444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US airbag systems market represents a critical component of the automotive safety ecosystem, experiencing robust growth driven by stringent safety regulations and advancing vehicle technologies. Airbag systems have evolved from basic driver-side protection to comprehensive multi-directional safety networks encompassing frontal, side-impact, curtain, and knee airbags. The market demonstrates strong momentum with projected growth rates of 6.2% CAGR through the forecast period, reflecting increasing consumer awareness and regulatory mandates.

Market dynamics indicate significant expansion across passenger vehicles, commercial vehicles, and emerging electric vehicle segments. The integration of smart airbag technologies incorporating sensors, advanced materials, and deployment algorithms has revolutionized occupant protection systems. Automotive manufacturers are increasingly adopting multi-stage airbag deployment systems that adjust inflation patterns based on crash severity, occupant size, and seating position.

Regional distribution shows concentrated activity in major automotive manufacturing hubs, with Michigan, Ohio, and Tennessee leading production capabilities. The market benefits from established supply chains, technological innovation centers, and proximity to major OEM facilities. Electric vehicle adoption is creating new opportunities for specialized airbag configurations designed for unique battery placement and structural considerations.

The US airbag systems market refers to the comprehensive ecosystem of inflatable safety devices designed to protect vehicle occupants during collisions by rapidly deploying cushioning barriers between passengers and vehicle structures. Airbag systems encompass various components including inflators, sensors, control modules, and fabric assemblies that work collectively to provide life-saving protection during automotive accidents.

Modern airbag systems extend beyond traditional driver and passenger airbags to include side-impact protection, curtain airbags, knee airbags, and specialized configurations for different vehicle types. The market includes both OEM installations and aftermarket solutions, covering passenger cars, light trucks, commercial vehicles, and emerging mobility platforms. Technology integration involves sophisticated crash detection algorithms, multi-stage deployment mechanisms, and adaptive inflation systems tailored to specific crash scenarios.

Market scope encompasses manufacturing, distribution, installation, and maintenance of airbag systems across the United States automotive industry. The definition includes traditional pyrotechnic inflators, hybrid systems, and next-generation technologies incorporating smart materials and connected vehicle capabilities for enhanced occupant protection.

The US airbag systems market demonstrates exceptional growth potential driven by evolving safety standards, technological advancement, and increasing vehicle production volumes. Market expansion is supported by federal safety mandates requiring comprehensive airbag coverage across vehicle categories, with NHTSA regulations establishing minimum protection standards that continue to evolve with emerging technologies.

Key growth drivers include the transition toward autonomous vehicles requiring specialized protection systems, electric vehicle adoption creating unique safety challenges, and consumer demand for enhanced occupant protection. The market shows 78% penetration of advanced multi-airbag systems in new vehicle sales, reflecting widespread adoption of comprehensive safety packages. Technology trends emphasize smart deployment systems, lightweight materials, and integration with vehicle connectivity platforms.

Competitive landscape features established global suppliers alongside emerging technology companies developing next-generation solutions. Innovation focus centers on reducing deployment time, improving protection effectiveness, and developing specialized systems for unique vehicle architectures. Market consolidation trends indicate strategic partnerships between traditional suppliers and technology companies to accelerate development of advanced safety systems.

Strategic market insights reveal several critical trends shaping the US airbag systems landscape:

Market penetration analysis shows significant opportunities in commercial vehicle segments, where adoption rates remain below passenger vehicle levels. Technology adoption patterns indicate accelerating integration of smart systems, with 42% of new installations incorporating advanced sensor technologies for optimized deployment timing and force.

Primary market drivers propelling US airbag systems growth encompass regulatory mandates, technological advancement, and evolving consumer safety expectations. Federal safety regulations continue expanding requirements for comprehensive occupant protection, with recent mandates extending coverage to commercial vehicles and specialized transportation segments.

Consumer awareness of vehicle safety has reached unprecedented levels, with safety ratings significantly influencing purchasing decisions. Insurance industry support through premium reductions for vehicles equipped with advanced safety systems creates additional market incentives. The growing emphasis on occupant protection extends beyond traditional crash scenarios to include rollover protection, pedestrian safety, and multi-impact events.

Technological advancement enables more sophisticated protection systems at competitive costs, making advanced airbag configurations accessible across broader vehicle segments. Electric vehicle growth creates new market opportunities as manufacturers develop specialized protection systems for unique battery configurations and structural designs. Autonomous vehicle development drives innovation in airbag systems designed for non-traditional seating arrangements and occupant positions.

Manufacturing efficiency improvements have reduced production costs while enhancing system reliability, supporting broader market adoption. Supply chain optimization ensures consistent availability of components, supporting steady market growth across all vehicle categories.

Market restraints affecting US airbag systems growth include cost pressures, technical complexity, and regulatory compliance challenges. High development costs for advanced systems can limit adoption in price-sensitive vehicle segments, particularly in entry-level passenger cars and commercial vehicles where cost considerations often outweigh advanced safety features.

Technical complexity associated with integrating multiple airbag systems creates challenges for vehicle manufacturers, particularly smaller companies with limited engineering resources. Recall risks associated with airbag malfunctions have created heightened scrutiny of system reliability, leading to more conservative adoption approaches and extended testing periods.

Supply chain vulnerabilities became apparent during recent global disruptions, highlighting dependencies on specialized components and materials. Regulatory complexity across different vehicle categories and applications creates compliance challenges for manufacturers seeking to standardize systems across product lines.

Consumer concerns about airbag deployment in minor accidents and potential injury risks from deployment force continue to influence market perception. Maintenance requirements and replacement costs for deployed systems create ongoing ownership considerations that may affect consumer acceptance of advanced multi-airbag configurations.

Significant market opportunities exist across emerging vehicle categories, technology integration, and international expansion initiatives. Electric vehicle growth presents substantial opportunities for specialized airbag systems designed for unique structural configurations and battery protection requirements. The expanding autonomous vehicle segment creates demand for innovative protection systems accommodating non-traditional seating arrangements.

Commercial vehicle modernization represents a substantial growth opportunity, with many fleet operators upgrading safety systems to reduce insurance costs and improve driver protection. Retrofit market potential exists for older vehicles seeking to upgrade safety systems, particularly in commercial and specialty vehicle applications.

Technology integration opportunities include connectivity with smart city infrastructure, integration with wearable devices for personalized protection, and development of predictive deployment systems using artificial intelligence. Material science advances enable development of lighter, more effective airbag systems that provide superior protection while reducing vehicle weight.

Export opportunities for US-manufactured airbag systems continue expanding as global safety standards align with US requirements. Aftermarket services including maintenance, inspection, and replacement create recurring revenue opportunities for market participants.

Market dynamics in the US airbag systems sector reflect complex interactions between regulatory requirements, technological innovation, and competitive pressures. Supply and demand balance remains favorable with consistent vehicle production growth driving steady demand for airbag systems across all categories.

Competitive intensity has increased as traditional suppliers face challenges from emerging technology companies developing next-generation solutions. Price competition remains significant in commodity airbag segments, while premium pricing is sustainable for advanced technology solutions offering superior protection capabilities.

Innovation cycles are accelerating as manufacturers seek competitive advantages through advanced materials, smart deployment systems, and integration with vehicle connectivity platforms. Regulatory influence continues shaping market development, with evolving safety standards driving consistent demand for upgraded systems.

Consumer behavior increasingly favors vehicles with comprehensive safety systems, creating market pull for advanced airbag configurations. Technology adoption patterns show 35% annual growth in smart airbag system installations, reflecting growing acceptance of advanced protection technologies. Market consolidation trends indicate strategic partnerships between suppliers and technology companies to accelerate innovation and market penetration.

Comprehensive research methodology employed for US airbag systems market analysis incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, automotive engineers, regulatory officials, and safety experts to gather firsthand insights into market trends and technological developments.

Secondary research encompasses analysis of government databases, industry publications, patent filings, and corporate financial reports to establish market baselines and identify growth patterns. Quantitative analysis utilizes statistical modeling to project market trends, while qualitative assessment provides context for understanding market dynamics and competitive positioning.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification to ensure research accuracy. Market segmentation analysis employs both top-down and bottom-up approaches to validate market sizing and growth projections across different vehicle categories and technology segments.

Regulatory analysis includes comprehensive review of federal safety standards, state regulations, and emerging policy trends affecting airbag system requirements. Technology assessment incorporates patent analysis, R&D investment tracking, and innovation pipeline evaluation to identify emerging trends and competitive advantages.

Regional analysis of the US airbag systems market reveals distinct patterns of concentration, growth, and technological advancement across different geographic areas. Great Lakes region maintains market leadership with 42% market share, driven by concentrated automotive manufacturing in Michigan, Ohio, and Indiana, where major OEM facilities and established supplier networks create robust demand for airbag systems.

Southeast region demonstrates rapid growth with 28% market share, supported by expanding automotive production in Tennessee, Alabama, and South Carolina. Foreign automotive manufacturers have established significant manufacturing presence in this region, driving demand for advanced airbag systems and creating opportunities for local suppliers.

West Coast markets show strong growth in electric vehicle applications, with California leading adoption of advanced airbag technologies designed for EV platforms. Technology innovation centers in Silicon Valley contribute to development of smart airbag systems incorporating artificial intelligence and connectivity features.

Texas market benefits from diverse automotive manufacturing including trucks, SUVs, and commercial vehicles, creating demand for specialized airbag configurations. Northeast region focuses primarily on aftermarket services and technology development, with limited manufacturing but significant research and development activities supporting market innovation.

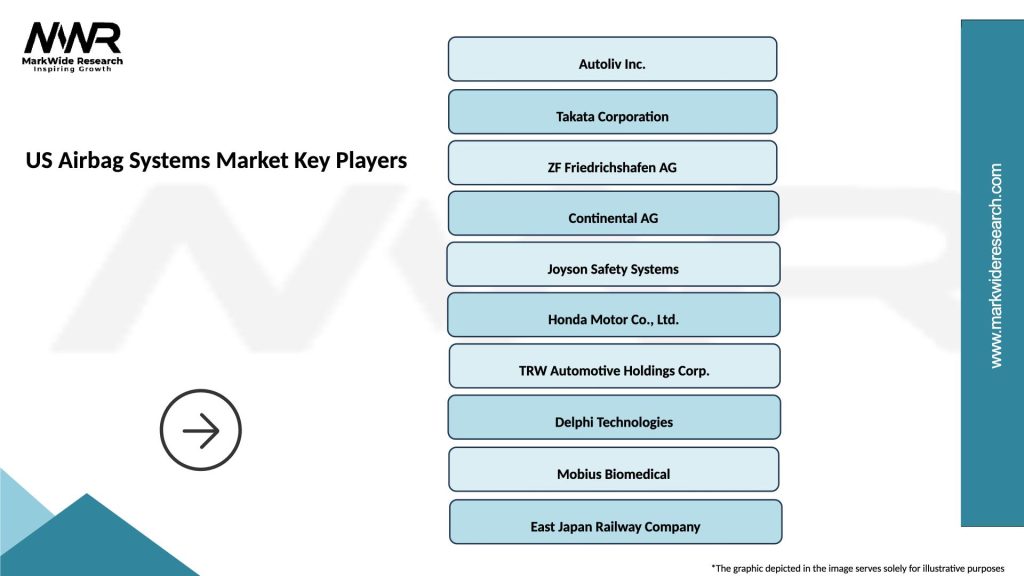

The competitive landscape in the US airbag systems market features established global suppliers, emerging technology companies, and specialized manufacturers serving niche applications. Market leadership is distributed among several key players with distinct competitive advantages:

Competitive strategies emphasize technology differentiation, cost optimization, and strategic partnerships with automotive manufacturers. Innovation focus centers on smart deployment systems, lightweight materials, and integration with vehicle connectivity platforms. Market positioning varies from premium technology providers to cost-focused suppliers serving price-sensitive segments.

Emerging competitors include technology companies developing next-generation solutions incorporating artificial intelligence, advanced sensors, and predictive deployment capabilities. Strategic alliances between traditional suppliers and technology companies are becoming increasingly common to accelerate innovation and market penetration.

Market segmentation analysis reveals distinct categories based on technology type, vehicle application, and deployment configuration. By Technology:

By Vehicle Type:

By Airbag Type:

Category-wise analysis reveals distinct growth patterns and opportunities across different airbag system segments. Frontal airbag systems maintain steady demand with 95% penetration in new vehicles, driven by federal mandates and consumer expectations for basic protection. Innovation focus in this category emphasizes deployment optimization and integration with advanced driver assistance systems.

Side-impact airbag systems show robust growth with increasing adoption in commercial vehicles and entry-level passenger cars. Technology advancement includes improved sensor systems for more accurate deployment timing and enhanced protection effectiveness. Market expansion is driven by evolving safety standards and insurance industry incentives.

Curtain airbag systems demonstrate strong growth potential, particularly in SUV and truck segments where rollover protection is critical. Advanced materials enable larger coverage areas while maintaining deployment speed and effectiveness. Integration opportunities exist with sunroof systems and advanced glazing technologies.

Knee airbag systems represent an emerging category with growing adoption in premium vehicle segments. Technology development focuses on optimizing deployment force and positioning for maximum protection effectiveness. Cost reduction initiatives are expanding adoption potential across broader vehicle categories.

Smart airbag systems show the highest growth potential with 67% annual adoption increase in new installations, reflecting growing demand for personalized protection systems that adapt to occupant characteristics and crash scenarios.

Industry participants in the US airbag systems market realize substantial benefits through technological advancement, market expansion, and strategic positioning opportunities. Automotive manufacturers benefit from enhanced safety ratings, reduced liability exposure, and competitive differentiation through advanced airbag system integration.

Supplier benefits include:

Consumer benefits encompass enhanced safety protection, reduced injury severity, and improved vehicle value retention. Insurance industry benefits include reduced claim costs, lower injury severity, and improved risk assessment capabilities through advanced safety system data.

Regulatory agencies benefit from improved road safety statistics, reduced fatality rates, and enhanced public safety outcomes. Economic benefits include job creation in manufacturing, research and development, and supporting industries throughout the automotive supply chain.

Technology companies entering the market benefit from growing demand for smart systems, connectivity integration, and artificial intelligence applications in automotive safety systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the US airbag systems landscape reflect technological evolution, regulatory development, and changing consumer expectations. Smart deployment systems incorporating artificial intelligence and machine learning algorithms are gaining traction, with 54% of premium vehicles now featuring adaptive airbag technologies that adjust deployment parameters based on crash severity and occupant characteristics.

Connectivity integration represents a significant trend as airbag systems begin incorporating vehicle-to-vehicle communication capabilities for predictive deployment. Material innovation focuses on lightweight fabrics and advanced inflator technologies that provide superior protection while reducing overall system weight and environmental impact.

Personalization trends include development of airbag systems that adapt to individual occupant characteristics such as height, weight, and seating position. Sustainability initiatives drive development of recyclable materials and environmentally friendly inflator technologies that reduce environmental impact throughout the product lifecycle.

Integration trends encompass coordination between airbag systems and other safety technologies including seat belts, crash structures, and advanced driver assistance systems. Predictive safety capabilities using sensor data and artificial intelligence enable proactive deployment decisions based on imminent crash scenarios.

Commercial vehicle adoption accelerates as fleet operators recognize safety and insurance benefits of advanced airbag systems, with 31% annual growth in commercial vehicle airbag installations reflecting this trend.

Recent industry developments highlight significant advancement in airbag system technology, regulatory evolution, and market expansion initiatives. MarkWide Research analysis indicates accelerating innovation in smart airbag systems, with major manufacturers investing heavily in artificial intelligence and sensor integration technologies.

Regulatory developments include expanded federal requirements for commercial vehicle airbag systems and enhanced testing standards for electric vehicle applications. Technology partnerships between traditional suppliers and Silicon Valley companies are creating next-generation solutions incorporating connectivity and predictive capabilities.

Manufacturing expansion includes new production facilities focused on electric vehicle airbag systems and smart deployment technologies. Research initiatives encompass development of biodegradable airbag materials and advanced inflator systems with reduced environmental impact.

Market consolidation activities include strategic acquisitions of technology companies by established suppliers seeking to accelerate innovation capabilities. International expansion efforts by US companies target emerging markets with growing automotive production and evolving safety standards.

Product launches feature advanced multi-stage airbag systems, lightweight materials, and integration with autonomous vehicle platforms. Investment activities include venture capital funding for startup companies developing revolutionary airbag technologies and alternative protection systems.

Strategic recommendations for US airbag systems market participants emphasize technology investment, market diversification, and strategic partnership development. Technology focus should prioritize smart deployment systems, connectivity integration, and artificial intelligence applications that provide competitive differentiation and premium pricing opportunities.

Market expansion strategies should target commercial vehicle segments, electric vehicle applications, and aftermarket services where growth potential exceeds traditional passenger car markets. Geographic diversification into international markets with aligned safety standards can provide additional revenue streams and reduce dependence on US automotive production cycles.

Partnership strategies should emphasize collaboration with technology companies, automotive manufacturers, and research institutions to accelerate innovation and market penetration. Supply chain optimization initiatives should focus on reducing dependencies, improving flexibility, and ensuring consistent component availability.

Investment priorities should include research and development capabilities, manufacturing modernization, and talent acquisition in critical technology areas. Risk management strategies should address recall prevention, quality assurance, and regulatory compliance to protect market position and reputation.

Sustainability initiatives should encompass environmental impact reduction, recyclable materials development, and lifecycle optimization to meet evolving consumer and regulatory expectations for environmentally responsible products.

Future outlook for the US airbag systems market indicates sustained growth driven by technological advancement, regulatory evolution, and expanding vehicle electrification. Market expansion is projected to continue with 8.1% annual growth in smart airbag system adoption, reflecting increasing consumer demand for advanced safety technologies and regulatory support for enhanced occupant protection.

Technology evolution will focus on artificial intelligence integration, predictive deployment capabilities, and personalized protection systems that adapt to individual occupant characteristics. Electric vehicle growth creates substantial opportunities for specialized airbag configurations designed for unique structural requirements and battery protection needs.

Autonomous vehicle development will drive innovation in airbag systems designed for non-traditional seating arrangements and occupant positions. Connectivity integration will enable coordination between vehicles and infrastructure for enhanced safety outcomes and predictive deployment capabilities.

Market consolidation trends will continue as companies seek scale advantages and technology capabilities through strategic partnerships and acquisitions. Regulatory evolution will expand airbag requirements across vehicle categories while establishing standards for emerging technologies and applications.

Sustainability focus will drive development of environmentally friendly materials and manufacturing processes, with MWR projecting 45% adoption of sustainable airbag technologies by the end of the forecast period. Global expansion opportunities will emerge as international safety standards align with US requirements, creating export potential for advanced airbag systems.

The US airbag systems market represents a dynamic and essential component of the automotive safety ecosystem, characterized by robust growth prospects, technological innovation, and expanding application opportunities. Market fundamentals remain strong with consistent regulatory support, growing consumer safety awareness, and advancing vehicle technologies driving sustained demand across all vehicle categories.

Technology advancement continues reshaping the market landscape through smart deployment systems, artificial intelligence integration, and connectivity capabilities that enhance protection effectiveness while enabling new applications. Market diversification into electric vehicles, autonomous platforms, and commercial applications creates multiple growth vectors beyond traditional passenger car markets.

Competitive dynamics favor companies with strong technology capabilities, established OEM relationships, and strategic vision for emerging market opportunities. Investment in innovation, manufacturing capabilities, and strategic partnerships will determine market leadership positions as the industry evolves toward more sophisticated and integrated safety systems.

Future success in the US airbag systems market will depend on balancing technological advancement with cost competitiveness, regulatory compliance with innovation speed, and market expansion with operational excellence. The market outlook remains highly positive with substantial opportunities for growth, differentiation, and value creation across the automotive safety ecosystem.

What is Airbag Systems?

Airbag systems are safety devices in vehicles designed to inflate rapidly during a collision, providing a cushion to protect occupants from injury. They are a critical component of modern automotive safety technology.

What are the key players in the US Airbag Systems Market?

Key players in the US Airbag Systems Market include companies like Autoliv, Takata, and ZF Friedrichshafen, which are known for their innovative airbag technologies and safety solutions, among others.

What are the main drivers of growth in the US Airbag Systems Market?

The main drivers of growth in the US Airbag Systems Market include increasing vehicle production, rising consumer awareness about safety features, and stringent government regulations mandating the use of airbags in vehicles.

What challenges does the US Airbag Systems Market face?

Challenges in the US Airbag Systems Market include the high cost of advanced airbag technologies and the complexity of integrating these systems into various vehicle models, which can hinder widespread adoption.

What opportunities exist in the US Airbag Systems Market?

Opportunities in the US Airbag Systems Market include the development of smart airbags that can adapt to different collision scenarios and the potential for expansion into electric and autonomous vehicles, which require advanced safety systems.

What trends are shaping the US Airbag Systems Market?

Trends shaping the US Airbag Systems Market include the integration of airbags with advanced driver-assistance systems (ADAS) and the increasing focus on passenger safety, leading to innovations in airbag design and deployment strategies.

US Airbag Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Frontal Airbags, Side Airbags, Curtain Airbags, Knee Airbags |

| Technology | Electromechanical, Pyrotechnic, Hybrid, Gas Generators |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Installation | Passenger Vehicles, Commercial Vehicles, Motorcycles, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Airbag Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at