444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States surveillance analog camera market represents a mature yet evolving segment within the broader security infrastructure landscape. Despite the rapid advancement of digital and IP-based surveillance technologies, analog cameras continue to maintain a significant presence in various applications across the country. The market demonstrates remarkable resilience, driven by cost-effectiveness, reliability, and compatibility with existing infrastructure systems.

Market dynamics indicate that analog surveillance cameras are experiencing a transformation rather than decline, with manufacturers focusing on enhanced resolution capabilities and hybrid solutions. The technology has evolved from traditional CCTV systems to high-definition analog formats, including HD-TVI, HD-CVI, and AHD technologies. These advancements have enabled analog systems to compete more effectively with digital alternatives while maintaining their inherent advantages of simplicity and affordability.

Growth patterns show that while the overall surveillance market shifts toward IP-based solutions, analog cameras maintain approximately 35% market share in specific segments, particularly in small to medium-sized installations. The market benefits from ongoing infrastructure upgrades, replacement cycles, and the need for cost-effective security solutions across various sectors including retail, residential, and small commercial establishments.

Regional distribution across the United States reveals strong adoption in both urban and rural areas, with particular concentration in states with high commercial activity and security concerns. The market’s stability stems from the extensive installed base of analog systems and the gradual migration path that many organizations prefer when upgrading their security infrastructure.

The United States surveillance analog camera market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, installation, and maintenance of analog-based video surveillance equipment within the American security infrastructure sector. This market includes traditional analog cameras, high-definition analog variants, supporting equipment, and associated services that enable organizations and individuals to implement effective video monitoring solutions.

Analog surveillance cameras operate by converting light into electrical signals that are transmitted over coaxial cables to recording devices or monitoring stations. Unlike digital IP cameras that process and compress video data internally, analog cameras rely on external equipment for signal processing and storage. This fundamental difference creates distinct advantages in terms of simplicity, reliability, and cost-effectiveness for specific applications.

Market scope encompasses various camera types including dome cameras, bullet cameras, PTZ (pan-tilt-zoom) systems, and specialized variants designed for specific environmental conditions. The ecosystem also includes supporting infrastructure such as digital video recorders (DVRs), monitors, cables, and power supplies that form complete surveillance solutions.

Strategic positioning of the United States surveillance analog camera market reflects a mature industry segment that continues to serve specific niches despite the broader industry trend toward digital solutions. The market demonstrates sustained demand driven by cost considerations, infrastructure compatibility, and reliability requirements across various application sectors.

Key performance indicators reveal that analog cameras maintain strong presence in retrofit applications, with approximately 42% of small business installations still preferring analog solutions due to budget constraints and existing infrastructure compatibility. The market benefits from technological enhancements that have improved image quality while preserving the fundamental advantages of analog systems.

Competitive landscape features established manufacturers who have adapted their product portfolios to include high-definition analog options alongside traditional offerings. Market leaders focus on providing comprehensive solutions that bridge the gap between legacy analog systems and modern digital requirements, enabling customers to upgrade incrementally.

Future trajectory suggests continued market presence with gradual evolution toward hybrid solutions that combine analog reliability with digital capabilities. The market is expected to maintain stability through specialized applications and cost-sensitive segments while adapting to changing security requirements and technological standards.

Market intelligence reveals several critical insights that define the current state and future direction of the United States surveillance analog camera market:

Primary market drivers propelling the United States surveillance analog camera market stem from both economic and practical considerations that continue to favor analog solutions in specific applications and market segments.

Cost effectiveness remains the most significant driver, as analog camera systems require lower initial investment and reduced ongoing maintenance costs. Organizations with budget constraints find analog solutions particularly attractive when implementing comprehensive surveillance coverage across large areas or multiple locations. The total cost of ownership advantage becomes more pronounced in installations requiring numerous cameras.

Infrastructure compatibility drives market demand as many facilities possess existing coaxial cable installations that can accommodate analog camera upgrades without extensive rewiring. This compatibility factor significantly reduces implementation costs and minimizes disruption during system upgrades, making analog solutions preferred for retrofit applications.

Simplicity and reliability continue to attract customers who prioritize straightforward operation and minimal technical complexity. Analog systems offer plug-and-play functionality that reduces training requirements and simplifies troubleshooting procedures. The inherent reliability of analog transmission over coaxial cables provides consistent performance in challenging environmental conditions.

Regulatory compliance in certain industries favors analog systems due to established standards and approval processes. Some sectors maintain preferences for analog technology due to proven performance records and simplified compliance documentation requirements.

Technological limitations present significant challenges for the United States surveillance analog camera market as customer expectations for advanced features and capabilities continue to evolve. Traditional analog systems cannot match the sophisticated analytics, remote accessibility, and integration capabilities offered by modern IP-based solutions.

Resolution constraints limit the effectiveness of analog cameras in applications requiring detailed image capture or forensic-quality video evidence. While high-definition analog technologies have improved image quality, they still cannot achieve the ultra-high resolutions available with digital camera systems, limiting their suitability for critical security applications.

Scalability challenges restrict the growth potential of analog systems in large-scale installations. The point-to-point wiring requirements and centralized recording limitations make analog systems less efficient for expansive surveillance networks compared to IP-based alternatives that leverage existing network infrastructure.

Integration difficulties with modern security management platforms and enterprise systems create operational inefficiencies. Analog cameras require additional hardware and software interfaces to integrate with contemporary security ecosystems, increasing complexity and costs for comprehensive security solutions.

Market perception increasingly views analog technology as outdated, influencing purchasing decisions toward digital alternatives. This perception challenge affects market growth as customers associate analog systems with legacy technology rather than modern security solutions.

Hybrid solution development presents substantial opportunities for the United States surveillance analog camera market by combining the reliability and cost-effectiveness of analog systems with digital capabilities. Manufacturers can capitalize on this trend by developing products that bridge the technology gap while preserving analog advantages.

Retrofit market expansion offers significant growth potential as organizations seek to upgrade existing analog installations without complete system replacement. Solutions that enhance analog system capabilities through digital recording, remote access, and analytics integration can capture substantial market share in this segment.

Specialized applications create niche opportunities where analog cameras excel due to specific environmental or operational requirements. Industrial environments, outdoor installations, and applications requiring extreme reliability can benefit from enhanced analog solutions tailored to these demanding conditions.

Cost-sensitive segments continue to provide opportunities for analog camera manufacturers, particularly in residential, small business, and educational markets where budget constraints prioritize affordability over advanced features. Developing value-engineered solutions for these segments can maintain market relevance.

International expansion through export opportunities allows US manufacturers to leverage their analog camera expertise in global markets where analog technology adoption remains strong due to infrastructure limitations or cost considerations.

Competitive forces within the United States surveillance analog camera market create a complex environment where traditional advantages must be balanced against evolving customer expectations and technological capabilities. The market experiences ongoing pressure from digital alternatives while maintaining relevance through specialized applications and cost advantages.

Supply chain dynamics influence market stability as manufacturers optimize production processes and distribution networks to maintain cost competitiveness. Component sourcing strategies focus on reliable suppliers who can provide consistent quality while supporting competitive pricing structures essential for analog market success.

Customer behavior patterns show increasing sophistication in evaluation criteria, with buyers seeking solutions that provide upgrade paths and future-proofing capabilities. This trend drives manufacturers to develop analog products that can integrate with digital systems and provide migration flexibility.

Technology convergence creates opportunities for analog systems to incorporate digital enhancements while maintaining core analog advantages. Hybrid approaches that combine analog capture with digital processing and transmission enable market participants to address evolving customer requirements.

Regulatory influences shape market development through standards that affect product specifications, installation requirements, and performance criteria. Compliance with evolving security standards requires ongoing product development investment to maintain market access and customer acceptance.

Comprehensive market analysis for the United States surveillance analog camera market employs multiple research methodologies to ensure accurate and reliable insights. The research approach combines quantitative data collection with qualitative analysis to provide a complete market perspective.

Primary research activities include structured interviews with industry executives, manufacturers, distributors, and end-users across various market segments. These interviews provide firsthand insights into market trends, customer preferences, competitive dynamics, and future outlook perspectives that inform strategic analysis.

Secondary research sources encompass industry publications, trade association reports, government databases, and company financial statements to validate primary findings and provide comprehensive market context. This multi-source approach ensures data accuracy and completeness across all market dimensions.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market trends and identify growth opportunities. The modeling process incorporates historical data patterns, current market indicators, and forward-looking assumptions to generate reliable market projections.

Data validation processes ensure research quality through cross-referencing multiple sources, expert review panels, and statistical verification procedures. This rigorous validation approach maintains research integrity and provides confidence in analytical conclusions and market recommendations.

Geographic distribution of the United States surveillance analog camera market reveals distinct regional patterns influenced by economic conditions, infrastructure characteristics, and security requirements across different areas of the country.

Northeast region demonstrates strong analog camera adoption in urban areas where existing infrastructure supports cost-effective upgrades. The region’s mature commercial and industrial base creates consistent demand for reliable surveillance solutions, with analog systems maintaining approximately 28% market share in small to medium business installations.

Southeast markets show robust growth in analog camera deployments driven by expanding commercial development and cost-conscious security implementations. The region’s preference for proven technology solutions supports analog market stability, particularly in retail and hospitality sectors where budget considerations influence purchasing decisions.

Midwest territories exhibit strong analog camera presence in agricultural, manufacturing, and distribution applications where reliability and simplicity are prioritized over advanced features. The region’s industrial base creates sustained demand for analog solutions that can withstand harsh environmental conditions while providing dependable performance.

Western states present mixed market dynamics with urban areas favoring digital solutions while rural and industrial applications maintain analog preferences. The region’s diverse economic base creates opportunities for both traditional analog systems and hybrid solutions that bridge technology gaps.

Southwest region demonstrates growing analog adoption in border security, transportation, and energy sector applications where system reliability and cost-effectiveness are critical factors. The area’s security-conscious environment supports continued analog market development through specialized applications.

Market leadership in the United States surveillance analog camera market is characterized by established manufacturers who have successfully adapted their product portfolios to address evolving customer requirements while maintaining analog technology advantages.

Competitive strategies focus on product differentiation through enhanced features, improved reliability, and cost optimization. Market leaders invest in research and development to extend analog technology capabilities while maintaining competitive pricing structures essential for market success.

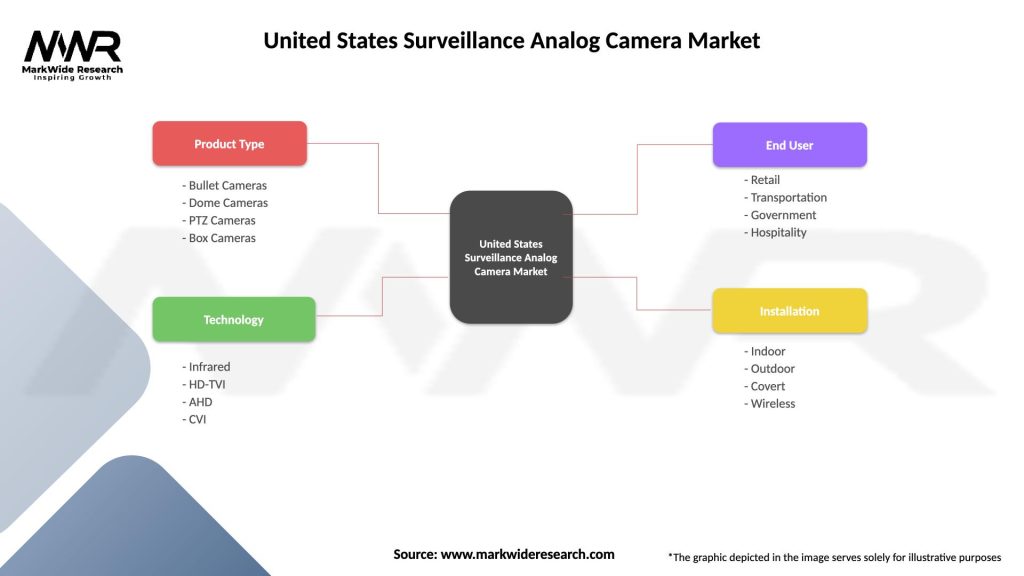

Market segmentation of the United States surveillance analog camera market reveals distinct categories based on technology type, application, end-user, and distribution channel characteristics that influence purchasing decisions and market dynamics.

By Technology:

By Application:

By End-User:

Technology category analysis reveals distinct performance characteristics and market positioning for different analog camera technologies within the United States surveillance market.

Traditional analog cameras maintain relevance in basic surveillance applications where cost minimization is the primary concern. These systems provide adequate image quality for general monitoring purposes while offering the lowest total cost of ownership. Market adoption remains steady at approximately 25% of total analog installations, primarily in residential and small commercial applications.

HD-TVI technology demonstrates strong growth potential by providing high-definition video quality over existing coaxial infrastructure. This technology category appeals to customers seeking image quality improvements without complete system replacement, capturing significant market share in retrofit applications where infrastructure compatibility is essential.

HD-CVI systems offer competitive advantages in long-distance transmission applications where cable runs exceed typical limitations of other analog technologies. The technology’s ability to maintain signal quality over extended distances makes it particularly suitable for large facility installations and outdoor applications.

AHD technology provides cost-effective high-definition capabilities that bridge the gap between traditional analog and digital systems. This category shows consistent growth in price-sensitive market segments where customers require improved image quality while maintaining analog system advantages.

Application category insights reveal varying adoption patterns across different use cases, with commercial security applications showing the strongest demand for enhanced analog technologies, while residential applications continue to favor traditional cost-effective solutions.

Manufacturers in the United States surveillance analog camera market benefit from established production processes, mature supply chains, and proven technology platforms that enable cost-effective manufacturing and reliable product quality. The market provides opportunities for companies to leverage existing expertise while developing enhanced analog solutions that address evolving customer requirements.

Distributors and resellers gain advantages from analog cameras’ straightforward sales process, reduced technical support requirements, and consistent customer demand across various market segments. The technology’s simplicity enables efficient inventory management and streamlined customer service operations that support profitable business models.

Installation professionals benefit from analog systems’ simplified installation procedures, reduced training requirements, and reliable performance characteristics that minimize service calls and warranty issues. The technology’s compatibility with existing infrastructure enables efficient project completion and customer satisfaction.

End-users realize significant benefits through lower total cost of ownership, simplified operation, and reliable performance that meets basic surveillance requirements. Analog systems provide cost-effective security solutions that deliver essential monitoring capabilities without complex technical requirements or ongoing maintenance challenges.

System integrators can leverage analog cameras’ compatibility advantages to develop comprehensive security solutions that integrate with existing infrastructure while providing upgrade paths for future enhancement. This flexibility enables integrators to serve diverse customer requirements and build long-term client relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology enhancement trends within the United States surveillance analog camera market focus on improving image quality and system capabilities while maintaining core analog advantages. Manufacturers are developing high-definition analog technologies that provide enhanced resolution and features without sacrificing reliability or cost-effectiveness.

Hybrid integration trends show increasing adoption of solutions that combine analog cameras with digital recording and management systems. This approach enables customers to leverage existing analog infrastructure while gaining access to modern features such as remote monitoring, cloud storage, and basic analytics capabilities.

Cost optimization trends drive manufacturers to develop more efficient production processes and component sourcing strategies that maintain competitive pricing while improving product quality. The focus on cost reduction enables analog systems to compete effectively against digital alternatives in price-sensitive market segments.

Market consolidation trends indicate ongoing industry restructuring as companies adapt to changing market conditions and customer preferences. Strategic partnerships and acquisitions enable market participants to strengthen their competitive positions and expand their product portfolios to address diverse customer requirements.

Application specialization trends reveal growing focus on specific market niches where analog cameras provide distinct advantages. Manufacturers are developing specialized products for industrial environments, outdoor applications, and other demanding conditions where analog technology excels over digital alternatives.

Product innovation developments in the United States surveillance analog camera market demonstrate manufacturers’ commitment to extending analog technology capabilities and market relevance. Recent innovations include enhanced low-light performance, improved weather resistance, and extended transmission distances that address specific customer requirements.

Manufacturing efficiency improvements have enabled cost reductions and quality enhancements that strengthen analog cameras’ competitive position. Advanced production techniques and automated assembly processes reduce manufacturing costs while improving product consistency and reliability.

Distribution channel expansion efforts focus on reaching new customer segments and geographic markets through enhanced dealer networks and online sales platforms. These initiatives improve market access and customer service capabilities while reducing distribution costs and improving market coverage.

Technology partnerships between analog camera manufacturers and digital system providers create opportunities for integrated solutions that combine the best aspects of both technologies. These collaborations enable customers to implement comprehensive security systems that leverage existing analog infrastructure while providing digital capabilities.

Standards development activities work to establish industry guidelines that ensure analog camera compatibility and performance consistency across different manufacturers and applications. These efforts support market stability and customer confidence in analog technology solutions.

Strategic positioning recommendations for participants in the United States surveillance analog camera market emphasize the importance of focusing on specific market niches where analog technology provides clear advantages over digital alternatives. MarkWide Research analysis suggests that companies should concentrate on cost-sensitive segments, retrofit applications, and specialized environments where analog cameras excel.

Product development priorities should focus on enhancing analog camera capabilities through hybrid approaches that incorporate digital features while maintaining analog reliability and cost advantages. Manufacturers should invest in technologies that extend analog system lifecycles and provide upgrade paths for existing installations.

Market expansion strategies should target underserved segments and geographic regions where analog cameras can compete effectively against digital alternatives. Companies should develop specialized solutions for specific applications and industries that value analog technology characteristics over advanced digital features.

Partnership opportunities with digital system providers and security integrators can create comprehensive solutions that leverage analog camera advantages within modern security ecosystems. These collaborations enable market participants to address customer requirements for integrated systems while maintaining analog technology benefits.

Investment recommendations suggest focusing resources on manufacturing efficiency improvements, supply chain optimization, and customer service enhancements that strengthen competitive positioning in price-sensitive market segments. Companies should also consider selective acquisitions that expand market reach or technical capabilities.

Market trajectory projections for the United States surveillance analog camera market indicate continued presence in specific segments despite overall industry trends toward digital solutions. The market is expected to maintain stability through specialized applications and cost-sensitive customer segments while gradually evolving toward hybrid solutions.

Technology evolution expectations suggest ongoing development of enhanced analog technologies that provide improved performance while preserving core advantages. Future innovations may include better integration capabilities, enhanced image quality, and specialized features for specific applications that maintain analog market relevance.

Customer behavior trends indicate increasing sophistication in evaluation criteria, with buyers seeking solutions that provide value optimization rather than simply lowest cost. This evolution creates opportunities for analog camera manufacturers to develop premium products that justify higher prices through enhanced capabilities and reliability.

Competitive landscape changes are expected to result in market consolidation as companies adapt to changing conditions and customer preferences. Successful participants will likely be those who can effectively balance cost competitiveness with product innovation and customer service excellence.

Growth projections suggest that while the overall analog camera market may experience modest decline, specific segments will maintain growth potential at approximately 3-5% annually through specialized applications and retrofit opportunities. MWR forecasts indicate that companies focusing on niche markets and hybrid solutions will achieve better performance than those competing directly against digital alternatives.

The United States surveillance analog camera market represents a mature industry segment that continues to serve important functions within the broader security infrastructure landscape. Despite ongoing technological advancement toward digital solutions, analog cameras maintain relevance through cost advantages, reliability characteristics, and compatibility with existing infrastructure systems.

Market sustainability depends on manufacturers’ ability to enhance analog technology capabilities while preserving core advantages that differentiate these systems from digital alternatives. The development of hybrid solutions and specialized applications provides pathways for continued market presence and selective growth opportunities.

Strategic success in this market requires focused approaches that target specific customer segments and applications where analog cameras provide clear value propositions. Companies that can effectively balance cost competitiveness with product innovation and customer service excellence will be best positioned for long-term success in this evolving market environment.

The future of the United States surveillance analog camera market lies in its ability to adapt to changing customer requirements while maintaining the fundamental characteristics that have sustained its market presence. Through continued innovation and strategic positioning, analog camera technology can remain a viable option for customers seeking reliable, cost-effective surveillance solutions.

What is Surveillance Analog Camera?

Surveillance Analog Camera refers to a type of video camera that transmits analog signals for monitoring and recording purposes. These cameras are commonly used in security systems for various applications, including residential, commercial, and industrial surveillance.

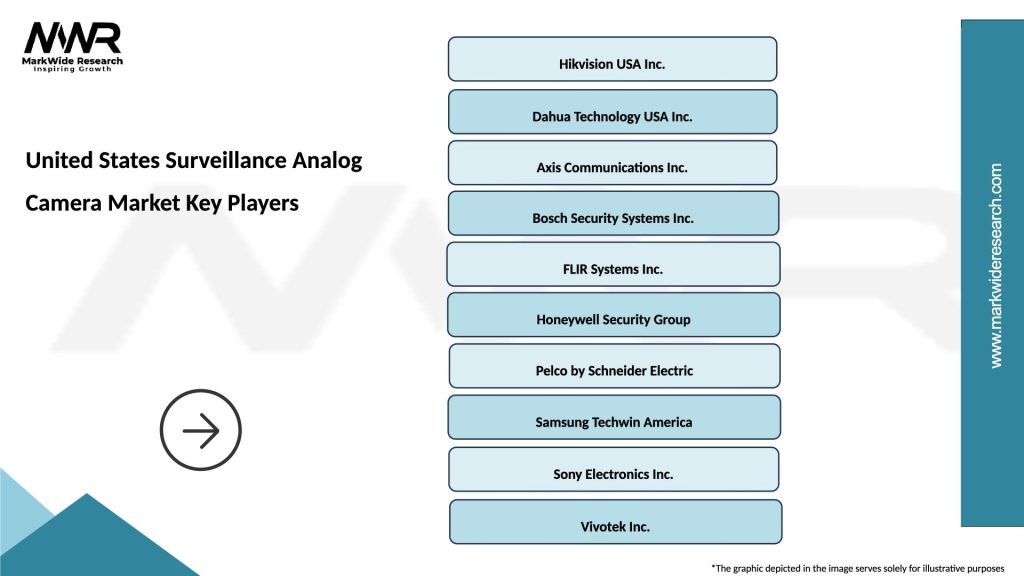

What are the key players in the United States Surveillance Analog Camera Market?

Key players in the United States Surveillance Analog Camera Market include companies like Hikvision, Dahua Technology, and Axis Communications. These companies are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the United States Surveillance Analog Camera Market?

The growth of the United States Surveillance Analog Camera Market is driven by increasing security concerns, advancements in camera technology, and the rising demand for surveillance in various sectors such as retail, transportation, and public safety.

What challenges does the United States Surveillance Analog Camera Market face?

Challenges in the United States Surveillance Analog Camera Market include the rapid advancement of digital technologies, which may render analog systems less appealing, and concerns regarding privacy and data security that can hinder adoption.

What opportunities exist in the United States Surveillance Analog Camera Market?

Opportunities in the United States Surveillance Analog Camera Market include the integration of smart technologies, such as AI and IoT, into surveillance systems, as well as the potential for growth in emerging markets and sectors requiring enhanced security solutions.

What trends are shaping the United States Surveillance Analog Camera Market?

Trends in the United States Surveillance Analog Camera Market include the shift towards hybrid systems that combine analog and digital technologies, increased focus on high-definition video quality, and the growing use of cloud-based storage solutions for surveillance footage.

United States Surveillance Analog Camera Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bullet Cameras, Dome Cameras, PTZ Cameras, Box Cameras |

| Technology | Infrared, HD-TVI, AHD, CVI |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Covert, Wireless |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Surveillance Analog Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at