444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The United States valves market stands as a vital pillar within the country’s industrial and manufacturing sectors. Valves, integral components in controlling the flow of liquids, gases, and vapors, play a pivotal role in various industries such as oil and gas, water and wastewater management, pharmaceuticals, and more. With a steadfast commitment to technological advancement and innovation, the U.S. valves market remains dynamic, reflecting both global trends and domestic demands.

Meaning of Valves:

Valves, often referred to as the gatekeepers of fluid systems, are devices that regulate, control, and direct the flow of liquids, gases, or slurries through pipes or channels. Their importance transcends mere mechanical components; they are the custodians of efficiency, safety, and reliability in industrial operations. In the United States, valves are omnipresent in sectors ranging from energy production to healthcare, illustrating their pervasive impact on modern society.

Executive Summary:

The U.S. valves market, characterized by its expansive scope, is driven by both its intrinsic demand and external factors that shape industrial landscapes. As the nation embraces innovation and sustainable practices, the valves sector aligns itself with these pursuits. While opportunities for growth abound, the market must also address various challenges to ensure long-term prosperity.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are contributing to the growth of the United States Valves Market:

Market Restraints

Despite its growth, the United States Valves Market faces several challenges:

Market Opportunities

The United States Valves Market offers several opportunities for growth:

Market Dynamics

The United States Valves Market is influenced by several key dynamics:

Regional Analysis

The United States Valves Market is geographically diverse, with different regions experiencing varying levels of demand:

Competitive Landscape

Leading Companies in the United States Valves Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

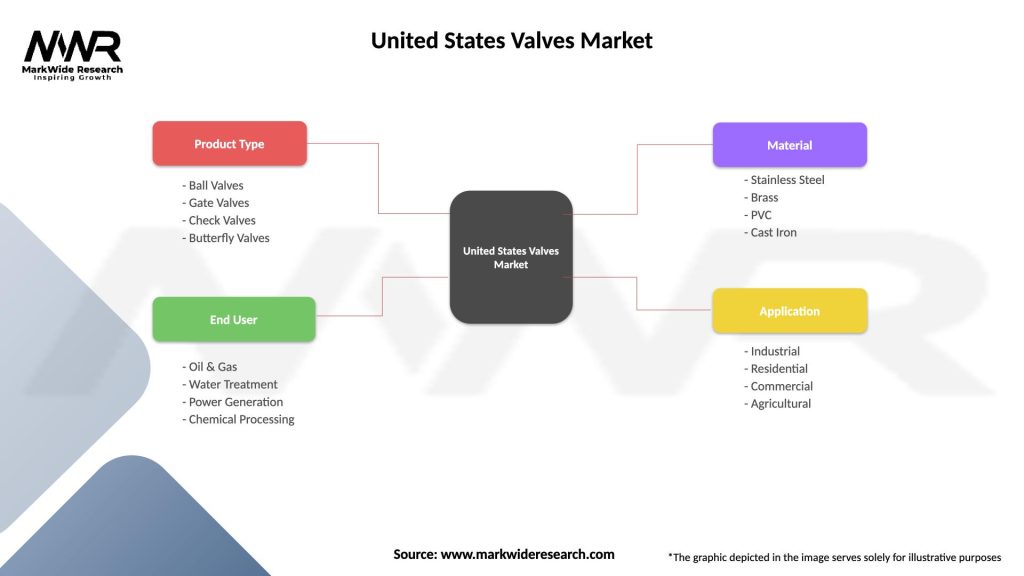

The United States Valves Market can be segmented by the following factors:

Product Type

Application

End-User

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact:

The Covid-19 pandemic ushered in unprecedented challenges, affecting the U.S. valves market. Supply chain disruptions highlighted vulnerabilities, urging players to diversify sourcing. Remote work arrangements expedited digitalization, amplifying the adoption of virtual collaboration tools. The crisis underscored the importance of agility and resilience in the face of adversity.

Key Industry Developments:

In recent years, the U.S. valves market has witnessed transformative developments. The emergence of 3D printing technology has revolutionized valve manufacturing, enhancing efficiency and customization. Furthermore, breakthroughs in valve materials, such as graphene-enhanced composites, hold the promise of heightened durability and performance.

Analyst Suggestions:

Industry analysts offer valuable suggestions to navigate the complexities of the U.S. valves market. Prioritizing innovation and staying attuned to technological trends is imperative. Building robust supply chain networks and diversifying sourcing mitigates risks. Embracing sustainable practices fosters resilience and addresses environmental concerns.

Future Outlook:

The future of the U.S. valves market is promising yet challenging. As renewable energy gains prominence, valves supporting solar and wind energy sectors will proliferate. Smart valve technologies will evolve, incorporating AI-driven insights and remote monitoring. Navigating regulatory shifts and geopolitical dynamics will be essential for sustainable growth.

Conclusion:

In conclusion, the United States valves market stands as a testament to industrial prowess and innovation. With a keen eye on technological advancement, sustainability, and adaptability, the market is poised for robust growth. While challenges persist, strategic collaborations, innovative solutions, and a commitment to excellence will empower the U.S. valves market to flourish in the dynamic currents of industry evolution.

What is Valves?

Valves are mechanical devices that control the flow of fluids, gases, or slurries within a system. They are essential components in various applications, including water supply, oil and gas, and chemical processing.

What are the key players in the United States Valves Market?

Key players in the United States Valves Market include Emerson Electric Co., Flowserve Corporation, and Parker Hannifin Corporation, among others. These companies are known for their innovative valve solutions and extensive product portfolios.

What are the main drivers of the United States Valves Market?

The main drivers of the United States Valves Market include the growing demand for automation in industrial processes, the expansion of the oil and gas sector, and the increasing need for water and wastewater management solutions.

What challenges does the United States Valves Market face?

The United States Valves Market faces challenges such as fluctuating raw material prices, stringent regulatory requirements, and the need for continuous innovation to meet evolving industry standards.

What opportunities exist in the United States Valves Market?

Opportunities in the United States Valves Market include the rising adoption of smart valves and IoT technologies, the growth of renewable energy projects, and the increasing focus on sustainable water management practices.

What trends are shaping the United States Valves Market?

Trends shaping the United States Valves Market include the integration of advanced materials for enhanced durability, the shift towards automation and remote monitoring, and the development of energy-efficient valve solutions.

United States Valves Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ball Valves, Gate Valves, Check Valves, Butterfly Valves |

| End User | Oil & Gas, Water Treatment, Power Generation, Chemical Processing |

| Material | Stainless Steel, Brass, PVC, Cast Iron |

| Application | Industrial, Residential, Commercial, Agricultural |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Valves Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at