444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Uruguay agricultural products market represents a cornerstone of the nation’s economy, establishing the country as a significant player in South American agricultural exports. Uruguay’s agricultural sector encompasses diverse product categories including beef cattle, dairy products, soybeans, wheat, rice, and wool, contributing substantially to the country’s GDP and export revenues. The market demonstrates remarkable resilience and growth potential, driven by favorable climatic conditions, advanced farming techniques, and strong international demand for high-quality agricultural commodities.

Market dynamics indicate that Uruguay’s agricultural sector has experienced consistent expansion, with the beef industry alone accounting for approximately 65% of total agricultural exports. The country’s strategic geographic location, coupled with its commitment to sustainable farming practices, positions it as a preferred supplier for premium agricultural products in global markets. Agricultural productivity has shown impressive improvements, with crop yields increasing by an average of 8.2% annually over the past five years.

International recognition of Uruguay’s agricultural quality standards has opened new market opportunities, particularly in Asia-Pacific regions where demand for premium protein sources continues to grow. The market benefits from government support initiatives, technological advancement adoption, and strategic partnerships with international agricultural organizations, creating a robust foundation for sustained growth.

The Uruguay agricultural products market refers to the comprehensive ecosystem of agricultural production, processing, distribution, and export activities within Uruguay’s borders, encompassing livestock farming, crop cultivation, dairy production, and related agricultural services. This market represents the collective value chain from primary agricultural production through final product delivery to domestic and international consumers.

Agricultural products in Uruguay’s context include traditional livestock products such as beef, lamb, and dairy, alongside crop productions including soybeans, wheat, barley, rice, and specialty products like wool and honey. The market encompasses both large-scale commercial operations and smaller family-owned farms, creating a diverse agricultural landscape that contributes to the country’s economic stability and export competitiveness.

Market significance extends beyond mere commodity production, incorporating value-added processing, quality certification systems, traceability programs, and sustainable farming practices that enhance product positioning in premium international markets. The agricultural products market serves as a critical economic pillar, supporting rural communities, generating foreign exchange earnings, and maintaining Uruguay’s reputation as a reliable supplier of high-quality agricultural commodities.

Uruguay’s agricultural products market demonstrates exceptional strength across multiple product categories, with livestock and crop production forming the backbone of the country’s agricultural economy. The market exhibits robust growth trajectories, supported by favorable natural conditions, advanced farming technologies, and strong international demand for premium agricultural products. Export performance remains particularly strong, with agricultural products representing approximately 78% of total national exports.

Key market drivers include increasing global demand for high-quality protein sources, expanding middle-class populations in target markets, and growing consumer preference for sustainably produced agricultural products. The beef sector maintains its dominant position, while dairy and crop production segments show accelerating growth rates. Technological adoption in precision agriculture has improved productivity by an estimated 15% across major crop categories.

Market challenges include climate variability, international trade policy changes, and increasing competition from neighboring countries. However, Uruguay’s commitment to quality standards, traceability systems, and sustainable practices provides competitive advantages that support market resilience. The agricultural sector’s contribution to employment remains significant, supporting approximately 12% of the national workforce directly and indirectly.

Strategic market insights reveal several critical factors driving Uruguay’s agricultural products market development and competitive positioning:

Market intelligence indicates that Uruguay’s agricultural sector benefits from strong institutional support, including research and development initiatives, farmer education programs, and export promotion activities that enhance overall market competitiveness.

Primary market drivers propelling Uruguay’s agricultural products market include increasing global food demand, particularly for high-quality protein sources and sustainably produced commodities. Population growth in key export markets, combined with rising income levels, creates sustained demand for premium agricultural products where Uruguay maintains competitive advantages.

Technological advancement serves as a significant driver, with precision agriculture, genetic improvement programs, and digital farming solutions enhancing productivity and quality standards. The adoption of modern farming techniques has resulted in yield improvements averaging 12% annually across major crop categories, while reducing environmental impact and production costs.

Government support initiatives including agricultural research funding, export promotion programs, and infrastructure development projects create favorable conditions for market expansion. Trade agreement negotiations and diplomatic efforts to open new markets provide additional growth opportunities for agricultural exporters.

Consumer trends toward organic, grass-fed, and sustainably produced agricultural products align perfectly with Uruguay’s natural production advantages. The country’s reputation for environmental stewardship and animal welfare standards supports premium pricing strategies and market differentiation efforts.

Market restraints affecting Uruguay’s agricultural products market include climate variability and extreme weather events that can impact production volumes and quality. Drought conditions and excessive rainfall periods create operational challenges for farmers, requiring adaptive management strategies and risk mitigation measures.

International trade barriers and changing regulatory requirements in export markets pose ongoing challenges for agricultural exporters. Tariff structures, sanitary and phytosanitary regulations, and certification requirements can limit market access and increase compliance costs for producers and exporters.

Competition from neighboring countries with similar agricultural products creates pricing pressure and market share challenges. Argentina and Brazil’s larger production scales and lower cost structures require Uruguay to focus on quality differentiation and niche market strategies.

Infrastructure limitations in transportation, storage, and processing facilities can constrain market growth potential. Rural road networks, port facilities, and cold chain logistics require continued investment to support expanding agricultural production and export activities.

Significant market opportunities exist in expanding value-added processing capabilities, allowing Uruguay to capture higher margins and reduce commodity price volatility exposure. Food processing investments in meat processing, dairy products, and specialty food items can enhance export revenues and create additional employment opportunities.

Organic agriculture expansion presents substantial growth potential, with global organic food markets experiencing rapid growth. Uruguay’s natural production conditions and environmental credentials provide competitive advantages in organic certification and premium market positioning.

Asian market penetration offers exceptional growth opportunities, particularly in China, Japan, and Southeast Asian countries where demand for high-quality protein sources continues expanding. Market research indicates potential for 25% annual growth in Asian agricultural exports over the next five years.

Agritourism development creates opportunities to diversify agricultural operations and generate additional revenue streams. Farm-based tourism, educational programs, and culinary experiences can showcase Uruguay’s agricultural heritage while supporting rural community development.

Market dynamics in Uruguay’s agricultural products sector reflect complex interactions between domestic production capabilities, international demand patterns, and global commodity price fluctuations. Supply chain efficiency improvements have reduced logistics costs by approximately 18% over recent years, enhancing overall market competitiveness.

Price volatility remains a characteristic feature of agricultural commodity markets, requiring producers and exporters to implement risk management strategies including forward contracting, price hedging, and market diversification approaches. The development of local commodity exchanges and financial instruments supports improved price discovery and risk management capabilities.

Seasonal production patterns influence market dynamics, with harvest timing and weather conditions affecting supply availability and pricing structures. Strategic storage and processing capabilities help smooth seasonal variations and optimize market timing for export sales.

Consumer preference evolution toward premium, traceable, and sustainably produced agricultural products creates opportunities for value enhancement and market differentiation. Uruguay’s investment in quality certification systems and traceability programs positions the country favorably for these market trends.

Research methodology for analyzing Uruguay’s agricultural products market incorporates comprehensive data collection from multiple sources including government agricultural statistics, export trade data, industry associations, and primary research with market participants. Quantitative analysis focuses on production volumes, export values, market share calculations, and trend identification across different product categories.

Primary research activities include structured interviews with agricultural producers, exporters, government officials, and industry experts to gather qualitative insights on market dynamics, challenges, and opportunities. Field visits to representative farms and processing facilities provide firsthand observations of production practices and operational capabilities.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and international trade databases to establish comprehensive market understanding. MarkWide Research methodologies ensure data accuracy and reliability through cross-verification and validation processes.

Market modeling techniques include trend analysis, correlation studies, and scenario planning to project future market developments and identify potential growth trajectories. Statistical analysis tools support quantitative findings and provide confidence intervals for market projections and growth estimates.

Regional analysis of Uruguay’s agricultural products market reveals distinct geographic patterns in production concentration and specialization. Northern regions including Rivera, Tacuarembó, and Salto account for approximately 45% of total livestock production, benefiting from extensive grasslands and favorable grazing conditions.

Southern regions around Montevideo and Canelones focus more heavily on dairy production, vegetable cultivation, and intensive agricultural operations serving domestic markets. These areas benefit from proximity to processing facilities, transportation infrastructure, and export ports, supporting higher-value agricultural activities.

Eastern regions including Rocha and Treinta y Tres specialize in rice production, taking advantage of suitable soil conditions and water availability for irrigated agriculture. Rice production in these regions contributes approximately 22% of total crop export revenues.

Western border regions with Argentina focus on crop production including soybeans, wheat, and barley, benefiting from fertile soils and established agricultural infrastructure. Cross-border trade relationships and shared agricultural technologies enhance productivity and market access in these areas.

Competitive landscape in Uruguay’s agricultural products market features a mix of large-scale commercial operations, cooperative organizations, and family-owned farms competing across different market segments and product categories.

Market competition focuses on quality differentiation, cost efficiency, and market access capabilities. Companies invest heavily in technology adoption, sustainability programs, and certification systems to maintain competitive advantages in premium market segments.

Market segmentation of Uruguay’s agricultural products market reveals distinct categories based on product type, production methods, and target markets:

By Product Type:

By Production Scale:

By Market Destination:

Livestock category dominates Uruguay’s agricultural products market, with beef production maintaining the strongest position due to favorable natural conditions and established market relationships. Cattle ranching benefits from extensive grasslands, temperate climate, and traditional expertise, supporting approximately 2.8 million head of cattle across the country.

Dairy sector shows strong growth potential, with modernization efforts and genetic improvement programs enhancing productivity and quality standards. Milk production has increased by 14% over the past three years, supported by improved breeding programs and nutritional management practices.

Crop production category demonstrates diversification success, with soybean cultivation expanding rapidly to meet international demand. Soybean exports now represent approximately 28% of total crop export revenues, reflecting successful adaptation to global commodity markets.

Specialty products including wool, honey, and organic commodities provide niche market opportunities with premium pricing potential. These categories benefit from Uruguay’s reputation for quality and environmental stewardship, supporting value-added marketing strategies.

Industry participants in Uruguay’s agricultural products market benefit from several competitive advantages and support systems that enhance operational efficiency and market success:

Stakeholder benefits extend to rural communities through employment opportunities, economic development, and improved living standards supported by agricultural sector growth and modernization initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Uruguay’s agricultural products market include accelerating adoption of precision agriculture technologies, with GPS-guided farming equipment and sensor-based monitoring systems becoming increasingly common across commercial operations. These technologies improve resource efficiency, reduce environmental impact, and enhance crop yields through data-driven decision making.

Sustainability focus represents a dominant trend, with producers implementing comprehensive environmental management programs, carbon footprint reduction initiatives, and biodiversity conservation practices. Consumer demand for sustainably produced agricultural products drives adoption of certification programs and traceability systems.

Value chain integration shows increasing importance, with agricultural producers investing in processing capabilities, direct marketing channels, and brand development activities. This vertical integration strategy helps capture additional value and reduce dependence on commodity price fluctuations.

Digital transformation accelerates across the agricultural sector, including farm management software, mobile applications for field monitoring, and blockchain-based traceability systems. MWR analysis indicates that digital technology adoption has improved operational efficiency by approximately 20% among early adopters.

Recent industry developments include significant investments in agricultural research and development, with new breeding programs, crop variety development, and livestock genetic improvement initiatives enhancing productivity and quality standards. Government and private sector collaboration supports innovation adoption and technology transfer activities.

Infrastructure modernization projects include port facility upgrades, rural road improvements, and cold storage capacity expansion to support growing export volumes and maintain product quality throughout the supply chain. These investments address historical infrastructure constraints and improve market competitiveness.

International market access improvements through trade agreement negotiations and diplomatic efforts have opened new export opportunities, particularly in Asian markets where demand for premium agricultural products continues growing. Sanitary and phytosanitary protocol agreements facilitate market entry and reduce trade barriers.

Sustainability certification programs have expanded significantly, with more producers obtaining organic, grass-fed, and environmental stewardship certifications to access premium market segments and meet evolving consumer preferences for responsibly produced agricultural products.

Strategic recommendations for Uruguay’s agricultural products market participants include prioritizing technology adoption to maintain competitiveness and improve operational efficiency. Precision agriculture investments should focus on data analytics, automated systems, and resource optimization technologies that deliver measurable productivity improvements.

Market diversification strategies should emphasize expanding into high-growth Asian markets while maintaining strong positions in traditional export destinations. Product differentiation through quality certification, traceability systems, and sustainability programs can support premium pricing strategies.

Value chain development initiatives should focus on processing capabilities, direct marketing channels, and brand building activities that capture additional value and reduce commodity price exposure. Cooperative approaches can help smaller producers access technology and markets more effectively.

Risk management programs including weather insurance, forward contracting, and financial hedging instruments should be implemented to address climate variability and price volatility challenges. MarkWide Research analysis suggests that comprehensive risk management can reduce income volatility by up to 30% for participating producers.

Future outlook for Uruguay’s agricultural products market appears highly positive, with sustained growth expected across multiple product categories driven by increasing global food demand, particularly for high-quality protein sources and sustainably produced commodities. Market projections indicate continued expansion in export revenues, with Asian markets expected to account for an increasing share of total agricultural exports.

Technology integration will accelerate, with precision agriculture, biotechnology, and digital farming solutions becoming standard practices across commercial operations. These technological advances should support productivity improvements averaging 6-8% annually while reducing environmental impact and production costs.

Sustainability leadership will become increasingly important for market positioning, with consumers and importing countries placing greater emphasis on environmental stewardship, animal welfare, and carbon footprint considerations. Uruguay’s natural advantages in sustainable production should support continued premium market positioning.

Infrastructure development projects will address historical constraints and support market expansion, with improved transportation networks, processing facilities, and logistics capabilities enhancing overall competitiveness in international markets. These investments should facilitate access to new market opportunities and improve supply chain efficiency.

Uruguay’s agricultural products market represents a dynamic and resilient sector with strong fundamentals supporting continued growth and development. The combination of natural resource advantages, quality reputation, and strategic market positioning creates a solid foundation for long-term success in increasingly competitive global agricultural markets.

Market opportunities in value-added processing, organic agriculture, and Asian market expansion provide clear pathways for growth and diversification. The sector’s commitment to sustainability, quality standards, and technological innovation positions Uruguay favorably for evolving consumer preferences and market requirements.

Strategic focus on technology adoption, market diversification, and value chain development will be essential for maintaining competitiveness and capturing growth opportunities. The agricultural sector’s continued contribution to economic development, employment, and export revenues underscores its critical importance to Uruguay’s overall economic prosperity and rural community development.

What is Uruguay Agricultural Products?

Uruguay Agricultural Products refer to the various crops, livestock, and other goods produced in Uruguay’s agricultural sector, including grains, fruits, vegetables, and dairy products.

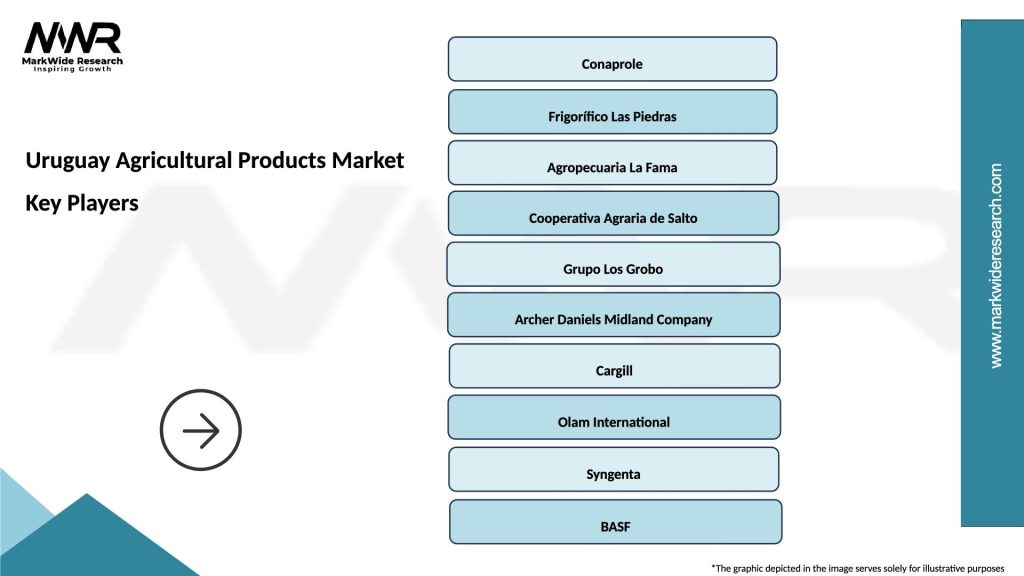

What are the key players in the Uruguay Agricultural Products Market?

Key players in the Uruguay Agricultural Products Market include companies like Conaprole, which is a major dairy producer, and Frigorífico Las Piedras, known for meat processing, among others.

What are the growth factors driving the Uruguay Agricultural Products Market?

The growth of the Uruguay Agricultural Products Market is driven by factors such as increasing global demand for organic products, advancements in agricultural technology, and favorable climatic conditions for crop production.

What challenges does the Uruguay Agricultural Products Market face?

The Uruguay Agricultural Products Market faces challenges such as fluctuating commodity prices, climate change impacts, and competition from other agricultural exporting countries.

What opportunities exist in the Uruguay Agricultural Products Market?

Opportunities in the Uruguay Agricultural Products Market include expanding export markets, increasing investment in sustainable farming practices, and the potential for innovation in food processing technologies.

What trends are shaping the Uruguay Agricultural Products Market?

Trends shaping the Uruguay Agricultural Products Market include a shift towards organic farming, the adoption of precision agriculture techniques, and growing consumer interest in locally sourced products.

Uruguay Agricultural Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cereals, Fruits, Vegetables, Livestock |

| End User | Food Processors, Exporters, Retailers, Wholesalers |

| Distribution Channel | Direct Sales, Online Retail, Supermarkets, Farmers’ Markets |

| Packaging Type | Bulk, Vacuum Sealed, Canned, Frozen |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Uruguay Agricultural Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at