444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US ambulatory surgical centers (ASCs) market has experienced significant growth in recent years. ASCs are healthcare facilities that provide same-day surgical care, allowing patients to undergo procedures and return home on the same day. These centers offer a wide range of surgical procedures, including orthopedic, ophthalmic, gastrointestinal, and urological surgeries, among others.

ASCs have become an increasingly popular choice for patients and healthcare providers due to several factors. These centers offer convenience, cost-effectiveness, shorter wait times, and reduced risk of hospital-acquired infections. The US ambulatory surgical centers market has witnessed substantial expansion, driven by the growing demand for outpatient surgical procedures and advancements in medical technology.

Meaning

Ambulatory surgical centers, also known as outpatient surgery centers, are healthcare facilities that specialize in providing same-day surgical care. These centers are equipped with state-of-the-art medical equipment and staffed by highly skilled surgeons and medical professionals. ASCs offer a wide range of surgical procedures, catering to various medical specialties.

The concept behind ASCs is to provide efficient and cost-effective surgical services outside the traditional hospital setting. Patients benefit from the convenience of undergoing surgeries and returning home on the same day, eliminating the need for overnight hospital stays. ASCs are designed to create a patient-centered environment, focusing on personalized care and shorter recovery times.

Executive Summary

The US ambulatory surgical centers market has experienced robust growth in recent years, driven by factors such as the rising demand for outpatient surgical procedures, technological advancements, and the shift towards value-based healthcare. ASCs offer numerous benefits, including convenience, cost-effectiveness, and reduced infection risk, making them an attractive choice for patients and healthcare providers.

The market is highly competitive, with a significant number of ASCs operating across the country. Key players in the industry strive to enhance their services, expand their geographical presence, and establish strategic partnerships to gain a competitive edge. The COVID-19 pandemic has also impacted the market, leading to temporary closures and disruptions in elective surgical procedures. However, as the situation improves, the market is expected to recover and witness continued growth.

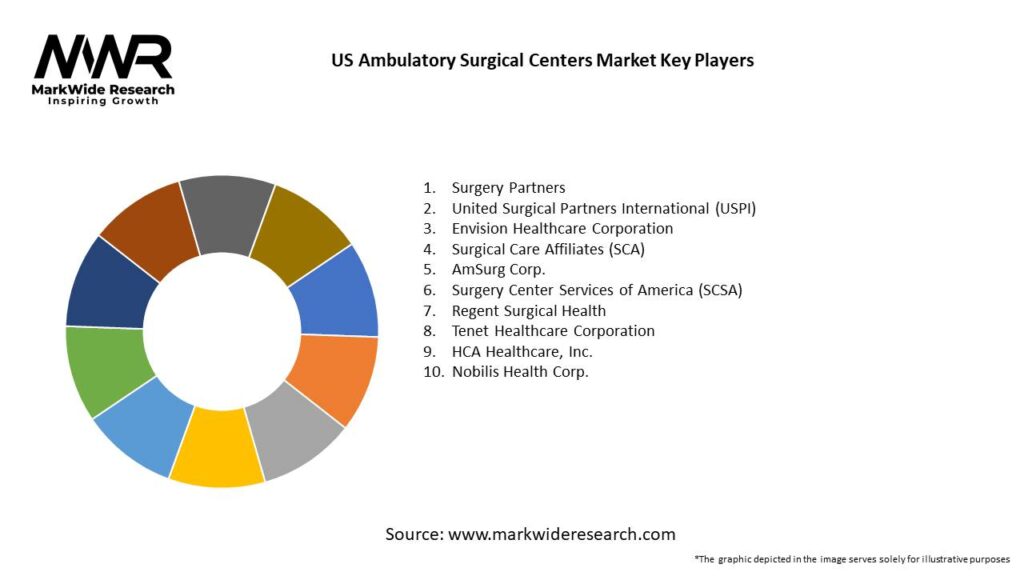

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US ambulatory surgical centers market is characterized by intense competition, technological advancements, changing healthcare policies, and evolving patient preferences. Several key dynamics shape the market landscape:

Regional Analysis

The US ambulatory surgical centers market exhibits regional variations in terms of market size, patient demographics, healthcare infrastructure, and regulatory landscape. While the market is significant throughout the country, certain regions may experience higher growth and demand for ASC services.

It is important to note that regional variations in reimbursement policies, regulatory frameworks, and market competition can influence the growth and dynamics of the US ambulatory surgical centers market.

Competitive Landscape

Leading Companies in US Ambulatory Surgical Centers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

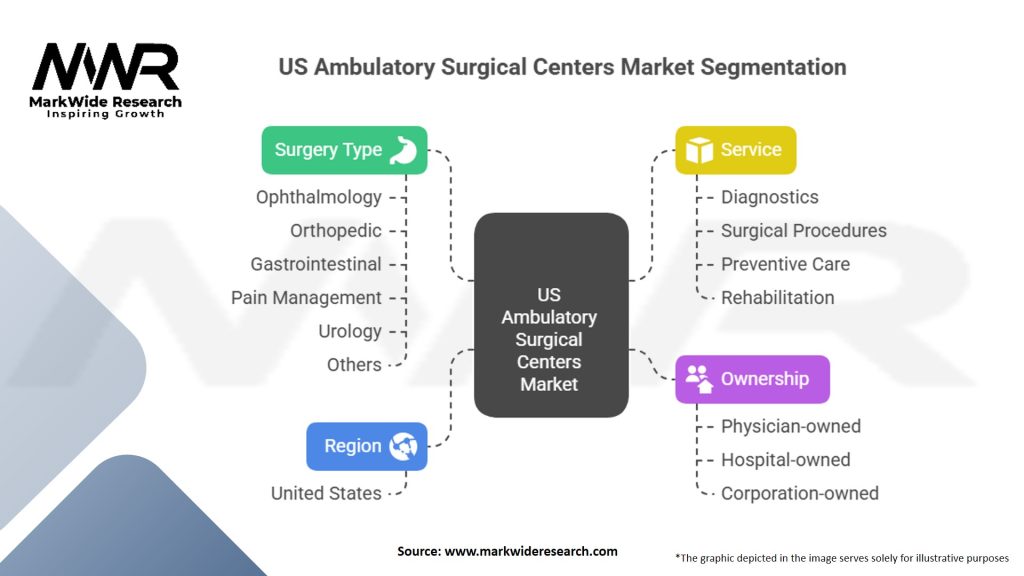

Segmentation

The US ambulatory surgical centers market can be segmented based on various factors, including surgical specialty, ownership type, and geography.

Segmentation allows for a deeper understanding of the market dynamics, patient demographics, and specialized surgical needs in different regions.

Category-wise Insights

These category-wise insights highlight the diverse surgical specialties served by ASCs and the specific market drivers within each category.

Key Benefits for Industry Participants and Stakeholders

The US ambulatory surgical centers market provides several benefits for various industry participants and stakeholders, promoting efficient and patient-centered surgical care.

SWOT Analysis

A SWOT analysis provides a comprehensive evaluation of the US ambulatory surgical centers market by assessing its strengths, weaknesses, opportunities, and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

A SWOT analysis helps industry participants understand the internal and external factors that can impact the US ambulatory surgical centers market and devise strategies accordingly.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the US ambulatory surgical centers market. The initial phase of the pandemic resulted in temporary closures and postponement of non-urgent elective surgeries in ASCs. This led to a decline in procedure volumes and revenue for ASC operators.

However, as the pandemic situation improved and healthcare systems adapted to the new normal, ASCs gradually resumed operations, implementing stringent safety protocols to ensure patient and staff safety. ASCs played a crucial role in reducing the backlog of postponed procedures and providing necessary surgical care.

The pandemic also accelerated the adoption of telemedicine and digital health solutions in ASCs, allowing for remote consultations, pre-operative assessments, and post-operative follow-ups. This digital transformation improved operational efficiency and enhanced patient access to care.

Despite the short-term challenges posed by the pandemic, the US ambulatory surgical centers market is expected to recover and continue its growth trajectory as vaccination rates increase and healthcare systems stabilize.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the US ambulatory surgical centers market appears promising, driven by the increasing demand for outpatient surgical procedures, advancements in surgical technology, and the emphasis on value-based care. ASCs are expected to continue expanding their service portfolios, adopting advanced surgical techniques, and enhancing patient experiences.

The market will likely witness further integration of digital health solutions, such as telemedicine platforms and electronic health records, to improve patient access, streamline operations, and enhance care coordination. ASCs will continue to play a vital role in reducing healthcare costs, improving patient outcomes, and meeting the growing demand for specialized surgical services.

However, challenges remain, including regulatory compliance, competition from hospitals, and potential disruptions from unforeseen events. ASC operators need to adapt to changing market dynamics, leverage strategic partnerships, and focus on delivering exceptional patient care to thrive in the evolving healthcare landscape.

Conclusion

The US ambulatory surgical centers market has experienced significant growth, driven by the increasing demand for outpatient surgical procedures, technological advancements, and the shift towards value-based care. ASCs provide convenient, cost-effective, and patient-centered surgical care, attracting patients and healthcare providers alike.

Despite challenges such as regulatory requirements and competition from hospitals, ASCs have opportunities for expansion into underserved regions, partnerships with healthcare systems, and the adoption of advanced technologies. The COVID-19 pandemic has posed temporary disruptions, but the market is expected to recover as healthcare systems stabilize.

ASC operators should focus on enhancing patient experiences, adopting technological innovations, optimizing operational efficiency, and monitoring regulatory changes. By addressing these key areas, ASCs can position themselves for sustained growth, improved patient outcomes, and success in the dynamic US ambulatory surgical centers market.

What is Ambulatory Surgical Centers?

Ambulatory Surgical Centers (ASCs) are healthcare facilities that provide same-day surgical care, including diagnostic and preventive procedures. They are designed to allow patients to undergo surgery and return home on the same day, enhancing convenience and efficiency in the healthcare system.

What are the key players in the US Ambulatory Surgical Centers Market?

Key players in the US Ambulatory Surgical Centers Market include HCA Healthcare, Tenet Healthcare, and Surgery Partners, among others. These companies operate numerous facilities across the country, providing a range of surgical services.

What are the growth factors driving the US Ambulatory Surgical Centers Market?

The growth of the US Ambulatory Surgical Centers Market is driven by factors such as the increasing preference for outpatient surgeries, advancements in surgical technology, and the rising demand for cost-effective healthcare solutions. Additionally, the aging population contributes to the growing need for surgical procedures.

What challenges does the US Ambulatory Surgical Centers Market face?

The US Ambulatory Surgical Centers Market faces challenges such as regulatory compliance issues, competition from hospital outpatient departments, and reimbursement pressures from insurance providers. These factors can impact the operational efficiency and profitability of ASCs.

What opportunities exist in the US Ambulatory Surgical Centers Market?

Opportunities in the US Ambulatory Surgical Centers Market include the expansion of services offered, such as pain management and orthopedic surgeries, and the potential for partnerships with hospitals to enhance service delivery. The growing trend towards minimally invasive procedures also presents significant growth potential.

What trends are shaping the US Ambulatory Surgical Centers Market?

Trends shaping the US Ambulatory Surgical Centers Market include the increasing adoption of telemedicine, the integration of advanced surgical technologies, and a focus on patient-centered care. These trends are enhancing the efficiency and effectiveness of surgical procedures in ASCs.

US Ambulatory Surgical Centers Market

| Segmentation Details | Description |

|---|---|

| Surgery Type | Ophthalmology, Orthopedic, Gastrointestinal, Pain Management, Urology, Others |

| Ownership | Physician-owned, Hospital-owned, Corporation-owned |

| Service | Diagnostics, Surgical Procedures, Preventive Care, Rehabilitation |

| Region | United States |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in US Ambulatory Surgical Centers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at