444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US animation, VFX and post production market represents a dynamic and rapidly evolving sector that has become integral to modern entertainment, advertising, and digital media industries. This comprehensive market encompasses traditional animation studios, cutting-edge visual effects companies, and sophisticated post-production facilities that serve diverse content creators across film, television, streaming platforms, gaming, and advertising sectors.

Market dynamics indicate robust growth driven by increasing demand for high-quality visual content across multiple platforms. The proliferation of streaming services, expansion of gaming industries, and growing adoption of virtual and augmented reality technologies have created unprecedented opportunities for animation and VFX professionals. Industry analysis reveals that the market is experiencing a compound annual growth rate of 8.2%, reflecting strong consumer appetite for visually compelling content.

Technological advancement continues to reshape the landscape, with artificial intelligence, machine learning, and cloud-based rendering solutions transforming traditional workflows. Major studios and independent creators alike are leveraging these innovations to enhance production efficiency while maintaining creative excellence. The integration of real-time rendering engines and virtual production techniques has revolutionized how content is conceptualized, created, and delivered to audiences.

Geographic distribution shows concentrated activity in key entertainment hubs including Los Angeles, New York, Atlanta, and emerging markets in Texas and North Carolina. This distribution reflects both traditional industry centers and new tax incentive-driven locations that attract production investments.

The US animation, VFX and post production market refers to the comprehensive ecosystem of companies, technologies, and services involved in creating, enhancing, and finalizing visual content for entertainment, advertising, and digital media applications. This market encompasses traditional hand-drawn animation, computer-generated imagery, visual effects integration, color correction, sound design, and final content assembly processes.

Animation services include 2D traditional animation, 3D computer animation, motion graphics, and emerging technologies like volumetric capture and procedural animation. Visual effects encompass compositing, digital environments, character animation, particle systems, and photorealistic rendering that seamlessly blend practical and digital elements.

Post production activities involve editing, color grading, audio mixing, visual effects integration, and final delivery preparation across multiple formats and platforms. This sector serves diverse clients including major film studios, television networks, streaming platforms, advertising agencies, gaming companies, and corporate communications departments.

Strategic analysis of the US animation, VFX and post production market reveals a sector experiencing unprecedented growth and transformation. The convergence of technological innovation, content demand explosion, and evolving consumer preferences has created a robust ecosystem supporting diverse creative and commercial applications.

Key growth drivers include the expansion of streaming platforms requiring original content, increased gaming industry investments, growing adoption of immersive technologies, and rising demand for high-quality advertising content. The market benefits from 65% of content creators reporting increased budgets for visual effects and animation services compared to previous years.

Technological disruption continues reshaping industry workflows, with cloud-based rendering, artificial intelligence-assisted animation, and real-time production techniques becoming standard practices. These innovations enable smaller studios to compete with established players while improving overall production efficiency and creative possibilities.

Competitive landscape features a mix of established entertainment giants, specialized boutique studios, and emerging technology-focused companies. This diversity creates opportunities for collaboration, specialization, and innovation across different market segments and client requirements.

Market intelligence reveals several critical insights shaping the US animation, VFX and post production landscape:

Primary market drivers propelling growth in the US animation, VFX and post production sector stem from fundamental shifts in content consumption patterns and technological capabilities. The proliferation of streaming platforms has created insatiable demand for original, high-quality visual content that differentiates services in an increasingly competitive landscape.

Gaming industry expansion represents another significant driver, with mobile gaming, console gaming, and emerging cloud gaming platforms requiring sophisticated animation and visual effects. The integration of cinematic storytelling techniques in gaming has elevated production values and created new opportunities for animation and VFX specialists.

Advertising evolution toward digital-first strategies has increased demand for animated and VFX-enhanced content across social media, web platforms, and interactive experiences. Brands recognize that compelling visual content drives engagement and conversion rates, leading to increased investment in professional animation and post-production services.

Technological accessibility has democratized content creation, enabling smaller studios and independent creators to produce professional-quality work. Cloud-based rendering, subscription software models, and powerful consumer hardware have lowered barriers to entry while maintaining high production standards.

Educational and corporate applications continue expanding, with organizations recognizing animation and VFX as effective tools for training, marketing, and communication. This diversification beyond traditional entertainment applications provides stable revenue streams and growth opportunities.

Significant challenges facing the US animation, VFX and post production market include talent shortages, technological complexity, and intense competitive pressures. The rapid industry growth has outpaced talent development, creating skills gaps in specialized areas like technical animation, pipeline development, and advanced compositing.

Cost pressures from clients seeking higher quality at lower prices challenge studio profitability and sustainability. The commoditization of basic services has forced companies to differentiate through specialization, innovation, or scale, creating pressure on smaller operators.

Technology investment requirements continue escalating as hardware, software, and infrastructure costs increase. Studios must balance investment in cutting-edge technology with maintaining competitive pricing and profitability margins.

Project timeline compression has become standard industry practice, with clients expecting faster turnaround times without quality compromises. This pressure affects workforce well-being, quality control processes, and long-term sustainability of creative practices.

Intellectual property complexities and rights management challenges create legal and operational hurdles, particularly for projects involving multiple stakeholders, international collaborations, and emerging technology applications.

Emerging opportunities in the US animation, VFX and post production market span multiple technological and application frontiers. Virtual and augmented reality content creation represents a rapidly expanding segment requiring specialized animation and VFX expertise for immersive experiences.

Artificial intelligence integration offers opportunities for studios to develop proprietary tools and workflows that enhance productivity while maintaining creative control. Companies investing in AI-assisted animation, automated rotoscoping, and intelligent compositing are positioning themselves for competitive advantages.

International collaboration opportunities continue expanding as global content demand grows and remote work technologies mature. US studios can leverage their expertise and reputation to serve international clients while accessing global talent pools.

Educational technology applications present substantial growth potential as institutions and corporations invest in immersive learning experiences. Animation and VFX techniques enhance educational content effectiveness and engagement across diverse subject areas.

Sustainability initiatives create opportunities for studios developing environmentally conscious production practices, energy-efficient workflows, and carbon-neutral rendering solutions that appeal to environmentally aware clients and stakeholders.

Complex market dynamics shape the US animation, VFX and post production landscape through interconnected technological, economic, and creative forces. The relationship between content creators, technology providers, and end consumers creates a dynamic ecosystem where innovation drives demand and demand stimulates further innovation.

Supply chain evolution has transformed from localized studio operations to global, distributed production networks. This shift enables cost optimization, talent access, and around-the-clock production cycles while creating new management and quality control challenges.

Client relationship dynamics have evolved toward longer-term partnerships and integrated service models. Studios increasingly serve as creative and technical consultants throughout project lifecycles rather than simply executing predetermined specifications.

Technology adoption cycles continue accelerating, with new tools and techniques emerging regularly. Studios must balance investment in proven technologies with experimentation in emerging solutions that may provide competitive advantages.

Workforce dynamics reflect changing expectations around remote work, work-life balance, and career development. Companies adapting to these preferences while maintaining collaborative creative cultures are better positioned for talent retention and attraction.

Comprehensive research methodology employed in analyzing the US animation, VFX and post production market combines quantitative data analysis with qualitative industry insights. Primary research includes extensive interviews with industry executives, creative professionals, technology providers, and client organizations across diverse market segments.

Data collection processes encompass financial analysis of publicly traded companies, private company performance indicators, industry association reports, and government economic data. This multi-source approach ensures comprehensive market understanding and validation of key findings.

Market segmentation analysis examines performance across different service categories, client types, geographic regions, and technology platforms. This granular approach reveals specific growth patterns, competitive dynamics, and opportunity areas within the broader market context.

Trend identification utilizes both historical data analysis and forward-looking indicator assessment. Technology adoption patterns, consumer behavior shifts, and regulatory changes are evaluated for their potential market impact and timing.

Validation procedures include cross-referencing multiple data sources, expert review processes, and market participant feedback to ensure accuracy and relevance of research conclusions and projections.

Geographic distribution of the US animation, VFX and post production market reveals concentrated activity in established entertainment centers while emerging markets gain prominence. California maintains the largest market share at 42% of total industry activity, driven by Hollywood’s continued dominance and Silicon Valley’s technology innovation.

Los Angeles region remains the primary hub for high-budget film and television production, hosting major studios, specialized VFX houses, and post-production facilities. The concentration of talent, infrastructure, and client relationships sustains this region’s market leadership despite cost pressures.

New York market represents approximately 18% of national activity, focusing on advertising, television production, and digital content creation. The region’s strength in financial services, fashion, and media industries creates steady demand for animation and VFX services.

Atlanta’s emergence as a production center has driven significant growth in animation and post-production services, with 12% market share reflecting tax incentive success and infrastructure development. The region attracts both established companies and new market entrants seeking cost-effective operations.

Secondary markets including Austin, Seattle, Chicago, and North Carolina continue developing specialized capabilities and attracting investment. These regions offer cost advantages, talent availability, and supportive business environments that appeal to both clients and service providers.

Competitive dynamics in the US animation, VFX and post production market feature a diverse ecosystem of established entertainment giants, specialized boutique studios, and emerging technology-focused companies. This multi-tiered structure creates opportunities for collaboration, competition, and specialization across different market segments.

Major market participants include:

Competitive strategies vary significantly across market segments, with larger studios leveraging scale and established relationships while smaller companies compete through specialization, agility, and innovative approaches to client service and creative solutions.

Market segmentation of the US animation, VFX and post production industry reveals distinct categories based on service type, client industry, and technology platform. This segmentation enables targeted analysis of growth patterns, competitive dynamics, and opportunity identification.

By Service Type:

By Client Industry:

Animation services demonstrate strong growth across both traditional and emerging applications. 2D animation experiences renewed interest driven by streaming platform demand for diverse visual styles and cost-effective content production. 3D animation dominance continues in film and gaming sectors, with technological advances enabling more sophisticated character animation and environmental design.

Visual effects integration has become standard practice across content categories, with even low-budget productions incorporating VFX elements. The democratization of VFX tools has expanded market participation while raising quality expectations across all budget levels.

Motion graphics applications show particularly strong growth in digital marketing and corporate communications. The rise of social media content and short-form video has created sustained demand for animated graphic design services that capture audience attention in crowded digital environments.

Post production services continue evolving toward integrated workflows that combine traditional editing with advanced color science, audio design, and delivery optimization. The proliferation of viewing platforms requires sophisticated technical expertise to ensure content quality across diverse playback environments.

Emerging categories including virtual production, volumetric capture, and AI-assisted animation represent high-growth segments attracting significant investment and innovation. These technologies are reshaping traditional production workflows and creating new service opportunities.

Content creators benefit from access to sophisticated animation and VFX capabilities that enhance storytelling effectiveness and audience engagement. Professional services enable creators to realize ambitious creative visions while maintaining production schedules and budget constraints.

Technology advancement provides studios with competitive advantages through improved efficiency, quality, and creative possibilities. Investment in cutting-edge tools and techniques enables differentiation in a competitive marketplace while attracting high-value projects and clients.

Economic impact extends beyond direct industry participants to include equipment manufacturers, software developers, educational institutions, and supporting service providers. The industry’s growth creates employment opportunities and drives innovation across related technology sectors.

Creative professionals enjoy expanded career opportunities, skill development pathways, and creative fulfillment through work on diverse, challenging projects. The industry’s growth supports specialized career tracks and entrepreneurial opportunities for talented individuals.

End consumers benefit from higher quality entertainment, more engaging advertising content, and innovative interactive experiences. The industry’s advancement directly contributes to improved media consumption experiences across all platforms and applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Real-time production techniques are revolutionizing traditional animation and VFX workflows by enabling immediate visualization and iteration during content creation. This trend reduces post-production timelines while improving creative collaboration between directors, artists, and technical teams.

Cloud-based rendering adoption continues accelerating as studios seek scalable, cost-effective solutions for compute-intensive tasks. This trend enables smaller studios to access enterprise-level capabilities while providing flexibility for project-based resource scaling.

Artificial intelligence integration spans multiple applications including automated rotoscoping, intelligent compositing, and procedural animation generation. Studios implementing AI tools report productivity improvements of 35% while maintaining creative control over final outputs.

Sustainable production practices gain prominence as environmental consciousness influences client preferences and corporate responsibility initiatives. Studios adopting green rendering, energy-efficient workflows, and carbon offset programs attract environmentally aware clients and talent.

Remote collaboration has become standard practice, with distributed teams working seamlessly across geographic boundaries. This trend expands talent access while reducing overhead costs and improving work-life balance for creative professionals.

Cross-platform content optimization addresses the need for content that performs effectively across diverse viewing environments, from large screens to mobile devices. This trend requires sophisticated technical expertise and quality control processes.

Major studio acquisitions continue reshaping the competitive landscape as companies seek to expand capabilities, access talent, and achieve operational scale. Recent consolidation activity reflects strategic positioning for growth in streaming and digital content markets.

Technology partnerships between animation studios and software developers are accelerating innovation in production tools and workflows. These collaborations result in specialized solutions that address specific industry challenges and creative requirements.

Educational initiatives expand as industry leaders partner with universities and training institutions to address talent development needs. These programs combine theoretical knowledge with practical, industry-relevant skills development.

International expansion strategies include both market development and production facility establishment in key global regions. US companies leverage their expertise and reputation to serve international clients while accessing diverse talent pools and cost structures.

Sustainability commitments from major studios include carbon neutrality goals, renewable energy adoption, and environmentally conscious production practices. These initiatives respond to stakeholder expectations while potentially reducing operational costs.

Innovation investments focus on emerging technologies including volumetric capture, neural rendering, and advanced simulation systems. Companies making strategic technology investments position themselves for competitive advantages in evolving market segments.

Strategic recommendations for industry participants emphasize the importance of technology investment, talent development, and market diversification. MarkWide Research analysis indicates that companies balancing creative excellence with operational efficiency achieve superior long-term performance.

Technology adoption should focus on solutions that enhance both productivity and creative capabilities rather than simply reducing costs. Studios investing in comprehensive technology strategies that include training, workflow optimization, and quality control systems realize greater returns on investment.

Talent retention strategies must address changing workforce expectations around remote work, professional development, and work-life balance. Companies creating positive, flexible work environments while maintaining collaborative creative cultures attract and retain top talent.

Market diversification across client industries, service types, and geographic regions reduces risk while creating growth opportunities. Studios serving multiple market segments demonstrate greater resilience during economic fluctuations and industry cycles.

Partnership development with technology providers, educational institutions, and complementary service companies creates competitive advantages and market expansion opportunities. Strategic alliances enable resource sharing, capability enhancement, and market access.

Quality focus remains essential as market competition intensifies and client expectations continue rising. Companies maintaining high creative and technical standards while improving operational efficiency achieve sustainable competitive positioning.

Long-term projections for the US animation, VFX and post production market indicate continued robust growth driven by expanding content demand, technological innovation, and application diversification. MWR analysis suggests the market will maintain strong momentum with projected annual growth rates of 7.5% over the next five years.

Technology evolution will continue transforming production workflows, with artificial intelligence, machine learning, and advanced automation becoming standard tools rather than experimental technologies. These advances will enable higher quality output while reducing production timelines and costs.

Market expansion beyond traditional entertainment applications will accelerate, with corporate communications, educational content, and emerging media formats driving demand growth. The integration of animation and VFX into diverse business applications creates stable, long-term revenue opportunities.

Global competition will intensify as international markets develop capabilities and compete for projects. US companies maintaining competitive advantages through innovation, quality, and client relationships will continue thriving in this evolving landscape.

Workforce evolution will reflect changing technology requirements, with increased demand for technical artists, pipeline developers, and professionals skilled in emerging technologies. Educational institutions and industry training programs will adapt to address these evolving skill requirements.

Sustainability integration will become increasingly important as environmental considerations influence client decisions and regulatory requirements. Studios implementing comprehensive sustainability strategies will gain competitive advantages while contributing to industry-wide environmental goals.

The US animation, VFX and post production market stands at a pivotal moment characterized by unprecedented growth opportunities, technological transformation, and evolving client expectations. Industry participants who successfully navigate this dynamic environment through strategic technology adoption, talent development, and market diversification will achieve sustainable competitive advantages.

Market fundamentals remain strong, supported by expanding content demand across streaming platforms, gaming applications, advertising channels, and emerging media formats. The convergence of creative excellence and technological innovation continues driving industry evolution while creating new opportunities for specialized service providers.

Future success will depend on companies’ ability to balance creative quality with operational efficiency, embrace technological advancement while maintaining human creativity, and serve diverse client needs while building sustainable business models. The industry’s continued growth and innovation promise exciting opportunities for all stakeholders in this dynamic, creative sector.

What is US Animation, Vfx And Post Production?

US Animation, Vfx And Post Production refers to the creative processes involved in producing animated content, visual effects, and post-production services for film, television, and digital media. This includes techniques such as 3D modeling, compositing, and editing.

What are the key companies in the US Animation, Vfx And Post Production Market?

Key companies in the US Animation, Vfx And Post Production Market include Pixar Animation Studios, Industrial Light & Magic, DreamWorks Animation, and Blue Sky Studios, among others.

What are the growth factors driving the US Animation, Vfx And Post Production Market?

The growth of the US Animation, Vfx And Post Production Market is driven by the increasing demand for high-quality visual content in films, the rise of streaming platforms, and advancements in technology such as virtual reality and augmented reality.

What challenges does the US Animation, Vfx And Post Production Market face?

The US Animation, Vfx And Post Production Market faces challenges such as high production costs, the need for skilled labor, and intense competition among studios, which can impact profitability and project timelines.

What opportunities exist in the US Animation, Vfx And Post Production Market?

Opportunities in the US Animation, Vfx And Post Production Market include the expansion of animated content in advertising, the growth of international co-productions, and the increasing use of animation in video games and educational content.

What trends are shaping the US Animation, Vfx And Post Production Market?

Trends in the US Animation, Vfx And Post Production Market include the rise of diverse storytelling, the integration of artificial intelligence in animation processes, and the growing popularity of short-form animated content on social media platforms.

US Animation, Vfx And Post Production Market

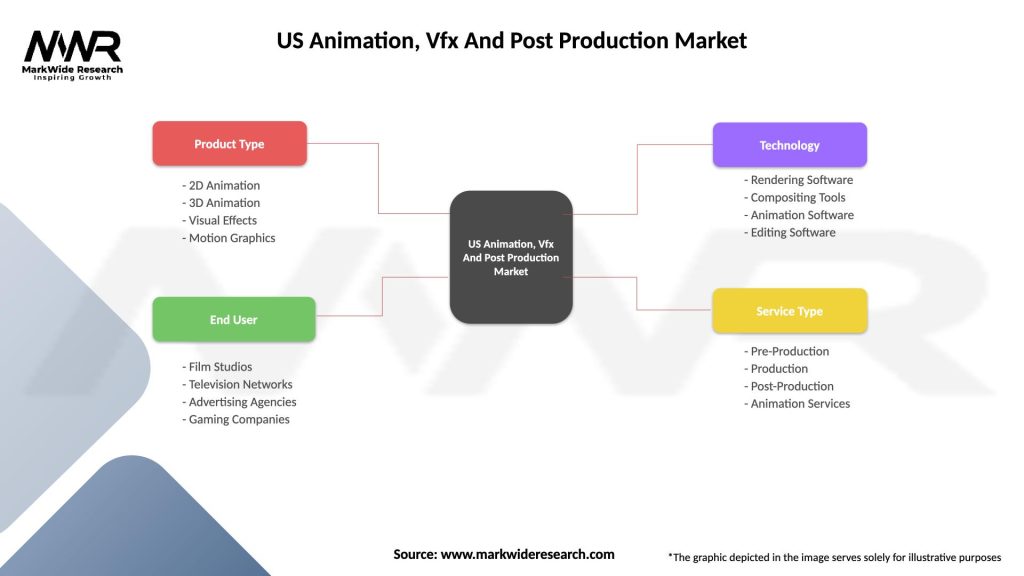

| Segmentation Details | Description |

|---|---|

| Product Type | 2D Animation, 3D Animation, Visual Effects, Motion Graphics |

| End User | Film Studios, Television Networks, Advertising Agencies, Gaming Companies |

| Technology | Rendering Software, Compositing Tools, Animation Software, Editing Software |

| Service Type | Pre-Production, Production, Post-Production, Animation Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Animation, Vfx And Post Production Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at