444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The unsecured business loans market has witnessed significant growth in recent years, driven by the increasing demand for financing options among small and medium-sized enterprises (SMEs). Unlike secured loans, unsecured business loans do not require collateral, making them more accessible to a broader range of businesses. This market analysis provides a comprehensive overview of the unsecured business loans market, including key insights, drivers, restraints, opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key industry trends, the impact of COVID-19, industry developments, analyst suggestions, future outlook, and conclusion.

Meaning:

Unsecured business loans are a type of financing option where businesses can access funds without pledging any collateral. These loans are typically provided based on the borrower’s creditworthiness, financial stability, and business potential. The absence of collateral requirements makes unsecured business loans an attractive option for small businesses or startups that may not have substantial assets to offer as security.

Executive Summary:

The unsecured business loans market has experienced robust growth in recent years, driven by the increasing demand for quick and accessible financing options. The market has witnessed the emergence of numerous lenders, including traditional banks, online lenders, and alternative lending platforms, offering unsecured loans to businesses. This executive summary provides a snapshot of the market analysis, highlighting the key market insights, drivers, restraints, opportunities, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The unsecured business loans market is characterized by intense competition and evolving customer preferences. Technological advancements have revolutionized the lending landscape, with online platforms streamlining the loan application and approval process. The market dynamics are shaped by factors such as changing regulatory frameworks, economic conditions, and the overall financial health of businesses.

Regional Analysis:

The unsecured business loans market varies across different regions, influenced by factors like economic development, government policies, and business landscape. In North America, the market is driven by a high concentration of SMEs and a favorable regulatory environment. Europe is witnessing a surge in online lending platforms, while Asia Pacific is experiencing rapid growth due to the rising number of startups and government initiatives promoting entrepreneurship.

Competitive Landscape:

Leading companies in the Unsecured Business Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

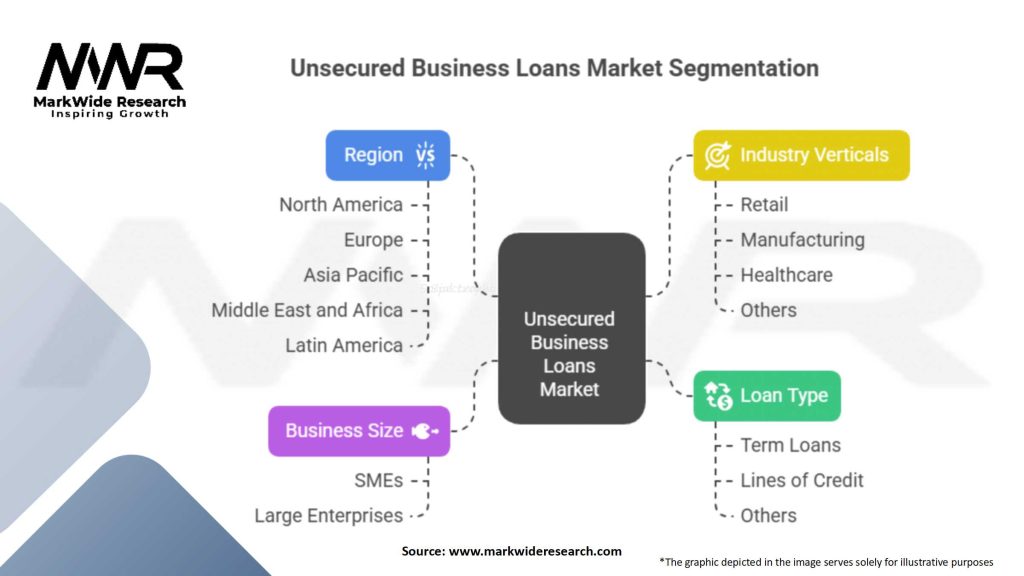

Segmentation:

The unsecured business loans market can be segmented based on loan type, business size, industry, and geographical region. By loan type, the market can be divided into short-term loans, lines of credit, merchant cash advances, and invoice financing. Business size segmentation includes small businesses, medium-sized enterprises, and startups. Industry-wise segmentation encompasses sectors such as retail, healthcare, manufacturing, and IT services.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic had a significant impact on the unsecured business loans market. Businesses faced challenges in accessing capital due to economic uncertainties and restricted lending activities. However, government stimulus packages and support measures helped mitigate some of the adverse effects. Online lending platforms gained traction as businesses sought quick and accessible financing options during the crisis.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The unsecured business loans market is expected to witness steady growth in the coming years, driven by the increasing demand for flexible financing options among SMEs. Technological advancements, such as AI and blockchain, will continue to reshape the lending landscape, improving risk assessment and loan processing. Collaboration between traditional lenders and fintech companies is likely to accelerate, leading to enhanced customer experiences and innovative loan products.

Conclusion:

The unsecured business loans market provides a valuable financing option for small businesses and startups, allowing them to access funds without pledging collateral. Despite higher interest rates and risk factors, the market continues to grow, driven by the increasing demand for quick and accessible financing solutions. As technological advancements and collaborations reshape the industry, lenders and borrowers alike can benefit from streamlined processes, personalized experiences, and improved access to capital. It is essential for industry participants to stay abreast of market trends, regulatory changes, and customer preferences to remain competitive in this dynamic landscape.

What is Unsecured Business Loans?

Unsecured business loans are financing options that do not require collateral, allowing businesses to access funds based on their creditworthiness. These loans are typically used for various purposes, including working capital, equipment purchases, and business expansion.

What are the key players in the Unsecured Business Loans Market?

Key players in the unsecured business loans market include companies like Kabbage, OnDeck, and Fundbox, which provide various loan products tailored for small to medium-sized enterprises. These companies focus on quick approval processes and flexible repayment terms, among others.

What are the main drivers of growth in the Unsecured Business Loans Market?

The growth of the unsecured business loans market is driven by the increasing demand for quick access to capital, the rise of e-commerce businesses, and the expansion of small businesses seeking to scale operations. Additionally, the ease of online applications has made these loans more accessible.

What challenges does the Unsecured Business Loans Market face?

Challenges in the unsecured business loans market include high-interest rates compared to secured loans, potential for over-indebtedness among borrowers, and stringent credit requirements that may exclude some businesses. These factors can limit access for certain segments of the market.

What opportunities exist in the Unsecured Business Loans Market?

Opportunities in the unsecured business loans market include the development of innovative lending platforms, the integration of artificial intelligence for credit assessments, and the potential for partnerships with fintech companies to enhance service delivery. These advancements can improve access for underserved businesses.

What trends are shaping the Unsecured Business Loans Market?

Trends in the unsecured business loans market include the growing popularity of peer-to-peer lending, the use of alternative data for credit scoring, and an increasing focus on customer experience in the loan application process. These trends are reshaping how businesses secure financing.

Unsecured Business Loans Market

| Segmentation | Details |

|---|---|

| Loan Type | Term Loans, Lines of Credit, Others |

| Business Size | Small and Medium Enterprises (SMEs), Large Enterprises |

| Industry Verticals | Retail, Manufacturing, Healthcare, Others |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Unsecured Business Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at