444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US adjustable bed bases market represents a dynamic and rapidly evolving segment within the broader sleep technology industry. This market encompasses a comprehensive range of motorized bed frames that allow users to adjust the positioning of their mattresses for enhanced comfort, health benefits, and improved sleep quality. Market dynamics indicate substantial growth driven by increasing consumer awareness of sleep health, an aging population, and technological innovations in smart home integration.

Consumer preferences have shifted significantly toward premium sleep solutions, with adjustable bed bases experiencing robust adoption rates across diverse demographic segments. The market demonstrates impressive growth momentum with a projected compound annual growth rate of 8.2% through 2030, reflecting strong demand fundamentals and expanding market penetration beyond traditional healthcare applications.

Technological advancement continues to reshape the landscape, with manufacturers integrating smart features, wireless connectivity, and health monitoring capabilities into their offerings. The convergence of sleep technology and wellness trends has positioned adjustable bed bases as essential components of modern bedroom environments, driving sustained market expansion across residential and commercial sectors.

The US adjustable bed bases market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of motorized bed frames that enable users to electronically adjust the head and foot positions of their sleeping surface. These sophisticated sleep systems utilize electric motors, remote controls, and increasingly smart technology to provide customizable positioning options for enhanced comfort and health benefits.

Adjustable bed bases have evolved from primarily medical devices used in hospitals and care facilities to mainstream consumer products that cater to lifestyle preferences and wellness objectives. Modern adjustable bases incorporate advanced features including massage functions, USB charging ports, under-bed lighting, and smartphone app connectivity, transforming the traditional bedroom experience into a personalized wellness environment.

Market definition encompasses various product categories ranging from basic two-motor systems offering head and foot adjustment to premium models featuring split-king configurations, zero-gravity positioning, and integrated health monitoring sensors. The market serves diverse consumer segments including health-conscious individuals, aging populations, couples with different sleep preferences, and technology enthusiasts seeking smart home integration.

Market performance in the US adjustable bed bases sector demonstrates exceptional resilience and growth potential, driven by fundamental demographic shifts and evolving consumer priorities regarding sleep quality and health optimization. The industry has successfully transitioned from a niche medical device market to a mainstream consumer category, achieving significant penetration across multiple distribution channels and price segments.

Key growth drivers include the aging baby boomer population, increasing prevalence of sleep disorders, rising healthcare costs driving preventive wellness investments, and growing consumer education about sleep hygiene benefits. Technology integration has emerged as a critical differentiator, with smart features accounting for approximately 35% of premium segment sales and driving higher average selling prices across the market.

Competitive dynamics reveal a market characterized by both established furniture manufacturers and innovative sleep technology companies, creating a diverse ecosystem that serves various consumer preferences and price points. The market benefits from strong retail partnerships, expanding e-commerce presence, and increasing acceptance of adjustable beds as standard bedroom furniture rather than specialized medical equipment.

Future prospects indicate continued robust growth supported by demographic trends, technological innovation, and expanding awareness of sleep health importance. Market penetration remains relatively low compared to traditional bed frames, suggesting substantial opportunity for continued expansion and market development across diverse consumer segments.

Consumer adoption patterns reveal significant insights into market dynamics and growth trajectories. The following key insights shape market understanding and strategic planning:

Demographic transformation serves as the primary catalyst driving sustained market growth, with the aging US population creating unprecedented demand for sleep solutions that address age-related comfort and health concerns. The baby boomer generation, representing the largest demographic cohort in US history, increasingly prioritizes sleep quality and health optimization, driving adoption of adjustable bed bases as essential wellness investments.

Health consciousness trends have fundamentally altered consumer perspectives on sleep quality and its impact on overall wellness. Growing awareness of sleep disorders, including sleep apnea, acid reflux, and circulation issues, has positioned adjustable bed bases as therapeutic solutions that provide tangible health benefits. Medical endorsements from healthcare professionals further validate the health benefits, with approximately 58% of purchases influenced by medical recommendations.

Technological innovation continues to expand market appeal through integration of smart home features, health monitoring capabilities, and enhanced user experiences. Modern adjustable bases offer sophisticated features including sleep tracking, automatic position adjustment, and integration with home automation systems, attracting technology-oriented consumers who value connected lifestyle solutions.

Lifestyle evolution reflects changing bedroom utilization patterns, with consumers increasingly viewing bedrooms as multi-functional spaces for relaxation, entertainment, and work. Adjustable bed bases enable comfortable positioning for reading, watching television, working on laptops, and other activities beyond traditional sleeping, expanding their utility and justifying premium pricing.

Price sensitivity remains a significant barrier to market expansion, particularly among price-conscious consumers who perceive adjustable bed bases as luxury items rather than essential furniture. The substantial price premium compared to traditional bed frames creates affordability challenges for middle-income households, limiting market penetration across broader demographic segments despite growing interest and awareness.

Installation complexity and space requirements present practical obstacles for some consumers, particularly those living in smaller homes or apartments with limited bedroom space. The mechanical components and electrical requirements of adjustable bases can complicate setup and maintenance, creating hesitation among consumers who prefer simple, maintenance-free furniture solutions.

Mattress compatibility concerns create additional purchase friction, as consumers must ensure their existing mattresses work effectively with adjustable bases or factor replacement costs into their investment decisions. Compatibility issues with memory foam, latex, and hybrid mattresses require consumer education and may necessitate additional purchases, increasing total ownership costs.

Durability perceptions and mechanical reliability concerns influence consumer confidence, particularly regarding long-term performance of motorized components and electronic systems. Past experiences with mechanical failures or inadequate customer service can create negative market sentiment and resistance to adoption among risk-averse consumers who prioritize reliability over advanced features.

Healthcare integration presents substantial expansion opportunities as medical professionals increasingly recognize and recommend adjustable bed bases for various health conditions. Partnerships with healthcare providers, insurance coverage expansion, and medical device classification could significantly broaden market accessibility and drive adoption among health-focused consumers seeking therapeutic sleep solutions.

Smart home ecosystem integration offers compelling growth potential as consumers embrace connected home technologies and seek seamless integration between sleep systems and broader home automation platforms. IoT connectivity enables advanced features including sleep optimization algorithms, health data integration, and personalized comfort settings that appeal to technology-oriented consumers.

Hospitality sector expansion represents an underexplored market opportunity, with hotels, resorts, and senior living facilities increasingly recognizing the competitive advantage of offering adjustable bed options. The hospitality market could drive significant volume growth while enhancing brand visibility and consumer familiarity with adjustable bed benefits.

Rental and subscription models could address affordability concerns while expanding market accessibility, particularly among younger consumers and urban dwellers who prefer flexible ownership models. Innovative financing approaches including rent-to-own programs and subscription services could lower barriers to entry and accelerate market penetration across price-sensitive segments.

Supply chain evolution continues to reshape market dynamics as manufacturers optimize production processes, component sourcing, and distribution networks to meet growing demand while managing cost pressures. The integration of advanced manufacturing technologies and automation has improved product quality while reducing production costs, enabling more competitive pricing across various market segments.

Competitive intensity has increased significantly as traditional furniture manufacturers, mattress companies, and specialized sleep technology firms compete for market share. This competition drives innovation, improves product quality, and creates more diverse product offerings that cater to specific consumer preferences and price points, ultimately benefiting end consumers through enhanced value propositions.

Distribution channel transformation reflects broader retail trends toward omnichannel experiences, with successful companies integrating online and offline touchpoints to provide comprehensive customer experiences. E-commerce growth has democratized market access while enabling direct-to-consumer models that improve margins and customer relationships.

Consumer education initiatives by manufacturers and retailers have significantly improved market awareness and understanding of adjustable bed benefits. Educational content, demonstration programs, and trial periods have reduced purchase hesitation and increased conversion rates, contributing to overall market growth and consumer satisfaction levels.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive consumer surveys, industry expert interviews, and retailer feedback sessions that provide direct market intelligence and validate secondary research findings through real-world perspectives and experiences.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documentation to understand market structure, competitive positioning, and technological trends. This approach provides historical context and identifies emerging patterns that influence market development and future growth trajectories.

Data validation processes ensure research accuracy through triangulation of multiple data sources, statistical analysis of market trends, and verification of key findings through industry expert consultation. MarkWide Research employs rigorous quality control measures to maintain research integrity and provide reliable market intelligence for strategic decision-making.

Market modeling utilizes advanced analytical techniques including regression analysis, trend extrapolation, and scenario planning to project future market conditions and identify potential growth opportunities. These methodologies enable comprehensive understanding of market dynamics and support strategic planning initiatives across various industry stakeholders.

Geographic distribution reveals distinct regional preferences and market characteristics across the United States, with certain regions demonstrating higher adoption rates and growth potential. The analysis encompasses demographic factors, economic conditions, and cultural preferences that influence regional market development and competitive dynamics.

West Coast markets lead in technology adoption and premium product penetration, with California representing approximately 22% of national market share driven by higher disposable incomes, health consciousness, and early technology adoption patterns. The region demonstrates strong preference for smart-enabled adjustable bases and premium features that align with lifestyle preferences and technological sophistication.

Southeast region shows robust growth potential driven by demographic trends including retirement migration and aging population concentration in states like Florida, Georgia, and North Carolina. This region accounts for approximately 28% of market growth and demonstrates increasing acceptance of adjustable beds as standard bedroom furniture rather than medical devices.

Midwest markets exhibit steady growth patterns with emphasis on value-oriented products and practical benefits rather than premium features. The region represents a significant portion of the replacement market, with consumers upgrading from basic adjustable bases to more advanced models as awareness and acceptance increase.

Northeast corridor demonstrates strong market maturity with established distribution networks and high consumer awareness levels. Urban markets in this region show particular interest in space-saving designs and multi-functional features that accommodate smaller living spaces and urban lifestyle preferences.

Market leadership is distributed among several key players who have established strong positions through different strategic approaches, including product innovation, distribution excellence, and brand recognition. The competitive environment encourages continuous improvement and innovation while providing consumers with diverse options across various price points and feature sets.

Product segmentation reveals distinct market categories based on features, price points, and target consumer preferences. Understanding these segments enables manufacturers and retailers to develop targeted strategies and optimize product portfolios for specific market opportunities.

By Technology:

By Size Configuration:

By Distribution Channel:

Premium segment analysis reveals strong growth momentum driven by consumers willing to invest in advanced features and superior build quality. This category demonstrates 12% annual growth and commands higher profit margins while establishing brand differentiation through innovation and customer experience excellence.

Mid-tier market represents the largest volume segment, balancing essential features with accessible pricing to appeal to mainstream consumers. This category benefits from increasing consumer awareness and acceptance while maintaining competitive pricing pressure that drives operational efficiency and value optimization.

Entry-level segment serves price-sensitive consumers and first-time buyers, providing essential adjustability features without premium amenities. This category plays a crucial role in market expansion by introducing new consumers to adjustable bed benefits and creating upgrade opportunities for future purchases.

Smart technology category emerges as a key growth driver, with connected features becoming increasingly important to consumer purchase decisions. Integration capabilities with popular smart home platforms and health monitoring devices create compelling value propositions that justify premium pricing and drive brand loyalty.

Healthcare-focused products address specific medical needs and therapeutic applications, often featuring specialized positioning options and medical device certifications. This category benefits from healthcare professional recommendations and insurance coverage possibilities, creating unique market opportunities and customer acquisition channels.

Manufacturers benefit from expanding market opportunities driven by demographic trends and increasing consumer acceptance of adjustable bed technology. The market offers attractive profit margins, particularly in premium segments, while enabling product differentiation through innovation and feature development that creates competitive advantages and brand loyalty.

Retailers gain from higher average transaction values and improved customer satisfaction associated with adjustable bed sales. These products often generate additional revenue through accessories, extended warranties, and related sleep products, while creating opportunities for consultative selling approaches that enhance customer relationships and repeat business.

Consumers receive significant value through improved sleep quality, health benefits, and enhanced bedroom functionality. Health improvements including better circulation, reduced acid reflux, and improved breathing can provide substantial quality of life enhancements that justify the investment in adjustable bed technology.

Healthcare providers can recommend adjustable beds as non-pharmaceutical interventions for various conditions, potentially reducing medication dependence and improving patient outcomes. These recommendations create professional credibility and patient satisfaction while supporting holistic treatment approaches.

Technology partners benefit from integration opportunities with smart home platforms, health monitoring devices, and mobile applications. These partnerships create new revenue streams while enhancing product functionality and consumer appeal through connected ecosystem development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart technology integration represents the most significant trend reshaping the adjustable bed market, with manufacturers increasingly incorporating IoT connectivity, mobile app controls, and artificial intelligence features. These technological advances enable personalized sleep optimization, health monitoring integration, and seamless smart home ecosystem compatibility that appeals to tech-savvy consumers and justifies premium pricing.

Health and wellness focus continues to drive product development and marketing strategies, with manufacturers emphasizing therapeutic benefits and medical applications. Sleep optimization features including position memory, automatic adjustment algorithms, and integration with wearable health devices create compelling value propositions for health-conscious consumers seeking comprehensive wellness solutions.

Sustainability initiatives are becoming increasingly important as environmentally conscious consumers seek eco-friendly sleep products. Manufacturers are responding with sustainable materials, energy-efficient motors, and recyclable components that appeal to environmentally aware consumers while supporting corporate social responsibility objectives.

Customization and personalization trends reflect consumer desire for products tailored to individual preferences and needs. Modular designs, extensive adjustment options, and personalized comfort settings enable consumers to create customized sleep environments that address specific requirements and preferences.

Direct-to-consumer growth continues to reshape distribution strategies as manufacturers seek to improve margins and customer relationships through direct sales channels. Online platforms enable comprehensive product education, virtual demonstrations, and convenient home delivery that appeals to modern consumer shopping preferences.

Product innovation acceleration has intensified across the industry, with manufacturers introducing advanced features including voice control integration, biometric sensors, and AI-powered sleep optimization algorithms. These developments represent significant investments in research and development that aim to differentiate products and create sustainable competitive advantages in an increasingly crowded marketplace.

Strategic partnerships between adjustable bed manufacturers and technology companies have expanded product capabilities and market reach. Collaboration initiatives with smart home platforms, health monitoring device manufacturers, and sleep research organizations create integrated solutions that provide enhanced value to consumers while opening new distribution channels.

Retail channel evolution continues to transform how consumers discover and purchase adjustable beds, with traditional furniture stores adapting to compete with online retailers and direct-to-consumer brands. Omnichannel strategies that combine online education with in-store demonstration and home trial programs have become essential for competitive success.

Manufacturing optimization initiatives focus on improving production efficiency, quality control, and cost management while maintaining product innovation capabilities. Advanced manufacturing technologies including automation and quality management systems enable consistent product quality while supporting competitive pricing strategies.

Market expansion efforts by leading manufacturers include geographic expansion, new product category development, and strategic acquisitions that broaden market presence and capabilities. These initiatives reflect confidence in long-term market growth potential and commitment to capturing emerging opportunities.

Investment priorities should focus on technology development and smart feature integration to maintain competitive relevance and appeal to evolving consumer preferences. MWR analysis indicates that companies investing in IoT connectivity and health monitoring capabilities achieve higher customer satisfaction rates and premium pricing power in competitive markets.

Distribution strategy optimization requires balancing online and offline channels to maximize market reach while maintaining cost efficiency. Successful companies should develop comprehensive omnichannel approaches that leverage digital marketing for customer acquisition while providing physical demonstration opportunities that reduce purchase hesitation and improve conversion rates.

Consumer education initiatives remain critical for market expansion, particularly in reaching younger demographic segments who may be unfamiliar with adjustable bed benefits. Educational content marketing, demonstration programs, and trial offers can effectively address awareness barriers while building brand credibility and consumer confidence.

Partnership development with healthcare providers, insurance companies, and technology platforms creates opportunities for market expansion and product differentiation. These strategic relationships can provide access to new customer segments while enhancing product credibility and value propositions through professional endorsements and integrated solutions.

Product portfolio diversification should address various price points and feature preferences to maximize market addressability. Companies should maintain offerings across entry-level, mid-tier, and premium segments while ensuring clear value differentiation and upgrade paths that encourage customer loyalty and repeat purchases.

Long-term growth prospects remain highly favorable, supported by fundamental demographic trends, increasing health consciousness, and continuous technological innovation. The market is positioned for sustained expansion as adjustable beds transition from specialty products to mainstream bedroom furniture, driven by growing consumer awareness and acceptance of sleep health importance.

Technology evolution will continue to reshape product capabilities and consumer expectations, with artificial intelligence, machine learning, and advanced sensors enabling increasingly sophisticated sleep optimization features. Future developments may include predictive health monitoring, automatic environmental adjustment, and integration with broader healthcare ecosystems that provide comprehensive wellness management.

Market penetration is expected to accelerate as prices become more accessible and consumer awareness increases through education and word-of-mouth recommendations. Demographic shifts including aging populations and increasing health consciousness across all age groups support sustained demand growth and market expansion opportunities.

Competitive dynamics will likely intensify as more companies enter the market and existing players expand their offerings. This competition should drive continued innovation, improve product quality, and create more diverse options for consumers while potentially moderating price premiums through increased efficiency and scale economies.

Global expansion opportunities present significant growth potential as adjustable bed awareness spreads internationally and emerging markets develop sufficient purchasing power for premium sleep products. MarkWide Research projects that successful US companies will leverage their technological expertise and market knowledge to capture international growth opportunities and diversify revenue sources.

The US adjustable bed bases market represents a compelling growth opportunity characterized by strong demographic tailwinds, increasing consumer health consciousness, and continuous technological innovation. The market has successfully evolved from a niche medical device category to a mainstream consumer product segment that appeals to diverse demographic groups seeking enhanced sleep quality and bedroom functionality.

Key success factors for market participants include technology integration, comprehensive distribution strategies, consumer education initiatives, and product portfolio diversification that addresses various price points and feature preferences. Companies that effectively balance innovation with accessibility while building strong brand recognition and customer relationships are positioned to capture disproportionate market share and growth opportunities.

Future market development will be driven by demographic trends, technological advancement, and expanding consumer awareness of sleep health importance. The convergence of smart home technology, health monitoring capabilities, and personalized comfort features creates compelling value propositions that justify premium pricing while expanding market addressability across broader consumer segments.

Strategic implications suggest that the US adjustable bed bases market will continue to offer attractive growth prospects for manufacturers, retailers, and technology partners who can effectively navigate competitive dynamics while delivering superior customer value through innovation, quality, and comprehensive market coverage. The market’s evolution from specialty to mainstream represents a fundamental shift that supports sustained long-term growth and expansion opportunities.

What is Adjustable Bed Bases?

Adjustable bed bases are specialized bed frames that allow users to adjust the position of the mattress for enhanced comfort and support. They are commonly used for various applications, including improving sleep quality, alleviating pain, and accommodating medical needs.

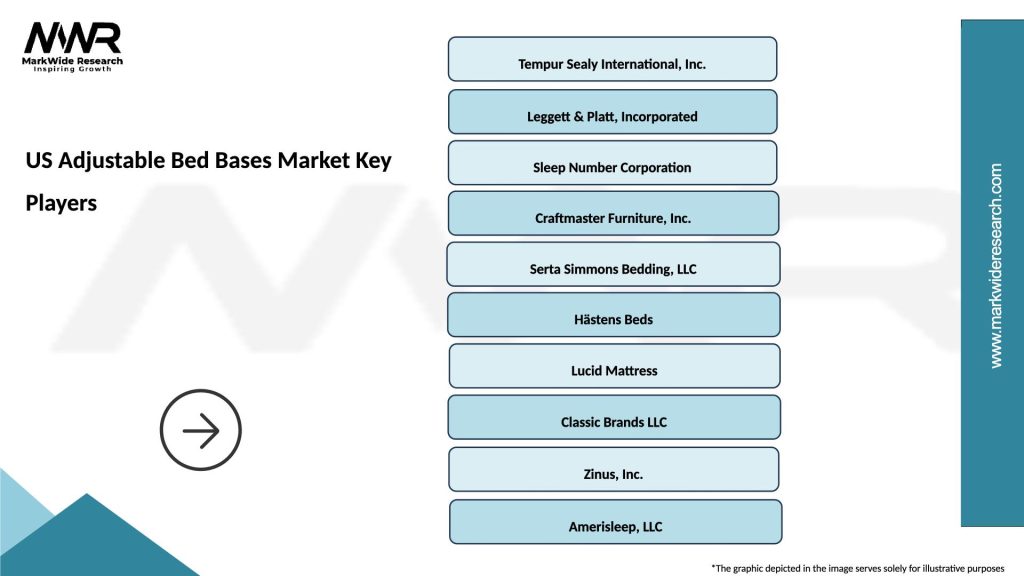

What are the key players in the US Adjustable Bed Bases Market?

Key players in the US Adjustable Bed Bases Market include Tempur-Pedic, Leggett & Platt, Reverie, and Saatva, among others. These companies are known for their innovative designs and technology in adjustable bed bases.

What are the growth factors driving the US Adjustable Bed Bases Market?

The growth of the US Adjustable Bed Bases Market is driven by increasing consumer awareness of sleep health, the rising prevalence of sleep disorders, and the growing demand for customizable sleep solutions. Additionally, advancements in technology and materials are enhancing product offerings.

What challenges does the US Adjustable Bed Bases Market face?

The US Adjustable Bed Bases Market faces challenges such as high manufacturing costs and competition from traditional bed frames. Additionally, consumer skepticism regarding the benefits of adjustable bases can hinder market growth.

What opportunities exist in the US Adjustable Bed Bases Market?

Opportunities in the US Adjustable Bed Bases Market include the potential for growth in e-commerce sales and the introduction of smart technology features. As consumers seek more personalized sleep experiences, innovative products can capture market interest.

What trends are shaping the US Adjustable Bed Bases Market?

Trends in the US Adjustable Bed Bases Market include the integration of smart technology, such as app-controlled adjustments and sleep tracking features. Additionally, there is a growing focus on eco-friendly materials and designs that cater to health-conscious consumers.

US Adjustable Bed Bases Market

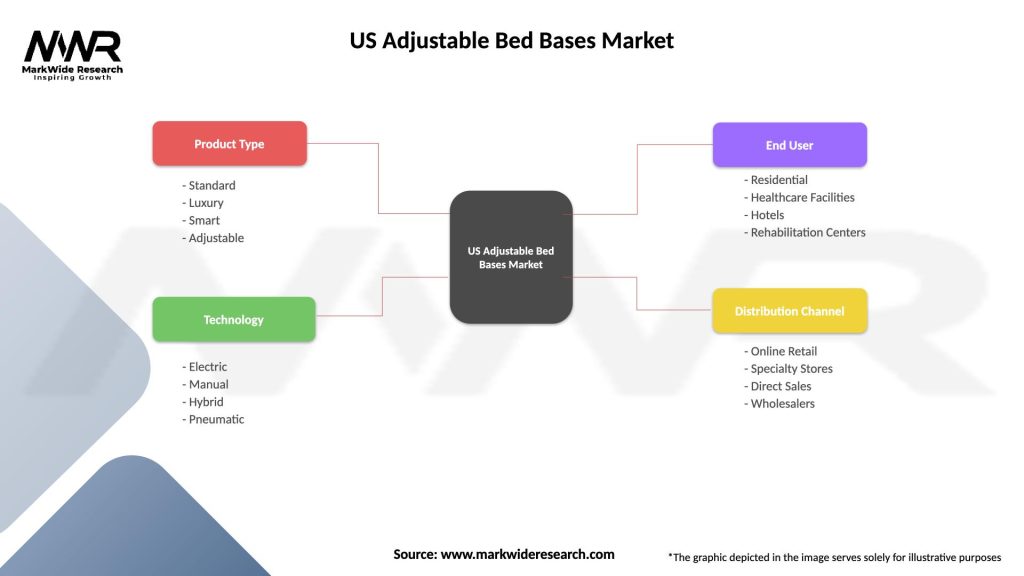

| Segmentation Details | Description |

|---|---|

| Product Type | Standard, Luxury, Smart, Adjustable |

| Technology | Electric, Manual, Hybrid, Pneumatic |

| End User | Residential, Healthcare Facilities, Hotels, Rehabilitation Centers |

| Distribution Channel | Online Retail, Specialty Stores, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Adjustable Bed Bases Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at