444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US aesthetic equipment market represents one of the most dynamic and rapidly evolving sectors within the medical device industry. This comprehensive market encompasses a wide range of sophisticated technologies designed to enhance appearance, reduce signs of aging, and improve overall aesthetic outcomes for patients across the United States. Market dynamics indicate sustained growth driven by increasing consumer awareness, technological advancements, and expanding treatment accessibility.

Current market conditions reflect a robust ecosystem where innovation meets consumer demand for non-invasive and minimally invasive aesthetic procedures. The market has experienced remarkable expansion, with annual growth rates consistently exceeding industry averages. Technology adoption has accelerated significantly, particularly in areas such as laser treatments, radiofrequency devices, and advanced imaging systems.

Regional distribution shows concentrated activity in major metropolitan areas, with California, New York, and Florida leading in both equipment deployment and procedure volumes. The market benefits from a well-established healthcare infrastructure, favorable regulatory environment, and high disposable income levels among target demographics. MarkWide Research analysis indicates that technological sophistication continues to drive market differentiation and competitive positioning.

Industry stakeholders include equipment manufacturers, aesthetic practitioners, medical spas, and dermatology clinics, all contributing to a comprehensive value chain that serves millions of patients annually. The market demonstrates strong resilience and adaptability, with growth projections indicating sustained expansion over the forecast period.

The US aesthetic equipment market refers to the comprehensive ecosystem of medical devices, technologies, and systems specifically designed for cosmetic and aesthetic enhancement procedures within the United States healthcare landscape. This market encompasses both surgical and non-surgical equipment used by qualified practitioners to improve patient appearance and address various aesthetic concerns.

Core components of this market include laser systems for hair removal and skin rejuvenation, radiofrequency devices for body contouring, ultrasound equipment for non-invasive treatments, and advanced imaging systems for treatment planning and monitoring. The market also incorporates consumables, accessories, and software solutions that support these primary technologies.

Market scope extends beyond traditional medical settings to include medical spas, wellness centers, and specialized aesthetic clinics. This broad application base reflects the democratization of aesthetic treatments and the increasing acceptance of cosmetic procedures across diverse demographic segments.

Regulatory framework ensures that all equipment meets stringent safety and efficacy standards established by the Food and Drug Administration (FDA), providing practitioners and patients with confidence in treatment outcomes and safety profiles.

Strategic market positioning reveals the US aesthetic equipment market as a cornerstone of the global cosmetic medicine industry, characterized by technological innovation, strong consumer demand, and robust regulatory oversight. The market demonstrates exceptional growth momentum, driven by demographic trends, technological advancement, and evolving consumer preferences toward non-invasive aesthetic solutions.

Key growth drivers include an aging population seeking age-reversal treatments, increasing social media influence on appearance standards, and growing acceptance of aesthetic procedures among younger demographics. Technology integration has reached approximately 78% adoption rates for advanced laser systems in major metropolitan markets, indicating strong market penetration and acceptance.

Market segmentation shows diverse applications across facial aesthetics, body contouring, skin rejuvenation, and hair restoration. Each segment demonstrates unique growth patterns and technology preferences, with non-invasive procedures accounting for approximately 85% of total treatment volumes across the market.

Competitive landscape features both established medical device manufacturers and innovative technology companies, creating a dynamic environment that fosters continuous innovation and improvement in treatment outcomes. The market benefits from strong intellectual property protection and significant research and development investments.

Future outlook indicates continued expansion driven by technological convergence, artificial intelligence integration, and personalized treatment approaches that enhance patient outcomes and practitioner efficiency.

Primary market insights reveal several critical trends shaping the US aesthetic equipment landscape:

Market penetration analysis shows that approximately 92% of dermatology practices now incorporate some form of aesthetic equipment, representing significant market saturation in traditional medical settings. Growth opportunities increasingly focus on medical spa expansion and consumer device markets.

Treatment efficacy improvements have reached remarkable levels, with modern laser systems achieving 95% patient satisfaction rates for hair removal procedures and radiofrequency devices showing 88% effectiveness in body contouring applications.

Demographic transformation serves as the primary catalyst driving US aesthetic equipment market expansion. The aging baby boomer population, combined with image-conscious millennials and Generation Z consumers, creates unprecedented demand for aesthetic enhancement solutions. Population dynamics indicate that individuals aged 35-65 represent the fastest-growing segment seeking aesthetic treatments.

Social media influence has fundamentally altered beauty standards and treatment awareness, with platforms like Instagram and TikTok driving consumer interest in aesthetic procedures. This digital influence translates directly into increased treatment demand and equipment utilization across all market segments.

Technological advancement continues to expand treatment possibilities while reducing associated risks and recovery times. Modern equipment offers enhanced precision, improved safety profiles, and superior patient comfort, making aesthetic procedures more accessible and appealing to broader demographics.

Economic factors support market growth through increased disposable income levels, expanded insurance coverage for certain procedures, and flexible financing options that make treatments more affordable. Consumer spending on aesthetic procedures has increased by approximately 12% annually over the past five years.

Regulatory support from the FDA has streamlined approval processes for innovative technologies while maintaining rigorous safety standards, encouraging continued innovation and market entry for new solutions.

Professional education and training programs have expanded significantly, creating a larger pool of qualified practitioners capable of operating advanced aesthetic equipment safely and effectively.

High capital costs represent the most significant barrier to market entry and expansion for many practitioners. Advanced aesthetic equipment often requires substantial initial investments, creating financial challenges for smaller practices and new market entrants. Equipment financing solutions have emerged to address this constraint, but cost considerations remain a primary concern.

Regulatory complexity can delay product launches and increase development costs for manufacturers. The FDA approval process, while ensuring safety and efficacy, requires extensive clinical trials and documentation that can extend time-to-market for innovative technologies.

Training requirements for practitioners create additional barriers to equipment adoption. Complex technologies require specialized education and certification, limiting the pool of qualified operators and potentially constraining market growth in certain regions.

Competition from alternative treatments includes both traditional surgical procedures and emerging non-device-based solutions such as injectables and topical treatments. This competitive pressure can limit equipment utilization and affect return on investment calculations.

Economic sensitivity affects market performance during economic downturns, as aesthetic procedures are typically considered discretionary spending. Market volatility during economic uncertainty can impact equipment sales and utilization rates.

Insurance limitations restrict coverage for most aesthetic procedures, placing the full financial burden on patients and potentially limiting market accessibility for price-sensitive consumers.

Emerging technologies present substantial opportunities for market expansion and differentiation. Areas such as nanotechnology, biotechnology integration, and advanced materials science offer pathways for developing next-generation aesthetic equipment with enhanced capabilities and improved patient outcomes.

Geographic expansion within the US market reveals significant untapped potential in secondary and tertiary markets. Rural and suburban areas show increasing demand for aesthetic services, creating opportunities for mobile treatment units and satellite clinic expansion.

Home-use device market represents a rapidly growing opportunity segment, with consumer demand for professional-grade results in convenient home settings. This market segment shows annual growth rates exceeding 25% as technology miniaturization makes sophisticated treatments accessible for home use.

Artificial intelligence integration offers opportunities for developing smart equipment that can optimize treatment parameters, predict outcomes, and enhance safety through automated monitoring and adjustment capabilities.

Combination therapies create opportunities for developing integrated platforms that deliver multiple treatment modalities simultaneously, improving efficiency and patient outcomes while differentiating products in competitive markets.

Subscription and service models present opportunities for recurring revenue streams and improved customer relationships through equipment-as-a-service offerings and comprehensive support packages.

International expansion opportunities exist for US-based companies to leverage domestic market success in global markets, particularly in emerging economies with growing middle-class populations and increasing aesthetic awareness.

Supply chain dynamics in the US aesthetic equipment market reflect a complex ecosystem involving component manufacturers, technology developers, equipment assemblers, and distribution networks. Market efficiency has improved significantly through vertical integration strategies and strategic partnerships that streamline production and reduce time-to-market for innovative solutions.

Demand patterns show seasonal variations with peak activity during fall and winter months when patients have more time for recovery and are preparing for social events. This cyclical demand influences inventory management, marketing strategies, and equipment utilization planning across the industry.

Price dynamics demonstrate ongoing pressure toward value-based pricing models that emphasize treatment outcomes and total cost of ownership rather than initial equipment costs. Market maturation has led to increased price competition, particularly in established technology segments.

Innovation cycles typically span 3-5 years for major technological advances, with incremental improvements occurring more frequently. Research and development investments average approximately 15% of revenue among leading manufacturers, indicating strong commitment to continued innovation.

Customer relationship dynamics have evolved toward long-term partnerships between equipment manufacturers and practitioners, with comprehensive training, support, and upgrade programs becoming standard industry practices.

Regulatory dynamics continue to evolve with advancing technology, requiring ongoing collaboration between industry stakeholders and regulatory authorities to ensure appropriate oversight while fostering innovation.

Comprehensive research approach employed multiple data collection methodologies to ensure accurate and complete market analysis. Primary research included extensive surveys of aesthetic practitioners, equipment manufacturers, and industry experts across diverse geographic regions and practice settings.

Secondary research incorporated analysis of industry reports, regulatory filings, patent databases, and academic publications to provide comprehensive market context and validate primary research findings. Data triangulation techniques ensured accuracy and reliability of all market insights and projections.

Market sizing methodology utilized bottom-up and top-down approaches to validate market scope and growth projections. Statistical analysis employed advanced modeling techniques to identify trends, correlations, and predictive indicators across multiple market segments.

Expert interviews with industry leaders, regulatory officials, and key opinion leaders provided qualitative insights that complement quantitative data analysis. These interviews covered technology trends, regulatory developments, and market outlook perspectives.

Technology assessment included hands-on evaluation of leading equipment platforms, analysis of clinical study results, and assessment of emerging technologies in development. This technical analysis provides foundation for technology trend identification and market impact assessment.

Competitive intelligence gathering utilized public information sources, trade show observations, and industry networking to develop comprehensive understanding of competitive landscape and strategic positioning.

West Coast dominance characterizes the US aesthetic equipment market, with California leading in both equipment deployment and procedure volumes. California market share represents approximately 28% of total US market activity, driven by high disposable incomes, aesthetic-conscious population, and concentration of innovative practitioners and clinics.

Northeast region demonstrates strong market presence, particularly in New York, New Jersey, and Massachusetts. This region benefits from high population density, sophisticated healthcare infrastructure, and strong consumer demand for advanced aesthetic treatments. Market penetration in major northeastern metropolitan areas exceeds 85% for basic laser systems.

Southeast markets show rapid growth, led by Florida, Texas, and Georgia. These states benefit from favorable demographics, growing populations, and increasing acceptance of aesthetic procedures across diverse age groups. Annual growth rates in southeastern markets average 18%, outpacing national averages.

Midwest expansion reveals emerging opportunities in states like Illinois, Ohio, and Michigan. While traditionally conservative regarding aesthetic procedures, these markets show increasing openness to non-invasive treatments and growing practitioner adoption of advanced equipment.

Mountain West region demonstrates selective growth concentrated in affluent areas of Colorado, Utah, and Arizona. These markets benefit from active, health-conscious populations with strong interest in maintaining youthful appearance and physical fitness.

Rural market development remains limited but shows potential for mobile treatment services and satellite clinic expansion as technology becomes more portable and user-friendly.

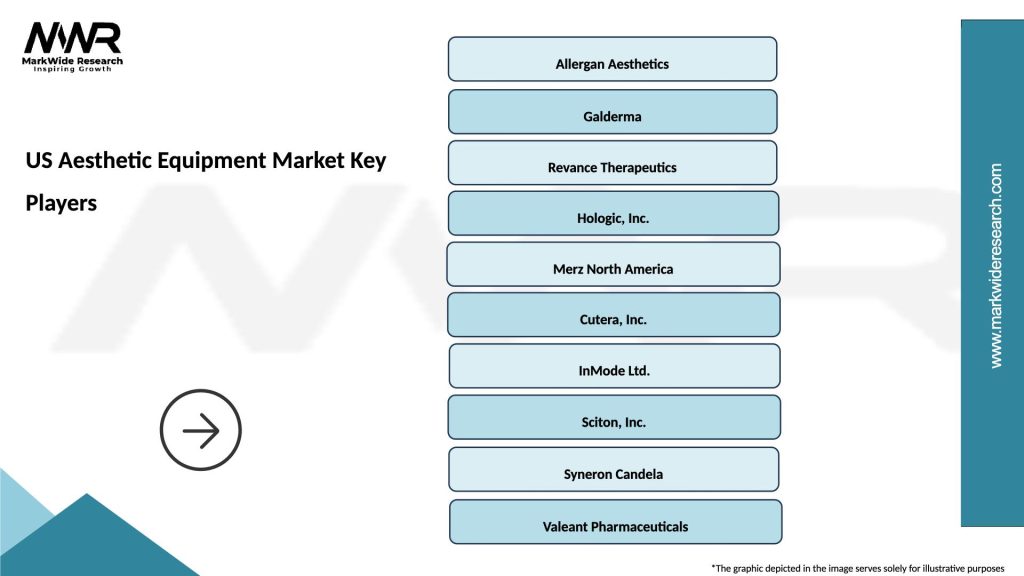

Market leadership is distributed among several key players, each with distinct technological strengths and market positioning strategies:

Competitive strategies emphasize technological differentiation, comprehensive training programs, and long-term customer relationships. Market consolidation continues through strategic acquisitions and partnerships that combine complementary technologies and market access capabilities.

Innovation competition drives continuous product development, with companies investing heavily in research and development to maintain technological leadership and market position. Patent portfolios serve as important competitive assets and barriers to entry for new market participants.

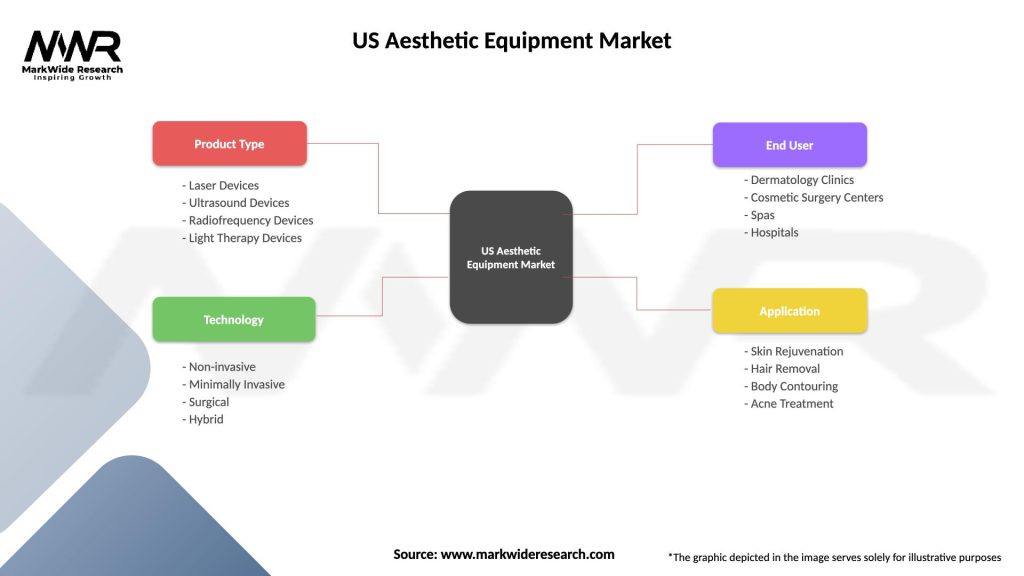

Technology-based segmentation reveals distinct market categories with unique growth patterns and competitive dynamics:

By Technology:

By Application:

By End User:

Laser technology category maintains market leadership through continuous innovation and expanding application possibilities. Fractional laser systems have revolutionized skin resurfacing treatments, offering superior results with reduced downtime compared to traditional ablative procedures. Technology advancement in this category focuses on wavelength optimization, pulse duration control, and integrated cooling systems.

Radiofrequency category demonstrates exceptional growth potential, particularly in body contouring and skin tightening applications. Monopolar and bipolar systems offer different treatment approaches, with newer fractional radiofrequency technologies providing enhanced precision and patient comfort. Market adoption in this category has accelerated due to proven efficacy and minimal side effects.

Ultrasound category represents the newest high-growth segment, with focused ultrasound technology enabling precise fat reduction and skin tightening without surgery. HIFU technology (High-Intensity Focused Ultrasound) has gained significant traction among practitioners seeking non-invasive alternatives to surgical procedures.

Combination therapy category emerges as a significant trend, with equipment manufacturers developing platforms that integrate multiple technologies for comprehensive treatment approaches. These systems offer practitioners flexibility and patients enhanced results through synergistic treatment effects.

Home-use category shows remarkable expansion, with consumer devices incorporating professional-grade technologies in user-friendly formats. Safety features and automated operation modes make these devices accessible to consumers while maintaining treatment efficacy.

Equipment manufacturers benefit from sustained market growth, technological innovation opportunities, and expanding global market access. The US market serves as a testing ground for new technologies and provides valuable clinical data for international expansion strategies.

Healthcare practitioners gain access to advanced technologies that enhance treatment outcomes, improve patient satisfaction, and create new revenue opportunities. Training and support programs provided by manufacturers ensure successful technology adoption and optimal clinical results.

Patients benefit from improved treatment options, reduced procedure times, enhanced safety profiles, and better aesthetic outcomes. Technology advancement has made many procedures more comfortable and accessible while delivering superior results.

Investors find attractive opportunities in a growing market with strong fundamentals, technological innovation, and expanding demographic demand. Market stability and growth predictability make aesthetic equipment an appealing investment sector.

Regulatory bodies benefit from industry collaboration in developing appropriate oversight frameworks that ensure patient safety while fostering innovation and market growth.

Research institutions gain opportunities for clinical studies, technology development partnerships, and advancement of aesthetic medicine knowledge through collaboration with industry participants.

Distribution partners benefit from growing demand, expanding product portfolios, and opportunities for value-added services including training, maintenance, and financing solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant technological trend reshaping the aesthetic equipment landscape. AI-powered systems now offer automated treatment planning, real-time parameter adjustment, and outcome prediction capabilities that enhance both safety and efficacy. Machine learning algorithms analyze patient data to optimize treatment protocols and improve results consistency.

Minimally invasive procedures continue to gain preference over traditional surgical approaches, driving demand for advanced non-surgical equipment. Patient preferences increasingly favor treatments with minimal downtime, natural-looking results, and reduced risk profiles.

Personalized treatment approaches utilize advanced imaging, genetic analysis, and patient history data to customize procedures for individual patients. This trend toward precision medicine in aesthetics improves outcomes and patient satisfaction while differentiating advanced practices.

Combination therapy platforms integrate multiple treatment modalities into single systems, offering practitioners versatility and patients comprehensive treatment options. These platforms improve practice efficiency and enable synergistic treatment effects.

Home-use device proliferation brings professional-grade technologies to consumer markets through miniaturization and safety automation. Consumer adoption rates for home aesthetic devices have increased by approximately 35% annually as technology becomes more accessible and affordable.

Sustainability focus drives development of energy-efficient equipment and environmentally responsible manufacturing processes. Green technology initiatives appeal to environmentally conscious practitioners and patients while reducing operational costs.

Subscription service models offer equipment access through leasing and service agreements, reducing capital requirements for practitioners and providing predictable revenue streams for manufacturers.

Recent technological breakthroughs have significantly advanced treatment capabilities and market opportunities. Picosecond laser technology has revolutionized tattoo removal and pigmentation treatment with superior results and reduced treatment sessions. Clinical outcomes show improvement rates exceeding 90% for previously difficult-to-treat conditions.

Regulatory approvals for new treatment indications have expanded market opportunities for existing technologies. FDA clearances for body contouring applications of radiofrequency and ultrasound devices have opened significant new revenue streams for practitioners and manufacturers.

Strategic partnerships between technology companies and healthcare providers have accelerated innovation and market penetration. These collaborations combine technological expertise with clinical experience to develop more effective and user-friendly solutions.

International expansion by US companies has strengthened domestic market position while providing global growth opportunities. Export growth of US aesthetic equipment has increased by approximately 28% over the past three years, demonstrating international competitiveness.

Investment activity in aesthetic technology companies has reached record levels, with venture capital and private equity funding supporting innovation and market expansion. MWR analysis indicates that funding levels have increased substantially, enabling accelerated product development and market entry.

Clinical research advancement continues to validate new treatment approaches and expand evidence-based practice in aesthetic medicine. Large-scale clinical trials provide the scientific foundation for new treatment protocols and regulatory approvals.

Technology investment priorities should focus on artificial intelligence integration, combination therapy platforms, and home-use device development. These areas offer the greatest potential for market differentiation and sustainable competitive advantage in an increasingly crowded marketplace.

Market expansion strategies should target underserved geographic regions and demographic segments, particularly rural markets and younger consumer groups. Mobile treatment services and satellite clinic models offer effective approaches for reaching these markets cost-effectively.

Partnership development with healthcare providers, medical spas, and wellness centers can accelerate market penetration and provide valuable clinical feedback for product improvement. Strategic alliances should emphasize long-term relationships rather than transactional equipment sales.

Regulatory engagement remains critical for successful market participation, particularly as new technologies and treatment applications emerge. Proactive collaboration with regulatory authorities can streamline approval processes and ensure appropriate oversight frameworks.

Training and education programs should be expanded to support practitioner adoption of advanced technologies. Comprehensive certification programs build confidence in new technologies while ensuring optimal clinical outcomes and patient safety.

International expansion opportunities should leverage US market success and technological leadership to penetrate growing global markets. Emerging economies with expanding middle-class populations represent particularly attractive opportunities for US aesthetic equipment companies.

Sustainability initiatives should be integrated into product development and manufacturing processes to meet growing environmental consciousness among practitioners and patients while reducing operational costs.

Long-term market projections indicate sustained growth driven by demographic trends, technological advancement, and expanding treatment accessibility. Market expansion is expected to continue at robust rates, with annual growth projected to maintain double-digit percentages through the forecast period.

Technology evolution will focus on artificial intelligence integration, nanotechnology applications, and biotechnology convergence. These advanced technologies promise to deliver unprecedented treatment precision, safety, and efficacy while expanding the range of treatable conditions.

Market democratization through home-use devices and accessible treatment options will expand the addressable market significantly. Consumer device adoption is projected to grow at annual rates exceeding 30% as technology becomes more sophisticated and user-friendly.

Regulatory evolution will adapt to accommodate new technologies while maintaining appropriate safety oversight. Streamlined approval processes for innovative technologies will accelerate market introduction while ensuring patient protection.

Global market integration will provide US companies with expanded opportunities while introducing international competition. Technology leadership positions US companies favorably for continued market success in global expansion.

Healthcare integration will see aesthetic treatments increasingly incorporated into comprehensive wellness and preventive care programs. This integration will expand market reach and improve treatment accessibility through healthcare system participation.

Innovation acceleration will continue through increased research and development investments, academic partnerships, and venture capital funding. Breakthrough technologies currently in development promise to create new market categories and treatment possibilities.

The US aesthetic equipment market stands as a dynamic and rapidly evolving sector that combines technological innovation with strong consumer demand to create exceptional growth opportunities. Market fundamentals remain robust, supported by favorable demographics, increasing treatment acceptance, and continuous technological advancement that expands treatment possibilities while improving outcomes.

Technology leadership positions the US market at the forefront of global aesthetic medicine innovation, with domestic companies developing breakthrough solutions that set international standards for safety, efficacy, and patient satisfaction. Regulatory framework provides market confidence while fostering continued innovation through appropriate oversight and support for technological advancement.

Future prospects indicate sustained growth across all market segments, with particular strength in non-invasive treatments, combination therapies, and home-use devices. Market expansion opportunities exist in underserved geographic regions and demographic segments, while international markets offer significant growth potential for US technology leaders.

Industry participants benefit from a market environment that rewards innovation, clinical excellence, and patient-focused solutions. Competitive dynamics encourage continuous improvement while providing multiple pathways for market success through technological differentiation, service excellence, and strategic partnerships.

The US aesthetic equipment market represents a compelling investment opportunity characterized by strong fundamentals, technological innovation, and expanding market reach that positions it for continued success in the evolving healthcare landscape.

What is Aesthetic Equipment?

Aesthetic equipment refers to devices and tools used in cosmetic procedures aimed at enhancing physical appearance. This includes laser systems, ultrasound devices, and radiofrequency machines, among others.

What are the key players in the US Aesthetic Equipment Market?

Key players in the US Aesthetic Equipment Market include Allergan, Merz Pharmaceuticals, and Cynosure, among others. These companies are known for their innovative products and strong market presence.

What are the main drivers of growth in the US Aesthetic Equipment Market?

The main drivers of growth in the US Aesthetic Equipment Market include increasing consumer demand for non-invasive cosmetic procedures, advancements in technology, and a growing awareness of aesthetic treatments among the general population.

What challenges does the US Aesthetic Equipment Market face?

Challenges in the US Aesthetic Equipment Market include regulatory hurdles, high costs of advanced equipment, and competition from alternative treatment options. These factors can impact market accessibility and growth.

What opportunities exist in the US Aesthetic Equipment Market?

Opportunities in the US Aesthetic Equipment Market include the expansion of telemedicine for aesthetic consultations, the rise of personalized treatments, and the increasing popularity of minimally invasive procedures.

What trends are shaping the US Aesthetic Equipment Market?

Trends shaping the US Aesthetic Equipment Market include the integration of artificial intelligence in treatment planning, the growing demand for skin rejuvenation technologies, and the rise of at-home aesthetic devices.

US Aesthetic Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Laser Devices, Ultrasound Devices, Radiofrequency Devices, Light Therapy Devices |

| Technology | Non-invasive, Minimally Invasive, Surgical, Hybrid |

| End User | Dermatology Clinics, Cosmetic Surgery Centers, Spas, Hospitals |

| Application | Skin Rejuvenation, Hair Removal, Body Contouring, Acne Treatment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Aesthetic Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at