444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States data center construction market represents a dynamic and rapidly evolving sector that forms the backbone of America’s digital infrastructure. This market encompasses the planning, design, and construction of specialized facilities that house critical computing equipment, servers, and networking infrastructure essential for modern business operations. Data center construction has emerged as a strategic priority for enterprises, cloud service providers, and colocation companies seeking to meet the exponential growth in data processing demands.

Market dynamics indicate robust expansion driven by digital transformation initiatives, cloud computing adoption, and the proliferation of Internet of Things (IoT) devices. The sector is experiencing unprecedented growth, with construction activity projected to maintain a compound annual growth rate (CAGR) of 8.2% through the forecast period. Hyperscale data centers are particularly driving construction demand, as major technology companies expand their infrastructure footprint to support growing user bases and emerging technologies like artificial intelligence and machine learning.

Regional distribution shows concentrated activity in key metropolitan areas, with approximately 35% of construction projects located in traditional data center hubs including Northern Virginia, Silicon Valley, and Chicago. However, edge computing requirements are driving geographic diversification, with emerging markets in secondary cities gaining significant traction as organizations seek to reduce latency and improve service delivery.

The United States data center construction market refers to the comprehensive ecosystem of activities, services, and investments involved in developing specialized facilities designed to house and operate critical computing infrastructure. This market encompasses everything from initial site selection and architectural design to mechanical and electrical systems installation, cooling infrastructure deployment, and security implementation.

Data center construction involves highly specialized engineering and construction processes that differ significantly from traditional commercial building projects. These facilities require precise environmental controls, redundant power systems, advanced cooling technologies, and robust security measures to ensure continuous operation of mission-critical computing equipment. Construction projects typically involve multiple phases including site preparation, structural construction, mechanical and electrical installation, and commissioning processes that can span several months to multiple years depending on facility size and complexity.

Market expansion in the United States data center construction sector reflects the nation’s position as a global leader in digital infrastructure development. The market is characterized by increasing demand from hyperscale cloud providers, enterprise organizations, and colocation service providers who require state-of-the-art facilities to support their growing computational needs. Construction activity has intensified significantly, with project pipelines reaching record levels as organizations prioritize digital infrastructure investments.

Key market drivers include the accelerating adoption of cloud services, which accounts for approximately 42% of construction demand, and the growing need for edge computing infrastructure to support low-latency applications. Sustainability initiatives are increasingly influencing construction decisions, with green building practices and energy-efficient designs becoming standard requirements rather than optional features.

Technological advancement continues to reshape construction methodologies, with modular construction techniques gaining popularity due to their ability to reduce project timelines by up to 25% while maintaining quality standards. The market is also witnessing increased investment in renewable energy integration and advanced cooling technologies that improve operational efficiency and reduce environmental impact.

Strategic insights reveal several critical trends shaping the United States data center construction landscape:

Digital transformation initiatives across industries serve as the primary catalyst for data center construction demand. Organizations are increasingly migrating workloads to cloud environments, requiring expanded infrastructure capacity to support these transitions. Cloud computing adoption continues to accelerate, with enterprises seeking reliable, scalable infrastructure solutions that can accommodate fluctuating computational demands.

Artificial intelligence and machine learning applications are driving unprecedented demand for high-performance computing infrastructure. These technologies require specialized facilities with enhanced cooling capabilities and robust power distribution systems. Data analytics growth is similarly contributing to construction demand, as organizations generate and process ever-increasing volumes of information requiring secure, efficient storage and processing capabilities.

5G network deployment represents another significant driver, necessitating edge computing infrastructure that brings processing capabilities closer to end users. This trend is spurring construction of smaller, distributed facilities in metropolitan areas and suburban locations. Internet of Things expansion is generating massive data volumes that require processing and storage infrastructure, further amplifying construction demand across various facility types and sizes.

Power grid limitations pose significant challenges in certain high-demand markets, where utility infrastructure cannot support the massive power requirements of modern data centers. These constraints force developers to seek alternative locations or invest heavily in grid upgrades, potentially delaying project timelines and increasing costs. Regulatory complexities in various jurisdictions can also slow construction progress, particularly regarding environmental compliance and zoning approvals.

Construction cost inflation continues to impact project economics, with material costs and specialized labor commanding premium pricing. Supply chain disruptions have created additional challenges, particularly for critical components like backup generators, cooling systems, and electrical equipment. These factors can extend project timelines and strain budgets, forcing developers to reassess project viability and timing.

Environmental concerns and sustainability regulations are creating additional compliance requirements that can complicate construction processes. While these initiatives ultimately benefit the industry, they require careful planning and potentially higher upfront investments. Skilled labor shortages in specialized trades continue to constrain construction capacity, particularly for complex mechanical and electrical installations that require extensive experience and certification.

Edge computing expansion presents substantial opportunities for construction companies specializing in smaller, distributed facilities. As organizations seek to reduce latency and improve user experiences, demand for edge data centers in secondary markets is expected to grow significantly. Retrofit and modernization projects offer additional revenue streams, as existing facilities require upgrades to accommodate new technologies and efficiency standards.

Sustainable construction practices are creating opportunities for companies that can deliver environmentally friendly solutions. Organizations increasingly prioritize green building certifications and energy-efficient designs, creating demand for specialized expertise in sustainable construction methodologies. Renewable energy integration represents a growing opportunity, as data center operators seek to reduce operational costs and meet sustainability commitments.

Modular construction techniques offer significant opportunities for companies that can deliver faster, more cost-effective solutions. These approaches can reduce construction timelines while maintaining quality standards, appealing to organizations with urgent capacity needs. International expansion opportunities exist for US-based construction companies with specialized data center expertise, as global demand for digital infrastructure continues to grow.

Competitive dynamics in the United States data center construction market reflect a complex ecosystem of specialized contractors, general construction companies, and integrated service providers. Market consolidation trends are evident as larger firms acquire specialized capabilities through strategic acquisitions, seeking to offer comprehensive solutions from design through commissioning.

Technology evolution continues to reshape construction approaches, with advanced building information modeling (BIM) and project management systems improving efficiency and reducing errors. Collaboration models are evolving, with increased emphasis on design-build partnerships that streamline project delivery and improve coordination between stakeholders.

Customer expectations are rising, with data center operators demanding faster delivery times, higher quality standards, and more sustainable construction practices. This is driving innovation in construction methodologies and materials selection. Risk management has become increasingly sophisticated, with comprehensive approaches to schedule, cost, and performance risk mitigation becoming standard practice across major projects.

Comprehensive market analysis for this research involved multiple data collection and validation methodologies to ensure accuracy and reliability. Primary research included extensive interviews with industry executives, construction professionals, data center operators, and technology providers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, construction permits, project announcements, and financial filings from publicly traded companies involved in data center construction. Market sizing utilized bottom-up and top-down approaches, incorporating construction activity data, project pipeline analysis, and capacity expansion announcements from major market participants.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews to verify findings, and utilizing statistical analysis to identify trends and patterns. MarkWide Research analysts employed advanced analytical frameworks to assess market dynamics, competitive positioning, and future growth prospects across various market segments and geographic regions.

Northern Virginia maintains its position as the dominant data center construction market, accounting for approximately 28% of national construction activity. The region benefits from robust fiber connectivity, favorable regulatory environment, and proximity to federal government agencies and major enterprises. Construction pipelines in the area remain strong, with multiple hyperscale projects in various development phases.

Silicon Valley and the broader Bay Area represent the second-largest construction market, driven by technology company headquarters and cloud service provider expansion. However, land constraints and high costs are pushing some development to adjacent markets in Central California and Nevada. Phoenix and Las Vegas are emerging as attractive alternatives, offering lower costs and favorable business climates.

Chicago continues to serve as a major hub for data center construction, benefiting from its central location and excellent connectivity to both coasts. The market shows particular strength in enterprise and colocation segments, with steady construction activity across multiple facility types. Texas markets including Dallas, Austin, and Houston are experiencing rapid growth, with construction activity increasing by approximately 15% annually as companies seek cost-effective alternatives to traditional hubs.

Market leadership in the United States data center construction sector is distributed among several categories of companies, each bringing distinct capabilities and specializations:

By Facility Type:

By Construction Type:

By Power Capacity:

Hyperscale construction dominates market activity, with these massive facilities requiring specialized expertise in power distribution, cooling systems, and structural engineering. Construction timelines for hyperscale projects typically range from 18 to 36 months, depending on complexity and size. These projects often involve phased construction approaches that allow operators to begin utilizing portions of facilities while construction continues on additional phases.

Colocation facility construction emphasizes flexibility and efficiency, with designs that accommodate multiple tenants with varying requirements. Modular approaches are particularly popular in this segment, allowing operators to scale capacity based on customer demand. Security considerations are paramount, with sophisticated access control systems and physical security measures integrated throughout the construction process.

Edge data center construction represents the fastest-growing segment, with projects typically smaller in scale but higher in quantity. These facilities require rapid deployment capabilities and often utilize standardized designs that can be replicated across multiple locations. Urban construction challenges including limited space and noise restrictions require specialized approaches and careful coordination with local authorities.

Construction companies benefit from the data center market’s stability and long-term growth prospects, with project pipelines providing visibility into future revenue streams. Specialized expertise in data center construction commands premium pricing and creates competitive advantages that are difficult for generalist contractors to replicate. Repeat business opportunities are common as successful projects lead to additional work with the same clients.

Data center operators gain access to state-of-the-art facilities designed specifically for their operational requirements, with construction partners who understand the unique challenges of mission-critical infrastructure. Risk mitigation through experienced contractors reduces the likelihood of costly delays or performance issues that could impact business operations.

Technology suppliers benefit from the growing market for specialized data center equipment and systems, with construction projects driving demand for power distribution, cooling, and monitoring technologies. Integration opportunities allow suppliers to work closely with construction teams to optimize system performance and efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has become a dominant trend, with approximately 68% of new construction projects incorporating renewable energy systems and advanced efficiency measures. Green building certifications are increasingly required by data center operators seeking to meet corporate sustainability commitments and reduce operational costs.

Modular construction adoption is accelerating, with prefabricated approaches reducing construction timelines and improving quality control. Standardized designs are becoming more common, particularly for edge computing facilities where rapid deployment is essential. Factory-built components allow for better quality control and weather-independent construction progress.

Artificial intelligence integration in construction processes is improving project management, scheduling, and quality control. Building information modeling has become standard practice, enabling better coordination between trades and reducing construction errors. Predictive analytics are being used to optimize construction schedules and resource allocation.

Major construction announcements continue to shape the market landscape, with several hyperscale projects exceeding traditional facility sizes. Technology partnerships between construction companies and equipment suppliers are becoming more strategic, focusing on integrated solutions that optimize both construction efficiency and operational performance.

Regulatory developments at state and local levels are influencing construction practices, particularly regarding energy efficiency standards and environmental impact assessments. Utility partnerships are becoming more important as data center operators work with power companies to ensure adequate grid capacity for large-scale developments.

Workforce development initiatives are addressing skilled labor shortages through specialized training programs and apprenticeships focused on data center construction techniques. MarkWide Research analysis indicates that these programs are beginning to show positive impact on project delivery capabilities and construction quality standards.

Strategic positioning recommendations for construction companies include developing specialized capabilities in emerging areas such as edge computing and sustainable construction practices. Geographic diversification strategies should consider secondary markets where land costs are lower and regulatory environments may be more favorable.

Technology investment in advanced project management systems and building information modeling capabilities will become increasingly important for maintaining competitive advantages. Partnership strategies with equipment suppliers and technology providers can create integrated solutions that appeal to data center operators seeking streamlined project delivery.

Workforce development should be a priority, with companies investing in training programs and retention strategies to address skilled labor shortages. Sustainability expertise will become increasingly valuable as environmental considerations continue to influence construction decisions and project requirements.

Long-term growth prospects for the United States data center construction market remain robust, driven by continued digital transformation and emerging technology adoption. Market expansion is expected to maintain strong momentum, with construction activity projected to grow at a CAGR of 8.5% over the next five years.

Geographic distribution will continue evolving, with edge computing driving construction activity into new markets and regions. MWR projections indicate that secondary markets could account for up to 40% of construction activity by the end of the forecast period, representing a significant shift from traditional hub concentration.

Technology integration will accelerate, with artificial intelligence, machine learning, and advanced automation becoming standard features in new data center facilities. Sustainability requirements will become more stringent, driving innovation in construction materials, energy systems, and cooling technologies that minimize environmental impact while maximizing operational efficiency.

The United States data center construction market represents a dynamic and essential component of the nation’s digital infrastructure ecosystem. Strong fundamentals including robust demand drivers, technological innovation, and geographic expansion opportunities position the market for continued growth and evolution.

Industry transformation through sustainable construction practices, modular approaches, and advanced technologies is reshaping how data centers are designed and built. Market participants who adapt to these changes while maintaining focus on quality, efficiency, and customer requirements will be best positioned to capitalize on future opportunities.

Strategic success in this market requires specialized expertise, strong partnerships, and continuous innovation in construction methodologies. As digital infrastructure demands continue expanding, the data center construction market will remain a critical enabler of America’s technological leadership and economic competitiveness in the global digital economy.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These facilities are designed to support the growing demand for data processing and storage in various industries.

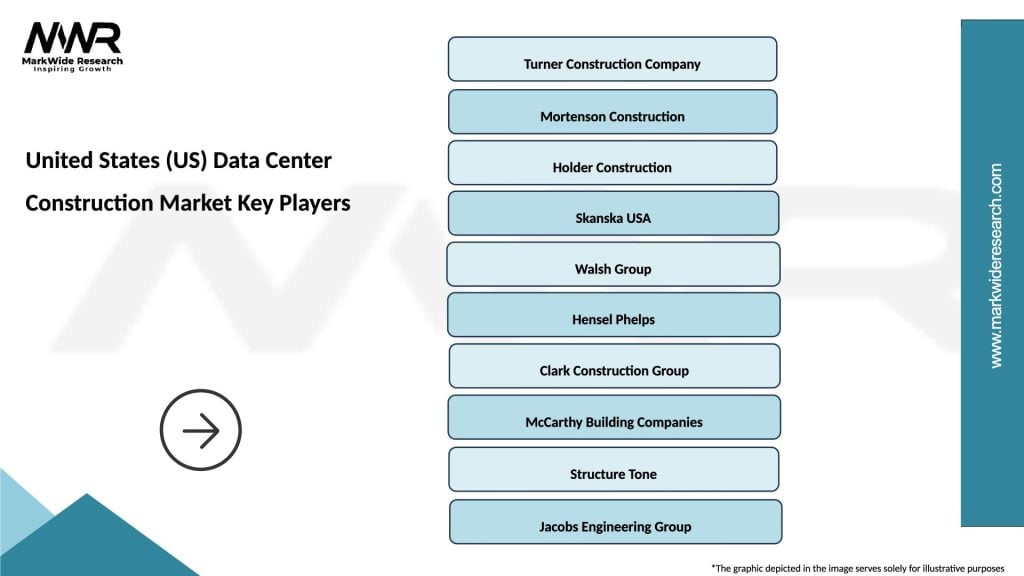

What are the key players in the United States (US) Data Center Construction Market?

Key players in the United States (US) Data Center Construction Market include companies like Turner Construction, DPR Construction, and Mortenson. These firms are known for their expertise in constructing large-scale data centers and infrastructure projects, among others.

What are the main drivers of growth in the United States (US) Data Center Construction Market?

The main drivers of growth in the United States (US) Data Center Construction Market include the increasing demand for cloud computing services, the rise of big data analytics, and the expansion of Internet of Things (IoT) applications. These factors contribute to the need for more robust data center infrastructure.

What challenges does the United States (US) Data Center Construction Market face?

The United States (US) Data Center Construction Market faces challenges such as high construction costs, regulatory compliance issues, and the need for sustainable building practices. These factors can impact project timelines and budgets.

What opportunities exist in the United States (US) Data Center Construction Market?

Opportunities in the United States (US) Data Center Construction Market include the growing demand for edge computing facilities, advancements in energy-efficient technologies, and the increasing focus on sustainability. These trends can lead to innovative construction solutions.

What trends are shaping the United States (US) Data Center Construction Market?

Trends shaping the United States (US) Data Center Construction Market include the adoption of modular construction techniques, the integration of renewable energy sources, and the emphasis on enhanced security measures. These trends reflect the evolving needs of data center operators.

United States (US) Data Center Construction Market

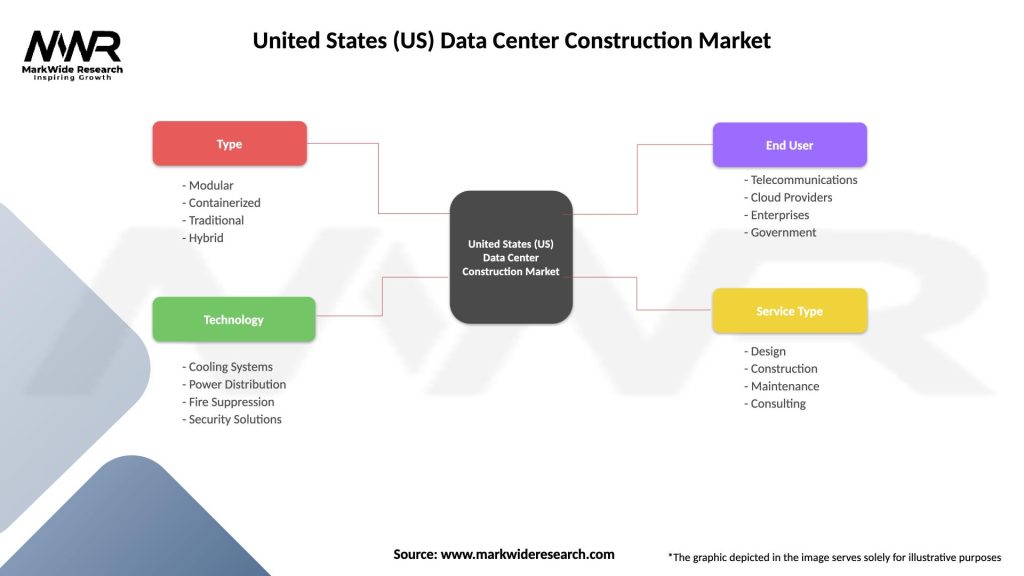

| Segmentation Details | Description |

|---|---|

| Type | Modular, Containerized, Traditional, Hybrid |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Providers, Enterprises, Government |

| Service Type | Design, Construction, Maintenance, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States (US) Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at