning applications can improve credit decision accuracy while expanding lending opportunities responsibly. Portfolio diversification across credit segments and geographic regions helps mitigate concentration risks and economic cyclicality impacts.

Partnership strategies should consider collaborations with automotive manufacturers, dealers, and technology companies to create competitive advantages and expand market reach. Strategic alliances can provide access to specialized expertise and customer segments without substantial internal investments. Data partnerships offer valuable insights for improved risk assessment and customer targeting capabilities.

Market positioning requires clear differentiation strategies based on customer service, technology capabilities, or specialized product offerings. Lenders should identify target customer segments and develop tailored value propositions that address specific needs and preferences. Brand development becomes increasingly important as digital channels reduce personal relationship advantages traditionally held by community-based lenders.

Market growth prospects remain favorable supported by consistent vehicle replacement cycles, population growth, and evolving consumer financing preferences. MarkWide Research analysis indicates the sector will continue expanding with projected growth rates of 6.2% annually over the next five years. Digital lending platforms are expected to capture increasing market share as consumer preferences shift toward convenient online experiences.

Technology evolution will continue transforming industry practices through artificial intelligence, blockchain applications, and enhanced data analytics capabilities. Automated underwriting systems will become more sophisticated while maintaining human oversight for complex credit decisions. Mobile-first approaches will become standard rather than competitive advantages as consumer expectations evolve.

Electric vehicle financing represents a significant growth opportunity as EV adoption accelerates and charging infrastructure expands nationwide. Specialized loan products addressing unique EV characteristics will become increasingly important for competitive positioning. Government incentives and environmental regulations will continue supporting EV market growth and related financing demand.

Regulatory environment will likely emphasize consumer protection, fair lending practices, and data privacy requirements while supporting market innovation and competition. Lenders must balance compliance requirements with operational efficiency and competitive positioning objectives. Industry consolidation may continue as scale economies become increasingly important for technology investments and regulatory compliance capabilities.

The US auto loan market demonstrates remarkable resilience and adaptability, successfully navigating economic uncertainties while embracing technological innovations that enhance customer experiences and operational efficiency. Market dynamics reflect the essential nature of vehicle ownership in American society, creating consistent demand for financing solutions across diverse consumer segments and economic conditions.

Digital transformation continues reshaping competitive landscapes as traditional lenders adapt to evolving consumer expectations while fintech challengers introduce innovative approaches to lending processes. The sector benefits from secured lending characteristics that provide favorable risk profiles compared to unsecured credit products, supporting stable returns and portfolio performance through various economic cycles.

Future success will depend on lenders’ ability to balance technology investments with risk management capabilities while maintaining competitive positioning in increasingly dynamic market conditions. Electric vehicle financing, alternative credit scoring, and digital customer experiences represent key growth opportunities for forward-thinking institutions. Strategic partnerships and operational excellence will become increasingly important differentiators as market competition intensifies and consumer expectations continue evolving toward seamless, technology-enabled financing solutions.

What is Auto Loan?

An auto loan is a type of financing that allows consumers to purchase vehicles by borrowing money from a lender, which is then paid back over time with interest. This financing option is commonly used for both new and used cars, making vehicle ownership more accessible to a wider range of consumers.

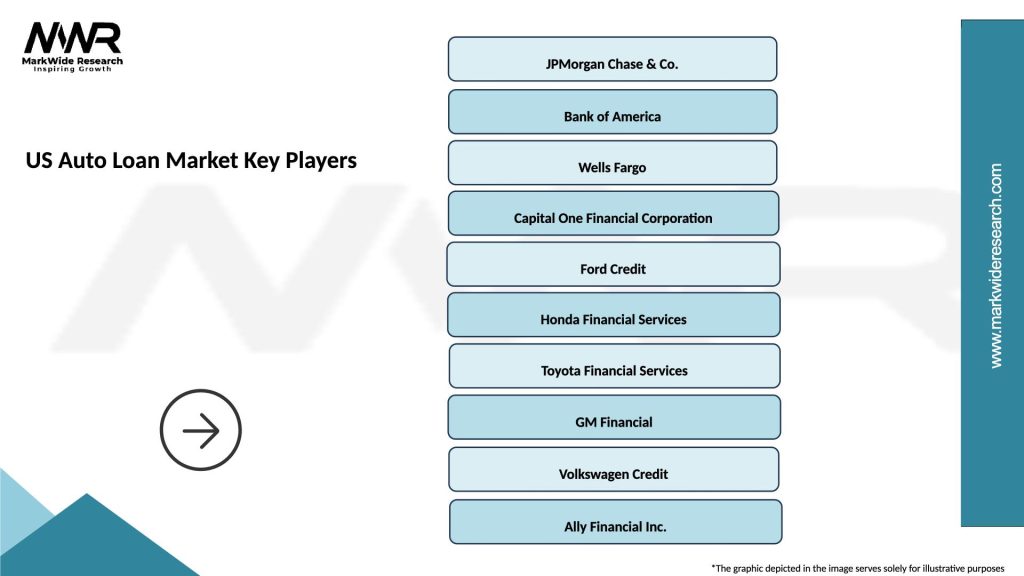

What are the key players in the US Auto Loan Market?

Key players in the US Auto Loan Market include major banks like JPMorgan Chase and Bank of America, as well as specialized auto finance companies such as Toyota Financial Services and Ford Credit. These companies provide various financing options to consumers and dealerships, among others.

What are the growth factors driving the US Auto Loan Market?

The US Auto Loan Market is driven by factors such as increasing vehicle sales, favorable interest rates, and a growing preference for financing options among consumers. Additionally, the rise of online lending platforms has made it easier for consumers to access auto loans.

What challenges does the US Auto Loan Market face?

Challenges in the US Auto Loan Market include rising interest rates, which can deter potential borrowers, and increasing vehicle prices that may lead to higher loan amounts. Additionally, economic uncertainties can impact consumer confidence and borrowing behavior.

What opportunities exist in the US Auto Loan Market?

Opportunities in the US Auto Loan Market include the expansion of electric vehicle financing options and the integration of technology in the loan application process. As consumers become more environmentally conscious, lenders may develop tailored products for electric and hybrid vehicles.

What trends are shaping the US Auto Loan Market?

Trends in the US Auto Loan Market include the increasing use of digital platforms for loan applications and approvals, as well as a shift towards longer loan terms. Additionally, there is a growing focus on providing personalized financing solutions to meet diverse consumer needs.

US Auto Loan Market

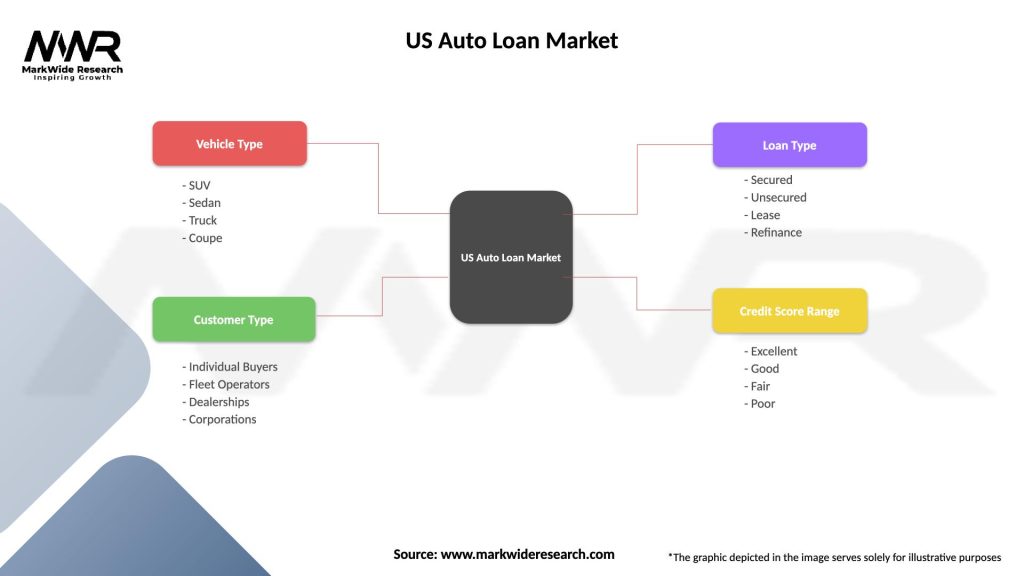

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Truck, Coupe |

| Customer Type | Individual Buyers, Fleet Operators, Dealerships, Corporations |

| Loan Type | Secured, Unsecured, Lease, Refinance |

| Credit Score Range | Excellent, Good, Fair, Poor |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Auto Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at