444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US alfalfa market represents one of the most significant agricultural sectors in American farming, encompassing the cultivation, processing, and distribution of this vital forage crop. Alfalfa production spans across multiple states, with concentrated activity in regions offering optimal growing conditions including adequate water resources and suitable soil compositions. The market demonstrates robust growth potential driven by increasing demand from livestock industries, export opportunities, and expanding applications in sustainable agriculture practices.

Market dynamics indicate strong performance with the sector experiencing approximately 4.2% annual growth in production efficiency improvements. The western United States dominates production volumes, accounting for nearly 68% of total domestic output, while emerging markets in the Midwest contribute an additional 22% market share. Technological advancement in irrigation systems, harvesting equipment, and crop management practices continues to enhance productivity across all major growing regions.

Industry stakeholders benefit from diversified market applications spanning dairy operations, beef cattle feeding, horse nutrition, and international export markets. The sector’s resilience stems from alfalfa’s position as a premium protein source for livestock, offering superior nutritional value compared to alternative forage crops. Sustainable farming practices increasingly influence market development, with organic alfalfa production experiencing particularly strong demand growth.

The US alfalfa market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of alfalfa crops within the United States agricultural economy. This market includes all activities from seed development and field cultivation through harvesting, processing into various forms including hay, pellets, and cubes, and final distribution to end-users including livestock operations, export markets, and specialty applications.

Alfalfa cultivation represents a sophisticated agricultural practice requiring specialized knowledge of soil management, irrigation techniques, pest control, and harvesting optimization. The market encompasses both traditional farming operations and modern precision agriculture approaches utilizing advanced technology for crop monitoring, yield optimization, and quality enhancement. Market participants include farmers, equipment manufacturers, processing facilities, distributors, and end-users across diverse agricultural sectors.

Economic significance extends beyond direct agricultural production to include supporting industries such as equipment manufacturing, transportation services, storage facilities, and export logistics. The market’s definition encompasses both domestic consumption patterns and international trade relationships, particularly with key export destinations in Asia and the Middle East where demand for high-quality American alfalfa continues expanding.

Strategic analysis reveals the US alfalfa market maintains a strong competitive position globally, supported by advanced agricultural practices, favorable growing conditions, and established distribution networks. The sector demonstrates consistent performance with production volumes stabilizing around optimal levels while quality improvements drive premium pricing opportunities. Market consolidation trends indicate larger operations gaining efficiency advantages through economies of scale and technology adoption.

Key growth drivers include expanding dairy industry demand, increasing export opportunities, and growing recognition of alfalfa’s environmental benefits including soil nitrogen fixation and carbon sequestration capabilities. The market benefits from strong fundamentals with livestock populations requiring consistent high-quality forage supplies regardless of economic conditions. Innovation initiatives focus on drought-resistant varieties, precision agriculture applications, and value-added processing techniques.

Competitive dynamics favor operations implementing sustainable practices, advanced irrigation systems, and efficient harvesting technologies. The market’s resilience stems from alfalfa’s essential role in livestock nutrition, creating stable demand patterns even during economic uncertainties. Future prospects appear favorable with increasing global protein demand supporting long-term growth trajectories for premium American alfalfa products.

Production efficiency improvements continue driving market competitiveness, with leading operations achieving yield increases through precision agriculture technologies and optimized crop management practices. Regional specialization patterns emerge as different growing areas focus on specific market segments, from high-protein dairy-quality alfalfa to export-grade products meeting international specifications.

Livestock industry expansion serves as the primary market driver, with growing dairy and beef cattle populations requiring consistent high-quality forage supplies. Dairy operations particularly value alfalfa’s superior protein content and digestibility characteristics, supporting premium pricing for top-quality products. The sector benefits from stable demand fundamentals as livestock nutrition requirements remain consistent regardless of economic conditions.

Export market opportunities provide significant growth potential, particularly in Asian markets where rising incomes drive increased protein consumption and corresponding livestock industry expansion. International buyers specifically seek American alfalfa for its consistent quality, reliable supply chains, and adherence to strict quality standards. Trade relationships continue strengthening with key importing nations recognizing the superior value proposition of US-produced alfalfa.

Technological advancement enables productivity improvements and cost reductions throughout the production cycle. Precision agriculture tools optimize input usage, improve harvest timing, and enhance overall crop management effectiveness. Equipment innovations reduce labor requirements while improving harvest efficiency and product quality. Sustainable agriculture practices attract environmentally conscious buyers and support premium pricing opportunities for certified sustainable products.

Climate adaptation strategies position the market favorably as producers develop drought-resistant varieties and water-efficient production systems. Research initiatives focus on developing alfalfa varieties optimized for specific regional conditions and market requirements. Government support programs encourage sustainable farming practices and provide resources for technology adoption and infrastructure improvements.

Water availability challenges represent the most significant constraint facing alfalfa production, particularly in western growing regions experiencing prolonged drought conditions. Irrigation costs continue rising as water resources become increasingly scarce and expensive, pressuring profit margins for producers dependent on supplemental irrigation. Regulatory restrictions on water usage in some regions limit expansion opportunities and may force production adjustments.

Labor shortage issues affect harvesting operations and general farm management activities, with agricultural workers becoming increasingly difficult to recruit and retain. Seasonal labor demands create particular challenges during critical harvest periods when timing significantly impacts crop quality and yield. Wage inflation in agricultural sectors increases production costs while potentially reducing competitiveness against alternative crops requiring less labor intensity.

Transportation costs impact market accessibility, particularly for operations located far from major livestock concentrations or export facilities. Fuel price volatility creates uncertainty in logistics planning and affects overall profitability calculations. Infrastructure limitations in some rural areas constrain efficient product movement and may limit market access for smaller operations.

Climate variability introduces production risks through extreme weather events, unexpected precipitation patterns, and temperature fluctuations affecting crop development. Pest and disease pressures require ongoing management investments and may impact yield potential or product quality. Market price volatility creates planning challenges for producers making long-term investment decisions in equipment, land, or infrastructure improvements.

Export expansion presents substantial growth opportunities as global protein demand increases and international markets recognize the superior quality of American alfalfa products. Asian markets particularly offer strong potential with growing livestock industries and increasing willingness to pay premium prices for high-quality forage. Middle Eastern markets provide additional opportunities for specialized products meeting specific regional requirements and quality standards.

Value-added processing opportunities enable producers to capture additional margins through pelletizing, cubing, and other processing activities that enhance product convenience and shelf life. Organic production commands significant price premiums while serving growing market segments focused on sustainable and natural products. Specialty applications including horse feed, small ruminant nutrition, and pet food ingredients offer niche market opportunities with attractive pricing potential.

Technology integration creates opportunities for efficiency improvements and cost reductions throughout the production and distribution chain. Precision agriculture applications enable optimized input usage, improved harvest timing, and enhanced quality control. Automation technologies address labor shortage challenges while potentially improving operational consistency and reducing long-term costs.

Sustainability initiatives align with growing consumer and buyer preferences for environmentally responsible products. Carbon credit programs may provide additional revenue streams for producers implementing soil carbon sequestration practices. Regenerative agriculture approaches offer opportunities to improve soil health while potentially accessing premium markets focused on sustainable production methods.

Supply and demand balance remains relatively stable with production levels generally matching consumption requirements, though regional variations create opportunities for efficient logistics and storage operations. Seasonal patterns influence pricing dynamics with harvest timing affecting market availability and price levels throughout the year. Quality differentiation becomes increasingly important as buyers seek specific nutritional profiles and consistency standards.

Competitive pressures drive continuous improvement in production efficiency, product quality, and customer service capabilities. Market consolidation trends favor larger operations capable of investing in advanced equipment and technology while achieving economies of scale. Vertical integration opportunities allow some operations to capture additional value through processing, distribution, or direct customer relationships.

Price discovery mechanisms evolve as markets become more sophisticated and transparent, with electronic trading platforms and standardized grading systems improving market efficiency. Risk management tools including crop insurance and forward contracting help producers manage price and production risks. Market information systems provide better visibility into supply and demand conditions, supporting more informed decision-making.

Regulatory environment influences production practices through water usage restrictions, environmental compliance requirements, and food safety standards. Trade policies affect export opportunities and competitive positioning in international markets. Government programs provide support for conservation practices, technology adoption, and market development initiatives that benefit the overall sector.

Comprehensive market analysis employs multiple research approaches including primary data collection through producer surveys, buyer interviews, and industry expert consultations. Secondary research incorporates government agricultural statistics, trade data, and industry publications to establish baseline market conditions and trends. Quantitative analysis utilizes statistical modeling to identify relationships between market variables and predict future trends.

Field research activities include on-site visits to representative production operations across major growing regions to understand current practices, challenges, and opportunities. Stakeholder interviews encompass producers, processors, distributors, equipment manufacturers, and end-users to capture diverse perspectives on market conditions and future prospects. Market observation through attendance at industry conferences, trade shows, and regional meetings provides insights into emerging trends and competitive dynamics.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert review of findings. Analytical frameworks incorporate both quantitative metrics and qualitative assessments to provide comprehensive market understanding. Trend analysis examines historical patterns while considering emerging factors that may influence future market development.

Geographic scope covers all major alfalfa-producing regions within the United States, with particular attention to areas experiencing significant changes in production practices or market conditions. Temporal analysis examines both short-term market fluctuations and long-term structural trends affecting the industry. Segmentation analysis evaluates different market segments including end-use applications, quality grades, and geographic markets to identify specific opportunities and challenges.

Western United States dominates alfalfa production with states including California, Idaho, Nevada, and Washington accounting for the majority of national output. California operations benefit from year-round growing seasons and established irrigation infrastructure, though face increasing water availability challenges. Idaho producers leverage favorable growing conditions and proximity to dairy operations while expanding export capabilities through Pacific Northwest ports.

Great Plains region contributes significant production volumes with states including Kansas, Nebraska, and South Dakota offering competitive production costs and access to major livestock feeding operations. Midwest production serves regional dairy and livestock industries while benefiting from generally adequate precipitation levels reducing irrigation requirements. Eastern regions focus primarily on local and regional markets with production concentrated in areas with suitable soil conditions and adequate moisture.

Regional specialization emerges as different areas optimize production for specific market segments and quality requirements. Export-oriented regions invest in port facilities and logistics infrastructure to serve international markets efficiently. Processing centers develop in areas with concentrated production to add value through pelletizing, cubing, and other processing activities.

Transportation networks significantly influence regional competitiveness with areas having efficient rail and truck access maintaining advantages in serving distant markets. Storage infrastructure varies by region with some areas developing sophisticated facilities to manage seasonal production patterns and optimize market timing. Regional cooperation through marketing associations and producer groups enhances market access and bargaining power for individual operations.

Market structure includes thousands of individual producers ranging from small family operations to large commercial enterprises, with significant variation in production scale, technology adoption, and market focus. Leading operations distinguish themselves through superior production efficiency, consistent quality, and strong customer relationships built over many years of reliable service.

Competitive advantages stem from factors including production efficiency, quality consistency, logistics capabilities, customer relationships, and financial resources for investment in technology and infrastructure. Market positioning varies with some operations focusing on cost leadership while others pursue premium quality strategies or specialized market niches.

By End-Use Application: The market segments into dairy feed applications representing the largest volume segment, followed by beef cattle feeding, horse nutrition, export markets, and specialty applications including small ruminants and pet food ingredients. Dairy applications demand highest protein content and digestibility characteristics, supporting premium pricing for top-quality products.

By Product Form: Traditional baled hay remains the dominant product form, while processed products including pellets, cubes, and chopped hay serve specific market niches requiring enhanced convenience, storage efficiency, or feeding characteristics. Processing activities add value while addressing transportation and storage challenges in some market segments.

By Quality Grade: Market segmentation includes premium/supreme grades commanding highest prices, good/choice grades serving mainstream markets, and utility grades for cost-sensitive applications. Quality differentiation based on protein content, fiber levels, color, and absence of foreign material significantly influences pricing and market access.

By Production Method: Conventional production dominates market volume while organic production serves premium market segments with strict certification requirements and higher pricing. Sustainable production practices gain importance as buyers increasingly consider environmental factors in purchasing decisions.

By Geographic Market: Domestic consumption serves regional livestock operations while export markets focus on specific quality requirements and packaging specifications. International segments often require specialized handling, documentation, and quality certifications creating barriers to entry but supporting premium pricing for qualified suppliers.

Dairy Feed Category: Represents the largest market segment with strict quality requirements including high protein content, excellent digestibility, and consistent nutritional profiles. Dairy operations value reliability and are willing to pay premiums for products meeting their specific requirements. Long-term contracts provide stability for both producers and buyers in this segment.

Export Category: Demonstrates strong growth potential with Asian markets leading demand for high-quality American alfalfa. Export specifications often exceed domestic quality standards, requiring specialized production and handling practices. Logistics coordination becomes critical for success in export markets with container availability and shipping schedules affecting competitiveness.

Horse Feed Category: Commands premium pricing due to strict quality requirements and smaller volume purchases. Horse owners prioritize product safety, nutritional consistency, and dust-free characteristics. Retail distribution through feed stores and direct sales to horse facilities characterize this market segment.

Processed Products Category: Includes pellets, cubes, and chopped products offering convenience benefits and enhanced storage efficiency. Processing operations add value while serving markets requiring specific product characteristics or handling convenience. Transportation efficiency improvements through compression and packaging innovations benefit this category.

Organic Category: Experiences strong growth driven by premium pricing and increasing buyer interest in certified organic products. Certification requirements create barriers to entry while supporting higher margins for qualified producers. Market development continues as organic livestock operations expand and consumer preferences evolve.

Producers benefit from diversified market opportunities allowing optimization of production systems for specific market segments and quality requirements. Crop rotation advantages include nitrogen fixation improving soil fertility for subsequent crops while providing environmental benefits. Multiple harvest opportunities throughout the growing season provide cash flow advantages compared to annual crops with single harvest periods.

Livestock operators gain access to high-quality protein sources supporting optimal animal nutrition and performance. Nutritional consistency enables precise ration formulation and predictable animal performance outcomes. Storage characteristics allow inventory management and feeding flexibility throughout the year.

Equipment manufacturers benefit from ongoing technology adoption as producers invest in advanced harvesting, processing, and handling equipment. Innovation opportunities exist for developing specialized equipment addressing specific market needs and production challenges. Service networks provide ongoing revenue streams through maintenance and support activities.

Transportation providers benefit from consistent shipping volumes and opportunities for specialized equipment and services. Export logistics create opportunities for container handling, port services, and international shipping coordination. Storage facilities provide value-added services including inventory management and quality preservation.

Financial institutions find opportunities in financing production operations, equipment purchases, and infrastructure development. Risk management products including crop insurance and commodity financing serve producer needs. Investment opportunities exist in processing facilities, storage infrastructure, and technology development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision Agriculture Adoption accelerates as producers implement GPS-guided equipment, variable rate application systems, and drone-based crop monitoring technologies. Data-driven decisions optimize input usage, harvest timing, and quality management while reducing environmental impact. Technology integration enables smaller operations to achieve efficiency levels previously available only to large commercial enterprises.

Sustainability Focus intensifies as buyers increasingly consider environmental factors in purchasing decisions. Carbon sequestration benefits of alfalfa production gain recognition as climate change concerns influence agricultural policies and market preferences. Water conservation technologies including drip irrigation and soil moisture monitoring become standard practices in water-scarce regions.

Export Market Development continues expanding with new markets emerging in Southeast Asia and Africa while established markets in East Asia show sustained growth. Quality standardization efforts improve market access and pricing transparency for export-oriented producers. Container optimization technologies enhance shipping efficiency and reduce transportation costs.

Value-Added Processing grows as producers seek margin enhancement through pelletizing, cubing, and specialized packaging. Processing innovation focuses on preserving nutritional value while improving handling convenience and storage life. Custom processing services enable smaller producers to access value-added market opportunities without major capital investments.

Organic Production Expansion responds to premium pricing opportunities and growing consumer preferences for certified organic products. Certification processes become more streamlined while maintaining strict quality standards. Organic livestock industry growth drives sustained demand for certified organic alfalfa products.

Technology partnerships between equipment manufacturers and software developers create integrated solutions for crop management, harvest optimization, and quality control. Precision agriculture platforms combine multiple data sources to provide comprehensive field management recommendations. Automation advances in harvesting equipment reduce labor requirements while improving harvest timing and product quality.

Research initiatives focus on developing drought-resistant alfalfa varieties suitable for regions with limited water availability. Genetic improvements target enhanced nutritional profiles, disease resistance, and yield stability under varying environmental conditions. University partnerships accelerate research translation into practical applications for commercial producers.

Infrastructure investments in port facilities, storage systems, and processing equipment support market expansion and efficiency improvements. Transportation innovations including specialized containers and handling equipment reduce logistics costs and improve product quality preservation. Storage technology advances enable better inventory management and quality maintenance.

Market development programs promote American alfalfa in international markets through trade missions, quality demonstrations, and buyer education initiatives. Quality certification systems enhance market access and support premium pricing for qualified producers. Industry associations coordinate marketing efforts and advocate for favorable trade policies.

Sustainability certifications gain importance as buyers seek verified environmental stewardship practices. Carbon credit programs provide additional revenue opportunities for producers implementing soil carbon sequestration practices. Water efficiency programs support technology adoption and conservation practice implementation.

MarkWide Research recommends producers prioritize water use efficiency improvements through advanced irrigation technologies and drought-resistant variety adoption. Investment strategies should focus on technologies providing measurable returns through reduced input costs or improved product quality. Market positioning efforts should emphasize quality differentiation and customer relationship development rather than competing solely on price.

Export market development requires sustained commitment to quality standards, logistics coordination, and customer relationship building. Market entry strategies should consider partnerships with established exporters or distributors having existing market relationships and infrastructure. Quality certification investments provide access to premium market segments and support long-term competitiveness.

Technology adoption should prioritize solutions addressing specific operational challenges rather than implementing technology for its own sake. Precision agriculture investments show strongest returns when integrated into comprehensive crop management systems. Automation opportunities should focus on labor-intensive activities where consistent availability and cost represent ongoing challenges.

Sustainability initiatives align with market trends while potentially providing cost savings through improved resource efficiency. Organic production consideration requires careful analysis of certification costs, market access, and premium pricing sustainability. Value-added processing opportunities should evaluate market demand, investment requirements, and competitive positioning before implementation.

Risk management strategies should address water availability, weather variability, and market price fluctuations through diversification, insurance, and contracting approaches. Financial planning must account for cyclical market conditions and infrastructure investment requirements. Market intelligence systems provide competitive advantages through better understanding of supply and demand dynamics.

Long-term prospects remain favorable for the US alfalfa market with growing global protein demand supporting sustained market development. Population growth and rising incomes in key export markets create expanding opportunities for high-quality American alfalfa products. Livestock industry expansion in developing countries provides additional market potential for producers capable of meeting international quality standards.

Technology advancement will continue transforming production practices with automation, precision agriculture, and biotechnology improvements enhancing productivity and sustainability. Climate adaptation strategies including drought-resistant varieties and water-efficient production systems position the industry for long-term resilience. Processing innovation creates opportunities for value addition and market differentiation.

Market evolution toward greater quality differentiation and traceability requirements favors operations investing in advanced production and handling systems. Sustainability standards will likely become increasingly important for market access, particularly in export markets and premium domestic segments. Consolidation trends may continue as larger operations achieve efficiency advantages through scale and technology adoption.

Export growth potential remains substantial with MWR analysis indicating continued expansion opportunities in Asian markets and emerging demand in other regions. Infrastructure development in port facilities and logistics systems will support market access and competitiveness. Trade relationships require ongoing attention to maintain favorable access conditions and competitive positioning.

Innovation opportunities span production practices, processing technologies, and market development initiatives. Research investments in variety development, production systems, and quality enhancement will drive future competitiveness. Industry collaboration through producer organizations, research institutions, and government programs will accelerate beneficial developments and market expansion efforts.

The US alfalfa market demonstrates strong fundamentals with established production capabilities, diverse market applications, and growing international recognition for quality and reliability. Market dynamics favor operations implementing advanced production practices, quality management systems, and customer-focused strategies. Growth opportunities exist across multiple market segments including export expansion, value-added processing, and specialty applications.

Challenges including water availability, labor shortages, and transportation costs require strategic responses through technology adoption, efficiency improvements, and market positioning adjustments. Successful operations will likely be those adapting to changing market conditions while maintaining focus on quality, sustainability, and customer satisfaction. Industry evolution continues toward greater sophistication in production practices, market segmentation, and value chain integration.

Future success in the US alfalfa market will depend on balancing production efficiency with quality maintenance while adapting to evolving buyer preferences and regulatory requirements. Strategic investments in technology, infrastructure, and market development provide the foundation for long-term competitiveness and profitability in this essential agricultural sector.

What is Alfalfa?

Alfalfa is a perennial flowering plant in the legume family, widely cultivated as a forage crop for livestock. It is known for its high protein content and is often used in animal feed, particularly for dairy cattle and horses.

What are the key players in the US Alfalfa Market?

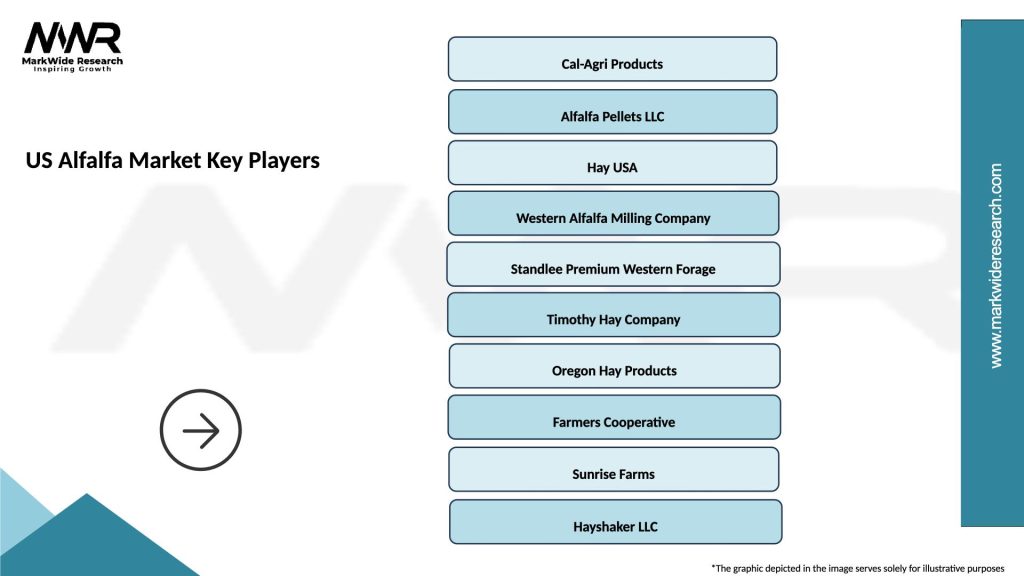

Key players in the US Alfalfa Market include companies such as Anderson Hay & Grain, Inc., Cal-Organic Farms, and Hay USA, among others. These companies are involved in the production, processing, and distribution of alfalfa products.

What are the growth factors driving the US Alfalfa Market?

The US Alfalfa Market is driven by factors such as the increasing demand for high-quality animal feed, the growth of the dairy industry, and the rising popularity of organic farming practices. Additionally, alfalfa’s nutritional benefits contribute to its demand.

What challenges does the US Alfalfa Market face?

Challenges in the US Alfalfa Market include water scarcity in key growing regions, fluctuating market prices, and competition from alternative feed sources. These factors can impact production levels and profitability for farmers.

What opportunities exist in the US Alfalfa Market?

Opportunities in the US Alfalfa Market include the potential for export growth, advancements in sustainable farming practices, and the development of new alfalfa varieties that are more resilient to climate change. These factors can enhance market competitiveness.

What trends are shaping the US Alfalfa Market?

Trends in the US Alfalfa Market include a shift towards organic alfalfa production, increased use of precision agriculture technologies, and a growing focus on sustainability. These trends are influencing how alfalfa is cultivated and marketed.

US Alfalfa Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hay, Pellets, Cubes, Silage |

| End User | Dairy Farms, Livestock Feeders, Horse Owners, Exporters |

| Grade | Premium, Good, Fair, Utility |

| Packaging Type | Bales, Bags, Bulk, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Alfalfa Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at