444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States smart sensor market represents a rapidly evolving technological landscape that continues to reshape industries across the nation. These intelligent sensing devices integrate advanced capabilities including data processing, wireless communication, and real-time analytics, making them essential components in the modern digital ecosystem. Smart sensors have become fundamental enablers of the Internet of Things (IoT), artificial intelligence applications, and Industry 4.0 initiatives throughout American enterprises.

Market dynamics indicate robust growth driven by increasing demand for automation, energy efficiency, and predictive maintenance solutions. The automotive sector leads adoption with 78% of new vehicles incorporating multiple smart sensor technologies for safety and performance optimization. Healthcare applications follow closely, with medical device integration expanding at unprecedented rates as providers seek enhanced patient monitoring capabilities.

Industrial applications dominate the commercial segment, where manufacturing facilities leverage smart sensors for process optimization, quality control, and operational efficiency improvements. The technology’s ability to provide real-time data analytics and predictive insights has made it indispensable for companies pursuing digital transformation initiatives. Consumer electronics adoption continues accelerating, with smart home devices and wearable technology driving significant market expansion.

The United States smart sensor market refers to the comprehensive ecosystem of intelligent sensing devices that combine traditional sensing capabilities with advanced processing, communication, and analytical functions. These sophisticated devices go beyond simple data collection to provide intelligent decision-making support through embedded microprocessors, wireless connectivity, and machine learning algorithms.

Smart sensors distinguish themselves from conventional sensors through their ability to perform on-device processing, self-calibration, and autonomous communication with other connected systems. They incorporate multiple sensing modalities, including temperature, pressure, motion, proximity, and environmental monitoring, while providing enhanced accuracy and reliability compared to traditional sensing solutions.

Key characteristics include built-in signal processing, digital communication interfaces, self-diagnostic capabilities, and adaptive functionality that enables real-time response to changing conditions. These devices serve as critical components in smart infrastructure, autonomous systems, and connected device networks throughout American industries and consumer applications.

Strategic analysis reveals the United States smart sensor market experiencing unprecedented growth across multiple industry verticals. The convergence of IoT adoption, artificial intelligence integration, and digital transformation initiatives creates a favorable environment for sustained market expansion. Technology advancement continues accelerating with the introduction of edge computing capabilities, enhanced wireless protocols, and improved power efficiency.

Industrial sectors demonstrate the strongest adoption rates, with manufacturing, automotive, and healthcare leading implementation efforts. The market benefits from supportive government policies promoting smart infrastructure development and energy efficiency initiatives. Consumer demand for connected devices and smart home solutions provides additional growth momentum, with 65% of American households expected to adopt smart sensor-enabled devices within the next three years.

Competitive dynamics feature established technology companies expanding their sensor portfolios while innovative startups introduce specialized solutions for niche applications. The market’s evolution toward sensor fusion technologies and artificial intelligence integration presents significant opportunities for companies developing next-generation sensing solutions.

Critical market insights reveal several transformative trends shaping the United States smart sensor landscape:

Primary market drivers propelling United States smart sensor adoption include the accelerating digital transformation across industries and increasing demand for automation solutions. Organizations recognize that intelligent sensing capabilities provide competitive advantages through improved operational efficiency, cost reduction, and enhanced decision-making capabilities.

IoT ecosystem expansion serves as a fundamental growth catalyst, with connected device proliferation creating unprecedented demand for smart sensing solutions. The integration of artificial intelligence and machine learning technologies enhances sensor capabilities, enabling predictive analytics and autonomous system operation that drives adoption across multiple sectors.

Government initiatives supporting smart infrastructure development and energy efficiency programs provide significant market stimulus. Federal and state policies promoting smart city development, renewable energy adoption, and advanced manufacturing create favorable conditions for smart sensor deployment. Healthcare digitization efforts, accelerated by recent global events, drive demand for remote monitoring solutions and connected medical devices.

Consumer behavior changes toward connected living and smart home adoption create substantial market opportunities. The growing awareness of energy efficiency benefits and convenience features associated with intelligent sensing systems drives residential market expansion.

Market restraints include significant implementation costs associated with smart sensor deployment and system integration challenges. Many organizations face budget constraints when considering comprehensive smart sensor implementations, particularly smaller enterprises with limited technology investment capabilities.

Technical complexity presents adoption barriers, as smart sensor systems require specialized expertise for installation, configuration, and maintenance. The shortage of skilled technicians and engineers familiar with advanced sensing technologies creates implementation challenges across various industries.

Cybersecurity concerns regarding connected sensor networks pose significant challenges for organizations prioritizing data security. The potential for network vulnerabilities and data breaches associated with IoT devices creates hesitation among security-conscious enterprises and government agencies.

Interoperability issues between different sensor platforms and existing systems complicate deployment efforts. The lack of standardized communication protocols and integration frameworks increases implementation complexity and costs for organizations seeking comprehensive sensing solutions.

Emerging opportunities in the United States smart sensor market center around next-generation applications in autonomous systems, advanced healthcare solutions, and smart infrastructure development. The convergence of 5G connectivity and edge computing creates new possibilities for real-time sensing applications with ultra-low latency requirements.

Artificial intelligence integration presents substantial opportunities for companies developing sensors with embedded machine learning capabilities. These intelligent sensing solutions can provide autonomous decision-making and adaptive functionality that significantly enhances system performance and user experience.

Sustainability initiatives create demand for environmental monitoring sensors and energy management solutions. Organizations pursuing carbon footprint reduction and resource optimization goals require sophisticated sensing technologies to monitor and control their environmental impact.

Healthcare innovation opportunities include development of specialized sensors for personalized medicine, chronic disease management, and preventive care applications. The aging American population creates growing demand for health monitoring solutions that enable independent living and early intervention capabilities.

Market dynamics reflect the complex interplay between technological advancement, regulatory requirements, and evolving customer needs. The rapid pace of innovation in sensor technologies creates both opportunities and challenges for market participants seeking to maintain competitive positioning.

Supply chain considerations significantly impact market dynamics, with semiconductor availability and manufacturing capacity affecting sensor production and pricing. Recent global supply chain disruptions highlight the importance of domestic manufacturing capabilities and supply chain resilience for critical sensing technologies.

Competitive pressures drive continuous innovation and cost optimization efforts among market participants. Companies must balance performance enhancement with cost-effectiveness to maintain market share in increasingly competitive segments.

Customer expectations continue evolving toward more sophisticated sensing capabilities, longer battery life, and seamless integration with existing systems. The demand for plug-and-play solutions and simplified deployment processes influences product development priorities across the industry.

Comprehensive research methodology employed for this analysis incorporates multiple data collection approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, technology developers, and end-users across various sectors utilizing smart sensor technologies.

Secondary research encompasses analysis of industry reports, patent filings, regulatory documents, and company financial statements to provide comprehensive market understanding. MarkWide Research analysts conducted detailed examination of market trends, competitive positioning, and technological developments affecting the United States smart sensor landscape.

Quantitative analysis includes statistical modeling of market trends, growth projections, and segmentation analysis based on verified industry data sources. The methodology incorporates cross-validation techniques to ensure data accuracy and eliminate potential biases in market assessment.

Expert validation processes involve consultation with technology specialists, industry veterans, and academic researchers to verify findings and ensure comprehensive coverage of market dynamics and emerging trends.

Regional analysis reveals significant variations in smart sensor adoption patterns across different United States geographic regions. The West Coast leads in technology innovation and early adoption, with California’s Silicon Valley ecosystem driving advanced sensor development and implementation across multiple industries.

Northeast regions demonstrate strong adoption in healthcare and financial services sectors, with established technology infrastructure supporting sophisticated sensing applications. The concentration of medical device companies and research institutions creates favorable conditions for healthcare-focused sensor development.

Midwest manufacturing centers show robust industrial sensor adoption, with automotive and heavy manufacturing industries driving demand for process monitoring and automation solutions. The region’s industrial heritage provides strong foundation for smart sensor integration in traditional manufacturing operations.

Southern states experience growing adoption in energy and agriculture sectors, with oil and gas operations implementing advanced monitoring systems and agricultural technology companies developing precision farming solutions. The region’s energy infrastructure modernization efforts create substantial opportunities for smart sensor deployment.

Competitive landscape features a diverse ecosystem of established technology giants, specialized sensor manufacturers, and innovative startups competing across various market segments. The market structure includes both horizontal players offering broad sensor portfolios and vertical specialists focusing on specific industry applications.

Major market participants include:

Competitive strategies focus on technological differentiation, strategic partnerships, and vertical market specialization to capture market share and maintain competitive positioning.

Market segmentation analysis reveals distinct categories based on technology type, application area, and end-user industry. Understanding these segments provides insight into market dynamics and growth opportunities across different smart sensor categories.

By Technology Type:

By Application Area:

Automotive category demonstrates the highest growth potential, with advanced driver assistance systems driving sensor integration across vehicle platforms. The transition toward electric and autonomous vehicles creates demand for sophisticated sensing capabilities including LiDAR, radar, and camera systems.

Industrial automation represents the largest current market segment, with manufacturing facilities implementing comprehensive sensor networks for operational optimization. The focus on predictive maintenance and quality control drives adoption of intelligent sensing solutions that provide real-time analytics and decision support.

Healthcare applications show accelerating growth with remote patient monitoring and telemedicine expansion. The development of specialized medical sensors for chronic disease management and preventive care creates significant market opportunities.

Consumer electronics continue evolving with smart home adoption and wearable technology advancement. The integration of multiple sensing modalities in compact form factors drives innovation in sensor fusion and power management technologies.

Infrastructure monitoring gains momentum through smart city initiatives and environmental compliance requirements. The deployment of sensor networks for traffic management, air quality monitoring, and energy optimization creates substantial market opportunities.

Industry participants benefit from smart sensor adoption through enhanced operational efficiency, reduced maintenance costs, and improved decision-making capabilities. The ability to collect and analyze real-time data enables proactive management of critical systems and processes.

Manufacturing stakeholders achieve significant benefits through predictive maintenance capabilities that reduce unplanned downtime and extend equipment life. Quality control improvements through continuous monitoring help maintain product standards and reduce waste.

Healthcare providers benefit from enhanced patient monitoring capabilities and improved treatment outcomes through continuous health data collection. The ability to provide remote care services expands access to healthcare while reducing costs for both providers and patients.

Consumer benefits include improved safety, convenience, and energy efficiency through smart sensor-enabled devices and systems. The integration of intelligent sensing in everyday products enhances user experience and provides valuable insights for lifestyle optimization.

Environmental stakeholders benefit from improved monitoring and control of environmental conditions, enabling better resource management and pollution control. Energy efficiency improvements through smart sensing contribute to sustainability goals and cost reduction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge computing integration emerges as a dominant trend, with smart sensors incorporating local processing capabilities to reduce latency and improve response times. This trend enables real-time decision-making at the sensor level, reducing dependence on cloud connectivity and enhancing system reliability.

Sensor fusion technologies gain prominence as applications require multiple sensing modalities for comprehensive environmental understanding. The combination of different sensor types provides enhanced accuracy and reliability compared to single-sensor solutions.

Wireless connectivity advancement through 5G, Wi-Fi 6, and specialized IoT protocols enables new applications requiring high-bandwidth, low-latency communication. These connectivity improvements support advanced sensing applications in autonomous systems and real-time monitoring.

Artificial intelligence integration at the sensor level enables autonomous operation and adaptive functionality. Machine learning algorithms embedded in smart sensors provide predictive capabilities and self-optimization features that enhance system performance.

Miniaturization trends continue driving sensor development toward smaller form factors with improved performance. Advanced manufacturing techniques enable compact sensor designs suitable for wearable devices and space-constrained applications.

Recent industry developments highlight the rapid evolution of smart sensor technologies and their expanding applications across various sectors. MWR analysis indicates significant advancement in sensor capabilities and market adoption rates throughout the United States.

Automotive sector developments include the introduction of advanced LiDAR sensors for autonomous vehicle applications and enhanced camera systems for driver assistance features. Major automotive manufacturers announce comprehensive sensor integration strategies for next-generation vehicle platforms.

Healthcare innovations feature the development of specialized sensors for continuous glucose monitoring, cardiac rhythm detection, and respiratory function assessment. The integration of AI-powered analytics in medical sensors enables early disease detection and personalized treatment recommendations.

Industrial IoT advancements include the deployment of wireless sensor networks for comprehensive facility monitoring and predictive maintenance applications. Manufacturing companies report significant efficiency improvements through smart sensor implementation.

Smart city initiatives across major metropolitan areas incorporate advanced sensor networks for traffic management, environmental monitoring, and public safety applications. These deployments demonstrate the potential for large-scale sensor integration in urban infrastructure.

Strategic recommendations for market participants include focusing on vertical market specialization to develop deep expertise in specific industry applications. Companies should prioritize solution integration capabilities rather than competing solely on sensor specifications.

Investment priorities should emphasize research and development in artificial intelligence integration, edge computing capabilities, and advanced wireless communication protocols. The development of comprehensive sensor platforms that address multiple sensing requirements provides competitive advantages.

Partnership strategies with system integrators, software developers, and industry specialists enable companies to deliver complete solutions rather than individual components. These collaborations facilitate market penetration and customer relationship development.

Cybersecurity investment becomes critical as connected sensor networks expand across industries. Companies must develop robust security frameworks and demonstrate compliance with evolving privacy regulations to maintain customer trust.

Market expansion opportunities exist in underserved segments including small and medium enterprises, agricultural applications, and specialized industrial niches. Developing cost-effective solutions for these markets can drive significant growth.

Future market outlook indicates sustained growth driven by continued digital transformation across industries and expanding IoT ecosystem development. The convergence of 5G connectivity, artificial intelligence, and edge computing creates unprecedented opportunities for smart sensor applications.

Technology evolution toward more sophisticated sensing capabilities, including quantum sensors and bio-inspired sensing systems, will create new market categories and applications. The development of self-powered sensors using energy harvesting technologies addresses power consumption challenges in remote applications.

Market expansion into emerging applications including space exploration, deep-sea monitoring, and extreme environment sensing creates new growth opportunities. The increasing focus on sustainability and environmental monitoring drives demand for specialized sensing solutions.

Industry consolidation may occur as larger companies acquire specialized sensor developers to expand their technology portfolios and market reach. This consolidation could accelerate innovation cycles and improve solution integration capabilities.

Regulatory developments regarding data privacy, cybersecurity, and environmental compliance will shape market evolution and create new requirements for sensor manufacturers and system integrators.

The United States smart sensor market represents a dynamic and rapidly expanding technology sector with substantial growth potential across multiple industries. The convergence of IoT adoption, artificial intelligence integration, and digital transformation initiatives creates a favorable environment for sustained market development.

Key success factors for market participants include technological innovation, vertical market specialization, and comprehensive solution development capabilities. Companies that can effectively integrate advanced sensing technologies with artificial intelligence and connectivity solutions will capture the greatest market opportunities.

Market challenges including implementation costs, cybersecurity concerns, and skills shortages require strategic attention from industry participants and policymakers. Addressing these challenges through collaborative efforts and targeted investments will facilitate broader market adoption and growth.

Future prospects remain highly positive, with emerging applications in autonomous systems, healthcare innovation, and smart infrastructure development driving continued expansion. The United States smart sensor market is positioned to maintain its leadership role in global sensor technology development and implementation, supported by strong domestic demand, technological innovation capabilities, and comprehensive industry ecosystem development.

What is Smart Sensor?

Smart sensors are devices that can collect, process, and transmit data, often incorporating advanced technologies such as IoT connectivity, artificial intelligence, and data analytics. They are widely used in various applications, including industrial automation, smart homes, and healthcare monitoring.

What are the key players in the United States Smart Sensor Market?

Key players in the United States Smart Sensor Market include companies like Texas Instruments, Honeywell, and Siemens, which are known for their innovative sensor technologies and solutions. These companies focus on various sectors such as automotive, healthcare, and industrial automation, among others.

What are the main drivers of growth in the United States Smart Sensor Market?

The growth of the United States Smart Sensor Market is driven by the increasing demand for automation in industries, the rise of smart homes, and advancements in IoT technology. Additionally, the need for real-time data analytics and improved efficiency in operations contributes to market expansion.

What challenges does the United States Smart Sensor Market face?

The United States Smart Sensor Market faces challenges such as data security concerns, high implementation costs, and the complexity of integrating smart sensors with existing systems. These factors can hinder widespread adoption and limit market growth.

What opportunities exist in the United States Smart Sensor Market?

Opportunities in the United States Smart Sensor Market include the growing demand for smart city initiatives, advancements in sensor technology, and the increasing adoption of wearable devices. These trends present avenues for innovation and expansion in various sectors.

What are the current trends in the United States Smart Sensor Market?

Current trends in the United States Smart Sensor Market include the integration of artificial intelligence for enhanced data processing, the rise of wireless sensor networks, and the focus on energy-efficient solutions. These trends are shaping the future of smart sensor applications across multiple industries.

United States Smart Sensor Market

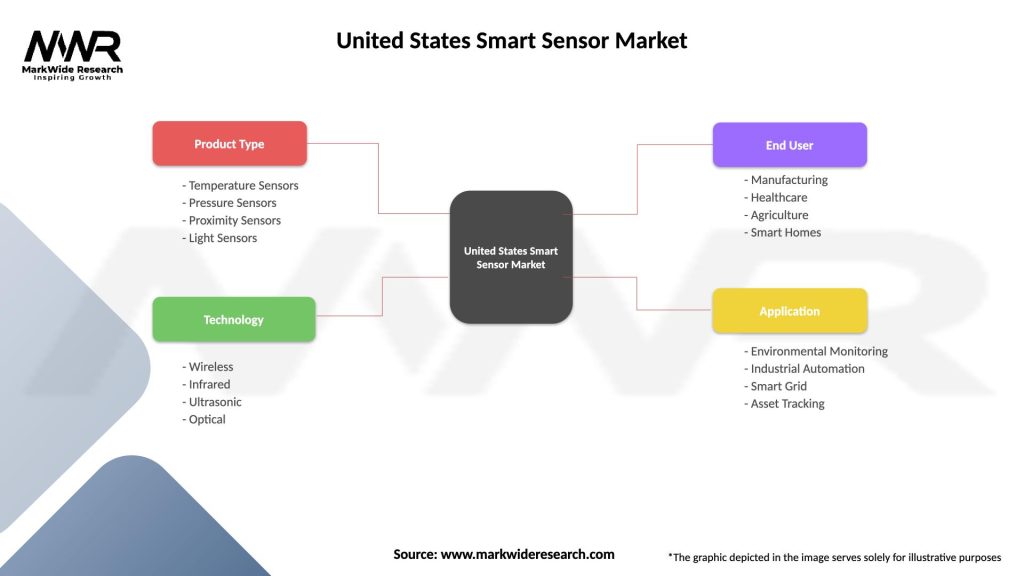

| Segmentation Details | Description |

|---|---|

| Product Type | Temperature Sensors, Pressure Sensors, Proximity Sensors, Light Sensors |

| Technology | Wireless, Infrared, Ultrasonic, Optical |

| End User | Manufacturing, Healthcare, Agriculture, Smart Homes |

| Application | Environmental Monitoring, Industrial Automation, Smart Grid, Asset Tracking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Smart Sensor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at