444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US air freight transport market represents a critical component of the nation’s logistics infrastructure, facilitating the rapid movement of goods across domestic and international routes. This dynamic sector encompasses cargo airlines, freight forwarders, and integrated logistics providers that collectively ensure efficient supply chain operations for businesses nationwide. Market dynamics indicate robust growth driven by e-commerce expansion, just-in-time manufacturing requirements, and increasing demand for expedited delivery services.

Current market conditions reflect a sector experiencing significant transformation, with traditional cargo carriers adapting to evolving customer expectations and technological advancements. The market demonstrates resilience through economic fluctuations, maintaining steady growth at approximately 4.2% CAGR over recent years. Industry participants continue to invest in fleet modernization, route optimization, and digital infrastructure to enhance operational efficiency and customer service capabilities.

Regional distribution shows concentrated activity in major metropolitan areas, with airports like Los Angeles, Memphis, and Louisville serving as primary cargo hubs. The market’s geographic spread reflects the nation’s economic centers, with 65% of cargo volume concentrated in the top ten metropolitan areas. Seasonal variations significantly impact market performance, with peak shipping periods during holiday seasons driving substantial volume increases.

The US air freight transport market refers to the comprehensive ecosystem of companies, infrastructure, and services dedicated to moving cargo via aircraft within and from the United States. This market encompasses domestic freight movement between US cities and international cargo transportation connecting American businesses to global markets.

Core components include dedicated cargo airlines operating freighter aircraft, passenger airlines utilizing belly cargo space, freight forwarding companies coordinating shipments, and ground handling services managing cargo processing at airports. The market serves diverse industries requiring rapid, reliable transportation of goods ranging from high-value electronics to time-sensitive pharmaceuticals and perishable products.

Service categories within this market include express delivery services, standard air freight, charter cargo flights, and specialized transportation for oversized or hazardous materials. Market participants provide end-to-end logistics solutions, combining air transportation with ground distribution networks to deliver comprehensive supply chain services to customers across various industry sectors.

Strategic analysis reveals the US air freight transport market as a mature yet evolving sector characterized by intense competition, technological innovation, and changing customer demands. The market benefits from America’s position as a global economic powerhouse, generating substantial domestic and international cargo flows that sustain industry growth and profitability.

Key performance indicators demonstrate market resilience, with cargo volumes recovering strongly from pandemic-related disruptions and achieving new growth trajectories. The sector shows particular strength in high-value, time-sensitive shipments, where air transport’s speed advantage justifies premium pricing. E-commerce growth contributes approximately 28% of volume increases in recent years, fundamentally reshaping market dynamics and service requirements.

Competitive landscape features established integrated carriers, specialized cargo airlines, and emerging technology-driven logistics providers competing for market share. Industry consolidation continues as companies seek economies of scale and expanded service capabilities. Operational efficiency improvements through automation and digital technologies enable carriers to maintain competitiveness while managing rising operational costs.

Future prospects indicate continued market expansion driven by globalization trends, supply chain diversification strategies, and increasing demand for rapid delivery services. The market’s evolution toward more sustainable operations and enhanced customer visibility represents key strategic priorities for industry participants seeking long-term competitive advantage.

Market intelligence reveals several critical insights shaping the US air freight transport landscape. The sector demonstrates remarkable adaptability to changing economic conditions and customer requirements, with companies continuously evolving service offerings to maintain competitive positioning.

Primary growth drivers propelling the US air freight transport market include the accelerating pace of global commerce, increasing consumer expectations for rapid delivery, and the critical role of air transport in maintaining supply chain efficiency. These fundamental forces create sustained demand for air freight services across multiple industry sectors.

E-commerce expansion serves as a particularly powerful market driver, with online retailers requiring fast, reliable shipping options to meet customer expectations. The growth of next-day and same-day delivery services directly translates to increased air freight volumes, especially for high-value consumer goods and electronics. Market penetration of e-commerce continues expanding at 12.8% annually, creating substantial opportunities for air freight providers.

Just-in-time manufacturing practices across industries necessitate reliable, predictable transportation services that air freight uniquely provides. Manufacturers increasingly depend on air transport for critical components and raw materials, particularly in high-tech industries where production delays can result in significant financial losses. Supply chain optimization strategies prioritize speed and reliability over cost considerations for essential shipments.

Globalization trends continue driving international trade volumes, with US companies expanding overseas operations and foreign businesses seeking access to American markets. This bilateral trade growth creates consistent demand for international air freight services, supporting route expansion and capacity investments by major carriers.

Significant challenges facing the US air freight transport market include rising operational costs, capacity constraints at key airports, and increasing environmental regulations that impact industry profitability and growth potential. These restraints require strategic responses from market participants to maintain competitive positioning.

Fuel cost volatility represents a persistent challenge for air freight operators, with jet fuel expenses comprising a substantial portion of operational costs. Price fluctuations directly impact profit margins and pricing strategies, requiring sophisticated hedging programs and operational efficiency improvements to mitigate financial risks. Cost pressures intensify during periods of high fuel prices, affecting service pricing and market competitiveness.

Airport congestion and infrastructure limitations constrain capacity growth at major cargo hubs, creating operational delays and increased costs. Limited runway availability, cargo handling facility constraints, and air traffic control restrictions impact service reliability and operational efficiency. Infrastructure bottlenecks affect approximately 35% of major cargo airports, limiting market expansion potential.

Regulatory compliance costs continue increasing as security requirements become more stringent and environmental regulations more demanding. These compliance obligations require substantial investments in technology, training, and operational procedures, creating barriers to entry for smaller operators and increasing operational complexity for established carriers.

Emerging opportunities within the US air freight transport market include technological innovation applications, expansion into underserved market segments, and development of specialized service offerings that address evolving customer needs. These opportunities enable market participants to differentiate services and capture additional market share.

Digital transformation initiatives create opportunities for enhanced customer service, operational efficiency, and supply chain visibility. Advanced analytics, artificial intelligence, and Internet of Things technologies enable predictive maintenance, route optimization, and real-time cargo tracking capabilities that add significant value for customers. Technology adoption rates among leading carriers exceed 78% for core digital platforms.

Specialized cargo segments present growth opportunities, particularly in pharmaceuticals, perishables, and high-value electronics requiring temperature-controlled transportation and enhanced security measures. These niche markets command premium pricing and demonstrate strong growth potential as industries expand and regulatory requirements increase.

Sustainable aviation initiatives offer opportunities for market differentiation and regulatory compliance advantages. Investment in fuel-efficient aircraft, alternative fuels, and carbon offset programs positions carriers favorably with environmentally conscious customers and regulatory authorities. Sustainability programs influence purchasing decisions for approximately 42% of enterprise customers.

Regional market expansion opportunities exist in secondary cities and emerging trade corridors where air freight services remain underdeveloped. Strategic route development and partnership arrangements can capture growing demand in these markets while establishing competitive advantages before market saturation occurs.

Complex market dynamics shape the competitive landscape of the US air freight transport sector, with multiple factors influencing pricing, service levels, and strategic positioning. Understanding these dynamics enables market participants to develop effective competitive strategies and operational approaches.

Competitive intensity remains high across all market segments, with established integrated carriers, specialized freight airlines, and emerging logistics providers competing for customer relationships and market share. Price competition intensifies during economic downturns, while service differentiation becomes critical during growth periods. Market concentration shows the top five carriers controlling approximately 68% of total capacity.

Customer bargaining power varies significantly by market segment, with large enterprise customers wielding substantial influence over pricing and service terms, while smaller shippers typically accept standard service offerings. Long-term contracts and volume commitments provide stability for carriers while securing favorable rates for major customers.

Seasonal demand fluctuations create operational challenges and opportunities, with peak shipping periods requiring additional capacity and resources while off-peak periods necessitate cost management strategies. Effective capacity management and flexible operational models enable carriers to optimize profitability across seasonal cycles.

Technological disruption continues reshaping market dynamics, with automation, artificial intelligence, and digital platforms changing customer expectations and operational requirements. Carriers investing in advanced technologies gain competitive advantages through improved efficiency and enhanced service capabilities.

Comprehensive research methodology employed in analyzing the US air freight transport market combines quantitative data analysis with qualitative industry insights to provide accurate market intelligence and strategic recommendations. This multi-faceted approach ensures thorough coverage of market dynamics and competitive conditions.

Primary research activities include extensive interviews with industry executives, operational managers, and customer representatives across various market segments. These discussions provide firsthand insights into market trends, operational challenges, and strategic priorities that shape industry direction. Interview coverage encompasses representatives from over 150 industry participants across all major market segments.

Secondary research analysis incorporates government transportation statistics, industry association reports, financial filings from public companies, and academic research studies. This comprehensive data collection provides quantitative foundations for market analysis and trend identification. Data validation processes ensure accuracy and reliability of all statistical information and market projections.

Market modeling techniques utilize advanced statistical methods to analyze historical trends, identify growth patterns, and develop future market projections. These models incorporate multiple variables including economic indicators, industry capacity data, and customer demand patterns to generate reliable forecasts and strategic insights.

Regional market analysis reveals significant variations in air freight activity across different US geographic regions, with concentration patterns reflecting economic activity, population density, and international trade flows. Understanding these regional dynamics enables strategic planning and resource allocation decisions.

West Coast markets demonstrate the highest international cargo volumes, driven by extensive trade relationships with Asia-Pacific countries and major port connections. Los Angeles and San Francisco serve as primary gateways, handling approximately 32% of total US international air cargo. The region benefits from proximity to major technology companies and manufacturing centers requiring rapid international shipping services.

East Coast operations focus heavily on transatlantic trade and domestic distribution networks, with New York, Miami, and Atlanta serving as major cargo hubs. These markets show strong performance in high-value cargo segments and express delivery services. Regional market share represents approximately 28% of national cargo volume, with particular strength in pharmaceutical and financial services shipments.

Central US markets serve as critical domestic distribution hubs, with Memphis, Louisville, and Chicago functioning as major sorting and transfer facilities for integrated carriers. These locations benefit from geographic centrality and excellent ground transportation connections. Domestic cargo processing in central markets accounts for 45% of total domestic air freight volume.

Southern markets show rapid growth driven by expanding manufacturing operations, international trade through Mexico, and growing population centers. Dallas, Houston, and Phoenix emerge as increasingly important cargo destinations and transfer points, supporting regional economic development and trade facilitation.

Competitive dynamics within the US air freight transport market feature a diverse mix of integrated logistics providers, dedicated cargo airlines, and specialized service providers competing across multiple service segments and geographic markets. This competitive environment drives continuous innovation and service improvement.

Market positioning strategies vary significantly among competitors, with some focusing on comprehensive logistics solutions while others specialize in specific service segments or geographic markets. Integrated carriers leverage extensive ground networks and customer relationships, while specialized cargo airlines compete on operational efficiency and service flexibility.

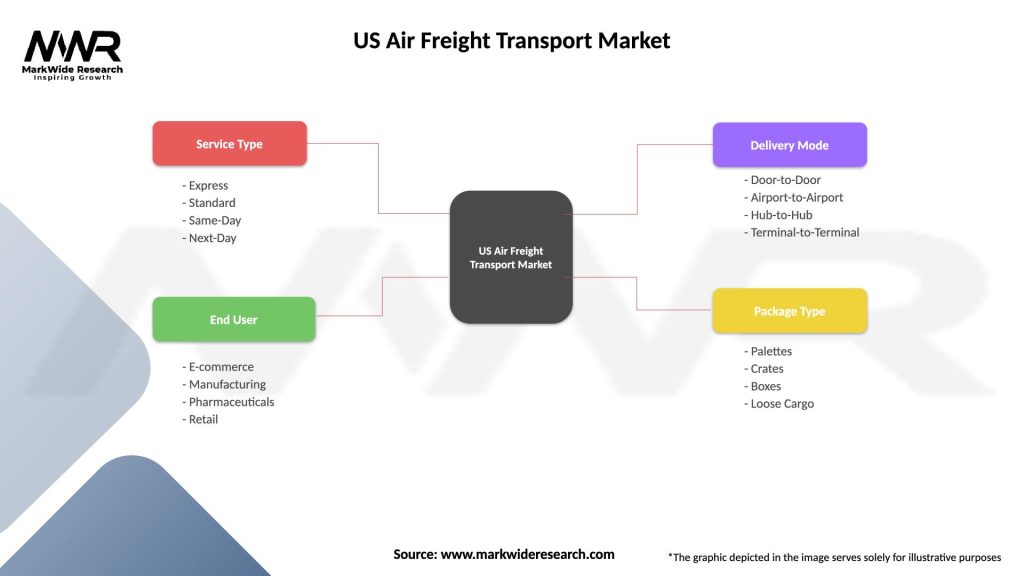

Market segmentation analysis reveals distinct customer groups and service categories within the US air freight transport market, each characterized by unique requirements, pricing sensitivities, and growth patterns. Understanding these segments enables targeted service development and marketing strategies.

By Service Type:

By Customer Segment:

By Geographic Scope:

Detailed category analysis provides insights into performance variations across different air freight market segments, revealing growth opportunities and competitive dynamics within specific service categories and customer groups.

Express delivery services demonstrate the strongest growth rates and profitability margins, driven by e-commerce expansion and customer expectations for rapid fulfillment. This category benefits from premium pricing and high customer loyalty, though it requires substantial infrastructure investments and operational complexity. Express segment growth exceeds overall market growth by 2.3 percentage points annually.

Standard air freight serves as the market foundation, providing cost-effective transportation for businesses prioritizing value over speed. This segment faces intense price competition but offers stable volumes and predictable demand patterns. Operational efficiency and route optimization become critical success factors in this price-sensitive category.

Specialized cargo services including temperature-controlled transportation, hazardous materials handling, and oversized cargo movement command premium pricing due to specialized equipment and expertise requirements. These niche segments offer attractive profit margins and growth potential as regulatory requirements increase and customer needs become more sophisticated.

International air freight benefits from global trade growth and supply chain diversification trends, though it faces challenges from trade policy changes and economic uncertainties. This category requires extensive regulatory compliance capabilities and international partnership networks to serve customer needs effectively.

Strategic advantages available to participants in the US air freight transport market include access to high-growth customer segments, opportunities for service differentiation, and potential for operational efficiency improvements through technology adoption and network optimization.

Revenue diversification opportunities enable carriers to reduce dependence on specific customer segments or trade lanes by developing comprehensive service portfolios and geographic coverage. This diversification strategy provides stability during economic downturns and positions companies for growth during expansion periods.

Technology integration benefits include enhanced operational efficiency, improved customer service capabilities, and reduced operational costs through automation and digital platforms. Advanced tracking systems, predictive analytics, and automated sorting facilities provide competitive advantages and customer value propositions.

Partnership opportunities with ground transportation providers, international carriers, and logistics service providers enable comprehensive supply chain solutions that command premium pricing and strengthen customer relationships. Strategic alliances expand service capabilities without requiring substantial capital investments.

Market expansion potential exists in underserved geographic markets, emerging industry segments, and specialized service categories where competition remains limited and customer needs continue evolving. Early market entry provides competitive advantages and customer relationship development opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the US air freight transport market include digital technology adoption, sustainability initiatives, and evolving customer service expectations that drive operational changes and strategic repositioning across the industry.

Digital transformation accelerates across all market segments, with carriers investing heavily in advanced analytics, artificial intelligence, and automated systems to improve operational efficiency and customer service quality. MarkWide Research analysis indicates that digital platform adoption rates among major carriers exceed 85% for core operational systems. These technologies enable predictive maintenance, route optimization, and real-time cargo tracking capabilities that provide significant competitive advantages.

Sustainability initiatives gain prominence as environmental regulations tighten and customers increasingly prioritize carbon-neutral shipping options. Carriers invest in fuel-efficient aircraft, alternative fuel research, and carbon offset programs to address environmental concerns while maintaining operational efficiency. Green logistics programs influence purchasing decisions for approximately 38% of enterprise customers.

Supply chain visibility becomes a critical customer requirement, with shippers demanding real-time tracking, predictive delivery notifications, and comprehensive shipment documentation. Advanced tracking technologies and customer portal development enable carriers to meet these expectations while differentiating services from competitors.

Last-mile integration trends show air freight carriers expanding into ground delivery services to provide comprehensive logistics solutions and capture additional revenue streams. This vertical integration strategy enables better service control and customer relationship management while improving overall supply chain efficiency.

Recent industry developments demonstrate the dynamic nature of the US air freight transport market, with significant investments in infrastructure, technology, and service capabilities reshaping competitive dynamics and operational approaches across the sector.

Fleet modernization initiatives continue as carriers invest in fuel-efficient aircraft and advanced cargo handling equipment to reduce operational costs and improve service reliability. These investments support capacity expansion while addressing environmental concerns and operational efficiency requirements.

Airport infrastructure expansion projects at major cargo hubs enhance capacity and operational efficiency, with significant investments in automated sorting systems, expanded cargo handling facilities, and improved ground transportation connections. These developments support market growth and improve service quality for customers.

Strategic partnerships and alliance formations enable carriers to expand service capabilities and geographic coverage without substantial capital investments. These collaborative arrangements provide access to new markets and customer segments while sharing operational risks and costs.

Technology acquisitions and development programs focus on artificial intelligence, blockchain applications, and Internet of Things integration to enhance operational efficiency and customer service capabilities. These investments position carriers for future competition and customer requirement evolution.

Regulatory compliance initiatives address evolving security requirements and environmental regulations through operational procedure updates, technology implementations, and staff training programs. These efforts ensure continued market access and customer confidence while managing compliance costs.

Strategic recommendations for US air freight transport market participants focus on operational efficiency improvements, customer service enhancement, and strategic positioning for long-term competitive advantage in an evolving market environment.

Technology investment priorities should emphasize customer-facing applications and operational efficiency systems that provide measurable returns on investment. Carriers should focus on integrated platforms that enhance visibility, improve operational control, and enable data-driven decision making across all business functions.

Service differentiation strategies become increasingly important as price competition intensifies across standard service categories. Companies should develop specialized capabilities in high-value segments such as temperature-controlled transportation, hazardous materials handling, and time-critical delivery services that command premium pricing.

Partnership development opportunities should focus on complementary service providers that enhance customer value propositions without creating competitive conflicts. Strategic alliances with ground transportation companies, international carriers, and technology providers can expand service capabilities while sharing investment requirements and operational risks.

Market expansion considerations should prioritize underserved geographic regions and emerging customer segments where competition remains limited and growth potential appears substantial. Early market entry provides opportunities to establish customer relationships and operational advantages before market maturation occurs.

Operational efficiency initiatives must balance cost reduction objectives with service quality maintenance to preserve customer satisfaction and competitive positioning. Focus areas should include fuel efficiency improvements, route optimization, and automation implementation where measurable benefits can be achieved.

Long-term market prospects for the US air freight transport sector indicate continued growth driven by e-commerce expansion, global trade development, and increasing demand for rapid, reliable transportation services. MWR projections suggest sustained market expansion at approximately 4.8% CAGR over the next five years, supported by fundamental economic trends and technological advancement adoption.

Technology evolution will continue reshaping operational approaches and customer service capabilities, with artificial intelligence, automation, and digital platforms becoming standard industry tools. Carriers investing early in these technologies will gain competitive advantages through improved efficiency and enhanced service offerings that meet evolving customer expectations.

Sustainability requirements will intensify as environmental regulations become more stringent and customer preferences shift toward carbon-neutral shipping options. The industry’s response through fuel-efficient aircraft adoption, alternative fuel development, and carbon offset programs will influence competitive positioning and regulatory compliance capabilities.

Market consolidation trends may accelerate as companies seek economies of scale and expanded service capabilities to compete effectively in an increasingly complex market environment. Strategic mergers and acquisitions will reshape competitive dynamics while potentially improving operational efficiency and customer service capabilities.

Customer service evolution will emphasize real-time visibility, predictive analytics, and integrated logistics solutions that provide comprehensive supply chain management capabilities. Carriers developing these advanced service offerings will capture premium pricing opportunities and strengthen customer relationships in competitive markets.

The US air freight transport market represents a dynamic and essential component of the nation’s logistics infrastructure, demonstrating resilience and adaptability in response to changing economic conditions and customer requirements. The sector’s continued evolution reflects broader trends in global commerce, technology adoption, and supply chain optimization that create both opportunities and challenges for market participants.

Strategic positioning for success in this competitive environment requires balanced approaches to operational efficiency, customer service excellence, and technological innovation. Companies that effectively integrate these elements while maintaining financial discipline will capture market share and achieve sustainable competitive advantages in an evolving marketplace.

Future market development will be shaped by continued e-commerce growth, international trade expansion, and increasing customer expectations for rapid, reliable, and environmentally responsible transportation services. The industry’s ability to address these requirements while managing operational costs and regulatory compliance will determine long-term success and market positioning for individual participants and the sector overall.

What is Air Freight Transport?

Air Freight Transport refers to the shipment of goods via air carriers, which is a crucial component of the logistics and supply chain industry. It is commonly used for transporting time-sensitive and high-value items across long distances.

What are the key players in the US Air Freight Transport Market?

Key players in the US Air Freight Transport Market include FedEx, UPS, and DHL, which provide extensive logistics services and air cargo solutions. These companies are known for their global reach and advanced tracking technologies, among others.

What are the main drivers of growth in the US Air Freight Transport Market?

The main drivers of growth in the US Air Freight Transport Market include the increasing demand for e-commerce, the need for faster delivery times, and the globalization of trade. Additionally, advancements in technology and logistics management are enhancing operational efficiencies.

What challenges does the US Air Freight Transport Market face?

The US Air Freight Transport Market faces challenges such as rising fuel costs, regulatory compliance issues, and capacity constraints. Additionally, fluctuations in demand and competition from alternative transport modes can impact market stability.

What opportunities exist in the US Air Freight Transport Market?

Opportunities in the US Air Freight Transport Market include the expansion of e-commerce logistics, the integration of automation and AI in operations, and the development of sustainable air transport solutions. These trends are expected to shape the future of the industry.

What trends are currently shaping the US Air Freight Transport Market?

Current trends in the US Air Freight Transport Market include the increasing use of digital platforms for booking and tracking shipments, a focus on sustainability, and the adoption of advanced technologies like drones and autonomous vehicles. These innovations are transforming traditional logistics practices.

US Air Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Service Type | Express, Standard, Same-Day, Next-Day |

| End User | E-commerce, Manufacturing, Pharmaceuticals, Retail |

| Delivery Mode | Door-to-Door, Airport-to-Airport, Hub-to-Hub, Terminal-to-Terminal |

| Package Type | Palettes, Crates, Boxes, Loose Cargo |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Air Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at