444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US agricultural tractor market represents a cornerstone of American farming infrastructure, driving mechanization and productivity across diverse agricultural landscapes. This dynamic sector encompasses a comprehensive range of equipment from compact utility tractors to high-horsepower field machines, serving everything from small-scale farming operations to large commercial agricultural enterprises. The market demonstrates remarkable resilience and continuous evolution, adapting to changing agricultural practices, technological advancements, and sustainability requirements.

Market dynamics indicate robust growth potential driven by increasing farm mechanization, precision agriculture adoption, and the need for enhanced operational efficiency. The sector benefits from strong domestic manufacturing capabilities, extensive dealer networks, and continuous innovation in engine technology, hydraulic systems, and digital integration. Current trends show growing demand for smart tractors equipped with GPS guidance, automated steering, and data analytics capabilities, reflecting the industry’s shift toward precision farming methodologies.

Regional distribution across the United States shows concentrated demand in major agricultural states including Iowa, Illinois, Nebraska, Kansas, and Texas, where large-scale crop production drives equipment needs. The market experiences seasonal fluctuations aligned with planting and harvesting cycles, with peak sales typically occurring during spring preparation and fall harvest periods. Growth projections suggest continued expansion at approximately 4.2% CAGR through the forecast period, supported by agricultural modernization initiatives and replacement demand for aging equipment fleets.

The US agricultural tractor market refers to the comprehensive ecosystem of wheeled and tracked agricultural vehicles designed for pulling, pushing, and powering various farming implements and machinery across American agricultural operations. This market encompasses the manufacturing, distribution, sales, and servicing of tractors ranging from compact utility models under 40 horsepower to high-performance field tractors exceeding 400 horsepower, along with specialized variants for specific agricultural applications.

Market scope includes traditional mechanical tractors, modern computerized units with advanced hydraulic systems, and emerging autonomous or semi-autonomous models incorporating artificial intelligence and machine learning capabilities. The definition extends beyond the vehicles themselves to encompass related components, attachments, precision agriculture technologies, telematics systems, and comprehensive service networks that support agricultural productivity and efficiency across diverse farming operations throughout the United States.

Strategic analysis reveals the US agricultural tractor market as a mature yet dynamically evolving sector characterized by technological innovation, consolidation among major manufacturers, and increasing integration of digital technologies. The market benefits from strong fundamentals including consistent agricultural production needs, government support programs, and ongoing modernization of farming operations across the country.

Key market drivers include the growing adoption of precision agriculture techniques, which account for approximately 68% of large farm operations, increasing labor costs driving mechanization demand, and environmental regulations promoting cleaner, more efficient equipment. The sector demonstrates resilience through economic cycles, supported by essential food production requirements and export market opportunities.

Competitive landscape features established global manufacturers with strong US market presence, including domestic production facilities and extensive dealer networks. Innovation focus centers on fuel efficiency improvements, emissions reduction, operator comfort enhancements, and integration of smart farming technologies. Market consolidation trends continue as manufacturers seek economies of scale and expanded technological capabilities to meet evolving customer demands.

Market intelligence reveals several critical insights shaping the US agricultural tractor industry’s trajectory and competitive dynamics:

Primary growth drivers propelling the US agricultural tractor market reflect fundamental changes in farming practices, economic pressures, and technological capabilities that reshape agricultural operations nationwide.

Farm consolidation trends create demand for larger, more powerful equipment capable of handling expanded acreage efficiently. As average farm sizes increase, operators require tractors with greater horsepower, wider implement compatibility, and enhanced productivity features. This consolidation drives replacement of multiple smaller units with fewer, more capable machines that can handle diverse tasks across larger operational areas.

Labor shortage challenges across agricultural sectors accelerate mechanization adoption and drive demand for automated features that reduce operator skill requirements. Rising labor costs and difficulty finding qualified agricultural workers make advanced tractors with automated guidance, implement control, and monitoring systems increasingly attractive investments for farm operations seeking to maintain productivity with reduced workforce requirements.

Precision agriculture adoption continues expanding as farmers recognize the economic benefits of variable rate application, GPS-guided operations, and data-driven decision making. Modern tractors serve as platforms for sophisticated precision farming technologies, creating demand for equipment capable of supporting advanced agricultural practices that optimize input usage and maximize yield potential.

Government support programs and agricultural policies provide financial incentives for equipment modernization, emissions compliance, and productivity improvements. Tax depreciation benefits, conservation program requirements, and environmental regulations encourage farmers to invest in newer, more efficient equipment that meets current standards while providing operational advantages.

Significant challenges facing the US agricultural tractor market include economic pressures, regulatory complexities, and structural industry factors that can limit growth potential and market expansion.

High capital costs associated with modern agricultural tractors create barriers for smaller farming operations and limit market accessibility. Advanced features, emissions control systems, and precision agriculture technologies significantly increase equipment prices, making new tractor acquisition challenging for operations with limited capital resources or uncertain economic conditions.

Economic volatility in agricultural commodity markets directly impacts farmer purchasing decisions and equipment investment timing. Fluctuating crop prices, weather-related production risks, and trade policy uncertainties create hesitation among potential buyers, leading to delayed replacement cycles and reduced new equipment sales during challenging economic periods.

Regulatory compliance costs associated with emissions standards, safety requirements, and environmental regulations increase manufacturing expenses and product complexity. Tier 4 emissions standards, operator safety features, and environmental protection requirements add significant costs to tractor production while requiring ongoing compliance investments from manufacturers.

Technology complexity and rapid innovation cycles create challenges for both manufacturers and end users. Sophisticated electronic systems, software integration requirements, and connectivity features increase maintenance complexity, technician training needs, and potential reliability concerns that may discourage adoption among traditional farming operations.

Emerging opportunities within the US agricultural tractor market present significant potential for growth, innovation, and market expansion across multiple dimensions of the agricultural equipment sector.

Autonomous farming technology represents a transformative opportunity as fully autonomous and semi-autonomous tractors move from development to commercial deployment. Early adoption of unmanned agricultural vehicles, robotic farming systems, and AI-driven equipment management creates new market segments and premium pricing opportunities for technology leaders.

Electrification trends in agricultural equipment open new possibilities for electric and hybrid tractor development, particularly for smaller operations and specialized applications. Battery technology improvements, charging infrastructure development, and environmental sustainability requirements create market opportunities for alternative power systems in agricultural applications.

Data monetization through connected equipment and precision agriculture platforms enables manufacturers to develop recurring revenue streams beyond traditional equipment sales. Telematics services, data analytics platforms, and digital farming solutions create ongoing customer relationships and additional value propositions that extend beyond initial equipment purchases.

Export market expansion leverages US manufacturing capabilities and technological leadership to serve growing international demand for advanced agricultural equipment. Emerging markets with developing agricultural sectors represent significant opportunities for US tractor manufacturers to expand their global footprint and diversify revenue sources.

Complex market dynamics shape the US agricultural tractor industry through interconnected forces affecting supply chains, customer behavior, competitive positioning, and technological evolution across the agricultural equipment ecosystem.

Supply chain integration between tractor manufacturers, component suppliers, and dealer networks creates both efficiencies and vulnerabilities that impact market performance. Global sourcing strategies, just-in-time manufacturing approaches, and inventory management practices influence product availability, pricing strategies, and customer satisfaction levels throughout the distribution system.

Seasonal demand patterns create cyclical market dynamics aligned with agricultural calendars, weather conditions, and farming operation requirements. Spring planting seasons and fall harvest periods generate peak demand periods, while winter months typically see reduced sales activity, requiring manufacturers and dealers to manage inventory and cash flow accordingly.

Technology adoption rates vary significantly across different farm sizes, geographic regions, and crop types, creating diverse market segments with distinct requirements and purchasing behaviors. Large commercial operations typically lead in advanced technology adoption, while smaller farms may prioritize reliability and cost-effectiveness over cutting-edge features.

Competitive intensity among major manufacturers drives continuous innovation, pricing pressures, and market share battles that benefit customers through improved products and competitive pricing. Consolidation trends, strategic partnerships, and technology licensing agreements reshape competitive dynamics and influence long-term market structure development.

Comprehensive research methodology employed in analyzing the US agricultural tractor market combines quantitative data analysis, qualitative industry insights, and primary research activities to develop accurate market intelligence and forecasting models.

Primary research activities include extensive interviews with industry executives, equipment dealers, agricultural producers, and technology providers to gather firsthand insights into market trends, customer preferences, and competitive dynamics. Survey methodologies capture quantitative data on purchasing patterns, feature preferences, and satisfaction levels across diverse customer segments.

Secondary research analysis incorporates government agricultural statistics, industry association reports, manufacturer financial disclosures, and trade publication data to establish market baselines and validate primary research findings. Economic indicators, demographic trends, and agricultural production data provide context for market analysis and forecasting activities.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop robust market forecasts and identify key growth drivers. Segmentation analysis, competitive benchmarking, and technology adoption modeling provide detailed insights into market structure and evolution patterns that inform strategic recommendations and market projections.

Geographic market distribution across the United States reveals distinct regional characteristics, demand patterns, and growth opportunities that reflect diverse agricultural practices, crop types, and farming operation structures throughout different areas of the country.

Midwest region dominates the US agricultural tractor market, accounting for approximately 52% of total sales volume, driven by extensive corn and soybean production across states including Iowa, Illinois, Indiana, Nebraska, and Minnesota. Large-scale farming operations, favorable soil conditions, and intensive agricultural practices create strong demand for high-horsepower tractors and advanced precision agriculture equipment.

Great Plains states including Kansas, Oklahoma, North Dakota, and South Dakota represent significant market opportunities with approximately 23% market share, characterized by wheat production, cattle ranching, and diverse crop rotations. The region’s emphasis on efficient large-scale operations drives demand for versatile tractors capable of handling multiple agricultural tasks across extensive acreage.

Southern agricultural regions encompassing Texas, Georgia, North Carolina, and other southeastern states account for roughly 18% of market activity, with demand driven by cotton production, livestock operations, and specialty crop cultivation. Climate considerations, soil types, and crop diversity requirements influence equipment specifications and feature preferences in these markets.

Western states including California, Washington, and Oregon contribute approximately 7% of market volume, with demand concentrated in specialty crop production, orchard operations, and vineyard management. Unique agricultural applications, environmental regulations, and high-value crop production create demand for specialized tractor configurations and precision agriculture capabilities.

Market leadership in the US agricultural tractor sector is characterized by established global manufacturers with strong domestic presence, extensive dealer networks, and comprehensive product portfolios serving diverse agricultural applications.

Competitive strategies emphasize technology differentiation, dealer support programs, financing solutions, and customer service excellence. Manufacturers invest heavily in research and development, focusing on fuel efficiency, emissions compliance, operator comfort, and precision agriculture integration to maintain competitive advantages in an increasingly sophisticated market environment.

Market segmentation analysis reveals distinct categories based on horsepower ratings, application types, and customer segments that drive different purchasing behaviors and product requirements across the US agricultural tractor market.

By Horsepower Range:

By Application Type:

Detailed category analysis provides specific insights into performance characteristics, growth trends, and competitive dynamics within distinct segments of the US agricultural tractor market.

Compact Tractor Segment demonstrates strong growth driven by hobby farming, rural property management, and landscaping applications. This category benefits from lower entry costs, simplified operation, and versatile attachment systems that appeal to non-traditional agricultural users. Market penetration continues expanding as suburban and rural property development increases demand for small-scale equipment solutions.

Utility Tractor Category serves as the workhorse segment for mid-sized farming operations, offering balanced performance, affordability, and operational flexibility. These tractors typically feature mechanical transmissions, standard hydraulic systems, and proven reliability that appeals to cost-conscious operators. Technology adoption in this segment focuses on practical improvements rather than advanced precision agriculture features.

Row Crop Tractor Segment represents the technology leadership category where manufacturers showcase advanced features, precision agriculture integration, and performance innovations. This segment drives premium pricing strategies and demonstrates highest adoption rates for GPS guidance, automated steering, and data management systems that optimize large-scale crop production efficiency.

High-Horsepower Category caters to the largest farming operations requiring maximum productivity and advanced capabilities. These tractors feature sophisticated transmissions, powerful hydraulic systems, and comprehensive technology packages that justify premium pricing through operational efficiency gains and productivity improvements in large-scale agricultural applications.

Comprehensive benefits accrue to various stakeholders throughout the US agricultural tractor market ecosystem, creating value for manufacturers, dealers, farmers, and supporting industries through improved efficiency, productivity, and economic opportunities.

For Manufacturers:

For Agricultural Producers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the US agricultural tractor market reflect technological advancement, changing agricultural practices, and evolving customer expectations that drive industry innovation and competitive dynamics.

Precision Agriculture Integration continues accelerating as farmers recognize the economic benefits of variable rate application, GPS-guided operations, and data-driven decision making. Modern tractors increasingly serve as platforms for sophisticated farming technologies, with adoption rates reaching approximately 82% among large commercial operations for basic GPS guidance systems.

Autonomous Operation Development represents the next frontier in agricultural mechanization, with manufacturers investing heavily in self-driving tractor technology, robotic field operations, and unmanned agricultural systems. Early commercial deployments demonstrate potential for labor cost reduction and operational efficiency improvements in large-scale farming applications.

Connectivity and Telematics expansion enables real-time equipment monitoring, predictive maintenance capabilities, and fleet management optimization. Connected tractors provide valuable operational data, maintenance alerts, and performance analytics that improve equipment utilization and reduce downtime for farming operations.

Sustainability Focus drives development of more fuel-efficient engines, alternative power systems, and environmentally friendly technologies. Manufacturers prioritize emissions reduction, fuel economy improvements, and sustainable manufacturing practices to meet regulatory requirements and customer environmental expectations.

Recent industry developments highlight significant technological advances, strategic partnerships, and market evolution activities that shape the competitive landscape and future direction of the US agricultural tractor market.

Technology Partnerships between traditional equipment manufacturers and technology companies accelerate innovation in autonomous systems, artificial intelligence, and digital agriculture platforms. These collaborations combine agricultural expertise with cutting-edge technology capabilities to develop next-generation farming solutions.

Manufacturing Investments in domestic production facilities demonstrate commitment to US market leadership and supply chain resilience. Major manufacturers continue expanding and modernizing production capabilities to meet growing demand and incorporate advanced manufacturing technologies.

Acquisition Activities among industry participants drive market consolidation and technology integration as companies seek to expand capabilities, access new markets, and achieve operational synergies. Strategic acquisitions focus on precision agriculture technologies, software platforms, and specialized equipment manufacturers.

Regulatory Adaptations to evolving emissions standards, safety requirements, and environmental regulations require continuous product development and compliance investments. Manufacturers proactively address regulatory changes while maintaining performance and reliability standards expected by agricultural customers.

Strategic recommendations for market participants reflect comprehensive analysis of industry trends, competitive dynamics, and growth opportunities within the evolving US agricultural tractor market landscape.

Technology Investment Priorities should focus on autonomous operation capabilities, precision agriculture integration, and connectivity features that provide measurable value to farming operations. MarkWide Research analysis indicates that technology-forward manufacturers achieve approximately 15% higher profit margins compared to traditional equipment providers.

Market Segmentation Strategies require tailored approaches for different customer segments, with compact tractor markets emphasizing ease of use and versatility, while high-horsepower segments prioritize advanced technology and productivity features. Manufacturers should develop segment-specific value propositions and marketing strategies.

Service Expansion Opportunities in maintenance, training, and digital services create recurring revenue streams and strengthen customer relationships. Comprehensive service offerings including remote monitoring, predictive maintenance, and operator training programs differentiate manufacturers in competitive markets.

Partnership Development with technology providers, software companies, and agricultural service organizations enables access to complementary capabilities and accelerates innovation timelines. Strategic alliances can provide competitive advantages in rapidly evolving precision agriculture markets.

Long-term market projections for the US agricultural tractor industry indicate continued growth driven by technological advancement, agricultural modernization, and evolving farming practices that reshape equipment requirements and market opportunities.

Growth trajectory analysis suggests sustained market expansion at approximately 4.8% CAGR over the next decade, supported by replacement demand for aging equipment fleets, technology upgrade cycles, and increasing adoption of precision agriculture practices. MWR projections indicate that high-technology tractor segments will experience above-average growth rates as farmers prioritize efficiency and productivity improvements.

Technology evolution will fundamentally transform agricultural equipment capabilities through autonomous operation, artificial intelligence integration, and advanced data analytics. Fully autonomous tractors are expected to achieve commercial viability within the next five to seven years, initially in large-scale farming operations before expanding to smaller agricultural segments.

Market structure changes may include increased consolidation among manufacturers, new entrants from technology sectors, and evolving distribution models that incorporate digital sales channels and direct-to-customer relationships. Traditional dealer networks will adapt to provide enhanced technical support and digital services alongside conventional sales and service functions.

Sustainability requirements will drive continued innovation in alternative power systems, emissions reduction technologies, and environmentally friendly manufacturing processes. Electric and hybrid tractors are expected to gain market traction in specific applications, while traditional diesel engines will become increasingly efficient and clean-burning to meet regulatory standards.

The US agricultural tractor market stands at a pivotal juncture where traditional agricultural equipment meets cutting-edge technology, creating unprecedented opportunities for innovation, growth, and market transformation. This comprehensive analysis reveals a dynamic industry characterized by strong fundamentals, technological leadership, and continuous evolution in response to changing agricultural practices and customer requirements.

Market resilience demonstrates the essential role of agricultural tractors in American food production systems, while growth drivers including precision agriculture adoption, farm consolidation trends, and labor shortage challenges create sustained demand for advanced equipment solutions. The industry’s commitment to innovation, evidenced by significant investments in autonomous technology, connectivity features, and sustainability improvements, positions manufacturers for long-term success in an evolving agricultural landscape.

Strategic opportunities abound for industry participants willing to embrace technological transformation, develop comprehensive service offerings, and adapt to changing customer expectations. Success in this market requires balancing traditional agricultural values with modern technology capabilities, creating equipment solutions that enhance productivity while maintaining the reliability and durability that farmers demand. The future belongs to manufacturers who can effectively integrate advanced technologies with practical agricultural applications, delivering measurable value to farming operations of all sizes across the diverse American agricultural sector.

What is Agricultural Tractor?

Agricultural tractors are powerful vehicles designed primarily for agricultural tasks such as plowing, tilling, and planting. They are essential for modern farming operations, providing the necessary power and versatility for various agricultural applications.

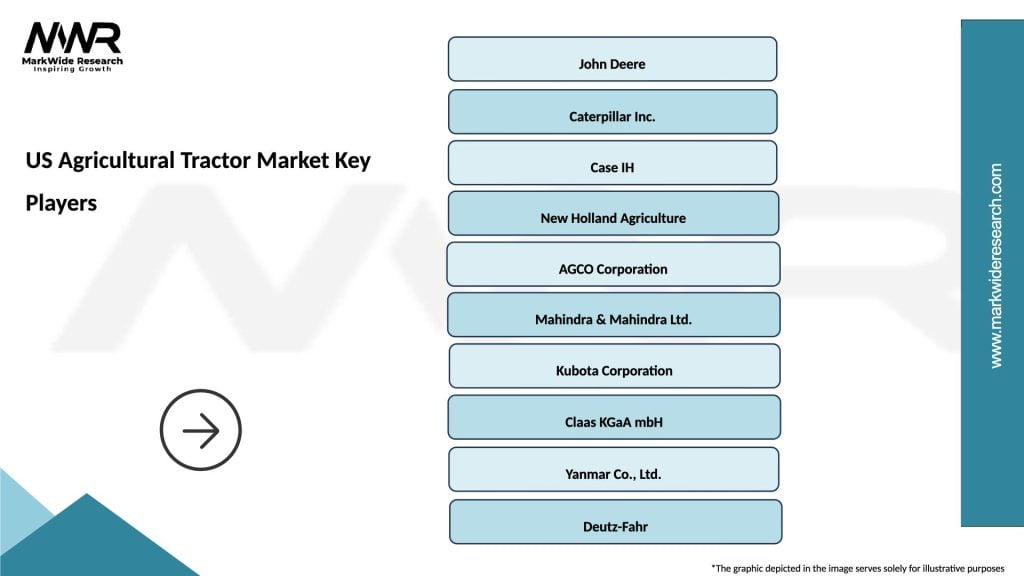

What are the key players in the US Agricultural Tractor Market?

Key players in the US Agricultural Tractor Market include John Deere, Case IH, and AGCO Corporation, which are known for their innovative tractor designs and advanced agricultural technologies. These companies compete on factors such as performance, fuel efficiency, and technological advancements, among others.

What are the growth factors driving the US Agricultural Tractor Market?

The US Agricultural Tractor Market is driven by factors such as the increasing demand for food production, advancements in agricultural technology, and the need for efficient farming practices. Additionally, the rise in precision agriculture is contributing to the growth of this market.

What challenges does the US Agricultural Tractor Market face?

Challenges in the US Agricultural Tractor Market include high initial costs of advanced tractors, fluctuating fuel prices, and the need for skilled operators. These factors can hinder adoption rates and impact overall market growth.

What opportunities exist in the US Agricultural Tractor Market?

Opportunities in the US Agricultural Tractor Market include the development of electric and hybrid tractors, which can reduce emissions and operating costs. Additionally, the integration of smart technologies and automation presents significant growth potential for manufacturers.

What trends are shaping the US Agricultural Tractor Market?

Trends in the US Agricultural Tractor Market include the increasing adoption of precision farming techniques, the rise of autonomous tractors, and the focus on sustainability. These trends are transforming how agricultural tasks are performed and enhancing productivity.

US Agricultural Tractor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Compact Tractors, Utility Tractors, Row Crop Tractors, Specialty Tractors |

| Technology | Hydraulic Systems, GPS Guidance, Autonomous Systems, Precision Farming |

| End User | Farmers, Agricultural Contractors, Government Agencies, Research Institutions |

| Fuel Type | Diesel, Gasoline, Electric, Biofuel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Agricultural Tractor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at