444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States surveillance storage market represents a rapidly expanding sector within the broader security technology landscape, driven by increasing security concerns and technological advancements in data storage solutions. Surveillance storage systems have become critical infrastructure components for organizations across various industries, from retail and healthcare to government and transportation. The market encompasses a comprehensive range of storage technologies specifically designed to handle the massive volumes of video data generated by modern surveillance systems.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.8% as organizations increasingly recognize the importance of reliable, scalable storage solutions for their security infrastructure. Digital transformation initiatives across enterprises have accelerated the adoption of advanced surveillance storage technologies, particularly those offering cloud integration and artificial intelligence capabilities.

Technology evolution continues to reshape the surveillance storage landscape, with emerging solutions offering enhanced compression algorithms, improved data analytics capabilities, and seamless integration with existing security ecosystems. The market benefits from increasing investments in smart city initiatives, critical infrastructure protection, and enterprise security modernization programs throughout the United States.

The United States surveillance storage market refers to the comprehensive ecosystem of specialized data storage solutions designed specifically for capturing, storing, managing, and retrieving video surveillance data across various applications and industries. Surveillance storage systems encompass hardware, software, and cloud-based platforms that provide secure, scalable, and reliable storage infrastructure for security video data.

Core components of surveillance storage solutions include network-attached storage (NAS) systems, storage area networks (SANs), hybrid cloud storage platforms, and edge storage devices. These systems are engineered to handle the unique requirements of video surveillance data, including continuous recording capabilities, high-bandwidth data ingestion, long-term retention policies, and rapid retrieval for forensic analysis.

Modern surveillance storage solutions integrate advanced features such as intelligent video analytics, automated data lifecycle management, redundancy protocols, and compliance frameworks to meet diverse organizational security requirements. The market encompasses both traditional on-premises storage solutions and innovative cloud-based platforms that offer enhanced scalability and remote accessibility.

Strategic market analysis reveals that the United States surveillance storage market is experiencing unprecedented growth driven by escalating security threats, regulatory compliance requirements, and technological innovations in video surveillance systems. Enterprise adoption of high-definition and ultra-high-definition surveillance cameras has created substantial demand for advanced storage solutions capable of managing exponentially increasing data volumes.

Key growth drivers include the proliferation of Internet of Things (IoT) devices, increasing deployment of smart city infrastructure, and rising concerns about public safety and asset protection. Cloud-based storage solutions are gaining significant traction, with adoption rates increasing by 34% annually as organizations seek scalable, cost-effective alternatives to traditional on-premises storage systems.

Market segmentation analysis indicates strong performance across multiple verticals, with retail, healthcare, transportation, and government sectors leading adoption rates. Technological convergence between surveillance storage and artificial intelligence platforms is creating new opportunities for intelligent video analytics and automated threat detection capabilities.

Competitive landscape dynamics show increasing consolidation among storage vendors, with established technology companies expanding their surveillance-specific offerings through strategic acquisitions and partnerships. Innovation focus remains centered on developing solutions that combine high-capacity storage with advanced analytics capabilities and seamless cloud integration.

Market intelligence reveals several critical insights shaping the United States surveillance storage landscape. Data volume growth represents the most significant challenge and opportunity, with surveillance systems generating increasingly massive datasets that require sophisticated storage management approaches.

Primary market drivers propelling the United States surveillance storage market include escalating security threats, technological advancements, and evolving regulatory requirements. Cybersecurity concerns have intensified organizational focus on comprehensive surveillance systems that require robust storage infrastructure to maintain continuous monitoring capabilities.

Smart city initiatives across major metropolitan areas are creating substantial demand for large-scale surveillance storage solutions. Municipal governments are investing heavily in integrated security systems that combine video surveillance with advanced analytics capabilities, requiring sophisticated storage platforms capable of managing massive data volumes while ensuring rapid access for emergency response teams.

Enterprise digital transformation programs are driving adoption of cloud-based surveillance storage solutions that offer enhanced scalability and cost-effectiveness. Remote work trends have increased organizational focus on facility security, leading to expanded surveillance deployments that require advanced storage management capabilities.

Regulatory compliance requirements continue to influence market growth, with industries such as healthcare, finance, and transportation facing stringent data retention mandates. Industry-specific regulations are driving demand for specialized storage solutions that ensure compliance while maintaining operational efficiency and cost-effectiveness.

Technology convergence between surveillance systems and artificial intelligence platforms is creating new market opportunities. Advanced analytics capabilities require sophisticated storage architectures that can support real-time processing while maintaining long-term data accessibility for forensic analysis and compliance reporting.

Market challenges facing the United States surveillance storage sector include high implementation costs, technical complexity, and data privacy concerns. Capital investment requirements for comprehensive surveillance storage solutions can be substantial, particularly for organizations requiring large-scale deployments with advanced analytics capabilities.

Technical complexity associated with integrating surveillance storage systems with existing security infrastructure presents significant challenges for many organizations. Legacy system compatibility issues often require extensive customization and professional services, increasing overall implementation costs and deployment timelines.

Data privacy regulations create compliance challenges that can limit market growth in certain sectors. Privacy concerns regarding video surveillance data collection and storage are leading to increased scrutiny from regulatory authorities and consumer advocacy groups, potentially impacting adoption rates in sensitive applications.

Bandwidth limitations in certain geographic regions can constrain the adoption of cloud-based surveillance storage solutions. Network infrastructure requirements for transmitting high-definition video data to cloud platforms may exceed available connectivity capabilities in rural or underserved areas.

Cybersecurity threats targeting surveillance systems create additional market challenges. Security vulnerabilities in storage platforms can expose organizations to data breaches and unauthorized access, leading to increased investment requirements for cybersecurity measures and potentially slowing adoption rates among risk-averse organizations.

Emerging opportunities in the United States surveillance storage market are driven by technological innovations, evolving security requirements, and expanding application areas. Artificial intelligence integration presents significant growth potential, with organizations increasingly seeking storage solutions that combine high-capacity data management with intelligent analytics capabilities.

Edge computing adoption creates new market opportunities for distributed surveillance storage solutions. Edge storage systems enable organizations to process and store video data closer to surveillance cameras, reducing bandwidth requirements and improving response times for critical security applications while maintaining centralized management capabilities.

Cloud-native solutions represent a substantial growth opportunity as organizations seek to leverage the scalability and cost-effectiveness of cloud platforms. Hybrid cloud architectures that combine on-premises and cloud-based storage are gaining traction, offering organizations flexibility in managing different types of surveillance data based on sensitivity and access requirements.

Vertical market expansion opportunities exist in sectors such as education, hospitality, and small-to-medium enterprises that are increasingly recognizing the value of comprehensive surveillance systems. Industry-specific solutions tailored to unique operational requirements and compliance mandates present opportunities for specialized storage providers.

Integration partnerships with surveillance camera manufacturers, security system integrators, and cloud service providers create opportunities for comprehensive solution offerings. Ecosystem collaboration enables storage vendors to develop integrated platforms that address complete surveillance infrastructure requirements while simplifying procurement and deployment processes for end-users.

Market dynamics in the United States surveillance storage sector are characterized by rapid technological evolution, increasing competitive intensity, and shifting customer preferences toward integrated solutions. Technology convergence between storage, analytics, and cloud platforms is reshaping traditional market boundaries and creating new competitive landscapes.

Customer expectations are evolving toward comprehensive solutions that combine storage capacity with advanced analytics capabilities. End-users increasingly demand platforms that offer seamless integration with existing security infrastructure while providing scalability for future expansion requirements. This trend is driving storage vendors to develop more sophisticated offerings that address complete surveillance ecosystem needs.

Competitive pressures are intensifying as traditional storage vendors compete with specialized surveillance technology companies and cloud service providers. Market consolidation through strategic acquisitions and partnerships is becoming more common as companies seek to expand their technology portfolios and market reach.

Pricing dynamics are influenced by increasing competition and technological commoditization in certain market segments. Cost optimization has become a critical factor in customer decision-making, leading to increased adoption of software-defined storage solutions and cloud-based platforms that offer more flexible pricing models.

Innovation cycles are accelerating as vendors invest in research and development to differentiate their offerings. Technology advancement in areas such as compression algorithms, artificial intelligence, and edge computing is creating new market opportunities while potentially disrupting established competitive positions.

Comprehensive research methodology employed in analyzing the United States surveillance storage market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry executives, technology vendors, system integrators, and end-users across various vertical markets.

Secondary research encompasses analysis of industry reports, company financial statements, technology specifications, and regulatory documentation to provide comprehensive market context. Data triangulation methods are employed to validate findings across multiple information sources and ensure consistency in market assessments.

Market sizing methodologies utilize bottom-up and top-down approaches to develop accurate market assessments. Bottom-up analysis involves detailed examination of individual market segments, technology categories, and geographic regions to build comprehensive market models from foundational data points.

Qualitative analysis techniques include expert interviews, focus groups, and case study development to understand market trends, customer preferences, and technology adoption patterns. Quantitative analysis incorporates statistical modeling, trend analysis, and forecasting methodologies to project future market developments and growth trajectories.

Validation processes ensure research accuracy through multiple review cycles, expert consultation, and cross-referencing with industry benchmarks. Continuous monitoring of market developments enables regular updates to research findings and maintains relevance of market insights for stakeholders.

Regional market dynamics across the United States reveal significant variations in surveillance storage adoption patterns, driven by local security requirements, regulatory environments, and economic conditions. West Coast markets demonstrate the highest adoption rates of advanced surveillance storage technologies, with California leading in cloud-based solution deployments at 42% market penetration.

Northeast corridor markets show strong demand for enterprise-grade surveillance storage solutions, driven by dense urban populations and extensive commercial infrastructure. New York and Massachusetts represent key growth markets, with financial services and healthcare sectors driving significant investments in compliance-focused storage platforms.

Southeast region demonstrates rapid growth in surveillance storage adoption, particularly in Florida, Texas, and Georgia. Smart city initiatives in major metropolitan areas are creating substantial demand for large-scale storage solutions, with municipal deployments accounting for 28% of regional market activity.

Midwest markets show steady growth in manufacturing and logistics applications, with organizations investing in surveillance storage solutions to protect critical infrastructure and supply chain operations. Industrial applications represent a significant portion of regional demand, driven by increasing focus on operational security and asset protection.

Mountain West region presents emerging opportunities in energy and natural resources sectors, where surveillance storage solutions support critical infrastructure monitoring and environmental compliance requirements. Rural connectivity challenges are driving increased adoption of edge storage solutions that reduce dependence on high-bandwidth network connections.

Competitive landscape analysis reveals a diverse ecosystem of technology vendors ranging from established storage companies to specialized surveillance technology providers. Market leadership positions are held by companies that successfully combine storage expertise with surveillance-specific capabilities and comprehensive service offerings.

Strategic partnerships between storage vendors and surveillance system manufacturers are becoming increasingly important for market success. Technology integration capabilities and ecosystem compatibility often determine competitive positioning more than traditional storage performance metrics.

Innovation focus among leading competitors centers on artificial intelligence integration, cloud-native architectures, and edge computing capabilities. Differentiation strategies increasingly emphasize complete solution offerings rather than standalone storage products, reflecting evolving customer preferences for integrated platforms.

Market segmentation analysis reveals distinct categories based on technology type, deployment model, application area, and organizational size. Technology segmentation encompasses traditional network-attached storage, software-defined storage, cloud-based platforms, and hybrid solutions that combine multiple approaches.

By Technology Type:

By Deployment Model:

By Application Vertical:

Category analysis reveals distinct performance patterns and growth trajectories across different surveillance storage segments. Cloud-based storage represents the fastest-growing category, with adoption rates increasing by 38% annually as organizations seek scalable, cost-effective alternatives to traditional infrastructure.

Enterprise NAS systems continue to dominate high-security applications where organizations require complete control over data and infrastructure. Performance characteristics of enterprise storage solutions make them particularly suitable for applications requiring low-latency access and high-bandwidth video streaming capabilities.

Software-defined storage is gaining traction among organizations seeking flexibility and cost optimization. Virtualization capabilities enable organizations to optimize storage resources across multiple applications while maintaining surveillance-specific performance requirements.

Edge storage solutions represent an emerging category driven by increasing deployment of distributed surveillance networks. Local processing capabilities reduce bandwidth requirements and improve response times for critical security applications while maintaining centralized management and analytics capabilities.

Hybrid storage architectures are becoming the preferred choice for large organizations that require both high-performance local storage and scalable cloud capacity. Data tiering capabilities enable organizations to optimize costs by automatically moving older surveillance data to lower-cost cloud storage while maintaining immediate access to recent recordings.

Industry participants across the surveillance storage ecosystem realize significant benefits from market growth and technological advancement. Technology vendors benefit from expanding market opportunities driven by increasing security awareness and digital transformation initiatives across multiple industry verticals.

System integrators gain opportunities to expand service offerings through comprehensive surveillance storage solutions that combine hardware, software, and professional services. Integration expertise becomes increasingly valuable as organizations seek turnkey solutions that address complete surveillance infrastructure requirements.

End-user organizations benefit from improved security capabilities, operational efficiency, and cost optimization through advanced surveillance storage solutions. Scalability advantages enable organizations to expand surveillance networks without significant infrastructure investments, while advanced analytics capabilities provide actionable insights for security and operational improvements.

Cloud service providers realize new revenue opportunities through specialized surveillance storage offerings that address unique requirements for video data management. Service differentiation through surveillance-optimized cloud platforms enables providers to capture premium pricing while addressing growing market demand.

Investment stakeholders benefit from strong market growth prospects and increasing consolidation opportunities within the surveillance storage sector. Technology convergence creates opportunities for strategic investments in companies developing innovative solutions that combine storage, analytics, and cloud capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the surveillance storage market, with organizations increasingly seeking solutions that combine high-capacity storage with intelligent video analytics capabilities. AI-powered platforms enable automated content analysis, threat detection, and data management, creating new value propositions for storage vendors.

Cloud-first strategies are becoming prevalent among organizations seeking to modernize surveillance infrastructure while optimizing costs. Hybrid cloud architectures that combine on-premises and cloud storage are gaining traction, with 67% of enterprises planning hybrid deployments within the next two years.

Edge computing adoption is accelerating as organizations seek to reduce bandwidth costs and improve response times for critical security applications. Edge storage solutions enable local processing and storage of surveillance data while maintaining centralized management and analytics capabilities.

Cybersecurity enhancement has become a critical focus area, with storage vendors investing heavily in advanced encryption, access controls, and threat detection capabilities. Zero-trust security models are being integrated into surveillance storage platforms to address evolving cybersecurity threats.

Sustainability initiatives are influencing technology choices, with organizations seeking energy-efficient storage solutions that reduce environmental impact. Green storage technologies and carbon-neutral cloud platforms are becoming important selection criteria for environmentally conscious organizations.

Recent industry developments highlight the dynamic nature of the surveillance storage market, with significant technological advancements and strategic initiatives shaping competitive landscapes. MarkWide Research analysis indicates that merger and acquisition activity has increased substantially, with established technology companies acquiring specialized surveillance storage providers to expand their market presence.

Technology partnerships between storage vendors and artificial intelligence companies are creating innovative platforms that combine high-capacity storage with advanced analytics capabilities. Integration initiatives focus on developing seamless connections between storage systems and popular video management platforms.

Cloud service expansion by major technology companies is creating new competitive dynamics in the surveillance storage market. Specialized offerings from cloud providers include surveillance-optimized storage tiers, integrated analytics services, and compliance management tools.

Regulatory developments at federal and state levels are influencing market growth patterns, with new privacy regulations creating both challenges and opportunities for surveillance storage providers. Compliance frameworks are being developed to address data retention, access controls, and privacy protection requirements.

Innovation investments in areas such as quantum storage, advanced compression algorithms, and blockchain-based data integrity are positioning the market for future technological disruption. Research and development spending has increased by 23% among leading surveillance storage vendors as companies compete to develop next-generation solutions.

Strategic recommendations for market participants emphasize the importance of developing comprehensive solution portfolios that address complete surveillance infrastructure requirements rather than focusing solely on storage capacity. Technology vendors should prioritize artificial intelligence integration and cloud-native architectures to remain competitive in evolving market conditions.

Investment priorities should focus on developing edge computing capabilities and hybrid cloud solutions that address diverse organizational requirements. Partnership strategies with surveillance camera manufacturers and system integrators can provide access to established customer relationships and distribution channels.

Market entry strategies for new participants should emphasize vertical market specialization and unique value propositions that differentiate from established competitors. Niche applications in sectors such as education, hospitality, and small-to-medium enterprises present opportunities for focused market development.

Customer engagement approaches should emphasize total cost of ownership benefits and operational efficiency improvements rather than traditional storage performance metrics. Demonstration capabilities that showcase integrated analytics and management features can help differentiate solutions in competitive evaluations.

Technology roadmaps should incorporate emerging trends such as 5G connectivity, Internet of Things integration, and sustainable computing practices. Future-proofing strategies that ensure compatibility with evolving surveillance technologies can provide competitive advantages in long-term customer relationships.

Future market prospects for the United States surveillance storage sector remain highly positive, driven by continuing security concerns, technological innovation, and expanding application areas. Growth projections indicate sustained expansion at a CAGR of 11.5% through the next five years, with cloud-based solutions expected to capture increasing market share.

Technology evolution will continue to reshape market dynamics, with artificial intelligence, edge computing, and 5G connectivity creating new opportunities for innovative storage solutions. Integration capabilities between storage platforms and emerging technologies will become increasingly important for competitive positioning.

Market consolidation is expected to continue as established technology companies acquire specialized surveillance storage providers to expand their solution portfolios. Strategic partnerships between storage vendors, cloud providers, and surveillance technology companies will create comprehensive ecosystem offerings.

Regulatory developments will continue to influence market growth patterns, with privacy regulations creating both challenges and opportunities for surveillance storage providers. Compliance capabilities will become increasingly important differentiators in competitive evaluations.

Emerging applications in areas such as autonomous vehicles, smart buildings, and industrial Internet of Things will create new market opportunities for specialized surveillance storage solutions. Vertical market expansion into previously underserved sectors presents significant growth potential for innovative storage providers.

Market analysis reveals that the United States surveillance storage market represents a dynamic and rapidly growing sector with substantial opportunities for technology vendors, system integrators, and end-user organizations. Strong fundamentals including increasing security awareness, regulatory compliance requirements, and technological innovation continue to drive market expansion across multiple industry verticals.

Technology convergence between storage, artificial intelligence, and cloud computing is creating new value propositions that extend beyond traditional storage capabilities. Organizations increasingly seek comprehensive solutions that combine high-capacity storage with advanced analytics and seamless integration capabilities, creating opportunities for vendors that can deliver complete surveillance infrastructure platforms.

Competitive dynamics favor companies that successfully combine storage expertise with surveillance-specific capabilities and comprehensive service offerings. Market success increasingly depends on ecosystem partnerships, vertical market specialization, and continuous innovation in emerging technology areas such as edge computing and artificial intelligence integration.

Future growth prospects remain positive, with expanding application areas, technological advancement, and increasing security investments creating sustained demand for advanced surveillance storage solutions. Organizations that strategically invest in comprehensive surveillance storage infrastructure will be well-positioned to address evolving security challenges while optimizing operational efficiency and compliance capabilities in an increasingly complex threat landscape.

What is Surveillance Storage?

Surveillance Storage refers to the systems and technologies used to store video and data captured by surveillance cameras and security systems. This includes various storage solutions such as cloud storage, Network Video Recorders (NVRs), and Digital Video Recorders (DVRs).

What are the key players in the United States Surveillance Storage Market?

Key players in the United States Surveillance Storage Market include companies like Seagate Technology, Western Digital, and NetApp, which provide a range of storage solutions tailored for surveillance applications, among others.

What are the main drivers of growth in the United States Surveillance Storage Market?

The growth of the United States Surveillance Storage Market is driven by increasing security concerns, the rise in smart city initiatives, and advancements in video surveillance technology. Additionally, the growing adoption of IoT devices contributes to the demand for efficient storage solutions.

What challenges does the United States Surveillance Storage Market face?

Challenges in the United States Surveillance Storage Market include data privacy concerns, the high cost of advanced storage solutions, and the need for continuous technological upgrades. These factors can hinder the adoption of new storage technologies in various sectors.

What opportunities exist in the United States Surveillance Storage Market?

Opportunities in the United States Surveillance Storage Market include the integration of artificial intelligence for enhanced data analysis and the expansion of cloud-based storage solutions. Additionally, the increasing demand for high-definition video surveillance presents significant growth potential.

What trends are shaping the United States Surveillance Storage Market?

Trends in the United States Surveillance Storage Market include the shift towards cloud storage solutions, the use of edge computing for real-time data processing, and the growing importance of cybersecurity measures. These trends are influencing how organizations manage and store surveillance data.

United States Surveillance Storage Market

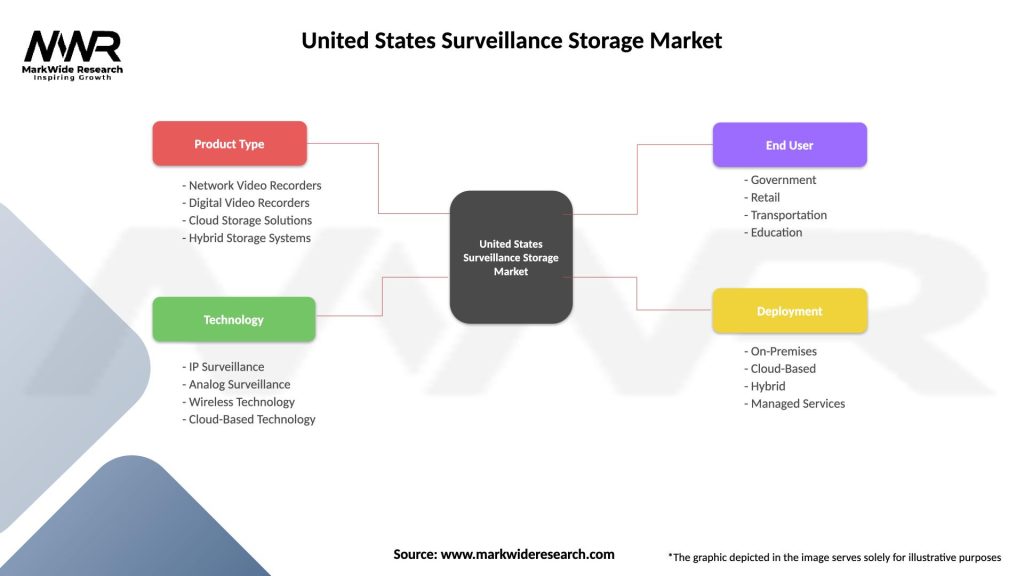

| Segmentation Details | Description |

|---|---|

| Product Type | Network Video Recorders, Digital Video Recorders, Cloud Storage Solutions, Hybrid Storage Systems |

| Technology | IP Surveillance, Analog Surveillance, Wireless Technology, Cloud-Based Technology |

| End User | Government, Retail, Transportation, Education |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Surveillance Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at