444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Within the intricate landscape of the United States financial sector, the Auditing Services market emerges as a pivotal and indispensable segment. Auditing services play a critical role in ensuring financial transparency, regulatory compliance, and maintaining the trust of stakeholders. This comprehensive exploration delves into the key facets shaping the US Auditing Services Market, providing insights into its significance, dynamics, competitive landscape, trends, and future prospects.

Meaning

The US Auditing Services Market encompasses a range of professional services aimed at independently examining financial records, processes, and controls of organizations. These services are vital for verifying the accuracy of financial statements, detecting fraud, assessing risks, and ensuring compliance with applicable regulations. Auditing services cater to various industries, including corporate entities, government agencies, nonprofit organizations, and more. They instill confidence among investors, lenders, and other stakeholders, contributing to the overall stability and credibility of the financial system.

Executive Summary

The US Auditing Services Market stands as a crucial pillar supporting the integrity of the country’s financial framework. With the increasing emphasis on accountability, transparency, and adherence to regulatory standards, auditing services have become indispensable. This executive summary encapsulates the essential insights derived from a comprehensive analysis, offering a glimpse into the market’s driving forces, challenges, opportunities, and the path ahead.

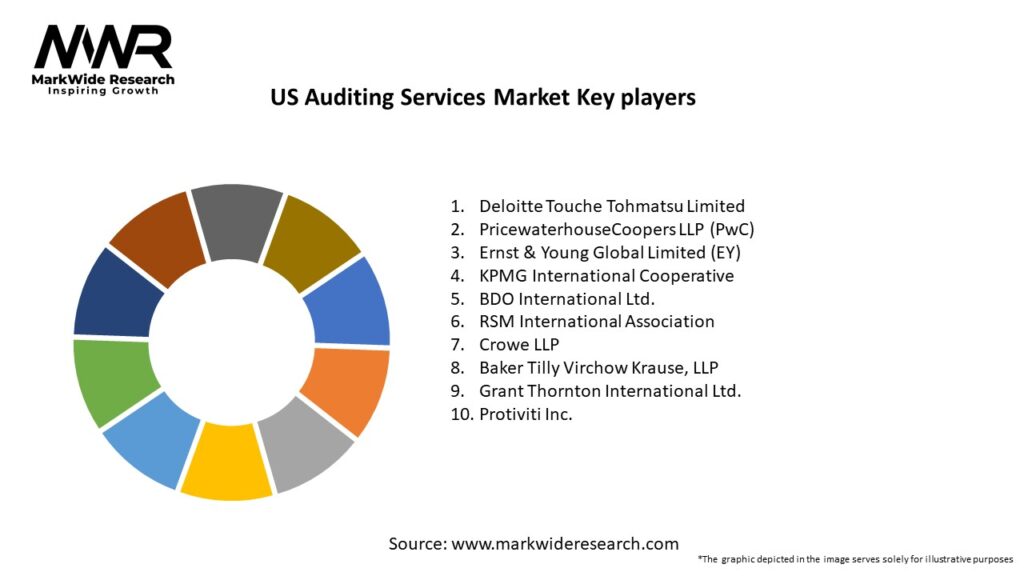

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the US Auditing Services Market:

Increased Regulatory Scrutiny: The tightening of regulations in the financial sector, including compliance with Sarbanes-Oxley Act and Dodd-Frank Act, is leading companies to invest in auditing services to avoid penalties and ensure legal compliance.

Complex Business Environments: As businesses grow in scale and complexity, the demand for external audits to assess financial accuracy and internal controls has increased, especially among large enterprises.

Rising Focus on Corporate Governance: Increased attention on corporate governance and accountability, particularly after high-profile financial scandals, has led to a surge in demand for auditing services aimed at enhancing transparency and minimizing fraud risks.

Adoption of Technology in Auditing: The integration of AI, machine learning, and data analytics in auditing processes is transforming the industry, making audits more efficient and cost-effective while enhancing the ability to detect financial anomalies.

Economic Recovery and Growth: As the US economy recovers from the pandemic and businesses resume their operations, there is an increased demand for auditing services, particularly for financial reporting, risk management, and compliance.

Market Restraints

Despite the growth, the US Auditing Services Market faces several challenges:

Rising Competition Among Audit Firms: The competitive landscape of the auditing industry is becoming more intense, particularly with the dominance of large audit firms like the Big Four (Deloitte, PwC, EY, and KPMG), which may limit opportunities for smaller firms.

High Cost of Auditing Services: The cost of comprehensive auditing services, especially for complex audits and specialized services, can be prohibitively high for small and medium-sized businesses (SMBs), limiting market growth among this segment.

Changing Regulations and Standards: Continuous changes in accounting standards and auditing regulations can create uncertainty and require frequent adjustments in auditing practices, making it challenging for audit firms to stay ahead.

Shortage of Skilled Auditors: The demand for skilled auditors, particularly those with expertise in IT, cybersecurity, and forensic accounting, exceeds supply, creating a talent gap in the industry and making it difficult for firms to meet client demands.

Market Opportunities

The US Auditing Services Market presents several growth opportunities:

Expansion of Non-Traditional Audits: The increasing reliance on IT systems, along with growing concerns about cybersecurity, fraud prevention, and financial crimes, presents significant opportunities for auditing firms to expand their services into IT audits, forensic audits, and cyber risk assessments.

Cloud-Based Auditing Services: The rise of cloud computing offers opportunities for auditing firms to provide cloud-based auditing services, improving efficiency and reducing costs for clients. These services also provide the benefit of real-time audits and data accessibility.

Sustainability Audits: The growing focus on sustainability and corporate social responsibility (CSR) offers a new area of growth. Companies are seeking audits to assess their environmental impact, carbon footprint, and adherence to sustainability practices.

Focus on SMBs: While large corporations dominate the market, there is an opportunity for auditing firms to offer specialized, cost-effective services tailored to small and medium-sized businesses (SMBs) that may not have the resources to hire large firms.

Adoption of Artificial Intelligence (AI) and Automation: The continued integration of AI and automation in auditing processes provides firms with the opportunity to streamline operations, enhance accuracy, and reduce costs, making auditing more accessible and efficient for businesses of all sizes.

Market Dynamics

The US Auditing Services market is influenced by several key dynamics:

Technological Disruption: Innovations in AI, blockchain, and automation are transforming auditing services, enabling auditors to conduct more efficient and data-driven audits while uncovering insights faster than traditional methods.

Corporate Governance: With an increased focus on corporate governance, stakeholders such as investors, regulators, and board members are placing greater importance on transparent and accurate audits, ensuring that companies are compliant and free from fraudulent activities.

Regulatory Changes: Constantly evolving regulations require audit firms to stay updated on new standards and compliance requirements. This creates demand for audit services that help businesses adhere to changing rules and mitigate risks.

Globalization of Business: As US businesses expand globally, there is a growing need for audits that address international financial reporting standards (IFRS) and multi-jurisdictional regulatory compliance. This increases the demand for auditing firms with global capabilities.

Regional Analysis

The US Auditing Services Market is highly concentrated in certain regions, with significant demand in areas where industries such as finance, technology, healthcare, and manufacturing are prevalent:

Northeast and West Coast: The major financial hubs such as New York, Boston, and San Francisco drive the demand for auditing services due to the high concentration of large corporations, financial institutions, and tech companies.

Midwest: The manufacturing sector in states like Michigan, Ohio, and Illinois presents strong demand for auditing services, particularly in areas such as compliance audits, financial reporting, and risk management.

South and Southeast: States like Texas, Florida, and Georgia are seeing growth in auditing demand due to the expansion of industries like healthcare, energy, and retail.

Competitive Landscape

Leading Companies in US Auditing Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The US Auditing Services Market can be segmented based on the following:

By Type: External Audits, Internal Audits, IT Audits, Forensic Audits, Sustainability Audits, Others.

By End-User Industry: Financial Services, Healthcare, Automotive, Technology, Manufacturing, Retail, Energy, Others.

By Service Provider: Big Four Firms (Deloitte, PwC, EY, KPMG), Mid-Tier Firms, Small Firms.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The US Auditing Services market offers several benefits for stakeholders:

Regulatory Compliance: Auditing services help businesses adhere to regulatory standards, mitigating risks related to non-compliance.

Financial Transparency: Audits provide investors, stakeholders, and regulators with confidence in the accuracy and transparency of financial reporting.

Risk Mitigation: Auditors identify potential risks in business processes and financial management, helping organizations improve their internal controls and reduce fraud.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic significantly impacted the US Auditing Services Market. Travel restrictions and remote work posed challenges to traditional audit practices. However, the crisis underscored the resilience of audit firms, prompting innovations in remote auditing and digital document verification. The pandemic reinforced the need for nimbleness and adaptability, as audits continued remotely while addressing emerging financial risks.

Key Industry Developments

Key developments in the US Auditing Services Market reflect the industry’s response to emerging trends and challenges. The integration of artificial intelligence and machine learning into audit procedures is enhancing risk assessment and fraud detection. Firms are also expanding their service offerings to provide cybersecurity assessments, aligning with the digital transformation of businesses. The push towards standardizing ESG reporting further extends the role of auditors in evaluating non-financial performance.

Analyst Suggestions

Industry analysts suggest that participants in the US Auditing Services Market focus on maintaining ethical practices, transparency, and professional skepticism. Embracing technology-driven solutions ensures competitiveness and relevance. As remote work becomes a norm, investing in secure virtual audit platforms can streamline assessments. Moreover, building cross-industry expertise and understanding emerging compliance regulations position auditing firms for future success.

Future Outlook

The future of the US Auditing Services Market is marked by transformative shifts. Technology will continue to reshape audit methodologies, driving efficiency and accuracy. The integration of ESG considerations into auditing will contribute to holistic risk assessment. As regulatory complexities increase, auditing firms that offer advisory and consulting services alongside traditional audits will cater to evolving client needs. The market’s evolution is intertwined with the changing landscape of corporate governance and societal expectations.

Conclusion

In conclusion, the US Auditing Services Market plays a pivotal role in fostering financial integrity, transparency, and accountability. As businesses navigate complex regulatory environments and stakeholder expectations, auditing services stand as a beacon of trust. While challenges such as technological disruptions and ethical concerns persist, opportunities for innovation and growth abound. By embracing innovation, staying attuned to industry trends, and upholding unwavering professionalism, industry participants can guide the US Auditing Services Market toward a resilient and prosperous future.

What is Auditing Services?

Auditing services involve the independent examination of financial information of any entity, whether profit-oriented or not, irrespective of its size. These services ensure accuracy and compliance with established standards and regulations.

What are the key players in the US Auditing Services Market?

Key players in the US Auditing Services Market include Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), and KPMG, among others. These firms provide a range of auditing services to various sectors, including healthcare, finance, and manufacturing.

What are the growth factors driving the US Auditing Services Market?

The growth of the US Auditing Services Market is driven by increasing regulatory requirements, the need for transparency in financial reporting, and the rising complexity of business operations. Additionally, the demand for risk management and compliance services is also contributing to market expansion.

What challenges does the US Auditing Services Market face?

The US Auditing Services Market faces challenges such as the increasing competition among firms, the need for continuous adaptation to regulatory changes, and the pressure to maintain audit quality while managing costs. These factors can impact the overall effectiveness of auditing services.

What opportunities exist in the US Auditing Services Market?

Opportunities in the US Auditing Services Market include the growing demand for digital auditing solutions, the integration of advanced technologies like AI and data analytics, and the expansion of services into emerging sectors. Firms can leverage these trends to enhance their service offerings.

What trends are shaping the US Auditing Services Market?

Trends shaping the US Auditing Services Market include the increasing use of technology in auditing processes, a focus on sustainability and ESG reporting, and the rise of remote auditing practices. These trends are transforming how audits are conducted and reported.

US Auditing Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Internal Audit, External Audit, Compliance Audit, Financial Audit |

| Industry Vertical | Healthcare, Manufacturing, Retail, Technology |

| Client Type | Public Companies, Private Companies, Non-Profits, Government Agencies |

| Engagement Type | Annual Audit, Interim Audit, Forensic Audit, Special Purpose Audit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in US Auditing Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at