444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States water consumption market represents a critical infrastructure sector that encompasses the distribution, treatment, and management of water resources across residential, commercial, industrial, and agricultural applications. This comprehensive market includes municipal water systems, private water utilities, bottled water companies, and water treatment technologies that serve over 330 million Americans daily. The market has experienced steady growth driven by population expansion, urbanization, and increasing awareness of water quality and sustainability issues.

Market dynamics indicate robust demand across multiple segments, with residential consumption accounting for approximately 12% of total water usage nationwide. The sector encompasses everything from municipal water treatment facilities and distribution networks to bottled water production and home filtration systems. Industrial applications represent the largest consumption category, followed by agricultural irrigation and thermoelectric power generation.

Regional variations significantly impact consumption patterns, with western states facing greater water scarcity challenges compared to eastern regions. The market continues evolving through technological innovations in water treatment, smart metering systems, and conservation technologies. Sustainability initiatives and regulatory frameworks increasingly influence market development, driving investments in water recycling, desalination, and efficient distribution systems.

The United States water consumption market refers to the comprehensive ecosystem of water supply, treatment, distribution, and consumption services that provide potable and non-potable water to residential, commercial, industrial, and agricultural users across the country. This market encompasses municipal water utilities, private water companies, bottled water manufacturers, water treatment equipment providers, and related infrastructure services that ensure reliable water access for all sectors of the American economy.

Water consumption includes both direct usage for drinking, cooking, and sanitation purposes, as well as indirect consumption through industrial processes, agricultural irrigation, and commercial operations. The market covers the entire value chain from water source extraction and treatment to final delivery and consumption, including emerging segments like water recycling, desalination, and smart water management technologies.

Market participants range from large municipal water authorities and investor-owned utilities to specialized bottled water companies and water technology providers. The sector operates under complex regulatory frameworks involving federal, state, and local authorities that govern water quality standards, environmental protection, and public health requirements.

The United States water consumption market demonstrates resilient growth patterns driven by fundamental demographic and economic factors. Population growth, urbanization trends, and industrial expansion continue supporting steady demand increases across all major consumption categories. The market benefits from essential service characteristics, providing stable revenue streams for utilities and water service providers.

Key growth drivers include aging infrastructure requiring modernization, increasing water quality standards, and growing consumer awareness of health and environmental issues. The residential segment shows consistent demand growth of approximately 2.1% annually, while industrial applications experience more variable patterns based on economic conditions and manufacturing activity levels.

Technology adoption accelerates across the market, with smart water meters, advanced treatment systems, and digital monitoring platforms gaining widespread implementation. Sustainability concerns drive investments in water recycling technologies, with municipal recycling programs achieving 15-20% efficiency improvements in participating communities.

Regulatory developments continue shaping market dynamics through updated water quality standards, environmental protection requirements, and infrastructure investment incentives. The sector faces ongoing challenges from climate variability, aging distribution systems, and evolving contamination concerns that require continuous adaptation and investment.

Market segmentation reveals distinct consumption patterns across different user categories, with each segment exhibiting unique growth characteristics and requirements:

Geographic distribution shows significant regional variations, with western states implementing more aggressive conservation measures due to water scarcity concerns. Technology integration accelerates across all segments, particularly in smart metering and treatment system automation.

Population growth serves as the fundamental driver of water consumption market expansion, with demographic projections indicating continued increases in water demand across residential and commercial segments. Urban development patterns concentrate population growth in metropolitan areas, requiring expanded water infrastructure and distribution capacity to serve growing communities effectively.

Industrial expansion drives significant water consumption increases, particularly in manufacturing, food processing, and technology sectors that require substantial water inputs for production processes. Economic growth correlates directly with industrial water demand, as business expansion and new facility development create additional consumption requirements.

Health consciousness among consumers increasingly influences water consumption patterns, driving demand for filtered, purified, and premium water products. Quality standards continue rising as consumers become more aware of water contamination issues and seek higher-quality water sources for drinking and cooking purposes.

Climate considerations impact water consumption patterns, with extreme weather events and changing precipitation patterns affecting both supply availability and demand characteristics. Agricultural needs fluctuate based on weather conditions, crop selection, and irrigation technology adoption, creating variable but substantial water consumption requirements.

Regulatory requirements drive market growth through mandated infrastructure improvements, water quality upgrades, and environmental compliance measures that require ongoing investment and system enhancements.

Water scarcity represents the most significant constraint facing the United States water consumption market, particularly in western and southwestern regions where drought conditions and limited freshwater resources restrict consumption growth. Supply limitations force communities to implement conservation measures and explore alternative water sources, potentially limiting market expansion in affected areas.

Infrastructure aging creates substantial challenges for water utilities, with distribution systems requiring extensive maintenance and replacement investments. Capital requirements for infrastructure modernization strain utility budgets and may limit service expansion capabilities in some regions.

Regulatory complexity increases operational costs and compliance burdens for water service providers, particularly smaller utilities that may lack resources for extensive regulatory compliance programs. Environmental regulations continue tightening, requiring additional treatment technologies and monitoring systems that increase operational expenses.

Economic sensitivity affects industrial and commercial water consumption, with economic downturns reducing demand from manufacturing and business sectors. Energy costs impact water treatment and distribution operations, as pumping, treatment, and delivery processes require substantial energy inputs.

Public opposition to rate increases and infrastructure projects can delay necessary improvements and limit utility revenue growth, creating challenges for system maintenance and expansion efforts.

Technology innovation presents substantial opportunities for market growth through smart water management systems, advanced treatment technologies, and efficiency improvement solutions. Digital transformation enables utilities to optimize operations, reduce waste, and improve customer service through data analytics and automated monitoring systems.

Water recycling and reuse technologies offer significant expansion opportunities, particularly in water-stressed regions where alternative water sources become increasingly valuable. Desalination projects along coastal areas provide new water supply options, creating opportunities for specialized technology providers and infrastructure developers.

Premium water segments continue expanding as consumers seek higher-quality water products, creating opportunities for bottled water companies, filtration system manufacturers, and specialty water service providers. Health-focused products drive innovation in water enhancement and treatment technologies.

Infrastructure investment programs at federal and state levels create opportunities for utilities, construction companies, and technology providers to participate in system modernization projects. Public-private partnerships enable innovative financing and development approaches for water infrastructure projects.

Sustainability initiatives drive demand for environmentally friendly water technologies, conservation systems, and renewable energy integration in water operations, creating opportunities for specialized technology providers.

Supply and demand dynamics in the United States water consumption market reflect complex interactions between natural resource availability, infrastructure capacity, and consumption patterns across different sectors. Demand elasticity varies significantly by user category, with residential consumption showing relatively inelastic characteristics while industrial usage demonstrates greater price sensitivity.

Seasonal variations significantly impact consumption patterns, with summer months typically showing 25-30% higher residential water usage due to irrigation and cooling needs. Regional differences create distinct market dynamics, with water-abundant eastern regions operating under different constraints compared to water-scarce western areas.

Pricing mechanisms influence consumption behavior, with tiered rate structures and conservation pricing encouraging efficient water use. Technology adoption accelerates market evolution, with smart metering systems providing detailed consumption data that enables better demand management and customer engagement.

Competitive dynamics vary by market segment, with municipal utilities operating as natural monopolies while bottled water and treatment equipment markets demonstrate intense competition. Consolidation trends continue in the utility sector, with larger companies acquiring smaller systems to achieve operational efficiencies.

Investment patterns focus increasingly on infrastructure resilience, water quality improvements, and sustainability initiatives that support long-term market stability and growth.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into United States water consumption market dynamics. Primary research includes extensive interviews with utility executives, water industry professionals, regulatory officials, and technology providers to gather firsthand market intelligence and trend insights.

Secondary research incorporates analysis of government databases, regulatory filings, industry publications, and academic studies to establish comprehensive market baseline data. Data sources include the Environmental Protection Agency, United States Geological Survey, American Water Works Association, and state utility commissions that provide authoritative consumption and infrastructure data.

Quantitative analysis utilizes statistical modeling techniques to identify consumption trends, growth patterns, and market correlations across different segments and geographic regions. Qualitative assessment examines regulatory developments, technology trends, and market dynamics that influence future growth prospects.

Market validation processes ensure data accuracy through cross-referencing multiple sources and expert review of findings and projections. Forecasting models incorporate demographic trends, economic indicators, and regulatory developments to project future market evolution.

Regional analysis examines state and local market conditions to identify geographic variations and opportunities within the broader national market context.

Western United States demonstrates unique market characteristics driven by water scarcity concerns and aggressive conservation policies. States like California, Arizona, and Nevada implement sophisticated water management systems and invest heavily in alternative water sources including desalination and recycling technologies. This region shows the highest adoption rates for water-efficient technologies and conservation measures.

Eastern regions benefit from more abundant water resources but face challenges from aging infrastructure and increasing quality standards. Northeast states focus on infrastructure modernization and treatment system upgrades to address legacy contamination issues and meet evolving regulatory requirements.

Southern states experience rapid population growth that drives water consumption increases, particularly in metropolitan areas like Texas, Florida, and Georgia. These regions balance growth accommodation with resource conservation, implementing smart growth policies and efficient water management practices.

Midwest regions leverage abundant freshwater resources from the Great Lakes system while addressing agricultural water needs and industrial consumption requirements. Agricultural states focus on irrigation efficiency improvements and sustainable farming practices that optimize water usage.

Market share distribution shows California representing approximately 12% of national consumption, followed by Texas at 8% and Florida at 6%, reflecting population concentrations and economic activity levels in these states.

Market leadership in the United States water consumption sector includes a diverse mix of municipal utilities, investor-owned companies, and specialized service providers that serve different market segments and geographic regions:

Competitive strategies focus on operational efficiency, customer service excellence, and technology innovation to differentiate service offerings. Market consolidation continues as larger utilities acquire smaller systems to achieve economies of scale and operational synergies.

By End-Use Application:

By Water Type:

By Distribution Method:

Residential Water Consumption represents the most visible market segment, with average household usage patterns showing steady growth aligned with population increases and housing development. Smart home integration drives adoption of advanced monitoring and conservation technologies that help consumers optimize water usage and reduce costs.

Industrial Water Applications demonstrate the highest consumption volumes, with manufacturing sectors like food processing, chemicals, and paper production requiring substantial water inputs. Process optimization and recycling technologies help industrial users improve efficiency while meeting production requirements.

Agricultural Irrigation shows significant regional concentration in western and central states, with precision irrigation technologies gaining adoption to maximize crop yields while minimizing water usage. Drought-resistant crops and improved irrigation scheduling help farmers adapt to water availability constraints.

Bottled Water Segment continues expanding through premium product development, convenience packaging innovations, and health-focused marketing strategies. Sustainability initiatives drive development of recyclable packaging and local sourcing strategies that reduce environmental impact.

Water Treatment Technologies experience robust growth as quality standards increase and contamination concerns drive demand for advanced filtration and purification systems across all market segments.

Utility Companies benefit from stable revenue streams generated by essential water services, with regulated rate structures providing predictable income sources. Infrastructure investments supported by rate recovery mechanisms enable system improvements and expansion capabilities that support long-term growth.

Technology Providers gain opportunities from increasing demand for water treatment, monitoring, and efficiency improvement solutions. Innovation incentives drive development of advanced technologies that address emerging market needs and regulatory requirements.

Consumers receive reliable access to safe, high-quality water services that support health, safety, and quality of life. Technology adoption provides consumers with better information about water usage patterns and opportunities for conservation and cost savings.

Industrial Users benefit from stable water supply sources that support manufacturing and processing operations. Efficiency improvements through advanced technologies help reduce operational costs and environmental impact while maintaining production capabilities.

Agricultural Producers gain access to reliable irrigation water sources and efficiency technologies that optimize crop production while managing resource constraints. Precision agriculture integration helps farmers maximize yields while minimizing water consumption.

Environmental Stakeholders benefit from improved water management practices, conservation initiatives, and sustainability programs that protect natural resources and ecosystem health.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Water Management emerges as a dominant trend, with utilities implementing advanced metering infrastructure, leak detection systems, and data analytics platforms to optimize operations and improve customer service. Digital transformation enables real-time monitoring and predictive maintenance capabilities that reduce costs and improve system reliability.

Sustainability Integration drives adoption of water recycling technologies, renewable energy systems, and environmental stewardship programs across the water industry. Circular economy principles influence utility operations and consumer behavior, promoting water conservation and reuse initiatives.

Quality Enhancement continues as a key trend, with consumers demanding higher water quality standards and utilities investing in advanced treatment technologies. Contaminant removal capabilities expand to address emerging pollutants and ensure compliance with evolving regulatory standards.

Infrastructure Resilience becomes increasingly important as utilities prepare for climate change impacts and extreme weather events. System hardening and redundancy improvements help ensure reliable water service during challenging conditions.

Customer Engagement evolves through digital platforms, mobile applications, and personalized service offerings that improve customer satisfaction and promote conservation behaviors. Data transparency helps consumers understand water usage patterns and make informed conservation decisions.

Regulatory Evolution continues shaping the water consumption market through updated drinking water standards, environmental protection requirements, and infrastructure investment incentives. Federal legislation supports water infrastructure improvements through funding programs and technical assistance initiatives.

Technology Partnerships between utilities and technology companies accelerate innovation adoption and system modernization efforts. Public-private collaborations enable innovative financing and development approaches for water infrastructure projects.

Consolidation Activity increases in the utility sector as larger companies acquire smaller systems to achieve operational efficiencies and improve service capabilities. Market consolidation creates opportunities for improved resource allocation and technology deployment.

Sustainability Initiatives expand across the industry, with utilities implementing renewable energy systems, water recycling programs, and environmental stewardship measures. Carbon neutrality goals drive adoption of clean energy technologies and efficiency improvements.

Research and Development investments focus on advanced treatment technologies, smart infrastructure solutions, and water quality monitoring systems. Innovation partnerships between utilities, technology companies, and research institutions accelerate development of next-generation water management solutions.

MarkWide Research analysis indicates that water utilities should prioritize infrastructure modernization investments to address aging systems and improve operational efficiency. Technology adoption represents a critical success factor, with utilities that implement smart water management systems achieving 15-25% operational cost reductions compared to traditional approaches.

Diversification strategies should focus on expanding service offerings beyond basic water supply to include water quality testing, conservation consulting, and technology services. Customer engagement programs that promote conservation and provide usage insights help utilities manage demand while improving customer satisfaction.

Regional expansion opportunities exist for utilities with strong operational capabilities and financial resources, particularly in growing metropolitan areas where water infrastructure development needs exceed local capacity. Strategic acquisitions of smaller systems can provide economies of scale and operational synergies.

Sustainability integration should become a core component of utility strategic planning, with investments in renewable energy, water recycling, and environmental stewardship programs supporting long-term competitiveness. Regulatory compliance capabilities must evolve to address increasingly complex water quality and environmental requirements.

Innovation partnerships with technology companies and research institutions can accelerate development and deployment of advanced water management solutions while sharing development costs and risks.

Market growth prospects remain positive for the United States water consumption sector, supported by fundamental demographic trends, economic expansion, and increasing quality standards. Population growth projections indicate continued demand increases across residential and commercial segments, with metropolitan areas showing the strongest growth potential.

Technology integration will accelerate market evolution, with smart water management systems, advanced treatment technologies, and digital customer platforms becoming standard industry practices. Artificial intelligence and machine learning applications will optimize system operations and predict maintenance needs, improving efficiency and reliability.

Sustainability focus will intensify, driven by climate change concerns, resource scarcity, and regulatory requirements. Water recycling and reuse technologies are projected to achieve 30-40% market penetration in water-stressed regions within the next decade.

Infrastructure investment will continue at elevated levels, supported by federal and state funding programs and utility rate recovery mechanisms. System modernization projects will focus on resilience, efficiency, and quality improvements that support long-term market stability.

MWR projections indicate that premium water segments will maintain strong growth momentum, driven by health consciousness and quality preferences among consumers. Innovation opportunities in water treatment, monitoring, and conservation technologies will create new market segments and competitive advantages for early adopters.

The United States water consumption market represents a fundamental and resilient sector of the American economy, providing essential services that support public health, economic activity, and quality of life across all regions and demographics. Market dynamics reflect the complex interplay between natural resource availability, infrastructure capacity, regulatory requirements, and evolving consumer expectations that continue shaping industry development.

Growth prospects remain favorable despite challenges from aging infrastructure, water scarcity concerns, and regulatory complexity. Technology innovation provides pathways for addressing these challenges while improving operational efficiency and service quality. The sector’s essential service nature ensures stable demand patterns that support long-term investment and development planning.

Strategic opportunities exist across all market segments, from utility consolidation and infrastructure modernization to premium water products and advanced technology solutions. Sustainability integration will become increasingly important as environmental concerns and resource constraints influence market development and regulatory frameworks.

The United States water consumption market is positioned for continued evolution and growth, driven by demographic trends, technological advancement, and increasing recognition of water as a critical resource requiring careful management and protection for future generations.

What is Water Consumption?

Water consumption refers to the total amount of water used by individuals, industries, and agriculture within a specific area. In the context of the United States, it encompasses residential, commercial, and agricultural usage patterns.

What are the key players in the United States Water Consumption Market?

Key players in the United States Water Consumption Market include companies like American Water Works, Veolia North America, and Aqua America, among others. These companies are involved in water supply, treatment, and management services.

What are the main drivers of the United States Water Consumption Market?

The main drivers of the United States Water Consumption Market include population growth, increased agricultural demands, and urbanization. These factors contribute to rising water needs across various sectors.

What challenges does the United States Water Consumption Market face?

The United States Water Consumption Market faces challenges such as water scarcity, aging infrastructure, and regulatory compliance. These issues can hinder efficient water distribution and management.

What opportunities exist in the United States Water Consumption Market?

Opportunities in the United States Water Consumption Market include advancements in water recycling technologies, smart water management systems, and increased investment in sustainable water practices. These innovations can enhance efficiency and reduce waste.

What trends are shaping the United States Water Consumption Market?

Trends shaping the United States Water Consumption Market include a growing emphasis on sustainability, the adoption of smart metering technologies, and increased public awareness of water conservation. These trends are influencing consumer behavior and industry practices.

United States Water Consumption Market

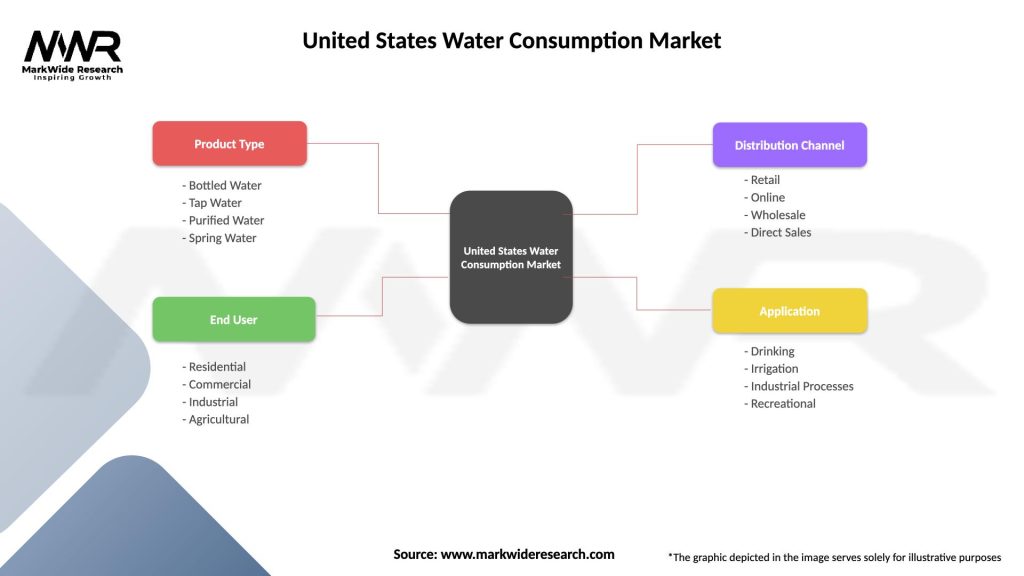

| Segmentation Details | Description |

|---|---|

| Product Type | Bottled Water, Tap Water, Purified Water, Spring Water |

| End User | Residential, Commercial, Industrial, Agricultural |

| Distribution Channel | Retail, Online, Wholesale, Direct Sales |

| Application | Drinking, Irrigation, Industrial Processes, Recreational |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at