444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States temperature sensors market represents a critical component of the nation’s industrial automation and monitoring infrastructure. Temperature sensors serve as fundamental devices that detect and measure thermal variations across diverse applications, from automotive systems to healthcare equipment. The market demonstrates robust growth momentum driven by increasing automation demands, stringent regulatory requirements, and technological advancements in sensor accuracy and connectivity.

Industrial sectors across the United States are experiencing unprecedented demand for precise temperature monitoring solutions. The market encompasses various sensor technologies including thermocouples, resistance temperature detectors (RTDs), thermistors, and infrared sensors. Manufacturing facilities increasingly rely on these devices to maintain optimal operating conditions, ensure product quality, and comply with safety standards.

Growth projections indicate the market is expanding at a compound annual growth rate of 6.2% through the forecast period. This expansion reflects the critical role temperature sensors play in emerging technologies such as Internet of Things (IoT) applications, smart buildings, and advanced automotive systems. Regional adoption varies significantly, with industrial hubs in the Midwest and technology centers on the West Coast leading market penetration.

The United States temperature sensors market refers to the comprehensive ecosystem of thermal measurement devices, technologies, and solutions deployed across American industries and consumer applications. These sensors function as critical monitoring instruments that convert thermal energy into electrical signals, enabling precise temperature measurement and control across diverse operational environments.

Temperature sensing technology encompasses multiple detection methodologies, each optimized for specific applications and environmental conditions. The market includes contact-based sensors that require physical interaction with measured objects and non-contact infrared sensors that detect thermal radiation. Integration capabilities have evolved to support wireless connectivity, data analytics, and real-time monitoring systems.

Market participants range from established sensor manufacturers to innovative technology startups developing next-generation sensing solutions. The ecosystem includes component suppliers, system integrators, and end-user industries that collectively drive demand for increasingly sophisticated temperature monitoring capabilities.

Market dynamics in the United States temperature sensors sector reflect a mature yet rapidly evolving landscape characterized by technological innovation and expanding application domains. The market benefits from strong industrial base, advanced manufacturing capabilities, and significant investment in research and development activities.

Key growth drivers include increasing automation in manufacturing processes, rising demand for energy-efficient systems, and stringent regulatory requirements across industries such as pharmaceuticals, food processing, and automotive manufacturing. Digital transformation initiatives are creating new opportunities for smart sensor integration and data-driven temperature management solutions.

Competitive landscape features both established multinational corporations and specialized sensor manufacturers competing through innovation, quality, and customer service. Market leaders focus on developing sensors with enhanced accuracy, extended operating ranges, and improved connectivity features. Adoption rates for wireless and IoT-enabled temperature sensors have increased by 38% annually as organizations prioritize remote monitoring capabilities.

Regional distribution shows concentrated demand in industrial corridors, with the Great Lakes region accounting for 28% of market share due to heavy manufacturing presence. Technology adoption varies by sector, with automotive and aerospace industries leading in advanced sensor implementation.

Technology evolution continues to reshape the United States temperature sensors market through innovations in materials science, miniaturization, and connectivity solutions. Smart sensor integration represents a fundamental shift toward intelligent monitoring systems capable of self-calibration, predictive maintenance, and real-time data analytics.

Industrial automation serves as the primary catalyst driving temperature sensor adoption across the United States manufacturing sector. Smart factory initiatives require comprehensive monitoring systems to optimize production processes, reduce energy consumption, and maintain consistent product quality. Temperature sensors provide critical data for automated control systems that manage heating, cooling, and processing operations.

Regulatory compliance requirements across industries create sustained demand for accurate temperature monitoring solutions. The pharmaceutical industry mandates precise temperature control throughout drug manufacturing and storage processes. Food safety regulations require continuous temperature monitoring in processing facilities, cold storage, and transportation systems to prevent contamination and ensure product integrity.

Energy efficiency initiatives drive adoption of advanced temperature sensing technologies in commercial and industrial buildings. HVAC optimization systems rely on distributed temperature sensors to maintain comfortable environments while minimizing energy consumption. Building automation systems integrate multiple sensor inputs to achieve energy savings of up to 25% compared to traditional control methods.

Automotive industry transformation toward electric vehicles and autonomous systems creates new opportunities for temperature sensor applications. Battery thermal management requires precise monitoring to ensure safety and optimize performance. Advanced driver assistance systems incorporate temperature sensors for component protection and environmental awareness.

High implementation costs present significant barriers for small and medium-sized enterprises considering advanced temperature sensing solutions. Initial capital investment requirements for comprehensive monitoring systems can strain budgets, particularly when retrofitting existing facilities with modern sensor networks.

Technical complexity associated with sensor integration and calibration challenges organizations lacking specialized expertise. System compatibility issues arise when integrating new sensors with legacy control systems, requiring additional engineering resources and potential infrastructure modifications.

Calibration requirements impose ongoing operational costs and maintenance burdens on organizations using precision temperature sensors. Regulatory compliance in industries such as pharmaceuticals and aerospace demands regular calibration procedures that require specialized equipment and trained personnel.

Environmental limitations restrict sensor performance in extreme conditions, limiting applications in harsh industrial environments. Sensor drift over time affects measurement accuracy, necessitating replacement schedules that increase total cost of ownership.

Internet of Things integration presents substantial growth opportunities for temperature sensor manufacturers and system integrators. Smart city initiatives across major metropolitan areas create demand for environmental monitoring networks that include distributed temperature sensing capabilities.

Healthcare sector expansion offers significant potential for specialized temperature sensors in medical devices, patient monitoring systems, and pharmaceutical storage applications. Telemedicine growth drives demand for consumer-grade temperature sensors capable of accurate remote monitoring.

Renewable energy infrastructure development creates new applications for temperature sensors in solar panel monitoring, wind turbine systems, and energy storage facilities. Grid modernization initiatives require comprehensive monitoring solutions to ensure reliable power distribution.

Advanced manufacturing techniques such as additive manufacturing and precision machining demand highly accurate temperature control systems. Industry 4.0 adoption accelerates integration of intelligent sensors throughout manufacturing processes.

Supply chain considerations significantly influence the United States temperature sensors market through component availability, manufacturing capacity, and distribution networks. Domestic manufacturing capabilities provide advantages in terms of supply security and reduced lead times for critical applications.

Technology convergence between temperature sensing and other measurement technologies creates opportunities for integrated solutions that provide comprehensive environmental monitoring. Sensor fusion approaches combine multiple measurement parameters to enhance system intelligence and reliability.

Market consolidation trends see larger corporations acquiring specialized sensor manufacturers to expand product portfolios and technological capabilities. Strategic partnerships between sensor manufacturers and system integrators facilitate market penetration and customer access.

Customer expectations continue evolving toward solutions that provide not just measurement data but actionable insights through advanced analytics and predictive capabilities. Service-oriented business models emerge as manufacturers offer sensor-as-a-service solutions that include maintenance, calibration, and data analytics.

Comprehensive market analysis employs multiple research methodologies to ensure accurate representation of the United States temperature sensors market landscape. Primary research includes extensive interviews with industry executives, technology developers, and end-user organizations across diverse application sectors.

Secondary research encompasses analysis of industry publications, regulatory filings, patent databases, and technical specifications from leading sensor manufacturers. Market data validation occurs through cross-referencing multiple information sources and expert consultation processes.

Quantitative analysis utilizes statistical modeling techniques to project market trends and identify growth patterns across different sensor technologies and application segments. Qualitative insights provide context for market dynamics and competitive positioning factors.

Regional analysis examines market characteristics across different geographic areas within the United States, considering industrial concentration, regulatory environments, and technology adoption patterns. Sector-specific research investigates unique requirements and growth drivers within key application industries.

Geographic distribution of the United States temperature sensors market reflects industrial concentration patterns and regional economic characteristics. Midwest region dominates market share with 32% of total demand driven by heavy manufacturing presence in automotive, steel, and chemical processing industries.

West Coast markets demonstrate strong growth in technology-intensive applications, with California accounting for 18% of market share through semiconductor manufacturing, aerospace, and renewable energy sectors. Silicon Valley serves as a hub for sensor innovation and next-generation technology development.

Southeast region shows increasing adoption rates driven by expanding manufacturing base and energy sector investments. Texas leads regional growth with significant oil and gas industry demand for specialized temperature sensors capable of operating in harsh environments.

Northeast corridor maintains steady demand through pharmaceutical manufacturing, research institutions, and advanced technology applications. Regional specialization varies significantly, with each area developing expertise in specific sensor technologies and applications relevant to local industry clusters.

Market leadership in the United States temperature sensors sector features established multinational corporations alongside specialized technology companies competing through innovation and customer service excellence.

Competitive strategies focus on technological differentiation, customer service excellence, and strategic partnerships with system integrators and original equipment manufacturers. Innovation investments concentrate on wireless connectivity, enhanced accuracy, and integration with analytics platforms.

Technology-based segmentation reveals distinct market characteristics across different temperature sensing methodologies, each optimized for specific applications and performance requirements.

By Technology:

By Application:

Industrial category represents the largest market segment, driven by manufacturing automation and process optimization requirements. Precision manufacturing applications demand sensors with accuracy levels of ±0.1°C or better, supporting quality control in semiconductor fabrication and pharmaceutical production.

Automotive segment demonstrates rapid growth through electric vehicle adoption and advanced driver assistance systems integration. Battery thermal management applications require sensors capable of monitoring multiple temperature points simultaneously while maintaining compact form factors.

Healthcare applications show increasing sophistication with demand for biocompatible sensors suitable for implantable devices and continuous patient monitoring systems. Regulatory compliance requirements drive adoption of sensors with documented calibration histories and traceability.

Consumer electronics category emphasizes cost optimization while maintaining adequate performance for applications such as smartphone thermal management and smart home devices. Integration trends favor sensors with built-in processing capabilities and wireless connectivity.

Manufacturers benefit from temperature sensor integration through improved process control, reduced waste, and enhanced product quality. Operational efficiency gains result from automated temperature management systems that optimize energy consumption and minimize manual intervention requirements.

System integrators find opportunities in developing comprehensive monitoring solutions that combine temperature sensors with data analytics platforms. Value-added services include sensor installation, calibration, and ongoing maintenance support that create recurring revenue streams.

End users achieve significant benefits through improved operational visibility, predictive maintenance capabilities, and regulatory compliance assurance. Cost savings result from reduced energy consumption, minimized equipment downtime, and optimized maintenance scheduling.

Technology developers benefit from expanding market opportunities as new applications emerge in IoT, smart cities, and renewable energy sectors. Innovation partnerships with sensor manufacturers accelerate development of specialized solutions for emerging market segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless sensor networks represent a transformative trend enabling distributed temperature monitoring without extensive wiring infrastructure. Battery life improvements now support sensors operating for over 10 years on single battery installations, making wireless solutions practical for remote monitoring applications.

Artificial intelligence integration enhances sensor capabilities through predictive analytics and automated calibration systems. Machine learning algorithms analyze temperature patterns to predict equipment failures and optimize maintenance schedules, reducing operational costs and improving reliability.

Miniaturization continues enabling sensor integration in space-constrained applications such as wearable devices and compact electronic systems. MEMS technology advances support production of sensors smaller than traditional solutions while maintaining accuracy and reliability standards.

Edge computing capabilities allow sensors to process data locally, reducing network bandwidth requirements and enabling real-time decision making. Distributed intelligence improves system responsiveness and reduces dependence on centralized processing systems.

Technology partnerships between sensor manufacturers and software companies accelerate development of integrated monitoring solutions. Strategic alliances focus on combining hardware excellence with advanced analytics capabilities to deliver comprehensive temperature management systems.

Manufacturing investments in automated production facilities improve sensor quality while reducing costs. Advanced manufacturing techniques including additive manufacturing enable production of specialized sensors for unique applications previously considered impractical.

Regulatory developments in industries such as pharmaceuticals and food processing drive demand for sensors with enhanced traceability and documentation capabilities. Compliance requirements increasingly emphasize continuous monitoring rather than periodic manual measurements.

Research initiatives at universities and national laboratories focus on next-generation sensing materials and technologies. Government funding supports development of sensors for critical infrastructure monitoring and national security applications.

Investment priorities should focus on wireless connectivity and IoT integration capabilities to capture growing demand for connected monitoring solutions. MarkWide Research analysis indicates that organizations investing in wireless sensor infrastructure achieve operational cost reductions of 15-20% compared to traditional wired systems.

Market positioning strategies should emphasize total cost of ownership rather than initial purchase price, highlighting long-term benefits of accurate temperature monitoring. Service-oriented business models provide opportunities for recurring revenue through maintenance, calibration, and data analytics services.

Technology development efforts should prioritize sensors capable of operating in harsh environments while maintaining connectivity and accuracy. Differentiation opportunities exist in developing sensors for emerging applications such as electric vehicle battery management and renewable energy systems.

Partnership strategies with system integrators and original equipment manufacturers accelerate market penetration and provide access to established customer relationships. Collaborative approaches enable faster development of application-specific solutions tailored to unique industry requirements.

Market trajectory indicates sustained growth driven by increasing automation adoption and regulatory compliance requirements across multiple industries. Technology evolution toward intelligent sensors with built-in analytics capabilities will reshape competitive dynamics and customer expectations.

Application expansion into emerging sectors such as smart agriculture, environmental monitoring, and renewable energy creates new growth opportunities. MWR projections suggest that these emerging applications could represent 25% of market demand within the next five years.

Integration trends favor sensors that seamlessly connect with existing industrial control systems and enterprise software platforms. Interoperability standards will become increasingly important as organizations seek to avoid vendor lock-in and maximize system flexibility.

Sustainability considerations will influence sensor design and manufacturing processes, with emphasis on energy efficiency, recyclability, and extended operational life. Environmental regulations may drive adoption of sensors that help organizations monitor and reduce their carbon footprint.

The United States temperature sensors market demonstrates robust growth potential driven by technological innovation, regulatory requirements, and expanding application domains. Market dynamics favor solutions that combine accuracy, connectivity, and intelligence to meet evolving customer needs across diverse industries.

Competitive success will depend on manufacturers’ ability to develop sensors that address specific application requirements while maintaining cost competitiveness. Technology integration capabilities, particularly in wireless connectivity and data analytics, represent key differentiators in the evolving market landscape.

Future opportunities lie in emerging applications such as IoT systems, smart cities, and renewable energy infrastructure. Organizations that invest in advanced sensor technologies and comprehensive monitoring solutions will be well-positioned to capitalize on the market’s continued expansion and technological evolution.

What is Temperature Sensors?

Temperature sensors are devices used to measure temperature in various applications, including industrial processes, HVAC systems, and consumer electronics. They can be classified into different types such as thermocouples, thermistors, and infrared sensors.

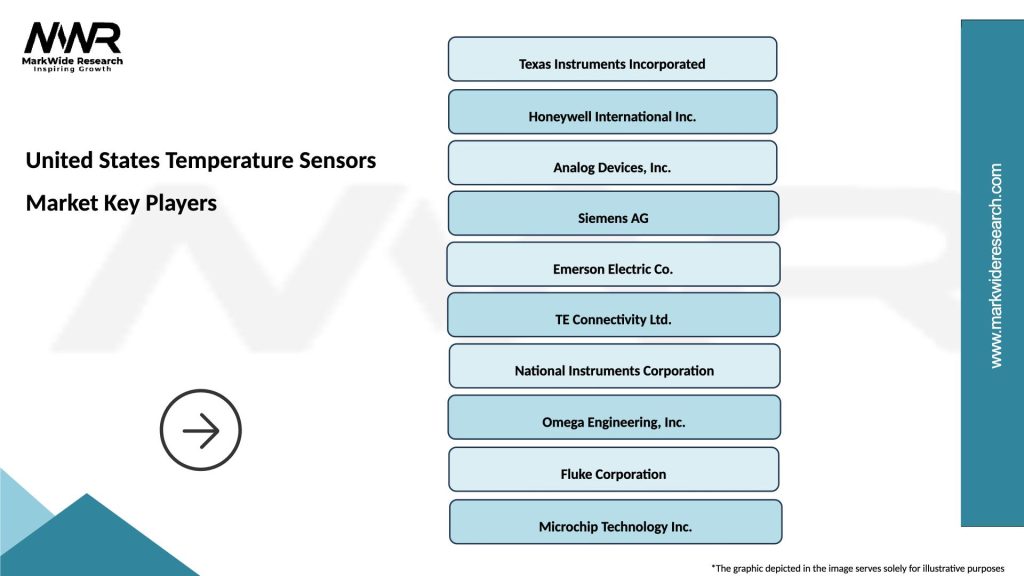

What are the key players in the United States Temperature Sensors Market?

Key players in the United States Temperature Sensors Market include companies like Texas Instruments, Honeywell, and Siemens. These companies are known for their innovative temperature sensing solutions and extensive product portfolios, among others.

What are the main drivers of the United States Temperature Sensors Market?

The main drivers of the United States Temperature Sensors Market include the growing demand for automation in industries, the increasing need for energy-efficient systems, and advancements in sensor technology. These factors contribute to the rising adoption of temperature sensors across various sectors.

What challenges does the United States Temperature Sensors Market face?

The United States Temperature Sensors Market faces challenges such as the high cost of advanced sensors and the complexity of integrating these devices into existing systems. Additionally, competition from alternative temperature measurement technologies can hinder market growth.

What opportunities exist in the United States Temperature Sensors Market?

Opportunities in the United States Temperature Sensors Market include the expansion of the Internet of Things (IoT) and smart home technologies, which require advanced temperature monitoring solutions. Furthermore, the growing focus on environmental sustainability is driving demand for energy-efficient temperature sensors.

What trends are shaping the United States Temperature Sensors Market?

Trends shaping the United States Temperature Sensors Market include the development of wireless and smart temperature sensors, increased integration with cloud computing, and the rise of miniaturized sensors for consumer applications. These innovations are enhancing the functionality and accessibility of temperature sensing technologies.

United States Temperature Sensors Market

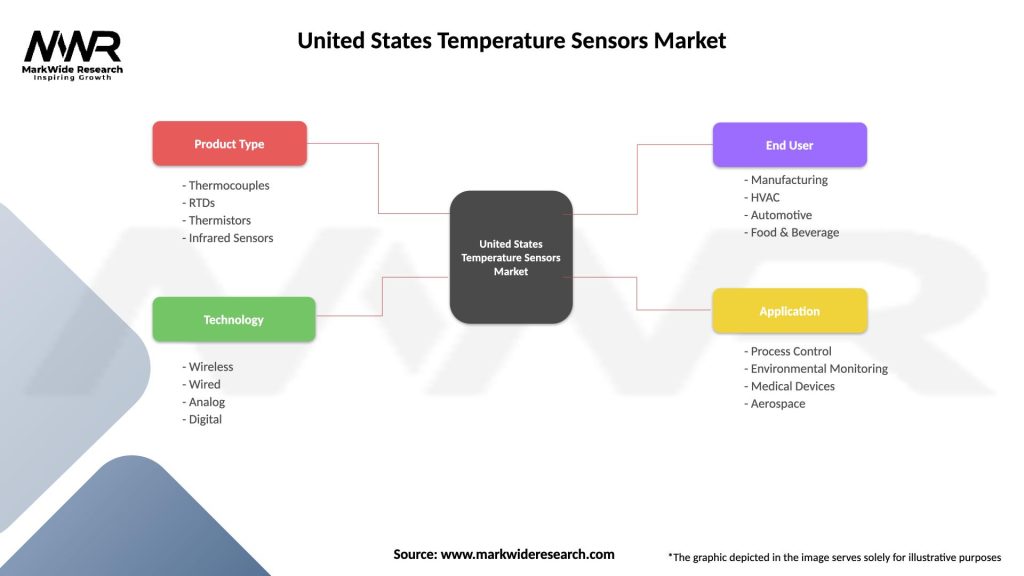

| Segmentation Details | Description |

|---|---|

| Product Type | Thermocouples, RTDs, Thermistors, Infrared Sensors |

| Technology | Wireless, Wired, Analog, Digital |

| End User | Manufacturing, HVAC, Automotive, Food & Beverage |

| Application | Process Control, Environmental Monitoring, Medical Devices, Aerospace |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Temperature Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at